Techincalanalysis

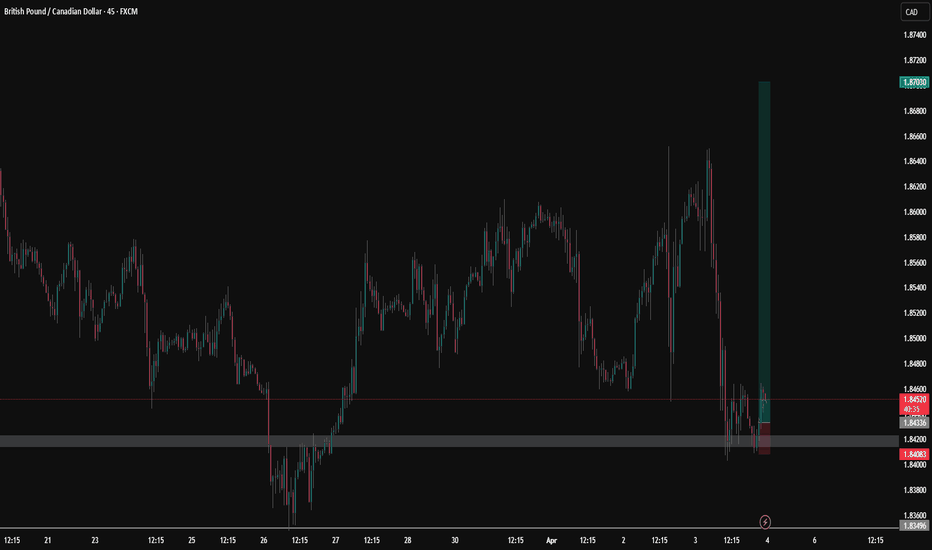

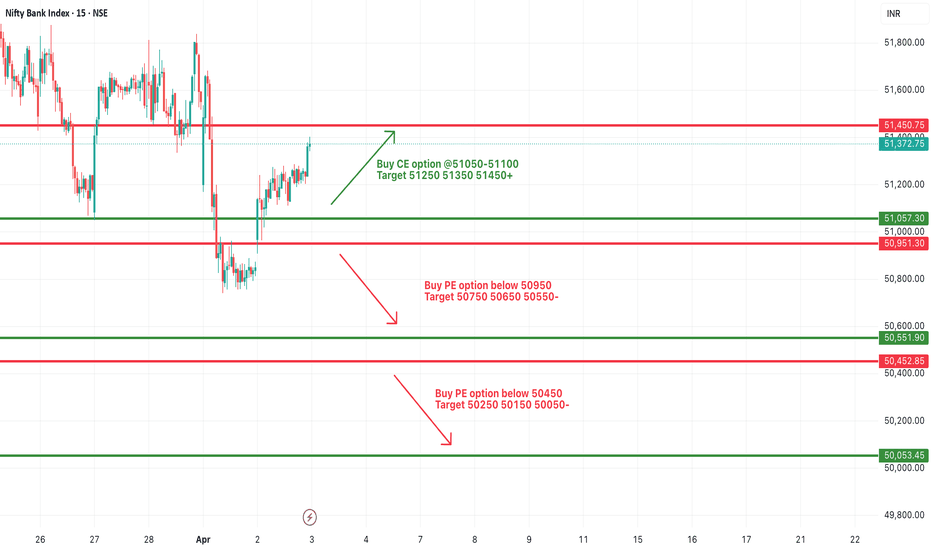

[INTRADAY] #BANKNIFTY PE & CE Levels(04/04/2025)Today will be gap down opening in banknifty. After opening if banknifty starts trading below 51450 level then expected downside upto 51050 level. For today's session 51000 level will act as a strong support for banknifty. Any major downside only expected below 50950 level. Strong upside rally possible if index starts trading and sustain above 51550 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(03/04/2025)Today will be gap down opening expected in index. Expected opening near 51000 level. After opening if banknifty sustain above 51050 level then possible upside movement upto 51450 in opening session. But in case banknifty starts trading below 50950 level then expected sharp downside movement upto 400-500+ points and this can extend further upto 50050 in case it gives breakdown of 50450 level.

DMart Charts showing strengthThe chart pattern assisted by all-time low valuations for DMart makes it worth studying.

The levels are marked clearly.

This isn't a recommendation. I intend to pass my knowledge of technical analysis through the published charts.

Conduct your own research before investing.

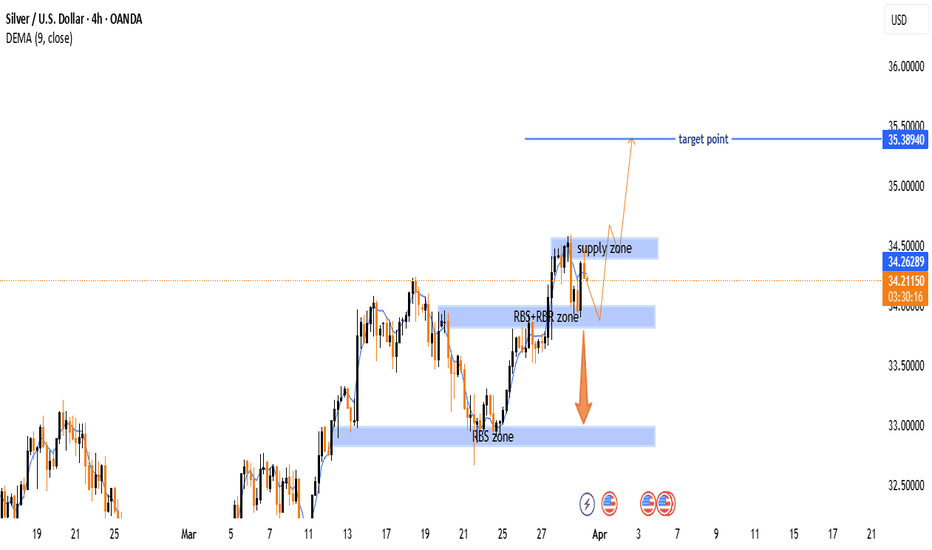

Silver (XAG/USD) Price Analysis – Key Levels & Market Outlook🔍 Key Observations:

📊 Current Price: 34.19250 USD

📈 DEMA (9, close): 34.25605 USD

🎯 Target Price: 35.38940 - 35.5000 USD

🔵 Zones Identified:

🟦 Supply Zone: 34.50 - 34.80 USD (🔼 Selling pressure area)

🟦 RBS Zone: 34.00 - 34.20 USD (🔽 Potential bounce zone)

🟦 Lower RBS Zone: 32.80 - 33.20 USD (⬇️ Strong support)

📉 Market Scenarios:

✅ Bullish Case:

Price bounces off the RBS zone at 34.00 USD ➡️ Uptrend resumes 🚀

Target: 35.50 USD 🎯

❌ Bearish Case:

Breaks below 34.00 USD ❗

Next stop: 33.00 USD ⚠️

📢 Final Thoughts:

🟢 Buyers: Wait for a bounce at 34.00 USD before entering 📈

🔴 Sellers: Look for rejection at 34.50 - 34.80 USD or breakdown below 34.00 USD 📉

⚡ Key Level to Watch: 34.00 USD 👀 A hold = bullish 📊, a break = bearish ⚠️

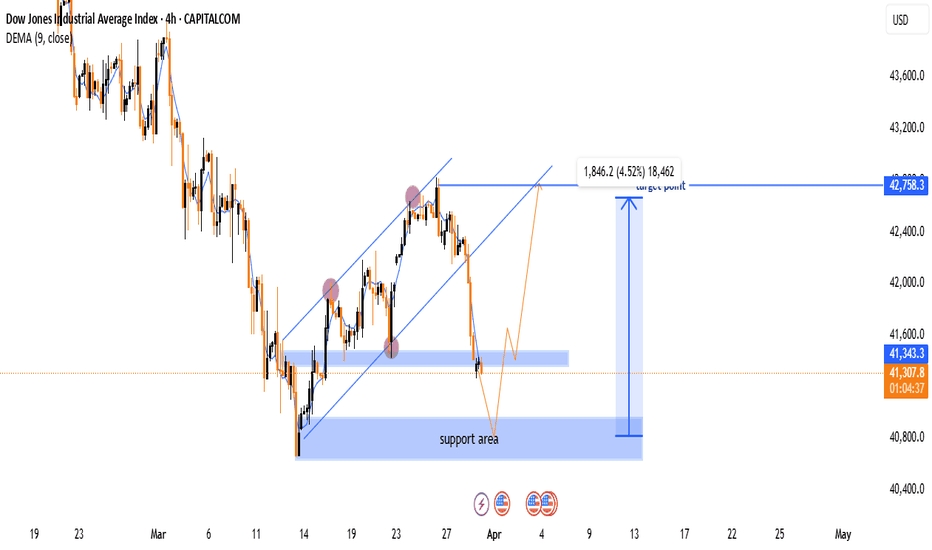

Dow Jones 4H Chart Analysis: Support Test & Potential Reversal 📉 Downtrend: The price was falling sharply before forming an upward channel.

📊 Channel Break: The price broke below the ascending channel 🚨.

🟦 Support Zone: The blue area marks a strong support region 📌.

🔵 Bounce Expected? If the price holds, a rebound could happen 📈.

🎯 Target: The projected upside target is 42,758.3 🚀.

⚠️ Risk: If the support fails, the price may drop further ⛔.

🔴 Watch for: A confirmed reversal near support or further breakdown!

Bitcoin (BTC/USD) Trade Setup – Potential Reversal & Target Leve🔵 Entry Point:

🔹 Around $83,678.04 – The suggested buying zone.

🛑 Stop Loss:

🔻 $82,998.62 – The price level where the trade will be exited if it moves against the plan.

🎯 Target Points:

✅ TP1: $84,144.23 – First profit target.

✅ TP2: $84,787.10 – Second profit target.

🏆 Final Target: $85,560.84 – The ultimate goal for the trade.

📈 Technical Overview:

🔹 The price is at a support level, with a potential reversal to the upside.

🔹 Risk-Reward Ratio is favorable, with a clear uptrend target.

🔹 DEMA (9) at $83,776.52 indicates a possible trend shift.

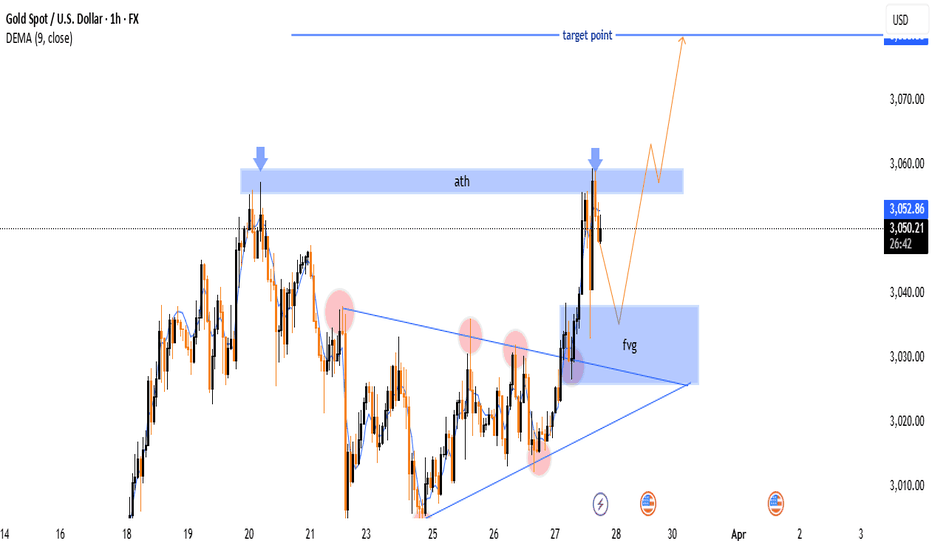

Gold (XAU/USD) Breakout & Retest: Next Stop $3,080?🔍 Key Observations:

🔹 Ascending Triangle Breakout:

📈 Price was consolidating in an ascending triangle (🔺) and has broken out above resistance.

🚀 Bullish momentum is in play.

🔹 All-Time High (ATH) Resistance Zone:

🛑 Resistance Area (🔵) is where price has struggled before.

🔵🔵 Rejection signs at this level indicate a possible pullback.

🔹 Fair Value Gap (FVG) Retest:

🔽 Price may pull back into the Fair Value Gap (FVG) (📦) before moving higher.

🎯 This zone ($3,030 - $3,040) could act as a buying area.

🔹 Target Point at $3,080:

🎯 Main target for bulls is $3,080 (📈).

🔝 Price could retest the ATH zone before a push

🔹 Dynamic Support (DEMA 9):

📊 DEMA 9 (📉) at $3,052.80 is acting as support.

🔮 Expected Price Action:

⚫ Scenario 1 (Bullish) 🚀

➡️ Pullback into FVG zone (📦) → Buyers step in → Move toward $3,080 🎯

⚫ Scenario 2 (Bearish) 📉

❌ If price breaks below FVG → Further downside risk

✅ Conclusion:

🟢 Bullish bias remains strong unless price falls below FVG.

📌 Traders may look for entries in the FVG zone for a move to $3,080 🎯.

🔥🚀 Gold could be setting up for another push!

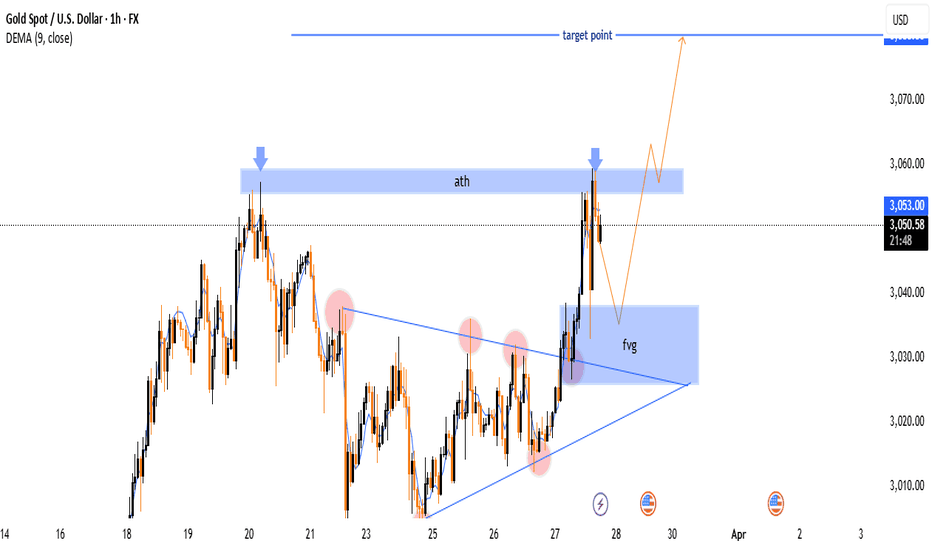

Gold (XAU/USD) Breakout & Retest: Next Stop $3,080?🔍 Key Observations:

🔹 Ascending Triangle Breakout:

📈 Price was consolidating in an ascending triangle (🔺) and has broken out above resistance.

🚀 Bullish momentum is in play.

🔹 All-Time High (ATH) Resistance Zone:

🛑 Resistance Area (🔵) is where price has struggled before.

🔵🔵 Rejection signs at this level indicate a possible pullback.

🔹 Fair Value Gap (FVG) Retest:

🔽 Price may pull back into the Fair Value Gap (FVG) (📦) before moving higher.

🎯 This zone ($3,030 - $3,040) could act as a buying area.

🔹 Target Point at $3,080:

🎯 Main target for bulls is $3,080 (📈).

🔝 Price could retest the ATH zone before a push

🔹 Dynamic Support (DEMA 9):

📊 DEMA 9 (📉) at $3,052.80 is acting as support.

🔮 Expected Price Action:

⚫ Scenario 1 (Bullish) 🚀

➡️ Pullback into FVG zone (📦) → Buyers step in → Move toward $3,080 🎯

⚫ Scenario 2 (Bearish) 📉

❌ If price breaks below FVG → Further downside risk

✅ Conclusion:

🟢 Bullish bias remains strong unless price falls below FVG.

📌 Traders may look for entries in the FVG zone for a move to $3,080 🎯.

🔥🚀 Gold could be setting up for another push!

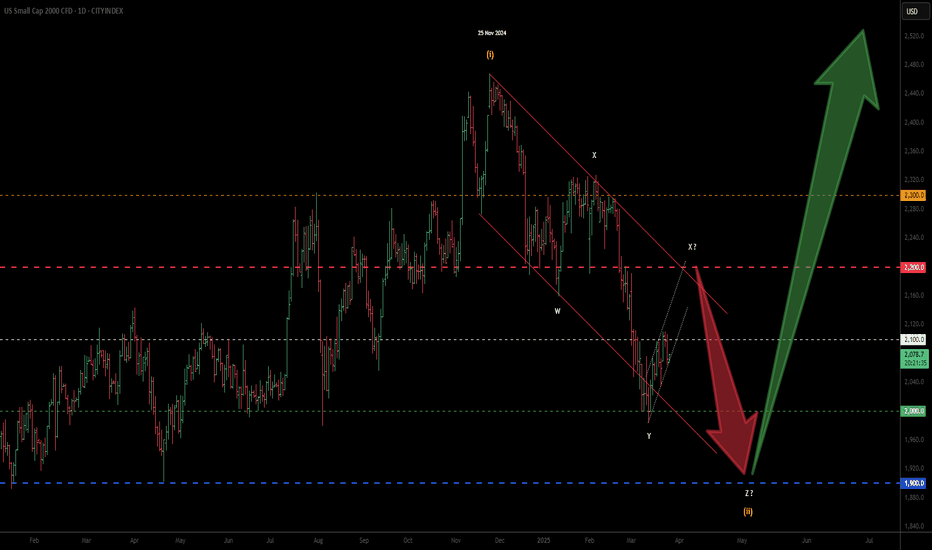

Russell 2000 Elliott Wave Analysis (WXYXZ in progress)Possible wave (ii) complex correction in the form of a WXYXZ still in progress.

Expecting corrective rally to fail around the 2200 resistance zone.

A final wave down from there should find a bottom around the 1900 support zone where wave (ii) should end.

Expecting wave (iii) to commence from there...

------

*would appreciate feedbacks and thoughts on this*

**this is not a trade recommendation, just an idea that I am working with**

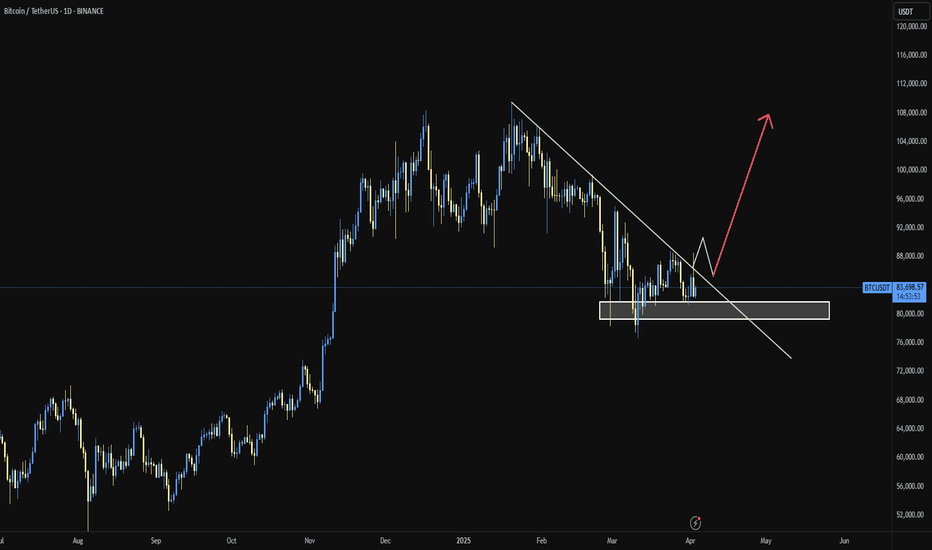

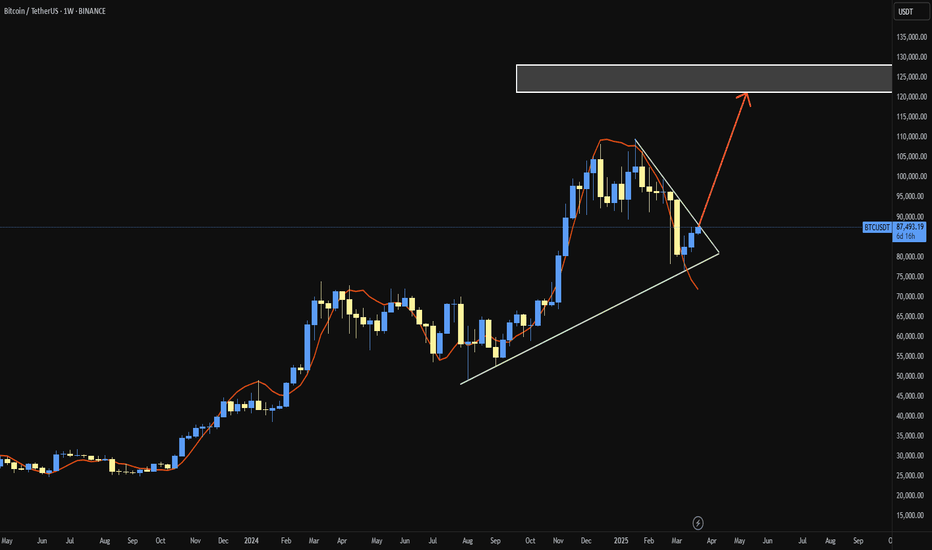

Bitcoin (BTC/USD) 4H Chart Analysis: Bullish Breakout Ahead?📈 Ascending Channel:

🔹 The price is moving upward within a parallel trend channel.

🔹 Blue arrows (🔵) indicate resistance points where the price struggled.

🔹 Red circles (🔴) highlight support areas where the price bounced.

🟦 Fair Value Gap (FVG) Zone:

🔸 The blue-shaded area (FVG zone) suggests a possible retracement before a bullish move.

🔸 If the price dips into this zone, it may find liquidity and bounce back up.

📊 Projected Price Movement:

⚡ Expected pullback → into FVG zone (🔽), then a bullish push (🚀) towards $90,686.72 🎯.

🟡 Yellow arrow shows the anticipated price path.

📉 Support & Resistance Levels:

✅ Support: Around $86,000 - $86,500 (FVG zone).

🚀 Target: $90,686.72 (next major resistance).

📌 Exponential Moving Average (DEMA - 9):

🔹 The blue line (DEMA 9) at $87,414.57 is acting as dynamic resistance.

🔹 A break above this could confirm further upside movement.

💡 Conclusion:

🔸 Bullish bias remains strong 📈.

🔸 Watch for a dip into the FVG zone before a potential rally 🚀.

🔸 If Bitcoin holds support, it may reach $90K+ soon 🎯🔥.

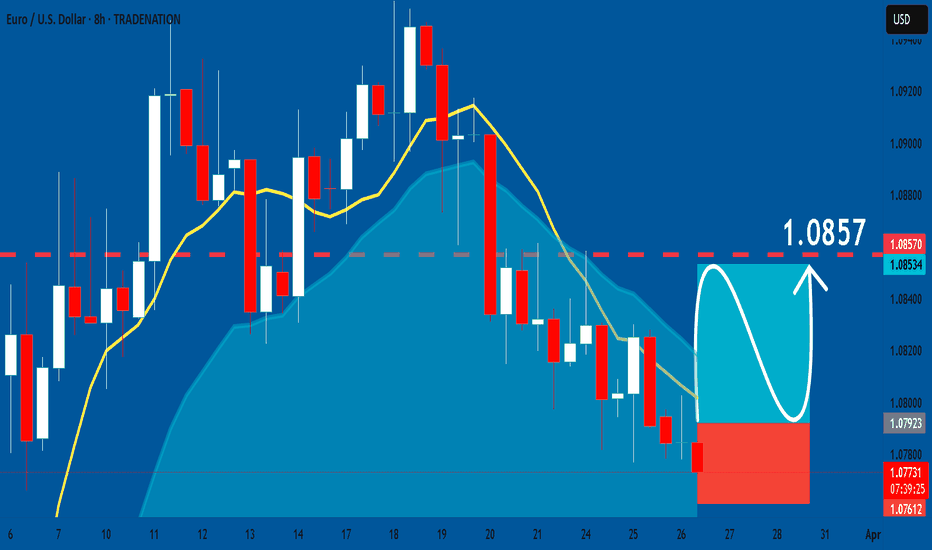

EURUSD: Long Trade with Entry/SL/TP

EURUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry Point - 1.0792

Stop Loss - 1.0761

Take Profit - 1.0857

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

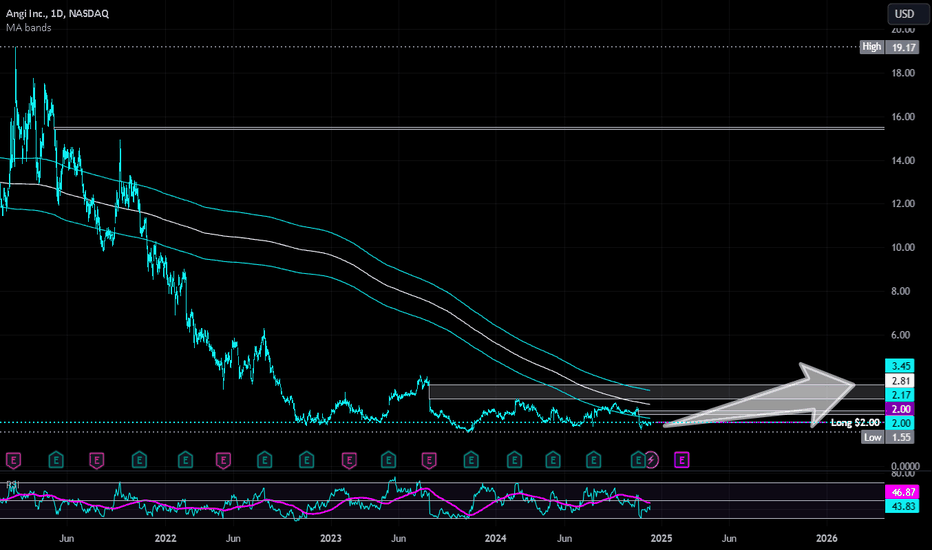

Angi's List | ANGI | Long at $2.00The historical simple moving average (SMA) I've selected for Angi Inc NASDAQ:ANGI is starting to enter stock price. This often means a directional change in price: up in this case. The price drop after the last earnings, I believe, was an algorithmic move for price entry/further consolidation. If true, the two large gaps above may be filled "soon". 70M float, 12% short interest...

Fundamentally, Angi maintains a solid financial foundation with $395 million in cash and cash equivalents. The company's free cash flow increased $29.2 million to $78.4 million for the first nine months of 2024, demonstrating strong cash generation capabilities. The company's transition to a consumer choice model, already successful in its European operations, positions Angi to capture greater market share. Despite revenue headwinds, Angi demonstrates robust financial health with operating income increasing to $7.8 million in third-quarter 2024, a significant improvement from the previous year. The company's adjusted EBITDA grew 27% to $35.4 million, while year-to-date operating income reached $20 million with adjusted EBITDA rising 47% to $114 million, showcasing effective cost management and improving operational efficiency.

Thus at $2.00, NASDAQ:ANGI is in a personal buy zone.

Target #1 = $2.25

Target #2 = $2.50

Target #3 = $3.00

Target #4 = $3.50

Target #5 = $3.70

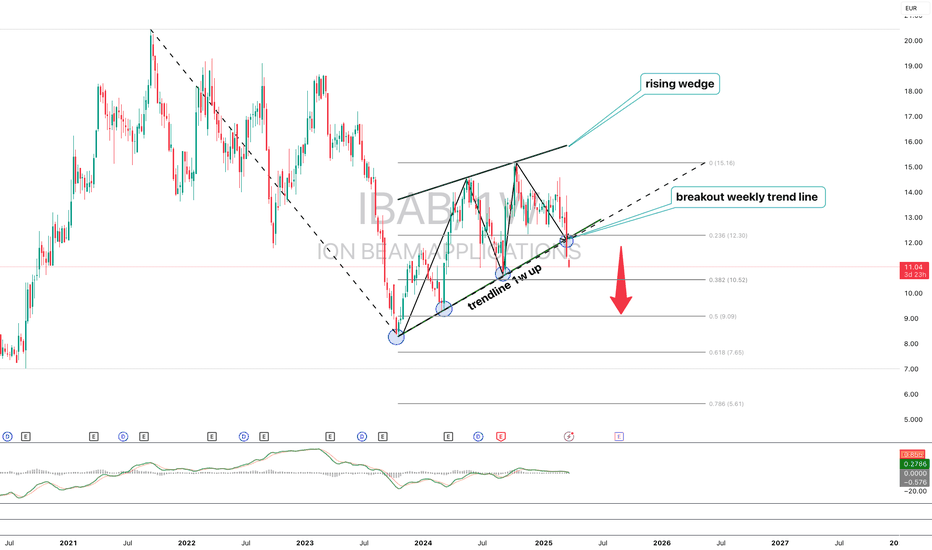

Ion Beam Applications S.A. (IBAB) 1WTechnical Analysis

The chart shows a breakout of the weekly ascending trendline and the formation of a "rising wedge", indicating a potential decline.

Key Levels:

- Support: 11.46 EUR, 9.00 EUR

- Resistance: 13.06 EUR, 14.01 EUR

Fundamental Analysis

Ion Beam Applications is a leader in radiation therapy and medical accelerators.

Factors influencing the stock:

- Financials: Revenue growth but high volatility.

- Macroeconomics: Interest rate impact on the tech sector.

- Competition: Rivalry with Varian and Elekta.

A breakdown below 11.46 EUR could open the way to 9.00 EUR. To regain an uptrend, the stock needs to reclaim 13.06 EUR.

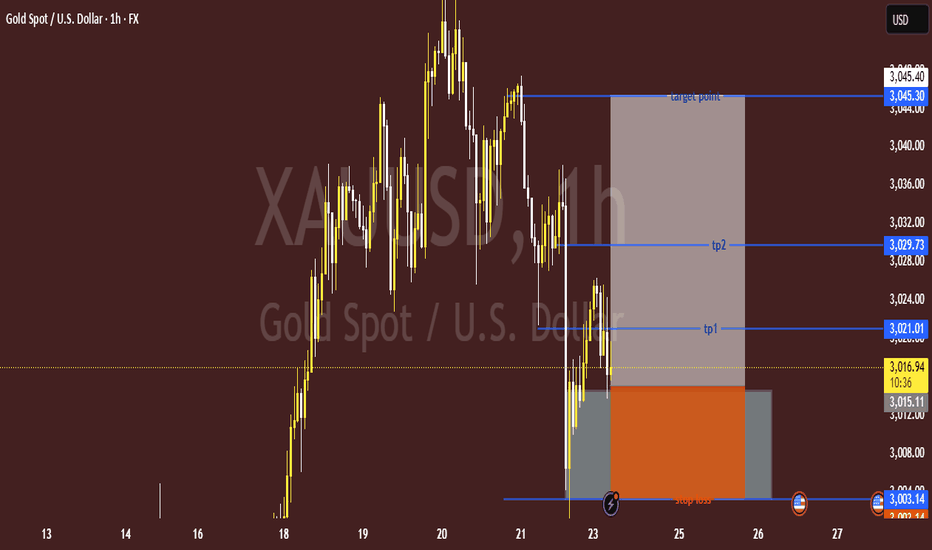

XAU/USD (Gold) Bullish Trade Setup – Key Levels & Targets📊 XAU/USD (Gold vs. USD) - 1H Chart Analysis

🔹 Entry & Risk-Reward Setup

🟢 Buy Zone: $3,015 - $3,017 ✅

🛑 Stop Loss: $3,003.14 ❌ (Protects against downside risk)

🎯 Target Point: $3,045.40 🚀

🔹 Take Profit Levels (TP)

🟡 TP1: $3,021.01 🥇 (First checkpoint)

🟡 TP2: $3,029.73 🥈 (Second target, stronger resistance)

🔵 Final Target: $3,045.40 🏆 (Major resistance level)

🔹 Market Structure & Price Action

📉 Recent Drop: Found support near $3,003 📌

📈 Potential Upside: Price attempting a bullish reversal 📊

⚠️ Watch for breakout at $3,021+ for confirmation! 🚀📊

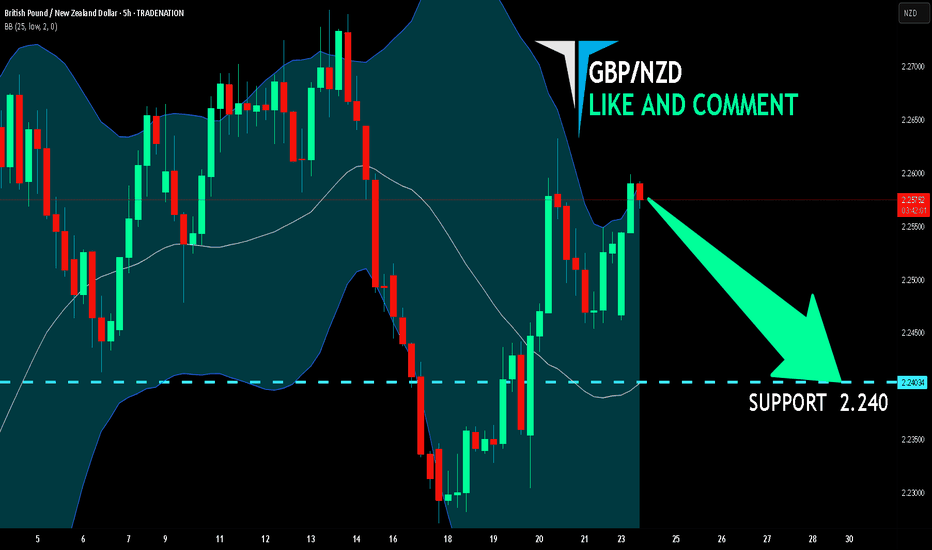

GBP/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 5H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.240 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

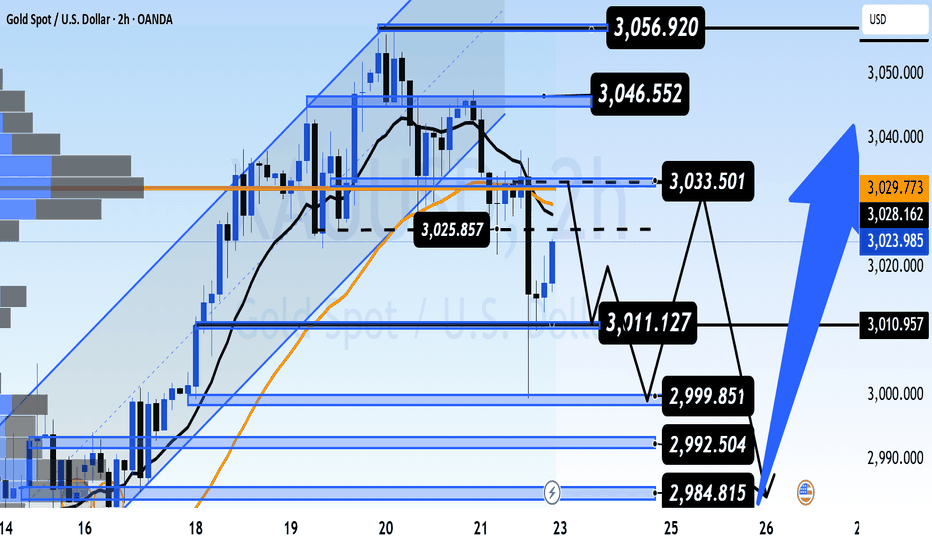

xAUUSD Structure, Sentiment & Strategic Patience📊 XAUUSD WEEKLY INSIGHT | Structure, Sentiment & Strategic Patience

As we close out a volatile trading week, let’s zoom out and assess what’s really happening with gold. The recent price action on the higher timeframes is revealing important signals — and it’s time to take a strategic pause before the next move.

🔍 WEEKLY SNAPSHOT:

Gold experienced a sharp correction of over $50, followed by a late-session recovery into the weekend. The result?

✅ Long upper wicks on both the W1 and D1 candles,

✅ Signs of rejection from all-time highs,

✅ Yet price still managed to close above the 50% candle body range — momentum is cooling, but not reversing (yet).

The big question now is:

Is this a healthy pullback within the uptrend… or the beginning of something deeper?

📐 Key Takeaways:

Structure on higher timeframes remains bullish – price is still moving within the primary ascending channel

Short-term retracement has reached the 0.5–0.618 Fibonacci zone on H1 and H2 – a potential decision area

End-of-week buying indicates positioning by informed participants, not random volatility

No confirmation of a major reversal yet – but conditions are developing

📌 Key Levels to Watch:

Resistance Zones: 3025 – 3033 – 3040 – 3046 – 3056

Support Zones: 3014 – 3005 – 3000 – 2993 – 2986

🧠 Mindset Going Into Next Week:

Don’t rush it.

Let Monday’s open reveal the volume story — whether through gaps, spikes, or clean structure. The best setups form after the market shows its hand, not before.

This is where strategic patience beats emotional trading.

📣 Final Note:

Stay focused on structure. Respect your levels. Watch how price reacts — not just where it goes.

And remember: sometimes no trade is a powerful trade when the market is indecisive.

More insights coming soon on market psychology and execution discipline.

💬 Feel free to leave a comment, follow for updates, or share your own views below.

Wishing everyone a strong and clear start to the new week,

— AD | Money Market Flow

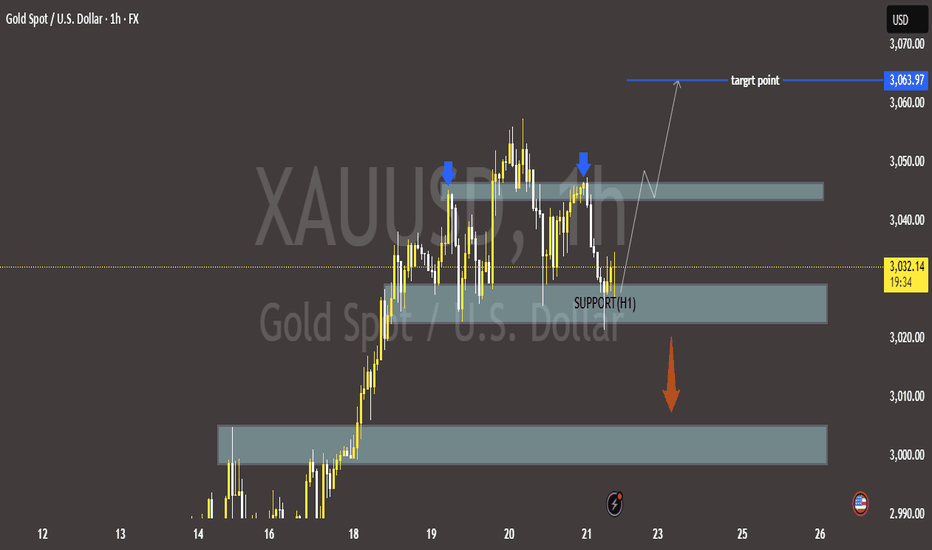

"XAU/USD Price Action Analysis: Targeting $3,063 or Reversal to Alright! Let's break down the chart analysis. 📊

🔹 Chart Overview:

Pair: XAU/USD (Gold vs. US Dollar)

Timeframe: 1-hour (H1)

Price Level: Current price at $3,030.44

Target Point: $3,063.97

🔥 Key Observations:

Supply and Demand Zones:

The highlighted blue zones suggest resistance (supply) where price was rejected twice (blue arrows).

The larger gray zones below indicate potential demand/support.

Double Top Formation:

The double blue arrows point to a possible double-top pattern, hinting at a bearish reversal. However, the price hasn't strongly broken below the neckline yet.

Scenario Analysis:

Bullish Scenario: If the price holds the current demand zone and breaks above the immediate resistance, we could see a rally towards the target of $3,063.97. 💹🚀

Bearish Scenario: If it fails to hold the support zone, it may drop to the lower demand area around $3,000. 🔻

📉 Conclusion:

Entry Idea: Long above the supply zone break with a target of $3,063.97.

Stop Loss: Below the current demand zone at around $3,020.

Risk Management: Watch for strong price action before entering.

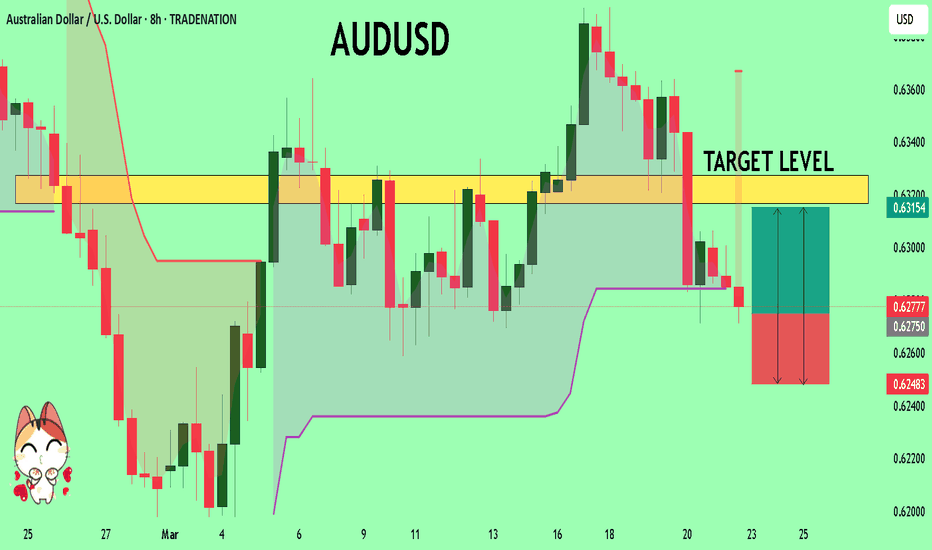

AUDUSD Will Explode! BUY!

My dear friends,

AUDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.6274 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.6316

Recommended Stop Loss - 0.6248

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK