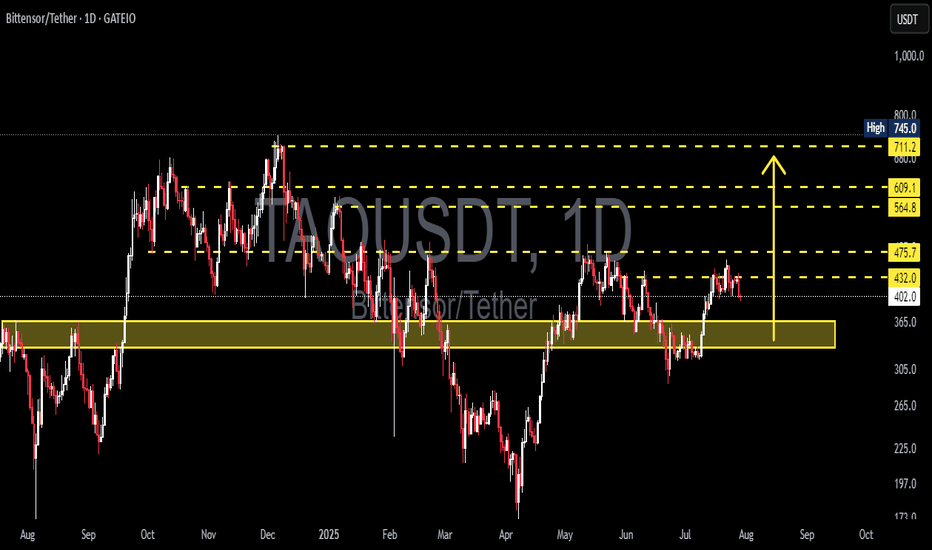

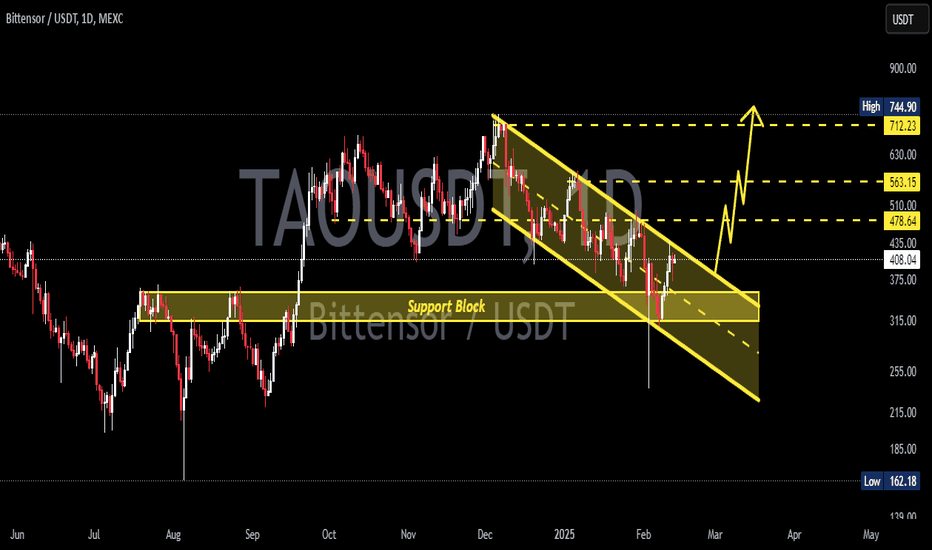

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone

TAOUSD

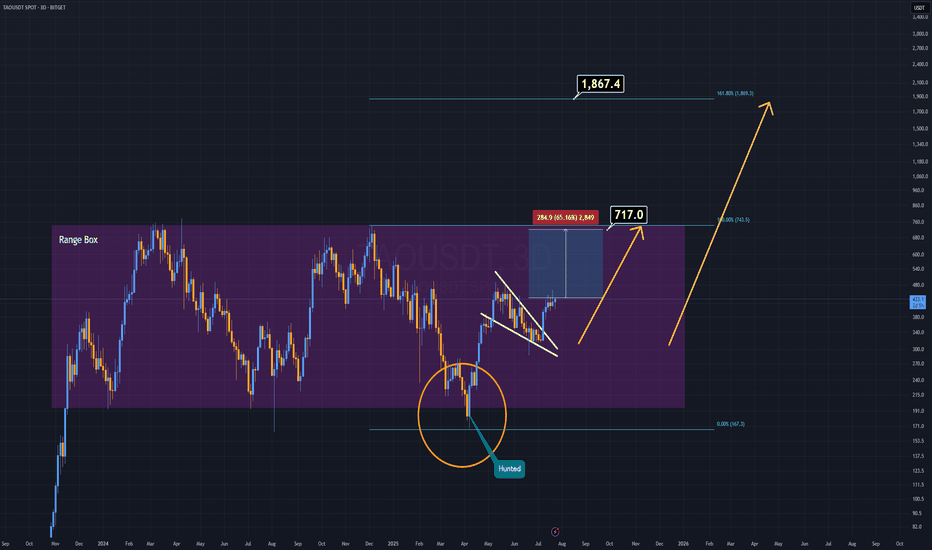

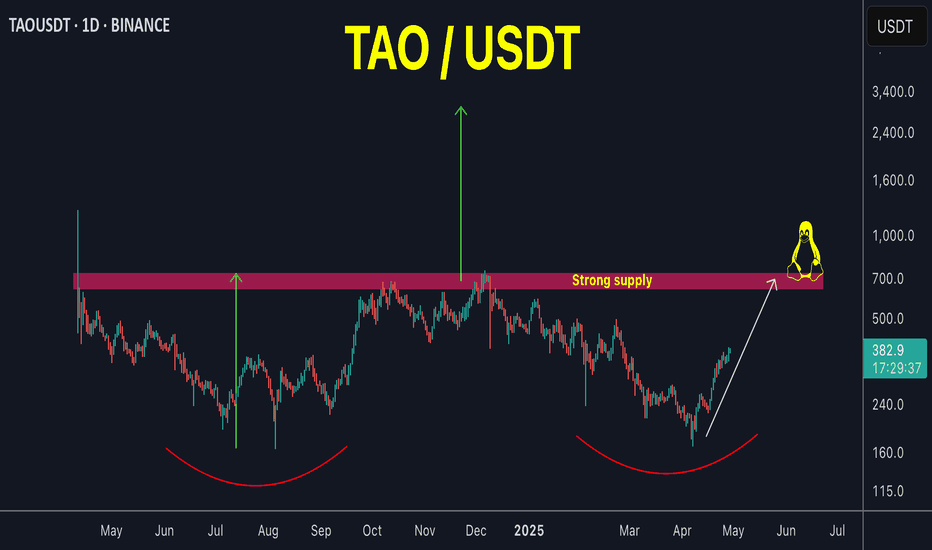

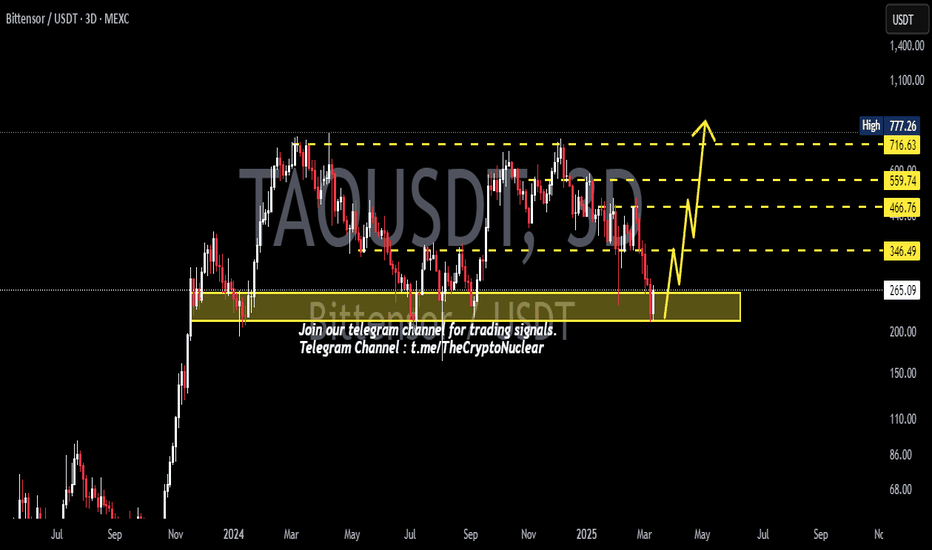

TAO Analysis (3D)Sometimes, there's no need for complex patterns or heavy indicators — and TAO is a perfect example of that.

For years, TAO has been consolidating inside a clearly defined accumulation box. Before the current bullish breakout, it liquidated all weak hands by sweeping the lows — convincing many that the project was dead.

Now, on the daily timeframe, we’re seeing a broken and active pennant formation, which is already being validated.

This structure alone is a strong technical buy signal.

With the upcoming AI-driven bull run, TAO has the potential to outperform many of its AI-sector peers.

This one might just fly ahead of the pack.

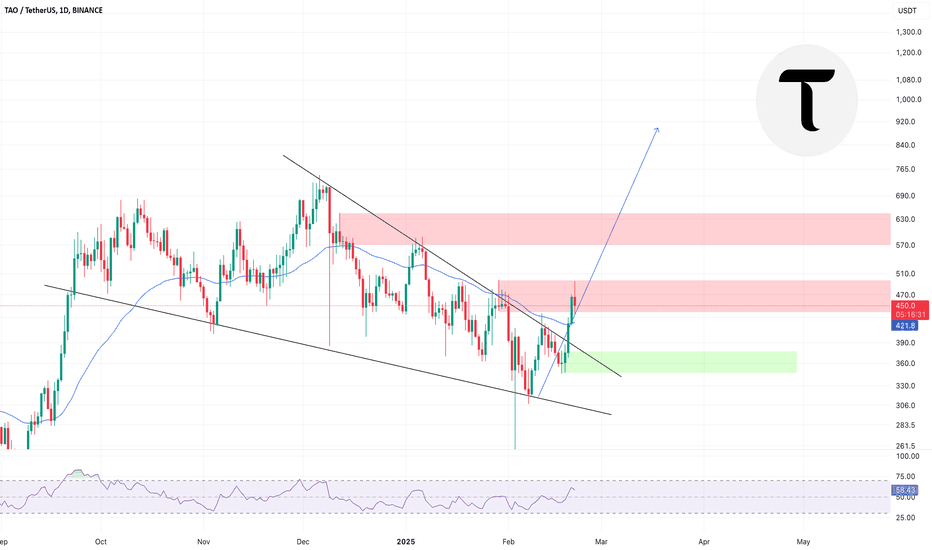

TAOUSDT Breaks Descending Trendline!BINANCE:TAOUSDT daily chart is showing a potential bullish breakout as price moves above a long-term descending trendline. This breakout, combined with support from the 100 and 200 EMAs, indicates growing upward momentum. If price holds above this trendline, the next key resistance lies around the $750 level. A successful breakout and retest could pave the way for a major rally toward $2,000. GETTEX:TAO

Regards

Hexa

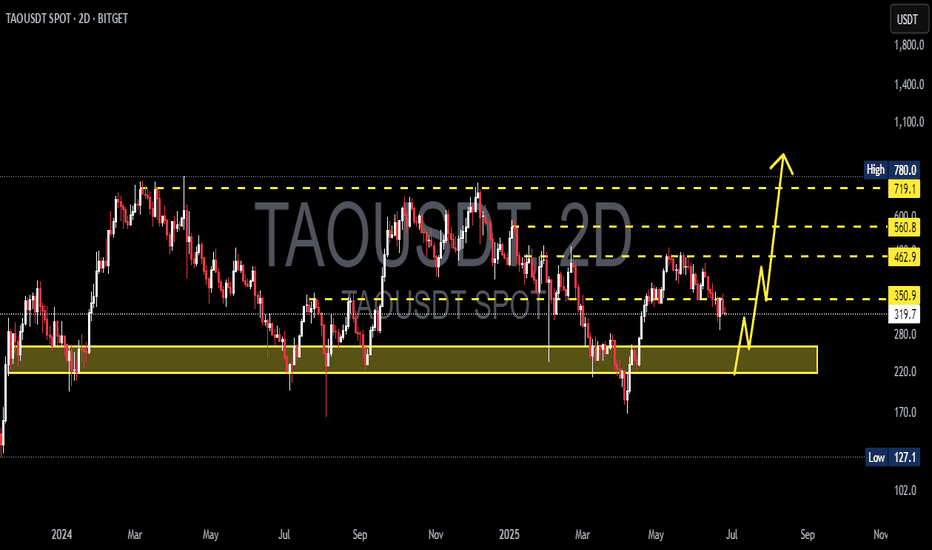

TAO/USDT Potential Reversal Zone – Major Bounce OpportunityTAO/USDT is currently testing a critical support zone (highlighted in yellow) between $220 – $280, which has historically acted as a strong accumulation area. The price has shown multiple reactions from this region throughout 2024 and 2025, signaling that bulls may be preparing for a reversal.

🔍 Key Technical Levels:

Major Support Zone: $220 – $280

Immediate Resistance Levels:

$350.9

$462.9

$560.8

$600

$719.1

Long-Term Resistance: $780 (local high)

🔄 Scenario: If TAO successfully holds this support zone, a bullish reversal could be triggered with a potential rally toward the $350 level first. A break and retest above this could open the door for a sustained move towards $560 and beyond. The bullish projection is illustrated with the yellow arrow path, showing a potential multi-stage rally through key Fibonacci and structural levels.

📉 Invalidation: A confirmed break below $220 would invalidate this bullish setup and could push TAO toward lower lows, potentially retesting $170 or even $127 support levels.

📌 Summary: TAO is approaching a historically strong support base. If the structure holds and volume supports the reversal, we could see a powerful leg up toward $560 and possibly $719 in the medium term. Risk management is essential, especially with volatility around macroeconomic events and Bitcoin price movements.

#TAO/USDT

#TAO

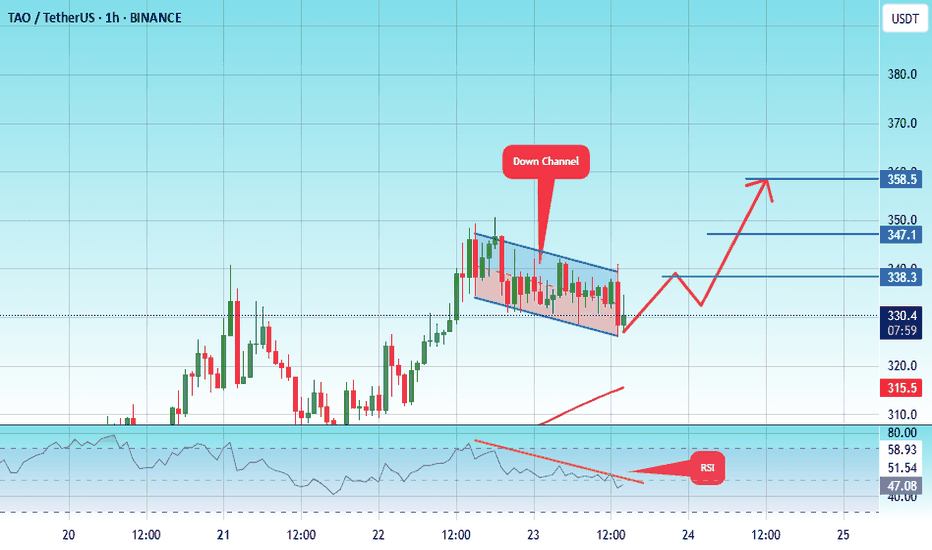

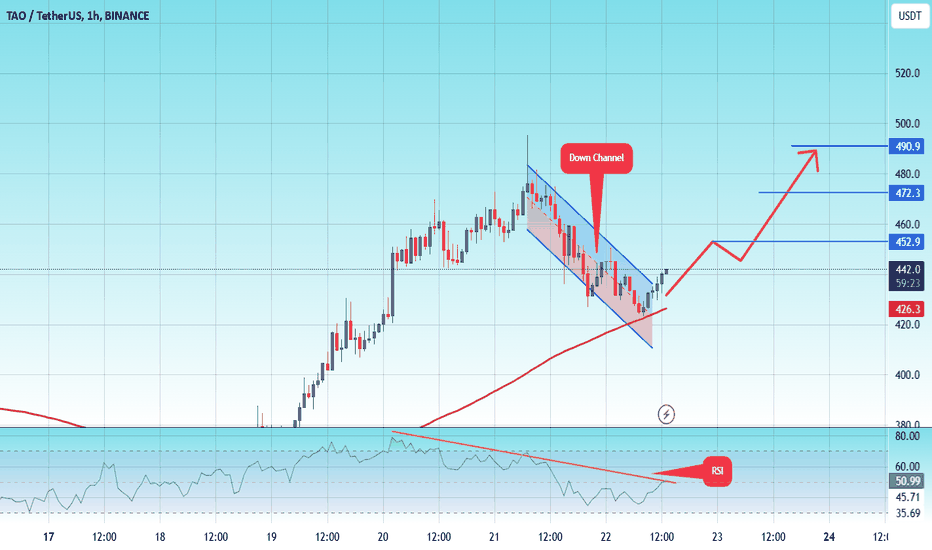

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, this support is at 326.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 330

First target: 338

Second target: 347

Third target: 358

$TAO back to the lows at sub $200 (or lower)Tao looks like it's topping here, I originally thought we'd stop at $247, but price has gone a little bit further. There's more confluence in resistance at this level and one more level above, but I think gains are limited here.

I think it's likely that from here we correct back down to the lows and break them. The most likely target is the $117-135 levels. However, won't rule out the possibility that we find support at the previous low, or that we potentially go lower all the way down to $56.

Let's see how it plays out over the coming weeks.

#TAO/USDTThe price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 213.

#TAO

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 262

First target: 294

Second target: 319

Third target: 354

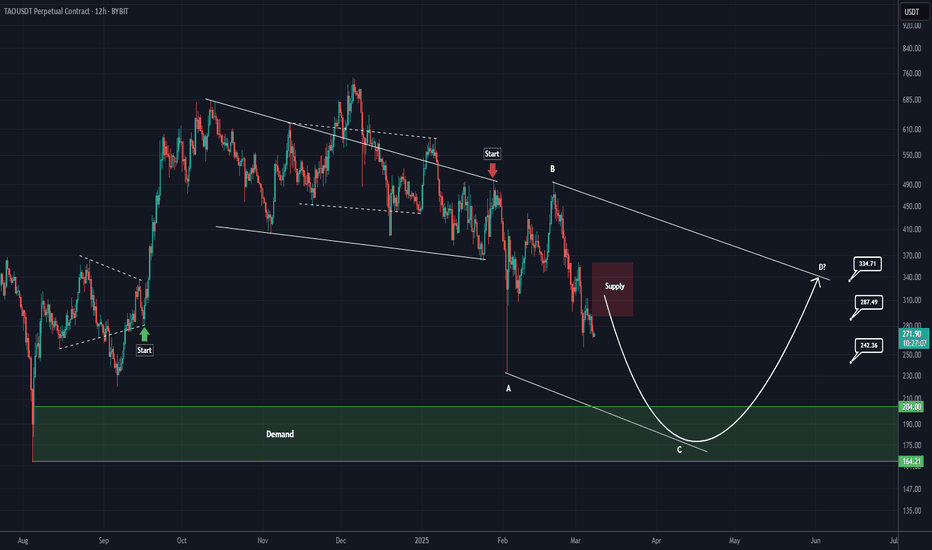

TAO Analysis (1D)TAO appears to be forming a new corrective pattern from the point where we placed the red arrow, with its wave C potentially completing within the green box.

We are looking for buy/long positions in the green zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

invalidation level = 150$

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

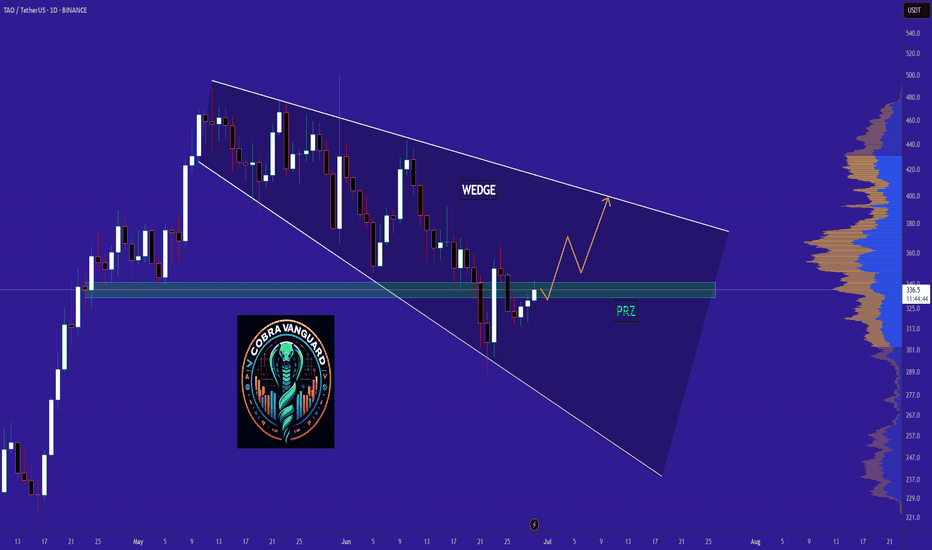

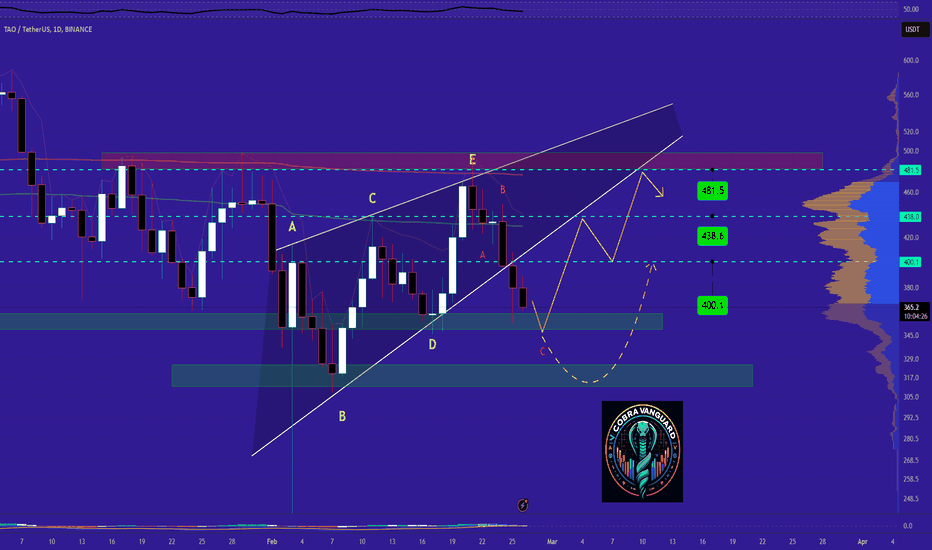

TAO Outlook after the Dip. What to expect NOW?Because of politics and misleading news, we are now witnessing these prices, and this caused most of my analyses to be wrong and not go according to my thoughts. However, now the price has a strong support area that if it reacts to it, the price will go up to $400 and create a V pattern. Since this market is filled with some politicians and some Persons & their misleading promises, maybe the price will drop again and go down to $310 and then grow again.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

❗Disclaimer

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

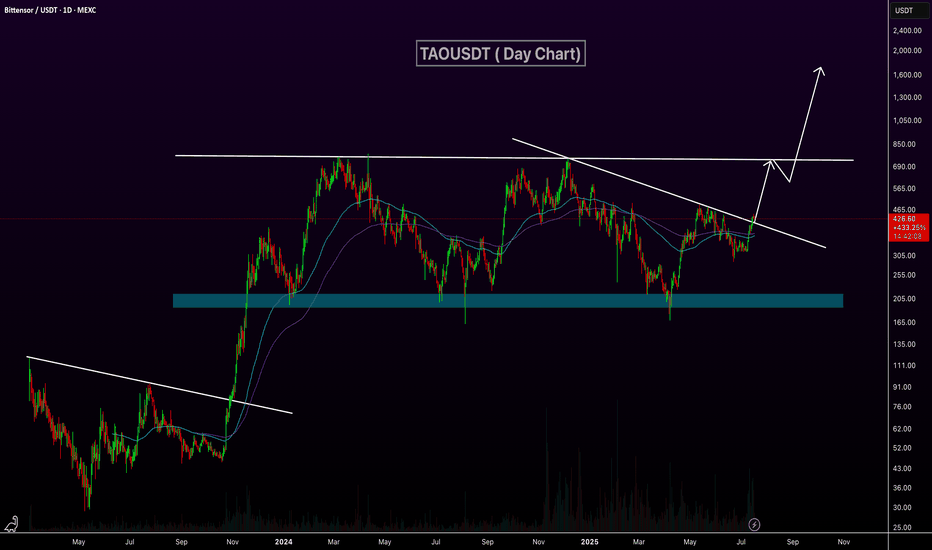

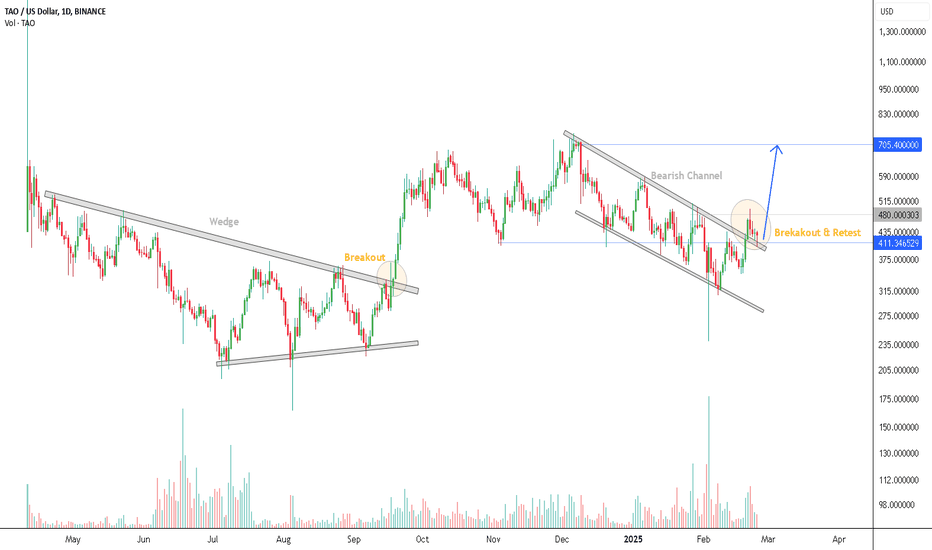

TAOUSD Breakout and Retest Confirms Bullish StructureTAOUSD has shown strong bullish potential after breakout of two key patterns. The first pattern was a wedge, which formed between May and September 2024. This pattern is typically a bullish reversal signal, and as expected, the breakout led to a strong rally. After reaching new highs, the price then entered a bearish channel, which served as a corrective phase rather than a trend reversal. Recently, TAOUSD successfully breakout of this bearish channel and has now retested the breakout zone around $411, confirming previous resistance as a new support level.

Currently, the $400 – $411 zone acts as a critical support area that needs to hold for further upside continuation. If the price maintains strength above this level, the next key resistance to watch is $480, where previous price rejections occurred. In the medium term, the major bullish target lies at $705 – $730, aligning with a previous major high. From a trading perspective, aggressive entries can be considered around $410 – $420 during this retest, while conservative traders may wait for confirmation with a strong breakout above $480. A stop-loss should ideally be placed below $400, as a breakdown below this level could invalidate the bullish outlook.

For confirmation, volume strength should be monitored, as a breakout with low volume may indicate weakness or a potential fakeout. Additionally, broader market sentiment, particularly Bitcoin’s trend, could influence TAOUSD’s price action.

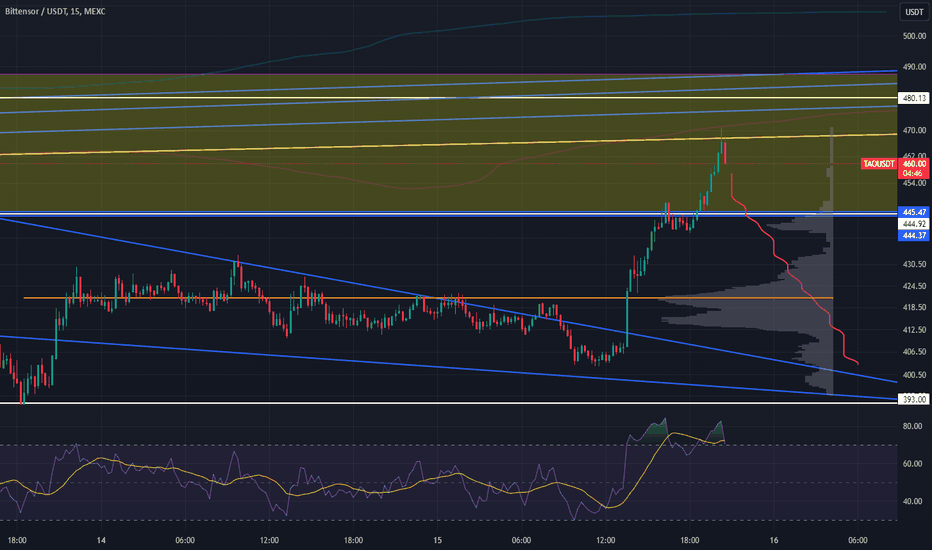

#TAO/USDT#TAO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 418

Entry price 440

First target 452

Second target 472

Third target 490

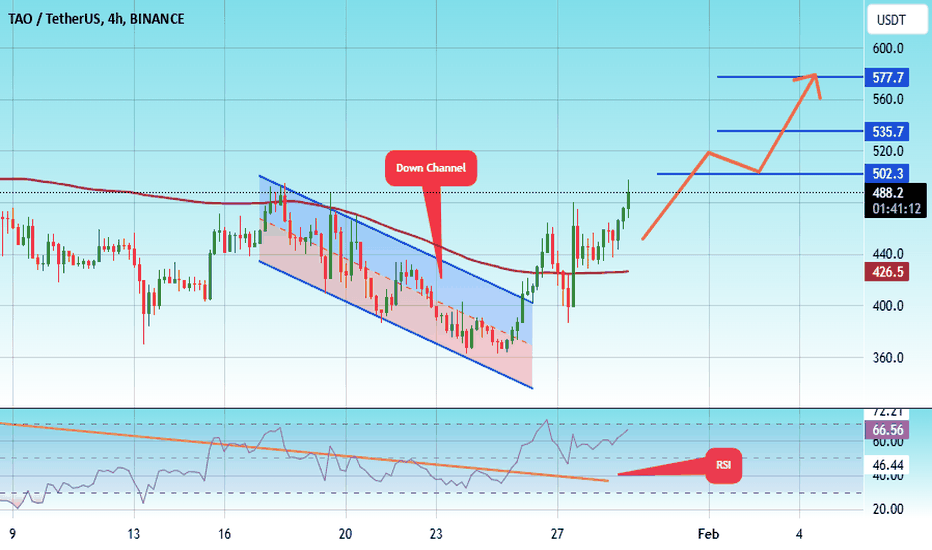

#TAO/USDT Ready to launch upwards#TAO

The price is moving in a descending channel on the 4-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 362

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 472

First target 502

Second target 535

Third target 577

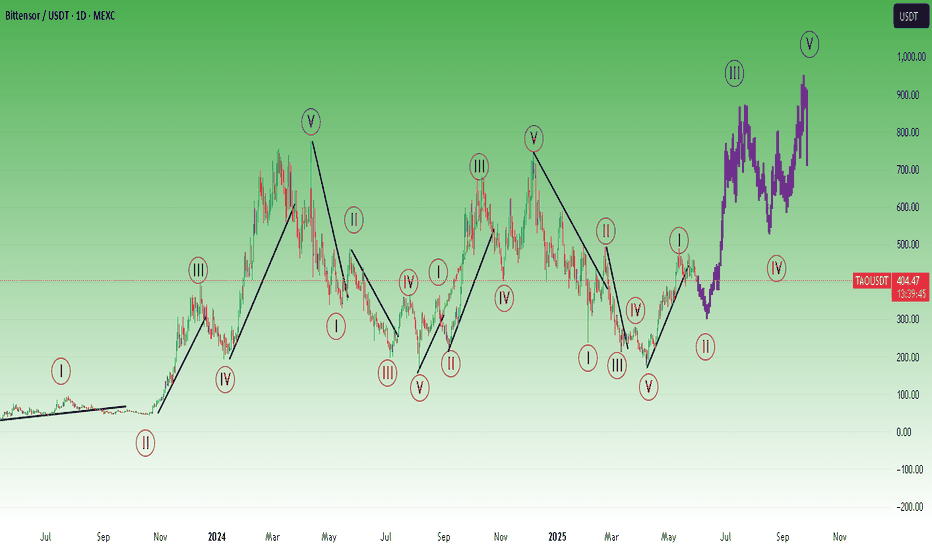

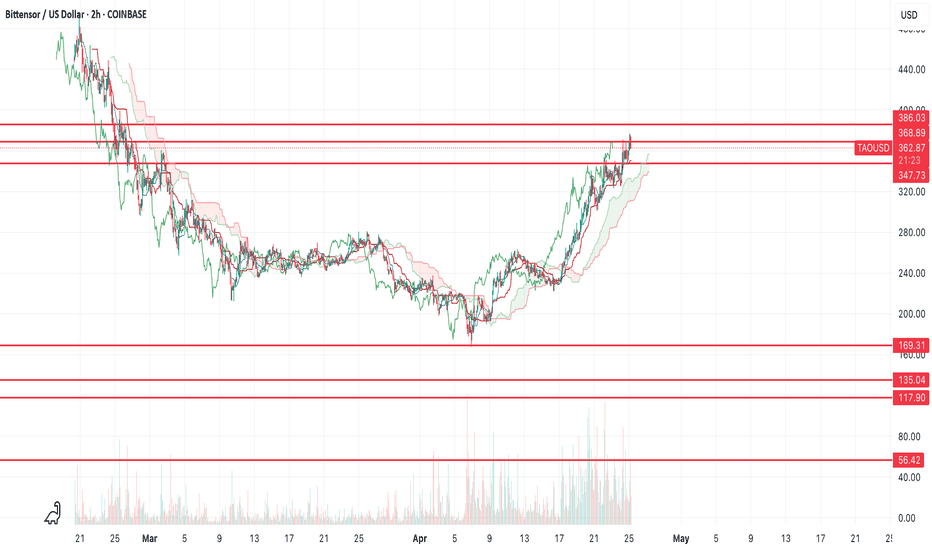

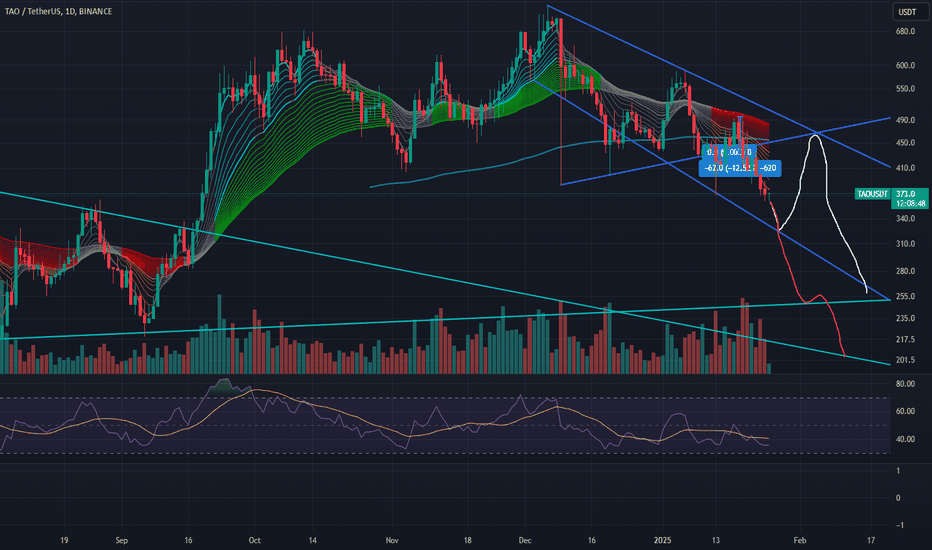

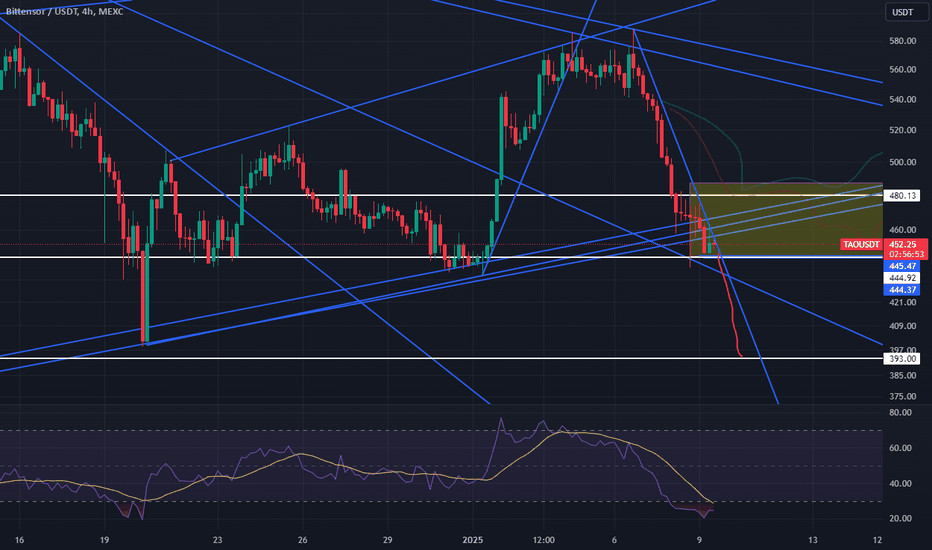

Hail Mary moment for BittensorBittensor about to enter a bear market of its own, breaking down key support levels. If it doesn't quickly reverse from here, which unfortunately seems unlikely, as it has had 2 chances to bounce,

then we are likely to go much lower.

Possible levels of interest are below.

Sad day for TAO, as just a month ago the set-up seemed bullish... how much can change over a month

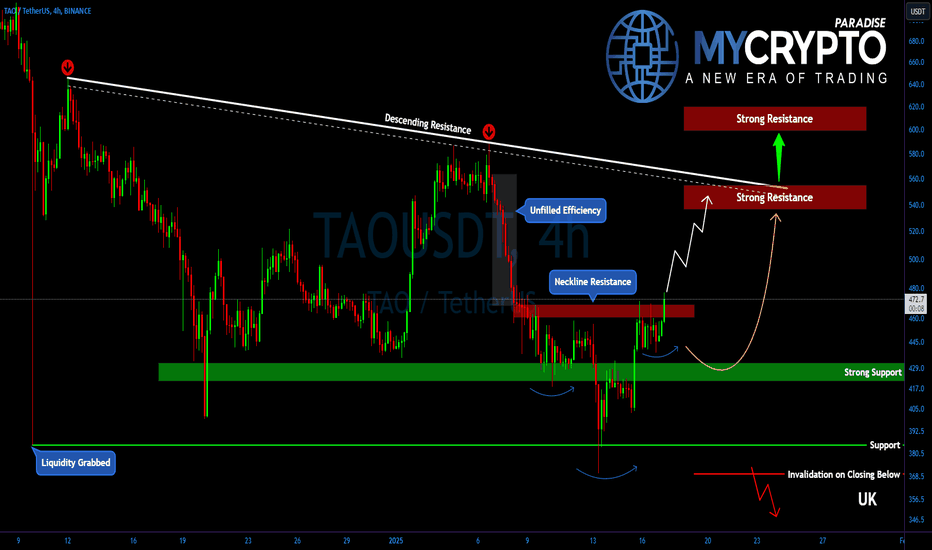

TAO Breakout Imminent? Watch These Crucial Levels Closely!Yello, Paradisers! Is #TAO gearing up for a powerful breakout, or are the bulls about to hit a wall? Let’s break this down step by step because this could be the turning point for TAO!

💎#TAOUSDT has reversed strongly after grabbing liquidity at lower levels, and it’s now shaping into an inverse head-and-shoulders pattern—one of the most promising bullish structures. If the breakout confirms, TAO could target the unfilled inefficiencies above. But will the bulls carry this momentum all the way?

💎Currently, TAO is testing the neckline of this pattern, with resistance sitting at the $460–$470 zone. A clean breakout and successful retest of this level as support could ignite further bullish momentum, pushing TAO toward $540–$550. This zone is critical as it holds the 61.8% Fibonacci retracement and aligns with the descending resistance, making it a significant hurdle for the bulls to conquer.

💎Should TAO break through $550, the next target lies at $620–$640—a region where the pattern target completes. However, be cautious here. This level could trigger aggressive profit-taking, and we know how markets react when the herd gets too excited.

💎On the flip side, TAO’s immediate goal is to flip the $460–$470 range into support. If this happens, it could act as a major catalyst for continued bullish momentum. If the bulls fail to hold this level, strong support lies below at the $430–$415 zone—a key area with the strength to absorb short-term selling pressure.

Patience and discipline are key here, Paradisers. The market often tests both bulls and bears before making decisive moves, so stay vigilant.

MyCryptoParadise

iFeel the success🌴

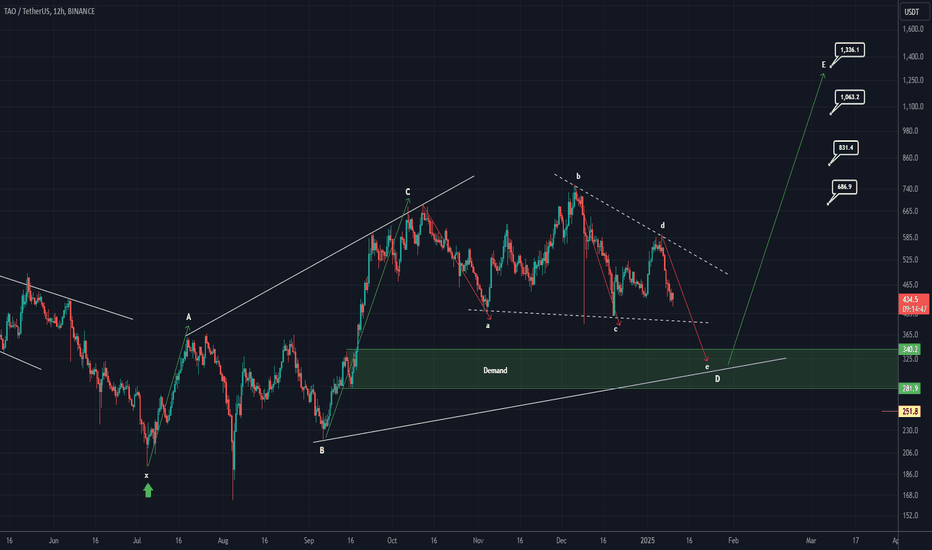

TAO roadmap (12H)It seems that TAO is forming an expanding triangle, currently in wave D of this triangle.

Wave D appears to have itself formed an expanding triangle (inverse expanding triangle).

It is expected that wave e of D will complete within the green zone.

From the green zone, it can move towards its targets.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TAO Bearish continuation likely incomingOur previous bearish trade on TAO has successfully reached its targets (analysis here)

The way selling candles cut through the box like warm butter indicates there is more downside to go

400 dollars target is on the horizon again

400 dollars is the major support level that has held twice

It needs to hold again, and ideally not be tested again

if it doesn't hold or is tested one more time afterwards, things will look very gloomy for bittensor