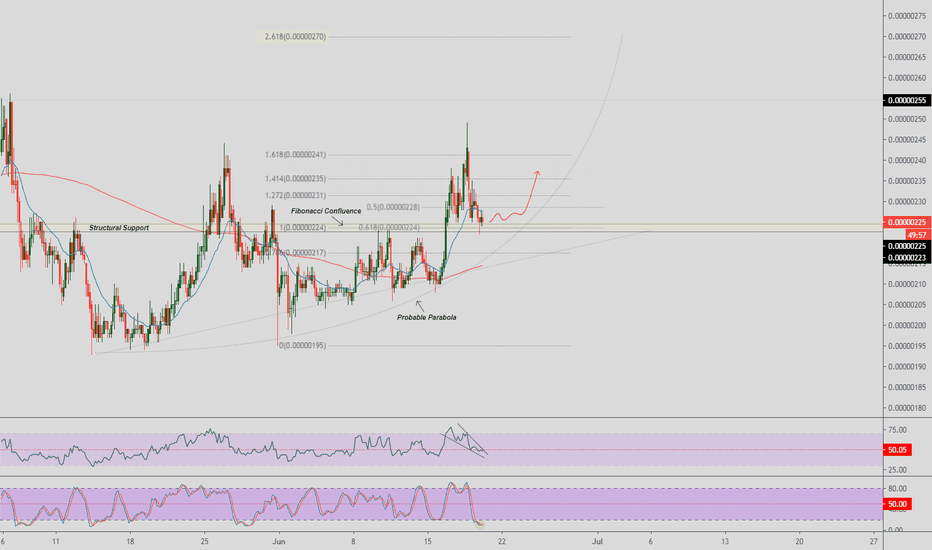

RVN Structural S/R Flip| Pivot Point| .618 Fibonacci| RSI WedgeEvening Traders,

Today’s Analysis – RENBTC – trading above structural level with Fibonacci confluence, RENBTC is likely to rise up validation of this level.

Points to consider,

- Structural S/R Flip (Retest)

- Technical Confluence (Trade location)

- RSI Falling Wedge pattern

- Bull Impulses (PA validation)

RENBTC is re-testing its structural S/R flip; further candle closes will solidify the level. This is a key support with technical confluence; market structure, key Fibonacci level (.618) and a Fibonacci Extension.

This indicates a true trade location and a pivotal point on the chart

The RSI is in a falling wedge pattern, breaking in either direction will dictate the overall trend. Stochastics are over extended, can stay trading here for an extended time, momentum is stored to the upside upon a valid buy cross.

Overall, in my opinion, price action will dictate the overall trend, strong bull impulses will be a sign of a probable parabola. Validating support will be very bullish, RENBTC will likely rise to Fibonacci targets.

What are your thoughts?

Please leave a like and comment,

And remember,

“Dangers of watching every tick are twofold: overtrading and increased chances of prematurely liquidating good positions” – Jack Schwager