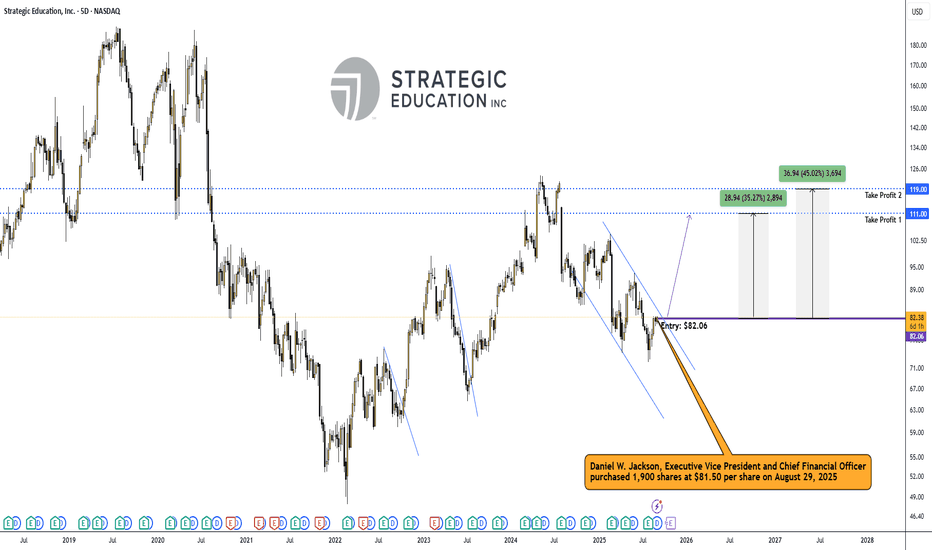

Strategic Education Inc. — September 02, 2025Sergio Richi Premium ✅

NASDAQ:STRA #StrategicEducation — Strategic Education Inc. (NASDAQ:STRA) Insider Activity Report | Consumer Defensive | Education & Training Services | USA | NASDAQ | September 02, 2025.

Price (Sept 2, 2025) : $82.12

On August 29th, Daniel Jackson, EVP & CFO of Strategic Education, stepped in with a 1,900-share open-market buy at $81.50 (~$155K). His total stake now tops 104K shares. It’s not the size of the purchase that matters here — it’s the timing: the transaction followed a Q2 earnings beat (EPS $1.52 vs. $1.42 est.) and nearly 8% YoY revenue growth, driven primarily by their Education Technology Services.

(SEC Form 4)

www.sec.gov

Insiders rarely commit fresh capital unless they see value that the market is missing. What stands out: institutions have been quietly adding — Marshfield Associates increased by 12,500 shares, and American Century expanded their stake earlier in the quarter. Insider ownership sits near 3.3%, and inflows continue despite a flat YTD chart.

1. Company at a glance:

• Runs Strayer University, Capella University, Torrens (AU/NZ), plus Sophia Learning & Workforce Edge.

• Focused on affordable, flexible, employer-aligned higher ed.

• Q2 revenue ~$300M, cash position $133.6M, dividend $0.60/qtr (~3% yield).

Market cap around $2B.

2. Catalysts on the horizon:

• Dividend payable Sept 15.

• Next earnings Oct 29 — potential follow-through if enrollment momentum stabilizes.

• Expanding EdTech footprint — Sophia & Workforce Edge gaining traction in B2B partnerships.

• Protocol adoption in Australia/NZ could re-accelerate international enrollment.

Charts:

• (5D)

Insider Trades:

STRA seasonality:

STRA Hedge Fund Flows:

STRA Ownership:

3. The setup:

Entry: $81.50–$82.06 (aligned with insider buy).

🎯 Take Profit 1: $111.00 (+35.27%)

🎯 Take Profit 2: $119.00 (+45.02%)

Base case: 35–45% upside in 6–12 months.

Bull case: test $119 on stronger EdTech growth + enrollment recovery.

STRA

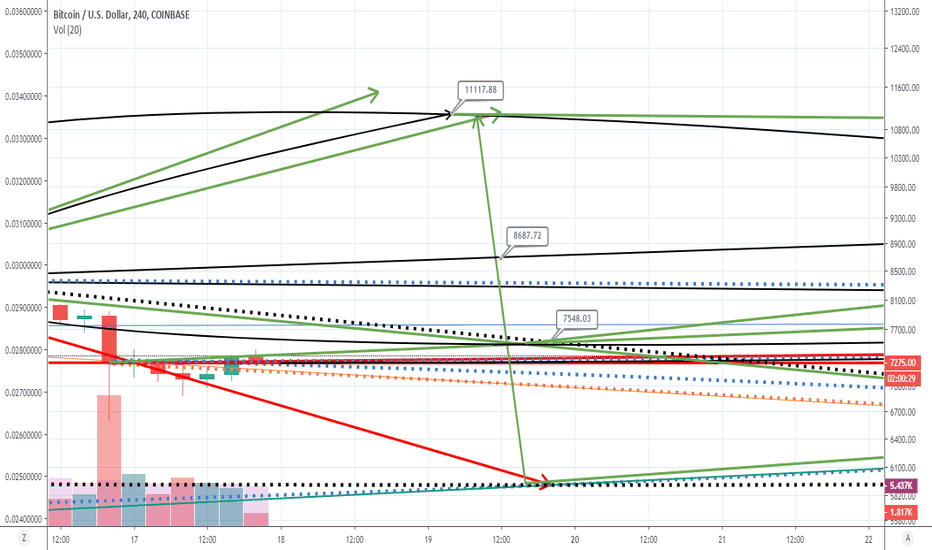

BTC/USD inflection at $7550 may signal return to $10K+ trackSome numbers presented here on the timeline. Near term, the first trend completion doesn't look to be in range though it is first up on the timeline.

One path considered likely sees consolidation around $7500-7600 with a continuation of the uptrend from there.

S&P 500: All Time HIGHS?Despite the binary expectations of analysts (if HC wins long, if DT wins short) we saw an amazing rebound followed by a green day. Apart from the unexpected price action, the MACD is also giving a buy signal. The 200DMA and 50DMA haven't crossed over, and thus I don't think this is the top. I would not be suprised if the price were to reach previous ATH or even create new ones. Still, despite the euphoric buying, I will not trade on either side the SP5000 . I will wait though for a top to form and then try to catch a good short entry. I will also NOT trade volatility and would recommend you to do so as well, unless you are very advanced.