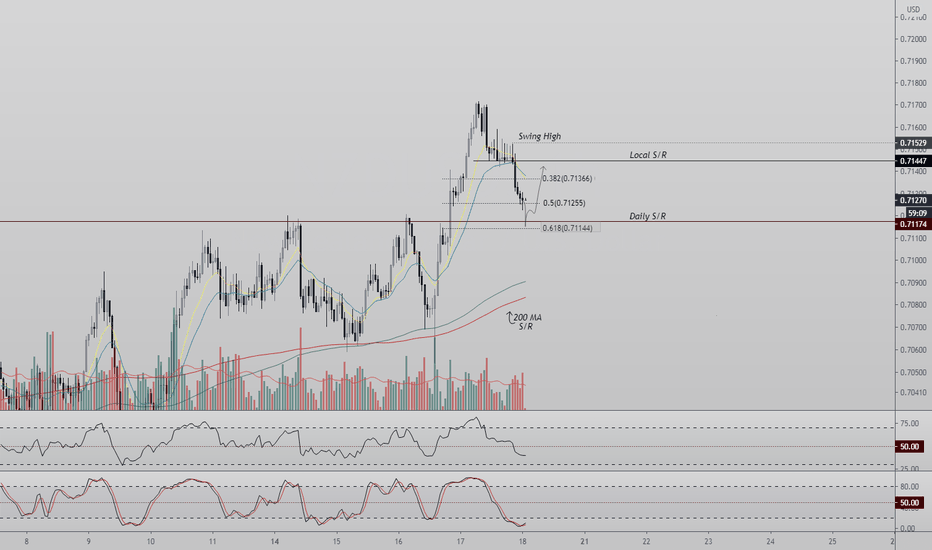

NZDUSD Daily S/R | .618 Fibonacci| Swing High| Price Action Evening Traders,

Today’s analysis – NZDUSD – trading above Daily S/R where a respect is probable,

Points to consider,

- Price action impulsive

- Daily S/R Support

- Swing High Objective

- Oscillators Extended

- Declining Volume

NZDUSD’s immediate price action is trading towards Daily S/R that is in confluence with .618 Fibonacci, a bounce here is probable.

Local S/R is current resistance, breaching this level will make swing high objective.

Both Oscillators are trading in over-extended conditions; a reversion to their mean is highly probable.

The Local Volume Nodes are bearish; an influx will indicate a temporary bottom where a wick reversal is probable.

Overall, in my opinion, NZDUSD is a valid long with defined risk, price action is to be used upon discretion/ management.

Hope this analysis helps!

Thank you for following my work

And remember,

“The expectation that you bring with you in trading is often the greatest obstacle you will encounter.”

― Yvan Byeajee

Strochastics

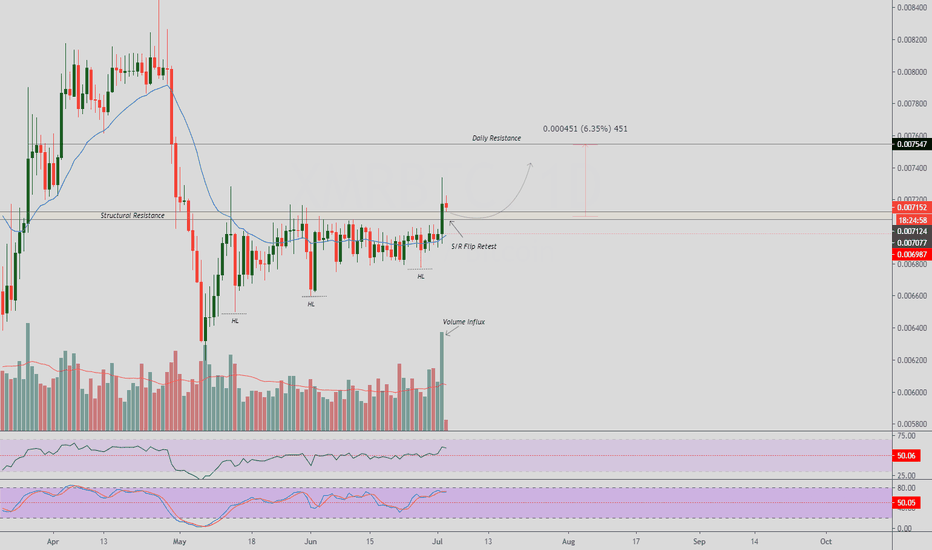

XMRBTC Trade| S/R Flip Retest |Daily Resistance|Volume Influx Evening Traders,

Today’s Analysis – XMRBTC – breaking key structure, immediate target is the daily resistance.

Points to consider,

- Market structure HL’s

- Structural Resistance breached (S/R Flip)

- Daily Resistance target

- RSI above 50

- Strong volume influx

XMRBTC’s market structure has been putting in consecutive higher lows under structural resistance; price has established a technical higher high with the recent push.

An S/R flip retest will solidify the structure before a probable impulse move into daily resistance (target).

The RSI is trading above 50 which indicate strength in the market. Momentum is also shifting with the recent stochastics rise.

An influx of volume is present; this indicates a true break of structure as the node engulfed all previous nodes.

Overall, in my opinion, XMRBTC needs to remain trading above structural resistance. This will increase the probability of testing daily resistance. A long trade is valid with a S/L below the 21 MA.

What are your thoughts?

Thank you for following my work!

And remember,

“Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your butt.” – Paul Tudor Jones

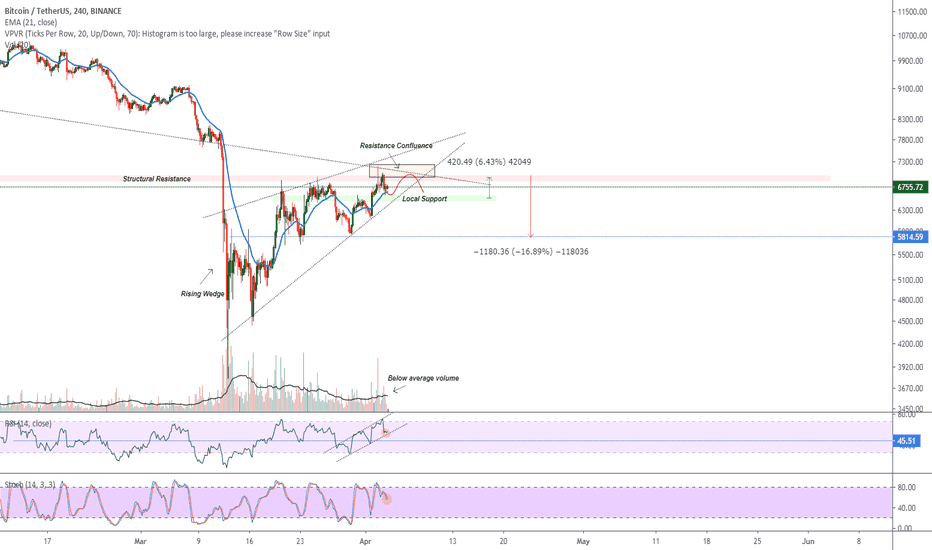

BTCUSDT Scalp Trade|Resistance/ Support Confluences|Rising WedgeEvening Traders,

Today’s technical analysis will be on a BTCUSDT, a probable scalp play from local support into resistance.

Points to consider,

- Trend making consecutive higher lows

- Strong structural resistance confluence

- Local support confluences

- RSI in a channel

- Stochastics projected down

- Volume declining (after impulses)

BTCUSDT local trend has been making consecutive higher lows against the potential rising wedge trend line.

Structural resistance has been a staunched area; it is in confluence with a diagonal resistance and nasty wicks. These wicks indicate heavy sell pressure, even after breaking this level, BTCUSDT will still be in a bearish formation.

Local support too has confluences with the 21 EMA coming in as support; this is a probable area of value. A breakdown of support will increase the likely hood of breaking the rising wedge formation as a whole.

The RSI is trading in a channel, currently on support; a move up to resistance will put it in oversold conditions.

The Stochastics however is projecting down, with stored momentum. A rejection in price will be in confluence with further downside momentum.

Volume is currently still below average even after impulses, this indicates that a true break is yet to come to fruition within this current range.

Overall, in my opinion, a small scalp long from local resistance can be at play as BTCUSDT is likely to retest structural resistance once again. If price does not break resistance, a short position is viable back down to lower support.

What are your thoughts?

Please leave a like and comment,

And remember,

“Gamblers obsess with big potential upside windfall profits. Intelligent speculators obsess with managing downside risk.” Peter Brandt