SYRUPUSDT 4H Chart Analysis | Trendline Breakout & Next MovesSYRUPUSDT 4H Chart Analysis | Trendline Breakout & Next Moves

🔍 Let’s break down the latest action on the SYRUP/USDT 4H chart and pinpoint what comes next as trend and momentum cues line up for traders.

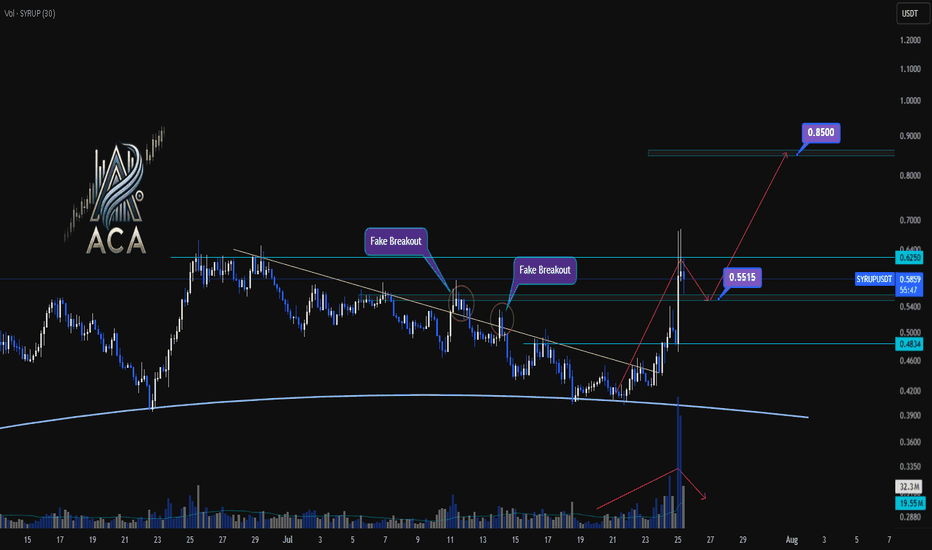

⏳ 4-Hour Overview

- The recent breakout above the key trendline was backed by a surge in volume, providing clear momentum confirmation and pushing price toward resistance.

- Price has already reached 1.5R of the initial breakout target, a strong sign the trend is in motion.

- Upon touching the $0.6250 resistance, momentum cooled, with volatility decreasing — a classic consolidation phase after a high-energy move.

🔻 Correction & Structure

- With volume subsiding and momentum slowing post-$0.6250, we’re now expecting a corrective move down toward $0.5515.

- This retracement zone will be critical to watch for higher low formation – a bullish structural signal if supported by volume confirmation.

🔺 Long Setup:

- Should SYRUP reclaim and break above $0.6250 after setting a higher low at $0.5515, and with renewed volume, we could see another strong leg higher.

- The next major resistance sits around $0.85 — this aligns as a logical upside target based on the range extension.

📊 Key Highlights:

- Trendline breakout with sharp volume spike = momentum confirmation.

- 1.5R reached before first deep pullback; structure remains bullish above $0.5515.

- Watch for a higher low and subsequent break of $0.6250 with volume to confirm the next move to $0.85.

🚨 Conclusion:

SYRUP’s chart is at a pivotal juncture: a constructive pullback to $0.5515 could set up the next wave higher if supported by volume. A confirmed breakout above $0.6250 targets $0.85 — stay patient and wait for volume signals at key levels.

Syrup

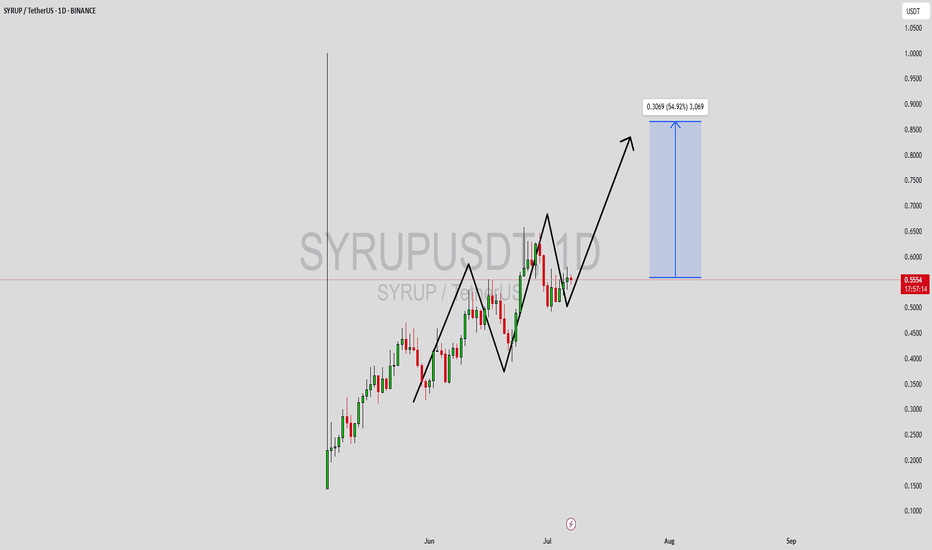

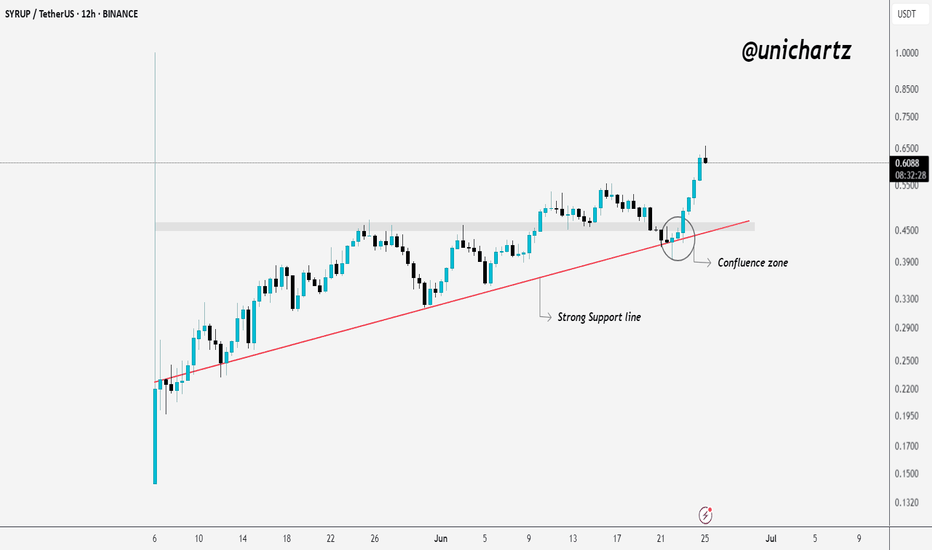

SYRUPUSDT Forming Upward ChannelSYRUPUSDT is catching the eyes of crypto traders with its steady climb and promising technical structure. The current chart shows that SYRUP is building a healthy upward channel, with good volume supporting the recent price action. This setup suggests that the pair could be preparing for another leg up, with an expected gain of around 40% to 50% from the current levels. Such potential upside makes SYRUPUSDT an attractive candidate for swing traders and medium-term investors looking for trending opportunities in the altcoin market.

SYRUP is gaining momentum as more investors begin to notice its unique project fundamentals and community-driven growth. As liquidity flows into this token, it adds further fuel to the rally, increasing the chances of sustained bullish momentum. This price action also reflects growing confidence among investors, which is crucial for any coin attempting to break out from key resistance levels. Watching how the price reacts to upcoming retests of support zones will be important for confirmation of the next move.

On the technical side, SYRUPUSDT appears to be forming a series of higher highs and higher lows, a classic sign of an established uptrend. If the token continues to respect its trendline support and buyers step in at pullbacks, there is a high probability that the projected target can be reached within a few weeks. Keep an eye on volume spikes and breakout candles for the best entry opportunities. The combination of positive market sentiment and strong chart structure makes SYRUP a token worth tracking closely.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

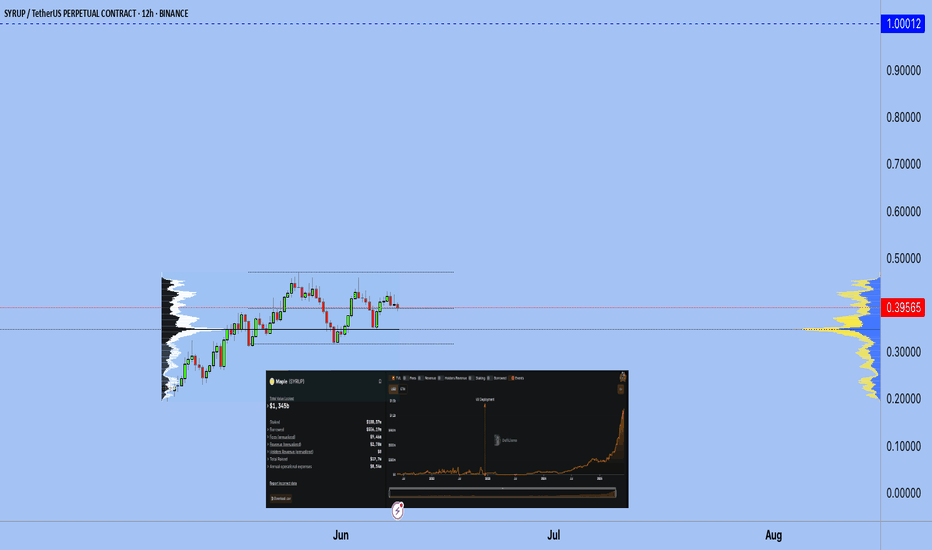

$SYRUP (formerly Maple): An Institutional-Level RelaunchMassive Reload: Brand, Token, Architecture

In May, the migration from MPL - SYRUP was completed, with the final 48-hour window taking place from May 19-21, 2025.

All products (syrupUSDC, syrupUSDT, etc.) have been integrated into the Maple ecosystem.

The Syrup.fi platform has been shut down. Unclaimed MPL tokens were redirected to the Syrup Strategic Fund (SSF) to support ecosystem liquidity and growth.

Key Developments & Growing Institutional Trust

Cantor Fitzgerald launched a $2B BTC lending program in partnership with Maple and FalconX (May 27) - a clear vote of confidence from the institutional world.

TVL has exceeded $1.6B, with nearly $1B in active loans - a significant milestone in the DeFi space.

Maple is expanding into Solana, launching syrupUSD:

Over $30M deployed already.

Additional $500K in incentives announced.

Chainlink CCIP is used for cross-chain communication between EVM and Solana ecosystems.

Analysis & Outlook: What the Structure Tells Us

Financial Infrastructure

Strong fundamentals: massive TVL growth and deep institutional participation.

Diversified architecture: Ethereum, Solana, and CEX liquidity all integrated into one unified system.

Behavioral & Market Signals

Despite temporary drops in on-chain activity and reduced whale holdings, the system’s DeFi structure remains robust and functional.

A short-term correction may occur due to whale profit-taking — potentially a great entry point.

What’s Next?

The launch of lstBTC — a compliant BTC yield solution — could be the next big catalyst.

Deeper Solana integration is likely to unlock new liquidity and broader user adoption.

Right now, we’re in the quiet build-up phase — when markets are silent, but infrastructure is forming. These are the moments where the best positions are taken.

I expect 1-1.4$ for 1 SYRUP

Best regards EXCAVO

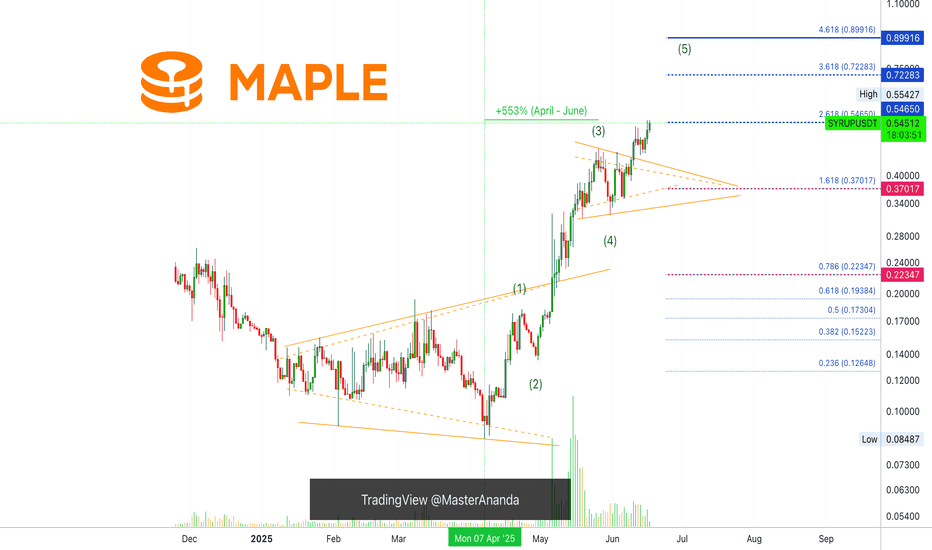

Maple (SYRUP) Bullish Impulse, Final Target & Correction Support+553% since its 7-April bottom, but the third wave is already in. Notice how the volume is super high until 15-May but then it drops as prices continue higher. This means that only the fifth wave remains. After the completion of the fifth wave there should be a correction before additional growth.

The two main targets for this current bullish impulse are shown on the chart but it can go higher of course. A number came up around $1.23 but this chart is just too young.

Once the correction starts, the main support will be where the 1.618 Fib. extension is now. Can wick lower but the 0.786 isn't likely to be tested. Maple Finance SYRUP.

Namaste.

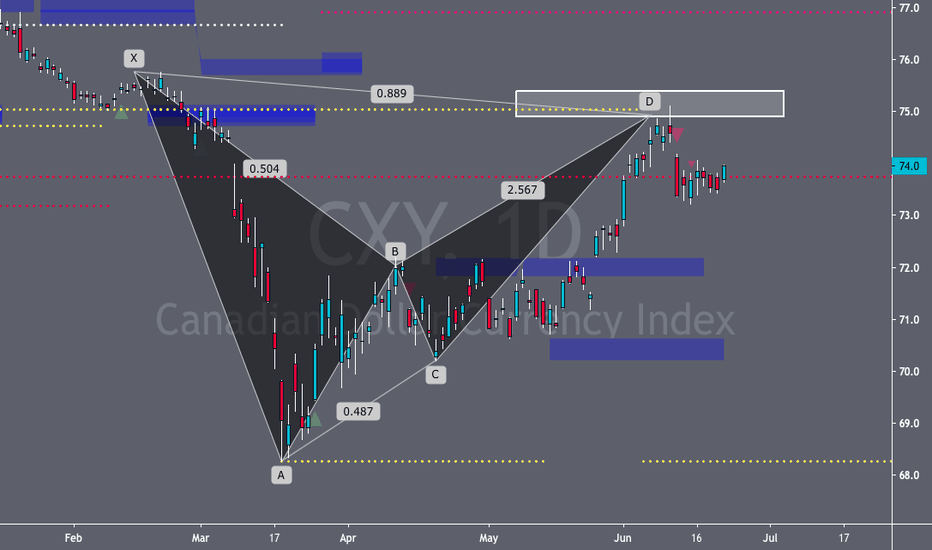

CXY (Canadian Dollar Index) Loonie So on the CXY we have an incomplete Bat Pattern we see PA enterered the PRZ and was severly rejected without completing the pattern. We need the entire box to be tested before the pattern is complete.

So, on the COT what we have are the Consumers and Producers buying and selling to eachother. As open interest has increased but the Non-Coms have reduced both their sides respectively while both sides of the commercials have increased thiers. if you were just looking at the Net Positions it would look as if the commercials are stepping to the Zero Line and the Non-Coms are stepping away from the Zero Line, but looking at the Line items the Commercials both have increased their positions, and the Non-Coms have reduced their positions. Now, interestingly enough the Non-Coms spread have increased thier Net-position. Now, normally we dont really pay attention to the spread as they are playing both sides of the plate. For example one company could be buying and selling the same currency. So, the Loonie might be stuck in a range this week so as a harmonic trader the CAD might be a pair I monitor closley as the Harmonic Trading strategy is best in a ranging market.

The COT Net Data:

Commercials- Current== 24,363 // Previous== 25,110

Non-Coms- Current== (25,486) // Previous== (24,829)