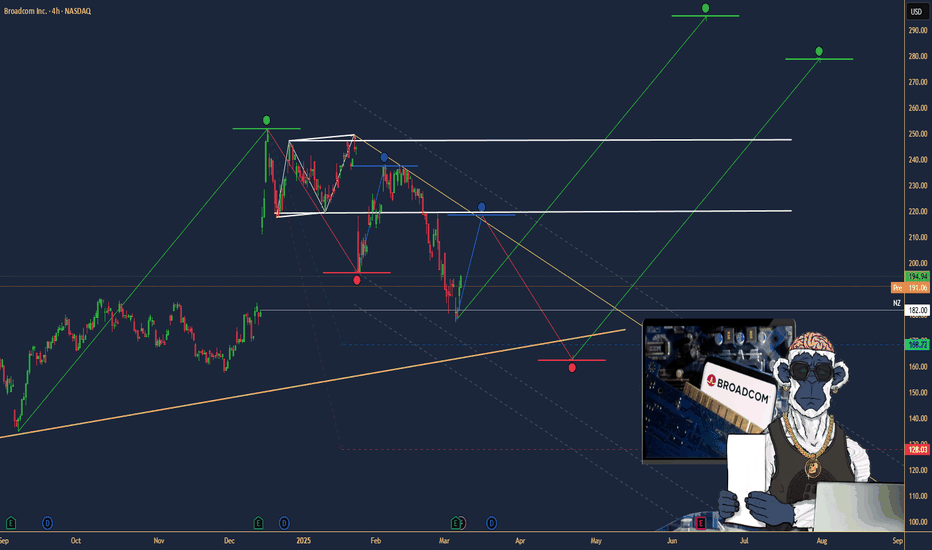

$AVGO: Broadcom – AI Chip Powerhouse or Tariff Tightrope?(1/9)

Good morning, crew! ☀️ NASDAQ:AVGO : Broadcom – AI Chip Powerhouse or Tariff Tightrope?

With NASDAQ:AVGO at $194.94 after a Q1 earnings slam dunk, is this semiconductor star riding the AI wave to glory or teetering on trade war woes? Let’s unpack the circuits! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 194.94 as of Mar 10, 2025 💰

• Q1 2025: Revenue $14.92B (up 23% YoY), EPS $1.60 📏

• Movement: Up 10% post-earnings Mar 6, +8.6% Mar 7 🌟

It’s buzzing like a chip factory on overdrive! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: ~$93.5B (151.62M shares) 🏆

• Operations: AI chips, software solutions ⏰

• Trend: 42% of 2024 revenue from software, per web data 🎯

A heavyweight in the AI silicon ring! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings: Q1 beat with $14.92B, Q2 forecast tops estimates 🔄

• AI Boom: Custom chips fuel hyperscaler demand 🌍

• Sentiment: Shares rallied, per Mar 6-7 posts 📋

Thriving, wired for the future! 💡

(5/9) – RISKS IN FOCUS ⚠️

• Tariffs: Trade uncertainties loom, per web reports 🔍

• Competition: Nvidia, Marvell in the race 📉

• Valuation: Premium pricing raises eyebrows ❄️

High stakes, but risks are on the radar! 🕵️

(6/9) – SWOT: STRENGTHS 💪

• Q1 Win: $14.92B revenue, EPS $1.60 beat 🥇

• AI Edge: 77% AI revenue growth in Q1 📊

• Forecast: Q2 sales outlook shines 🔧

Powered up for the AI era! 🔋

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Tariff risks, high valuation 📉

• Opportunities: 18% earnings growth projected 📈

Can it outrun trade clouds and soar? 🤔

(8/9) – 📢Broadcom at $194.94, AI chips sizzling—your vibe? 🗳️

• Bullish: $220+ by June, AI rules 🐂

• Neutral: Stable, tariffs balance ⚖️

• Bearish: $170 slide, risks bite 🐻

Drop your pick below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Broadcom’s $14.92B Q1 haul screams AI strength 📈, but tariff shadows hover 🌫️. Volatility’s our sidekick—dips are DCA dynamite 💰. Snap ‘em up, ride the surge! Goldmine or gamble?

Techboom

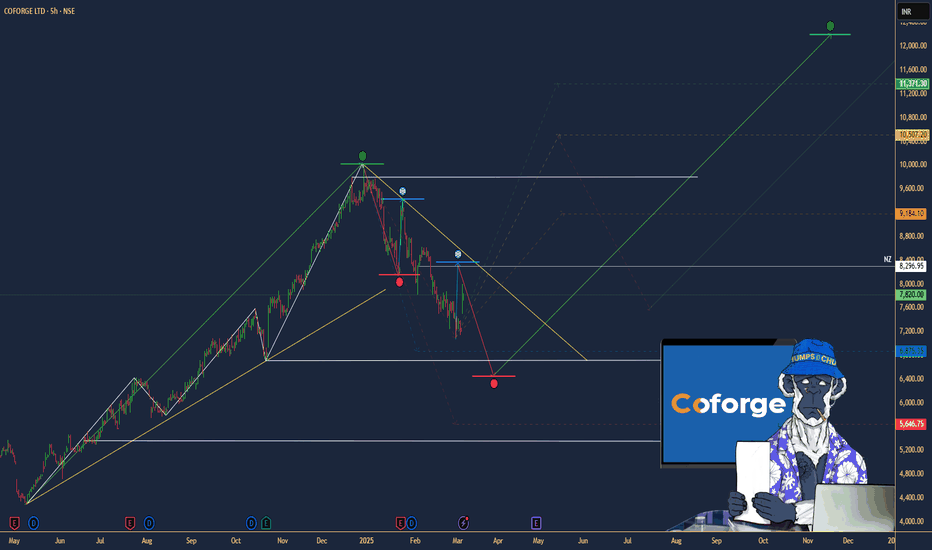

$COFORGE: Coforge Ltd. – AI Travel Tech Titan or Overhyped?(1/9)

Good afternoon, everyone! 🌞 NSE:COFORGE : Coforge Ltd. – AI Travel Tech Titan or Overhyped Split?

Coforge snags a $1.56B Sabre deal and a 1:5 stock split—shares spike 10%! Is this IT gem ready to soar or just riding AI hype? Let’s unpack the buzz! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Surge: Shares up 10% post-Sabre deal news 💰

• Stock Split: 1:5 split announced, boosting accessibility 📏

• Sector Trend: IT outsourcing on fire, per X posts 🌟

It’s a hot streak, fueled by big moves! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Not specified, but shares soaring 🏆

• Operations: Global IT player, travel tech focus ⏰

• Trend: $1.56B deal lifts travel sector outlook 🎯

Firm, staking its claim in AI-driven IT! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Sabre Deal: $1.56B, 13-year AI partnership 🔄

• Revenue Boost: Travel sector growth projected, per analysts 🌍

• Market Reaction: 10% jump, analyst upgrades flying 📋

Scaling up, with AI as the jet fuel! 💡

(5/9) – RISKS IN FOCUS ⚡

• Execution Risk: Big deal, big delivery pressure 🔍

• Hype Factor: AI buzz could overinflate expectations 📉

• Competition: IT giants crowding the space ❄️

High stakes, but risks are real! ⚠️

(6/9) – SWOT: STRENGTHS 💪

• Mega Deal: $1.56B Sabre contract, 13 years locked 🥇

• Travel Tech: Niche expertise shining 📊

• Split Appeal: 1:5 makes it investor-friendly 🔧

Loaded with ammo for growth! 💼

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Execution hiccups could trip it up 📉

• Opportunities: AI adoption, travel sector boom 📈

Can it deliver or just dazzle? 🤔

(8/9) – 📢Coforge shares up 10%, $1.56B deal in pocket—your take? 🗳️

• Bullish: Skyrocketing on AI wings 🐂

• Neutral: Solid, but watch execution ⚖️

• Bearish: Hype outpaces reality 🐻

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Coforge’s $1.56B Sabre deal sparks a 10% surge 📈, with a 1:5 split sweetening the pot 🌱. Volatility’s our playground—dips are DCA gems 💰. Snag ‘em cheap, ride the wave! Goldmine or glitter?