Stocktowatch

Gail can give good gains.GAIL (INDIA) LTD. is a leading natural gas company with diversified interest across natural gas value chain of trading, transmission, LPG production, petrochemicals and many more. It owns and operates a network around 15,413 km of natural gas pipeline across the country. GAIL commands 70% market share in gas transmission and has a Gas trading share of over 50% in India. GAIL CMP is 105.20.

Negative aspects of the company are declining annual net profits and FIIs are decreasing stake. Positive aspects of the company are low debt, improving cash from operations annual, zero promoter pledge and MFs are increasing stake. Dividend yield of the stock is 4.4% at CMP.

Entry after closing above 107. Targets in the stock will be 109 and 110. Long term target in the stock will be 113.8. Stop loss in the stock should be maintained at closing below 102.

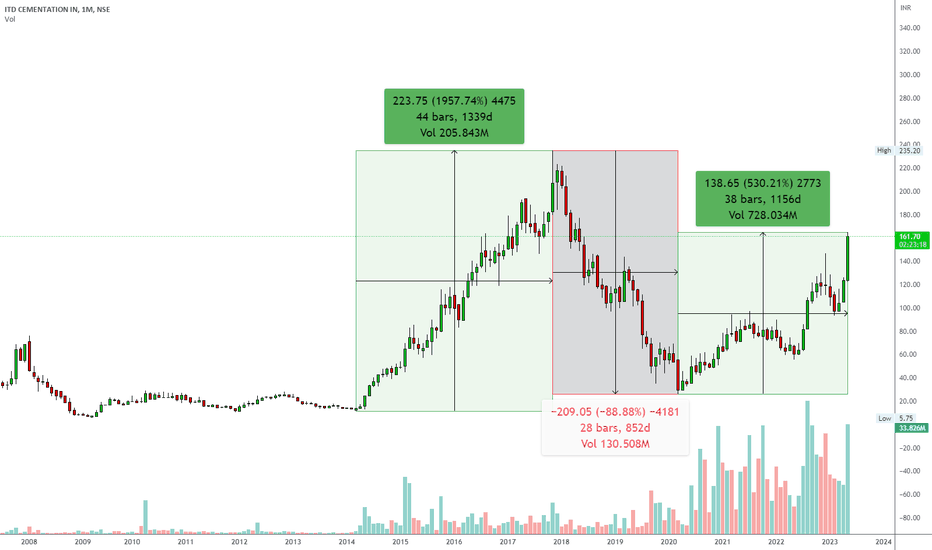

ITD Cementation - going get good now?NSE:ITDCEM

Is it a good time to invest in ITD Cementation?

Knowing when to exit and re-enter the market is crucial to navigating it successfully. A great way to illustrate this concept is by using a clear example of ITD cementation.

Disclosure: I have invested and want to share it for educational purposes.

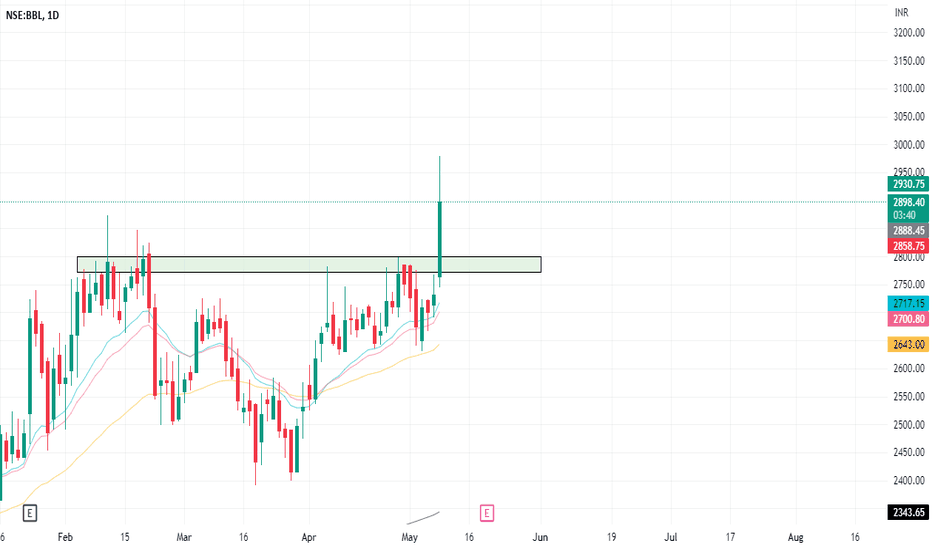

Necklace Pattern Trading - "S Chand & Company"This has been highly dependable stock since last 1 month. When benchmark Index "Nifty" fell by 500 points, this stock was rock solid holding its swing high level & stayed in the range of just 20 points. This is my Necklace Pattern stock it will be interesting to see how story unfolds when it reaches its previous swing highs.

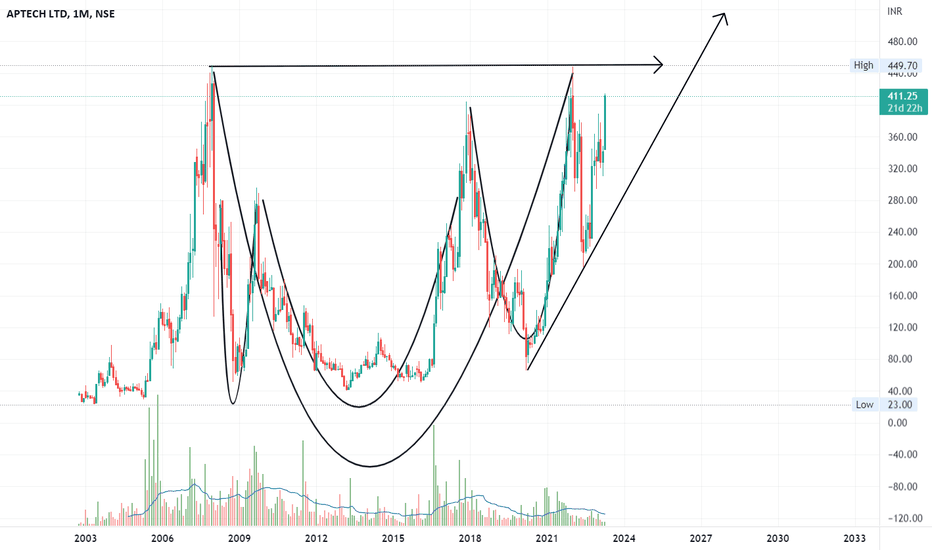

Necklace Pattern Series -"Career Point"This Stock is creating repeated Necklace patterns, i.e. rounded bottom in follow up manner. When such stock tries to reach higher high or tries to defend lower levels repeatedly, it may touch its past glory i.e. its previous Life Time High & explode further.

This chart is for study purpose & not a buy call!

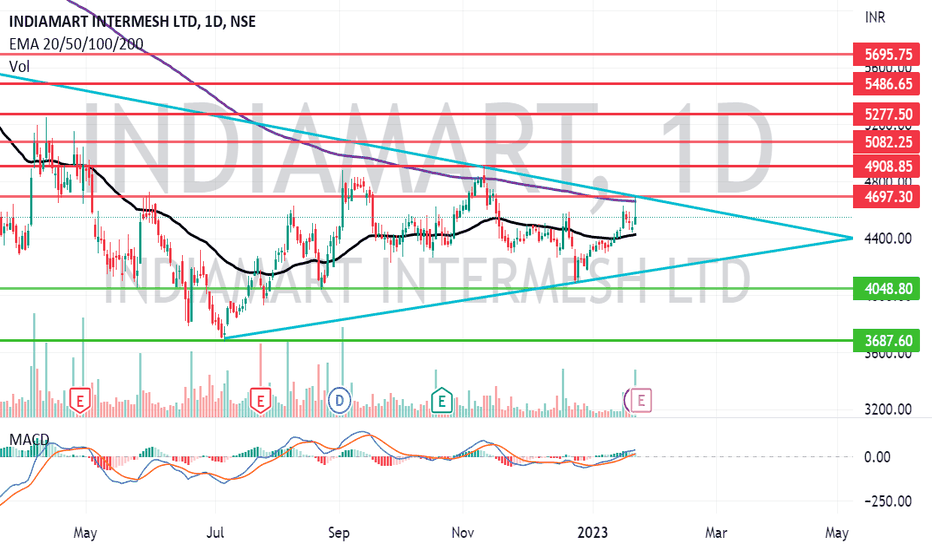

Indiamart may get a start soon...IndiaMart Intermesh is an India e-commerce company that provides B2B and customer to customer sales service via its web portal. IndiaMart intermesh is an India’s largest online B2B market place, connecting buyers with supplies. CMP – 4549.60. Negatives of the company are high valuation (P.E. = 48.8) and declining annual net profit. Positive of the company are MFs and FIIs are increasing stake. No debt, zero promoter pledge, improving cash from operating activity annual and improving book value per share. Entry in the stock can be taken after closing above 4698. The Long Term Target in the stock will be 4908 and 5082. In a very long run the stock can reach 5277 and 5400+. Stop Loss should be maintained at a closing below 4400. For Paper Trading.

Mahindra Lifespace may move upward in full flow. Mahindra lifespaces Developers is an Indian real estate and infrastructure development company. Mahindra lifespaces businesses is Residential Homes, Integrated Cities and Industrial clusters. CMP of the stock is 372.05. Negatives of the company are moderately high valuation (P.E. = 25.1), declining cash from operating activity annual and MFs decreasing stake. Positive aspects of the company are that FIIs are increasing the stake, annual net profit is increasing, Mahindra Lifespace is a low debt with zero promoter pledge. Entry in the stock can be taken after closing above 376. Targets will be 404, 415 and 448. Long term target in the company is 475+. Stop loss in the company should be maintained at closing below 344. Mahindra Lifespace is a Long term investment idea. For Paper Trading.