JAIBALAJI : uplift is coming?1. Jai Balaji Industries Ltd

Analysis:

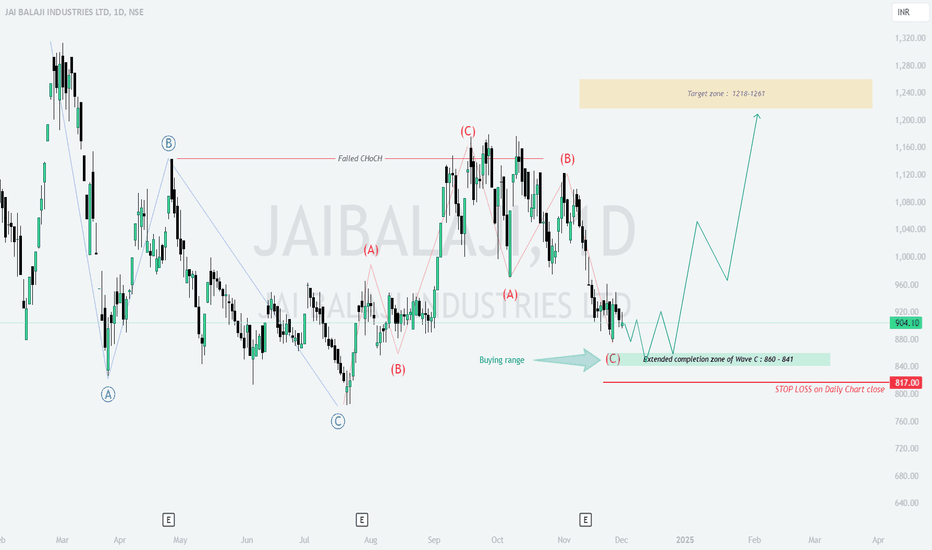

Wave Structure: Identifies an Elliott Wave correction (ABC structure). Wave C is nearing completion in the 860-841 INR zone.

Buying Range: Highlighted between 860-841 INR.

Target Zone: Marked at 1218-1261 INR, suggesting strong upside potential.

Stop Loss: Defined at 817 INR, just below the buying zone.

Trading Plan:

Action: Place buy orders in the range of 860-841 INR using a staggered accumulation strategy.

Stop Loss: Set at 817 INR to account for potential false breakdowns.

Targets:

First Target: 1218 INR.

Final Target: 1261 INR.

Reasoning:

Wave C completion near the buying range suggests a potential reversal.

Targets align with historical resistance levels, making them logical profit zones.