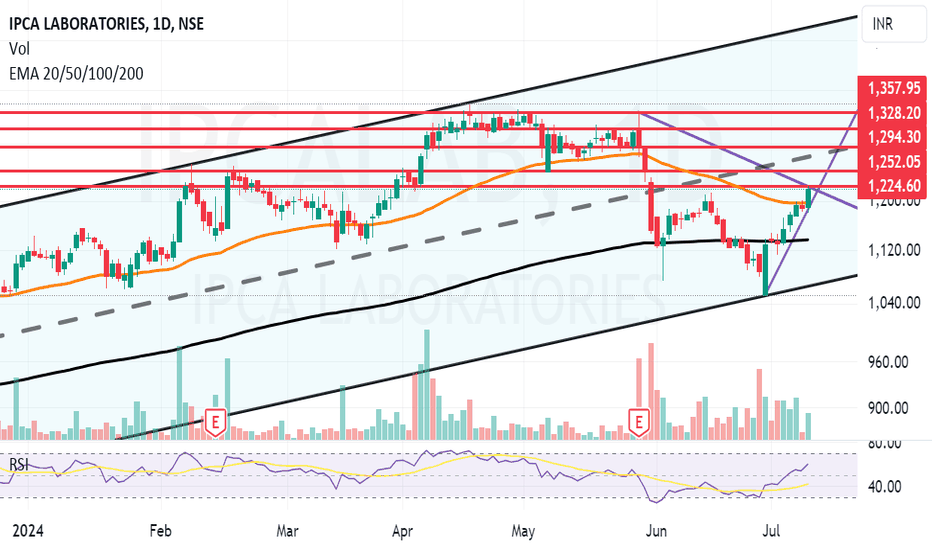

Can IPCA Break the trend?Ipca Laboratories Ltd. engages in the manufacturing, marketing, research, and development of pharmaceutical products. Its products include Hydroxychloroquine Sulphate, Artemether and Lumefantrine and Acceclofenac and its combinations. The Company has 18 manufacturing units in India manufacturing API's and formulations for the world market.

Ipca Laboratories Ltd CMP 1220.75. The positive aspects of the company are Mutual Funds Increased Shareholding in Past Month, Company with Low Debt, Company with Zero Promoter Pledge and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are High PE (PE=56.6), MFs decreased their shareholding last quarter, Declining Net Cash Flow : Companies not able to generate net cash and De-growth in Revenue, Profits and Operating Profit Margin in recent results.

Entry can be taken after closing above 1225. Targets in the stock will be 1252 and 1294. The long-term target in the stock will be 1328 and 1357. Stop loss in the stock should be maintained at Closing below 1136.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Stocsksignals

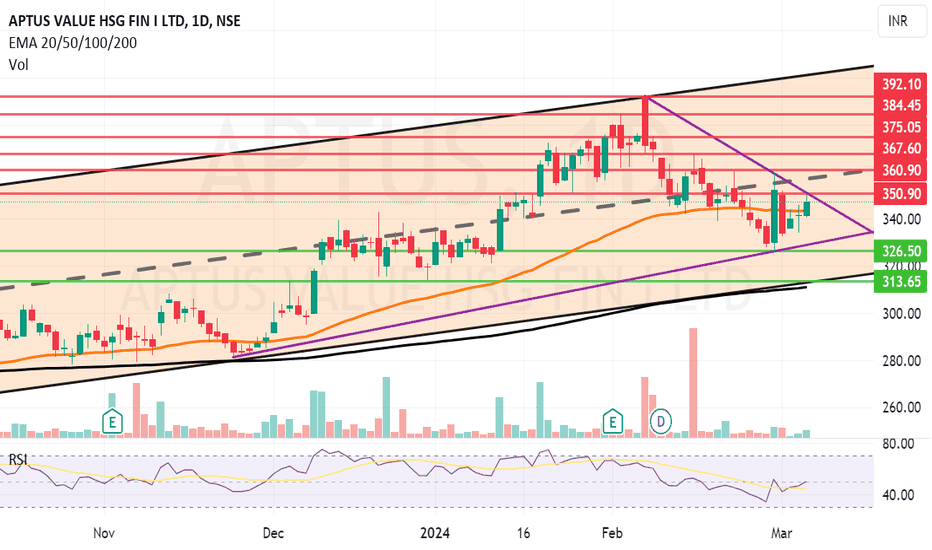

Aptus may get a Techincal impetusAptus Value Housing Finance India Ltd is a Home Loan Company. Aptus has been formed to primarily address the housing finance needs of self-employed, belonging to Low and Middle Income Families primarily from semi urban and rural markets.

Negative aspects of the company are promoter decreasing the stake and high PE 29.7 of the company. Positive aspect of the company are good quarterly growth, FIIs and MFs increasing stake in the company.

Entry can be taken after closing above 351. Targets in the stock will be 360, 367 and 375. The long-term target in the stock will be 384 and 392. Stop loss in the stock should be maintained at Closing below 326 or 313 depending upon your risk taking ability.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.