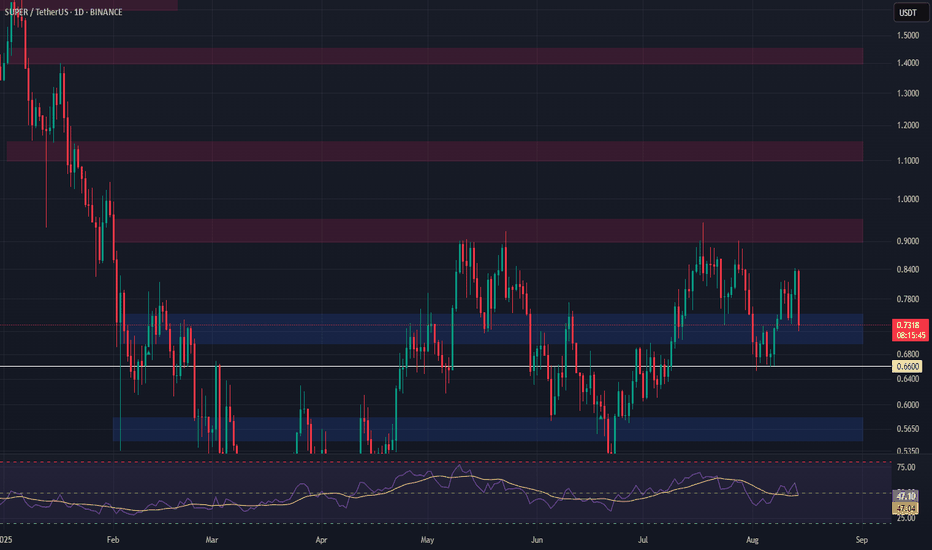

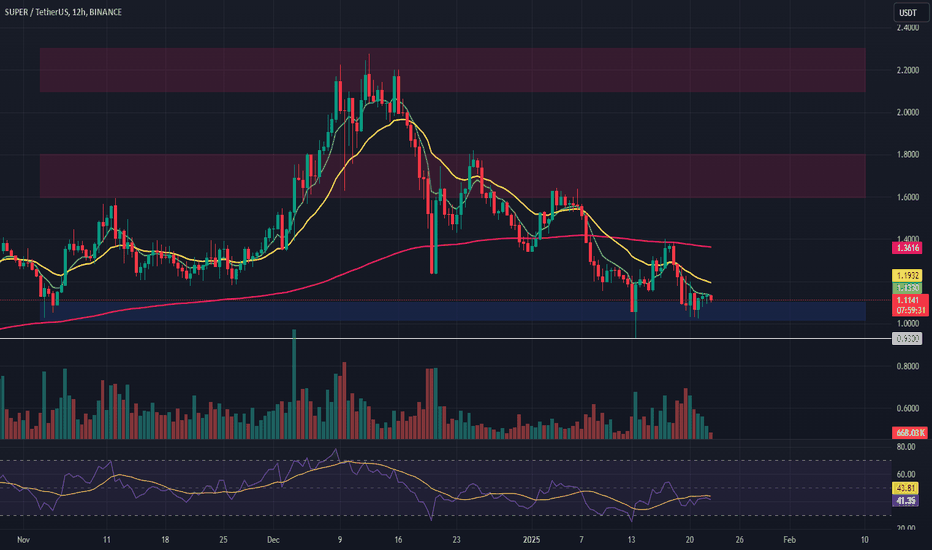

SUPER | Major Support Retest — Spot Long SetupSUPER is currently testing a significant support zone, potentially setting the stage for a bullish reversal or bounce.

📌 Entry Zone: $0.70 – $0.75

🎯 Targets:

• TP1: $0.90 – $0.95

• TP2: $1.10 – $1.15

• TP3: $1.40 – $1.45

🛑 Stop Loss: Just below $0.66

This support region has held well in the past — if it holds again, we could see a strong upward move. Look for confirmation and volume uptick before entering.

📈 Risk management is key — plan your trade, trade your plan.

SUPERUSDT

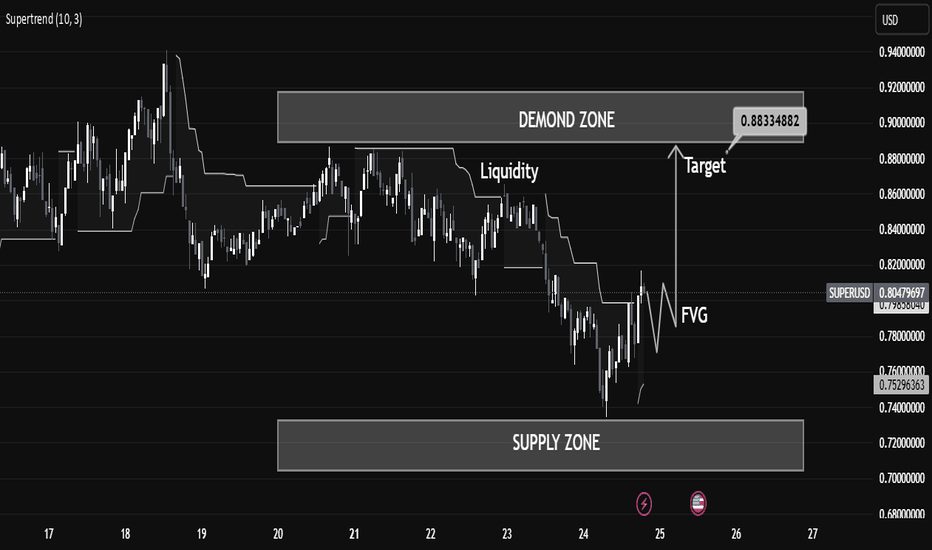

Smart Money Trap Identified! FVG + Liquidity Grab“Smart Money Trap Identified! FVG + Liquidity Grab Before Super USD Skyrockets to Target Zone ”

⸻

🧠 Technical Breakdown:

1. Liquidity Sweep (Manipulation Phase):

We see price aggressively sweep local liquidity around July 23, likely triggering stop-losses of early longs or breakout traders. This is a classic Smart Money trap, where big players induce volatility to grab liquidity before a move in the real direction.

2. Fair Value Gap (FVG):

A clear bullish FVG (imbalance) has formed post-liquidity grab, suggesting a potential institutional entry zone. This imbalance typically acts as a magnet for price and an entry point for Smart Money after manipulation.

3. Demand Zone & Target Projection:

• Price is now reacting from a well-defined Demand Zone, with clear rejection wicks indicating aggressive buying interest.

• The target zone (0.88334882) sits just below a previous supply zone, aligning with a potential distribution area where Smart Money may begin profit-taking.

4. Supertrend Indicator:

The supertrend has flipped bullish, confirming potential momentum shift, supporting the bullish bias as long as the FVG holds.

5. Confluence Factors:

✅ Liquidity Grab

✅ FVG Reaction

✅ Demand Zone Bounce

✅ Supertrend Confirmation

✅ High-Risk/High-Reward Entry Before Smart Money Run

⸻

🎯 Trade Idea (For Educational Purpose Only):

• Entry: On pullback into the FVG zone

• Stop Loss: Below the recent swing low or Demand Zone

• Target: 0.8833 (inside the upper supply/demand imbalance)

⸻

🧠 Educational Note:

This chart beautifully showcases how market makers operate — manipulate liquidity, fill imbalances, and target inefficiencies. Always think like Smart Money, not retail traders.

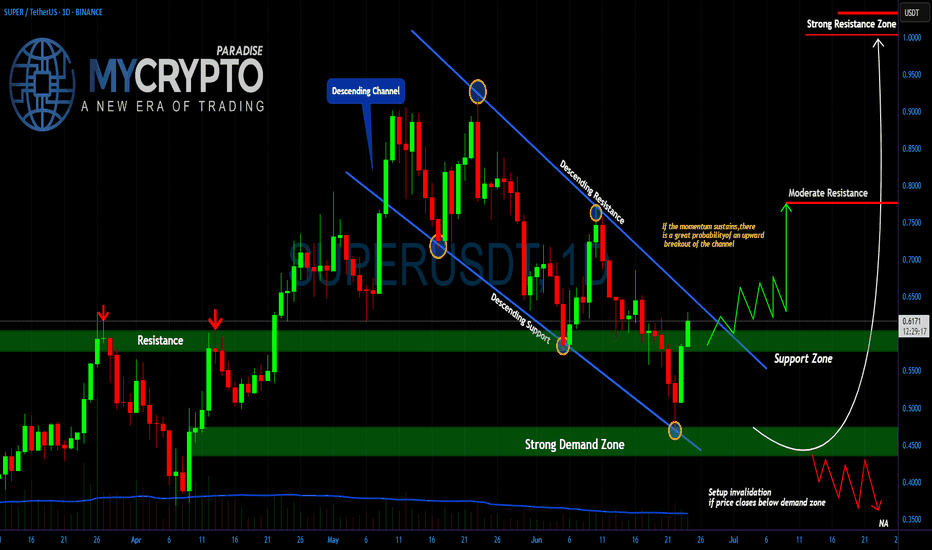

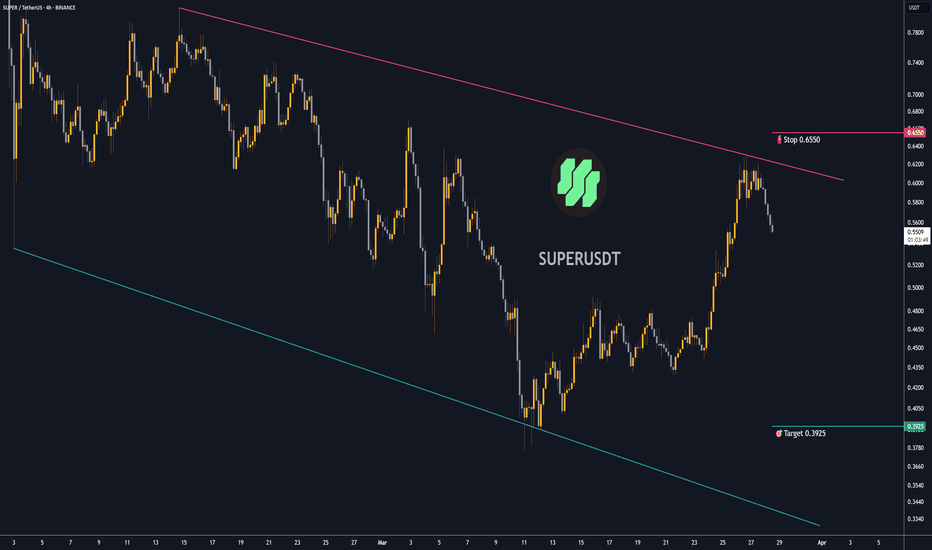

SUPER Breakout Incoming or Just Another Trap Before the Flush?Yello, Paradisers is SUPER about to explode out of this structure, or are we being lured into a fakeout before the next rug pull? This setup is too clean to ignore, and the next few candles will tell us everything.

💎The daily chart on #SUPERUSDT reveals a well-respected descending channel that has dictated price action for over two months. After multiple rejections from the upper boundary and rebounds off the lower trendline, the price has now shown its first serious signs of momentum since bottoming in the strong demand zone around $0.45–$0.50. This zone has held firmly, marking the third time price has bounced from this key level a textbook area of interest where buyers consistently step in.

💎What's notable here is the confluence between the demand zone and the descending support line. The most recent bounce was not only from this dual-support area, but also accompanied by a shift in momentum that has pushed the price back toward a critical inflection point the resistance-turned-support zone at $0.58–$0.62. This level has acted as resistance before and now becomes the level to reclaim for the bullish scenario to stay valid.

💎If the price breaks and closes above the upper boundary of the descending channel and holds above the $0.60–$0.62 region, the path opens toward the moderate resistance at $0.75. Should bullish momentum continue, we could be looking at a retest of the psychological and historical strong resistance zone near the $1.00 mark where we’d expect both aggressive profit-taking and liquidity to build up.

💎On the flip side, any failure to break out and sustain above the current resistance would likely send price back down to retest the demand zone. If the structure gives in and closes below $0.45 on the daily timeframe, this would invalidate the bullish thesis completely and could trigger a sharper drop toward $0.35 or even lower as the broader market liquidates over-leveraged longs.

MyCryptoParadise

iFeel the success🌴

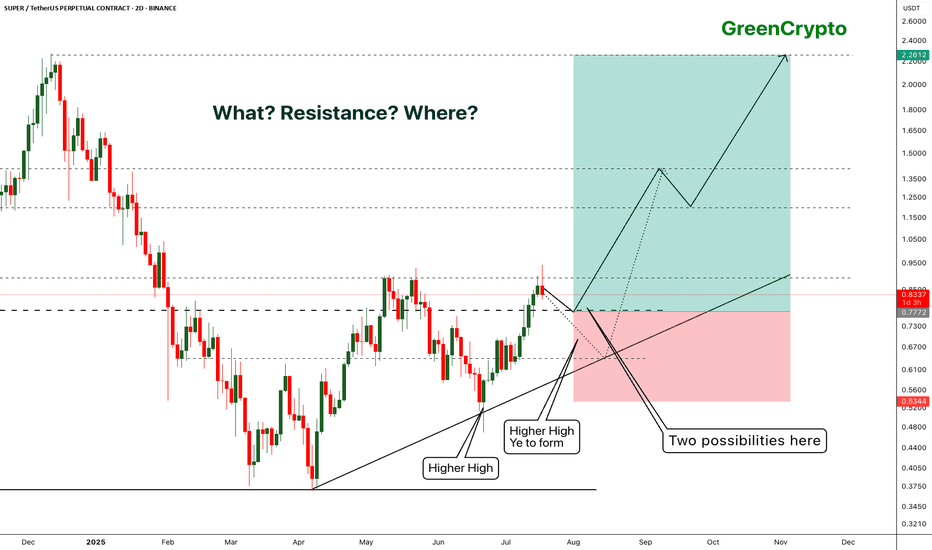

SUPER - Getting ready for the super run- Price is trading near the resistance after forming higher high.

- it's highly likely that price will get rejected around the resistance and will form another higher high.

- this is an excellent opportunity for us to enter the trade.

Entry Price: 0.7322

Stop Loss: 0.5344

TP1: 0.8939

TP2: 1.0517

TP3: 1.2867

TP4: 1.6336

TP5: 2.2243

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

[UPD] Trend analysis: BTC / ETH / SOL / XRP and other Just recorded a new video overview of the crypto market and the current trend developments in major coins: CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , CRYPTOCAP:LINK , GETTEX:HYPE , BSE:SUPER , $FLOKI.

Among the new assets on my radar I shared my view on the trend structure of $RENDER.

In my personal investment planning, I continue to treat any potential corrections into key support zones as opportunities to add or open new positions.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

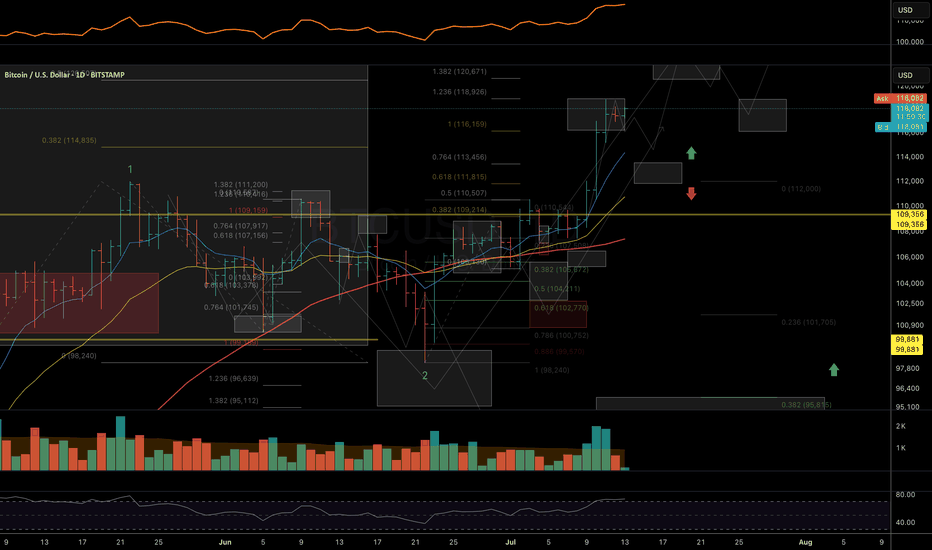

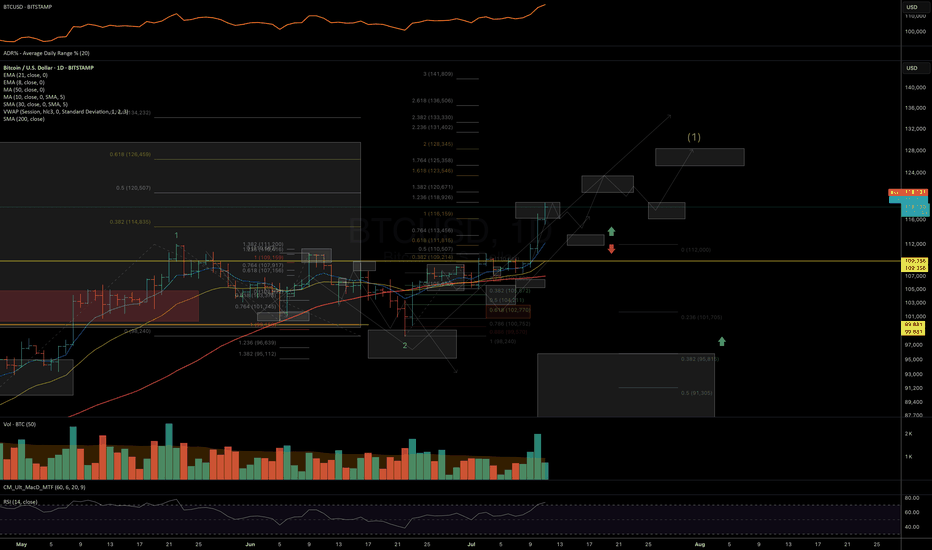

[UPD] BTC / ETH / SOL / XRP / HYPE / SUPER / FLOKIUpdating my view on intermediate trend structures I am tracking in CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , GETTEX:HYPE , BSE:SUPER and SEED_DONKEYDAN_MARKET_CAP:FLOKI highlighting key support and resistance zones to watch in the coming sessions

Charts featured in the video:

BTC

ETH

XRP

SOL

HYPE

SUPER

FLOKI

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

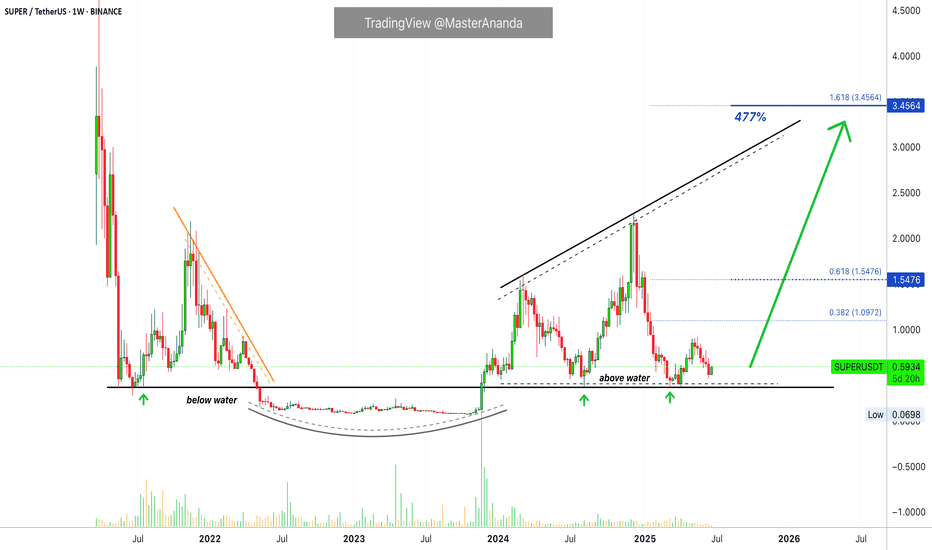

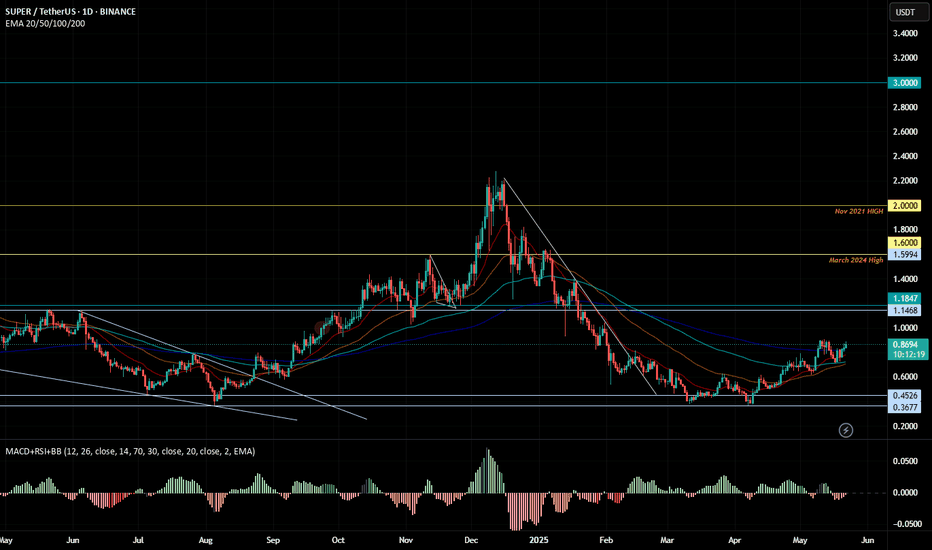

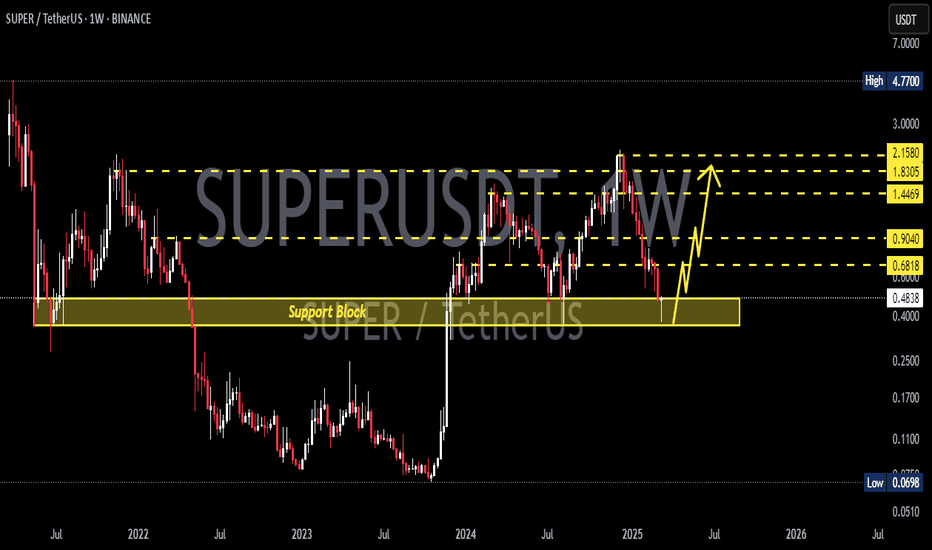

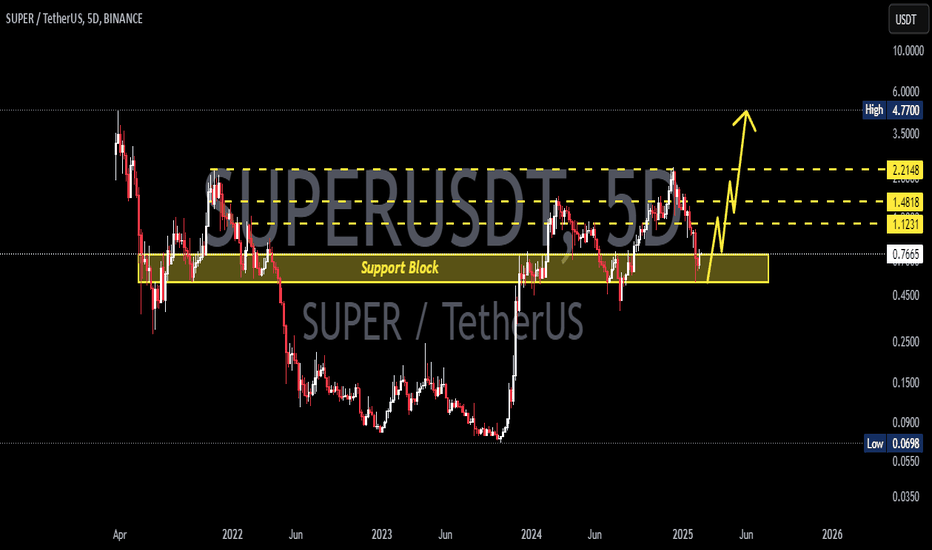

SuperVerse "Above Water," Higher Highs With A Solid BaseHere we have a really long-term support. In May and June 2021 SuperVerse (SUPERUSDT) found support at the same level as in August 2024 and March/April 2025. Amazing.

Back in 2021 SUPERUSDT was coming down from a high point and this support zone worked to produce a small bounce before a long-term market bottom was established. SuperVerse went 'below water' for 560 days. Once back 'above water' the bulls have the upper hand and this is where the action is happening today.

In simple terms, the bullish zone. SUPERUSDT confirmed recently its long-term support producing higher highs with a solid base. The bottom is flat but the peaks become higher with each bullish wave. This is to say that the next high will be a major new high and the biggest ever for this pair-project.

SuperVerse has never experienced what it is about to experience. It started in a bear market and it did good in late 2023, but 2023 was the recovery year, part of a long-term transition between bear and bull.

Now the year is 2025 and this is the bull market year. Notice that between 2022 and 2023 SUPERUSDT traded below water. In 2024 and 2025 it trades above water. We are about to experience the best yet.

Prepare for maximum growth.

SuperVerse will go higher than the easy target shown on the chart. Much higher.

Namaste.

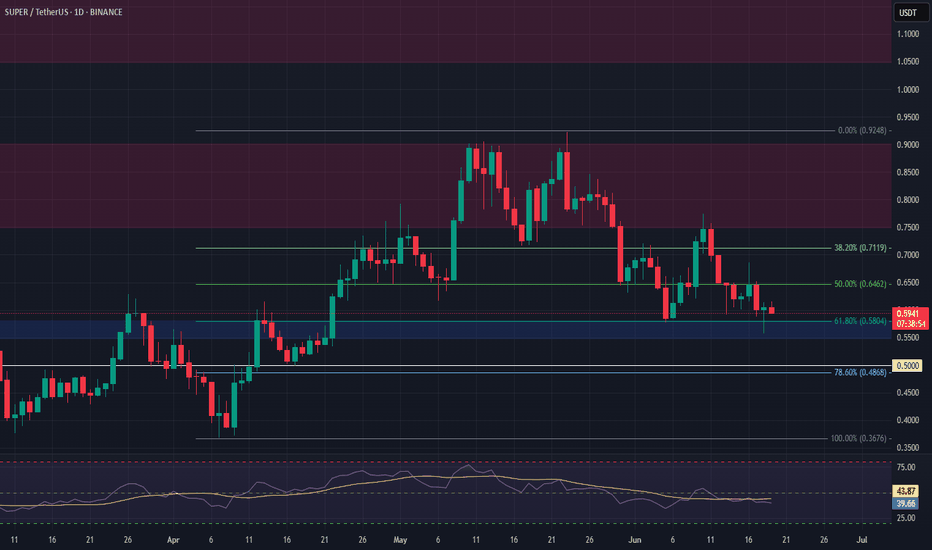

SUPER Long Setup – Confluence of Fibonacci and Major SupportSUPER has retraced into a strong confluence zone, aligning with the 61.8% Fibonacci level and a major support area. The $0.55–$0.58 range offers a solid opportunity to enter a long swing trade.

📌 Trade Setup:

• Entry Zone: $0.55 – $0.58

• Take Profit Targets:

o 🥇 $0.75 – $0.90

o 🥈 $1.05 – $1.20

• Stop Loss: Daily close below $0.50

#SUPER/USDT#SUPER

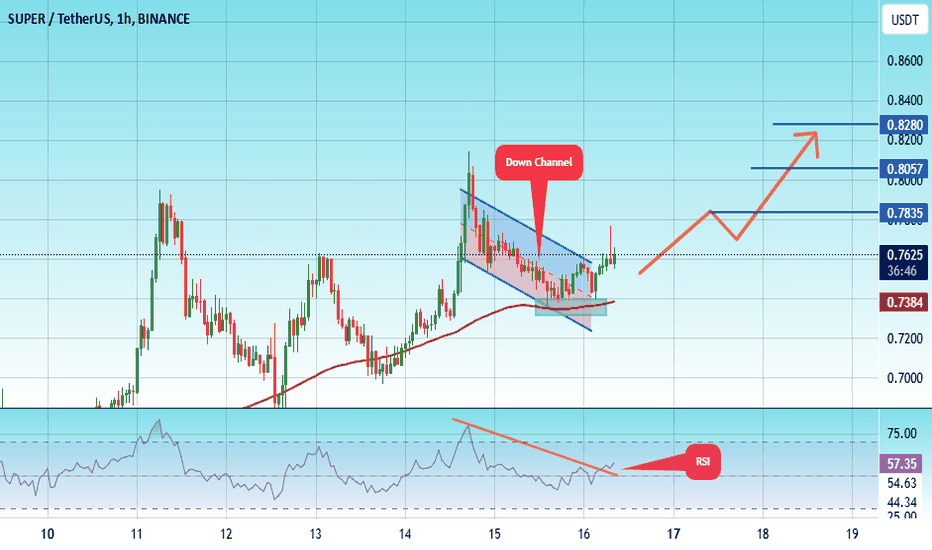

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.7294

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.8327

First target: 0.8729

Second target: 0.9236

Third target: 0.9953

#SUPER/USDT#SUPER

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.7300

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.7624

First target 0.7835

Second target 0.8057

Third target 0.8280

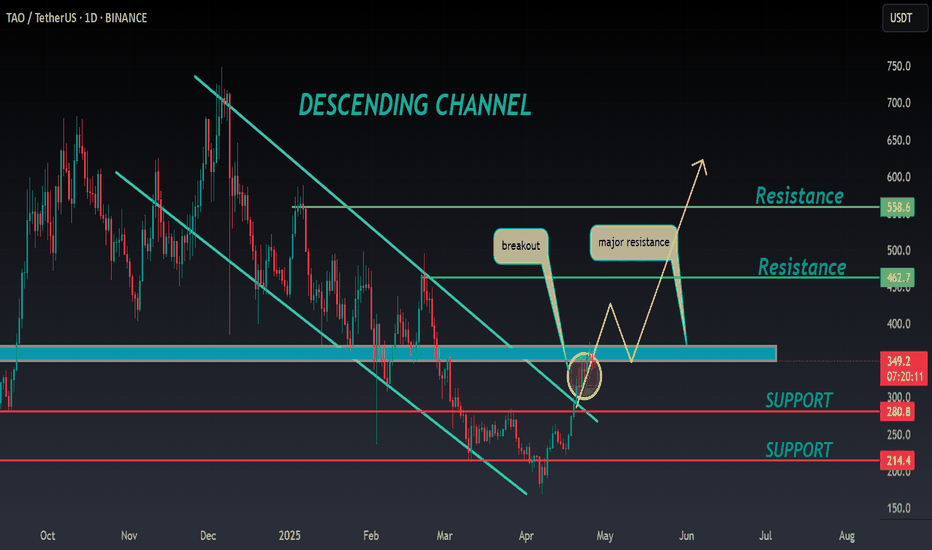

TAO ANALYSIS📊 #TAOAnalysis

✅There is a formation of Descending Channel Pattern in daily time frame in #TAO .

Also there is a perfect breakout and retest. Now we can expect a bullish move. If the price sustains the major resistance zone then we will see more bullish move

👀Current Price: $349

🎯 Target Price : $460

⚡️What to do ?

👀Keep an eye on #TAO price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#TAO #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

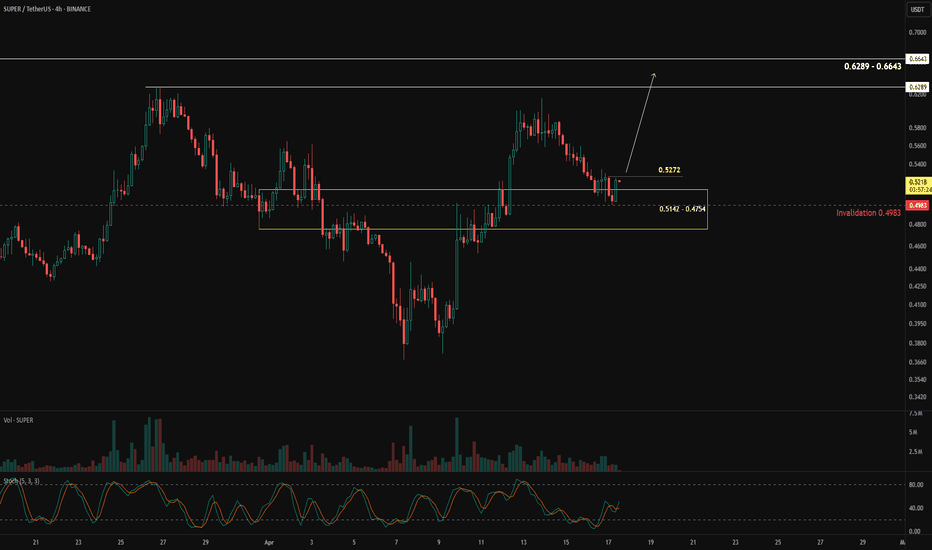

Is This The End of Pullback?BINANCE:SUPERUSDT has entered the support zone between 0.5142 – 0.4754 after a strong impulsive move to the upside.

This support zone is considered valid due to multiple rejections that occurred within this area in the past—indicating strong buyer interest.

Ideally, this is where we expect price to bounce and resume the bullish trend. The first sign of confirmation would be a break above 0.5272, which may open the path toward higher targets.

However, the bullish scenario remains valid only if the price stays above 0.4983—a key invalidation level.

Note:

If this level is breached before a clear candlestick confirmation, the candle pattern being used to validate the move becomes invalid.

Even if the price breaks below the invalidation level, as long as it remains within the support zone, the support is still valid — but it would require the formation of a new bullish candlestick pattern to re-confirm the potential for an upward move.

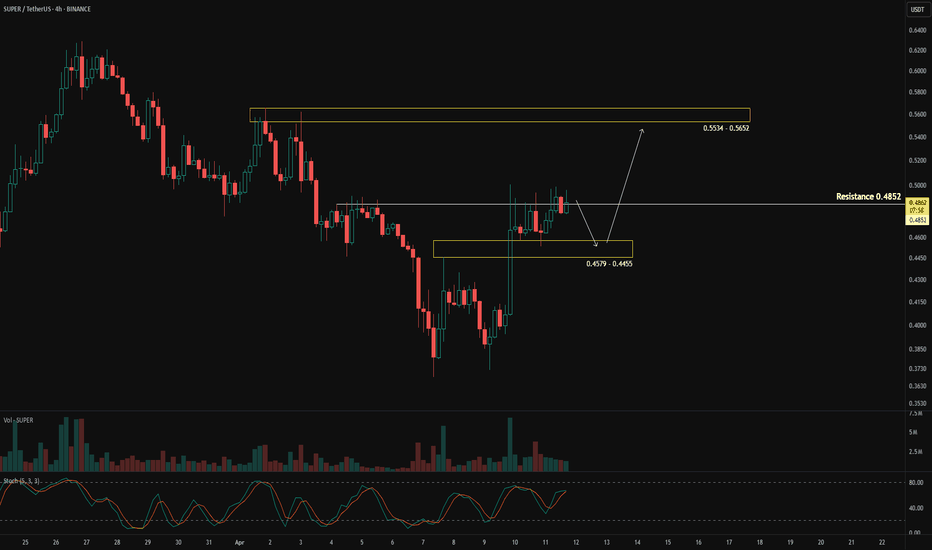

Buyers Still in Control?Price surged from 0.4000, broke the previous high, and reached the 0.4852 resistance level. The current sideways movement around the resistance suggests that sellers lack the strength to push the price lower. Even if a pullback occurs, the 0.4579 – 0.4455 area is expected to act as a support zone, potentially holding the price and allowing the uptrend to continue toward 0.5534 – 0.5652.

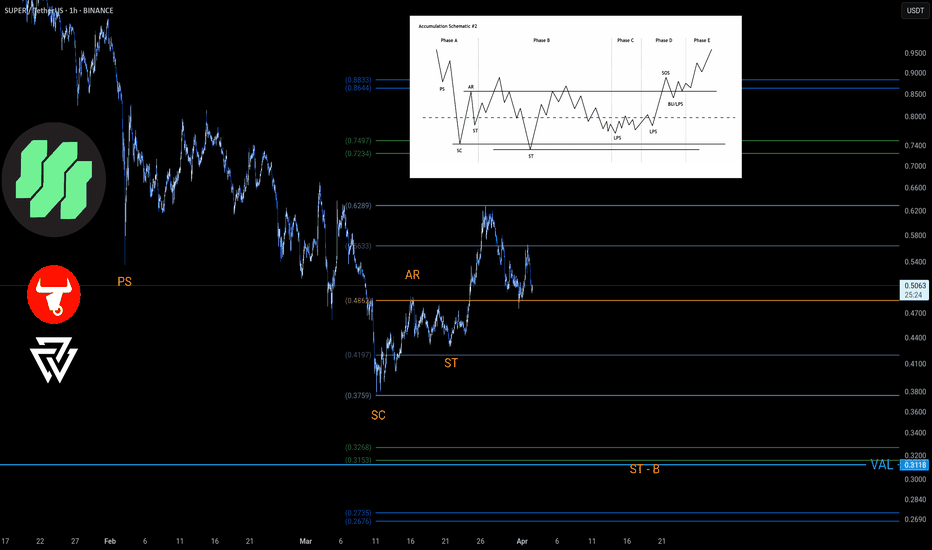

$SUPER Wyckoff Accumulation – Schematic #1 or #2 in PlayBSE:SUPER Wyckoff Accumulation – Schematic #1 or #2

My base case at the moment is Wyckoff Accumulation Schematic #2 , where the Secondary Test ( ST-B ) could mark the very bottom. This idea will be validated for me especially if we see interaction with the High Time Frame VAL .

Green Zone:

We have confluence with VAL and Green TRP Zone from HTF ReAccumulation idea.

High Time Frame Wyckoff ReAccumulation Idea:

SUPER Trade Setup - Waiting for Support EntrySUPER has had a strong rally over the last two weeks, and it's now facing resistance. We're eyeing a pullback to the next support level for an optimal long spot trade.

🛠 Trade Details:

Entry: Around $0.54

Take Profit Targets:

$0.60 - $0.66 (First Target)

$0.73 – $0.80 (Extended Target)

Stop Loss: Just below $0.45

📊 We'll monitor for support confirmation before entering. Stay tuned for updates! 📈

SUPER Long Swing Opportunity Market Context:

SUPER is trading in a key support zone, offering a high-probability long entry. If support holds, we anticipate a bullish continuation toward key resistance levels.

Trade Details:

Entry Zone: $0.58 - $0.78

Take Profit Targets:

$1.00

$1.34

$1.60

Stop Loss: Daily close below $0.54

This setup provides a strong risk-to-reward opportunity, aligning with broader market sentiment. Monitor price action for confirmation! 📈🔥

Trade Setup: SUPER Long Swing OpportunityMarket Context:

SUPER has reached a significant support level, making this an ideal zone to consider a long swing trade. The current consolidation within this area increases the likelihood of a bullish rebound.

Trade Details:

Entry Zone: $1.02 - $1.10

Take Profit Targets:

$1.60 - $1.80

$2.10 - $2.30

Stop Loss: Below $0.93

This setup offers a favorable risk-to-reward ratio, targeting the next major resistance zones. 📈