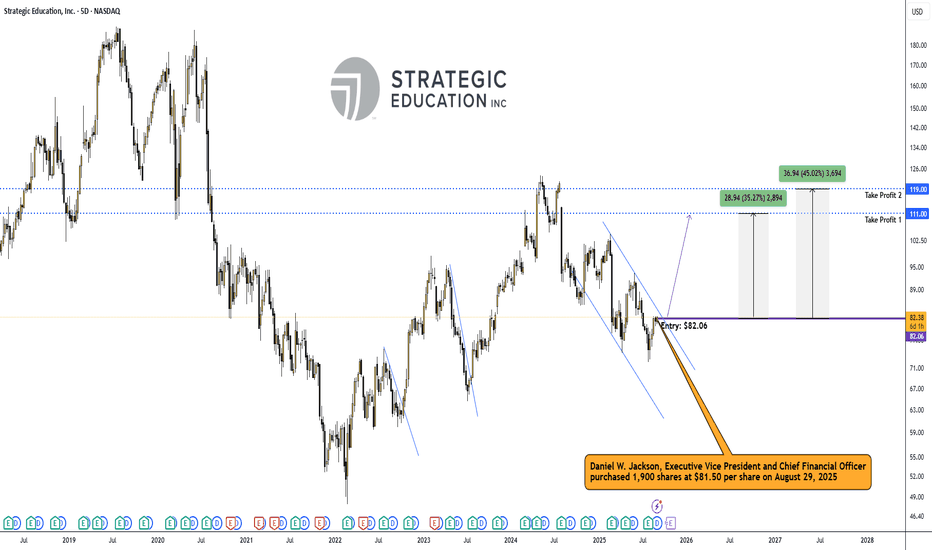

Strategic Education Inc. — September 02, 2025Sergio Richi Premium ✅

NASDAQ:STRA #StrategicEducation — Strategic Education Inc. (NASDAQ:STRA) Insider Activity Report | Consumer Defensive | Education & Training Services | USA | NASDAQ | September 02, 2025.

Price (Sept 2, 2025) : $82.12

On August 29th, Daniel Jackson, EVP & CFO of Strategic Education, stepped in with a 1,900-share open-market buy at $81.50 (~$155K). His total stake now tops 104K shares. It’s not the size of the purchase that matters here — it’s the timing: the transaction followed a Q2 earnings beat (EPS $1.52 vs. $1.42 est.) and nearly 8% YoY revenue growth, driven primarily by their Education Technology Services.

(SEC Form 4)

www.sec.gov

Insiders rarely commit fresh capital unless they see value that the market is missing. What stands out: institutions have been quietly adding — Marshfield Associates increased by 12,500 shares, and American Century expanded their stake earlier in the quarter. Insider ownership sits near 3.3%, and inflows continue despite a flat YTD chart.

1. Company at a glance:

• Runs Strayer University, Capella University, Torrens (AU/NZ), plus Sophia Learning & Workforce Edge.

• Focused on affordable, flexible, employer-aligned higher ed.

• Q2 revenue ~$300M, cash position $133.6M, dividend $0.60/qtr (~3% yield).

Market cap around $2B.

2. Catalysts on the horizon:

• Dividend payable Sept 15.

• Next earnings Oct 29 — potential follow-through if enrollment momentum stabilizes.

• Expanding EdTech footprint — Sophia & Workforce Edge gaining traction in B2B partnerships.

• Protocol adoption in Australia/NZ could re-accelerate international enrollment.

Charts:

• (5D)

Insider Trades:

STRA seasonality:

STRA Hedge Fund Flows:

STRA Ownership:

3. The setup:

Entry: $81.50–$82.06 (aligned with insider buy).

🎯 Take Profit 1: $111.00 (+35.27%)

🎯 Take Profit 2: $119.00 (+45.02%)

Base case: 35–45% upside in 6–12 months.

Bull case: test $119 on stronger EdTech growth + enrollment recovery.