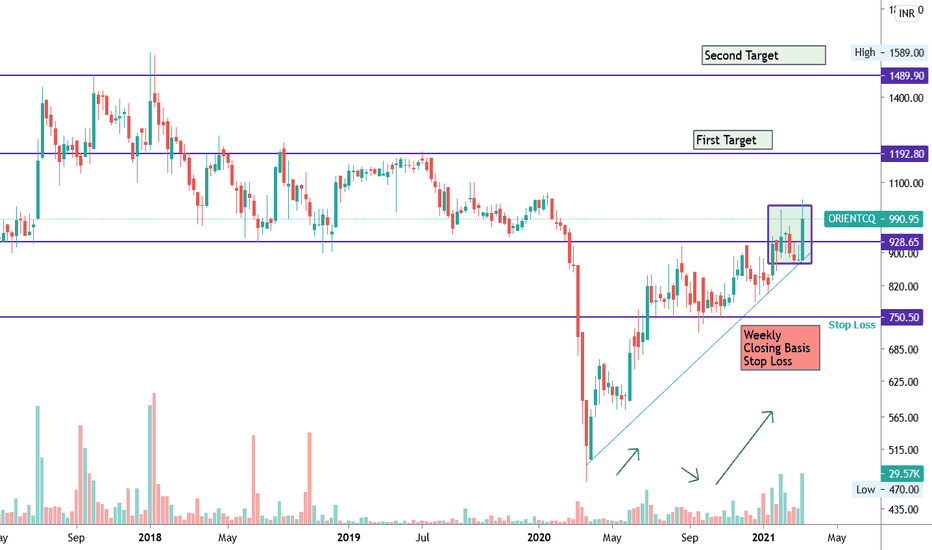

(NSE:OCCL )Oriental Carbon on move up Market Share: #

OCCL is the sole manufacturer of Insoluble Sulphur (IS) in the domestic market.

Majority of demand for insoluble sulphur is derived from the automotive tyres industry.

It enjoy a domestic market share of nearly 55%-60% and around 10% market share in the global market.

OCCL has established itself as a preferred first/second supplier to all major tyre manufacturers in global markets

Capacity as of FY20: #

IS plant spread across 2 units (Dharuhera & SEZ Mundra) of 34,000 metric tonnes per annum.

Upcoming Capex #

Capacity expansion underway to expand the Insoluble Sulphur capacity by 11,000 MTPA & Sulphuric acid capacity by 42,000 MTPA, spread across two phases at its Dharuhera facility.

Total project will cost 216 Cr, funded with a debt equity ratio of 2:1.

Phase-I of IS capacity expansion by 5500 MTPA along with Sulphuric acid capacity at an outlay of 156 Cr is underway. Commissioning for the project has been pushed to July2021 from Q3FY21 as envisaged earlier for phase-1.

reference: Screener.in

Stocktobuy

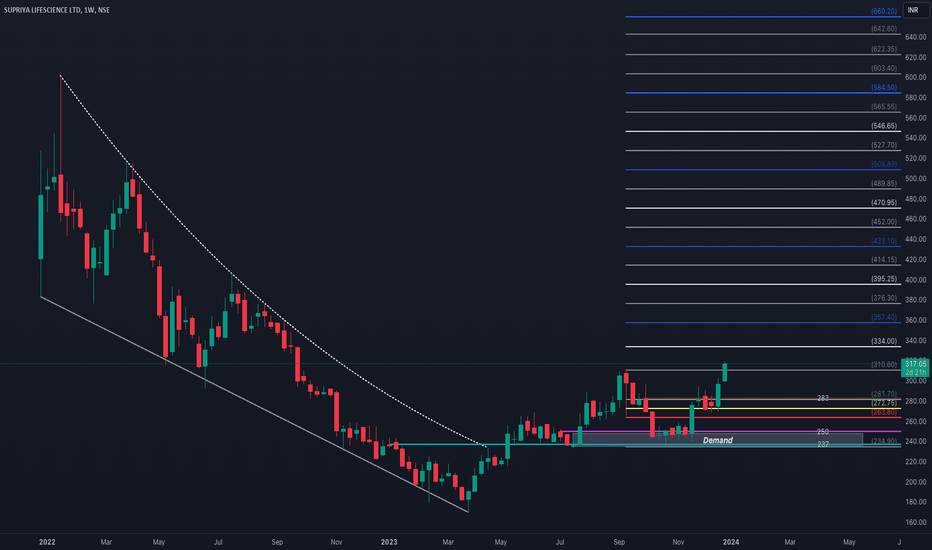

Supriya Life science Weekly Timeframe analysis for long term

NSE:SUPRIYA has formed clear bullish structure and taken solid bounce from support 237-250 zone.

Buy Level is 283. We can see long term move above 300 with SL of 260 if it give pullback buy more near 280 to 290 range.

Major targets levels are highlighted in blue lines.

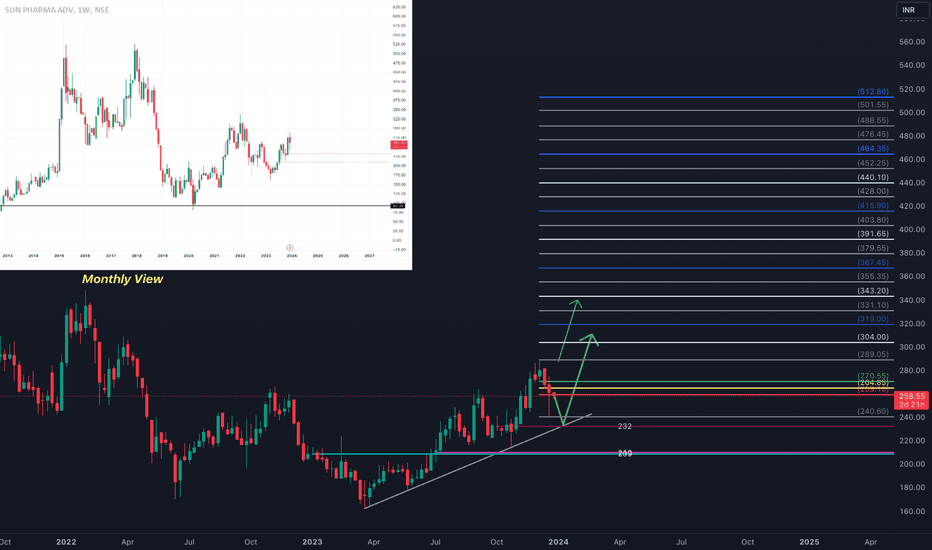

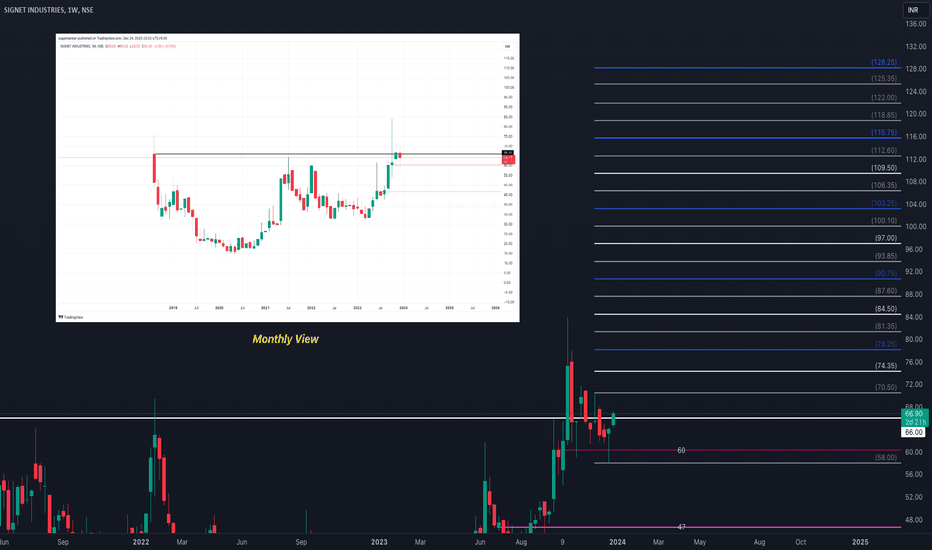

SIGNET INDUSTRIES Weekly Timeframe Analysis for long term

NSE:SIGIND has created Cup And Handle Pattern in Monthly Timeframe and also breakout Opening Price 66 when it was listed in NSE.

We can see long term move above 66 with SL of 58 can average till 55.

Major targets levels are highlighted in blue lines.

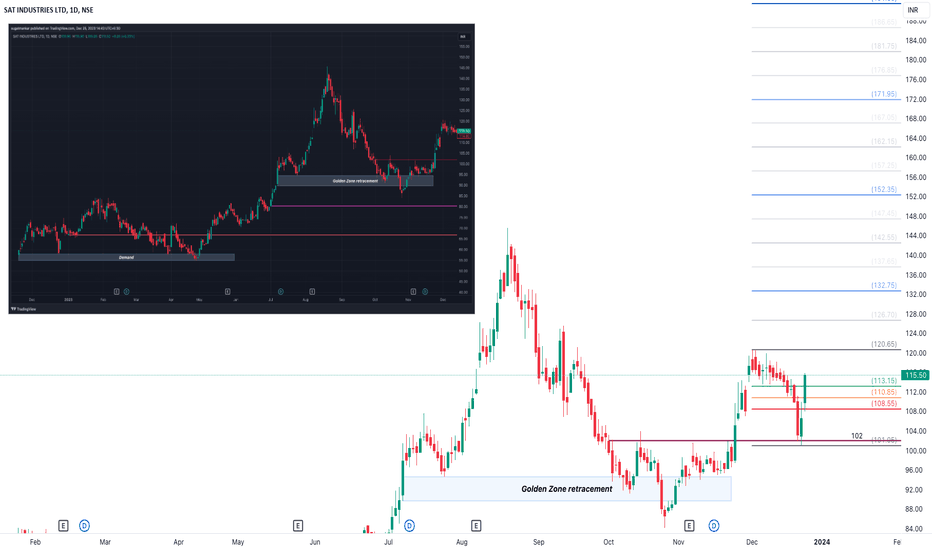

SAT Industries Daily timeframe analysis for long term

NSE:SATINDLTD has given strong breakout to inverse head and shoulder pattern after strong retracement from golden zone.

We can see long term move above 113 with SL of 102 and can average till 105.

Major targets levels are highlighted in blue lines.

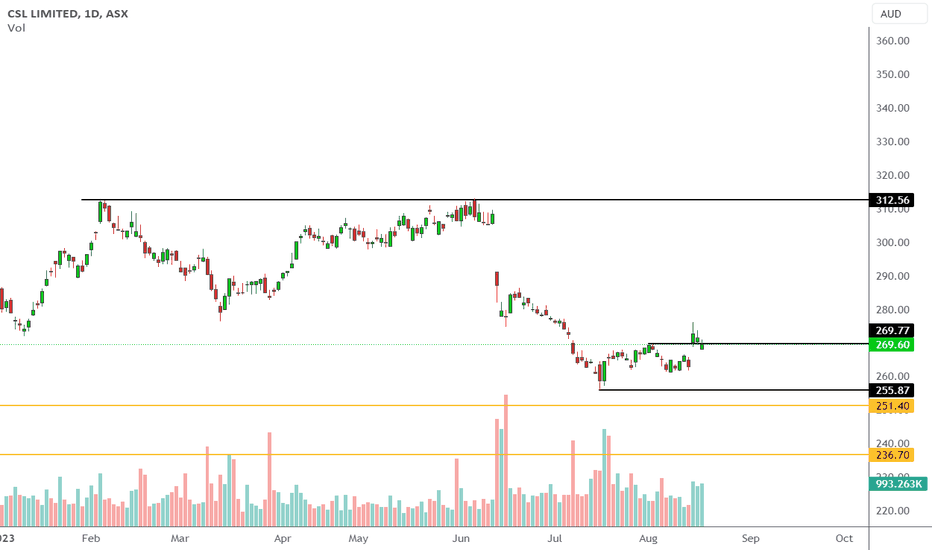

Time to enter ASX:CSL ⁉️Last week, CSL management received positive feedback and the stock is currently in a base. While there is no confirmation of a new trend, the risk-reward ratio is favorable to add a small amount and let the market guide for further additions. I will only add up to 50% of my position in the low base, so if the stock fails to reach its all-time high, I will still have some gains to take away. The stock symbol is $ASX:CSL.

Disclosure: I am investing in my super account for the first trance I cannot provide any recommendations to buy or sell. It is essential for you to conduct your own research.

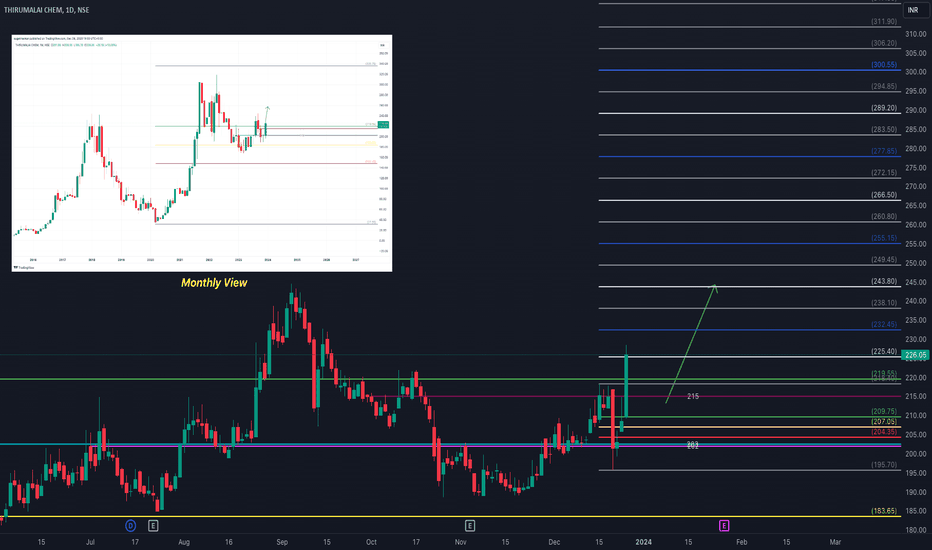

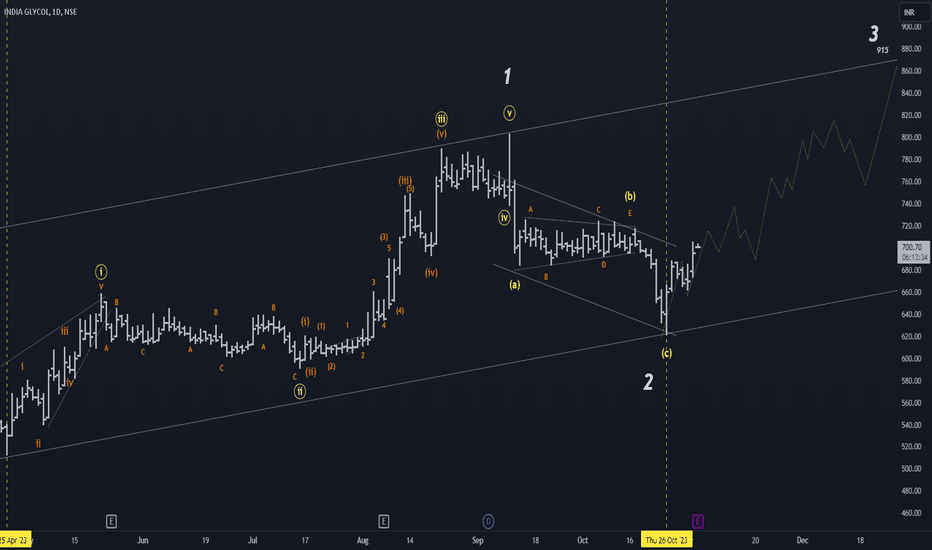

Wave 3 begins in INDIA GLYCOL The correction to the impulse wave up(April 2023) completed in the stock with a zig zag and achieving 61.8% retracement of the wave up.

Wave 3 seems to have now started and the projected target zone would be around 910-920 zone.

Sl-659

CMP 700

Target - 915

Note*- This post is for educational purpose only