Supply and Demand

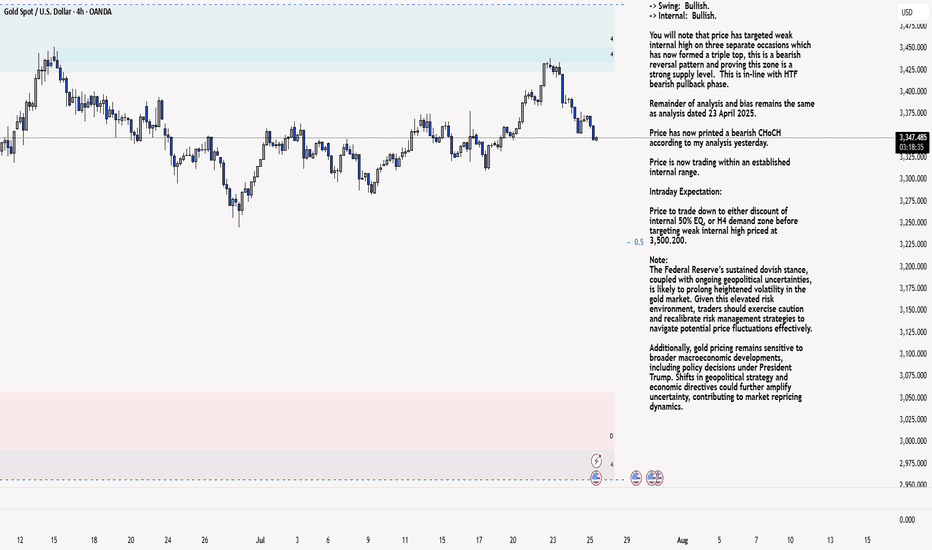

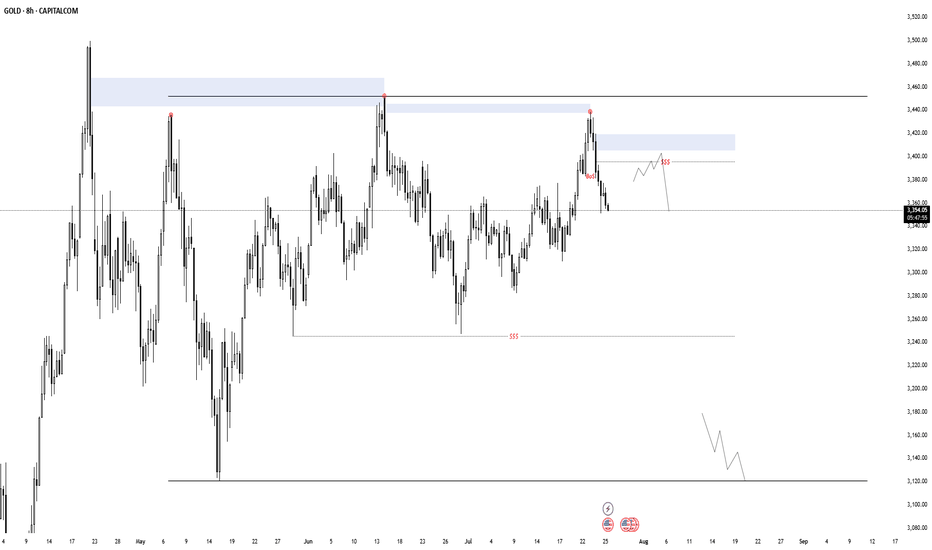

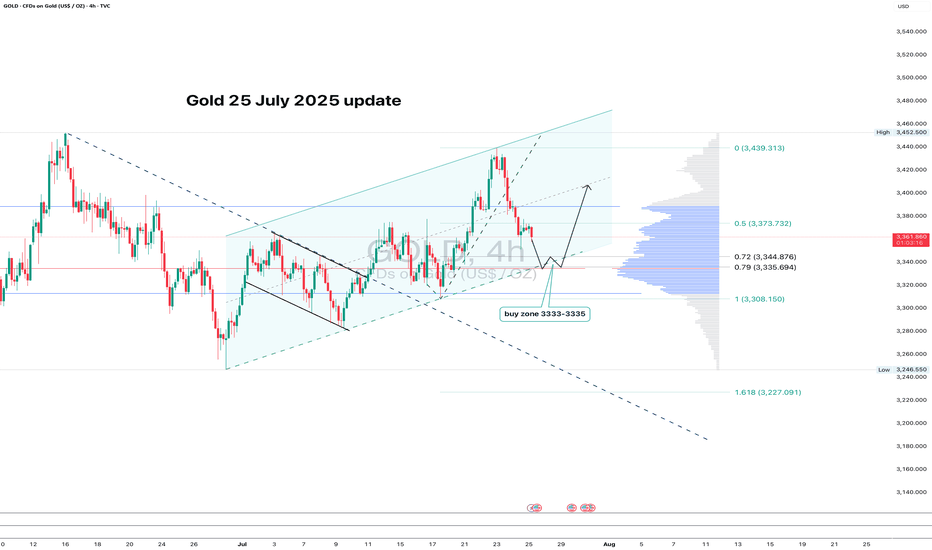

XAU/USD 25 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on three separate occasions which has now formed a triple top, this is a bearish reversal pattern and proving this zone is a strong supply level. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

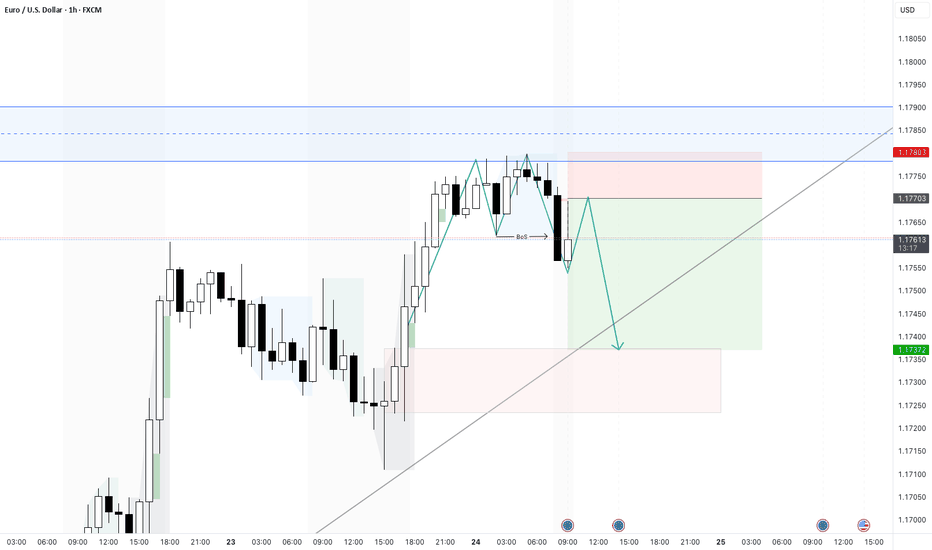

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

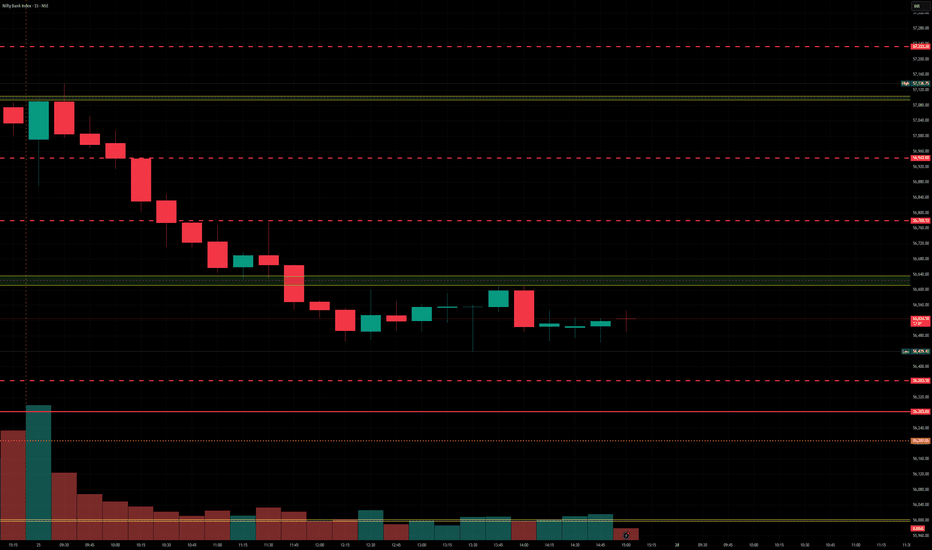

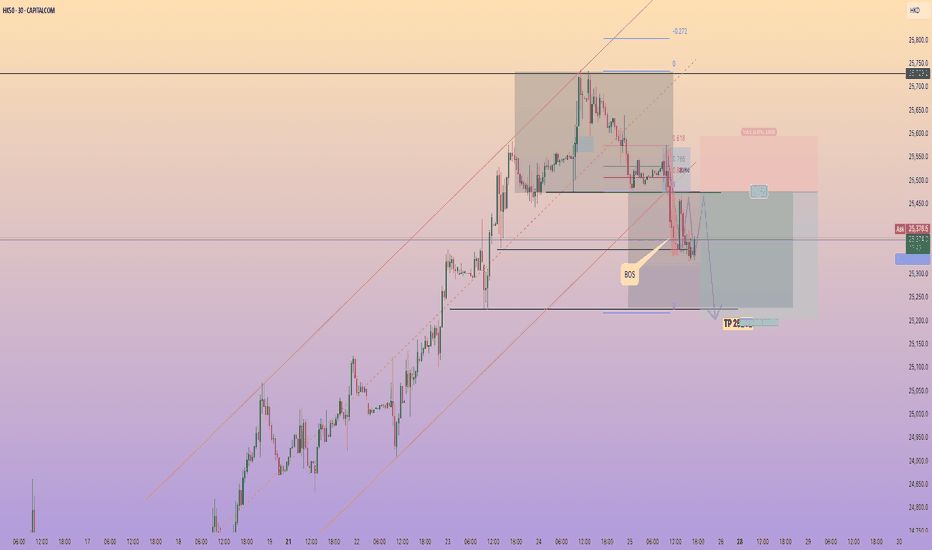

BankNifty levels - Jul 28, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

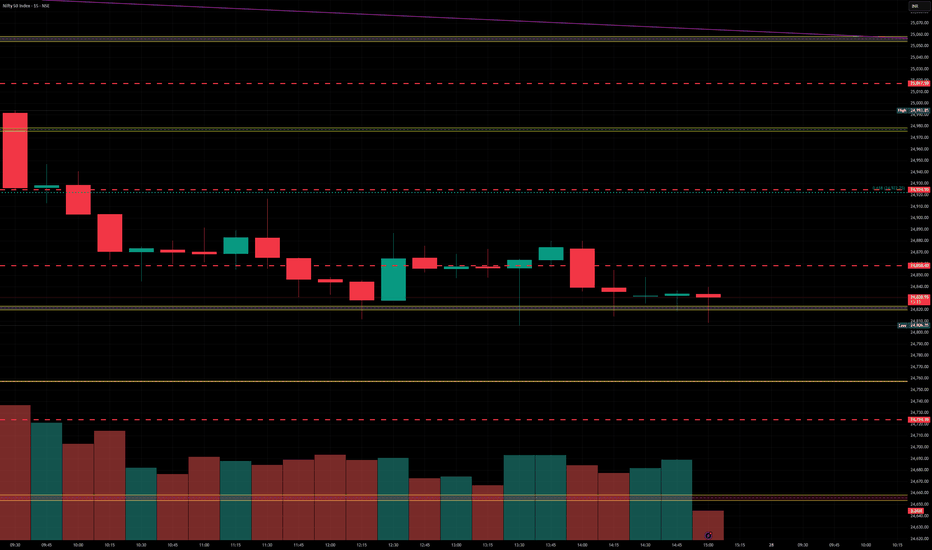

Nifty levels - Jul 28, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

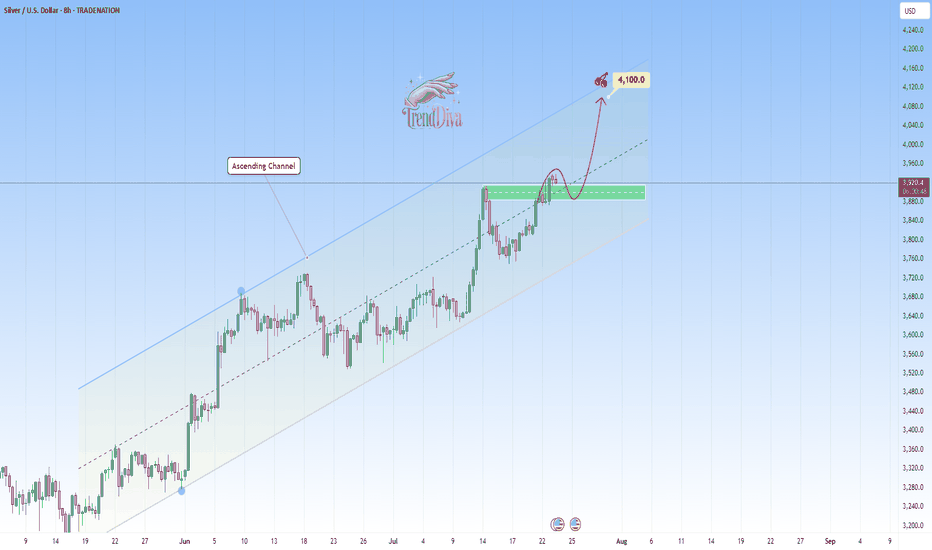

SILVER Analysis - Can buyers push toward 4,100$?TRADENATION:XAGUSD is trading within a clear ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting there's chances for potential continuation on the upside.

The price has recently broken above a key resistance zone and now came back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward the 4,100 target, which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook stays intact. However, a failure to hold above this level could invalidate the bullish scenario and increase the likelihood of a deeper pullback.

Remember, always confirm your setups and use proper risk management.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

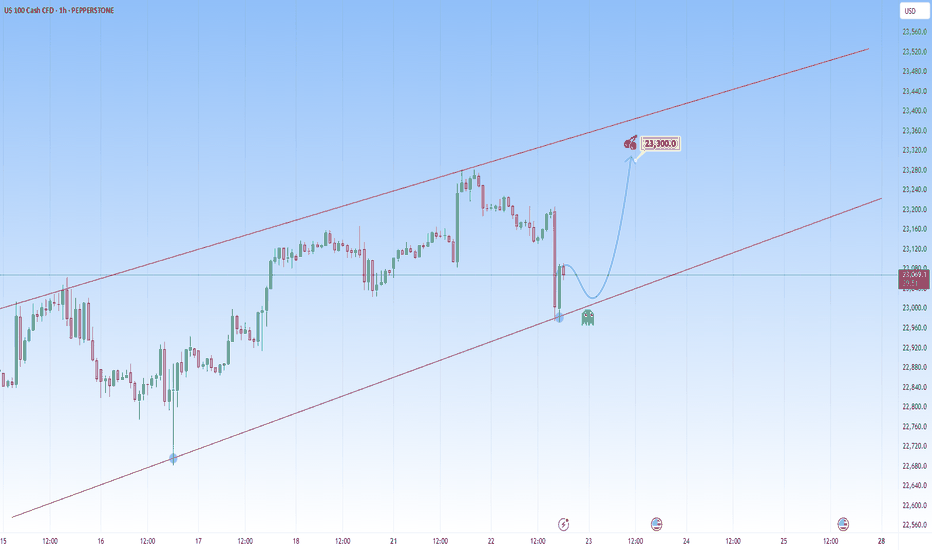

NAS100 steadies at high levels, pay attention nextThe most recent move on NAS100 saw a sharp drop that briefly recovered, likely triggering stops before aggressively reversing from the lower boundary of the newly projected channel. This isn't a cause for concern, on the contrary, it's another opportunity to get involved.

That is because this drop and recovery is a common behavior in strong uptrends before resuming bullish momentum.

The market is likely in the early stages of a new impulsive leg to the upside right here.

We could either have short-term consolidation or pullback, then a continuation toward the upper channel boundary or straight upwards, and with NAS100, the latter is more plausible.

My target will be at 23,300 around the upper boundary of the projected channel resistance.

In this context, the market remains bullish clearly. The most interesting aspect is the emotional flush on the last drop, trapping sellers before fueling what could be another big leg up.

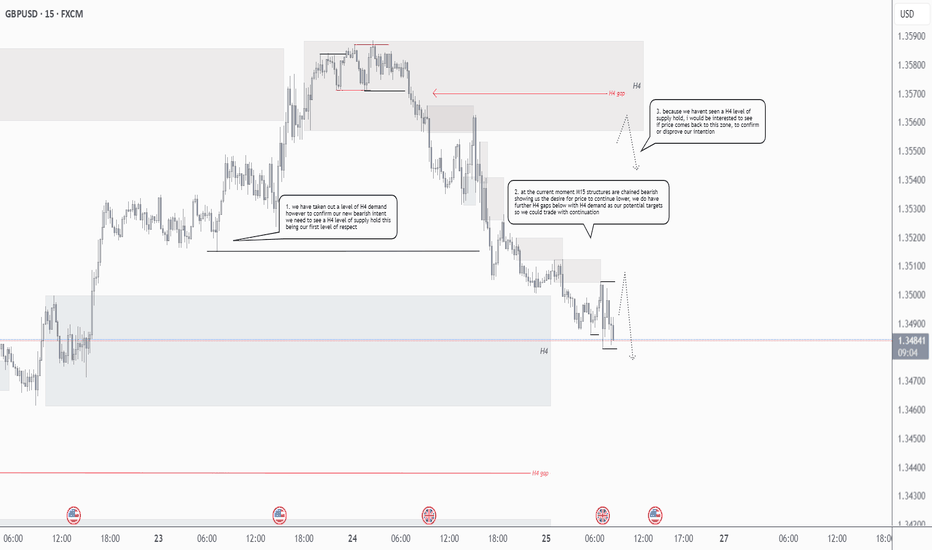

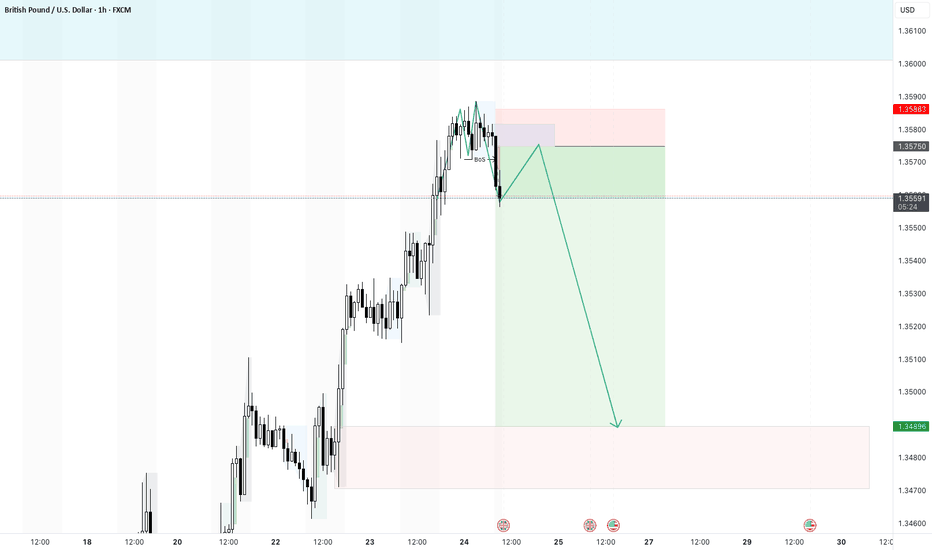

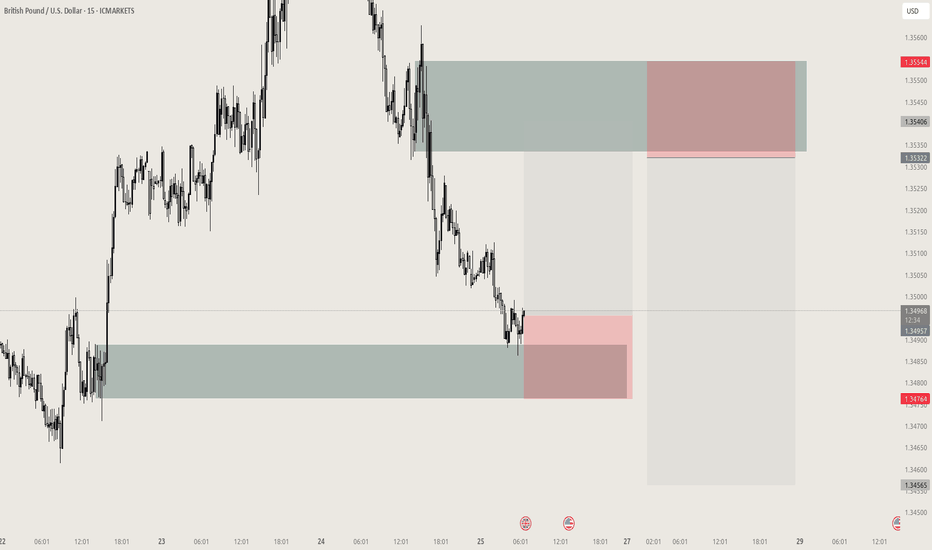

GU 25/071. we have taken out a level of H4 demand, however to confirm our new bearish intent we need to see a H4 level of supply hold this being our first level of respect.

2. at the current moment M15 structures are chained bearish showing us the desire for price to continue lower, we do have further H4 gaps below with H4 demand as our potential targets so we could trade with continuation lower, we just have to be wary that we are within a H4 demand zone if we wish to look for shorts

3. because we havent seen a H4 level of supply hold, i would be interested to see if price comes back to this zone, to confirm or disprove our intention.

As they say, trade what you see not what you anticipate so in this instance I am seeing bearish orderflow on the M15, a level of demand broken on the H4 so I am seeing shorting oppurtunities until proven wrong. In order to consider longs id want to see from the current H4 demand zone were in, a level of M15 supply fail typically with a sweep of a low, then M15 demand hold as the FLOR (first level of respect) followed by a second failure of supply where id then look for a long opportunity from the new demand area!

On another note its friday, its been a long week for me with work and other tasks so I hope you all have a great weekend also, ciao!

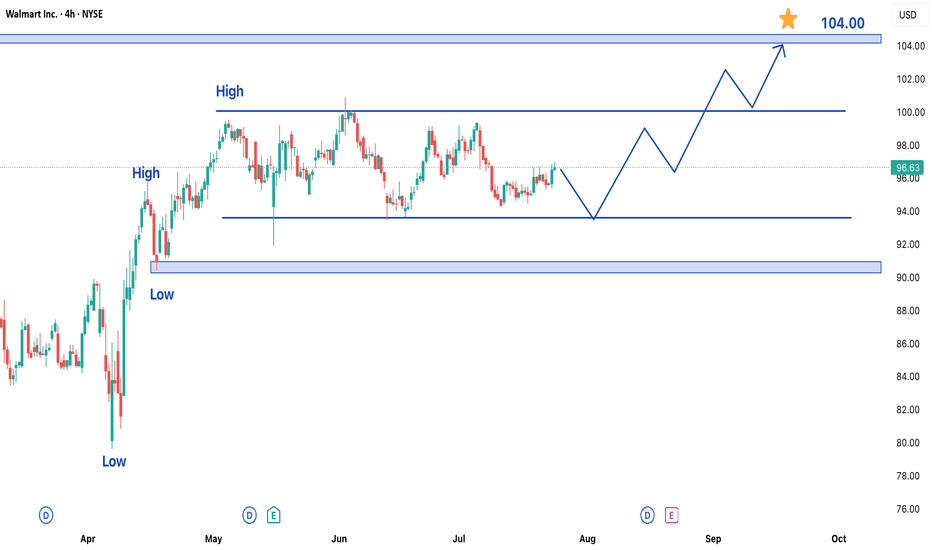

Walmart Stock Trading in Bullish Trend – Upside Potential AheadWalmart Inc. (WMT) shares are currently exhibiting a bullish trend, maintaining upward momentum over recent trading sessions. While the stock has been consolidating in a range over the past few days, the broader outlook remains positive, suggesting potential for further gains in upcoming sessions.

Key Observations:

- Established Uptrend: Walmart's price action reflects sustained buying interest, keeping the stock in a bullish phase.

- Range-Bound Consolidation: Recent sideways movement indicates a temporary pause, often a precursor to the next directional move.

- Strong Support & Resistance Levels: The stock has formed clear reference points for traders to watch.

Price Projections:

- Upside Target at $105: A breakout above the current range could propel WMT toward the $105 resistance level, representing a significant upside opportunity.

- Key Support at $90: On the downside, the $90 level has emerged as a strong support zone. Any pullback is likely to find buying interest near this area.

Market Implications:

1. Bullish Continuation Likely: The consolidation within an uptrend typically resolves in the direction of the prevailing trend—in this case, upward.

2. Breakout Potential: A decisive move above the recent range high could accelerate buying momentum toward $105.

3. Risk Management Consideration: While the bias is bullish, a drop below $90 would signal weakening momentum and potentially invalidate the near-term upside scenario.

Trading Strategy:

- Entry: Consider long positions on a confirmed breakout above the range, or on dips near $90 support.

- Stop Loss: A close below $90 would suggest a trend reversal, warranting exit from bullish positions.

- Target: $105 serves as the primary upside objective, with interim resistance levels to monitor along the way.

Final Thoughts:

Walmart’s stock appears poised for further gains, with $105 as the next key target. Traders should watch for a breakout from the current range while keeping an eye on the $90 support level for risk management. As always, confirmation through price action and volume will be crucial for validating the bullish thesis.

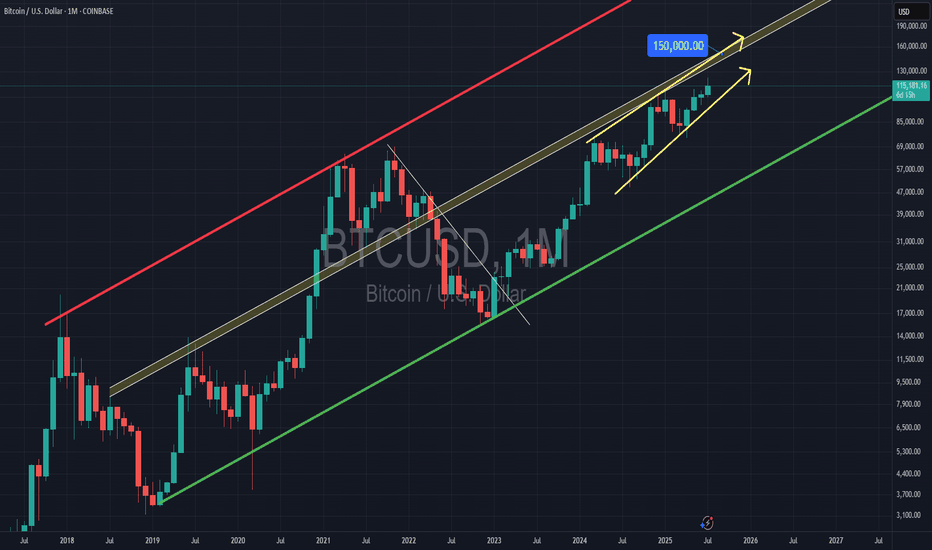

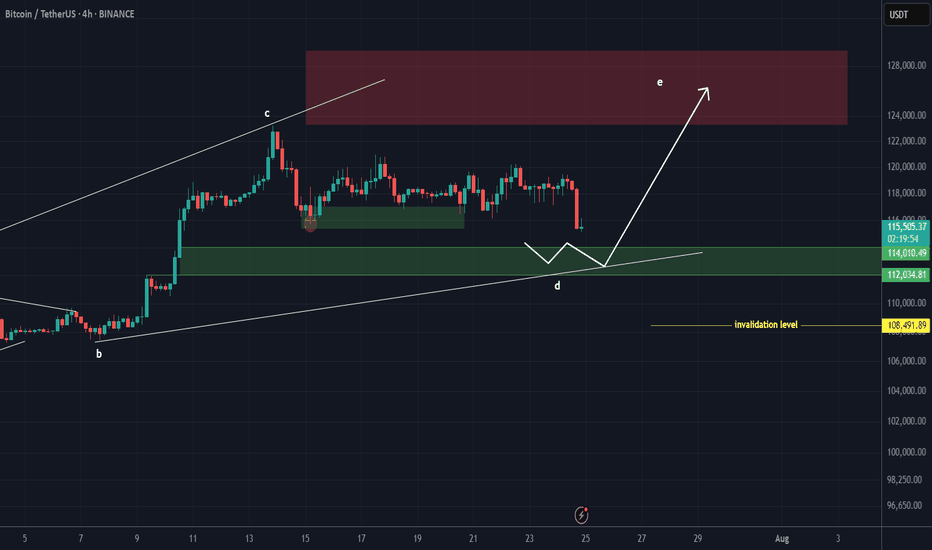

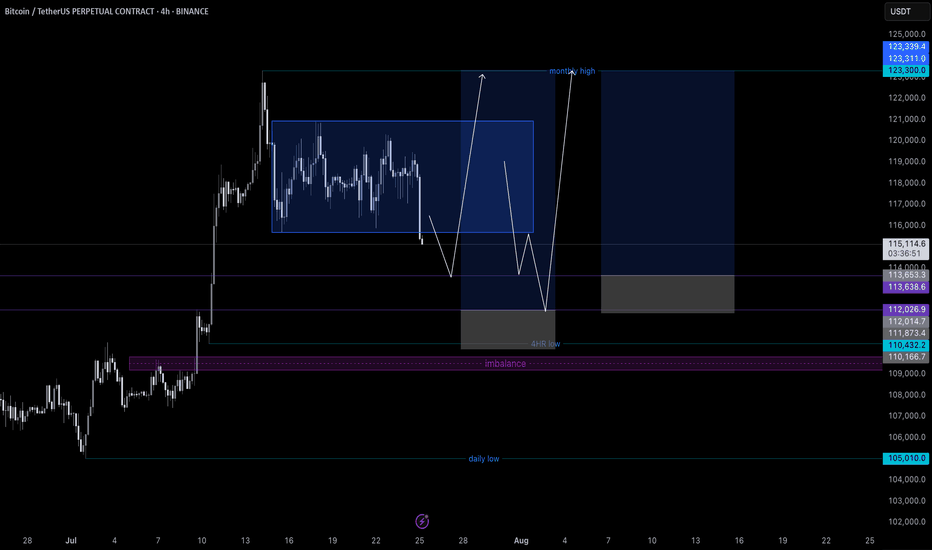

BTC New Upodate (4H)This analysis is an update of the analysis you see in the "Related publications" section

We previously stated that Bitcoin lacks the strength to move upward, and we expect the price to soon reach the green zone (114K-112K).

The price is now dropping toward this zone, which is the rebuy area.

The process of reaching the green zone has been and still is somewhat time-consuming, and during this time, it may repeatedly mislead beginners.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

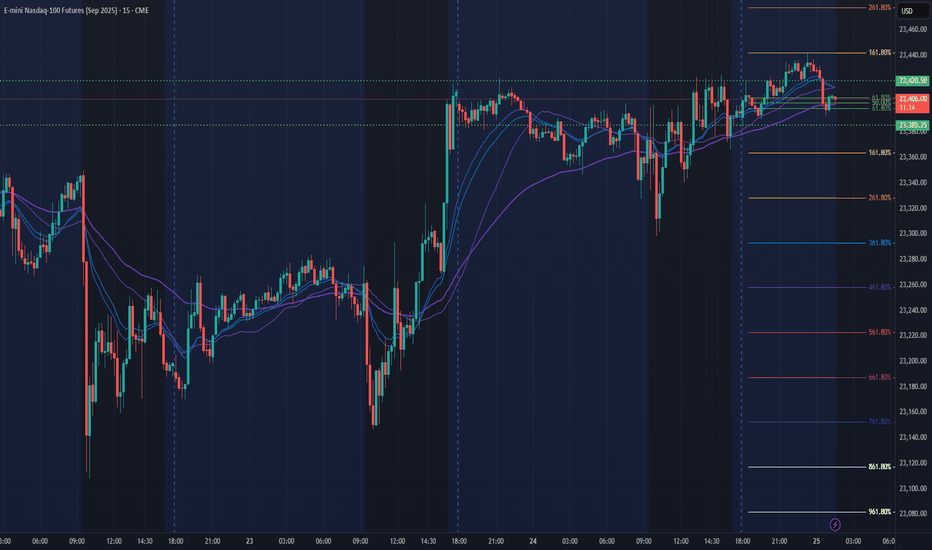

NQ Power Range Report with FIB Ext - 7/25/2025 SessionCME_MINI:NQU2025

- PR High: 23420.50

- PR Low: 23385.00

- NZ Spread: 79.5

Key scheduled economic events:

08:30 | Durable Goods Orders

Session open ATH break and retrace

Session Open Stats (As of 12:45 AM 7/25)

- Session Open ATR: 248.86

- Volume: 20K

- Open Int: 274K

- Trend Grade: Long

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

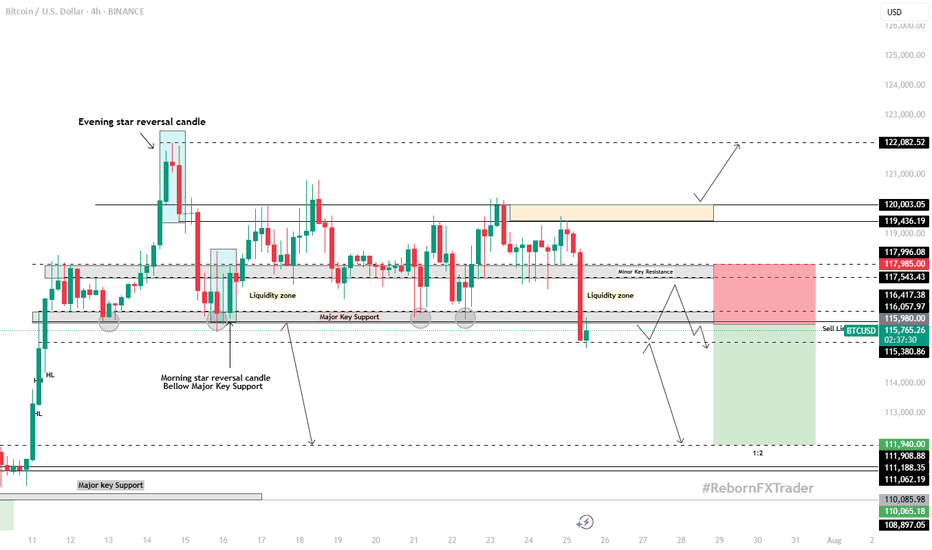

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

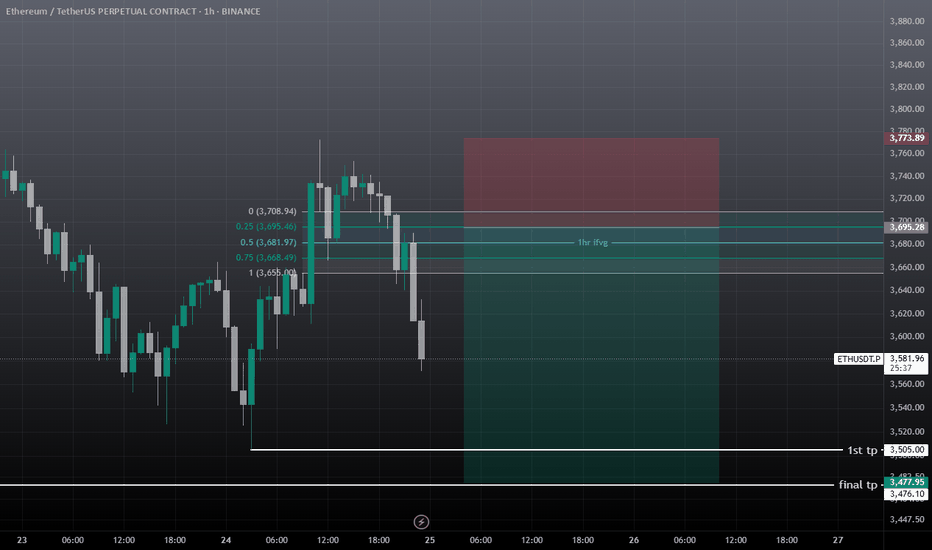

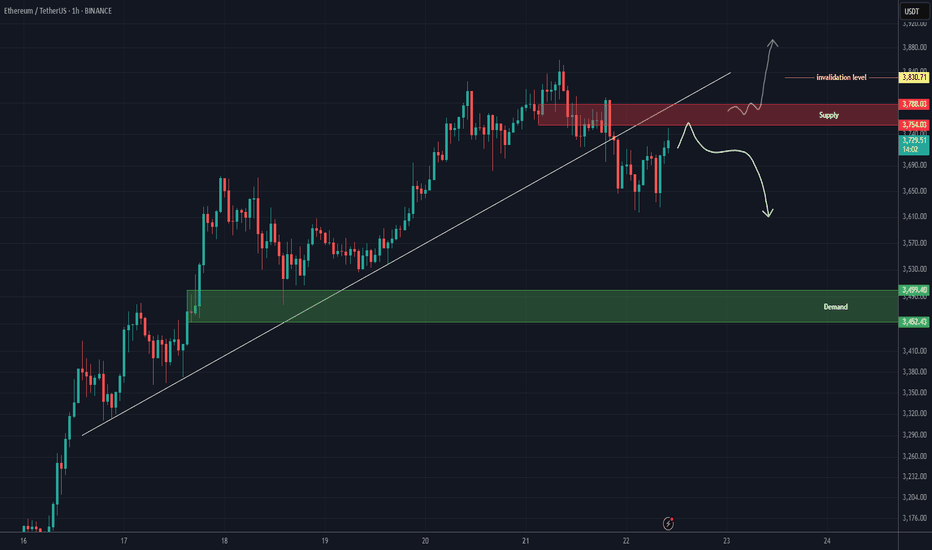

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

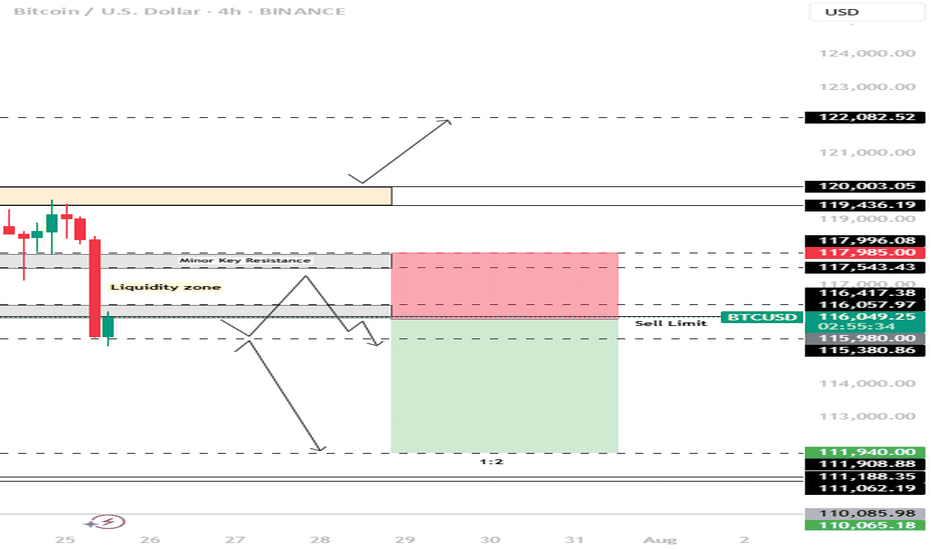

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

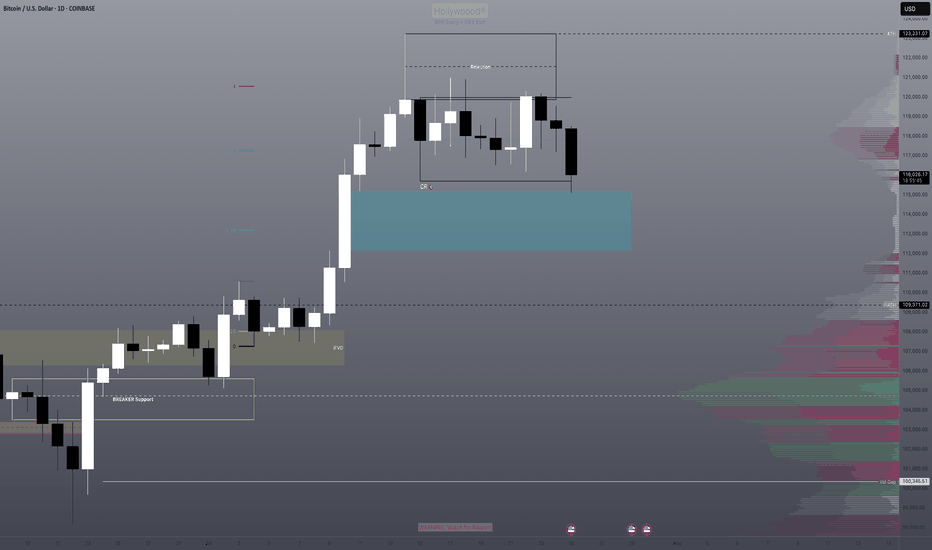

Will the low of this BTC zone be used as a buy point?We have an imbalance high being tested. We know that this also represents the consolidation range low where both TPs and long entries will be triggered.

Will this be enough to send us back bullish or will be need further correction of the imbalance? I think there's a high probability of this with DXY also running into it's daily bearish imbalance range.

GOLD: clean pullback - now let’s see if support holdsGold continues to trade within an ascending channel on the 4H chart. After a local high, the price pulled back and is now approaching the key zone at 3333–3335. This area lines up with the 0.79 Fib retracement, the lower channel boundary, and a major volume cluster — a classic confluence zone.

If buyers show up here and we get a bullish reversal candle, this becomes a valid long setup with a tight stop just below the level. First target is 3373 (0.5 Fib), followed by a potential retest of the high near 3439.

The structure remains intact, the pullback is orderly, and volume supports the move. As long as the channel holds - the bias stays bullish.

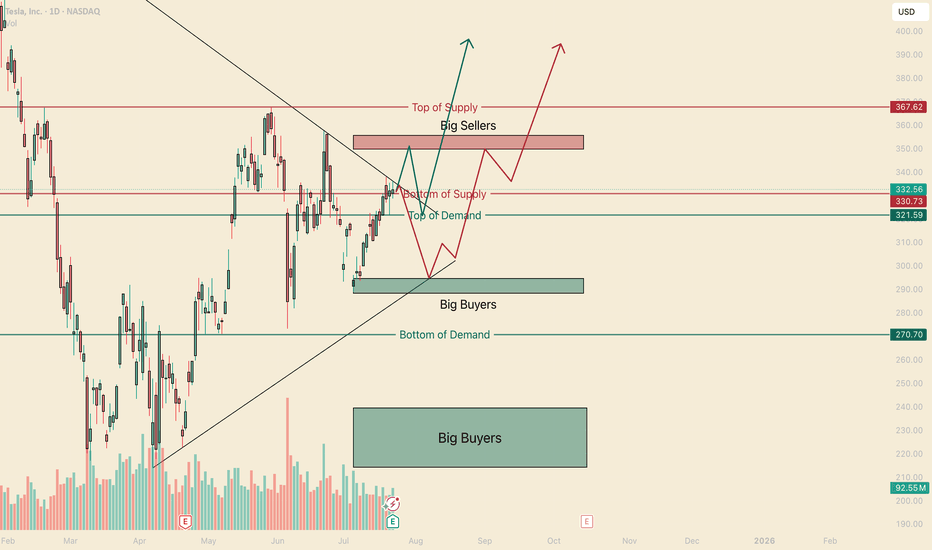

Two Trades to go Bullish on TSLAHello, I’m The Cafe Trader.

We’ve been tracking the MAG 7, and Tesla is the next focus for our short-term options or swing trade strategy.

I’m looking at two scenarios that are likely to play out with TSLA over the next few weeks.

For fundamental and long-term analysis, check my other article on TradingView.

⸻

Even though we’re sitting near the middle, bulls have just pushed into a bearish liquidity level (marked “Bottom of Supply”). We don’t know how much supply is left here, but the fact that bulls are pressing in suggests the bears are losing steam. This doesn’t mean price won’t pull back—it just means bearish follow-through may be weaker.

With that in mind, here are the two main scenarios:

⸻

1. Green Arrow — Bullish Test of Sellers

– Stock

If bulls keep the pressure on, we may see a test of the “Big Sellers” zone. The reaction there will tell us a lot.

If we see a sharp rejection (a quick tag followed by a flush) or a fake breakout that reverses, I’d approach longs more cautiously.

However, an aggressive entry long around the “Top of Demand” (around $321) could make sense, especially considering how buyers have been stepping in. This setup is primed to retest highs.

– Options

Pricing will be key here—especially post-earnings (EOD).

I’d look 2 weeks out. If you can snag a 335C for $5.00–$7.00, that’s solid.

Target profit would be into the Big Sellers zone. If we get a strong move before then that nets 3R–5R, I’d take it.

⸻

2. Red Arrow — Bearish Reaction + Big Buyer Support

– Stock

If earnings disappoint, we could see a shift in momentum. That said, big buyers should step in around $295.

This is actually the more likely scenario in my view.

From there, I’d look for a swing back up into the 330–350 range.

We’ll need to see how sellers handle the drop—are they aggressive, or is it just a lack of buyer interest?

Either way, this could align well with long-term buy zones.

– Options

On a flush to $295, I’d look for 3–5 day expiration calls around the 305 strike. @ a price between $1.50–$1.70 (look for 2-3R)

After the bounce, I’d expect a pause or retest of the uptrend line.

Then I’d look 2–3 weeks out for the 325C or 330C, ideally between $3.00–$5.00.

I’ll keep an eye on option pricing and update if we reach that level.

⸻

That’s all for short-term TSLA.

Follow for more charting and trade ideas.

📲 @thecafetrader