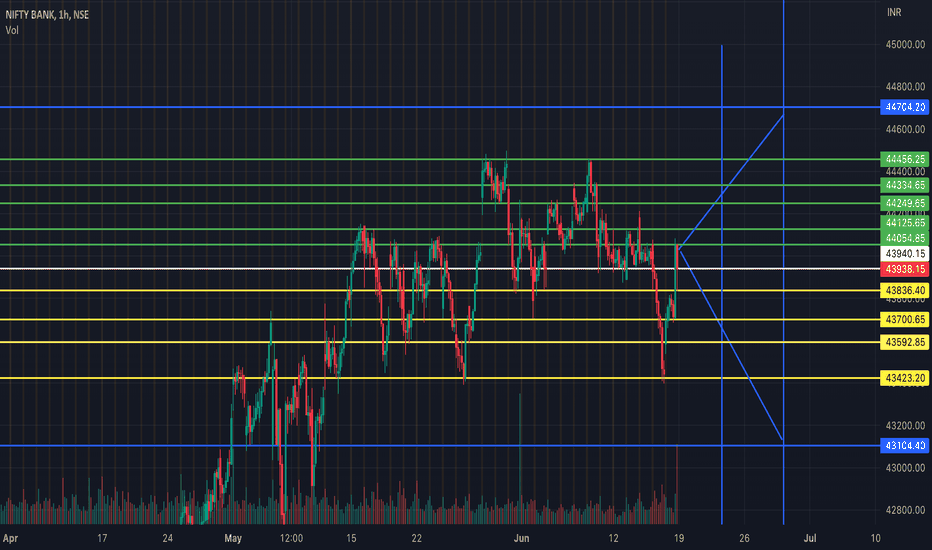

Nifty Bank - June end ExpiryNifty Bank is bullish currently. The green lines will act as resistance in the upper side and yellow lines will act as support in the lower end. I expect Nifty Bank will not breach the blue line during this month expiry. HDFC bank merger news may act as a bullish catalyst and international economic news may act as an bearish catalyst.

This is only for educational purpose.

Strategy!

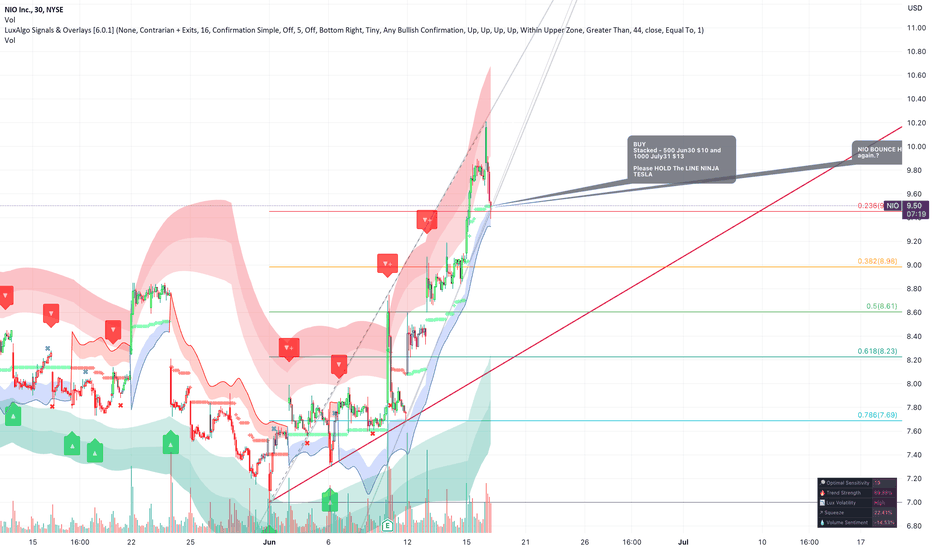

Teslas ninja bro - chopping before move to $13.50Tesla, Lucent, Rivian, Nio not too many new names entering the scene in the last year... Nio will boost the worst has been put in. IMO 6 month call options OTM $13 plus should be pretty safe. Lots of potential direct or indirect headline catalysts here through EV, AI, and Tesla tailwinds.

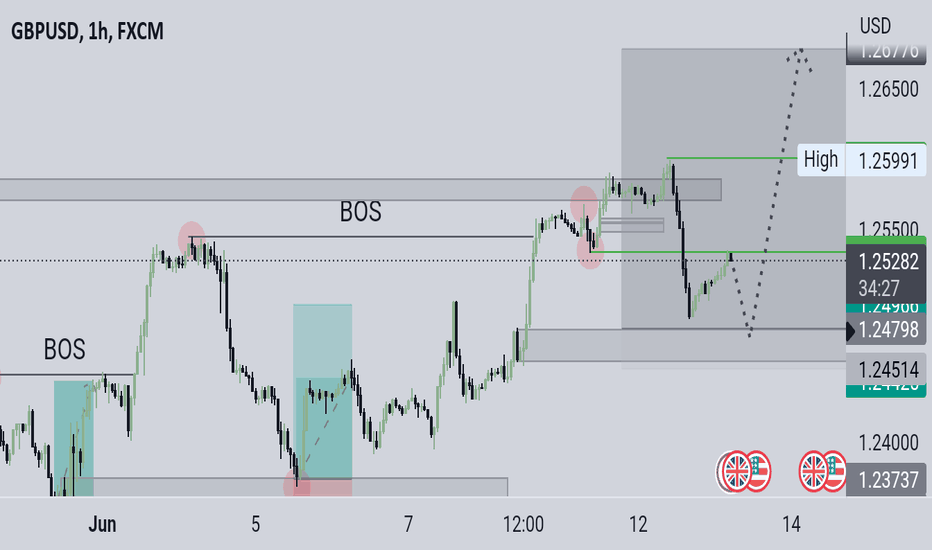

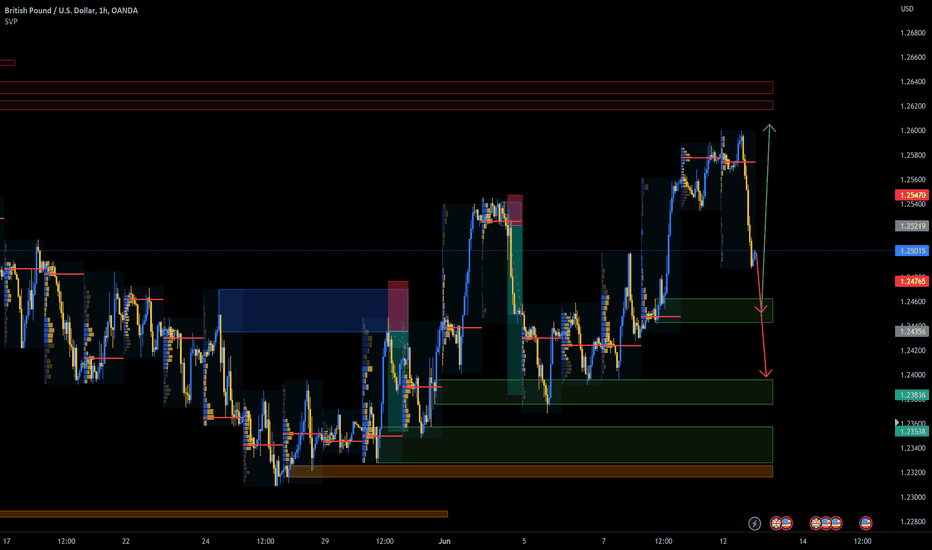

GBPUSD DOUBLE SETUP BEFORE ECB RATESIn April, UK GDP grew by 0.2% m/m, recovering from the previous month's decline of -0.3% m/m. The rebound was driven by the services sector, with services expanding by 0.3% m/m and contributing 0.26 percentage points to overall GDP growth. The wholesale and retail sector, as well as the information and communication sector, made significant contributions. However, manufacturing and the health sector experienced declines. Manufacturing contracted by 0.3% m/m, with the pharmaceuticals sector playing a major role. The construction sector also declined by 0.6% m/m due to a slowdown in housing activity. Overall, UK GDP growth remains relatively stagnant, but PMI surveys indicate increased activity in April and May, especially in services, projecting a 0.3%-0.4% q/q growth rate for Q2. However, the extra bank holiday in May is expected to result in a significant contraction in GDP, potentially impacting the entire second quarter, although the effect on Bank of England policy is expected to be minimal.

Nicola, CEO Forex48 Trading Academy

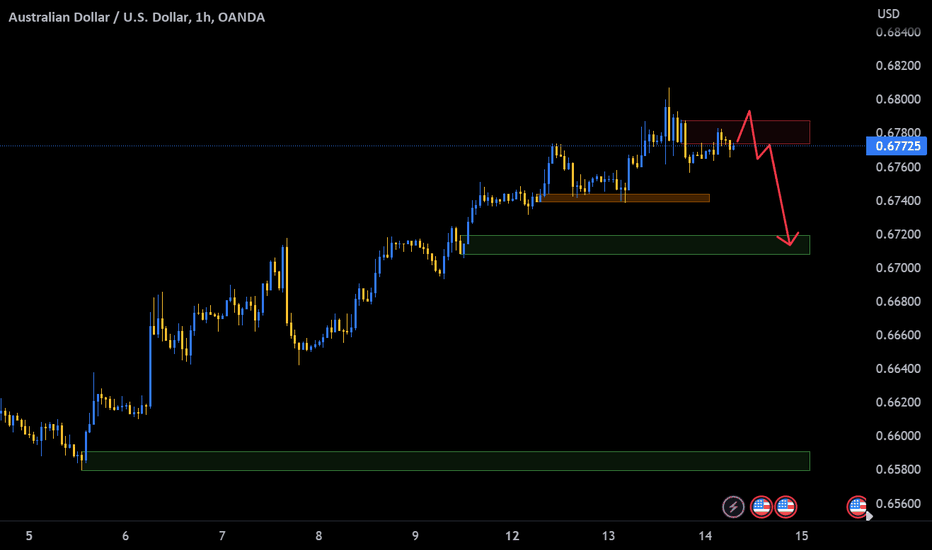

AUDUSD THE BIG SHORT IS READYThe AUD/USD pair is consolidating near the critical resistance level of 0.6800, following a recent climb to a one-month high. Mixed economic data and anticipation surrounding the Federal Reserve's statement have led to a need for consolidation or a possible correction. The Australian dollar received support from the People's Bank of China's decision to ease short-term policy rates. In the US, consumer inflation eased, solidifying expectations of a Fed pause. The pair's near-term direction hinges on the performance of the US dollar and overall risk sentiment. Technical indicators suggest the potential for a correction, although a daily close above 0.6800 would indicate further upside potential. Key support levels to monitor are at 0.6745, 0.6710, and 0.6680, while resistance levels can be found at 0.6780, 0.6820, and 0.6845. Traders should conduct thorough analysis before making any trading decisions.

Nicola, CEO of Forex48 Trading Academy

EURUSD SHORT BEFORE ECB RATESEUR/USD pair retreated below 1.0800 during the American session, facing resistance at the 1.0820 level and the 100-day SMA at 1.0805. The short-term bullish bias remains, but technical indicators offer mixed signals. The pair's retreat from recent highs suggests potential downside, with support levels at 1.0760 and 1.0740. However, the overall bias remains bullish, despite volatility expected due to the upcoming FOMC meeting and ECB meeting.

In Germany, May's inflation data confirmed a decrease from April, while the ZEW survey showed unexpected improvement. Germany's Wholesale Price Index and Eurozone Industrial Production data will be released, with expectations for a 25 basis point hike by the ECB.

The US CPI for May showed a lower-than-expected increase, indicating slowing inflation. This may influence the Federal Reserve's tightening cycle decisions. The Greenback initially tumbled after the report but later recovered. The direction of the EUR/USD pair will depend on the US Dollar's performance ahead of the FOMC statement.

Overall, caution is advised in light of market volatility and the impact of central bank meetings. Traders should closely monitor economic data and the guidance provided by central banks to make informed investment decisions.

Nicola, CEO of Forex48 Trading Academy

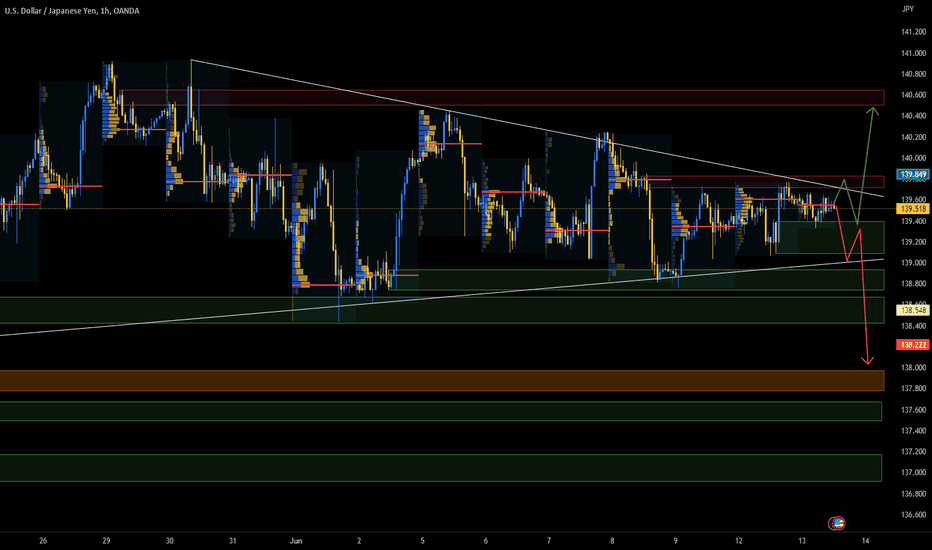

USDJPY LONG & SHORT SETUP - US NEWSDuring the European session, the US/JPY pair remains stagnant, trading within a limited range just below the significant resistance level of 140.00. The market is characterized by volatile fluctuations as investors adopt a cautious approach in anticipation of the upcoming release of US inflation data.

In London, S&P500 futures have gained as investors hope the Fed will delay interest rate hikes and weaken the US Dollar. The US Dollar Index reached a two-week low at 103.21 due to expectations of a neutral interest rate policy and softening US inflation. Analysts predict May's CPI will remain unchanged, but core inflation will stay strong. The Bank of Japan is likely to maintain its interest rate policy, aiming for inflation above 2%.

Nicola, CEO of Forex48 Trading Academy

GBPUSD - FIRST STEP IS SHORT GBP/USD capitalized on the overall weakness of the US Dollar (USD) on Monday, reaching its highest level in a month above 1.2590. However, the pair is likely to encounter resistance at 1.2600, and there is a possibility of a downward correction before the next upward movement.

The optimistic market sentiment at the start of the week has prevented the safe-haven USD from maintaining its strength against its main rivals. This has provided support for GBP/USD to remain in positive territory. In the European session, the UK's FTSE 100 Index rose by 0.3%, while US stock index futures recorded gains ranging from 0.1% to 0.3%.

Earlier in the day, the Pound Sterling received a boost from hawkish comments made by Bank of England (BoE) policymaker Jonathan Haskel. In an article published in The Scotsman newspaper, Haskel expressed the importance of addressing the risks of inflation momentum and did not rule out the possibility of further interest rate hikes.

On Tuesday, the UK's Office for National Statistics is set to release labor market data. It is expected that annual wage inflation, as measured by Average Earnings Excluding Bonus, will rise to 6.9% in April from 6.7% in March. Currently, the markets have fully priced in a 25 basis points (bps) rate hike by the Bank of England at the upcoming policy meeting on June 22. Therefore, if wage inflation turns out to be lower than anticipated, it may pose challenges for Pound Sterling to continue outperforming its competitors. Conversely, a stronger-than-expected reading could have a short-lived positive impact on the currency.

The release of May inflation data from the US and a speech by Bank of England Governor Andrew Bailey before the Lords Economic Affairs Committee hearing on Tuesday could also lead to significant fluctuations in the GBP/USD pair.

Nicola CEO of Forex48 Trading Academy

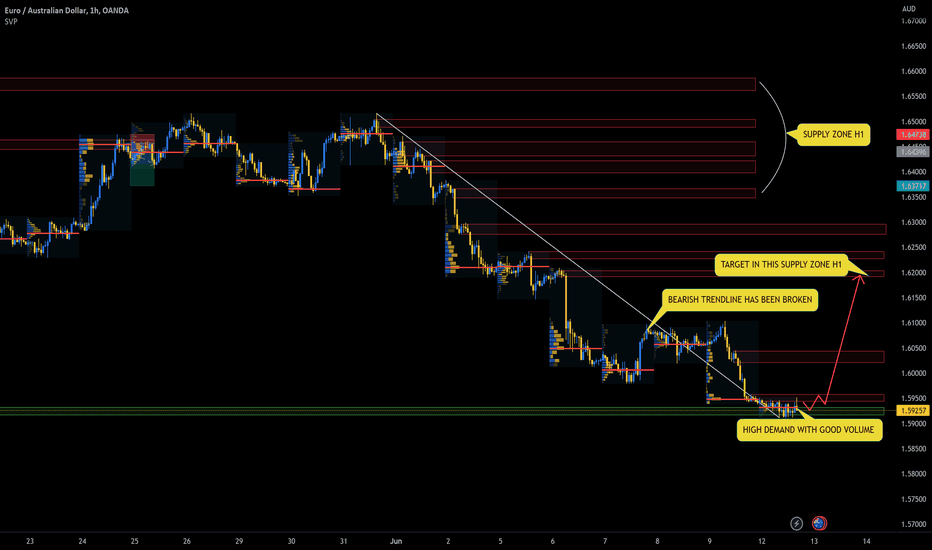

EURAUD BULLISH SETUP IS READYOn EURAUD, we notice a price consolidating around 1.592 within a demand zone. The price is consolidating after breaking a bearish trendline. In this area, many buying orders are accumulating, suggesting a potential increase in the stock price up to 1.62, where we have an interesting supply zone. I don't exclude a rise towards the 1.64 area.

Share your perspective.

Happy trading to all.

Nicola CEO of Forex48 Trading Academy

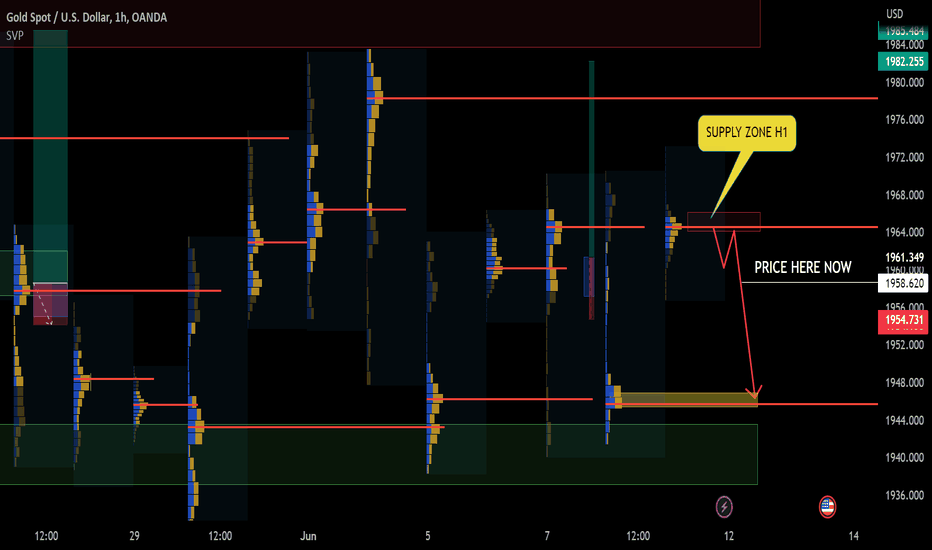

XAUUSD SHORT BEFORE FED RATESOn gold, we have a price that, after reaching the 1965 zone within a supply zone, reversed its course due to the significant volume present in the area. Now, the price has started to decline, and a target is expected around the 1946 zone, where there is a high concentration of orders and a demand zone at the 1943 level. Therefore, currently, we have a profitable short trade.

Share your perspective.

Wishing everyone successful trading, Nicola, CEO of Forex48 Trading Academy.

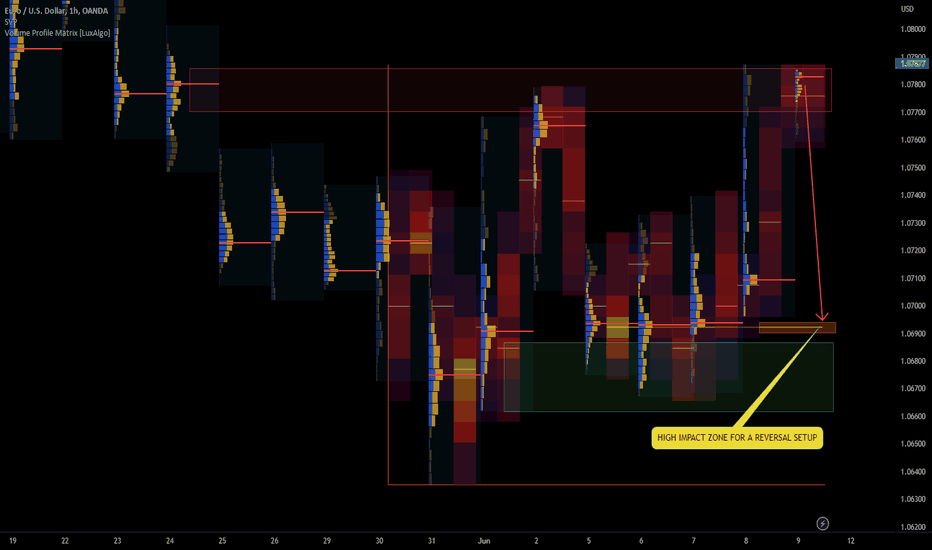

EURUSD SHORT BEFORE FED RATES On EURUSD, we have a bearish setup with the price, after reaching the 1.079 area in a supply zone, starting to retrace towards a target point in anticipation of the upcoming week, which includes the Fed and ECB rate hikes, along with numerous macroeconomic data. Please share your expectations in the comments. Happy trading to everyone. Nicola, CEO of Forex48 Trading Academy.

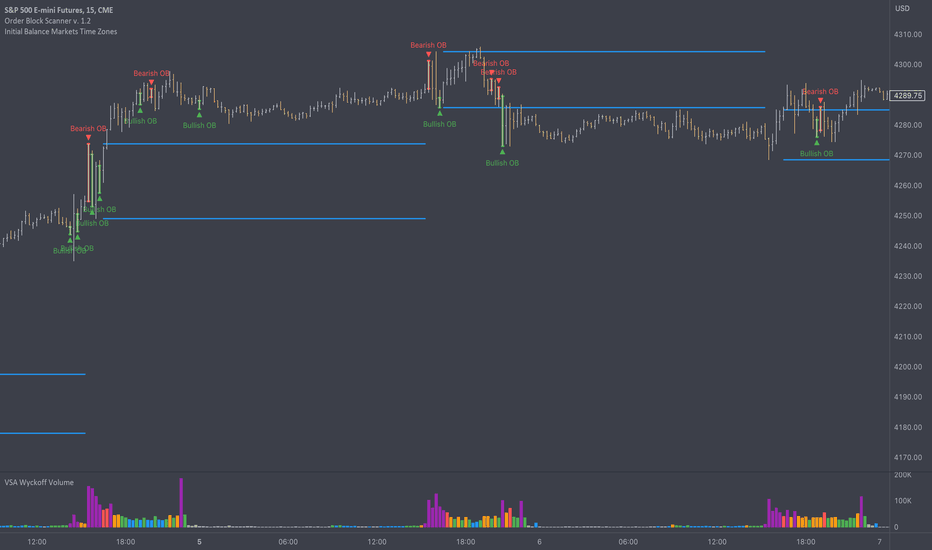

Riding the Market Tides with the Initial Balance Ahoy, fellow traders! So you’re itching to become the Captain Jack Sparrow of trading, eh? Before you swashbuckle through the stock market, you need a treasure map. Enter the Initial Balance trading strategy! This nifty tool can be the compass guiding you through stormy market seas. But hold your horses, we’re not talking about a literal balance here; it's more like the market’s opening mood ring. Hang tight as we steer you through the nuts and bolts of this golden strategy.

Setting Sail: What’s the Initial Balance Trading Strategy?

The Initial Balance trading strategy is like that morning coffee - it sets the tone for the day. Here's how it works: You observe the high and low of the first hour of trading. This range, my friends, is the Initial Balance. It’s a harbinger of how the market may swing for the rest of the day. The million-dollar question is, how do you use this to fill your coffers?

Anchors Aweigh: Establishing the Initial Balance

First things first, you need to get a grip on that Initial Balance. Let’s break it down step by step:

Watch the market like a hawk from the opening bell.

Jot down the highest and lowest points during the first hour.

Plot them on your chart and voila! That's your Initial Balance.

Sailing Through Uncharted Waters: Price Action

When the price takes a leap of faith outside this range, that's when the magic happens. It might indicate a trend in making. Hold on to your hats, because this is where you can swoop in and take a position.

The North Star: Using Indicators

Now, I wouldn’t bet my last doubloon solely on the Initial Balance. It’s a guide, not gospel. Bring in some allies like volume indicators and moving averages to keep you from sailing off the edge of the world.

Why Is the Initial Balance Trading Strategy the X Marks the Spot?

Oh, the Initial Balance trading strategy has a special place in traders' hearts for a reason. Here’s what makes it the go-to guide for many:

First Mover Advantage: Get a jump on the crowd. Being in the know from the get-go can be your secret weapon.

Flexibility: This ain't a one-trick pony. Use it for day trading or merge it with other indicators to build a rock-solid strategy.

Early Warning System: When the seas are rough, it’s best to stay ashore. The Initial Balance can help you gauge the market’s mood and steer clear if needed.

Weathering the Storms: Potential Pitfalls

Hold up! No treasure hunt is complete without booby traps. So, what could possibly go wrong?

False Breakouts: Sometimes the market’s just messing with you. The price could break out of the Initial Balance, only to do an about-face.

Overnight News: A sneaky villain. News from across the seven seas can throw a monkey wrench in the works, and your Initial Balance may end up as useful as a chocolate teapot.

FAQs

1. Can I use the Initial Balance trading strategy for any market?

Aye, matey! Whether stocks, forex, or commodities, it’s all fair game.

2. What time frame should I use to establish the Initial Balance?

Traditionally, it’s the first hour. But hey, if you like living on the edge, some traders narrow it down to the first 30 minutes.

3. Can the Initial Balance Trading Strategy be my only strategy?

Well, putting all your eggs in one basket might leave you with egg on your face. It's good to mix and match with other strategies.

Concluding Our Voyage: All Hands on Deck!

To wrap this shindig up, the Initial Balance trading strategy can be the wind in your sails. But don’t go sailing blindfolded; be sure to have some extra navigational tools on hand. It’s a pirate’s life for you, but remember, even the savviest pirates have a trusty crew and a sturdy ship. So weigh anchor, and let the Initial Balance be your first mate on this high-seas adventure. Happy trading!

AUDCAD SHORT TRADE BEFORE CAD NEWSOn AUDCAD, we have a bullish setup with the price, after yesterday's rally, stalling around the 0.891 area where we have a strong volume concentration. This is a potential reversal zone where the price could reverse course and reabsorb the liquidity left in the market. In fact, we can observe a significant cluster of trades at the 88.90 level. That level will be the target objective in case of a short trade.

Please share your expectations.

Happy trading to everyone.

Nicola CEO of Forex48 Trading Academy

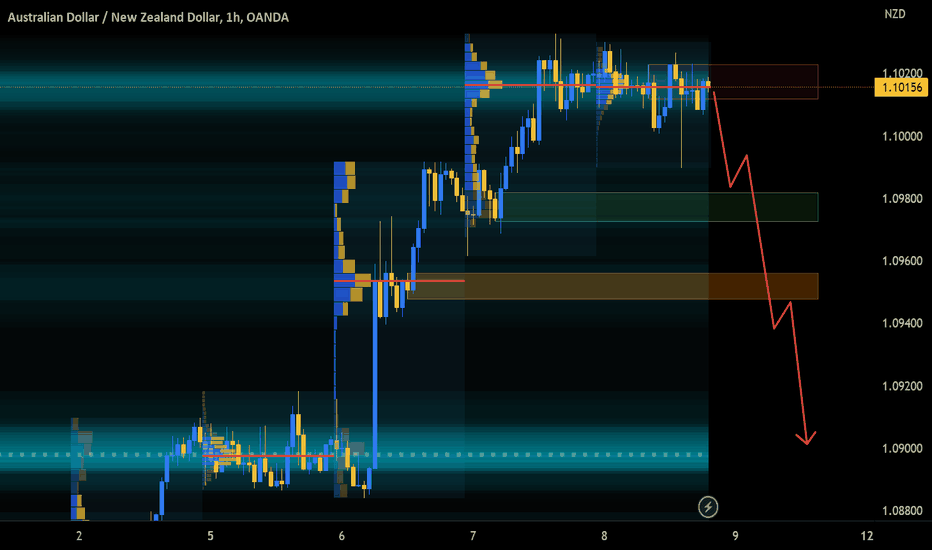

AUDNZD FINALLY WE HAVE A SHORT TRADEOn AUDNZD, we have a price around 1.101 within an H1 supply zone. It's an area where the majority of trading volumes have occurred for the past two days. The expectation is to go short, with the price potentially dropping to 1.09, where we can observe further order intensity.

Share your expectation.

Happy trading to everyone from Nicola, the CEO of Forex48 Trading Academy.

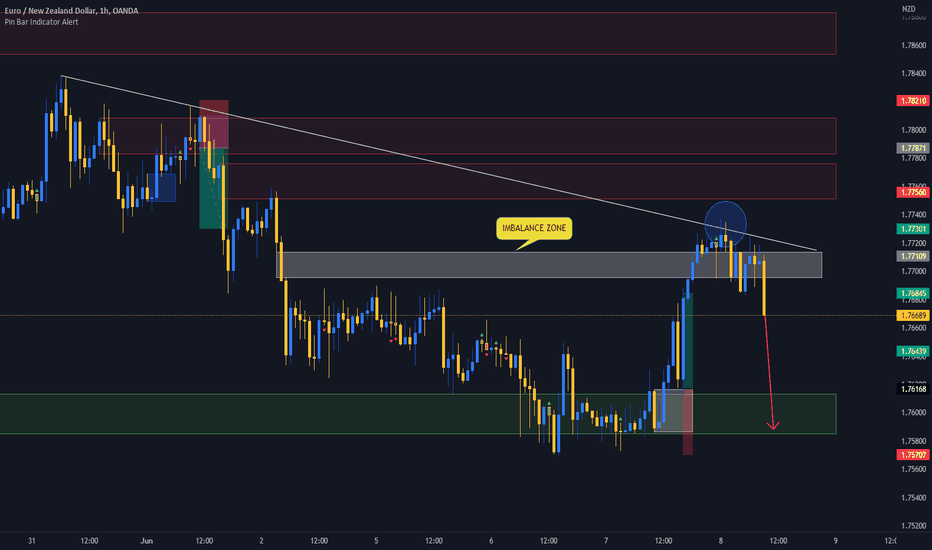

EURNZD BEARISH SIGNALS BEFORE EURO PILOn EURNZD this morning, the price made a third bounce around 1.7710 within an imbalance zone and near a downward trendline. The forecast now is to see the price around 1.7571. This is also considering the data released this morning on the Eurozone's GDP.

Share your expectation.

Happy trading to all from Nicola, CEO of Forex48 Trading Academy.