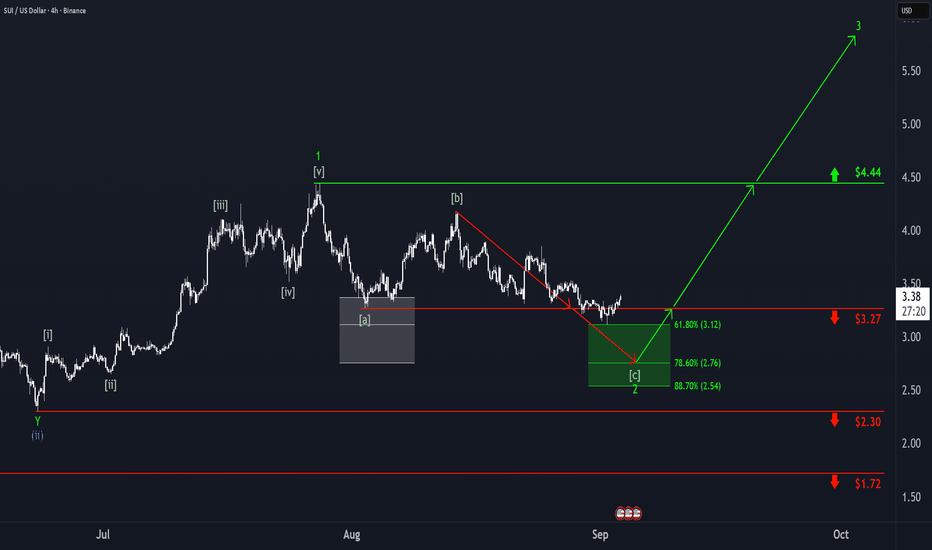

SUI: Dip and Go?On Monday, SUI dipped into our green Target Zone ($3.12 – $2.54) but quickly rebounded and climbed back above the $3.27 level. While it’s possible that wave 2 has already bottomed, we’re still allowing for potential new lows within this range. Once this interim correction wraps up, we expect an impulsive rally as green wave 3 takes shape, which should push well above the $4.44 resistance.

Suiforecast

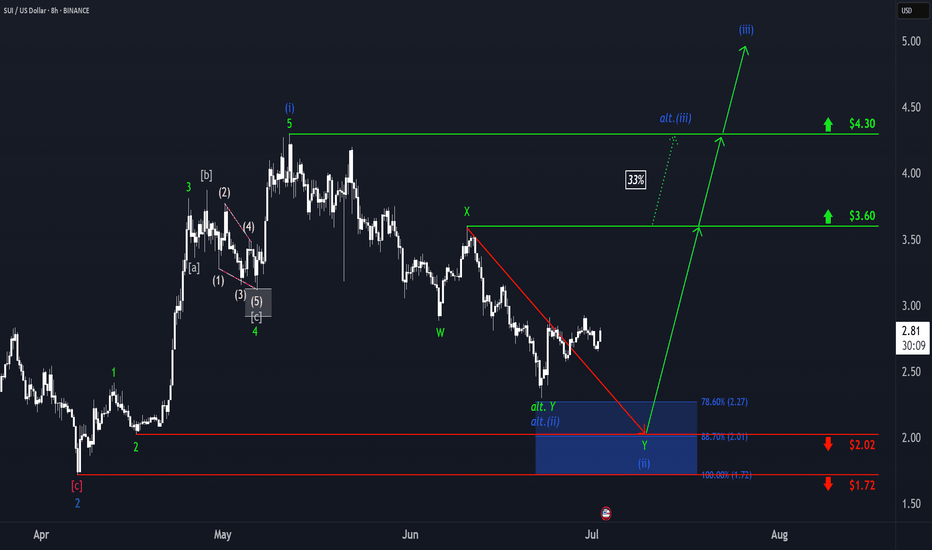

SUI: Closing in on the Target Zone?SUI should continue closing in on our blue Target Zone between $2.27 and $1.72. We expect blue wave (ii) to complete there, ideally above support at $2.02, before the next move higher kicks off in wave (iii). However, because the June 22 low came within just $0.03 of our zone, we must consider the possibility that blue wave alt.(ii) has already concluded. In that case, a direct breakout above resistance at $3.60 could follow (33% probability).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

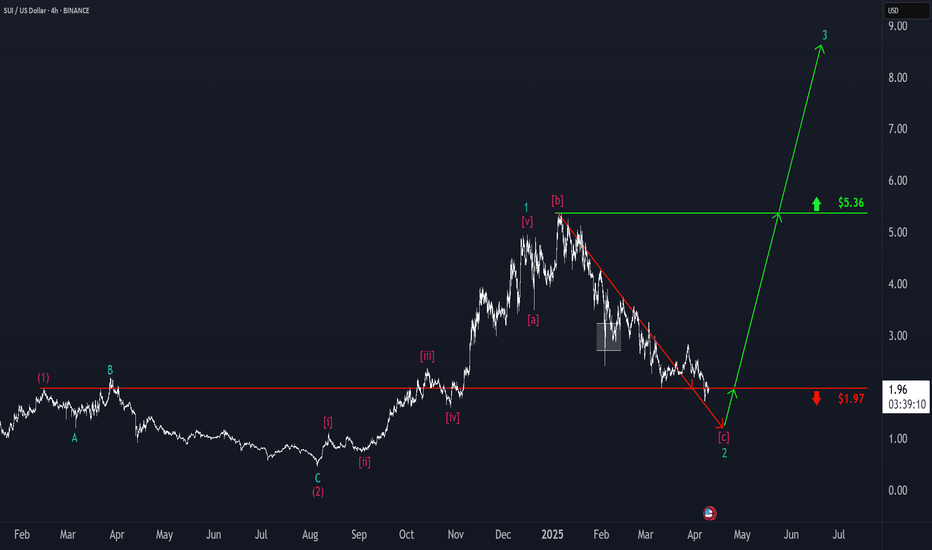

SUI: Toward All-Time Low?SUI broke the support at $1.97 and tested it once again from below with yesterday's brief countermovement. It should now proceed downward so that the turquoise corrective wave 2 can be properly completed. Subsequently, the turquoise impulse wave 3 should provide new upward momentum, racing toward new all-time highs. The resistance at $5.36 should only be a milestone.

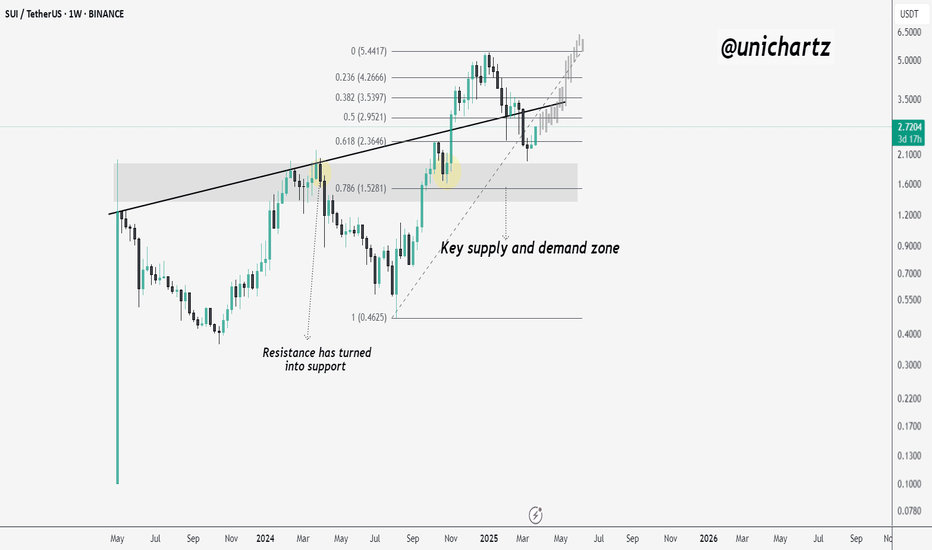

SUI Rebounds from Key Demand Zone – Bullish Continuation Ahead?SUI has recently bounced from a key supply and demand zone between the 0.618 ($2.36) and 0.786 ($1.52) Fibonacci retracement levels, showing strong buyer interest in this range. This zone also coincides with a previous resistance line that has now flipped into support, adding further confluence to this area as a significant level for trend continuation.

After pulling back from its recent high around $5.44, SUI respected the 0.618 Fib level and has begun to recover, currently trading around $2.71. If momentum continues, the next resistance levels lie at the 0.5 ($2.95) and 0.382 ($3.54) Fib levels, followed by a potential move back toward the $4.26 zone.

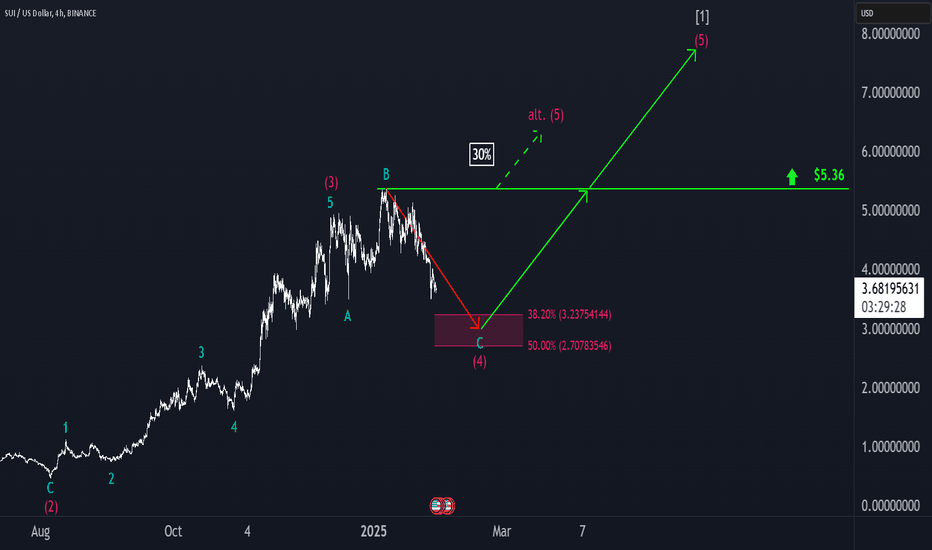

SUI: Further DownSui has sold off sharply in recent days, losing around 35% of its value since the top of the turquoise wave B at the resistance near $5.36. In the short term, this decline should continue until the price reaches the anticipated low of the magenta corrective wave (4) within the same-colored Target Zone between $3.23 and $2.70. From there, we expect an impulsive rise with the magenta wave (5), allowing Sui to break well above the $5.36 resistance and establish the high of the larger green wave . A premature breakout beyond $5.36 has a 30% probability according to our primary scenario.

SUI price. What are the prospects: buy, sell or wait?Hype project SUI

Please write in the comments why it is interesting to you?

Currently, 6% of the maximum possible number of coins are circulating on the market.

On the one hand, while the number of coins on the market is still small, it is cheaper to organize a "pump".

On the other hand, when many coins are put on the market, there will be a lot of pressure on the price.

This is the basis of the "law of supply and demand".

The unlocking schedule:

- early July +0.6%.

- beginning of August +0.7%

- beginning of September +0.7%

- beginning of October +0.8%

- beginning of November +22%

In other words, theoretically, the highest chance of a pump in the SUI price is before November 2023.

But first, two obstacles need to be overcome:

the trend line of recent months is around $0.90

a powerful liquidity zone of $1-1.20, where a month ago users were actively buying SUI in anticipation of growth, but the SUIUSDT price had other plans and dropped by more than 2 times. Therefore, it is very likely that there will be active sales in this liquidity zone by those who want to "break even", as human psychology works.

Based on the above assumptions, "the active pumping" of the SUIUSD price has a chance to develop only after the price is firmly established above $1.20

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more