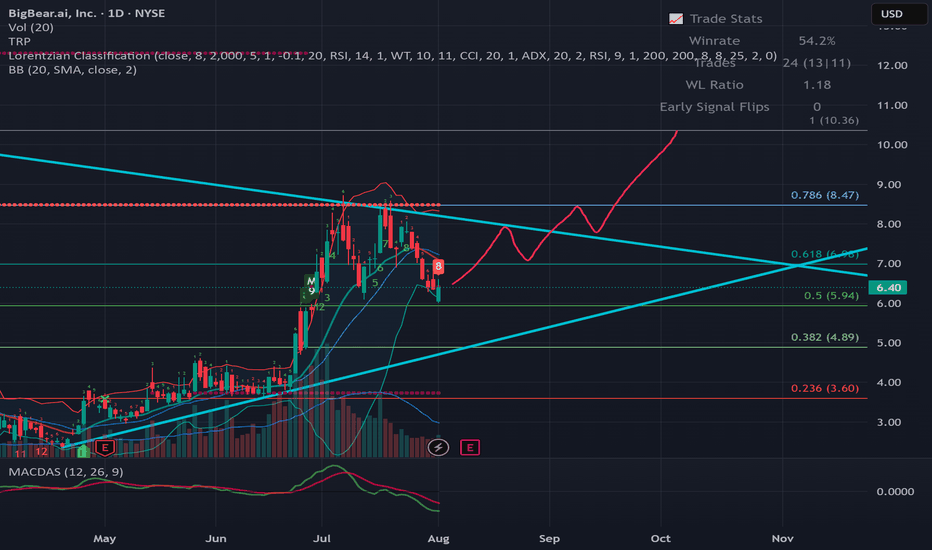

BBAI - Good Time to buy?Hello Everyone,

Happy Sunday to All.

is it a good time to buy BBAI Bigbear AI?

I tried to analyze possibilities and you can monitor next week and make your decisions.

It is almost %26 down from previous high which was hit last month.

5.85 - 5.95 is a first support level and looks like it reacte

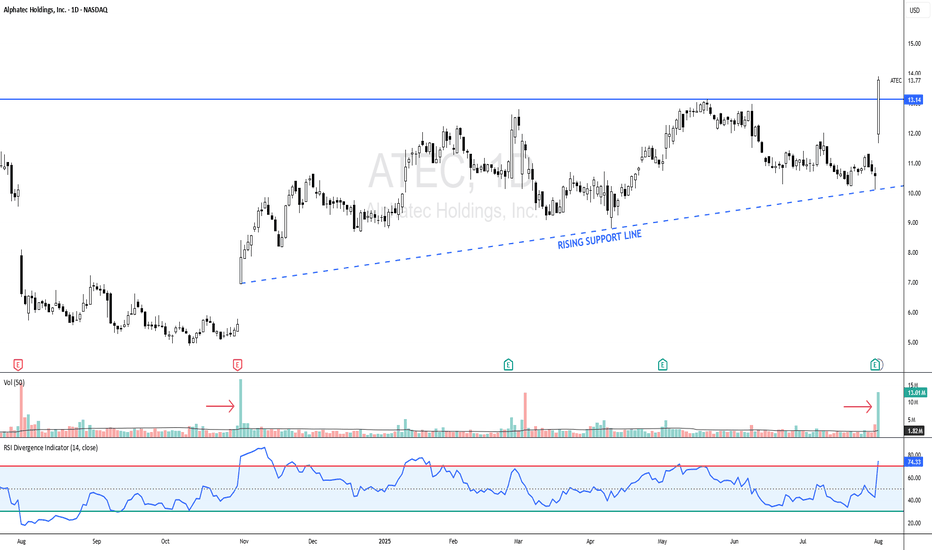

ATEC - NEW 52-WEEK HIGHATEC - CURRENT PRICE : 13.77

ATEC made a new 52-week high last Friday with burst in trading activity. Look at the volume pointed by red arrows. On 31 Oct 2024 there was a significant gap up with high volume, from there the stock continue rises - indicating strong buying interest. Now same scenario

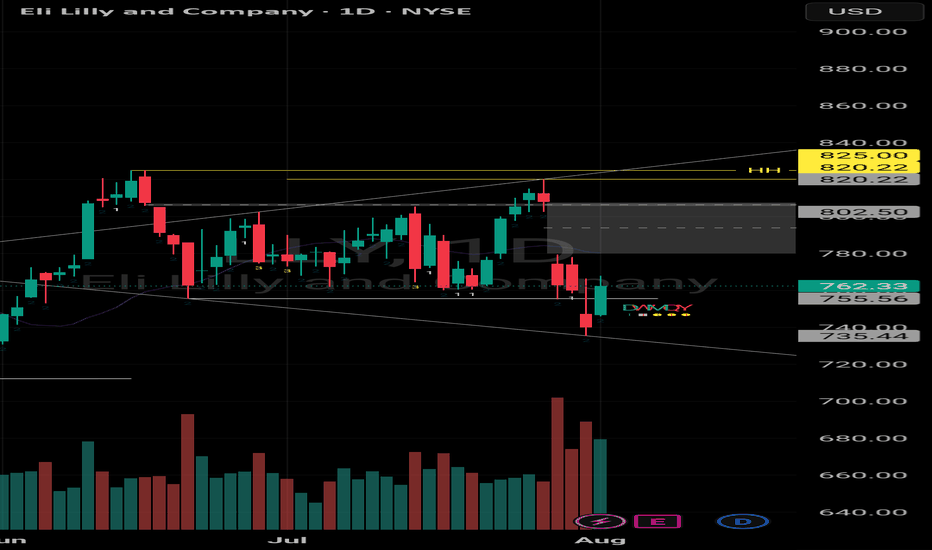

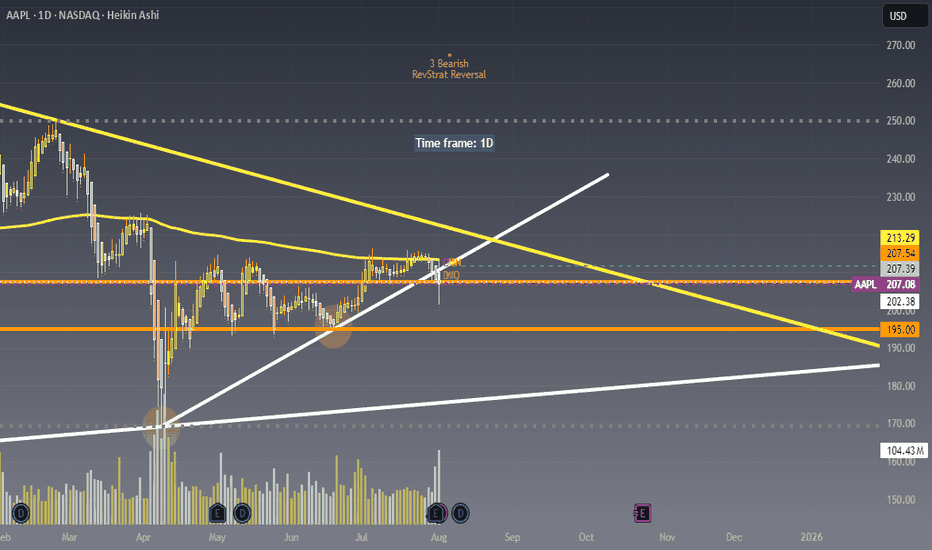

Watching AAPL closely here !!!Not financial advice – just sharing my outlook. 📉📈

Price is currently rejecting the upper trendline resistance around $213 and struggling to hold above the $207-$208 zone.

Looking for potential puts as long as price remains under this key resistance area.

Will be buying the dip near the $195 or $1

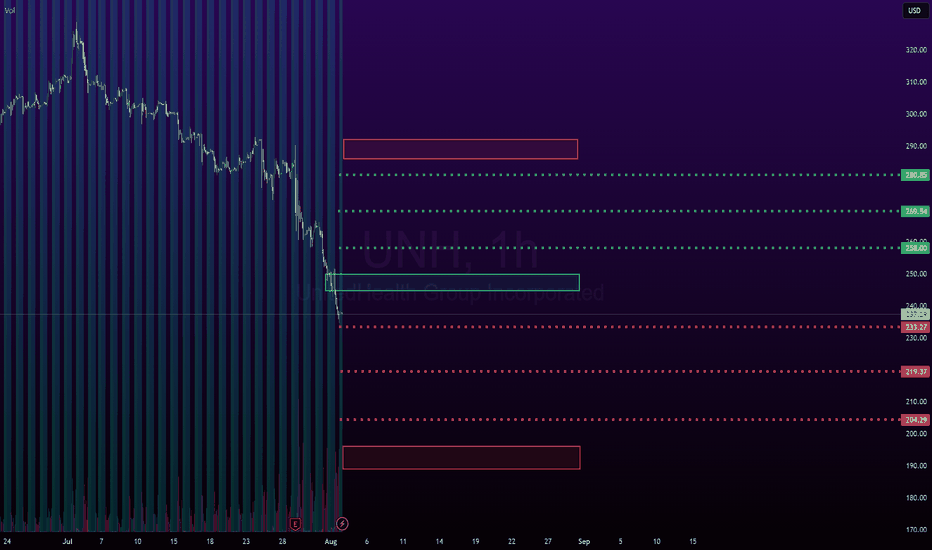

UNH: Monthly outlook UNH is an interesting case study, fundamentals vs technicals vs math.

If you were sleeping, here are the cliff notes on UNH:

UNH is alleged to have commited the following violations/criminal offences

Medicare Overbilling: The U.S. Department of Justice has accused UNH of overcharging Medica

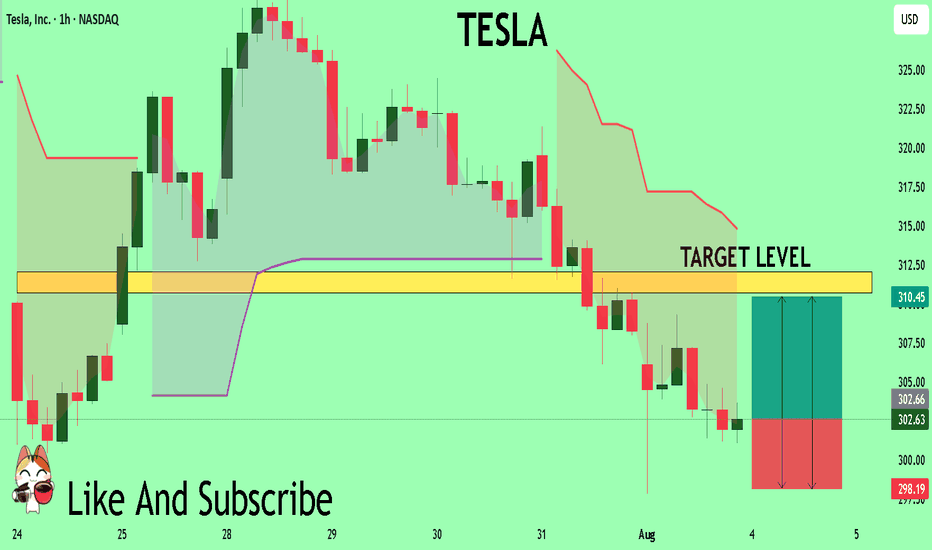

TESLA Sellers In Panic! BUY!

My dear friends,

TESLA looks like it will make a good move, and here are the details:

The market is trading on 302.63 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the mar

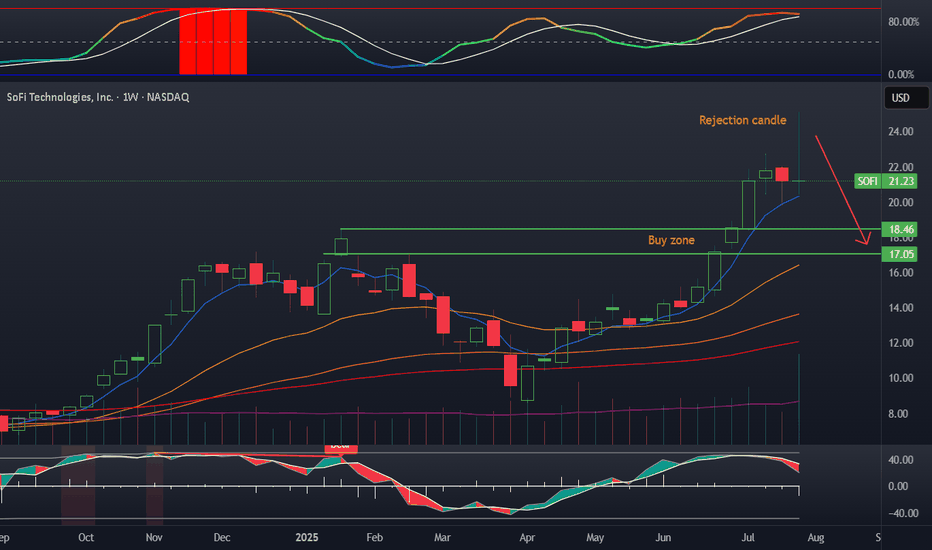

Getting ready for another Sofi longSofi as expected had tremendously good earnings. The CEO is executing and I believe this will continue. At the current moment most of my Sofi trades have been LEAPs. I am planning on entering again with ultra safe in the money options. Stochastic is resetting, volatility was heating up and needs to

NVDA Weekly Trade Setup (2025-08-02)

### 🟢 NVDA Weekly Trade Setup (2025-08-02)

🚀 **BULLISH CONSENSUS** across 5 top-tier models

📉 Daily RSI: Weak — but weekly trend is STRONG

💼 Institutional Volume: Confirmed accumulation

📊 Options Flow: Call/Put leaning bullish

---

### 🎯 TRADE SETUP

**💥 Direction:** CALL (LONG)

**📍 Strike:** \$1

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

KOSKosmos Energy Ltd.

Actual

−0.19

USD

Estimate

−0.07

USD

Today

ENREnergizer Holdings, Inc.

Actual

1.13

USD

Estimate

0.62

USD

Today

WATWaters Corporation

Actual

2.95

USD

Estimate

2.94

USD

Today

CNACNA Financial Corporation

Actual

1.23

USD

Estimate

0.97

USD

Today

SPNTSiriusPoint Ltd.

Actual

0.50

USD

Estimate

0.57

USD

Today

LLoews Corporation

Actual

2.16

USD

Estimate

—

Today

EEXEmerald Holding, Inc.

Actual

0.01

USD

Estimate

0.01

USD

Today

IDXXIDEXX Laboratories, Inc.

Actual

3.63

USD

Estimate

3.30

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Non-Durables | ||||||||

| Producer Manufacturing | ||||||||

| Energy Minerals | ||||||||

| Consumer Services | ||||||||

| Consumer Durables |