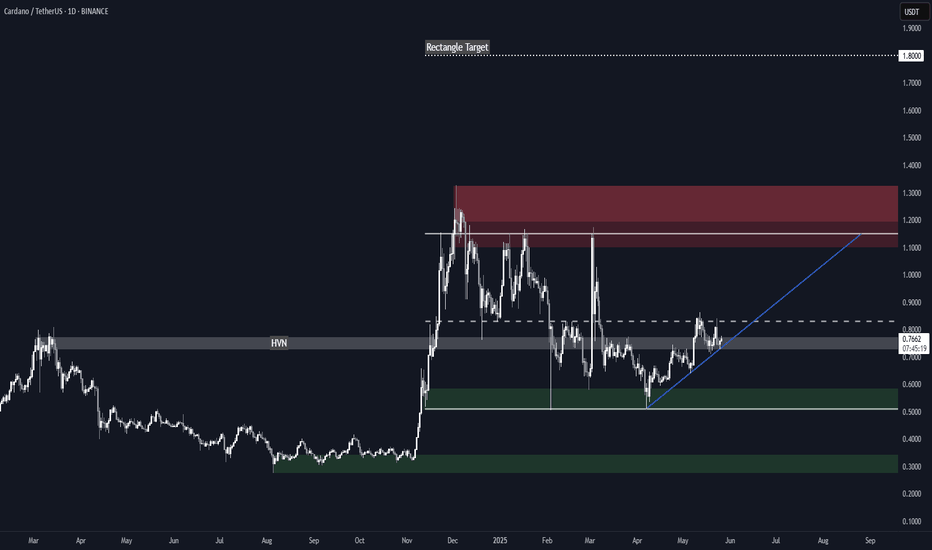

Cardano (ADA) Rectangle + Internal Uptrend (1D)BINANCE:ADAUSDT has spent months ranging between ~$0.51 and ~$1.15, and the structure now clearly qualifies as a rectangle pattern.

After a 3rd touch on support in April, Cardano is showing strength with steady higher lows and a reclaim of a key High Volume Node (HVN).

Key Levels to Watch

• Main Demand: ~$0.51-$0.58

• Rectangle Support: ~$0.51

• Rectangle Resistance: ~$1.15

• Internal Uptrend Support: Rising diagonal from April

• HVN Zone: ~$0.75 — key volume cluster

• Rectangle Midline: ~$0.83 — also a previous S/R

• Main Supply: $1.10–$1.32

Measured Target

If price breaks above $1.15 with volume, the rectangle measured move points to ~$1.80.

Context

ADA has respected this range for nearly half a year. A breakout could mark the start of a macro bullish leg.

Triggers

• Bullish: Clean daily close above $1.15 with volume → $1.80 target activated. For a safer entry, it could be worth waiting a full breakout from the main supply above $1.32.

• Bearish: Breakdown of the ascending trendline and HVN → Potential return to ~$0.51. Failure to hold that level could lead to further downside to the previous ~$0.30 demand zone.

Supply Zone

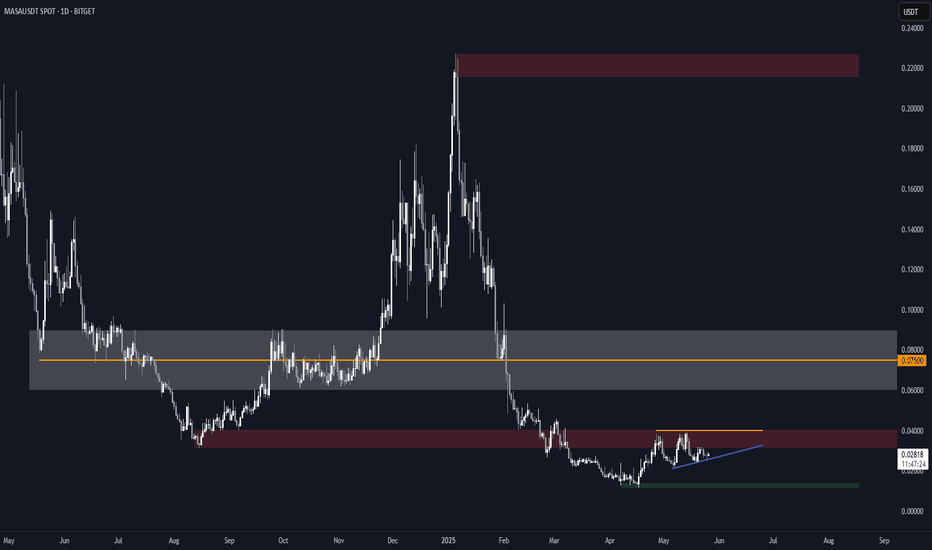

MASA Ascending Triangle (1D) + Key LevelsBITGET:MASAUSDT is currently forming an ascending triangle on the daily chart, with horizontal resistance around $0.040 and rising support.

This structure typically leans bullish and suggests accumulation under resistance.

Structure & Zones

• Resistance: ~$0.040 (triangle top, within flipped demand → supply zone)

• Support: Rising diagonal since early May

• Demand: ~$0.013

• Main Supply: $0.06-$0.09 (High Volume Node, with $0.075 as a key S/R)

Breakout Target

A breakout with strong volume could trigger a measured move toward ~$0.060, aligning with the lower boundary of the High Volume Node (HVN) and the previous price cluster.

Context

The grey $0.06-$0.09 HVN has acted as a pivotal area — both as support and resistance — and could become the next key level if price breaks out.

Triggers

• A clean daily close above $0.040 with volume would be a strong bullish signal

• A breakdown below the ascending support would invalidate the pattern and likely lead to a retest of ~$0.013

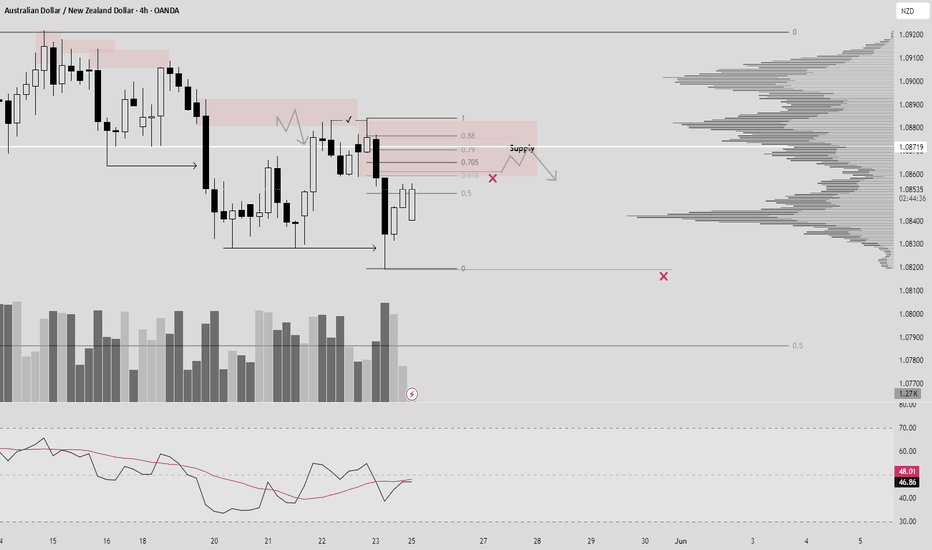

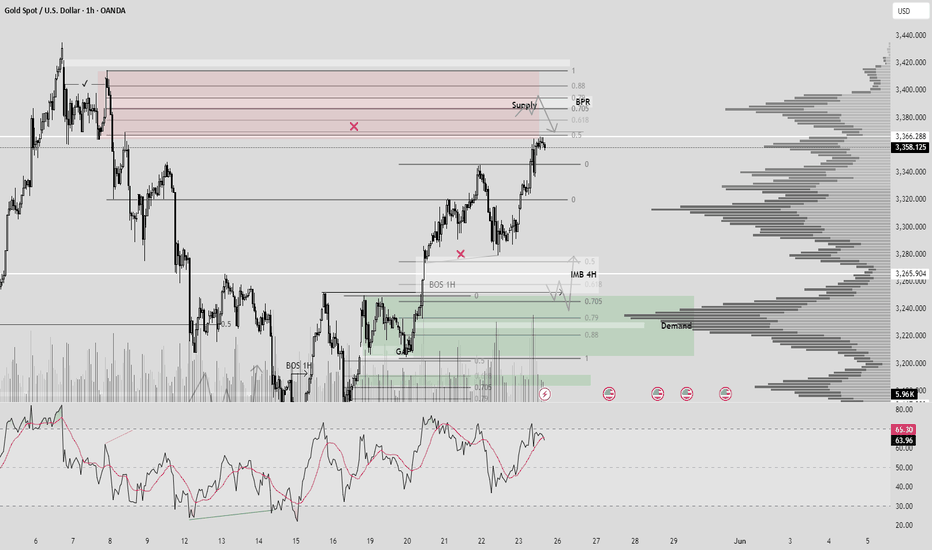

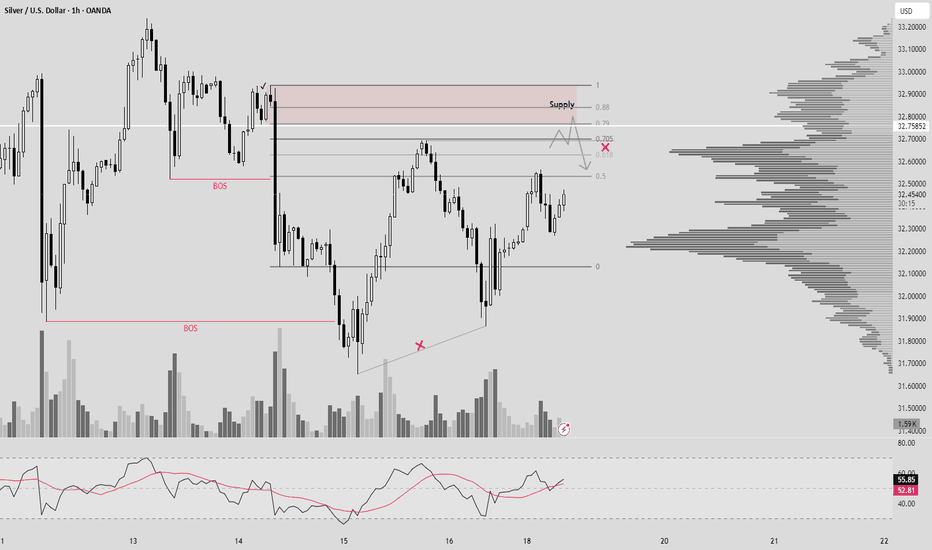

XAUUSD (BPR + SUPPLY + VOLUME + OTE)Hello traders!

1) Price come back to our demand zone, and for me 0.5 Supply still strong zone for selling +BPR 1H + Volume + OTE. RSI in oversold.

2) Also we have open BOS 1H + Demand 0.5 + Volume + Close IMB + OTE.

Have a profitable day and don't forget to subscribe for updates!

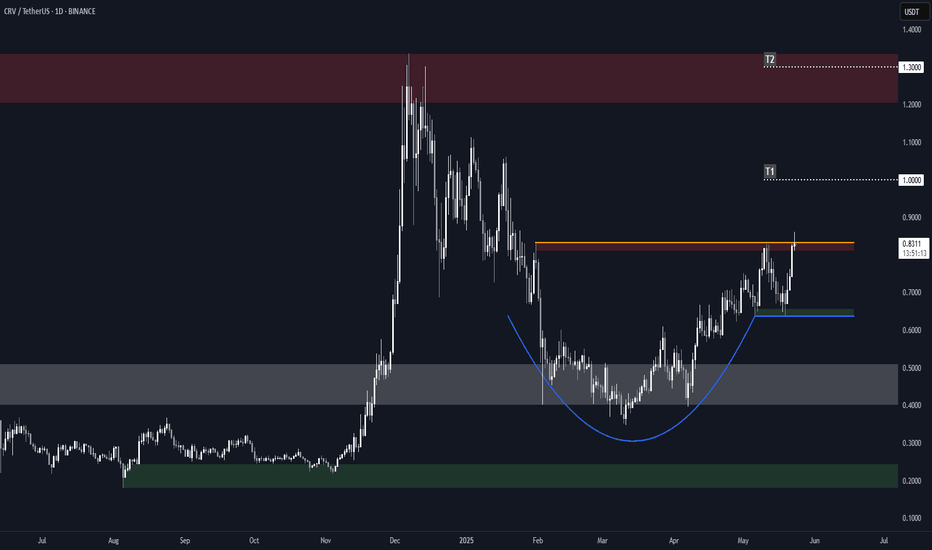

Curve (CRV) Structure Analysis (1D)BINANCE:CRVUSDT formed a rounded bottom (cup) and a minor rectangle, and it's currently attempting to break above the local $0.83 resistance.

Key Levels to Watch

• $0.64: Current support and minor rectangle lower boundary

• $0.83: Current resistance, cup and rectangle upper boundary

• $1.00: Measured target from the minor rectangle pattern

• $1.30: Measured target from the cup pattern (within a key supply zone)

Other Important Levels

• $0.20: Key demand zone, and 2024 low

• $0.40-$0.50: Key S/R dating back to November 2022, aligned with the cup bottom

• $1.20-$1.30: Main supply zone, dating back to February 2023

A daily close above $0.83 with volume would confirm the breakout and trigger the targets.

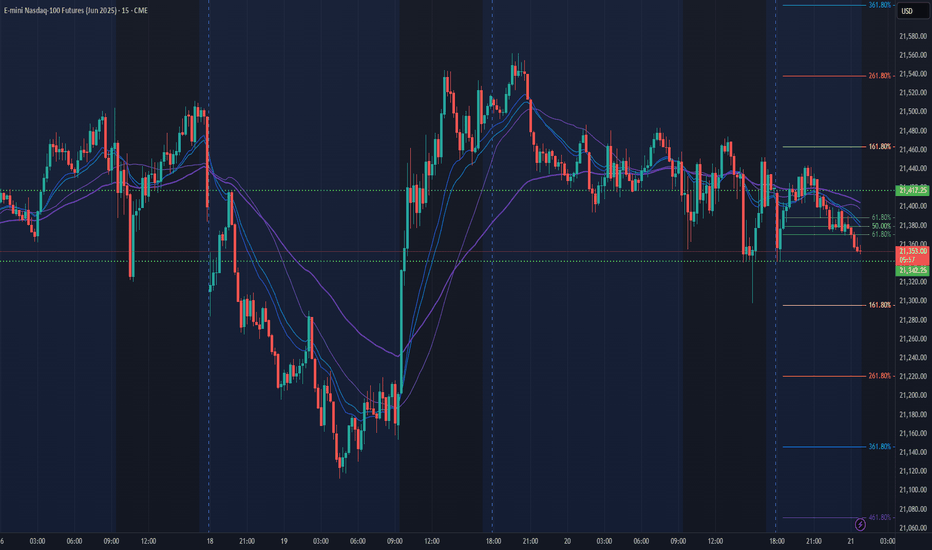

NQ Power Range Report with FIB Ext - 5/23/2025 SessionCME_MINI:NQM2025

- PR High: 21236.00

- PR Low: 21139.00

- NZ Spread: 217.0

Key scheduled economic events:

10:00 | New Home Sales

Early close Monday

- Previous session closed as daily inside print

- Overall sentiment unchanged

Session Open Stats (As of 12:45 AM 5/23)

- Session Open ATR: 447.96

- Volume: 29K

- Open Int: 277K

- Trend Grade: Neutral

- From BA ATH: -6.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

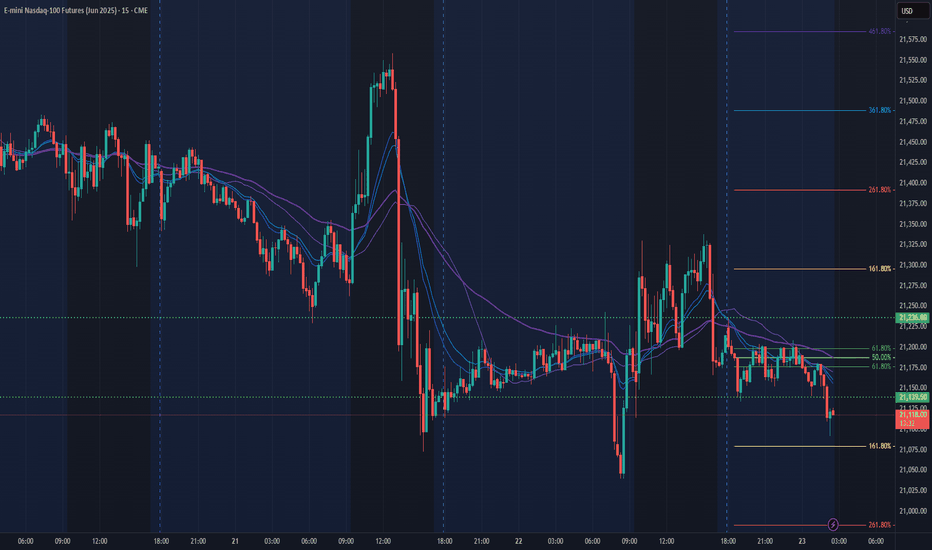

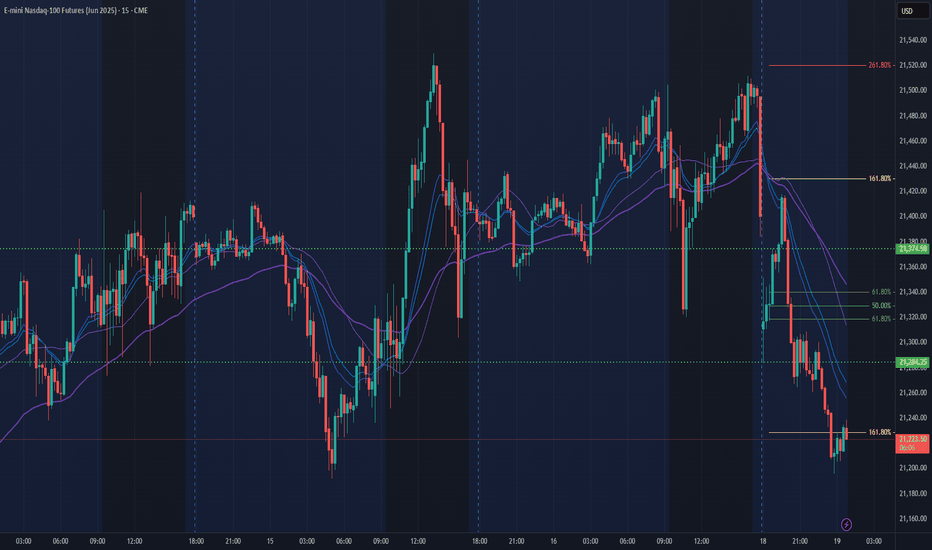

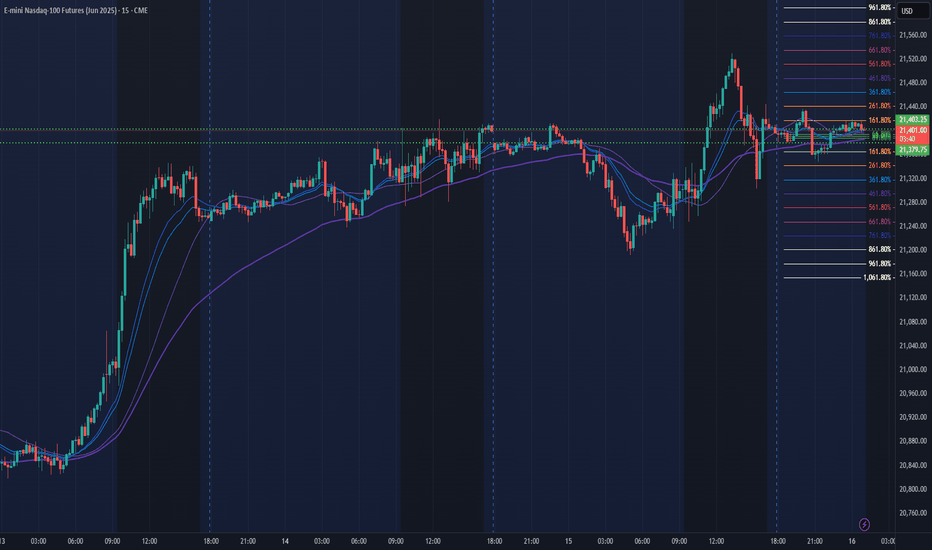

NQ Power Range Report with FIB Ext - 5/22/2025 SessionCME_MINI:NQM2025

- PR High: 21177.00

- PR Low: 21113.75

- NZ Spread: 141.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

09:45| S&P Global Manufacturing PMI

- S&P Global Services PMI

10:00 | Existing Home Sales

Value decline follow-through following morning bull run

- Auction holding at Monday's lows

Session Open Stats (As of 12:45 AM 5/22)

- Session Open ATR: 460.09

- Volume: 31K

- Open Int: 276K

- Trend Grade: Neutral

- From BA ATH: -6.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

DOG Rectangle + Structure AnalysisBITGET:DOGUSDT has been trading in a rectangle since June 2024, with well-defined boundaries.

After a downside deviation in March, it managed to reclaim the range and it's now attempting to break above $0.0040, a key S/R throughout its price history.

Key Levels to Watch

• $0.0018-$0.0020: Main demand zone

• $0.0040: Key S/R in place since May 2024

• $0.0058-$0.0060: Rectangle midline and previous S/R

• $0.0095-$0.0099: Main supply zone

• $0.0170: Measured rectangle target in case of a breakout

A successful daily close above $0.0040 should set the next target around ~$0.0060. Above that, there isn't much separating DOG from another retest of the main demand zone and ATH.

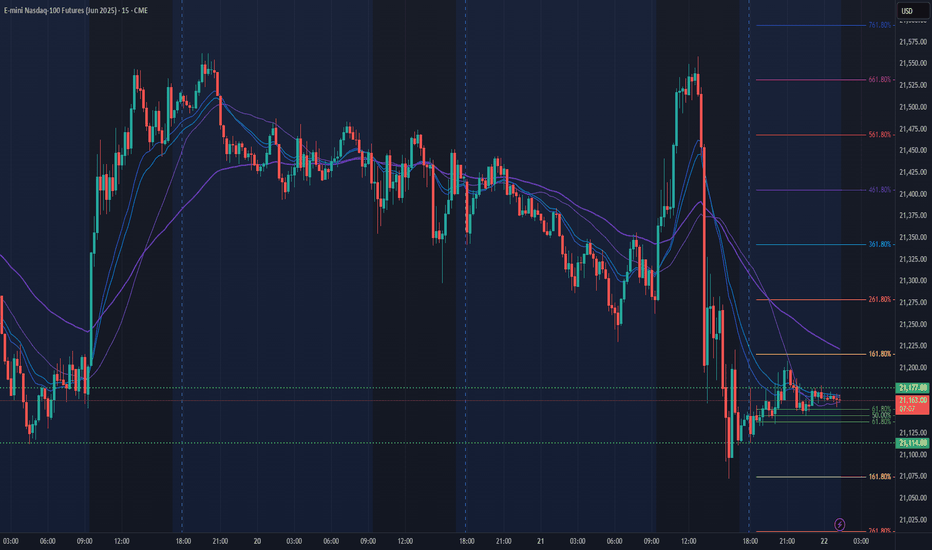

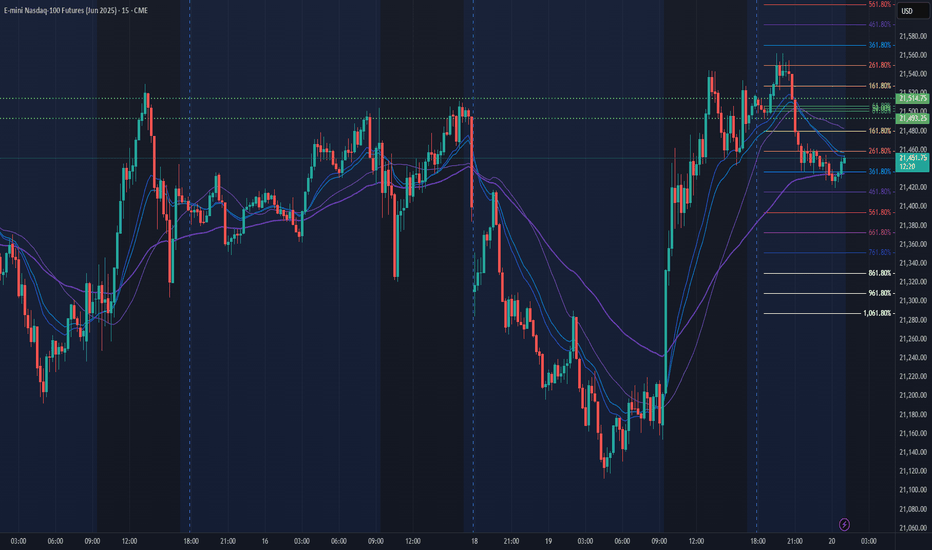

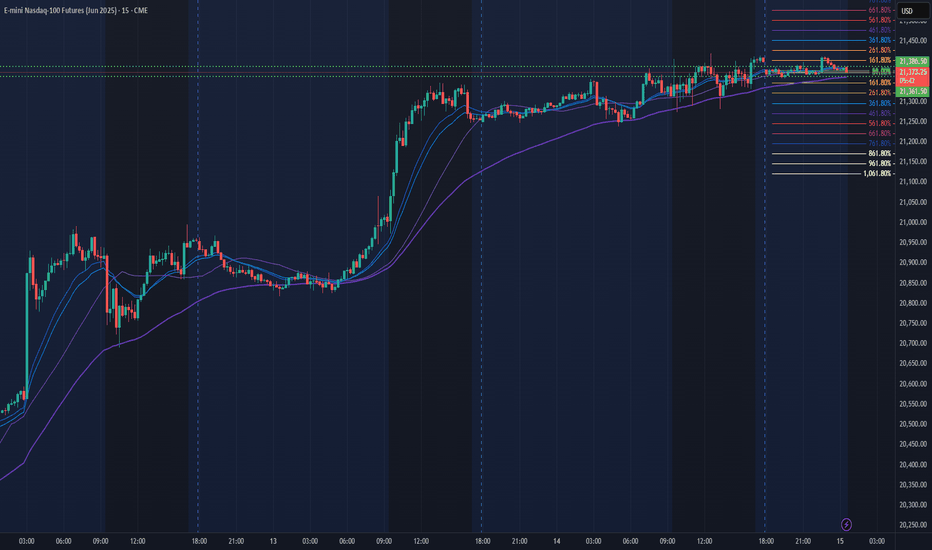

NQ Power Range Report with FIB Ext - 5/21/2025 SessionCME_MINI:NQM2025

- PR High: 21417.25

- PR Low: 21342.00

- NZ Spread: 168.25

No key scheduled economic events

Maintaining Monday-Friday range, currently back at the lows

- Advertising "indecision"

- Will need to break 21100 to follow through on rollover back to mean

Session Open Stats (As of 12:45 AM 5/21)

- Session Open ATR: 460.78

- Volume: 30K

- Open Int: 276K

- Trend Grade: Neutral

- From BA ATH: -5.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 5/20/2025 SessionCME_MINI:NQM2025

- PR High: 21515.00

- PR Low: 21493.00

- NZ Spread: 49.0

No key scheduled economic events

Return to previous week's highs following full supply sweep session

Session Open Stats (As of 12:45 AM 5/20)

- Session Open ATR: 479.66

- Volume: 34K

- Open Int: 281K

- Trend Grade: Neutral

- From BA ATH: -5.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 5/19/2025 SessionCME_MINI:NQM2025

- PR High: 21374.75

- PR Low: 21283.75

- NZ Spread: 203.25

No key scheduled economic events

Beginning anticipated rotation, holding at Thursday's lows

- Daily gap remains below 20400 ahead of Keltner average cloud

Session Open Stats (As of 12:25 AM 5/19)

- Session Open ATR: 490.62

- Volume: 54K

- Open Int: 283K

- Trend Grade: Neutral

- From BA ATH: -6.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

GBP/USD potential shorts back downMy analysis revolves around a possible bearish reaction from the 2‑hour supply zones. If price does respect these zones, I’ll look for a sell setup to drive price lower—though I’ll approach with caution because there’s liquidity resting just above those points of interest.

Should price push downward, my next target is the 10‑hour demand zone that triggered the recent change of character. This discounted area could spark a bullish response.

Confluences for GU sells are as follows:

- An unmitigated 4‑hour supply zone overhead.

- A “sell‑to‑buy” scenario fits: price sits closer to supply and still needs a retracement.

- Imbalance and untapped liquidity lie below, inviting a move south.

- Liquidity has just been swept above, leaving a clean supply zone behind.

P.S. If price punches through these supply zones and breaks structure to the upside, I’ll watch for the new zone that forms—there could be a nearer‑term long opportunity from there.

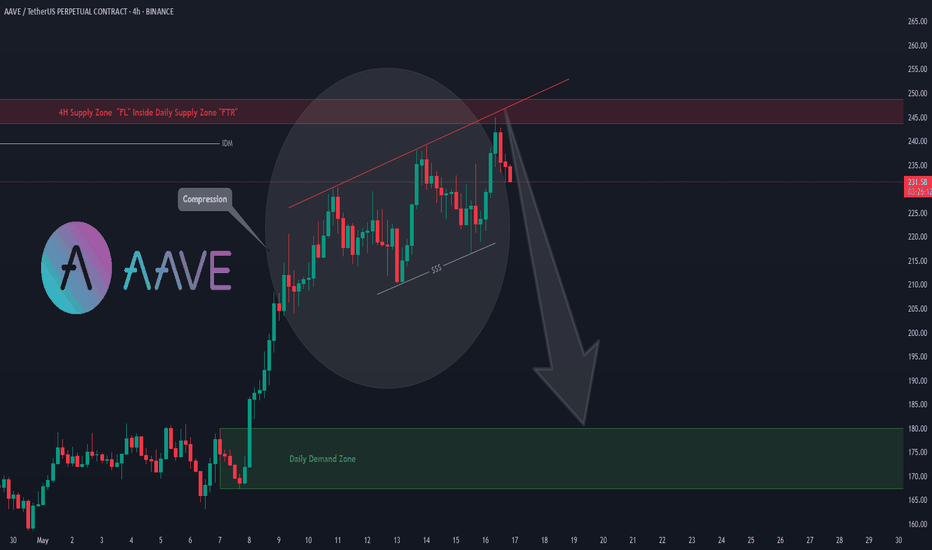

#AAVE #AAVEUSD #AAVEUSDT #Analysis #Eddy#AAVE #AAVEUSD #AAVEUSDT #Analysis #Eddy

As can be seen in the chart, the price has moved towards the supply area with a compression and has formed the 3-drive and can fall from the indicated supply area towards the daily demand zone.

I have identified the important supply and demand zones of the daily timeframe for you.

This analysis is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this analysis to enter the trade.

Don't forget about risk and capital management.

The responsibility for the transaction is yours and I have no responsibility for your failure to comply with your risk and capital management.

💬 Note: Stop losses behind the supply and demand zones are usually hunted by market makers. Be careful of stop hunts and do not enter a trade without getting confirmation and without having a proper trading setup.

Be successful and profitable.

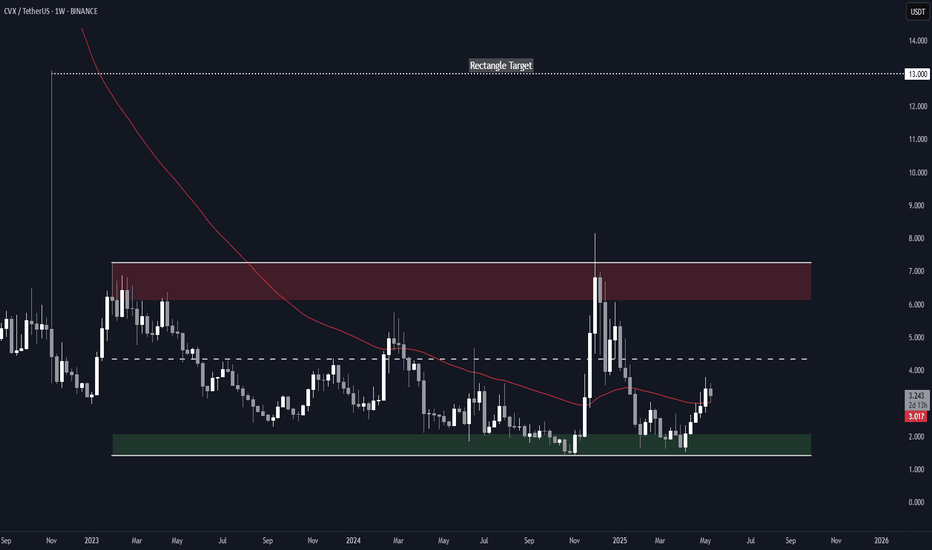

Convex Finance (CVX) Rectangle (1W)BINANCE:CVXUSDT has been trading in a rectangle with well-defined boundaries since January 2023, and it has recently reclaimed the 1-year EMA, potentially shifting the bias to bullish.

Key Levels to Watch

• $1.5-$2.0: Main demand zone and invalidation point for any bullish TA if broken

• $3.0: 1-year EMA, successfully reclaimed and retested as support

• $4.4: Rectangle midline, previously relevant as a S/R

• $6.1-$7.2: Main supply zone and upper boundary of the rectangle

• $13.0: Previous swing high and rectangle breakout target, which would be confirmed by a weekly close above $7.2 with good volume

NQ Power Range Report with FIB Ext - 5/16/2025 SessionCME_MINI:NQM2025

- PR High: 21379.50

- PR Low: 21403.25

- NZ Spread: 53.25

No key scheduled economic events

Holding Wednesday range, holding short bias participants hostage

- Still advertising rotation below 21200

Session Open Stats (As of 12:55 AM 5/16)

- Session Open ATR: 503.83

- Volume: 26K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -5.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Optimism (OP) Falling WedgeBINANCE:OPUSDT is attempting a breakout from a 14 months long falling wedge.

A sustained break above the resistance in the near term would set the target at $3.80, just shy of the main $4.00-$4.80 supply zone.

Key Levels to Watch

• $0.55-$0.60: Main demand zone and invalidation point for the setup

• $1.00-$1.20: High Volume Node and key S/R dating back to June 2023.*

• $2.50-$2.80: High Volume Node and wedge high point.*

• $4.00-$4.80: Main supply zone.

* These could offer resistance and represent good levels for partial TPs.

NQ Power Range Report with FIB Ext - 5/15/2025 SessionCME_MINI:NQM2025

- PR High: 21386.50

- PR Low: 21361.50

- NZ Spread: 56.0

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Retail Sales (Core|MoM)

- PPI

- Philadelphia Fed Manufacturing Index

08:40 | Fed Chair Powell Speaks

Temp 25% AMP margins increase for Powell expected pre-RTH volatility spike

- Extending week highs, holding previous session high

- Advertising potential rotation with weekend gap motivation

Session Open Stats (As of 12:15 AM 5/15)

- Session Open ATR: 515.63

- Volume: 25K

- Open Int: 290K

- Trend Grade: Bear

- From BA ATH: -5.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 22096

- Mid: 20383

- Short: 19246

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

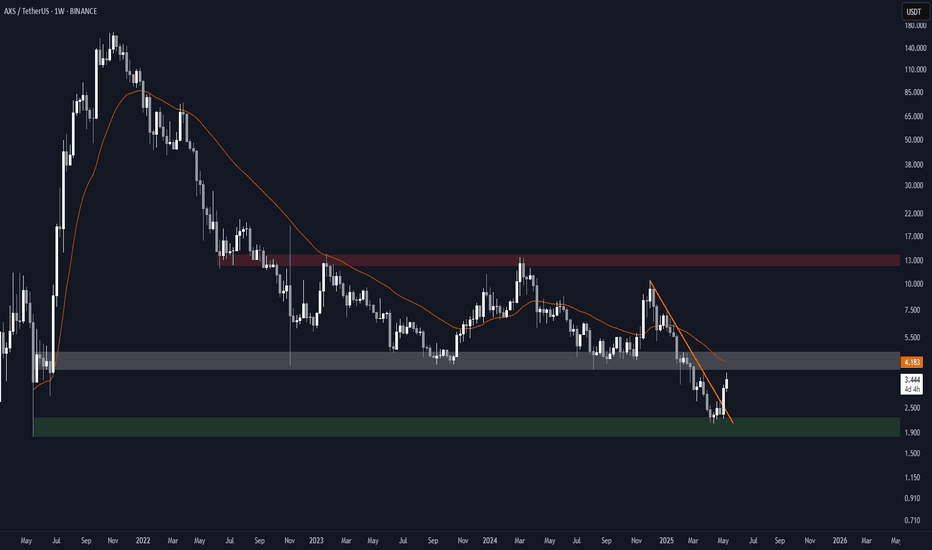

Axie (AXS) Structure Analysis (1W - Log)After retesting the ~$2.0 demand zone, BINANCE:AXSUSDT broke out of its recent downtrend and could be headed for an attempt to reclaim the ~$4.0 S/R.

Key Levels to Watch

• ~$2.0: Demand zone dating back to May 2021, and current support. Any sustained break below it would invalidate any bullish TA.

• ~$4.0: Previous multi-year key support, and likely a strong resistance. Reclaiming it would flip the bias to bullish. It also aligns with the 200-day EMA, which has been very relevant for AXS in the past.

• ~$13.0: Multi-year S/R, and a reasonable target if ~$4.0 is reclaimed.

Still in a No-Trade Zone for me, until ~$4.0 is successfully reclaimed.

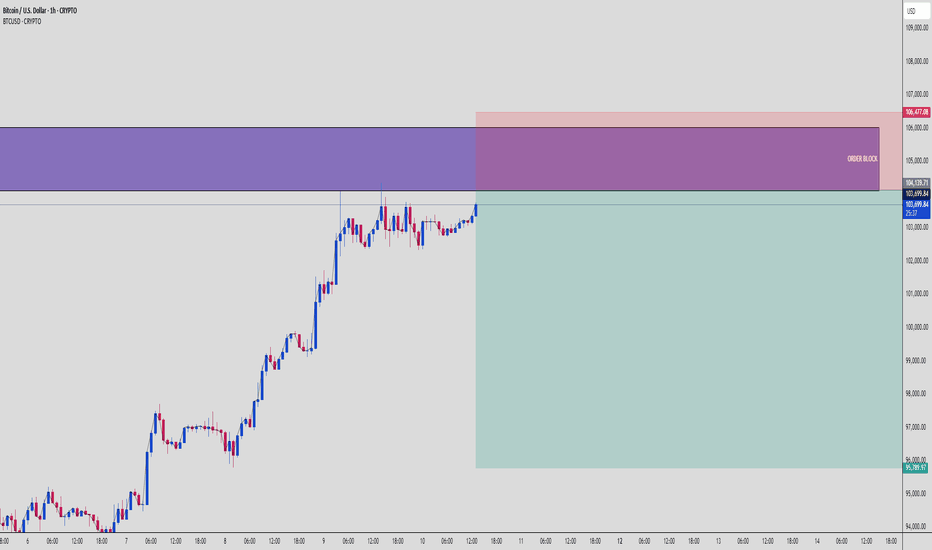

BTCUSD 1H Short Setup | Order Block + Premium Rejection⚠️ BTCUSD | 1H Rejection at Supply Zone | May 10, 2025

Bitcoin is showing signs of exhaustion after a sharp rally into a high-value Supply Zone marked by a bearish Order Block at ~$104.1k–$106.4k. Price tapped right into premium levels, triggering potential Smart Money distribution.

🔍 KEY CONFLUENCES:

🧱 1H Bearish Order Block at 104,139–106,477

⚖️ Price in premium zone (>50% range)

🧠 Clean liquidity grab from prior swing high

🚫 Signs of buying weakness inside OB

📉 Anticipated move down toward imbalance and demand zone near $96k

📊 Setup Specs:

Pair: BTCUSD

Timeframe: 1H

Entry Zone: 104,139 – 106,477

SL: 106,477

TP: 95,789

RR: Approx. 1:4+

📌 Smart Money Breakdown:

After explosive rallies, institutions often offload in supply-rich OB zones while retail buys the top. This setup shows textbook SMC signs of distribution, imbalance below, and a clean trade idea toward unmitigated demand.

🧠 Chart Ninjas Tip:

“Never short early — wait for price to enter the OB and show weakness. That’s where smart entries live.”

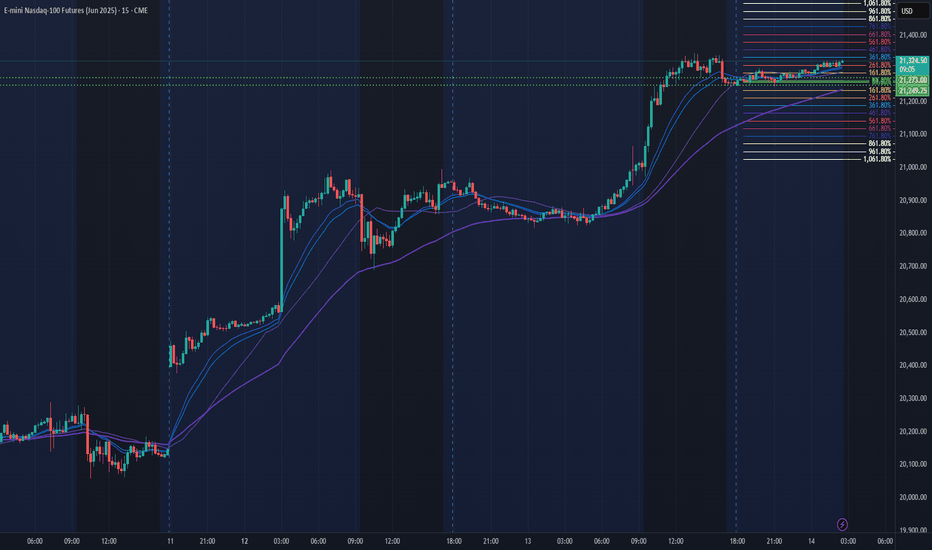

NQ Power Range Report with FIB Ext - 5/14/2025 SessionCME_MINI:NQM2025

- PR High: 21273.00

- PR Low: 21249.50

- NZ Spread: 52.5

No key scheduled economic events

Value continues to creep another 2%, increasing distance from weekend gap

- Mechanically, holding previous session highs

Session Open Stats (As of 12:35 AM 5/14)

- Session Open ATR: 543.13

- Volume: 33K

- Open Int: 281K

- Trend Grade: Bear

- From BA ATH: -5.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

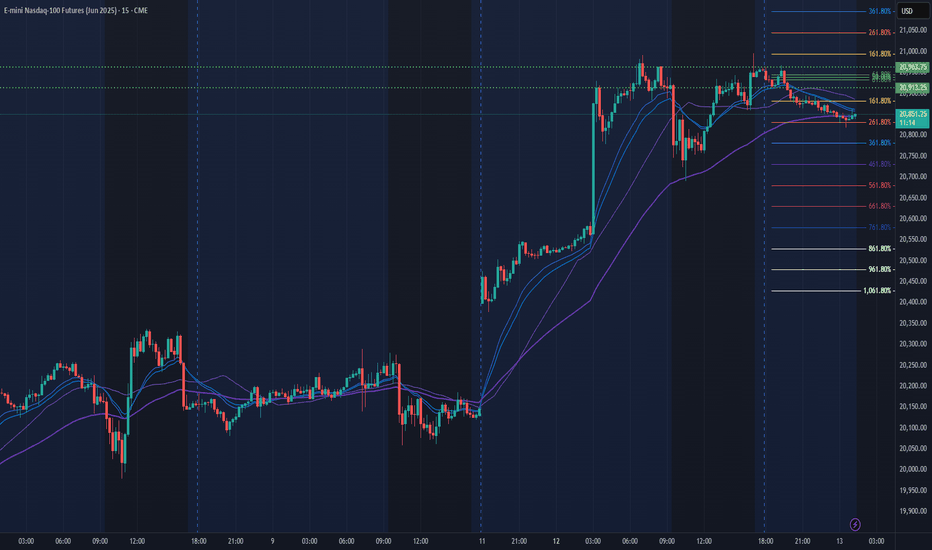

NQ Power Range Report with FIB Ext - 5/13/2025 SessionCME_MINI:NQM2025

- PR High: 20963.50

- PR Low: 20913.25

- NZ Spread: 112.25

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

Weekend gap strongly remains unfilled

- 25% AMP margins increase for expected CPI volatility spike

Session Open Stats (As of 12:25 AM 5/13)

- Session Open ATR: 551.55

- Volume: 32K

- Open Int: 275K

- Trend Grade: Bear

- From BA ATH: -7.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone