Daily Outlook – September 2025 (XAUUSD)Hello traders,

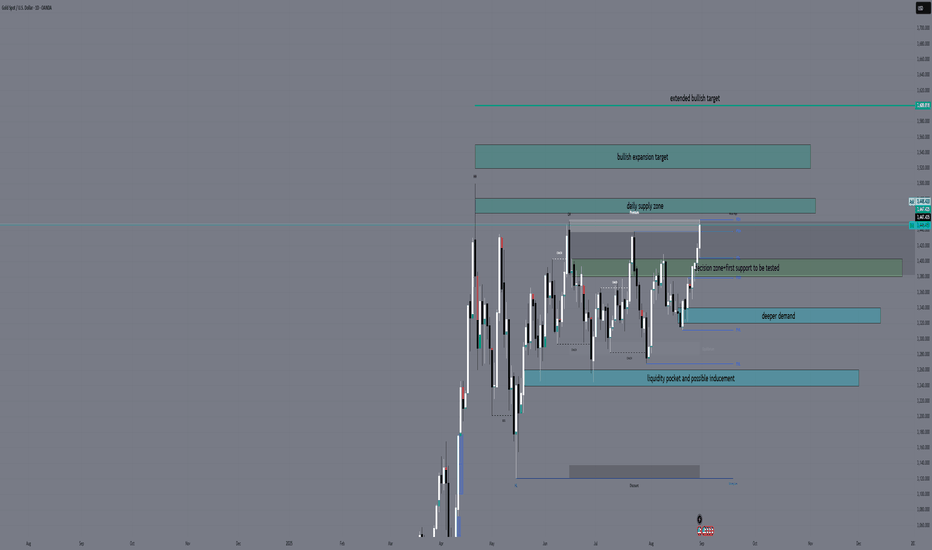

Gold closed August with a strong daily close in premium territory, pressing into the 3460–3480 supply. Bulls still control momentum, but September opens with price testing critical levels where continuation or retracement will be decided.

🔹 Daily Structural Zones

Premium Supply Zone (3460–3480) → overhead resistance where sellers may attempt control.

Decision Zone (3400–3380) → first key support, aligned with EMA 21, pivot for continuation or correction.

Mid-Term Demand Zone (3340–3320) → valid Order Block, aligned with EMA 100, stronger structural support.

Liquidity Retest Zone (3260–3240) → liquidity pocket / inducement area, a level where short-term sweeps and reactions may occur.

🔹 EMA Confluence (Daily)

EMA 5 (3409) → immediate bullish guide.

EMA 21 (3370) → inside Decision Zone.

EMA 50 (3349) → near Mid-Term Demand.

EMA 100 (3330) → aligned with Mid-Term Demand Zone.

EMA 200 (3074) → deeper long-term support, outside daily range.

💡 Interpretation: EMAs confirm layered supports. Decision Zone is short-term pivot, Mid-Term Demand is the first true OB, and below it price could sweep the Liquidity Retest Zone.

🔹 Daily Progression Map

Bullish scenario:

Break above Premium Supply (3460–3480) → unlocks Bullish Expansion Target (3520–3550).

Further continuation → Extended Bullish Target (3600).

Bearish scenario:

Rejection at Premium Supply → pullback into Decision Zone (3400–3380, EMA 21 confluence).

If Decision Zone fails → test into Mid-Term Demand OB (3340–3320, EMA 100 confluence).

Break below 3320 → liquidity sweep into Liquidity Retest Zone (3260–3240) before deeper targets are considered.

🔹 Daily Bias – September

Bullish → while above 3400 (Decision Zone).

Neutral → range between 3480 and 3400.

Bearish shift → only if D1 closes below 3320.

🔹 Conclusion

Gold opens September in premium territory, facing resistance at supply.

Breakout above 3480 → continuation to 3520–3550 and 3600.

Rejection → correction into Decision Zone (3400–3380), then Mid-Term Demand OB (3340–3320).

Below 3320 → expect liquidity play around 3260–3240 before any deeper move.

✨ What’s your view for gold in September? Drop your thoughts below 👇

Don’t forget to🚀🚀🚀my plan and follow GoldFxMinds for daily outlooks and precision sniper-entry plans 🚀📈