Wheaton (WPM) – Streaming Growth + Precious Metals TailwindsCompany Snapshot:

Wheaton Precious Metals NYSE:WPM is a top-tier precious metals streaming company, giving investors leveraged exposure to gold & silver while avoiding traditional mining risks.

Key Catalysts:

Production Growth Pipeline 🚀

Blackwater, Goose, Platreef, and Mineral Park all scheduled to begin production by late 2025.

Expected to meaningfully boost output, cash flow, and dividend capacity.

Commodity Tailwinds 📈

Rising gold & silver prices supported by central bank buying, geopolitical tensions, and persistent inflation.

Fixed-cost streaming model maximizes margin expansion in a bull metals market.

Earnings Acceleration 💵

Q2 2025 EPS forecast: $0.58 (+44% YoY).

Revenue forecast: $424M (+42% YoY).

Potential for valuation re-rating as growth trends materialize.

Shareholder Appeal 📊

$0.165 quarterly dividend offers both income and growth upside for investors.

Investment Outlook:

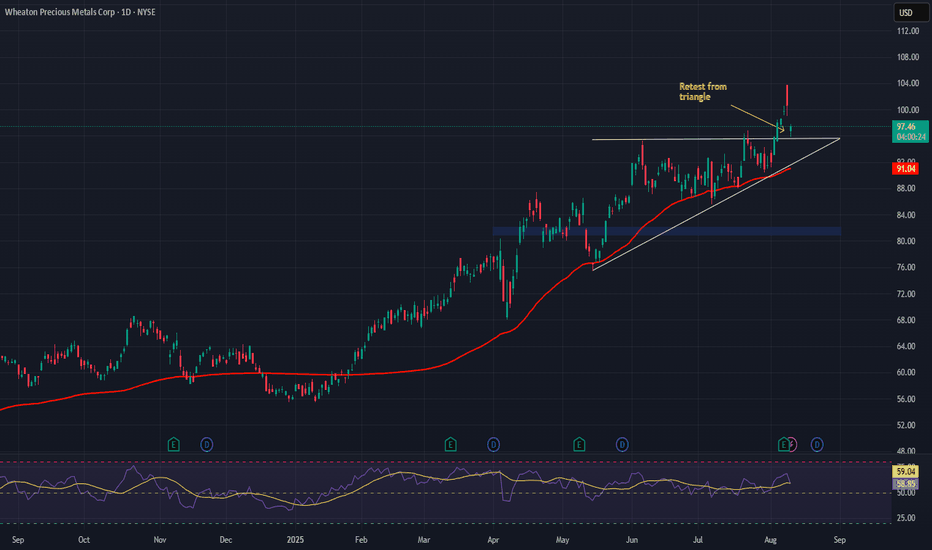

Bullish Entry Zone: Above $81.00–$82.00

Upside Target: $115.00–$120.00, driven by new mine ramps, commodity strength, and operational leverage.

#WPM #Gold #Silver #PreciousMetals #Mining #StreamingModel #Commodities #InflationHedge #DividendStocks #SafeHavenAssets