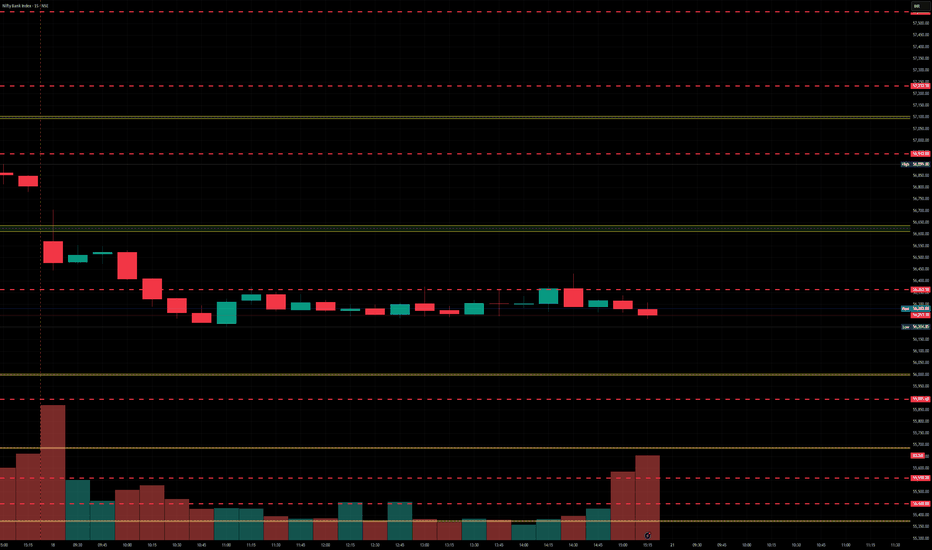

BankNifty levels - Jul 21, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

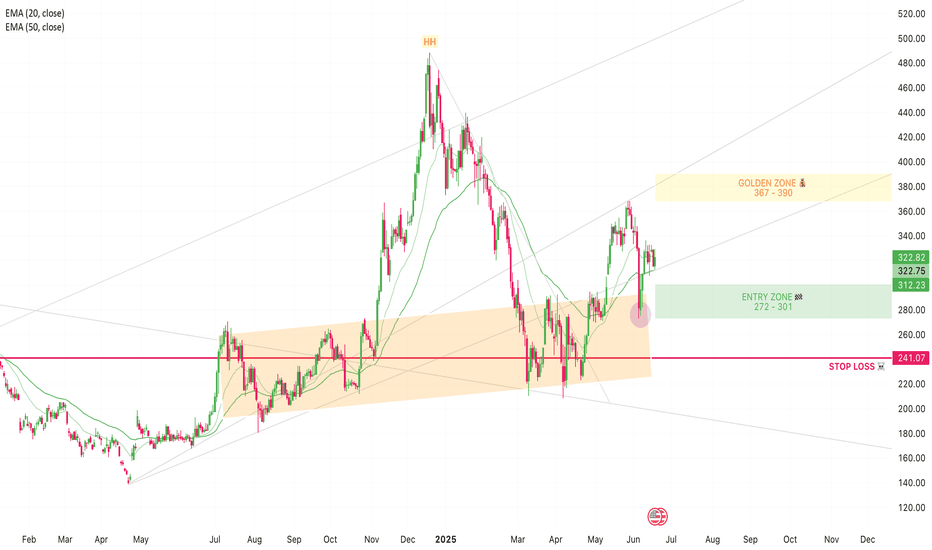

Supply and Demand

TSLA: Don't Sleep on the PullbackTesla’s bullish momentum is still in control – the weekly chart shows we’re still in an uptrend, and the trend is still our best friend. After a strong bounce from support a couple weeks ago, price is now rejecting off a weak resistance zone. Ideally, this pulls it back into my entry zone to retest the bottom or the 50% mark of the current swing. I’m using trend lines for guidance and expecting the next swing to push up into that confluence area. My golden zone is set between $367–$390, with partial profits be taken at $367 (top of the channel) and the rest near $390, where we meet the trend line. Stop loss is placed at $241, just below the level where momentum would likely shift.

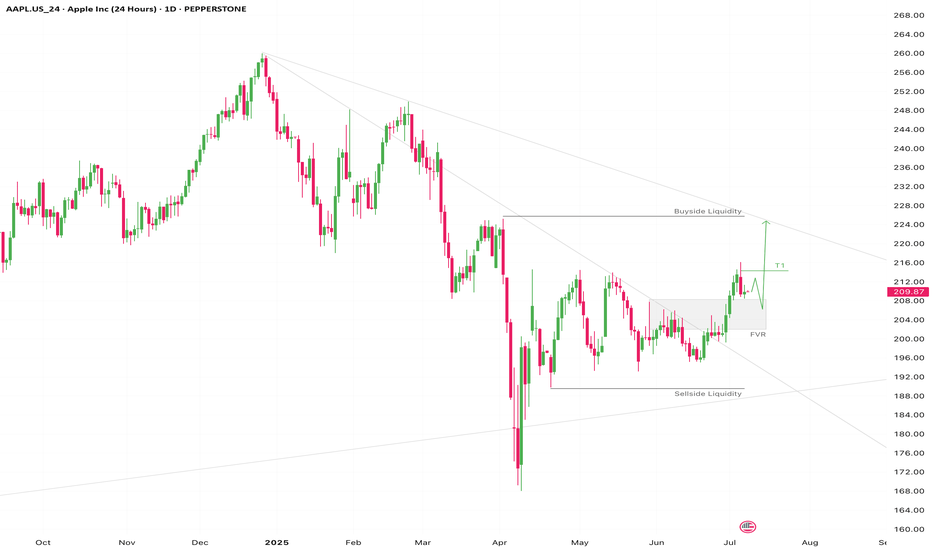

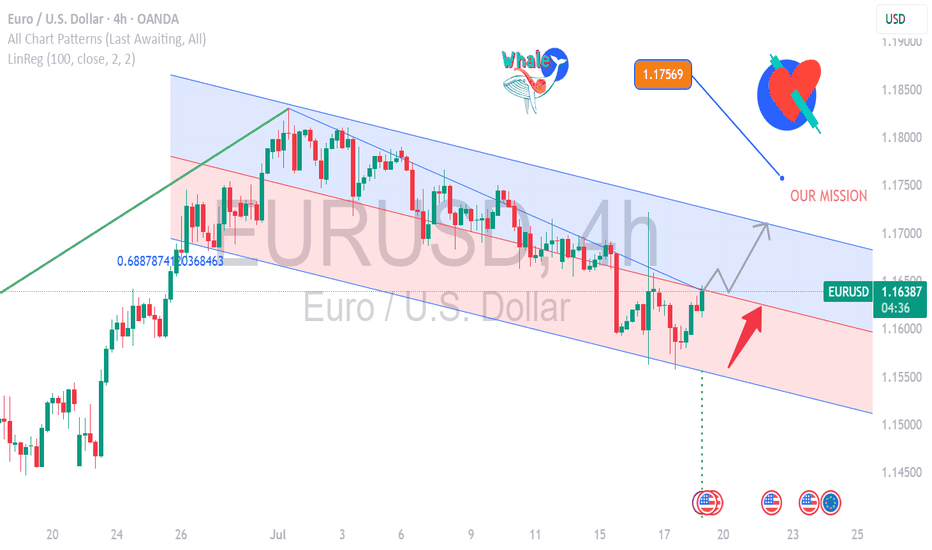

EUR/USD Flexing Strength- Is the Next Big Coming? EUR/USD Market Update – Bullish Setup at 1.16440

EUR/USD is trading around 1.16440, maintaining its bullish momentum in the current uptrend.

🔹 Current Price: 1.16440

🔹 Support Zone: 1.1600 – 1.1620

🔹 Resistance Zone: 1.1680 – 1.1700

🔹 Trend: Strong bullish structure with clear upward momentum

The pair is holding above key support and aiming for the next resistance at 1.1700. A breakout above this level could open the door to further upside. Traders watching for a retest near support or breakout entry above resistance.

🎯 Trading Plan:

Buy on dips above 1.1620 or wait for a confirmed breakout above 1.1680 with volume.

#EURUSD #ForexAnalysis #BullishSetup #ResistanceSupport #TechnicalAnalysis #PriceAction #TrendTrading #SmartTrader #FXSignals

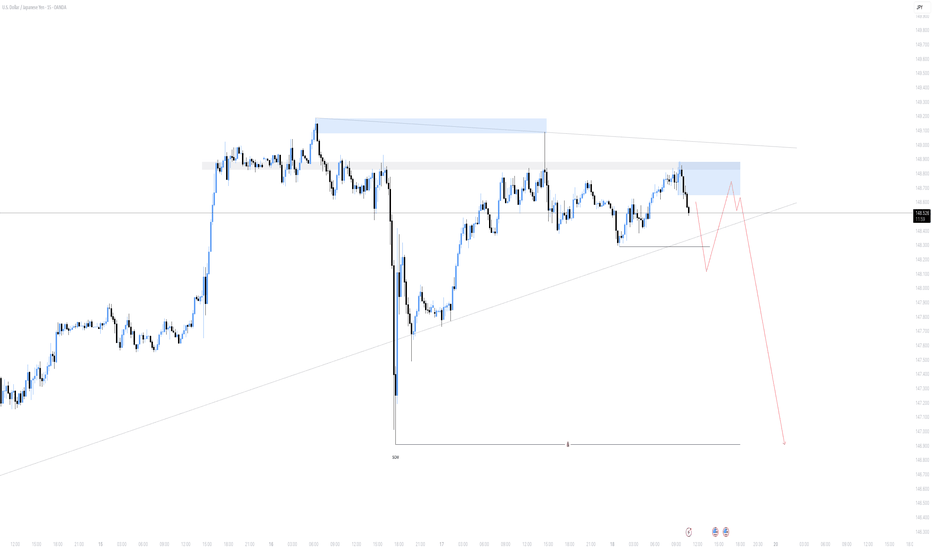

UJ shortsThe dollar is looking weak, I expect UJ to fall as well.

UJ showed some strong weakness last Wednesday following the drop in price of the dollar.

Looks like supply is in control atm, I would like to see price breaking the newest low to confirm the bearishness on UJ.

When it does, I'll start looking for new short opportunities when price mitigates the current move.

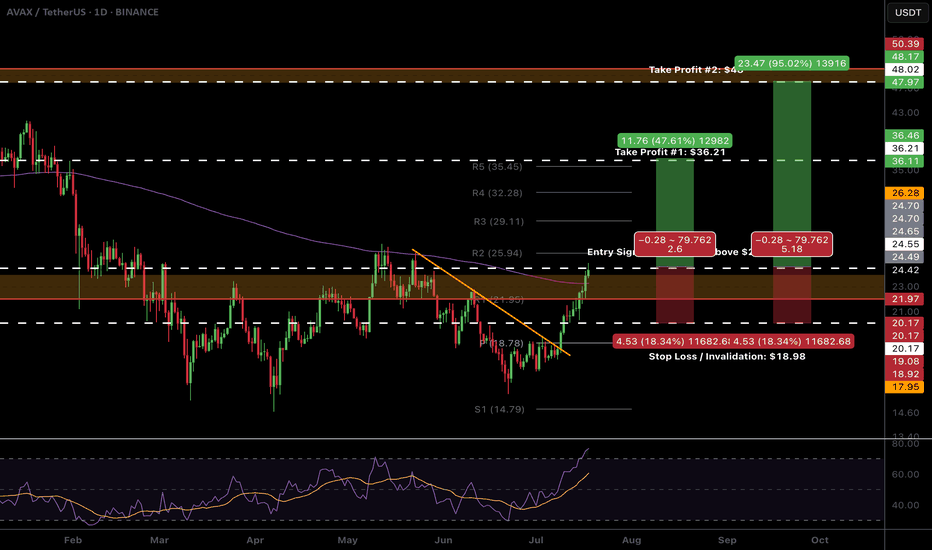

$AVAX Ready to breakout!CRYPTOCAP:AVAX looks ready to pop.

High Volume Node resistance and daily 200EMA is clear and now support. We don't want to see price rejected and moving back below this area.

The R5 daily pivot is my first partial take profit $35-36 followed by the major resistance High Volume Node at $48

Daily RSI is overbought with unconfirmed bearish divergence so watch out for this but should be good to run in the mean time. BTC permitting...

Safe trading

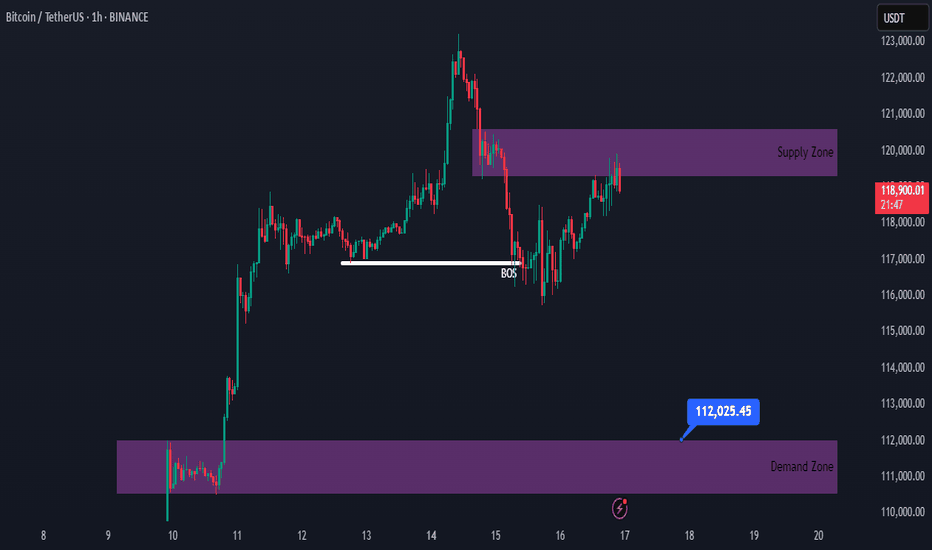

Bitcoin Bullish, but a Correction Might Be AheadHello traders!

Obviously, Bitcoin has a strong bullish momentum.

However, after noticing a minor shift in market structure, we may see a correction toward the 112,000 area.

If the supply area doesn’t break, we can look for a sell position here.

#BTC #Bitcoin

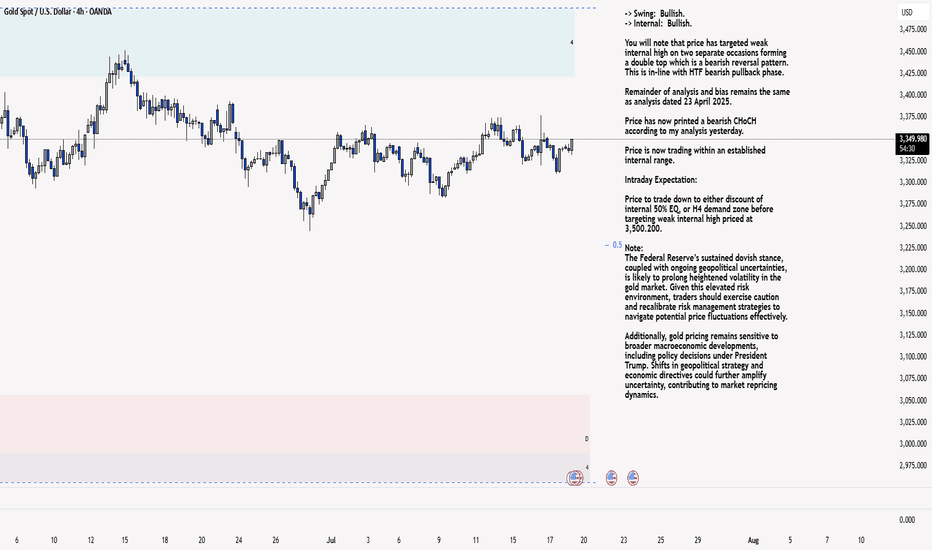

XAU/USD 18 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

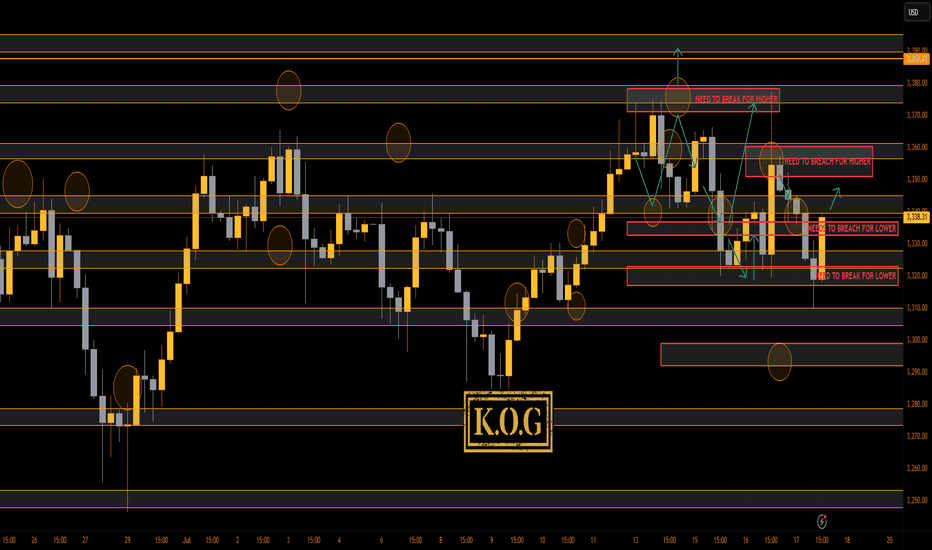

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Nice! Our idea from yesterday worked well giving the short trade into the level we wanted, to then break below the bias level and give us our 2 Gold Excalibur targets and 1 of our red box targets shared with the wider community. We suggested our traders watch the level of 3310 for a potential RIP, and that's exactly what we got upside.

Now, we have support at the 3330-27 level and resistance above at 3340-3. We have a red box above as well so we'll be waiting to see if the close is significant enough for us to target higher tomorrow! For now, keep an eye on the retracement into the 3335-2 level initially.

RED BOXES:

Break above 3335 for 3341, 3355, 3362, 3370 and 3376 in extension of the move

Break below 3320 for 3310✅, 3304, 3297 and 3294 in extension of the move

As always, trade safe.

KOG

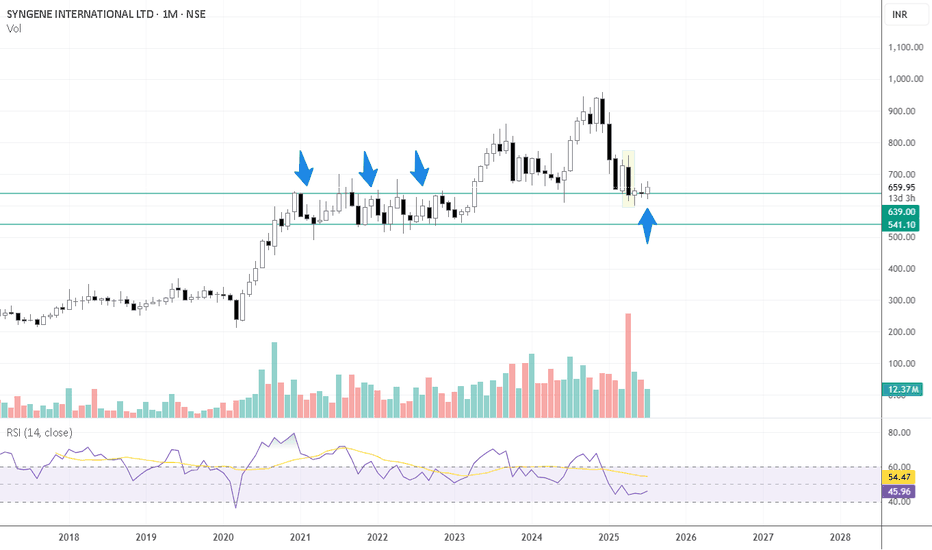

SYNGENE INTERNATIONAL LTD at Old Peaks Key Support 📈 Monthly Chart – Key Support at Old Peaks

The stock has recently revisited the ₹600–₹610 range, which corresponds to a previous consolidation and monthly swing-low zone (~₹607) from November 2020 to April 2023 on the monthly timeframe

This zone isn’t just another support level—it represents an area where price historically spent over 2.5 years, making multiple tests before breaking higher. Such zones often act as strong demand zones when revisited

A sustained hold above ₹607 would reinforce this support, signaling a potential base for a multi-month reversal or bounce

🕯️ April Monthly Candle – Selling Exhaustion?

Large bearish candle in April (FY25 Q4 results month).

High volume, which often signals capitulation or Selling climax.

Price has since stayed within the range of this candle-no breakout above or below.

Indicates a potential exhaustion of sellers if the stock holds above the low of that candle, this structure often represents a volatility compression after a sharp move-like a spring coiling.

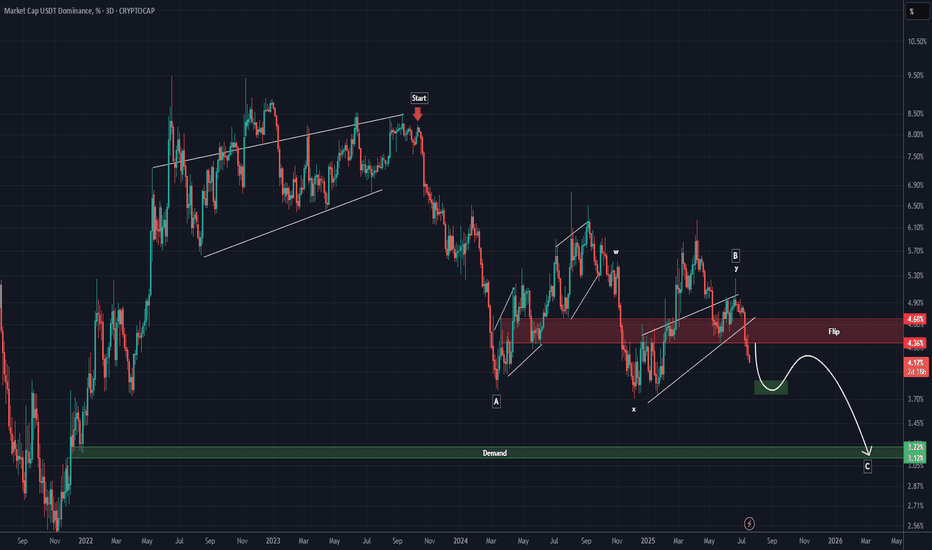

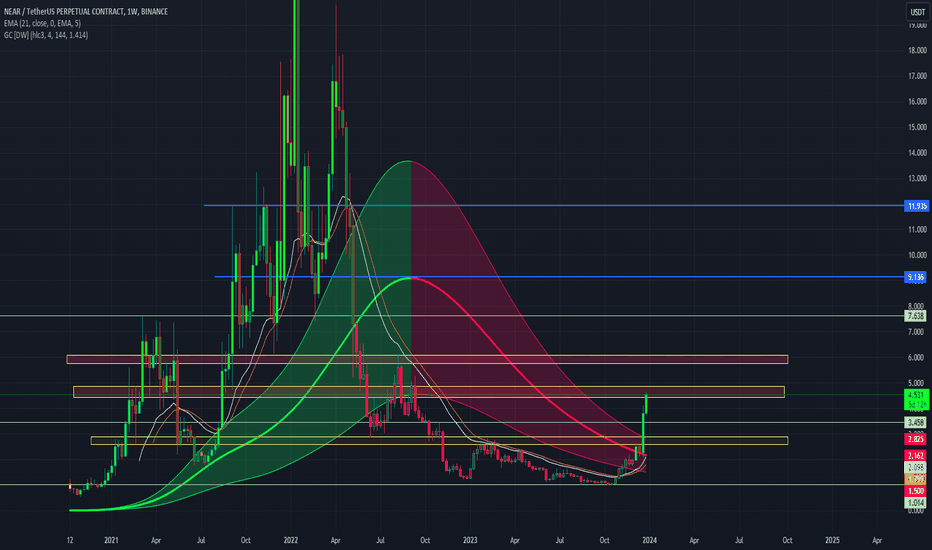

USDT Dominance Looks Really Bearish In Big TimeFrames (3D)Before anything else, pay close attention to the timeframe | it’s a high timeframe and will take time to play out.

From the point where we placed the red arrow on the chart, it seems that the correction of USDT dominance has begun on the higher timeframes.

After wave A completed, the price entered wave B, which formed a symmetrical pattern, followed by an X wave and then a triangle.

Now that the triangle appears to be complete, we seem to be in the bearish wave C of a larger degree.

It is expected that in the coming months, the price will reach the green zone.

Note that this is a high timeframe analysis, and the move will take time, with lots of fluctuations along the way.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

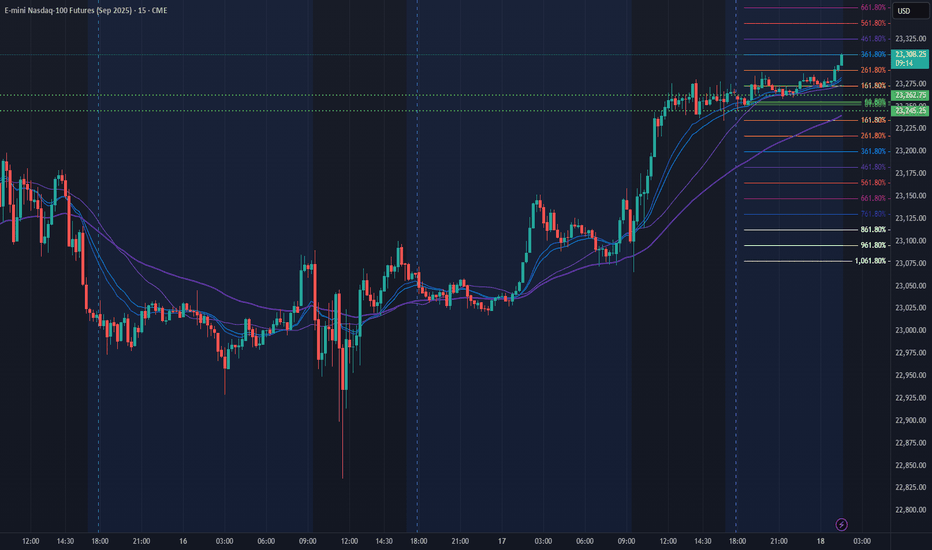

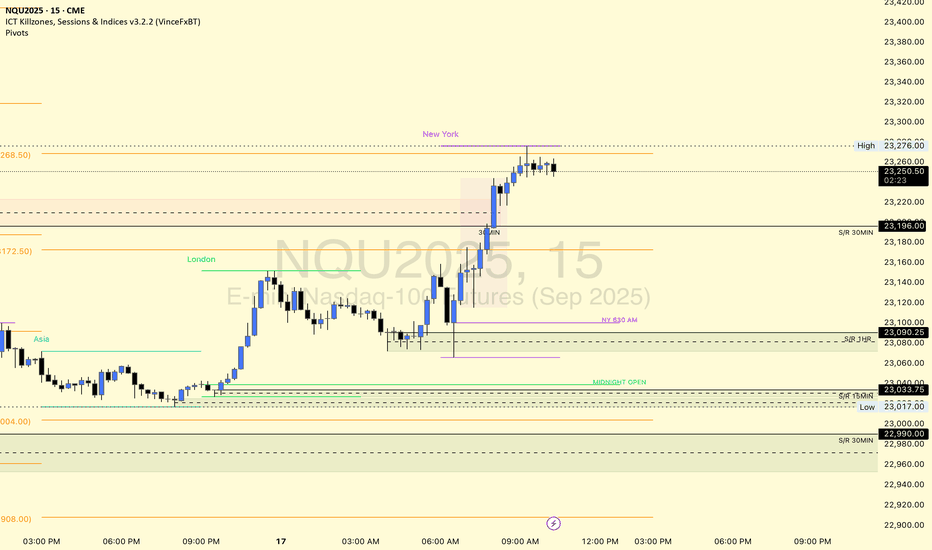

NQ Power Range Report with FIB Ext - 7/18/2025 SessionCME_MINI:NQU2025

- PR High: 23262.75

- PR Low: 23245.25

- NZ Spread: 39.0

No key scheduled economic events

Pushing ATH through overnight hours

Session Open Stats (As of 1:15 AM 7/18)

- Session Open ATR: 272.56

- Volume: 18K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

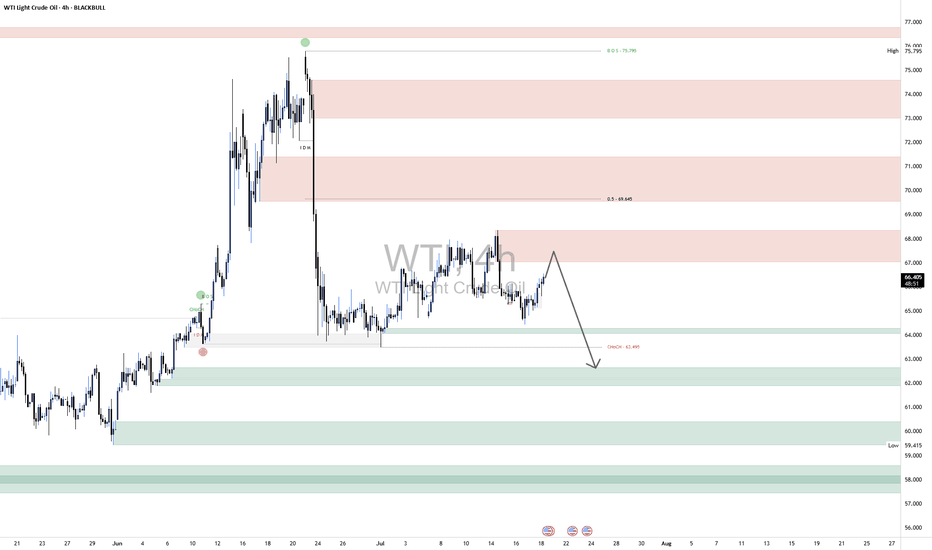

WTI Crude Oil ShortWTI Crude Oil – Technical & Macro Outlook

🔻 1. Supply Zone Rejection Expected (66.50–68.00 Range)

Price is currently approaching a newly established supply zone between $66.50 and $68.00, which coincides with a prior consolidation area that preceded the recent sharp sell-off. This confluence enhances the zone’s relevance, especially given its position just below the 0.5 Fibonacci retracement level (~$69.47), derived from the swing high at $75.79 to the swing low.

📌 Outlook:

This region is expected to act as a high-probability rejection zone, likely attracting institutional sell-side interest. Price action within this zone should be monitored for signs of weakness or distribution.

📉 2. Downside Target: $61.50–$63.00 Demand Cluster

Should the supply zone hold, downside momentum could drive WTI toward the $61.50–$63.00 demand range. This area is technically significant, supported by the following factors:

Previous Change of Character (ChoCH) at $63.49, which marked the beginning of the recent bullish correction and represents a key structural pivot.

Presence of stacked demand zones below $64, increasing the likelihood of a meaningful reaction from buyers.

📌 Outlook:

This zone is expected to attract strong buying interest, making it a short-term profit-taking region for bears and a potential entry point for swing long setups, depending on confirmation.

🌍 Geopolitical Risk Landscape & Supply Dynamics

Recent geopolitical developments continue to influence crude oil pricing dynamics:

Middle East instability (e.g., Iraqi disruptions and ceasefire delays) has led to tightened supply conditions, pushing WTI above $67.

Persistent uncertainty stemming from Iranian nuclear negotiations, ongoing U.S.–China tariff risks, and regional tensions contributes to a sustained risk premium.

While OPEC+ is incrementally increasing production, this is offset by rising Saudi exports and weakening demand forecasts, which may result in inventory builds by late 2025.

Russia’s export resilience—bolstered by strategic redirection toward Asia—suggests that any anticipated supply contraction could be less severe than expected.

🛢 WTI at $62 – Technical and Macro Implications

A decline to $62 would place WTI at a major technical support level, closely watched by institutional participants. If tested, the market could react in the following ways:

Bargain hunting and value-based buying may emerge, especially if macroeconomic data aligns with a recovery narrative.

Heightened volatility is likely, driven by sensitivity to any shifts in global risk sentiment—particularly those tied to trade policy, OPEC+ production surprises, or further geopolitical escalations.

📌 Summary

Resistance: $66.50–$68.00 (pre-breakdown supply + 0.5 Fib)

Support / Target: $61.50–$63.00 (demand + structural ChoCH)

Bias: Short-term bearish toward demand, with high reactivity expected near $62

Risk Factors: Elevated geopolitical uncertainty and diverging supply dynamics across OPEC+, Russia, and the U.S.

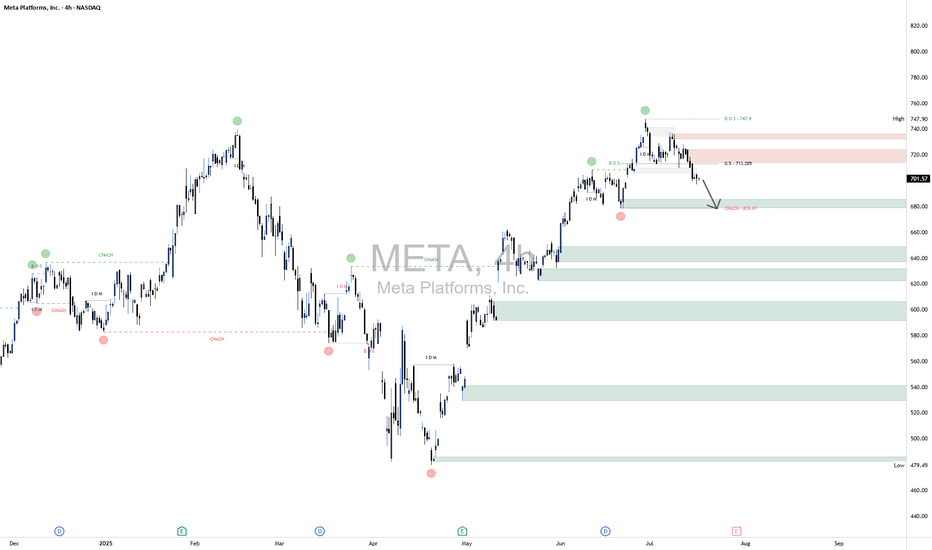

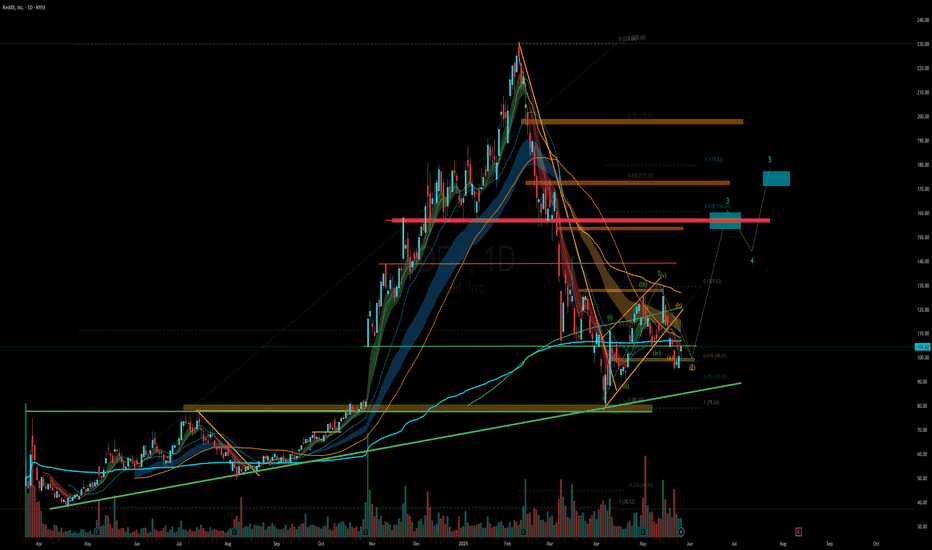

META Short📈 Scenario Outlook:

Bias: Bearish

Primary Expectation: Price is currently in a corrective decline and is expected to continue toward the 676.67 CHoCH level.

Bearish confirmation was seen upon rejection from the 713.20 mid-level, with price now printing lower highs and lower lows on the 4H chart.

This move may ultimately form a larger distribution pattern on the daily timeframe.

📌 Key Zones ("Your Borders"):

🔴 Mid-Supply Rejection Zone (Resistance)

Level: ~713.20 (50% equilibrium of last bearish swing)

This level acted as the midpoint during the retracement following the initial selloff from the top.

The market respected this region as a mid-range rejection, further reinforcing bearish momentum.

Failure to reclaim this level confirms bearish dominance in the short-to-medium term.

⚪ Target Zone / CHoCH Demand Test

Zone: 676.67 (CHoCH)

This is your projected draw on liquidity and primary downside target. It marks a structurally significant low where prior bullish order flow initiated.

If this level fails to hold, META may shift into a broader corrective phase, potentially unwinding a large portion of the prior rally.

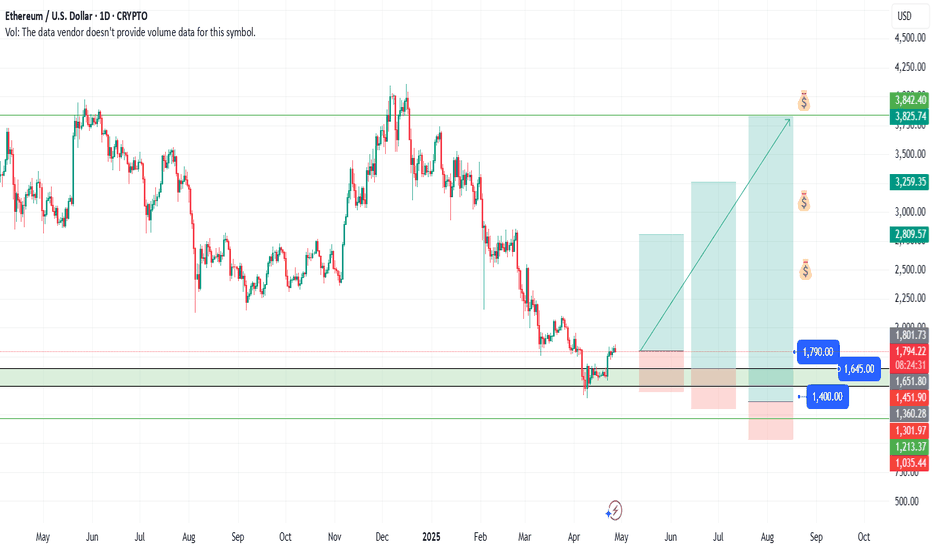

Ethereum (ETH) – Strategic Trade PlanEthereum (ETH) continues to show resilience, currently trading around $1,790 after a strong bounce earlier this month. While the crypto market remains volatile, ETH is holding key technical levels that could fuel a major move in the coming weeks.

🎯 Entry Points:

Market Price: $1,790 — Ideal for an early position, as ETH holds above critical support zones.

$1,645 — Secondary strong support, aligning with the 20-day EMA; great for scaling in if market pulls back.

$1,400 — Deep value zone, offering a high-risk/high-reward setup if broader market correction occurs.

💰 Profit Targets:

$2,500 — First major resistance. A realistic mid-term target if bullish momentum sustains.

$3,000 — Psychological milestone and breakout confirmation level.

$3,800+ — Ambitious but achievable with broader crypto market recovery and strong ETH network metrics.

🛡️ Risk Management:

Set stop-losses dynamically below each entry support level.

Scale into positions progressively to manage volatility.

Monitor macroeconomic trends and Bitcoin's influence closely.

🔍 Key Observations:

Strong on-chain activity supports a bullish thesis.

Current resistance around $1,812 must be broken to confirm bullish continuation.

Be cautious of sudden market-wide corrections — always plan your exits and manage your risk accordingly.

📢 Disclaimer: This is not financial advice. Trading cryptocurrencies involves significant risk, and you should only invest what you can afford to lose. Always perform your own research before entering any position.

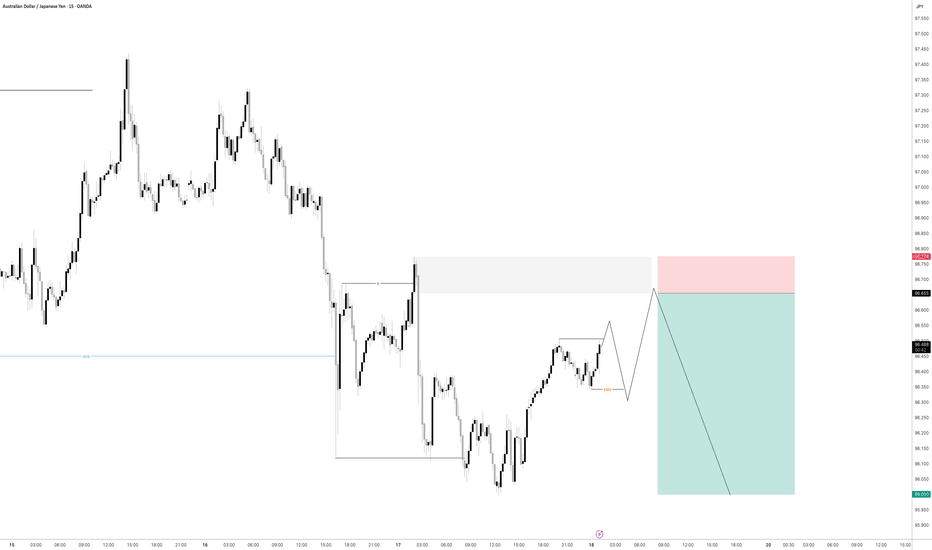

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

$NQ Supply and Demand Zones - All Time High! 7/17/25This chart is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ only.

We recently hit ATH this AM session and now price is accumulating and we are waiting to see what it wants to do next. Continue to hold support at ATH before we breakout higher, or break below and close below ATH support for a retest lower?

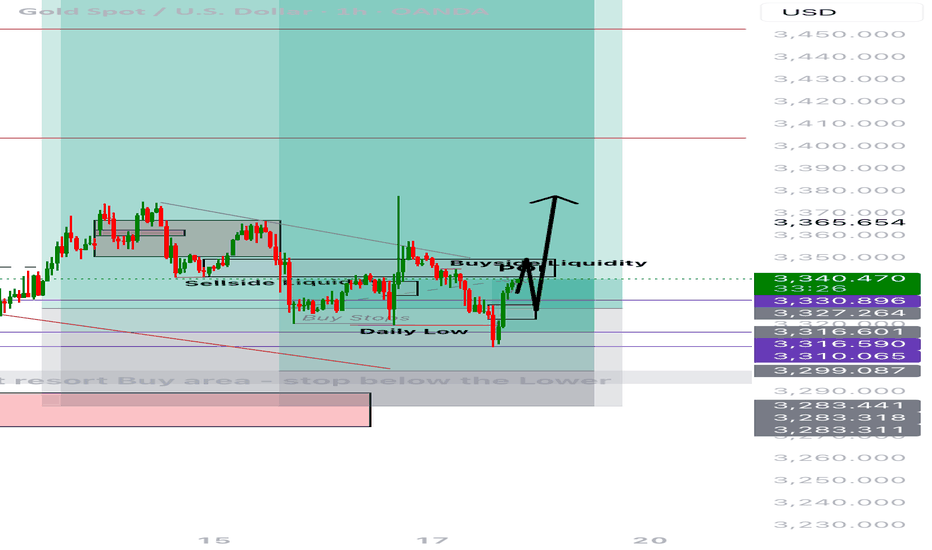

Re-attempt to buy?Trade Journal Entry – XAUUSD (Gold Spot)

Date: July 17, 2025

Platform: TradingView (Demo Account)

Timeframe: 1H/4H

Direction: Long Bias

Status: Stopped Out – Awaiting New Setup

Result of Last Trade: +£33

New Plan: Wait for buy opportunity in Asian or London session

Previous Trade Outcome

Entry was valid at POI based on bullish setup logic.

Trade failed to break structure to the upside convincingly.

Stop-out occurred after price pushed below mitigation zone (~3,316).

However, due to early partials and trade management, the result was a net profit of £33.

Updated Outlook

Price has rebounded aggressively from just below Daily Low.

Current price near 3,339.305 — strong push back into prior structure.

Buyside liquidity and POI overhead acting as short-term magnet.

Ideal pathing (marked with black arrows):

→ Sweep POI

→ Retest structure (likely near 3,327–3,330)

→ Continuation toward 3,365+, targeting liquidity void above.

Entry Plan

Await price to revisit POI, potentially after liquidity run.

Ideal confirmation setup:

- SFP or bullish engulfing on M15–H1

- Volume divergence or re-accumulation pattern

Target entry during Asian or early London session when liquidity is typically engineered.

Management Approach

- Keep risk tight on re-entry (0.5% max risk)

- SL below new HL formed during retest

- TP: 3,365 / extended 3,380–3,390 depending on session follow-through

- If no clean retest, skip trade — don’t chase

Emotional Reflection

Felt more in control than previous attempts. Took the stop like a professional.

No revenge trades — staying focused on structure and quality.

Grateful that proper risk management led to a small win despite being stopped out.

Reflection Questions

- Did I adjust my expectations quickly once structure failed?

- Am I giving the market enough space and time to form clean entries?

- Will I stay patient for session-specific setups?

GBPCAD – Key Level, Buy Setup & Dual StrategyRight now, price is sitting on a major level.

📌 If a valid buy signal shows up, I’ll enter a long position.

But that’s not all…

🔁 If price reaches the next resistance level, I’ll:

Hold my long position

Open a short position there

This way: ✅ If price reverses → my long trade is closed by trailing stop

✅ And my short trade runs into profit

→ I profit both from below and above

⚠️ If my short trade’s SL hits, no worries —

My long is still open and growing in profit.

📈 But if the resistance breaks and we get a pullback,

➡️ I’ll activate pyramiding and build more position with zero added risk.

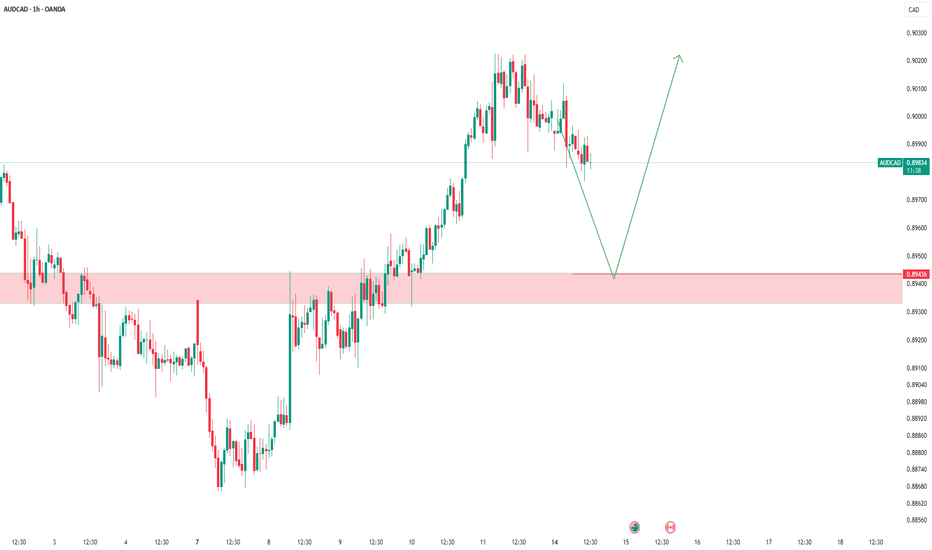

AUDCAD - Possible Buy Setup AheadThe market is approaching a significant zone.

We’re standing by — no rush, no guessing.

If a clean bullish signal appears, we go long.

If it breaks through, we wait for a pullback and adapt.

Our job isn’t prediction — it’s reaction.

Follow the plan. Let the profits take care of themselves