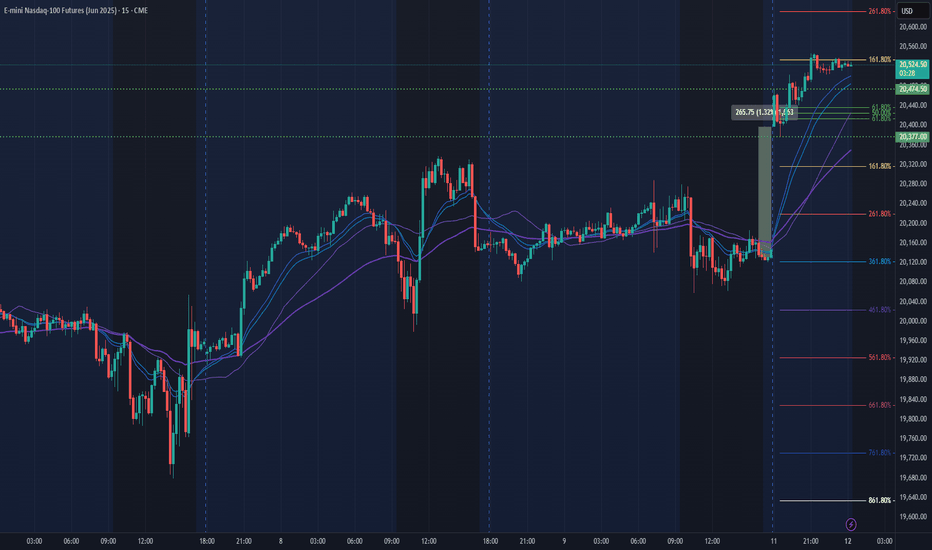

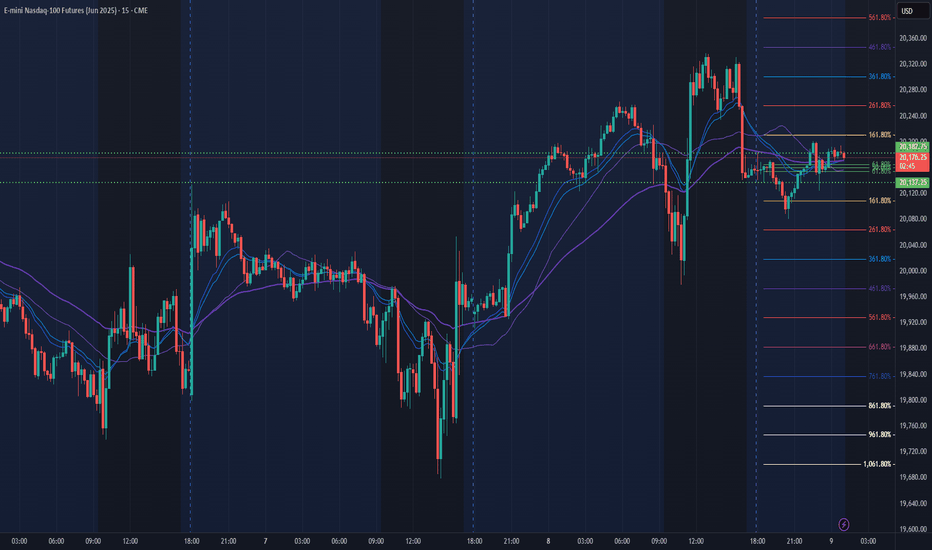

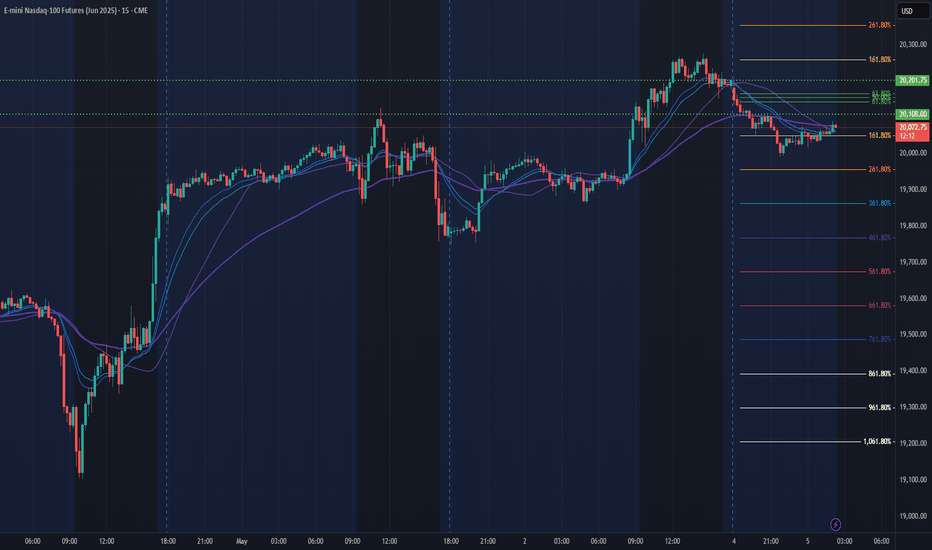

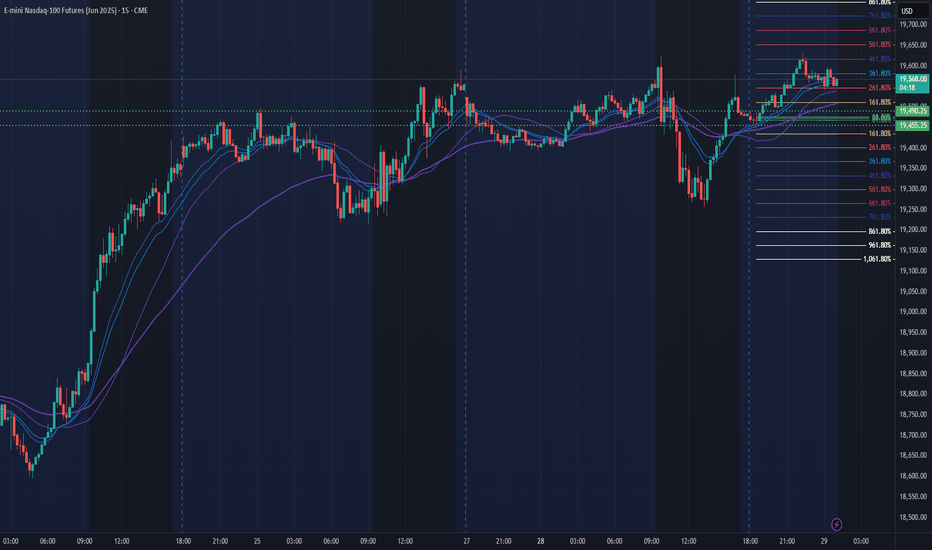

NQ Power Range Report with FIB Ext - 5/12/2025 SessionCME_MINI:NQM2025

- PR High: 20474.75

- PR Low: 20376.75

- NZ Spread: 218.75

No key scheduled economic events

Unfilled weekend gap up over 1%

- Gap fills below 20160

- Auction pausing at March 26 pivot

Session Open Stats (As of 12:15 AM 5/12)

- Session Open ATR: 551.42

- Volume: 47K

- Open Int: 260K

- Trend Grade: Bear

- From BA ATH: -10.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Supply Zone

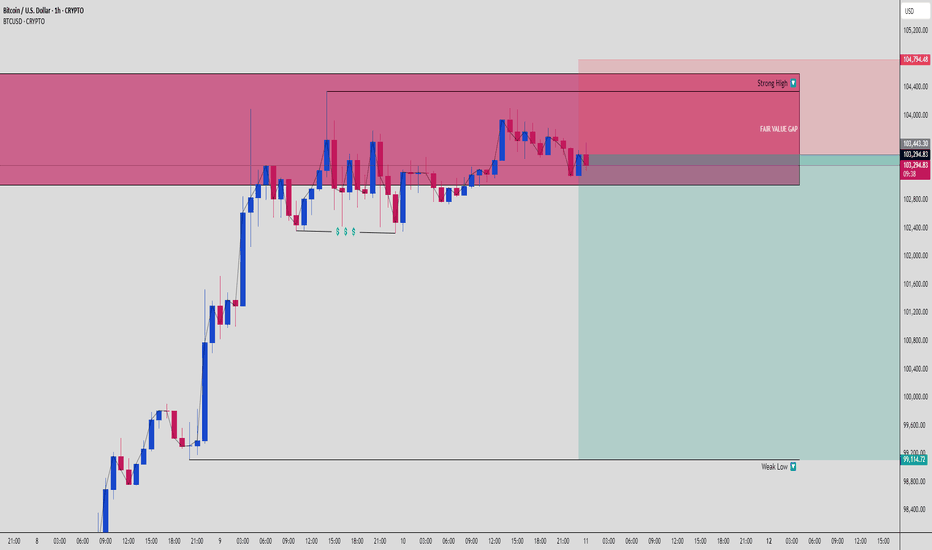

BTCUSD Supply Zone Play: Smart Money Dump in Progress!🚨 Bitcoin (BTCUSD) is playing the classic Smart Money trap — and you’re either the bait or the sniper.

Let’s decode this fresh 1H chart with laser precision 👇

📈 Market Structure:

BTC had a clean rally with momentum, but notice what happened next — price tapped directly into a 1H Bearish Order Block and Fair Value Gap (FVG) combo.

That red zone? That’s where smart money was waiting.

Now, price is consolidating and rejecting inside that OB. This isn’t just sideways action — this is distribution. 📉

📉 Liquidity Engineering:

See those equal lows below? 👀

Retail sees them as support.

Smart money sees them as liquidity to be harvested.

✅ Triple tap lows (marked by $$)

✅ Buy-side liquidity swept at the strong high (104.79k)

✅ Fair Value Gap left open as inefficiency magnet

This screams: "Trap the breakout chasers, then dump."

🔥 Smart Money Setup:

Entry was timed post-rejection inside the OB after tapping the Fair Value Gap.

This is distribution at premium pricing, exactly where big players unload while retail buys the top.

✅ OB Rejection

✅ Inside Premium

✅ Strong High respected

✅ Perfect Risk-to-Reward opportunity

🎯 Targets:

TP1: Local support flip or structure break near 101.2k

TP2: Full move into Weak Low / imbalance fill at ~99.1k

SL: Above OB / strong high @ 104,794.48

Risk-Reward? Solid 1:4+ sniper-grade setup 🔥

🧠 Psychology Tip:

Most traders get chopped here by overtrading or entering too early.

Be the sniper — not the machine gun. 🧘♂️💥

Wait for price to enter premium, show weakness, then strike with precision.

🚀 Summary of Confluences:

OB + FVG stacked

Strong High as invalidation

Distribution signs within premium

Weak Lows begging to be swept

Clear imbalance toward 99.1k

BTC is delivering textbook SMC setups — your job is to stop chasing and start planning like Smart Money.

➡️ Comment “BTC READY” if you're watching this setup!

➡️ Save this post for your backtesting journal! 🔥

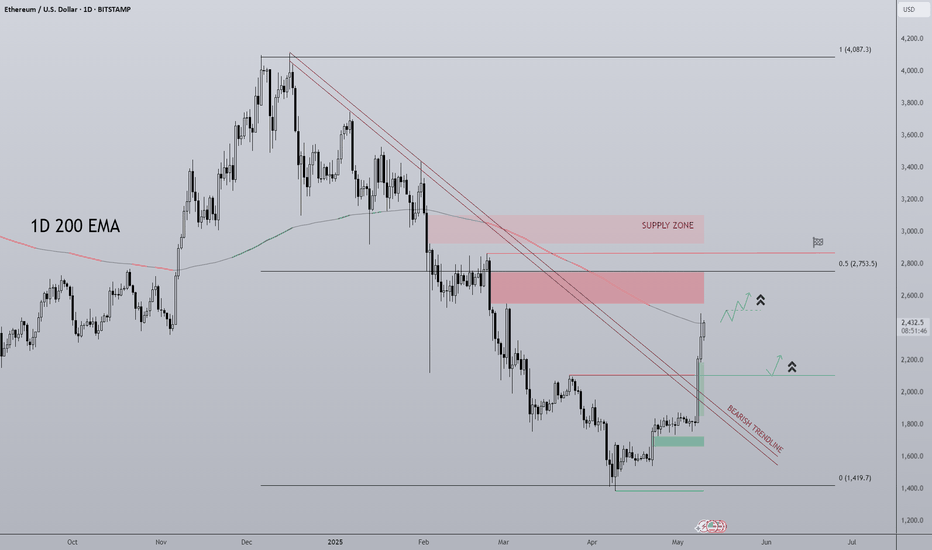

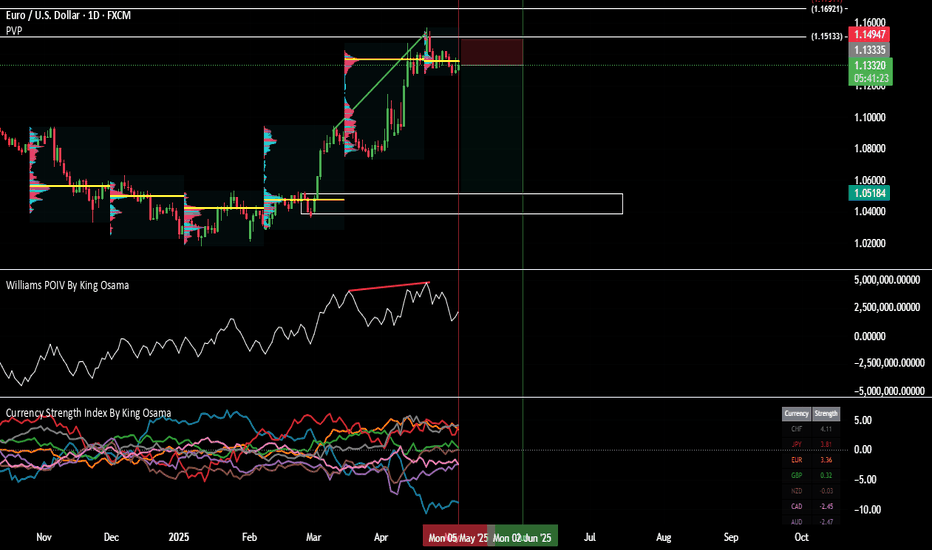

Ethereum waking up?One of the most disappointing projects in the crypto space in recent years has to be ETH, losing ground on BTC since September '22. Finally ETH looks to have woken up outpacing BTC this week and broken out from the daily downtrend channel and currently at the underside of the DAILY 200 EMA.

BTC.D has printed a SFP and dropped 2% from 65.4% to 63%, could we be seeing a rollover and rotation into altcoins?

How I see it the moving average should cap off this move for now and a retrace towards the breakout area & previous lower high. That would then be the first higher high and higher low of this calendar year, a very bullish change in structure.

A more aggressive bullish scenario in the short term would be a reclaim of the 1D 200 EMA, leaving the inefficiency zone at the breakout level unfilled.

Either way the next HTF target is $2,800 for ETH which would bring price to the range midpoint and a key supply zone with many resting Stop losses.

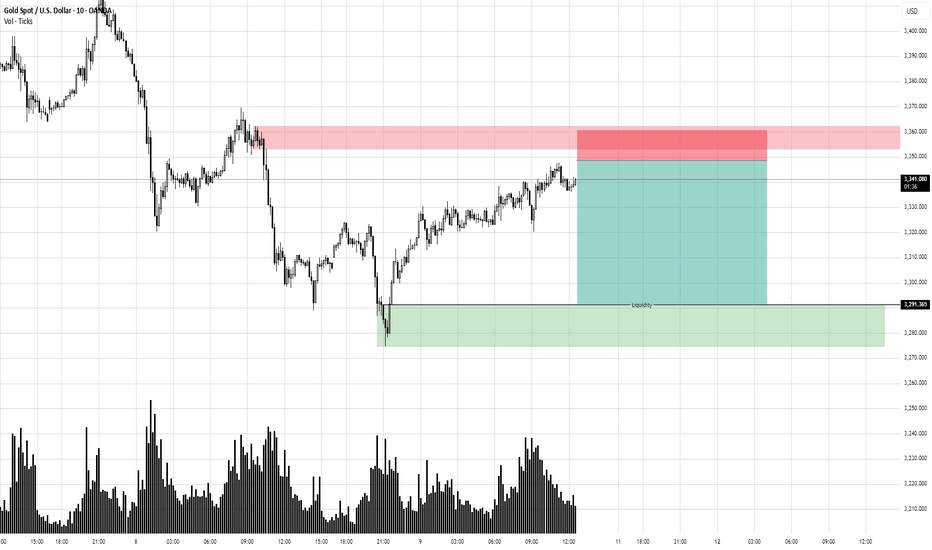

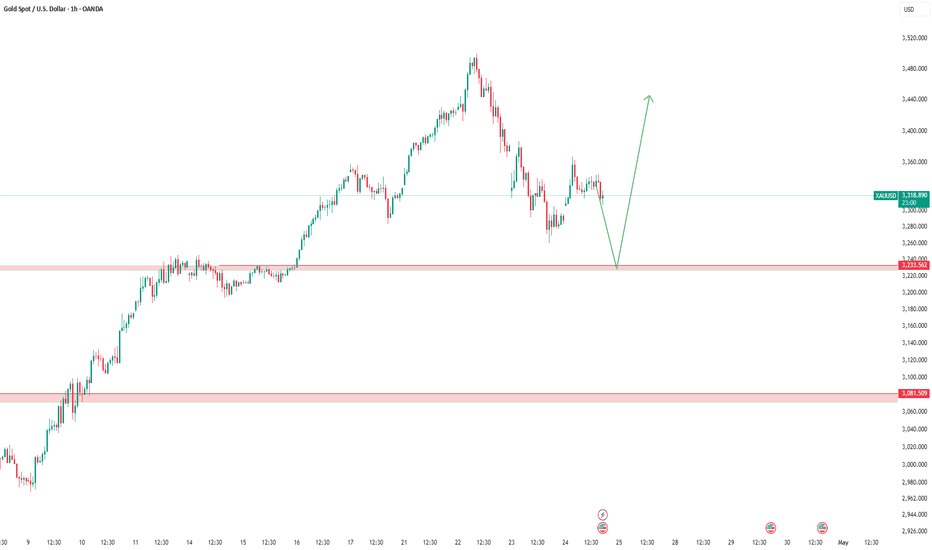

OptionsMastery: A potential short opportunity for GOLD!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

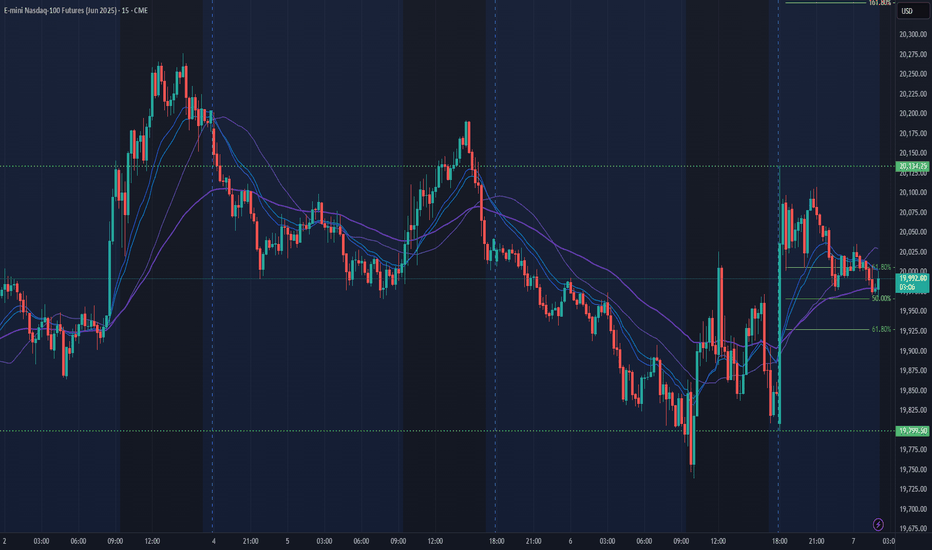

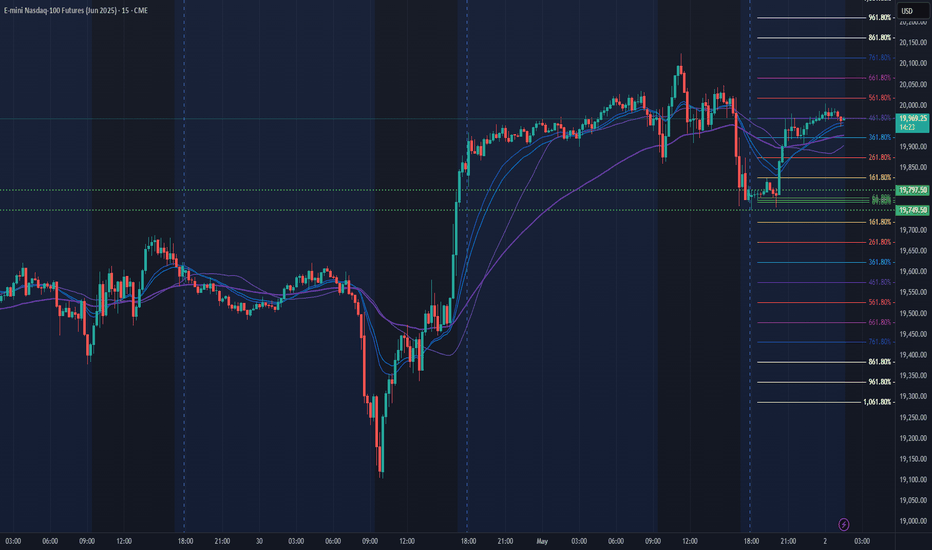

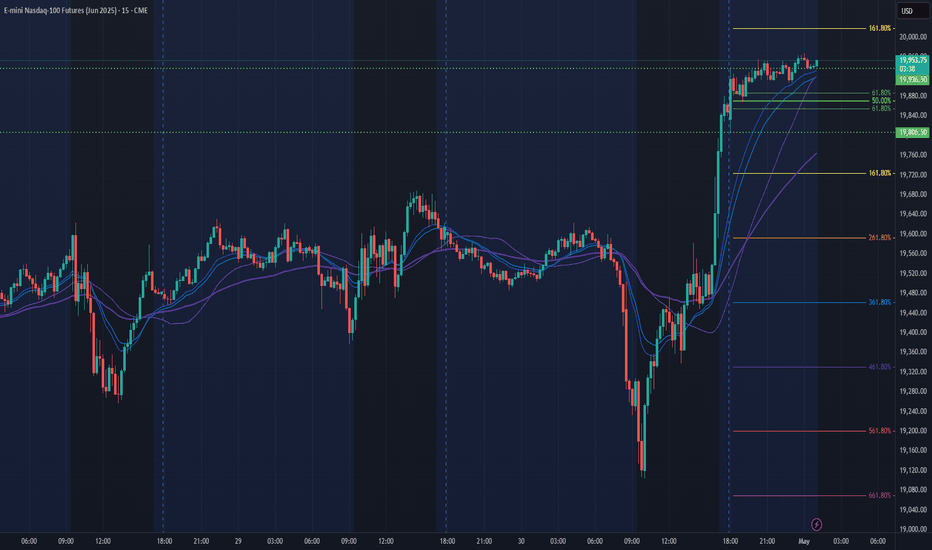

NQ Power Range Report with FIB Ext - 5/9/2025 SessionCME_MINI:NQM2025

- PR High: 20182.50

- PR Low: 20137.00

- NZ Spread: 101.5

No key scheduled economic events

Auction maintaining week range, holding in the highs

Session Open Stats (As of 12:55 AM 5/9)

- Session Open ATR: 555.12

- Volume: 33K

- Open Int: 260K

- Trend Grade: Bear

- From BA ATH: -10.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

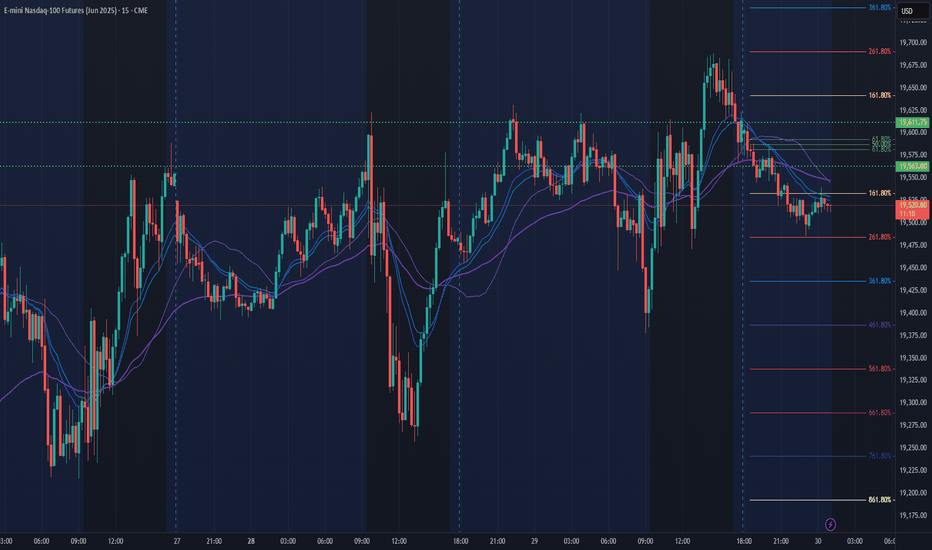

NQ Power Range Report with FIB Ext - 5/8/2025 SessionCME_MINI:NQM2025

- PR High: 19957.25

- PR Low: 19910.75

- NZ Spread: 103.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

13:00 | 30-Year Bond Auction

Auction remains inside week range, 19920 to 20200

- Contained inside Friday's range, advertising return to 20280 high

- Strong value increase through Asian hours

Session Open Stats (As of 12:35 AM 5/8)

- Session Open ATR: 578.32

- Volume: 43K

- Open Int: 257K

- Trend Grade: Bear

- From BA ATH: -10.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

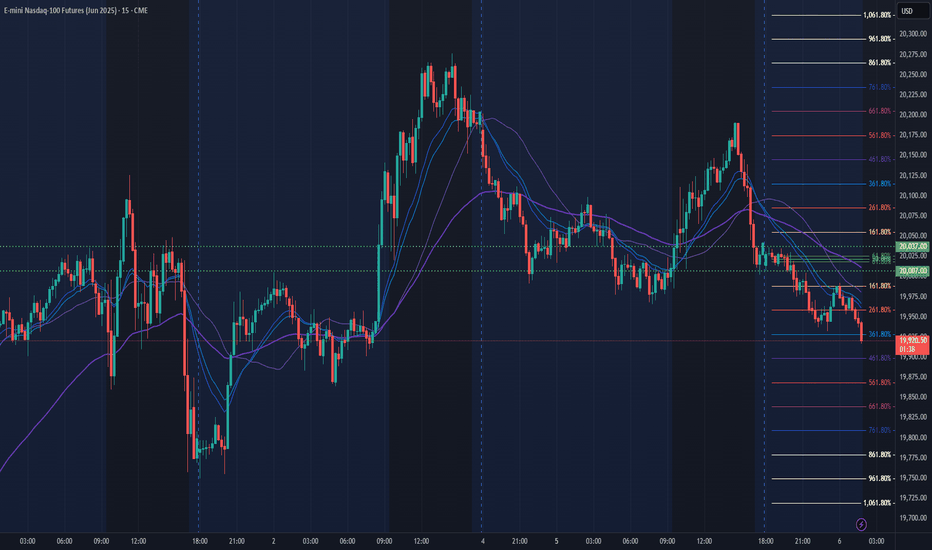

NQ Power Range Report with FIB Ext - 5/7/2025 SessionCME_MINI:NQM2025

- PR High: 20133.75

- PR Low: 19799.50

- NZ Spread: 746.25

Key scheduled economic events:

10:30 | Crude Inventories

14:00 | FOMC Statement

Fed Interest Rate Decision

14:30 | FOMC Press Conference

Temporary AMP margins increase for upcoming FOMC (25%)

- Session open volatility creates 334 point initial range

- Maintaining Friday's range, holding 20200 rotation advertisement

Session Open Stats (As of 12:55 AM 5/7)

- Session Open ATR: 592.41

- Volume: 57K

- Open Int: 257K

- Trend Grade: Bear

- From BA ATH: -11.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 5/6/2025 SessionCME_MINI:NQM2025

- PR High: 20036.75

- PR Low: 20007.00

- NZ Spread: 66.75

Key scheduled economic events:

13:00 | 10-Year Note Auction

Auction holding around 50% of Friday's breakout range

- Value gradually declining below previous session low

Session Open Stats (As of 12:25 AM 5/6)

- Session Open ATR: 598.47

- Volume: 27K

- Open Int: 255K

- Trend Grade: Bear

- From BA ATH: -11.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 5/6/2025 SessionCME_MINI:NQM2025

- PR High: 20201.75

- PR Low: 20108.25

- NZ Spread: 209.0

Key scheduled economic events:

09:45 | S&P Global Services

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

Holding previous week's highs

- Advertising ability to break 20400 into Mach 26 daily pivot

Session Open Stats (As of 12:55 AM 5/6)

- Session Open ATR: 634.22

- Volume: 43K

- Open Int: 258K

- Trend Grade: Bear

- From BA ATH: -11.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

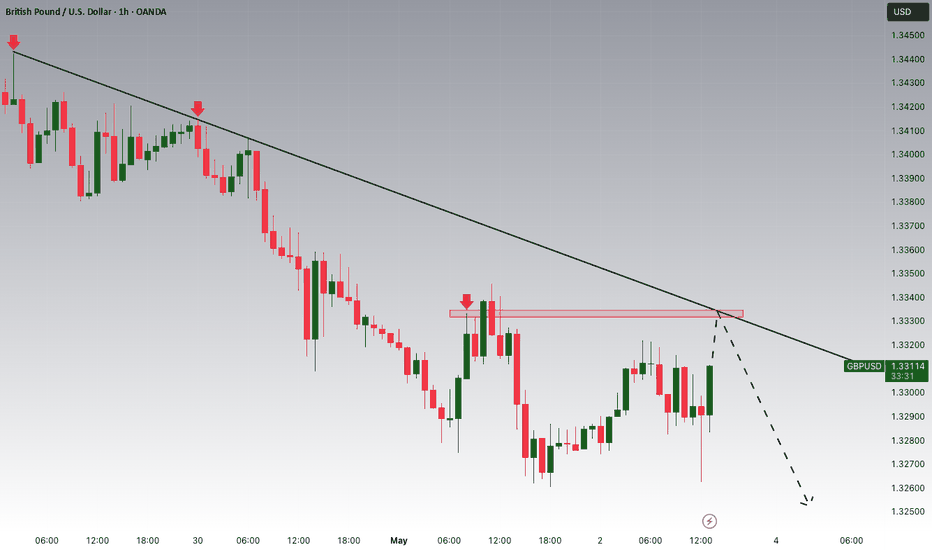

GBPUSD Potential DownsidesHey Traders, in today's trading session we are monitoring GBPUSD for a selling opportunity around 1.33300 zone, GBPUSD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.33300 support and resistance area.

Trade safe, Joe.

NQ Power Range Report with FIB Ext - 5/2/2025 SessionCME_MINI:NQM2025

- PR High: 19797.25

- PR Low: 19749.50

- NZ Spread: 106.75

Key scheduled economic events:

08:30 | Average Hourly Earnings

Nonfarm Payrolls

Unemployment Rate

Advertising rotation short off 20100

- Holding auction inside previous session range

Session Open Stats (As of 12:55 AM 5/2)

- Session Open ATR: 647.21

- Volume: 47K

- Open Int: 250K

- Trend Grade: Bear

- From BA ATH: -11.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

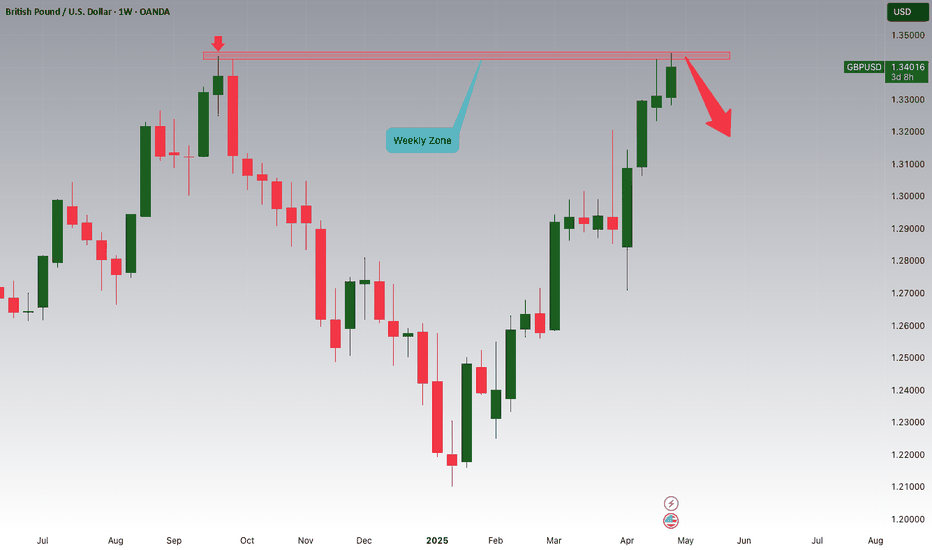

GBPUSD is Forming a Weekly Double Top!!!Hey Traders!

In today's session, we're closely watching GBPUSD for a potential short setup around the 1.34200 level.

The pair is currently forming a double top pattern on the weekly timeframe, a classic reversal signal. Price action is showing signs of rejection at the neckline, suggesting possible downside momentum from this key resistance zone.

Trade safe, Joe.

NQ Power Range Report with FIB Ext - 5/1/2025 SessionCME_MINI:NQM2025

- PR High: 19936.00

- PR Low: 19805.00

- NZ Spread: 292.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

09:45 | S&P Global Manufacturing PMI

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Prices

Wide previous session swing expanding week high and low

- Continuing to push highs back towards 20k

Session Open Stats (As of 12:25 AM 5/1)

- Session Open ATR: 662.61

- Volume: 47K

- Open Int: 241K

- Trend Grade: Bear

- From BA ATH: -11.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

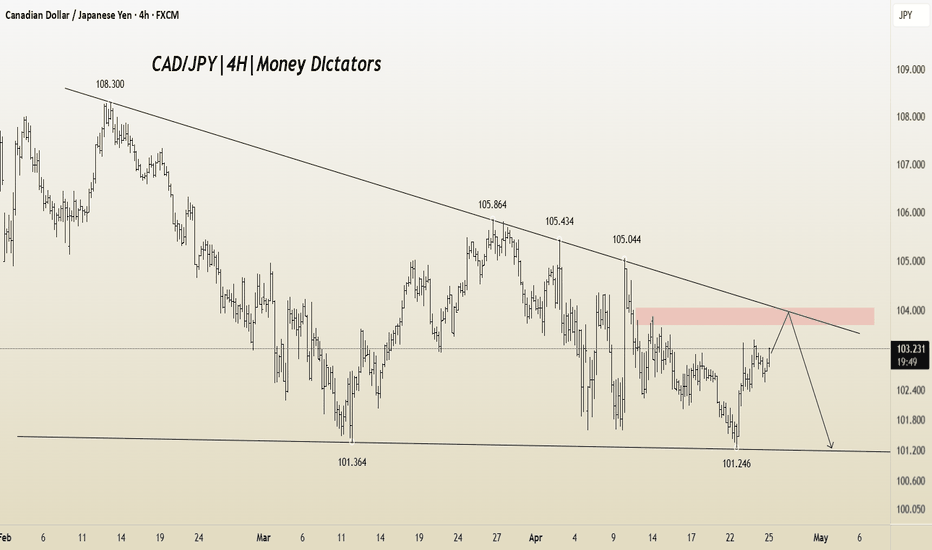

CAD/JPY Rally Could Fade Near Resistance – Watch for ShortsThe CAD/JPY pair is currently trading within a well-defined descending trendline. Multiple rejections are visible around the 108.300, 105.864, 105.434, and 105.044 levels, confirming strong bearish control over the medium term.

Price has recently bounced from a critical horizontal support near 101.246, forming a short-term bullish move toward the descending trendline. We are now approaching a confluence zone near the 103.800–104.000 area, where the downtrend line intersects. This zone is a potential supply area and could act as a strong resistance.

Trade Idea: Sell Setup Near Trendline (103.800–104.000)

Target: 102.532, 101.250

Invalidation: Break and close above 104.200

NQ Power Range Report with FIB Ext - 4/30/2025 SessionCME_MINI:NQM2025

- PR High: 19611.75

- PR Low: 19563.25

- NZ Spread: 108.5

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

08:30 | GDP

09:45 | Chicago PMI

10:00 | Core PCE Price Index (YoY|MoM)

10:30 | Crude Inventories

Maintaining inside print week range

Session Open Stats (As of 12:55 AM 4/30)

- Session Open ATR: 654.86

- Volume: 32K

- Open Int: 245K

- Trend Grade: Bear

- From BA ATH: -13.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/29/2025 SessionCME_MINI:NQM2025

- PR High: 19490.25

- PR Low: 19455.50

- NZ Spread: 77.75

Key scheduled economic events:

10:00 | CB Consumer Confidence

JOLTs Job Openings

Session Open Stats (As of 12:35 AM 4/29)

- Session Open ATR: 685.67

- Volume: 32K

- Open Int: 245K

- Trend Grade: Bear

- From BA ATH: -13.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/25/2025 SessionCME_MINI:NQM2025

- PR High: 19427.00

- PR Low: 19352.25

- NZ Spread: 167.0

No key scheduled economic events

Wednesday session gap remains partially filled below 18595.00

- Auction lifting into supply above daily Keltner average

- Value hovering previous session high

Session Open Stats (As of 12:35 AM 4/25)

- Session Open ATR: 736.63

- Volume: 44K

- Open Int: 241K

- Trend Grade: Bear

- From BA ATH: -14.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

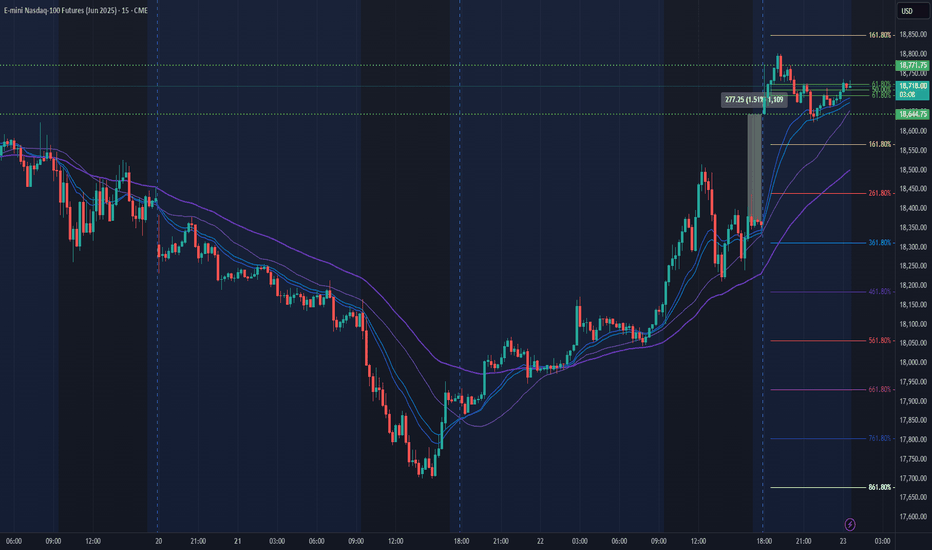

NQ Power Range Report with FIB Ext - 4/24/2025 SessionCME_MINI:NQM2025

- PR High: 18842.25

- PR Low: 18740.50

- NZ Spread: 277.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Durable Goods Orders

10:00 | Existing Home Sales

Previous session gap remains unfilled

- Advertising rotation inside daily Keltner average cloud

Session Open Stats (As of 12:45 AM 4/24)

- Session Open ATR: 734.74

- Volume: 36K

- Open Int: 238K

- Trend Grade: Bear

- From BA ATH: -17.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

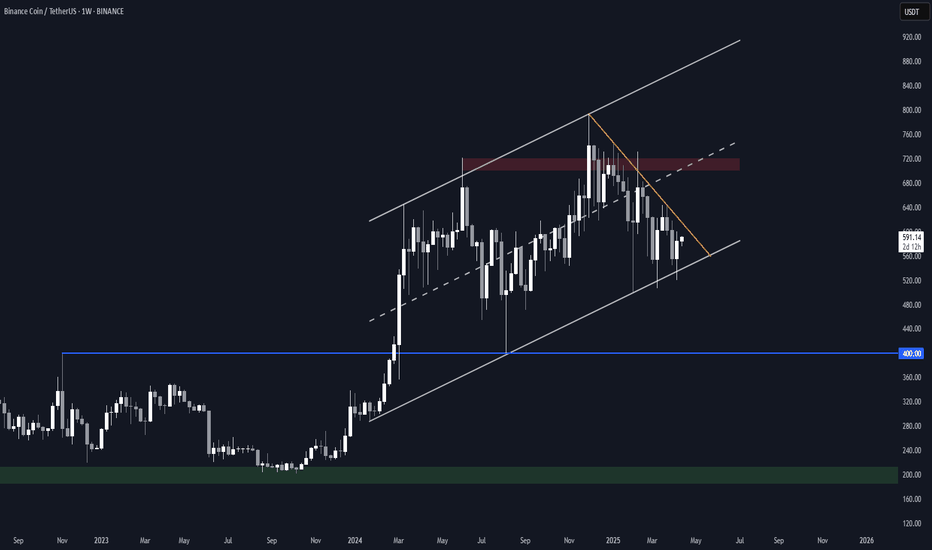

BNB Ascending Channel (1W)BINANCE:BNBUSDT remains within an ascending channel dating back to January 2024, with multiple strong reactions at both boundaries.

After testing the upper boundary and hitting a new ATH last December, it entered a clear downtrend (orange trendline) that led to multiple attempts at the channel's support.

Price action is now getting compressed, and we could see a breakout soon.

Key Levels

• To the upside, the main resistance remains ~$700 area.

• Above that, CRYPTOCAP:BNB could have a shot at a new ATH and potentially the channel's upper boundary in the ~$900 area.

• To the downside, in case of a channel breakdown, $400 seems the first logical support (important S/R for previous swings).

Still very uncertain and in a No-Trade Zone until a breakout is confirmed.

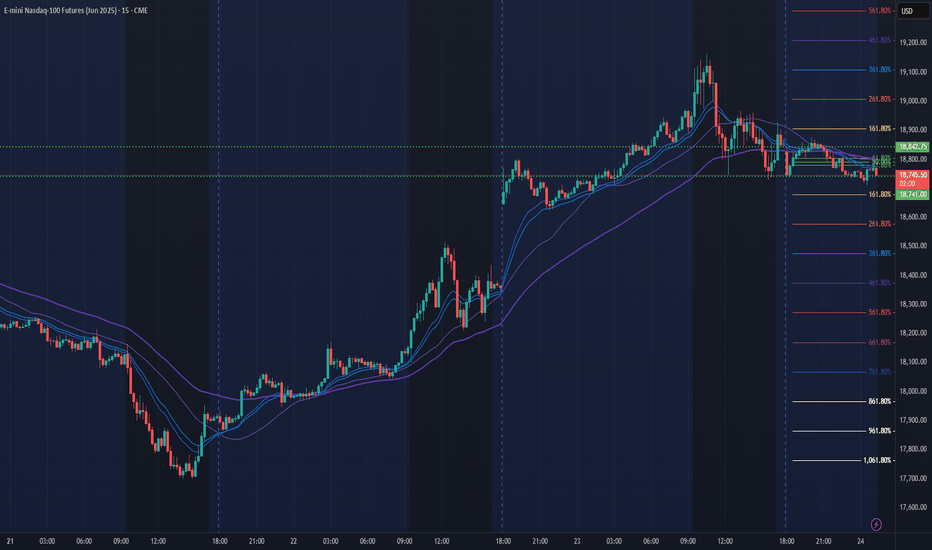

NQ Power Range Report with FIB Ext - 4/23/2025 SessionCME_MINI:NQM2025

- PR High: 18771.75

- PR Low: 18644.00

- NZ Spread: 285.75

Key scheduled economic events:

09:45 | S&P Global Manufacturing PMI

- S&P Global Services PMI

10:00 | New Home Sales

10:30 | Crude Inventories

Major +1.5% session gap, unfilled to 18400

Session Open Stats (As of 12:15 AM 4/23)

- Session Open ATR: 752.66

- Volume: 58K

- Open Int: 241K

- Trend Grade: Bear

- From BA ATH: -17.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

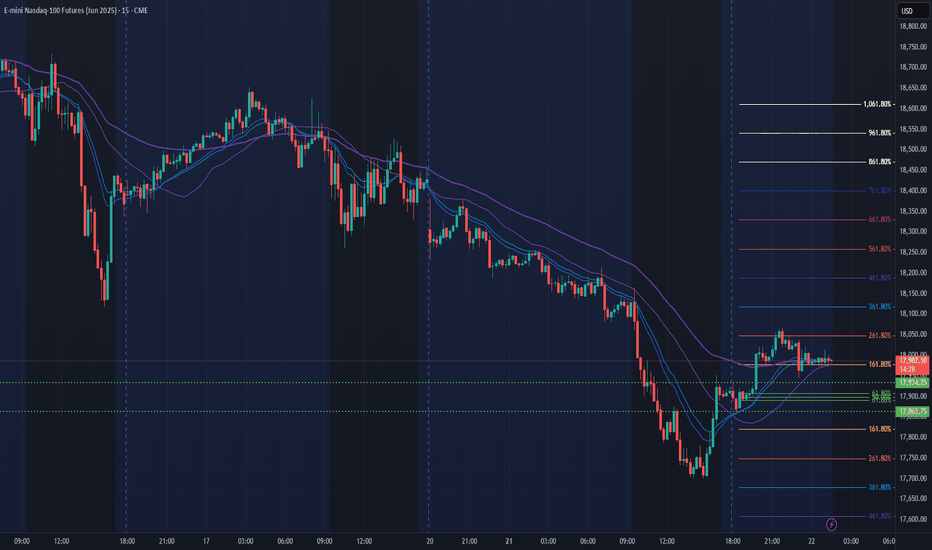

NQ Power Range Report with FIB Ext - 4/22/2025 SessionCME_MINI:NQM2025

- PR High: 17934.25

- PR Low: 17863.75

- NZ Spread: 157.5

No key scheduled economic events

Rollover to 17700 inventory

- Responding above previous session close, beginning inside print

Session Open Stats (As of 12:45 AM 4/22)

- Session Open ATR: 744.58

- Volume: 42K

- Open Int: 242K

- Trend Grade: Bear

- From BA ATH: -20.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19246

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone