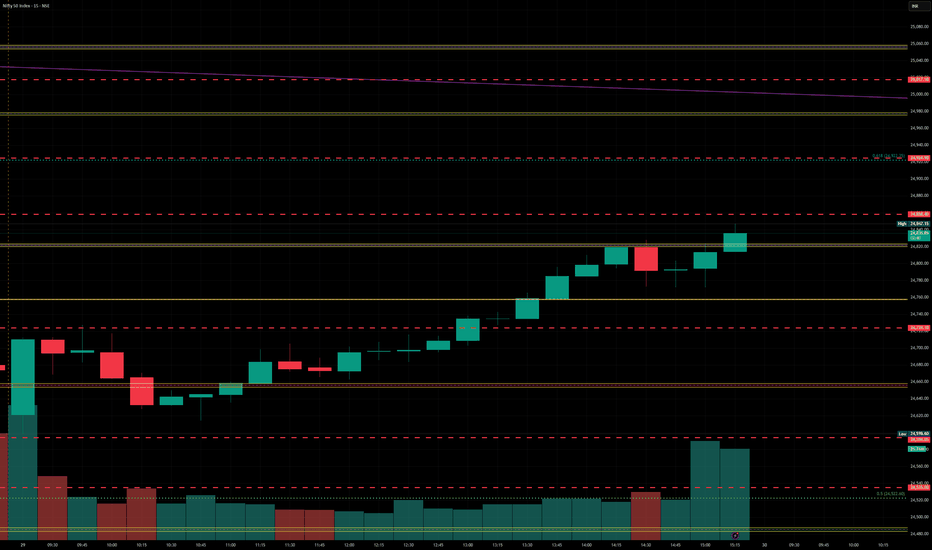

Nifty levels - Jul 30, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Supply and Demand

EURCAD 1H longEURCAD 1 H made a beatiful sharp drop, now stalling arround some good support levels.

When such a drop happens with no pullback formed yet I'm happy to buy the way down.

Because the pullback has to come soon buyers step in at the support levels.

My plan is simple I open a manual grid at the support levels I draw and aim for a 2R profit

Current grid 3 levels

1 market order

2 buy limits

Tp 2R

extra confirmation RSI is oversold

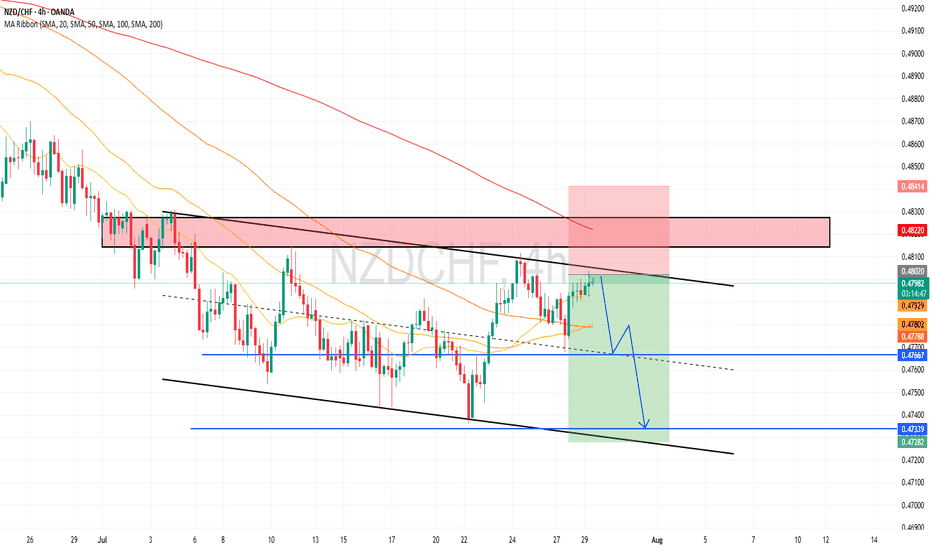

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

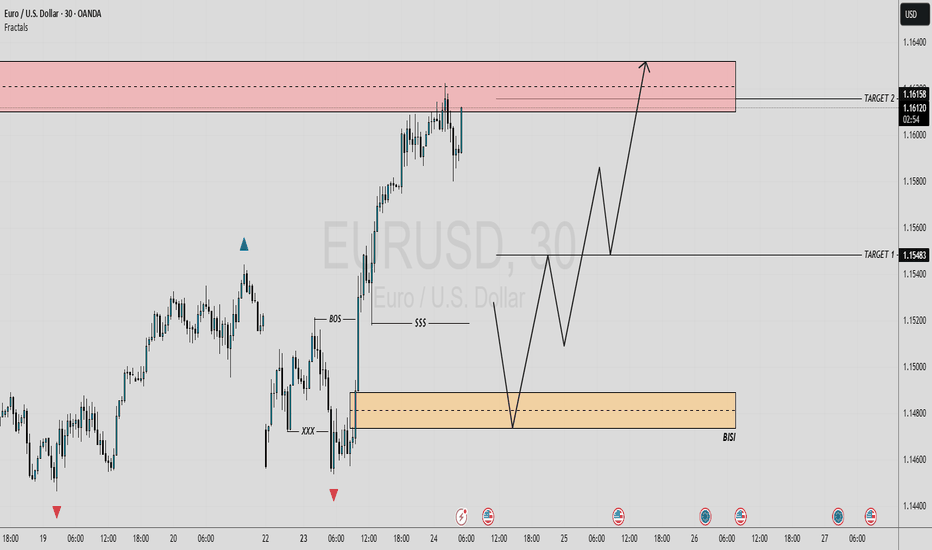

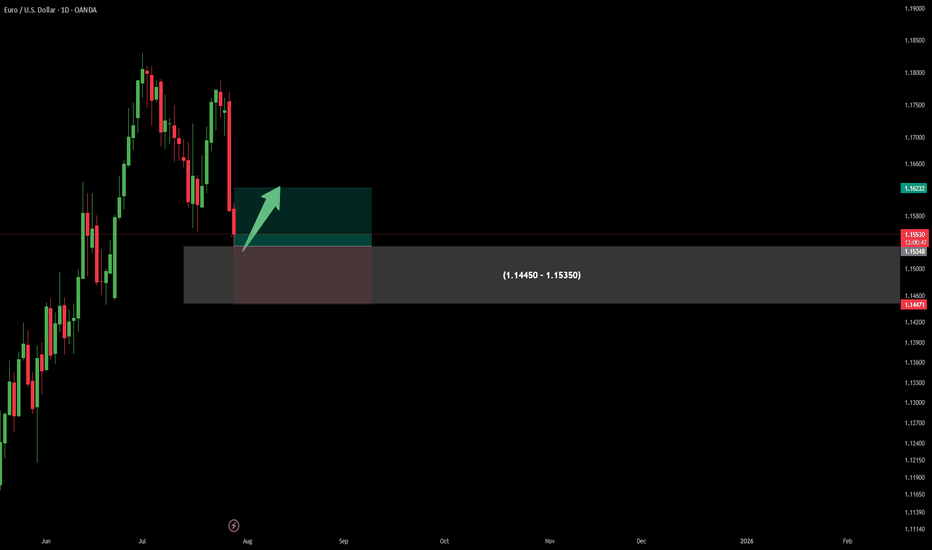

EUR/USD 30-MIN ANALYSISThis EURUSD setup showcases a clean bullish continuation scenario following a confirmed Break of Structure (BOS) and a sharp rally driven by momentum and liquidity imbalance.

After sweeping a key low (XXX), price impulsively broke structure to the upside, confirming a potential shift in market intent. A retracement is now expected to mitigate the Buy-Side Imbalance (BISI) zone.

BOS & SSS (Short-Term Structural Shift): Confirmed bullish intent.

Imbalance (BISI): Price left behind an unfilled imbalance zone a likely magnet for a pullback.

Re-Entry Zone: (BISI) provides a high probability area for long re-entry.

Upside Targets:

Target 1: 1.15483 – intermediate structural level.

Target 2: 1.16158 – premium supply / liquidity target.

#EURUSD 30M Technical Analysis Expected Move.

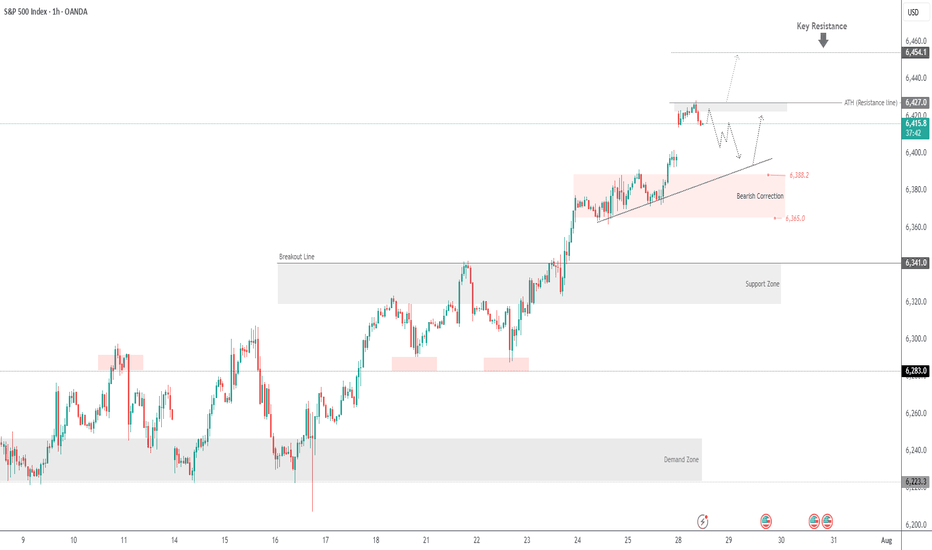

SPX500 Correction Before Rally? Key Levels in FocusSPX500 Correction Before Rally? Key Levels in FocusSPX500 OVERVIEW

Fundamental Context:

The U.S. and EU have averted a tariff standoff. The agreement reduces the baseline tariff on most European imports to 15%, down from the previously threatened 30% by the Trump administration. In return, the EU has committed to investing approximately $600 billion in the U.S.

Additionally, U.S.–China trade talks are ongoing in Stockholm, with reports suggesting a possible 90-day extension to the tariff deadline.

Technical Outlook:

SPX500 maintains a bullish bias due to easing trade tensions. However, as long as the price trades below 6421, a short-term correction toward 6397 and 6388 is likely. A rebound is expected if the price stabilizes above 6388.

🔺 Bullish Continuation will be confirmed if a 1H candle closes above 6427, potentially targeting 6454 and 6470.

Key Levels

• Support: 6397 – 6388 – 6365

• Resistance: 6454 – 6470

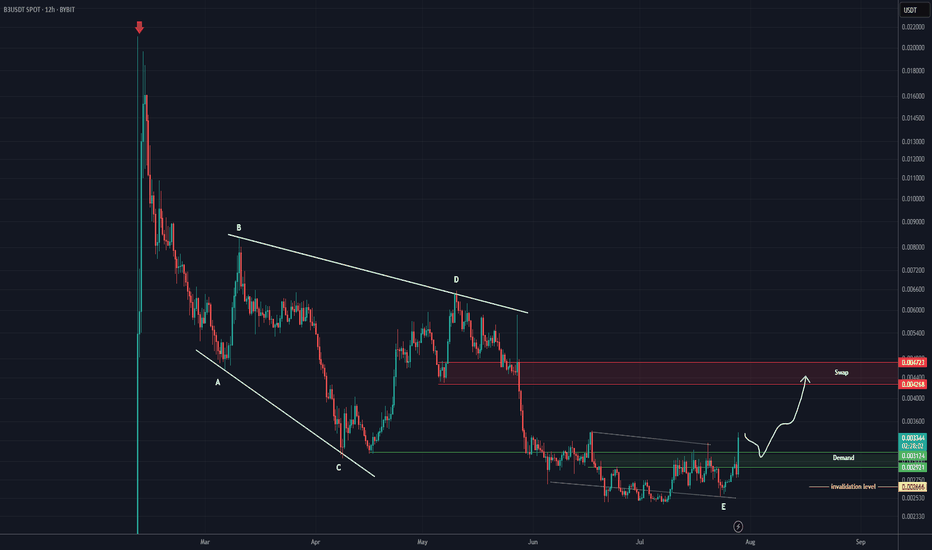

B3 Analysis (12H)From the point where the red arrow is placed on the chart, the B3 correction has started. It appears we have an expanding/diagonal/symmetrical triangle, and wave E now seems to be complete.

As long as the green zone holds, the price could move toward the red box, which is a swap zone.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

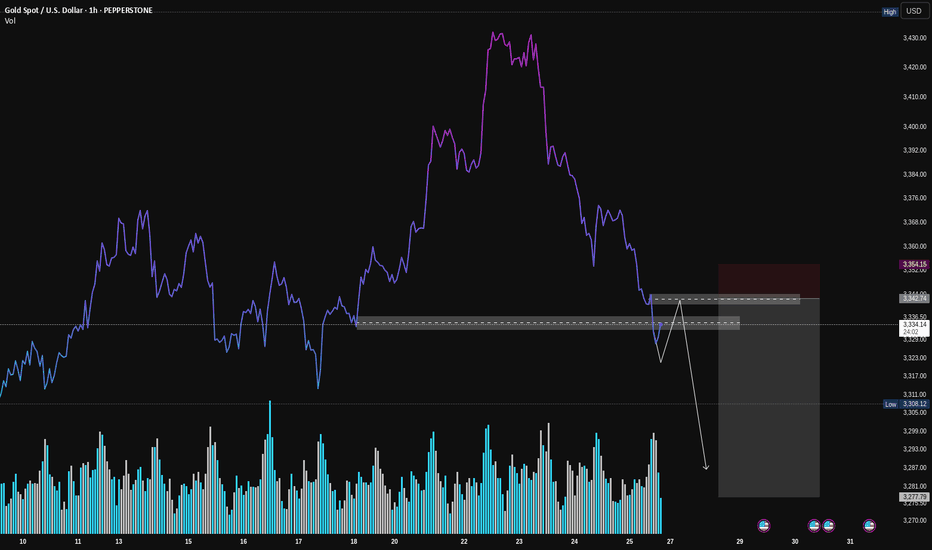

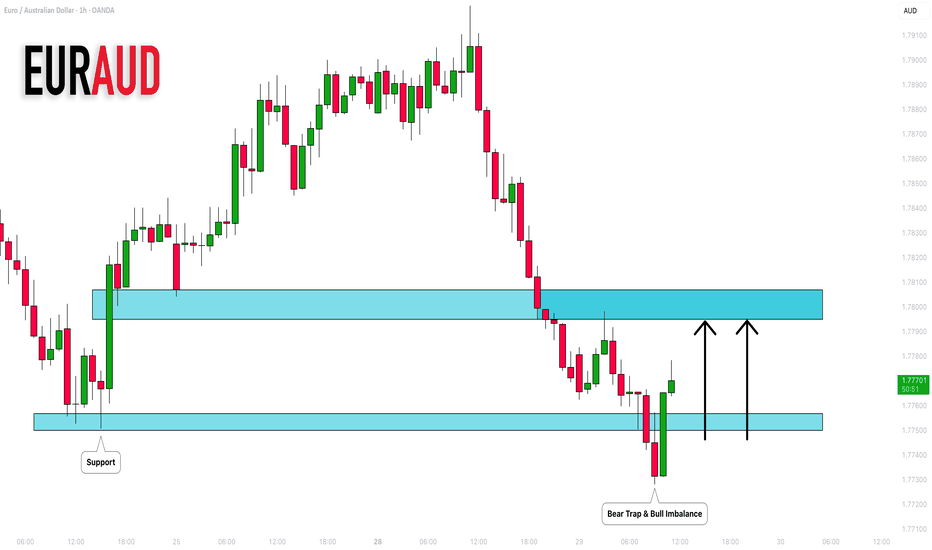

Gold (XAU/USD): A Classic VSA Short Setup in PlayHey Traders,

Following up on the general weakness we discussed in Gold, here's a closer look at a specific trade setup that's unfolding right now. This is a textbook example of a high-probability short setup according to Volume Spread Analysis (VSA).

Let's break down the story the volume is telling us.

1. The Breakdown: Sellers Show Their Hand

First, look at how the price broke down hard through that support level (the grey box). Notice the volume on that sharp drop? It was high. This is our clue that sellers are strong and in control. They had enough power to smash right through a level that was previously holding the price up.

2. The Retest: Buyers Don't Show Up

Now, the price is creeping back up to that same exact level. But here's the most important clue: look at the volume on this rally. It's much lower than the volume on the breakdown.

This is what VSA calls a "No Demand" rally. It’s like the market is trying to push a car uphill without any gas. It tells us that strong buyers (the "smart money") have no interest in buying at these prices.

3. The Setup: Selling into Weakness

This combination creates a classic short setup:

Logic: We are looking to sell at a level where old support has flipped into new resistance.

Confirmation: The low volume on the retest confirms the rally is weak and likely to fail.

How to Potentially Trade It

The grey box represents a high-probability entry zone. To time an entry, you could watch for a clear rejection signal right inside this zone. For example:

A "rejection candle" (like a pin bar) that pushes into the zone but gets slammed back down.

An up-bar with a tiny body and very low volume, showing buyers are completely exhausted.

Seeing one of these signs would be the final confirmation that sellers are about to take back control.

Conclusion:

This is a powerful setup because all the pieces line up: the background is weak, sellers have shown their strength, and buyers are now showing no interest at a key resistance level.

Disclaimer: This is my personal analysis using VSA and is for educational purposes only. It is not financial advice. Always do your own research and manage your risk. Good luck, traders!

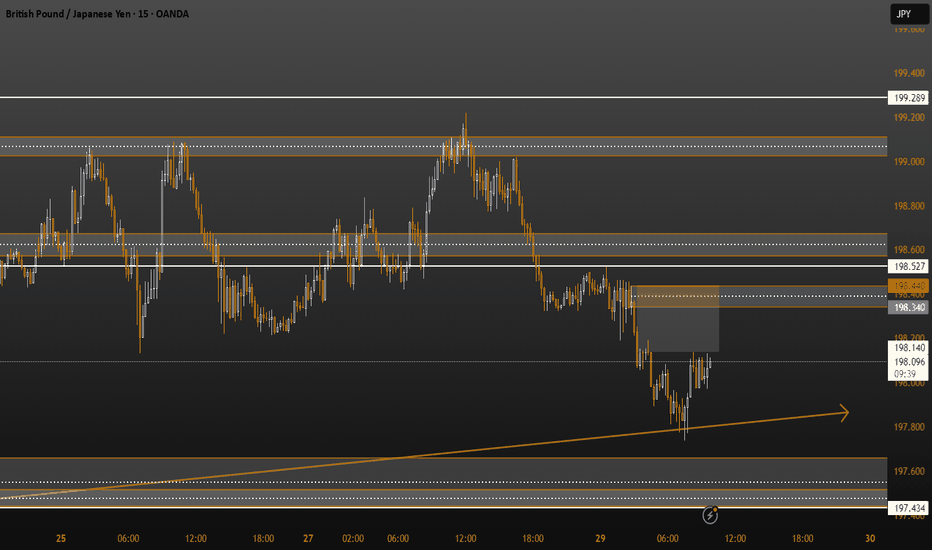

GJ SHORT (Scalp)I have a Supply zone lined at 198.345, found on the 15min. It also correlates with previous hourly resistance found towards the end of June.

I don't expect a massive falloff from this point so I'm just targeting at 1:2RR.

If extreme bearish momentum is to be found, I personally would wait for the unfilled gap at 199.500 to be filled first.

However, by the time you could consider a shift to bullish structure.

For now, I'm focusing on my 1:2 short today.

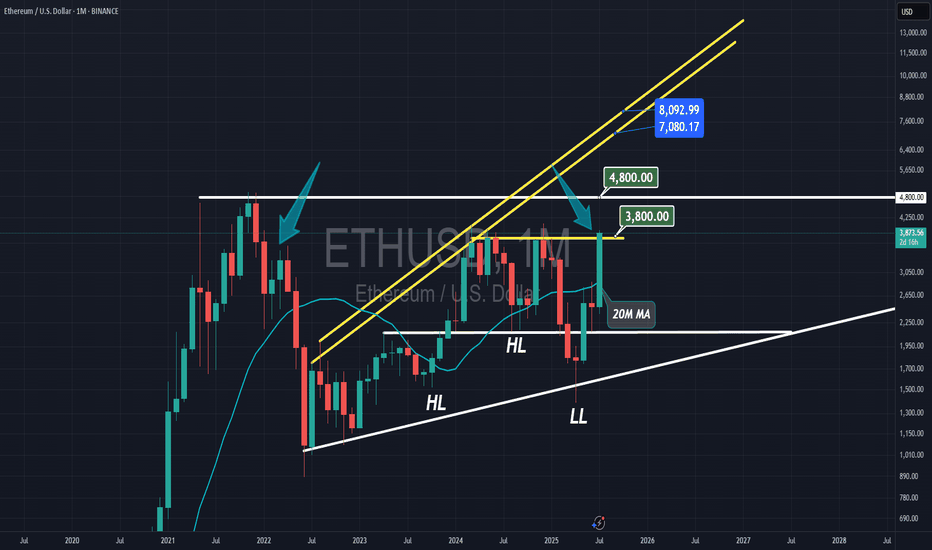

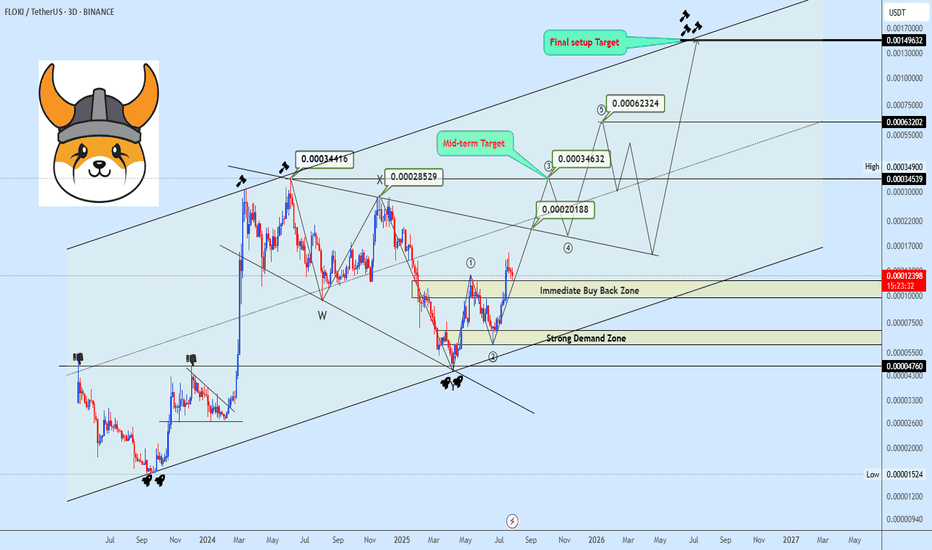

Wave 3 Loading? FLOKI Prepares for Potential Upside ContinuationFLOKIUSDT is trading within an ascending channel, recently rejecting from the upper boundary near $0.00034416. Price has since entered a prolonged consolidation phase, forming a descending broadening wedge.

The current focus remains on the $0.00020188 region; a breakout from this level would validate a potential wave 3 extension. Overall structure still targets a revisit to the channel’s upper boundary, supported by the recent bounce from the lower channel trendline.

Key levels and targets are illustrated on the chart.

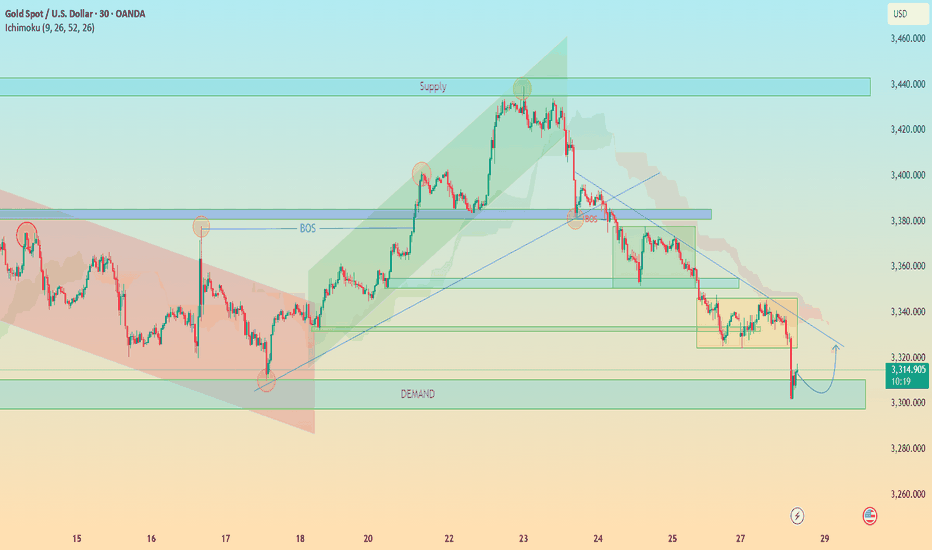

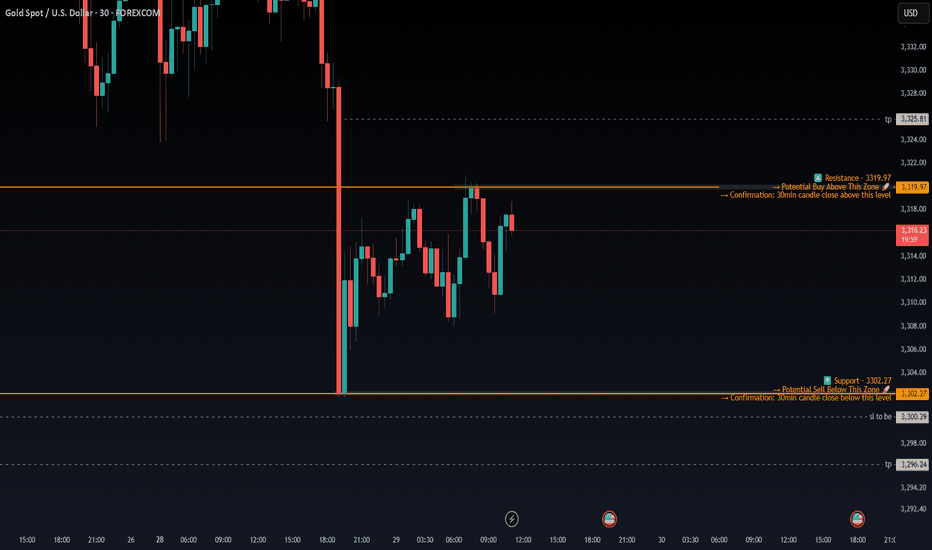

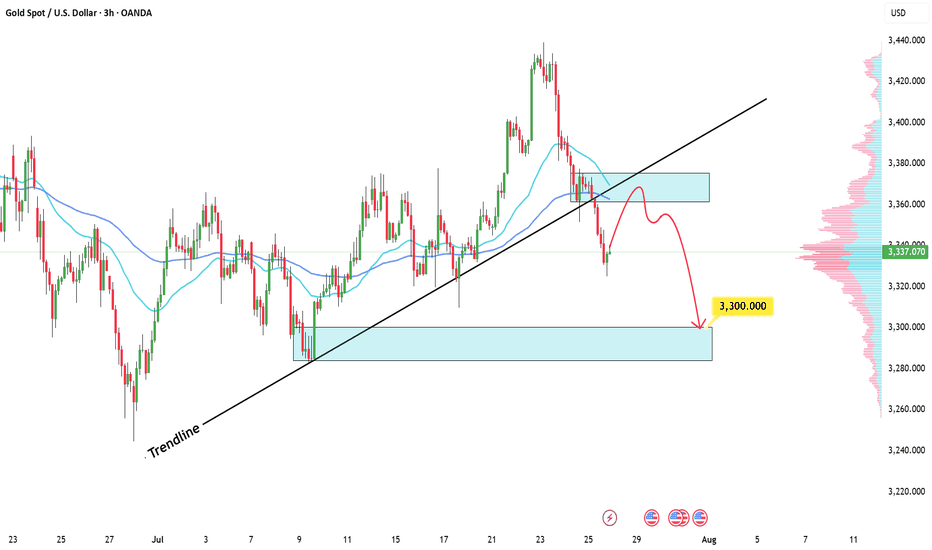

XAUUSD: Demand Rejection or Breakdown? All Eyes on 3,300 ZoneChart Analysis Breakdown (30m TF – Gold/USD)

1. Market Structure Overview

Bearish Trend Dominance:

The price has shifted into a bearish structure after a Break of Structure (BOS) to the downside, indicating bearish control after failing to sustain higher highs.

Lower Highs & Lower Lows:

A consistent formation of LHs and LLs confirms bearish momentum.

2. Key Zones & Reactions

🟩 Demand Zone (~3,300–3,310):

Current price is reacting from a clearly defined demand zone.

Strong buying wick indicates interest and potential short-term bounce.

This zone has historical significance — previous reversal point.

🟥 Supply Zone (~3,420–3,445):

Price reversed sharply from here.

This is a key liquidity zone; expect heavy resistance if price retraces.

🔵 BOS Areas Marked:

Confirmed transitions in structure:

Bullish BOS followed by a bearish BOS — great illustration of shift in control.

🟨 Consolidation Blocks:

Highlighted ranging periods show distribution/accumulation phases before breakouts.

3. Trendlines & Channel Patterns

📉 Descending Trendline:

Acts as dynamic resistance.

If price retraces to this level (around 3,330–3,340), expect potential rejection unless broken cleanly.

📈 Previous Bullish Channel (Broken):

Price moved out of a bullish ascending channel, confirming bearish intent.

4. Ichimoku Cloud Context

Price is below the Kumo cloud, suggesting bearish bias remains intact.

Future cloud is bearish.

However, short-term pullback into cloud possible (especially if demand zone holds).

📊 Forecast & Trade Idea

Scenario 1: Bullish Rejection from Demand

Price may bounce towards 3,340 (previous S/R + trendline retest).

Watch for reaction at this level.

Scenario 2: Clean Break of Demand Zone

Opens path toward deeper downside (e.g., 3,280 or even lower).

Could trigger liquidity grab before reversal.

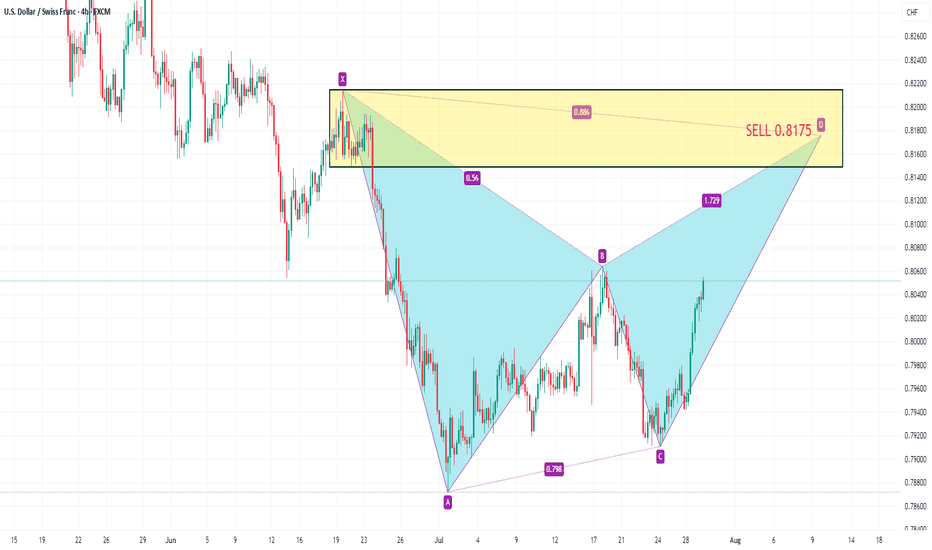

USDCHF SELL 0.8175On the 4-hour chart, USDCHF has stabilized and rebounded from its lows, forming a potential double bottom pattern in the short term. In the short term, USDCHF may continue to rise, with an upside target of around 0.8175, which is a potential short position for a bearish bat pattern and is within the previous supply zone.

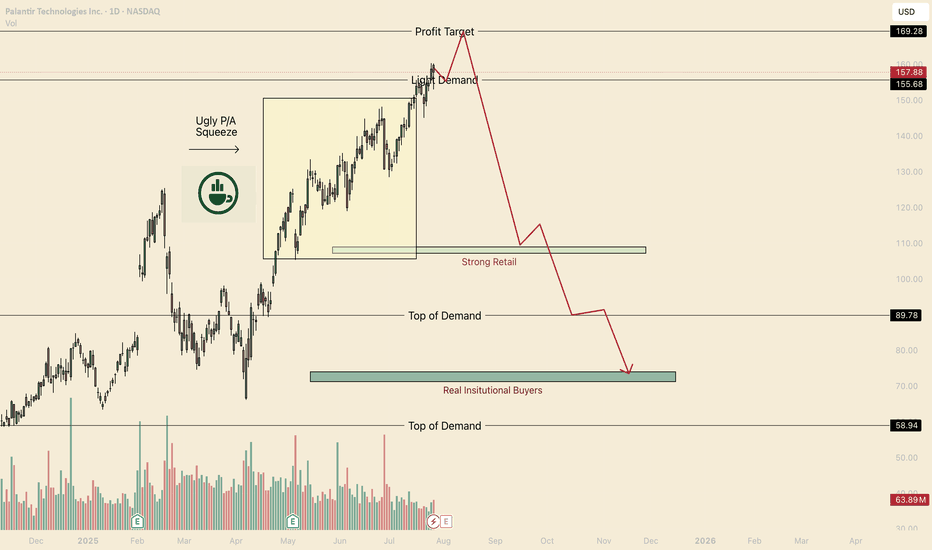

Hot Take, PLTR is a BubbleHello I am the Cafe Trader.

Price Action suggest we haven't had a proper buyer since $90.

Now I know that this can sound a bit off putting (especially if you bought above $90).

Even if this crashed, I am not suggesting you sell your long term position. I would instead look into hedging your position, giving yourself some exposure to the downside.

Consider these 2 non-biased reasons before writing me off.

Point 1

Price action suggests we have been in a short squeeze since April. Although in the short term I do see current retail buyers taking this to 169.

Point 2

If we do not land new Strong Buyer (someone that can support the price) all of this squeeze will come crashing back down to where they can support the price.

Conclusion

If we close below 152.50 on the day, this would suggest that bears have or are in control. This would expose many to tons of risk.

Here are my long Term prices for PLTR

Aggressive = 120

Fair = 107.50 - 108.50

Good = 89

Steal = 71-74.50

That's all for PLTR take a look at my other articles if you are interested in more!

Happy Trading!

@thecafetrader

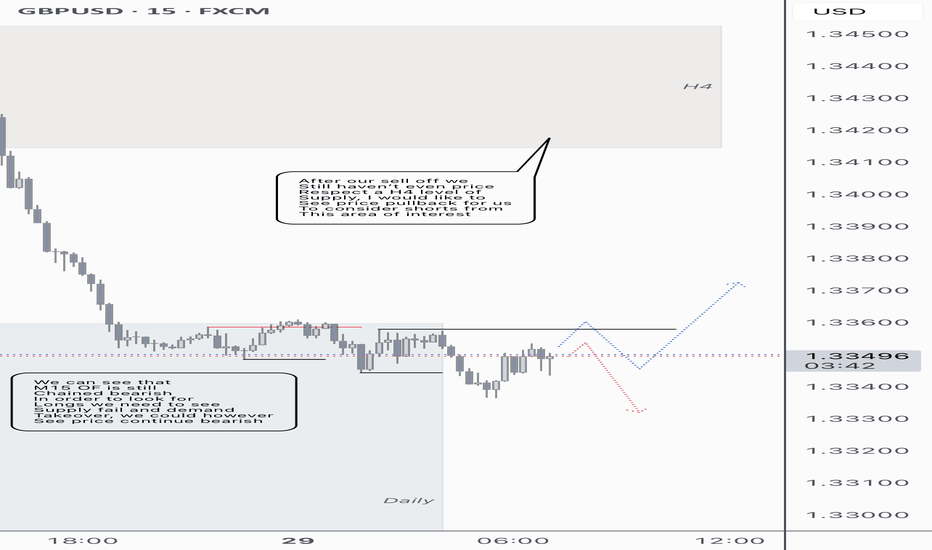

GU 29/08 H4 bearish M15 bearishWe are now within our daily demand zone after purging liquidity, after our sell off from silt supply we still haven’t seen price respect a H4 level of supply, I would like to see price pullback for us to consider shorts from this area of interest.

We can see that M15 OF is still chained bearish in order to look for longs we need to see supply fail and demand takeover, we could however see price continue bearish

I still see all structure as bearish so shouldn’t look for longs until we have out FLOR and bullish intention on the M15

XAUUSD (GOLD) - SCALPING IDEA🧠 Clean Price Action Outlook – Patience Until the Range Breaks

Currently, price is consolidating between 3319.97 (resistance) and 3302.27 (support) a well defined short-term range that’s been respected multiple times. Both levels are holding firmly, with wicks and reactions showing that buyers and sellers are actively defending these zones.

Right now, I'm not interested in trading inside this chop zone there's too much noise and no clear directional conviction. My focus is on waiting for price to break cleanly out of the range with confirmation.

📈 Bullish Scenario (Buy Plan):

If price breaks and closes above 3319.97 on the 30-minute timeframe, that would be the first sign of bullish strength. Ideally, I want to see:

A strong bullish candle close above 3319.97

Follow-through in the next candle (not a fakeout or wick trap)

Volume pickup or price holding above the level during retest

📍 If this happens, I’ll look to enter long trades on confirmation, with a potential target around 3325.81, which is the next minor resistance.

SL would ideally be placed just below the breakout candle or the breakout zone itself depending on the price structure at the time.

📉 Bearish Scenario (Sell Plan):

On the flip side, if price breaks down below 3302.27 and closes below it on the 30-minute chart, that opens the door for shorts.

Here’s what I want to see:

A full candle body close below the level (not just a wick spike)

Possibly a retest + rejection of 3302.27 from below

Weak price action around the level confirming sellers are in control

If that plays out, I’ll consider short entries with an SL above the structure (around 3304+), and a first target around 3296.00, where there’s minor demand.

⚠️ Until Then – No Trade Zone

Until we get a confirmed breakout, I’m staying out. No point guessing which side will win the market will show us.

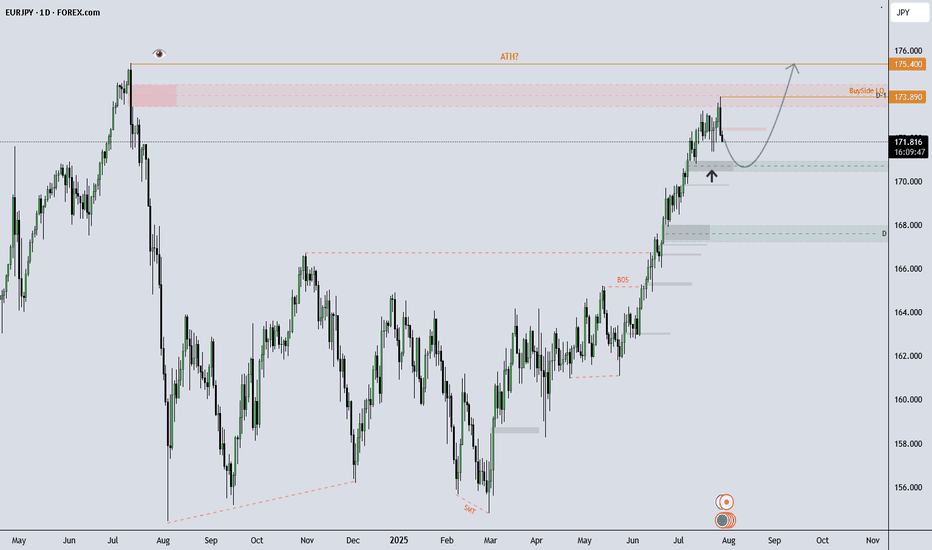

EURJPY Eyes New Highs After Pullback?What I see!

EURJPY Technical Outlook –

EURJPY remains in a strong uptrend and recently tapped into buy-side liquidity at 173.89, which now marks the All-Time High (ATH). After a brief rejection from that level, price is currently showing signs of a healthy pullback.

I’m observing the 170.00–171.00 zone, which aligns with previous demand. If price continues to respect this area, the overall bullish structure remains intact, with potential for a move back toward (and possibly beyond) the ATH.

A sustained break below 170.00 could indicate room for a deeper pullback, potentially toward the 168.00s, which would be a key area to monitor.

This analysis is shared for educational and discussion purposes only.

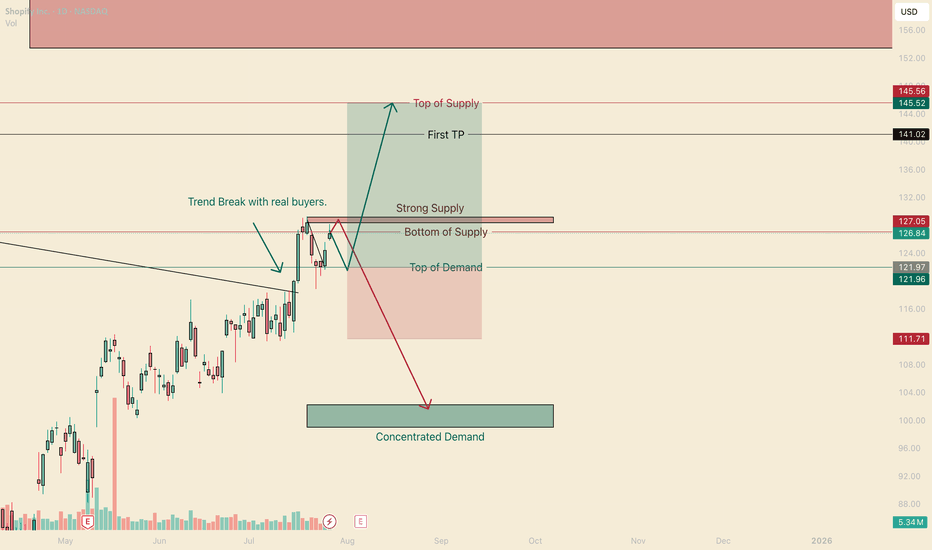

SHOP has one more seller to BuyHello I am the Cafe Trader.

Today we are going to be looking at Shopify, Thanks to a request from a follower.

Couple things to note here. This is a Massive range for a decent stock.

With a bottom of 23.61, and a high of 176.34 some may wonder if we might see some more downside before testing the highs (rightfully so).

Today we are going to look at some long term prices I think are suitable for your personal risk tolerance. as well as two possible short term scenarios and how you can navigate them.

Enough talking let's get into the charts.

Long Term

These prices are chosen from current market participants. I've measured them in order of your own conviction.

Aggressive = 122 (Top of Demand)

Fair Price = 99-102 (Concentrated demand)

Steal = 70-81 (Top of Strong Buyers)

Short Term

I'm going to be honest here, I don't particularly like the positioning of the range to go long here. That Strong Supply area is still very active, and we may have to hit that concentrated demand before having enough strength to get through that supply.

As this stands though, Bulls are in control. We have that trend break with real buyers, this is looking to hit top of supply in it's current context.

If at all we close above that strong supply (especially on friday) This is a great case to have a continuation.

If we cannot get above this strong supply after a test or two more, this is going to put pressure on the buyers.

Green Scenario

Entry 122

Stop 111.50

1st TP 141

Final TP 145.50

Red Scenario

If bulls make a big push and fail back below the strong supply, Bulls will be trapped, and This will put alot of pressure on the "Top of Demand".

Entry = close of the candle that is the false breakout.

Stop = Depends on how big the wick was on the false breakout. I'll assume about 131.50. but if its a huge wick, it will need to be higher. I'll update this depending.

1st TP = 106

Final = 102.5

That's all for SHOP Stay tuned for updates and more charts!

Happy Trading!

@thecafetrader

@livelclark

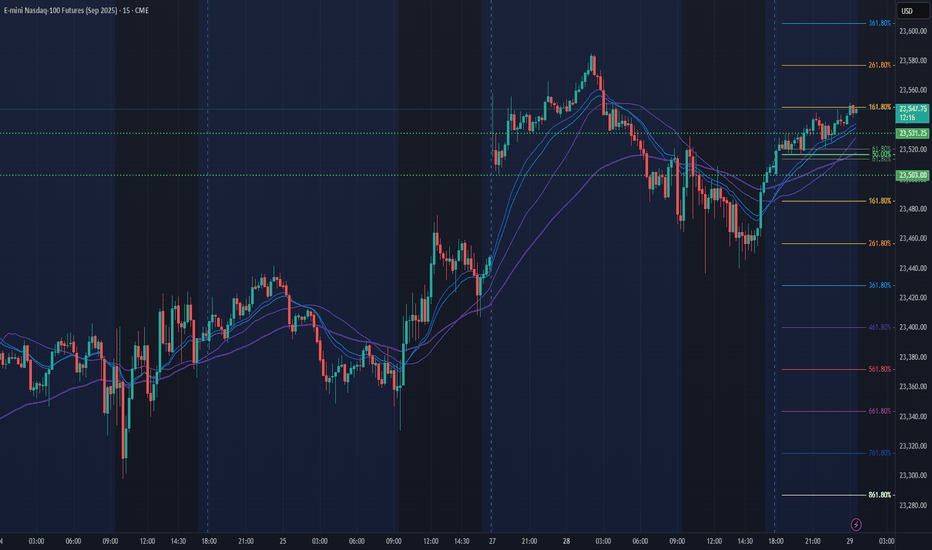

NQ Power Range Report with FIB Ext - 7/29/2025 SessionCME_MINI:NQU2025

- PR High: 23531.00

- PR Low: 23503.00

- NZ Spread: 62.5

Key scheduled economic events:

10:00 | CB Consumer Confidence

- JOLTs Job Openings

Session Open Stats (As of 12:25 AM 7/29)

- Session Open ATR: 233.38

- Volume: 17K

- Open Int: 280K

- Trend Grade: Long

- From BA ATH: -0.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

XAUUSD: Bearish Bias SetupI am watching for a possible reversal in XAUUSD, predicting a rejection with a downside target around 3.300.

This downside target is reasonable based on this setup, as it is based on a previous bullish move, from which price could find support and bounce, or break below, and the downside momentum could start to continue down.

I am just sharing my thoughts on the chart, this is not financial advice. Always confirm your setup and manage your risk accordingly.