Structure-trade

XAUUSD: A Return to Previous StructureTypically a rally is what i would expect from this type of falling wedge formation, however because it's in the middle of nowhere the bullish move isn't on my radar. What would be on my radar is a move back up into previous structure support which could potentially act as support now looking for a continuation to the downside.

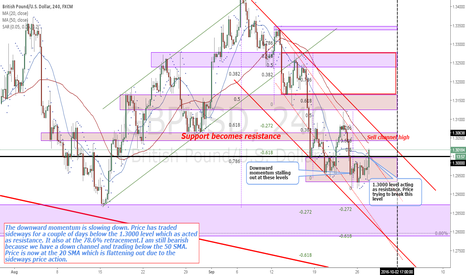

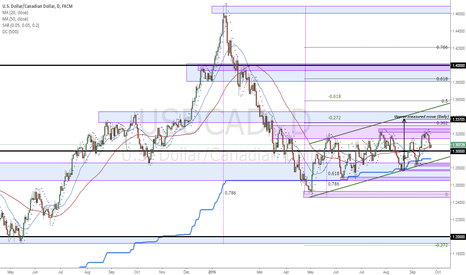

IF I AM A BULL? IF I AM A BEAR?IF I AM A BULL: Wait to buy the bull channel low or previous swing lows. Or wait to buy a pullback into the 1.3000 region after a strong move higher.

IF I AM A BEAR: Wait to sell the 38.2%, 61.8% retracement which might coincide with the bear channel high and previous swing high. My two sell zones are show on the chart.

GBPUSD Price structure analysis (4H)GBPUSD (4H) The downward momentum is slowing down. Price has traded sideways for a couple of days below the 1.3000 level which as acted as resistance. It also at the 78.6% retracement.I am still bearish because we have a down channel and trading below the 50 SMA. Price is now at the 20 SMA which is flattening out due to the sideways price action.

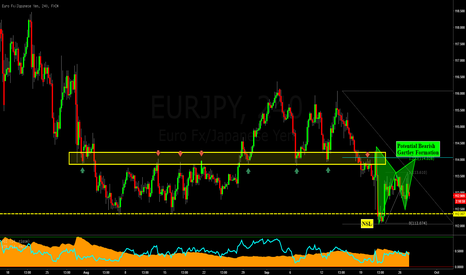

EURJPY: Potential Bearish Gartley Formation after the LLLCHey traders!

Looking at a potential bearish Advanced Gartley Formation setting up here on the EURJPY 0.00% . LOOKING LEFT at the predicted "D" completion price you'll also notice that this level has recently been respected as both previous structure support and resistance .

The "A" leg of the Gartley Formation also represents a break and close below previous structure support which will help with our longer term analysis for those looking to take extended targets.

I know a lot of you have taken advantage of this weeks offer, so we'll be reviewing this in a few hours as we start our trading week. See you there!

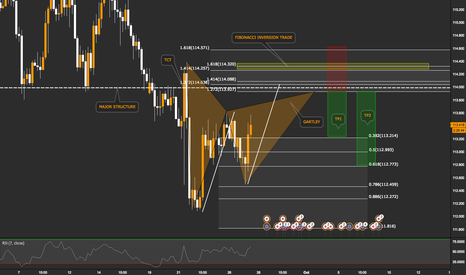

Cypher Pattern forming alongside a double topFolks...

If the price breaks and closes above the price range, then we have an uptrend.

Probable factor is that it will stay below the green line and takes it as a resistance and continue with the cypher pattern.

If the price holds the same signature as portrayed, then we have a winning trade., good luck,

Regards,

Hearty

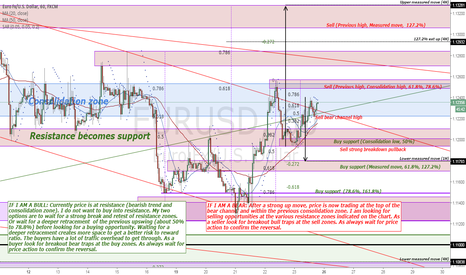

IF I AM A BULL? IF I AM A BEAR?

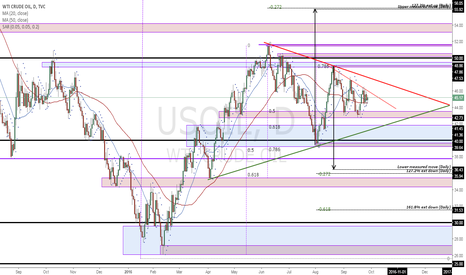

IF I AM A BULL: Currently price is at resistance (bearish trend and consolidation zone). I do not want to buy into resistance. My two options are to wait for a strong break and retest of resistance zones. Or wait for a deeper retracement of the previous upswing (about 50% to 78.8%) before looking for a buying opportunity. Waiting for a deeper retracement creates more space to get a better risk to reward ratio. The buyers have a lot of traffic overhead to get through. As a buyer look for breakout bear traps at the buy zones. As always wait for price action to confirm the reversal.

IF I AM A BEAR: After a strong up move, price is now trading at the top of the bear channel and within the previous consolidation zone. I am looking for selling opportunities at the various resistance zones indicated on the chart. As a seller look for breakout bull traps at the sell zones. As always wait for price action to confirm the reversal.

USDCAD Price structure analysis (1H)USDCAD Price structure analysis (1H). After a very strong move down I am looking for selling opportunities as price pulls back into the resistance zones market on the chart. There is also confluence with the 50% and 61.8 fib retracement levels. Wait for price action to confirm the reversal. On the 1 hour timeframe I remain bearish while price keeps trading below the 50 SMA.

GBPUSD (1h) Wait to sell resistance and channel highsGBPUSD (1h) Wait to sell resistance and channel highs. Price is now at the inner channel high, 50% retracement, close to 127 fib inversion and has just broken a previous swing high. Look for false upward breakout for shorting opportunities and a test of the outer down channel line. Wait for price action to confirm the reversal.

EURUSD Price structure analysis (1H)EURUSD Price structure analysis (1H). Price has broken through the resistance zone like it was not there. That zone now becomes support. Price is now at the 78.6 fib retracement and slightly above the 127 inversion. It is also in a zone of previous congestion. At these levels I expect some profit taking and a retracement to wards the support zone. I expect the buyers to step back in and take prices higher. Look for bear traps at the lows to go higher. Note that the down trend line has been broken. The reverse size of the trend line should now act as support. I prefer to sell into bull traps at the highs. Wait for price action to confirm the reversal.