Takeprofit

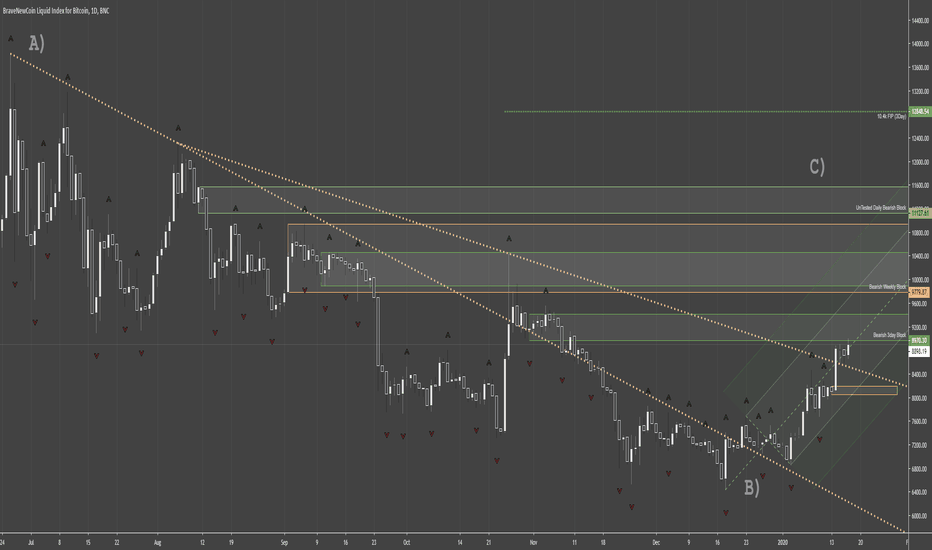

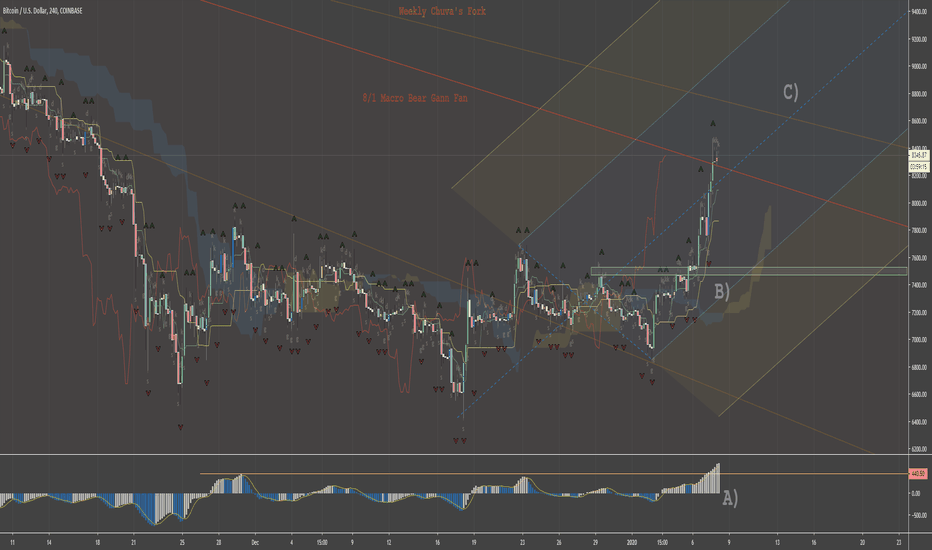

I may have to give up my hopes of 5.4k....In my last post I called for 8.6-8.8k. We hit our target, and then some. I hope you guys took at least some profits.

A) Was our 14k* top. At which point we created a beautiful Chuva Fork on the WEEKLY Chart (Pale Orange Dotted Lines from 14k % 12k). We proceeded to correct down to 6.4k.

B) 6.4k saw a beautiful bounce after clearing the stops from 6.5k, and we haven't looked back since...

C) We're now dipping our toes into a Bearish 3Day Block, so I expect at least a minor correction. A pullback into the Bullish block in yellow (around 8-8.2k) would be ideal, and quite healthy. That being said, we can certainly grind further into this block before correcting.

Ultimately, I think this leg up has some more fuel, and probabilistic-ally, I see us testing that Daily Bearish Block around 11.1k (currently UnTested). So long as we hold that Yellow Box & or Pitchfork, I remain Bullish, targeting said areas. Should we lose the Pitchfork, I'd be flat on all leveraged positions, only holding my Long-Term Spot.

As always, practice solid Risk Management, and good luck trading!

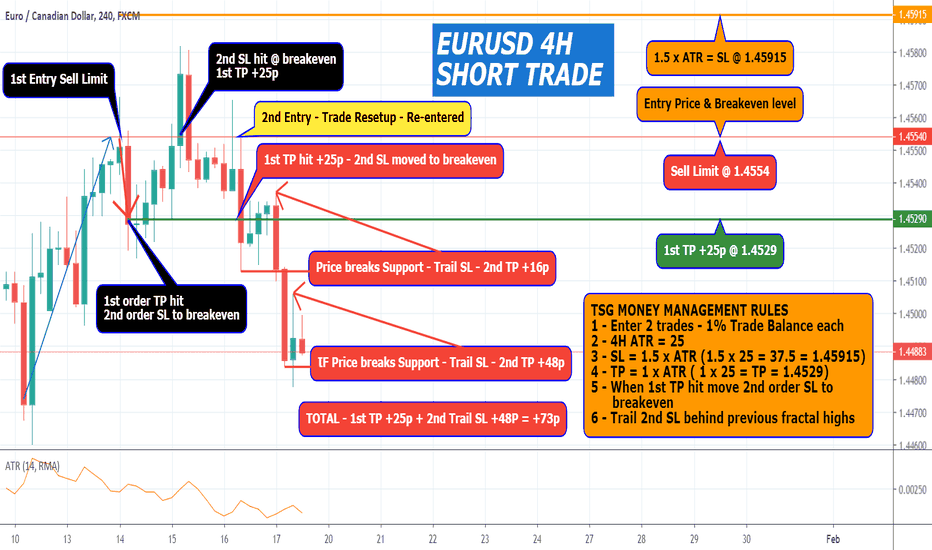

EURCAD 4H SHORT TRADETSG MONEY MANAGEMENT RULES.

1 - Enter 2 trades @ Sell Limit @ 1.4554 - 1% Trade Balance each.

2 - 4H ATR = 25.

3 - SL = 1.5 x ATR (1.5 x 25 = 37.5 = 1.45915) SL for both trades.

4 - TP = 1 x ATR ( 1 x 25 = TP = 1.4529) TP is for 1st order only, 2nd order no TP let profit run.

5 - When 1st TP hit move 2nd order SL to breakeven.

6 - Trail 2nd SL behind previous fractal highs.

Price moved up to retest a previous Sup/Res level.

Sell Limit made @ 1.4554 for 2 trades.

1st TP hit @ 1.4529, move 2nd trade SL to breakeven @ 1.4554.

Price had a bullish pullback and hit 2nd trade SL

Price stayed below the previous Sell Limit level of 1.4554.

Price re-setup short trade and re-entered another Sell Limit order @ 1.4554.

1st TP hit @ 1.4529, 2nd SL moved to breakeven.

Price created a new current fractal low support of 1.4513.

Moved Trail SL to current fractal high @ 1.4537.

Price created a 2nd current fractal low support at 1.4483.

If Price breaks that level then Trail SL to 1.4505 current fractal high.

Continue to trail SL if Price continues its bearish move.

This current EURCAD 4H Short trade was found by DACapitalTrading Jan 13th.

We added to this short trade our TSG money management trade plan.

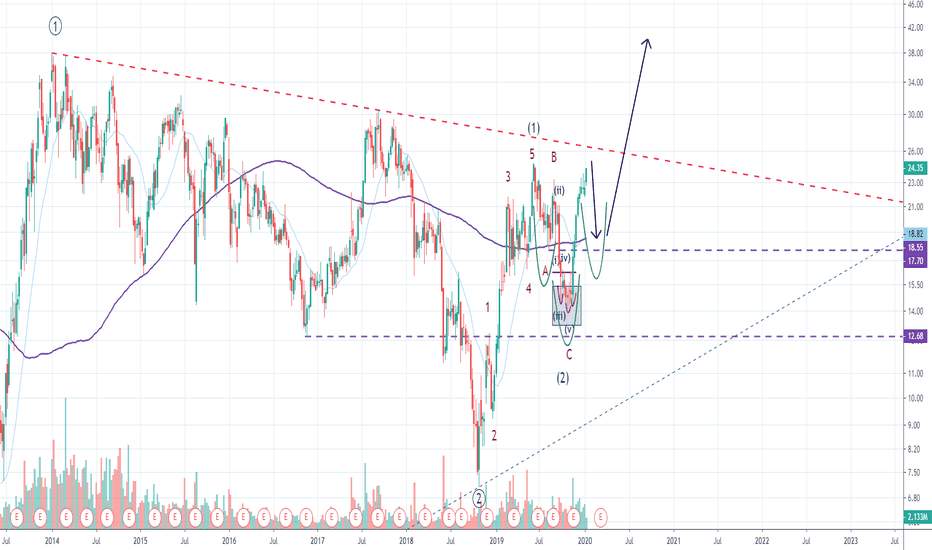

JKS - time to take some profits?Since recommendation in November NYSE:JKS is +40%, and is now appraoching major resistance region. Therefore, it is wise to take some profits, with idea to reload after some period of consolidation.

Overall, chart is very constructive and healthy pullback with potential inverted H&S should build strength for much higher levels in the years to come.

8.5 as anticipated, now what for BTC...Ok, you got me, $8470. In my previous post, Bull-still-not-giving-up/ , I set my sites on 8.5, which corresponded to the 8/1 Gann Fan coming down from 14k. A "Last Stand Level" for Bears, if you will. We tapped it (near), and got rejected (as anticipated). I hope you guys took some profit at/near these levels. No one ever went broke taking a profit!

A) Our Osci has put in a new high, leading me to believe we still have more Bull Juice in the tank.

B) The consolidation which led to this breakout, the green box, is Un-Tested. Should we correct, be it now, or at 8750, or 9.2 or <>...This would be an area I'd watch closely for an opportunity to Re-Enter Long (7.5ish).

C) This 8.6-8.8k still looks like a good area to stop and re-fuel (correct). I'd like to see us take 8.8 or so, then correct to 7.5 or 7.6, for another run at 10k+....but I digress, and we're just speculating now.

Ultimately, we're in the beginnings of a possible turnaround (mid term/macro scale). Breaking that 8/1 and holding (so far) is a very Bullish sign for BTC. Should BTC Break/Hold 8.6-8.8k region, the FOMO will likely start really ramping up. As always, practice strict risk management, enjoy yourself, and good luck trading.

7.5 or so is a clear Buy The Dip zone at this point. 8k may even be a possible opportunity, I'll be monitoring PA development closely.

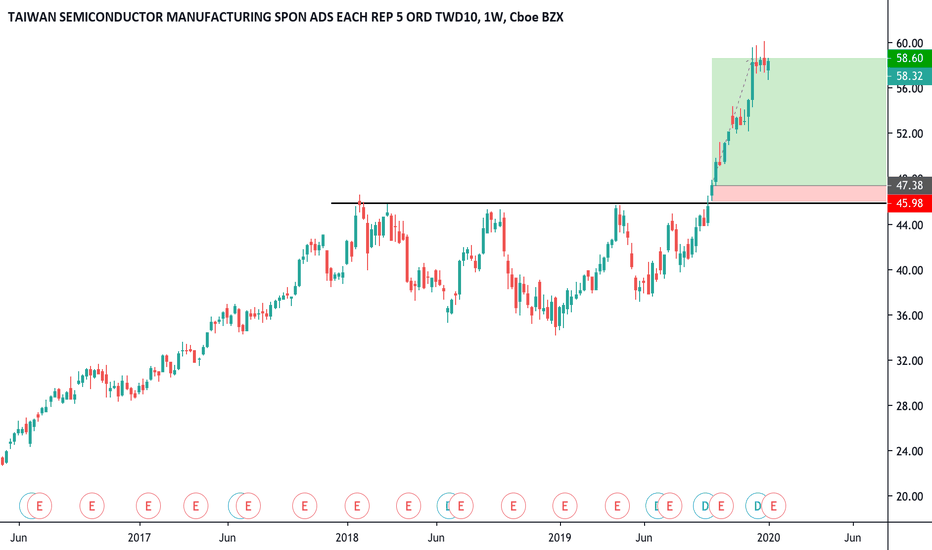

TSM, Taiwan Semiconductor Manufactoring - Take ProftNYSE:TSM

How do we look for the classic patterns of technical analysis?

Every weekend we screen the markets of our interest and set alerts.

When do we enter our trades?

On our classic strategy, we enter on Friday, i.e. after the confirmation of the whole week.

In this case you can easily determine at first sight this head and shoulders of continuation.

So you think it is difficult to visually detect these patterns?

Good Trading to All!

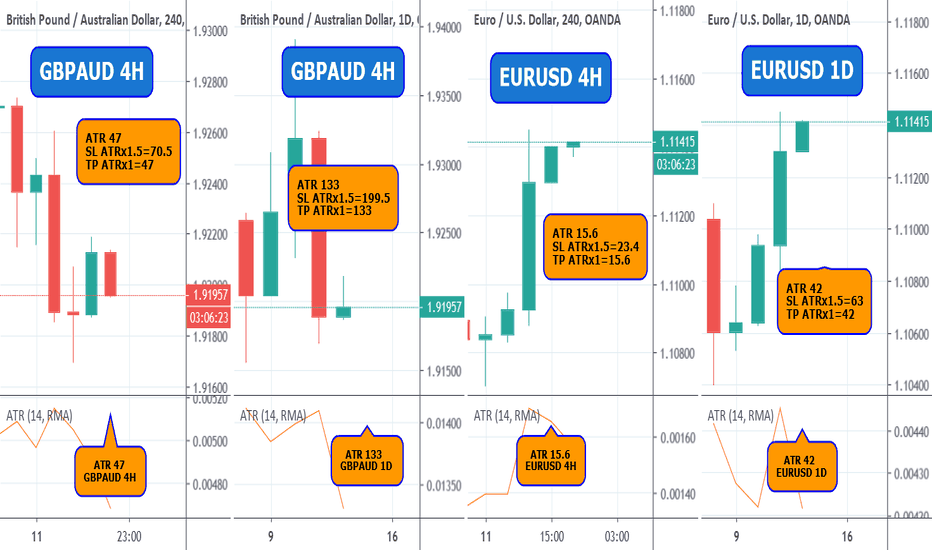

ATR MONEY MANAGEMENT FOR GBPAUD & EURUSD 4H & 1DUsing a set amount for SL and TP for different pairs and time frames is not effective money management.

Using the ATR for a specific pair and time frame lets you custom yur SL & TP for what that pair actually moves.

ATR 1D takes the last 14 candles and adds up then up together and then divides that figure by 14.

Now you have an average of how much that pair moves in a day.

GBPAUD 1D ATR moves 133 pips

GBPAUD 4H ATR moves 47 pips

EURUSD 1D ATR moves 42 pips

EURUSD 4H ATR moves 15,6 pips

This helps me determine a more accurate setting for my SL and TP for the pair I am trading and the time frame I am using.

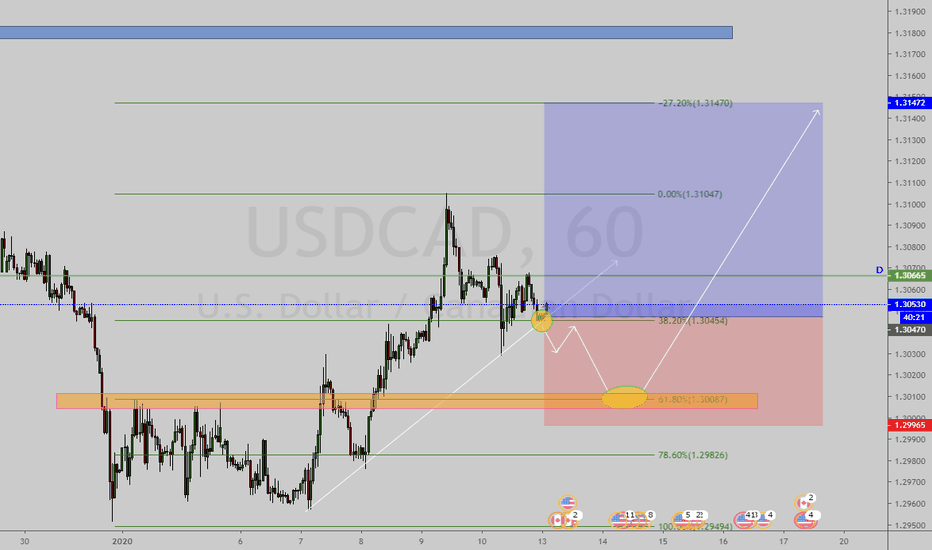

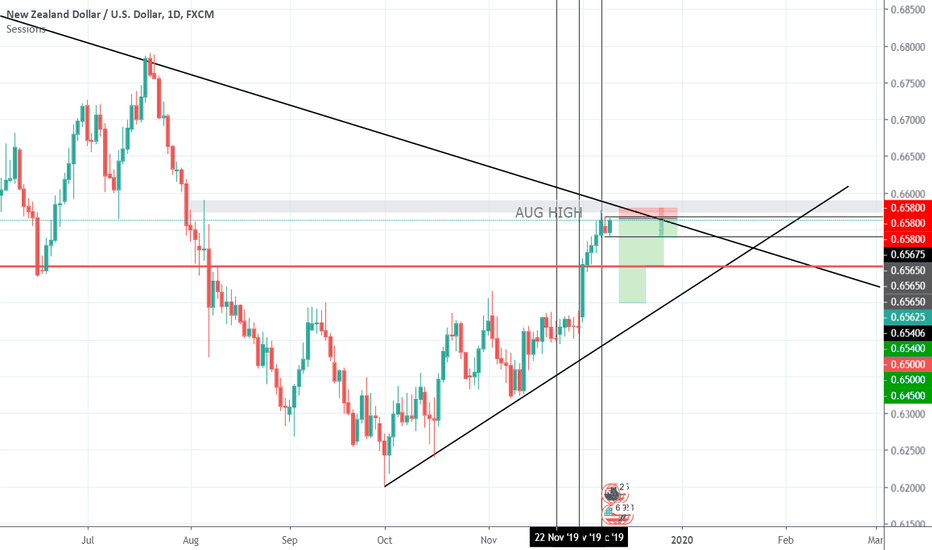

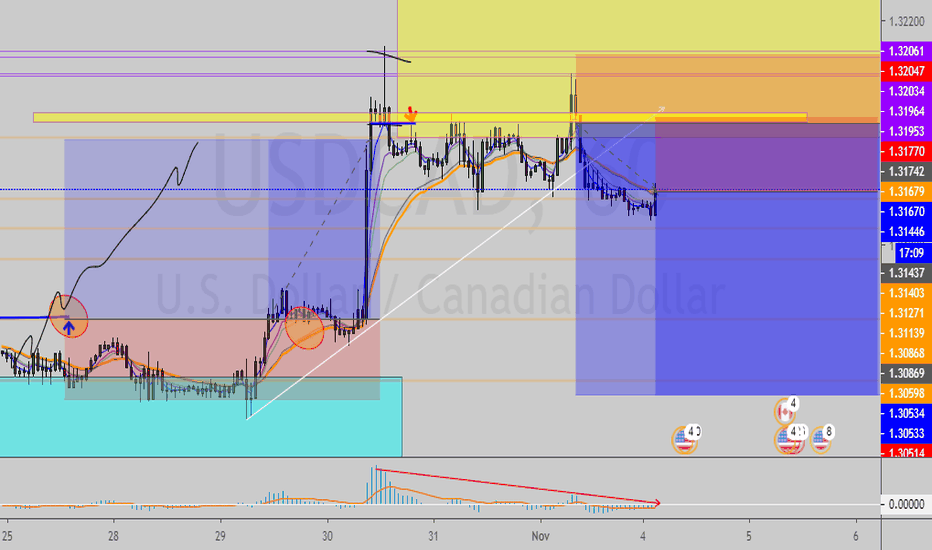

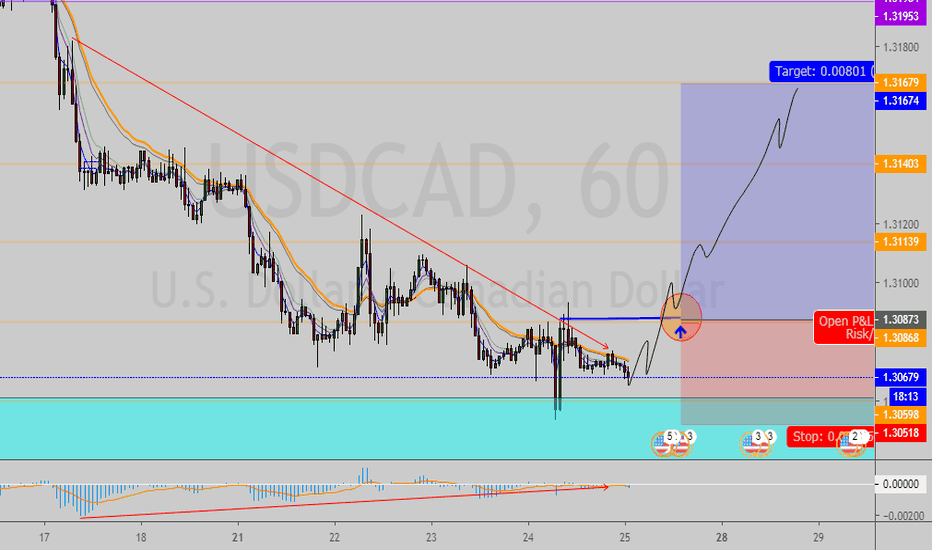

USDCAD SHORT TWING, SINGW & INTRADAY en las 2 entradas anteriores posteadas del USDCAD tomamos ganancia por un total de 300 pips ahora vemos como el precio llego a la zona marcada para buscar ventas en 4h y 1d y observamos que nos crea un patrón de doble techo junto con divergencia y confirmacion con fibonacci en temporalidad mayor, esperamos shift of momentum en 5M y tomamos una entrada a corto en swing, y la entrada en 1h la tomamos despues del doble techo y ahora esta dando reentrada al retesteo de la ema 20.

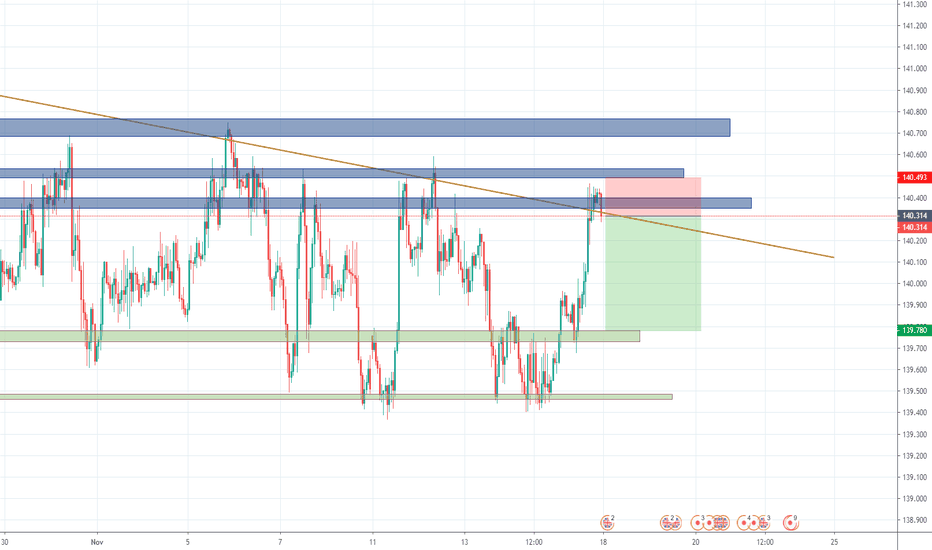

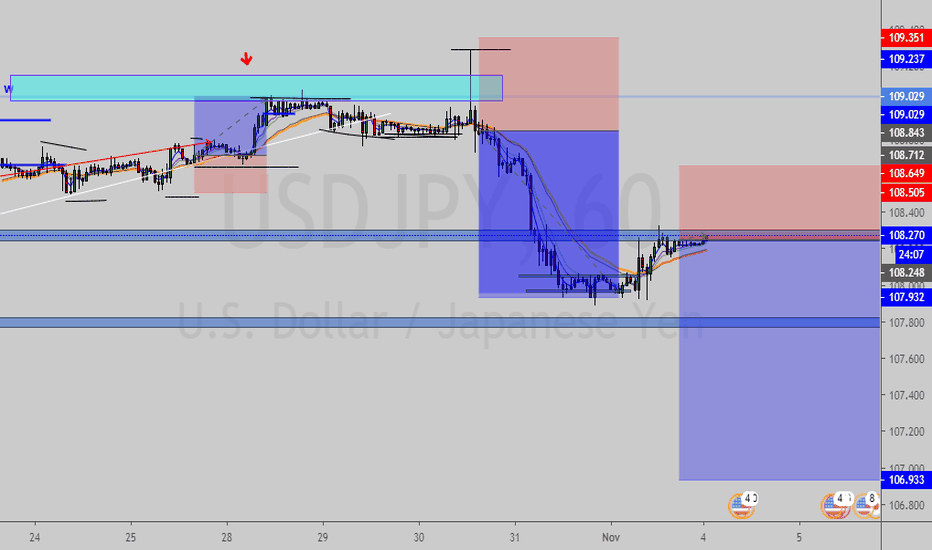

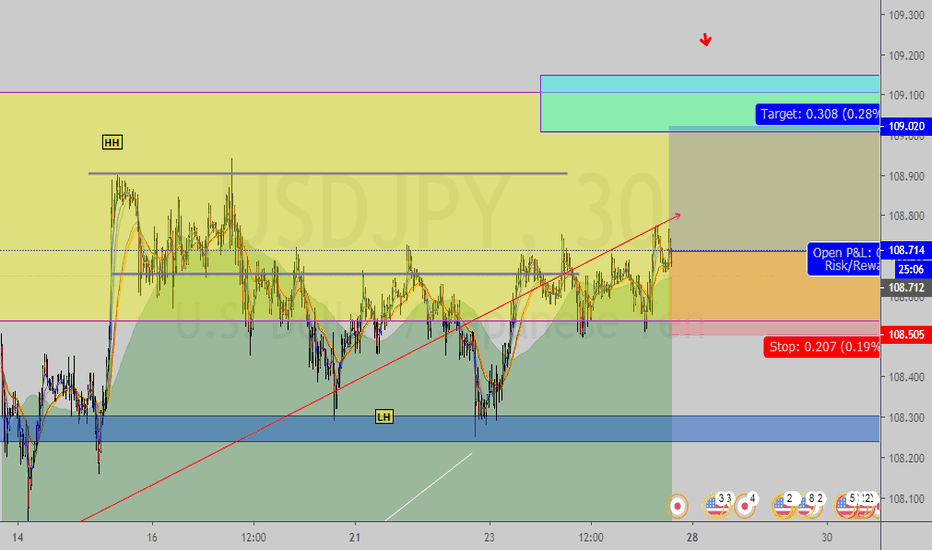

USDJPY CORTO TWIN, SWING y INTRADAYtomamos ganancia de las dos ultimas entradas publicadas en la idea anterior +120pips profit. tenemos una venta a swing abierta desde la semana pasada posteada en los comentarios y ahora el mercado nos esta dando una reentrada en 1h, vamos por 40pips de stoploss y 130 de takeprofit. Blessings

4H

USDCAD LONG correcion bajistatomamos ganancia de 220 pips con la entrada de la anterior publicacion de USDCAD, ahora esperamos confirmacion para operar su respectivo retroceso, y vemos como ale llegar a la zona marcada como objetivo anterior, la tendencia se empieza a debilitar y observamos una divergencia en el macd desde temporalidad de 4H. espero que me rompa el alto mas bajo anterior en temporalidad de m15 o m5 y entro al retesteo despues de romper la estructura bajista asi como esta marcado en el grafico.

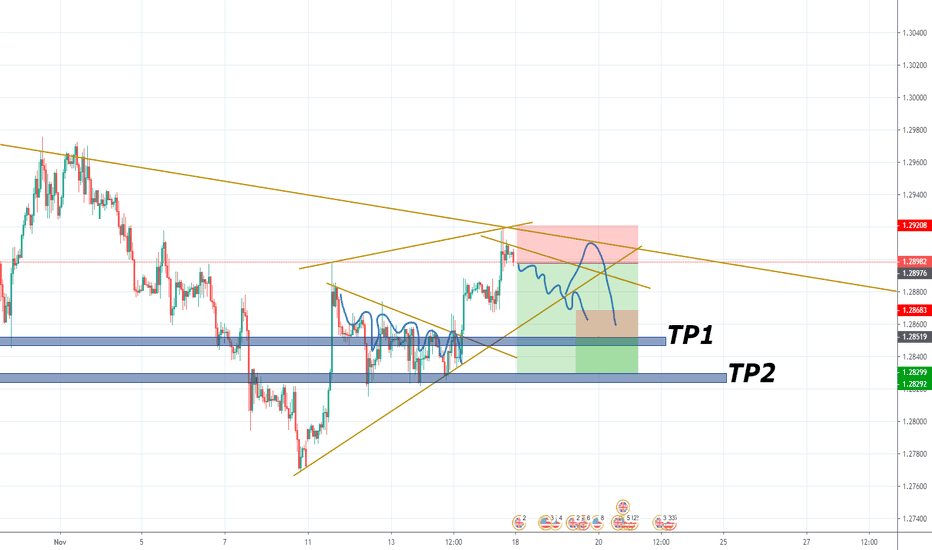

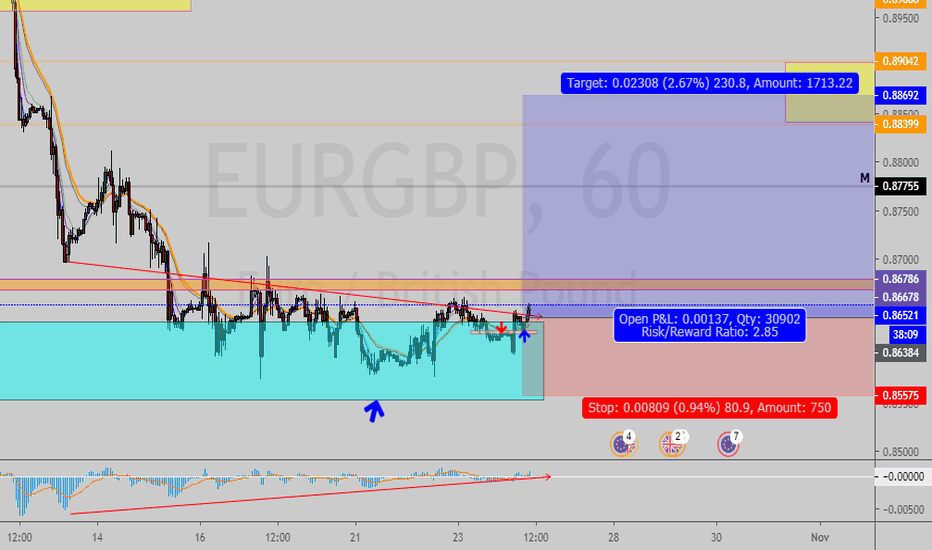

EURGBP LONGpodemos observar una clara divergencia en 4h y 1h, tanbien vemos como ya llego al objetivo diario y ahora busca un nuevo retroceso, vemos la consolidación, el cansansio de la tendencia bajista y el rompimiento de dicha estructura. tomamos entrada con (shif of momentum) en el quibre de estructura de 5min.

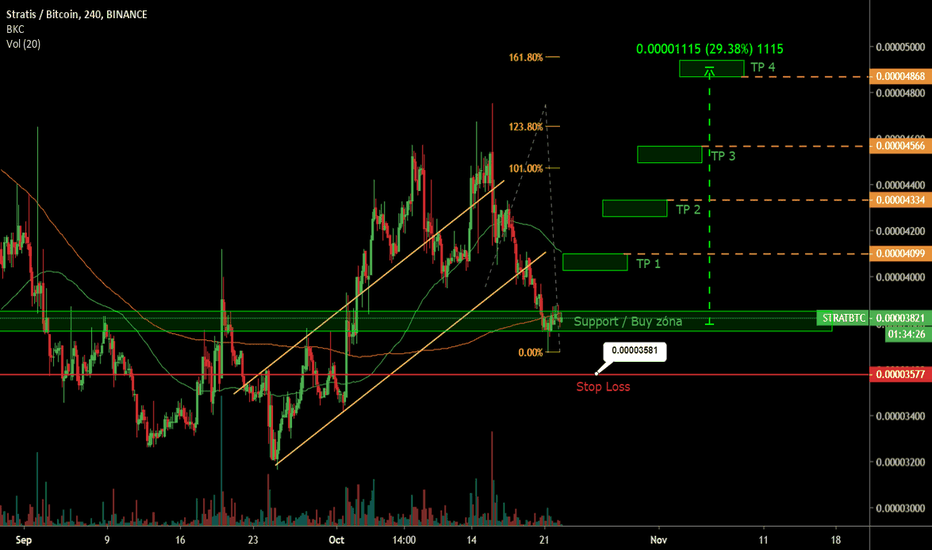

STRATBTC BullishSTRATIS is ending correcting structure. Right now is in Buy zone / Support so it is the best situation for perfect buy order ! :) I used resistance as following target. Stop Loss, Take Profits, Support, Buy zone, Resistance in chart ;)