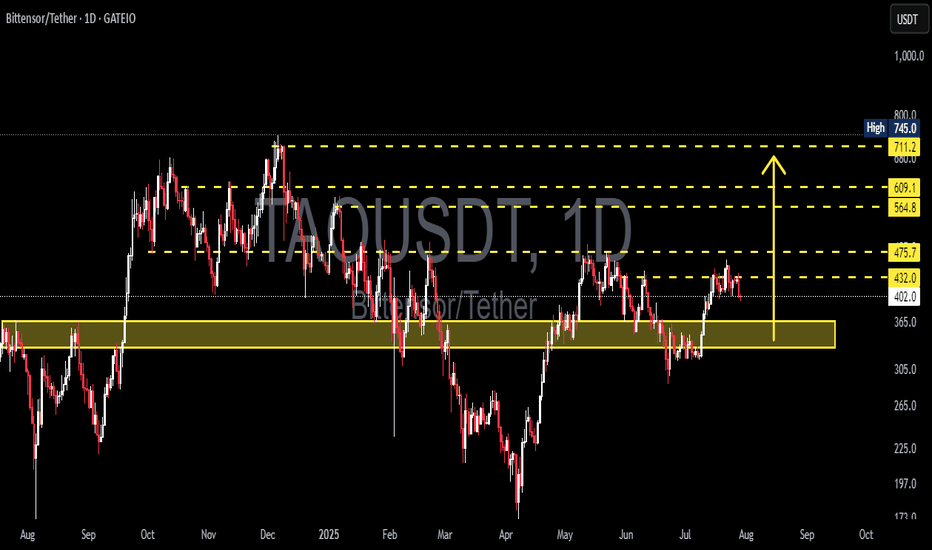

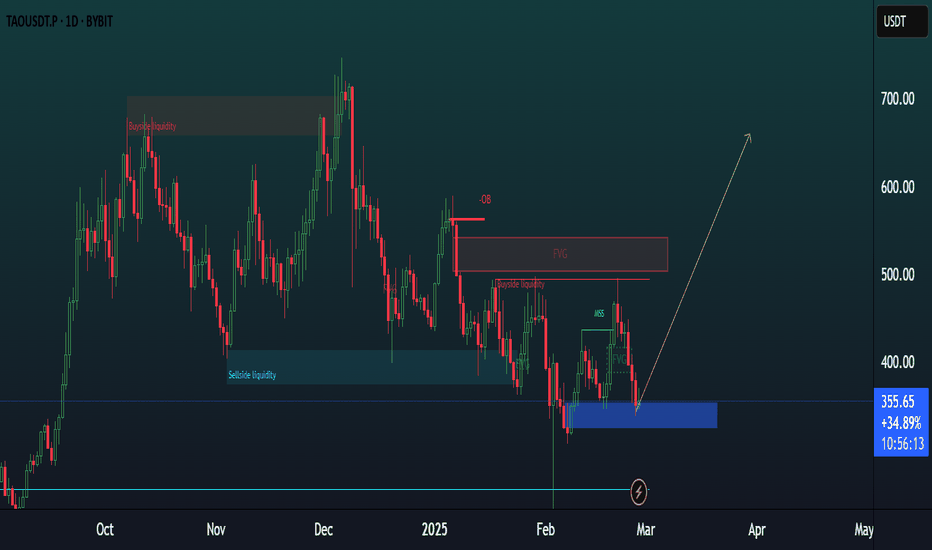

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone

Taousdtperp

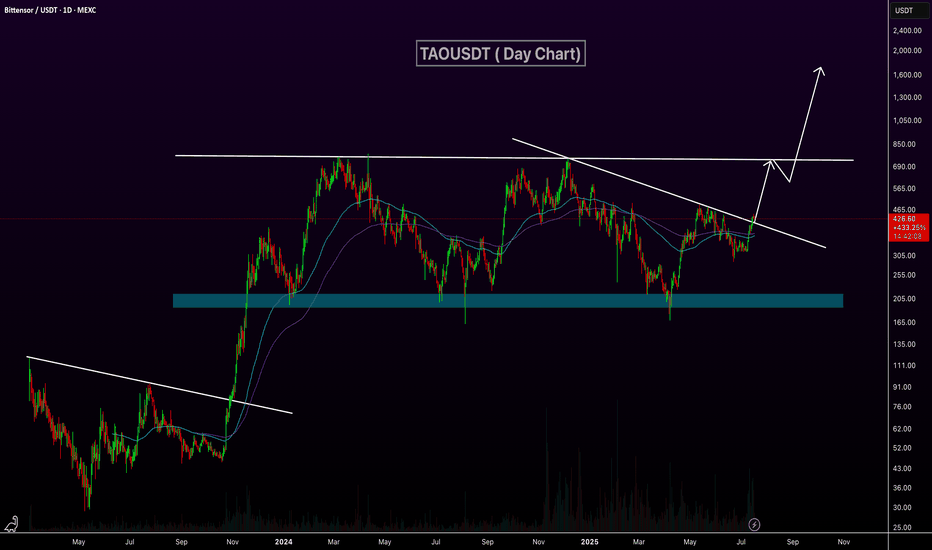

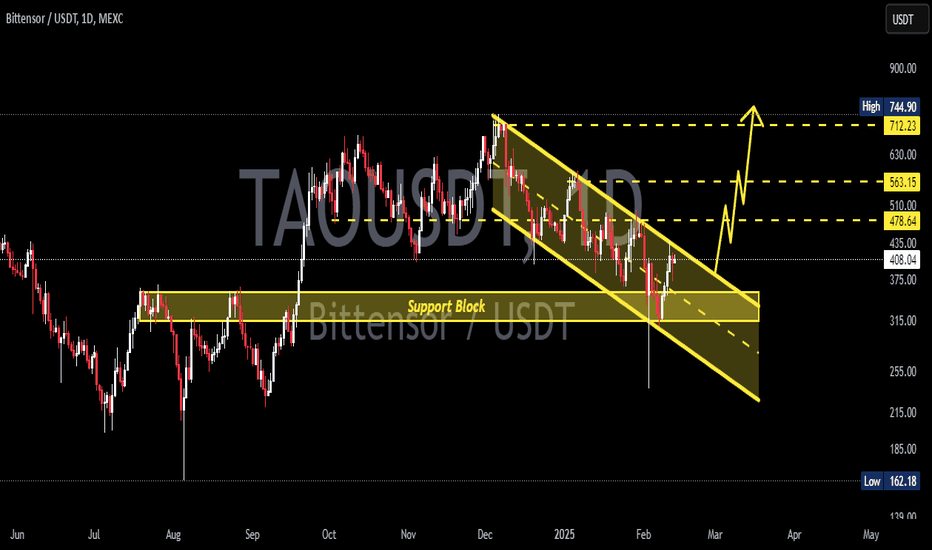

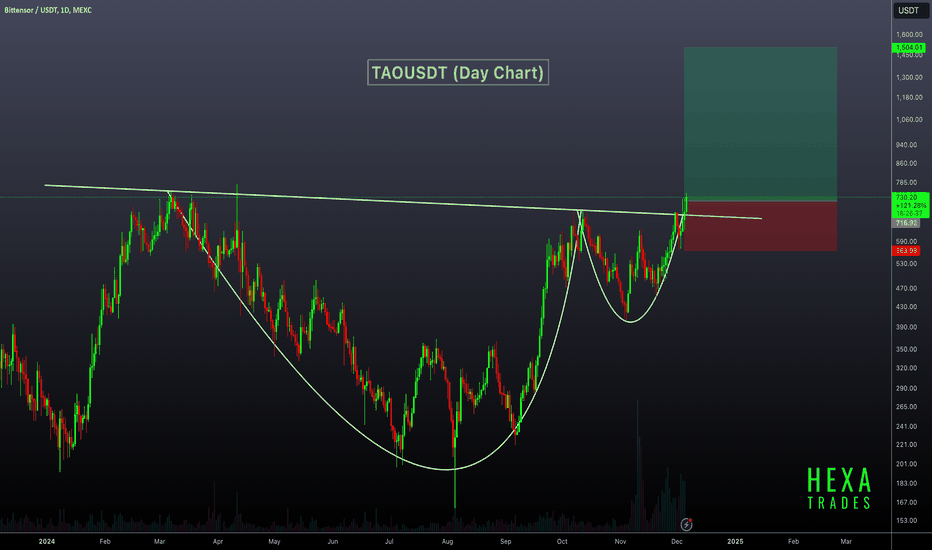

TAOUSDT Breaks Descending Trendline!BINANCE:TAOUSDT daily chart is showing a potential bullish breakout as price moves above a long-term descending trendline. This breakout, combined with support from the 100 and 200 EMAs, indicates growing upward momentum. If price holds above this trendline, the next key resistance lies around the $750 level. A successful breakout and retest could pave the way for a major rally toward $2,000. GETTEX:TAO

Regards

Hexa

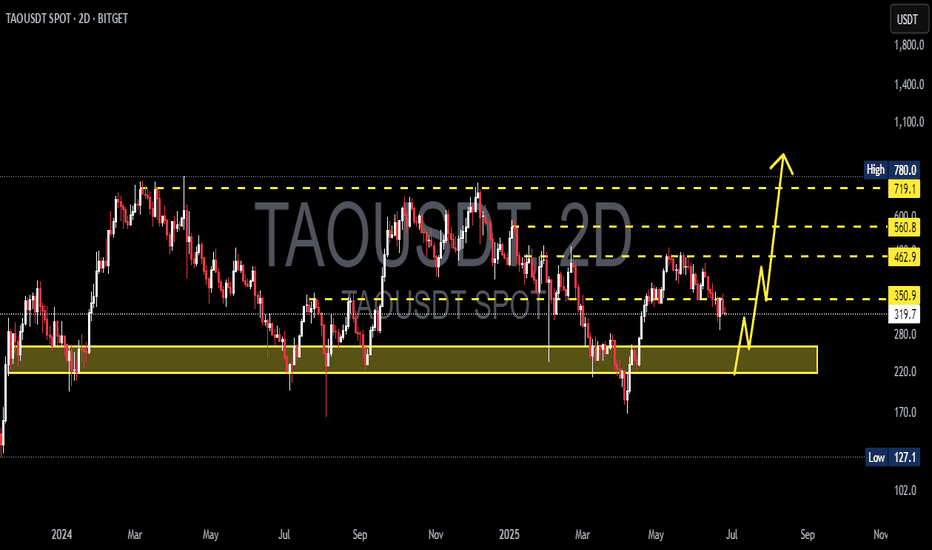

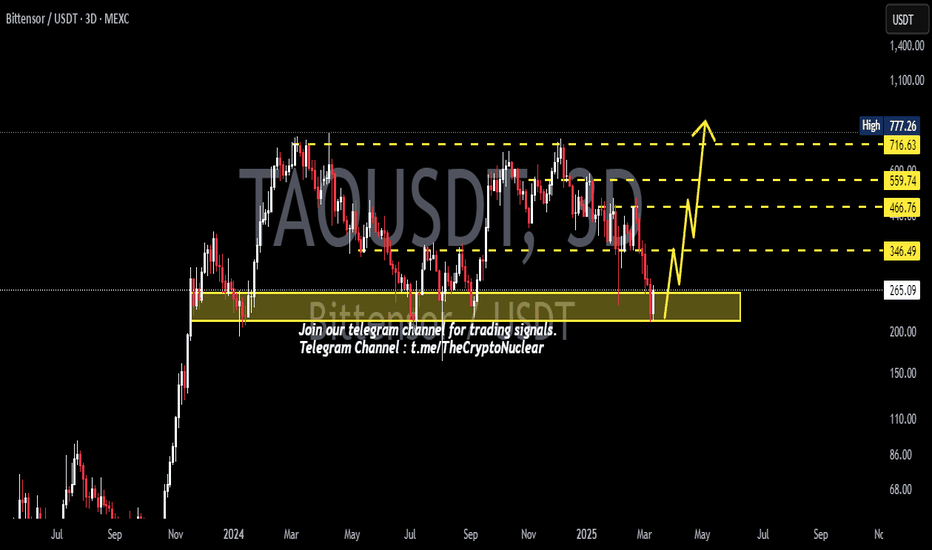

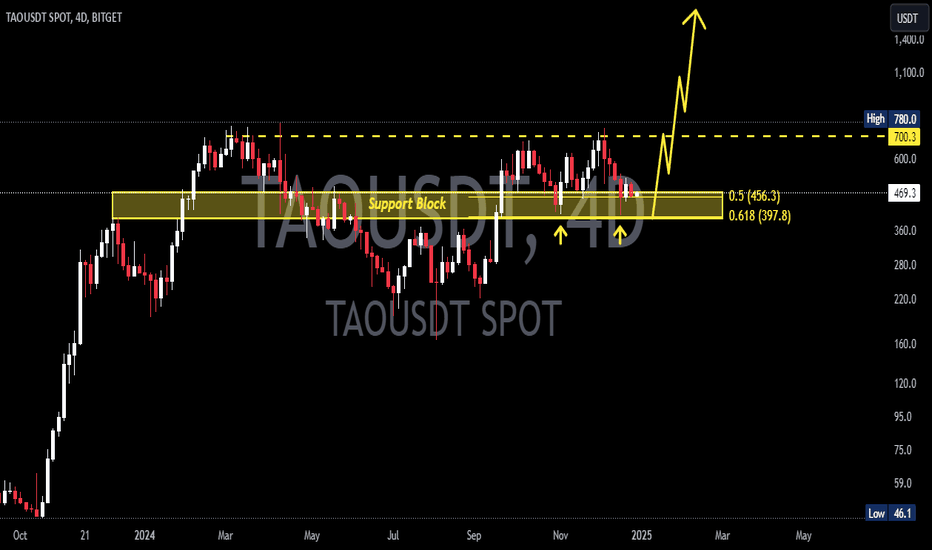

TAO/USDT Potential Reversal Zone – Major Bounce OpportunityTAO/USDT is currently testing a critical support zone (highlighted in yellow) between $220 – $280, which has historically acted as a strong accumulation area. The price has shown multiple reactions from this region throughout 2024 and 2025, signaling that bulls may be preparing for a reversal.

🔍 Key Technical Levels:

Major Support Zone: $220 – $280

Immediate Resistance Levels:

$350.9

$462.9

$560.8

$600

$719.1

Long-Term Resistance: $780 (local high)

🔄 Scenario: If TAO successfully holds this support zone, a bullish reversal could be triggered with a potential rally toward the $350 level first. A break and retest above this could open the door for a sustained move towards $560 and beyond. The bullish projection is illustrated with the yellow arrow path, showing a potential multi-stage rally through key Fibonacci and structural levels.

📉 Invalidation: A confirmed break below $220 would invalidate this bullish setup and could push TAO toward lower lows, potentially retesting $170 or even $127 support levels.

📌 Summary: TAO is approaching a historically strong support base. If the structure holds and volume supports the reversal, we could see a powerful leg up toward $560 and possibly $719 in the medium term. Risk management is essential, especially with volatility around macroeconomic events and Bitcoin price movements.

#TAO/USDT

#TAO

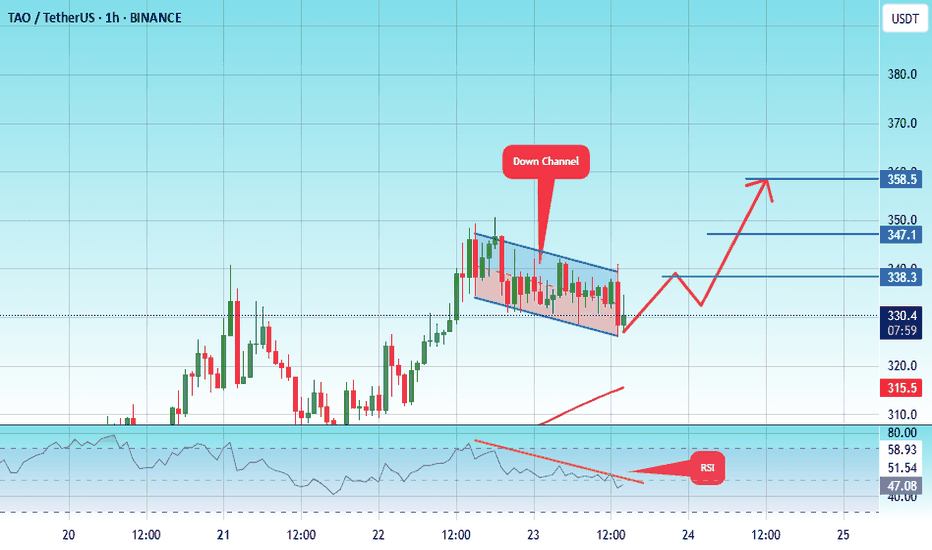

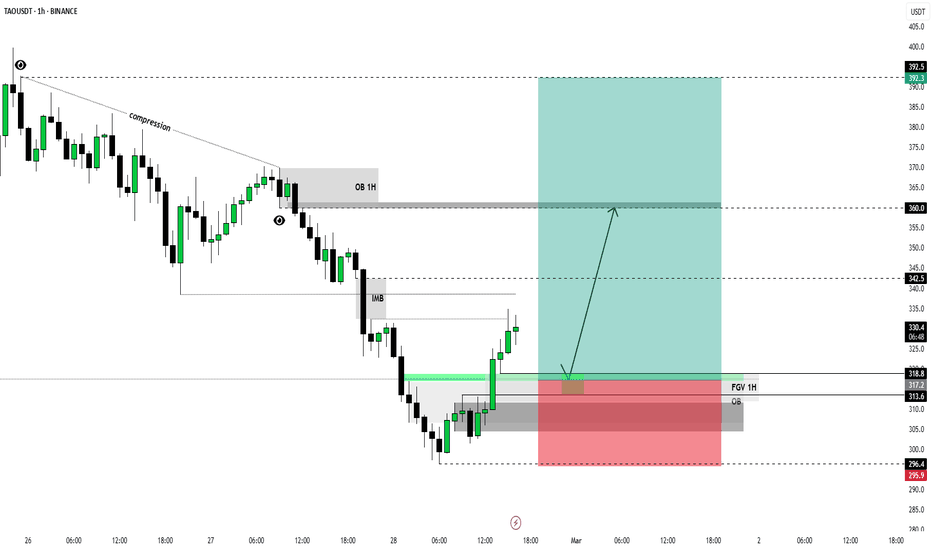

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, this support is at 326.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 330

First target: 338

Second target: 347

Third target: 358

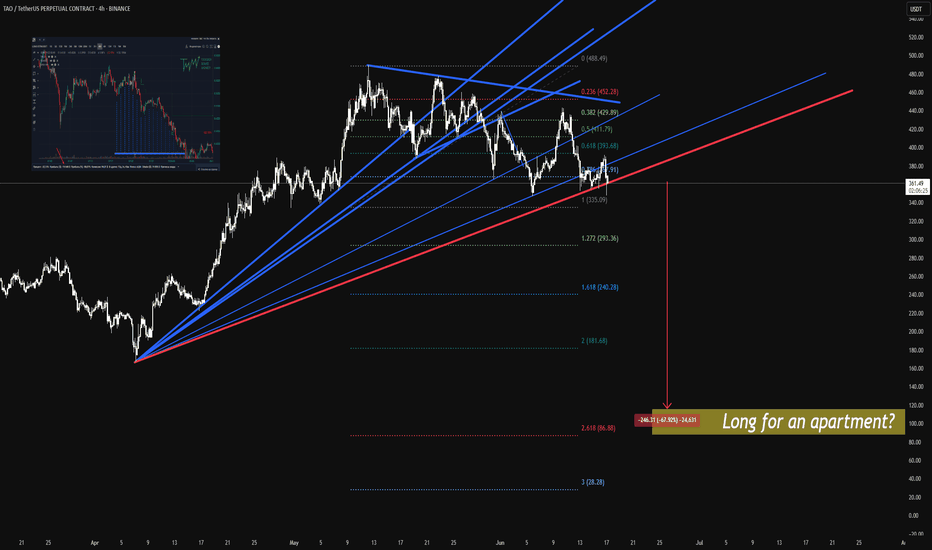

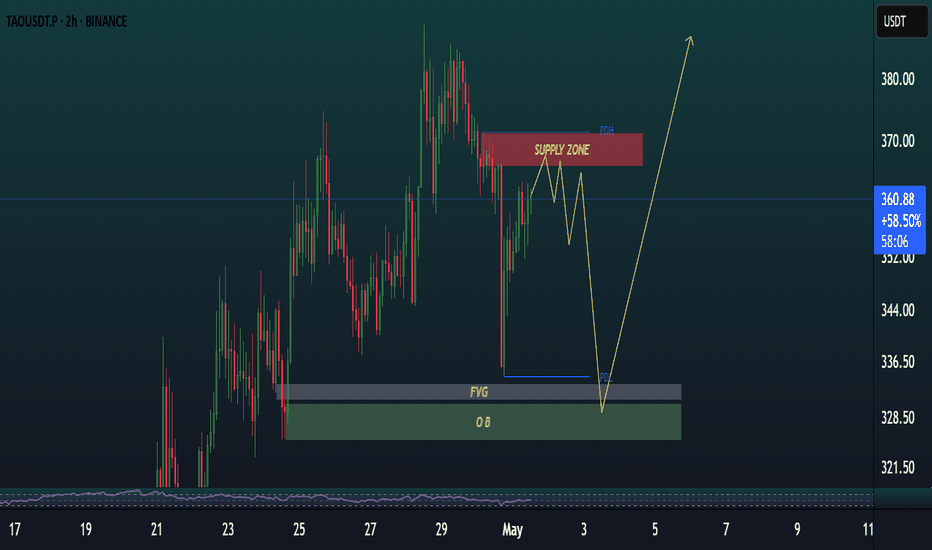

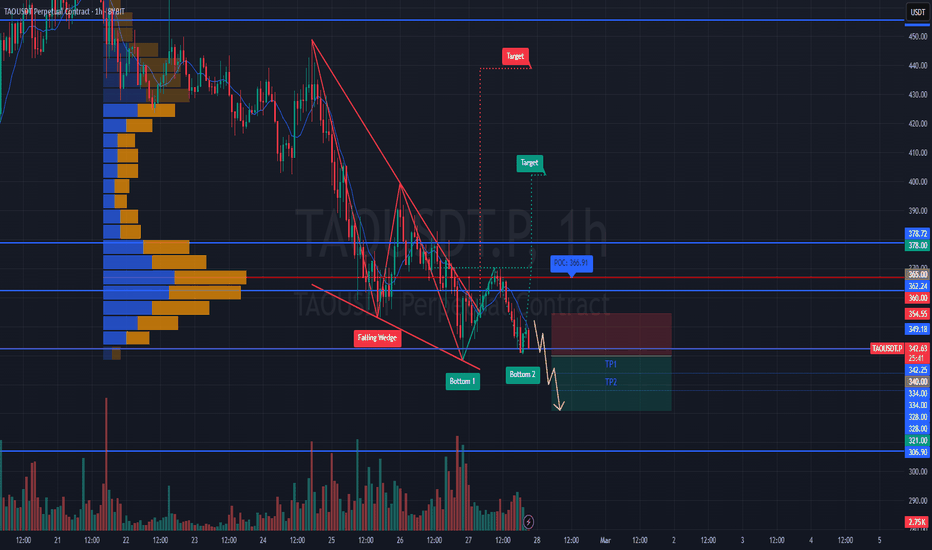

TAO/USDT.P Short Setup – Riding the Downtrend with PrecisionTrade Details:

Leverage: CROSS 15x - 20x

Entry: 348 - 351 USDT

Stop: 361.1 USDT

Targets:

TP1: 332 USDT

TP2: 319 USDT

TP3: 300 USDT

Why This Trade Makes Sense:

✅ Risk Management: Stop-loss placed at 361.1 USDT ensures protection above the supply levels.

✅ Strategic Targets: The targets are set at key support levels (332, 319, and 300 USDT), where price is likely to react.

Final Thought:

With tight risk management and logical profit-taking targets, it offers a solid chance to ride the market lower. Patience and discipline are key—keep an eye on price action and stick to the plan!

#TAO/USDTThe price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 213.

#TAO

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 262

First target: 294

Second target: 319

Third target: 354

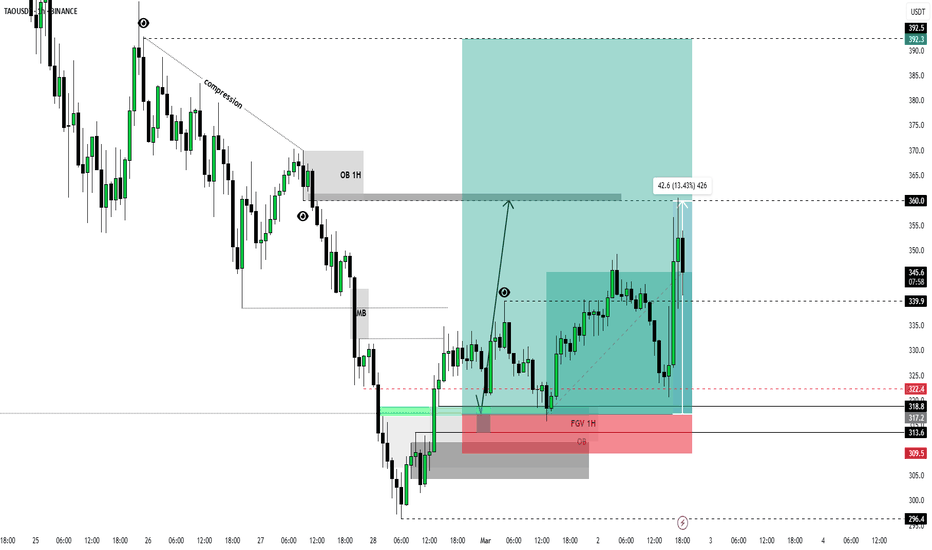

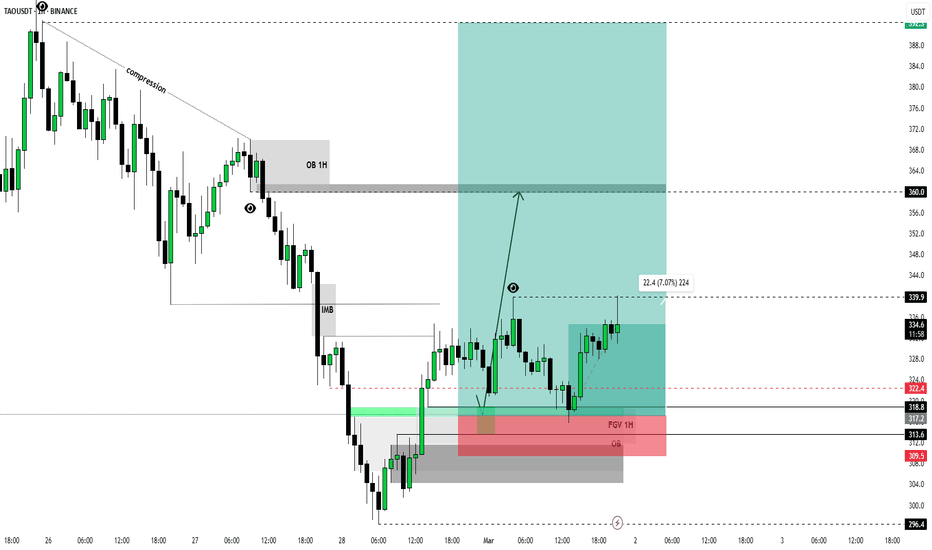

TAOUSDT LONG 1H (2Target Done! Congratulation)An excellent situation from the trading plan.

The second goal has been achieved and the stop is at breakeven.

I would like to emphasize that the $320-322 block (break block) confirmed the retention level. You can move the stop order to this level and calmly wait for new variables from the market

UPdate:

1-st target:

TAOUSDT LONG 1H (1st Target Done! Congratulation)In this position, the first target from the update has been achieved. The stop order is moved to breakeven and new variables are expected to arrive from the market.

Initial review:

Update:https://tradingview.sweetlogin.com/chart/TAOUSDT/tLc5vyIX-TAOUSDT-LONG-1H-Update/

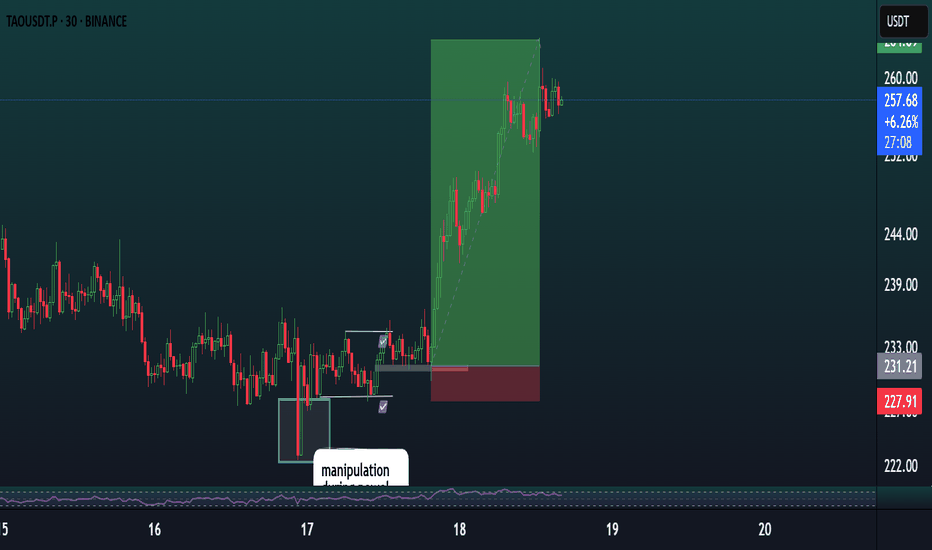

TAOUSDT LONG 1H (Update)The position opened perfectly, as expected from the trading plan:

In connection with the resulting market variable in the form of the hh structure, I change the first target and move the stop a little higher.

Critical level 321.95 - 322.00$

If it is tested again and is not held, I will close the position at breakeven. The market is manipulative, you need to carefully evaluate its entire structure.

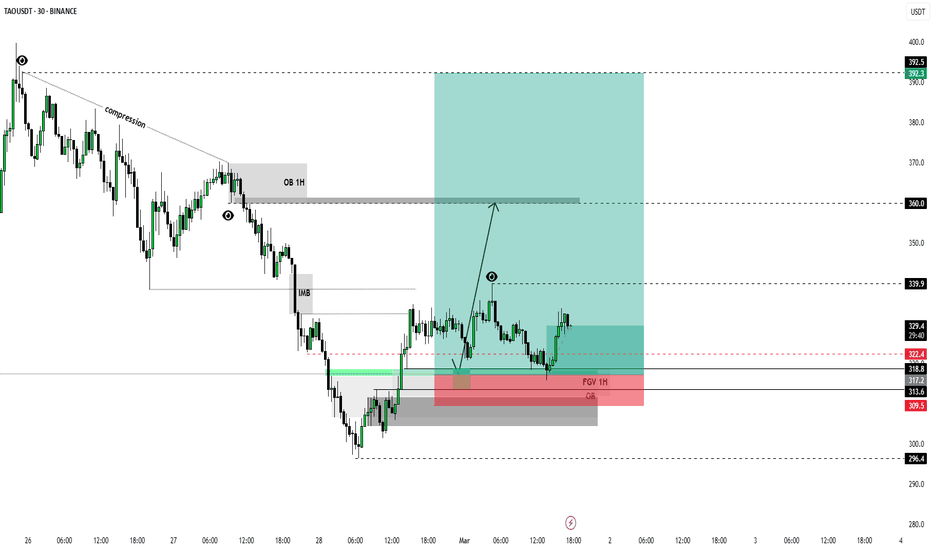

TAOUSDT LONG 1HLocal signs of a price reversal are forming on the TAO coin , which opens up new opportunities for finding good long entry points.

I'm waiting for confirmation of the POI block with the subsequent reaction of purchases. If the variables are positive, I will open a Long position with the following targets:

$342.50

$360.00

$392.30

Risk management - 1% on stop order

#TAOUSDT – Fast Trade, Monitoring Price Action📉 SHORT BYBIT:TAOUSDT.P from $340.00

🛡 Stop Loss: $354.55

⏱ 1H Timeframe

⚡ Trade Plan:

✅ The BYBIT:TAOUSDT.P price is forming a downtrend after breaking a Falling Wedge pattern.

✅ The asset is trading below POC (Point of Control) at $363.85, confirming seller dominance. ✅ After forming a double bottom (Bottom 1 & Bottom 2), the price tested resistance but failed to hold above it.

🎯 TP Targets:

💎 TP 1: $334.00

🔥 TP 2: $328.00

⚡ TP 3: $321.00

📢 This is a fast trade – it's crucial to monitor the coin's behavior and quickly adjust take-profits.

📢 A close below $340.00 would confirm further downside movement.

📢 POC at $363.85 is a key volume area where sellers are in control.

📢 Increasing volume on the drop supports the bearish outlook.

📢 Taking partial profits at TP1 ($334.00) is a smart risk-management strategy.

🚨 BYBIT:TAOUSDT.P remains in a downtrend – monitoring for confirmation and securing profits at TP levels!

#TAO/USDT#TAO

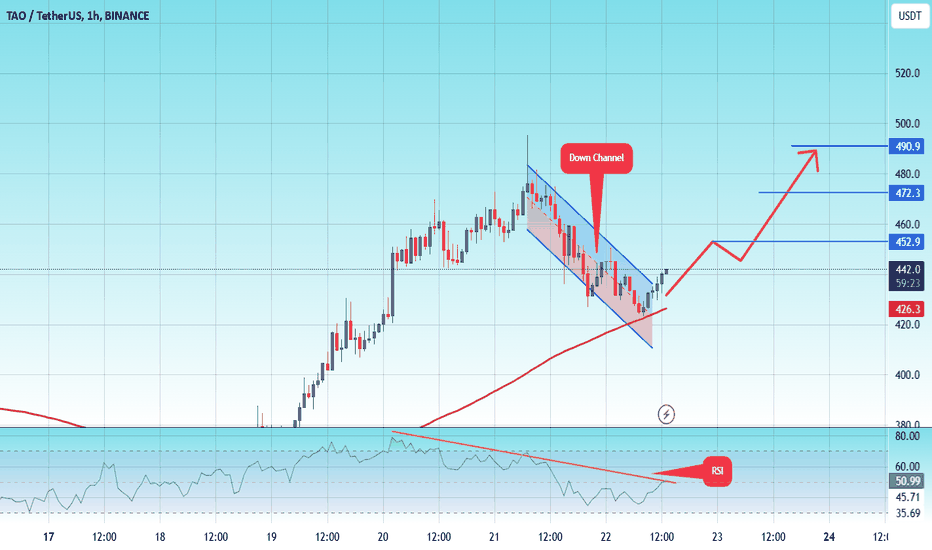

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 418

Entry price 440

First target 452

Second target 472

Third target 490

#TAO/USDT Ready to launch upwards#TAO

The price is moving in a descending channel on the 4-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 362

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 472

First target 502

Second target 535

Third target 577

#TAO/USDT Ready to go up#TAO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 435

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 447

First target 469

Second target 482

Third target 500

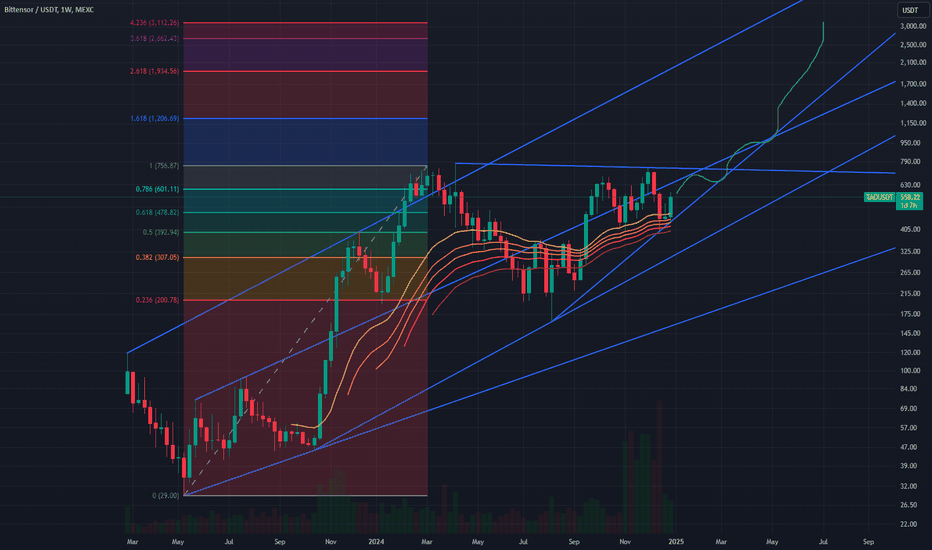

Short term correction over, long term momentum returns for TAOAfter our previous short-term correction trade for TAO is complete, we return to the long-term time-frame for Bittensor. The correction did happen as predicted, but the buy support was extremely strong and thus TAO rebounded convincingly and quickly.

According to long term FIB extension long-term targets are somewhere around 3100 USD, which is a reasonable target for AI as the dominant thesis of crypto.

Very bullish on Bittensor long-term.

TAOUSDT Cup And Handle PatternTAOUSDT Technical analysis update

BINANCE:TAOUSDT has formed a cup and handle pattern on the daily chart. With high volume, the price has broken above the neckline resistance, signaling a potential strong bullish move in the coming days.

Buy zone : Below $720

Stop loss : $560

Take Profit 1: $855

Take Profit 2: $1100

Take Profit 3: $1500