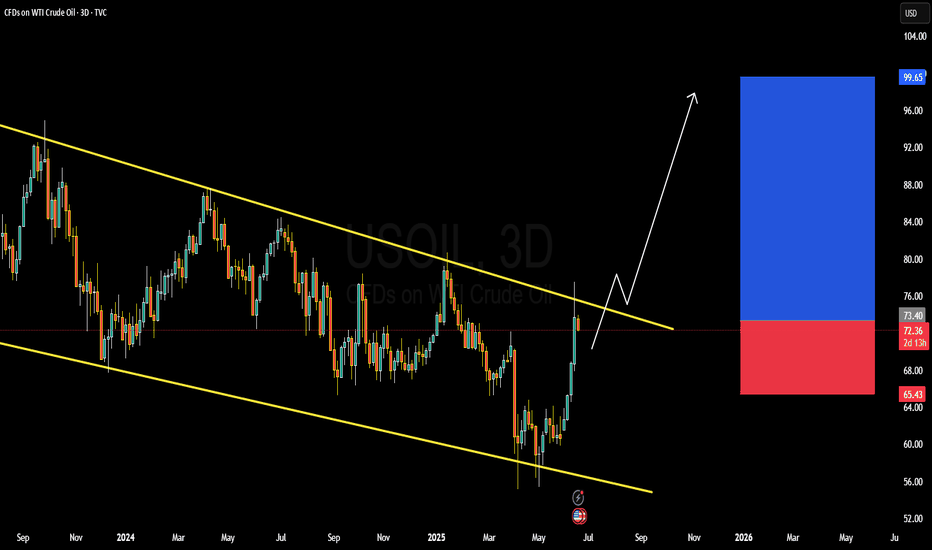

USOIL FUNDAMENTALS AND TECHNICALS USOIL (WTI Crude) is currently trading near the 72.00 level and is setting up for a potential breakout from a long-standing descending channel on the higher time frame (3D chart). Price has approached the upper boundary of this bearish channel after a strong bullish rally in recent sessions. This indicates growing bullish momentum, and any sustained breakout above the descending trendline could open the path toward the 98.00 zone, a major structural target based on previous price action and Fibonacci projections.

The recent bullish surge in crude oil prices has been fueled by a combination of supply-side constraints and renewed optimism around global demand. OPEC+ continues to show discipline in supply management, and geopolitical tensions in oil-producing regions are adding risk premiums. Furthermore, the Fed’s recent signals of a potential pause in tightening, combined with an improving outlook for Chinese demand recovery, are creating a supportive environment for commodities, particularly oil. These fundamental tailwinds align with the technical structure hinting at an upside breakout.

Technically, USOIL has broken back above a critical mid-channel support level and is now challenging the descending resistance line. The most recent impulsive candles suggest strong buyer conviction. If this momentum holds, we could see a retest followed by continuation toward the 98.00 psychological level. The structure also supports a higher low formation, which is another bullish signal for long-term traders watching the macro channel breakout.

From a trading standpoint, this setup is high probability with a well-defined invalidation zone below 65.00. The confluence of macro catalysts, technical breakout formation, and seasonal demand trends makes this a compelling bullish opportunity. I am closely monitoring price action for confirmation to go long on the breakout and ride the potential wave toward the upper supply region near 98.00.

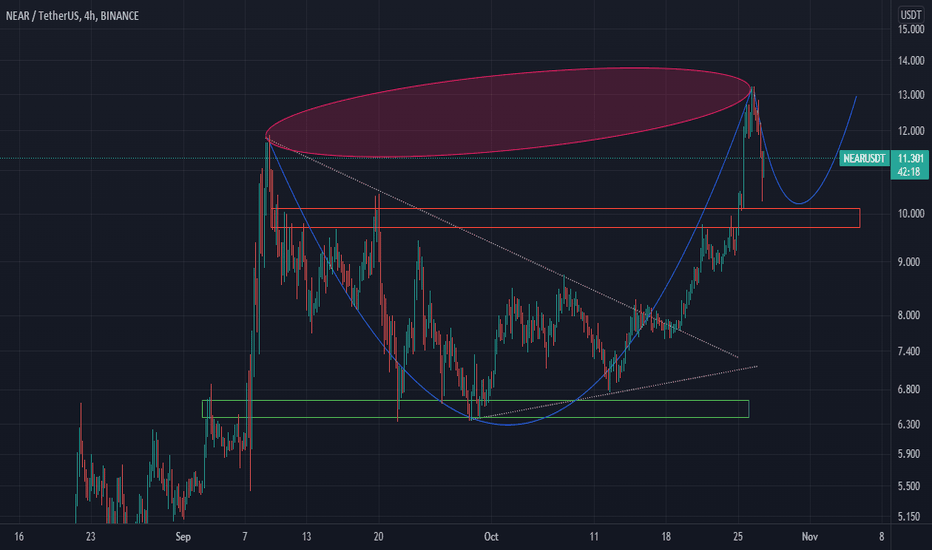

U

Techicals

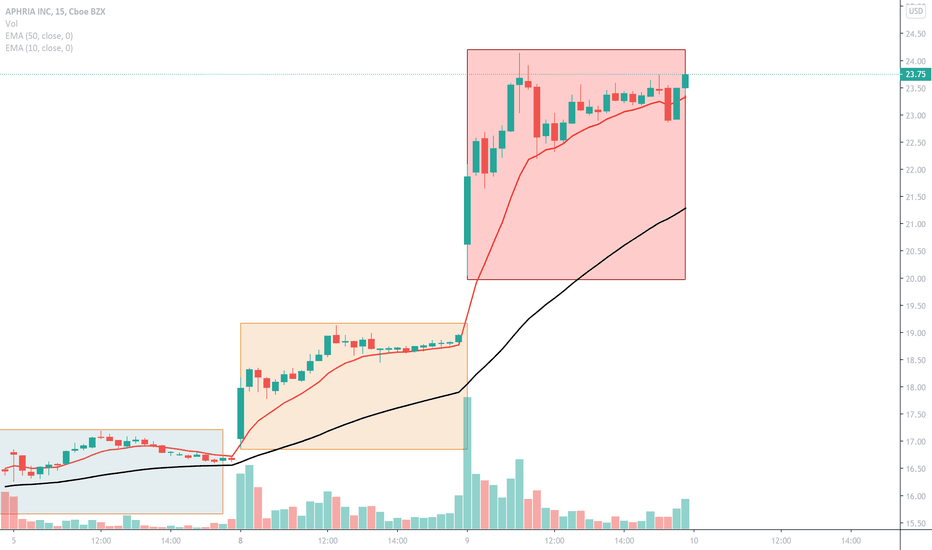

APHA LongAPHA looks to respect the 10 ema pretty well. Might consolidate down a bit, but overall I'm thinking more bullish momentum.

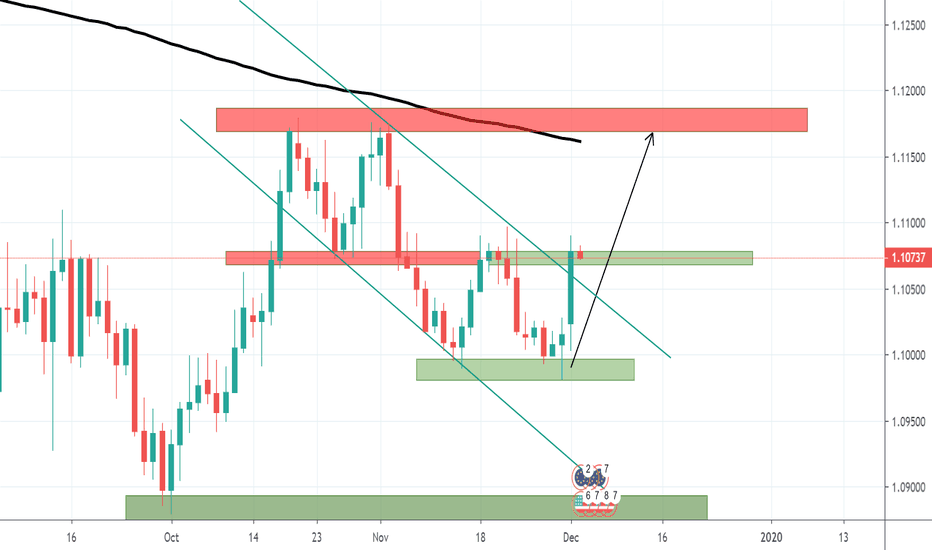

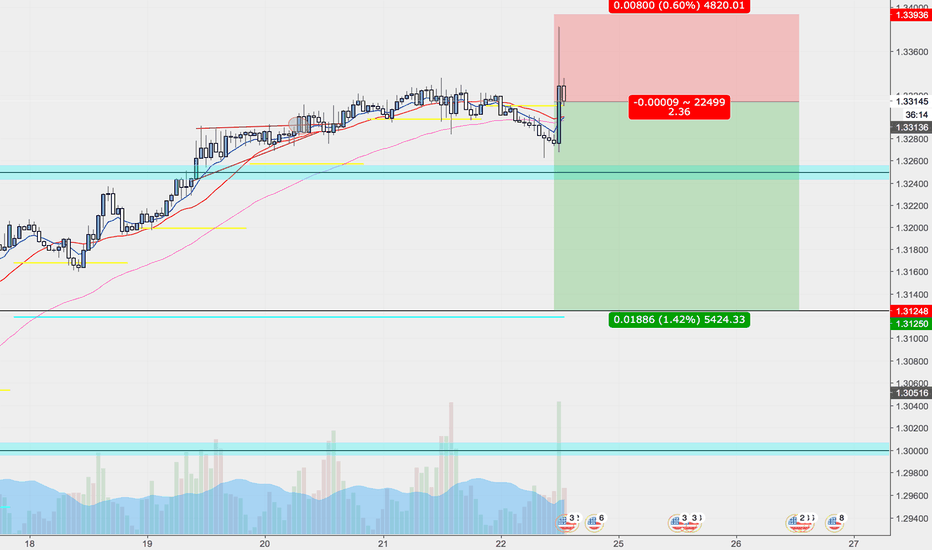

EURCHF LONG OR SHORT??I will be looking to go long on eurchf b ased on some technical analysis reason. But there, there are confirmations to be made, before making an entry on this one. Eurchf breached my 1.17000 monthly resistance level,came back for a retest and rejected around 61.8 fib level, previously gave me a 3 strike trend line strategy. in order to make this brief and not also expose all my secret on technical analysis, ill not really go deep in the technicals. currently, what i am expecting as confirmation to go long, is a break and close of a h4 candle above 1.17226 resistance region, as my confirmation to go long on this currency pair. join my free telegram channel for more analysis also on crpto, forex and signals t.me