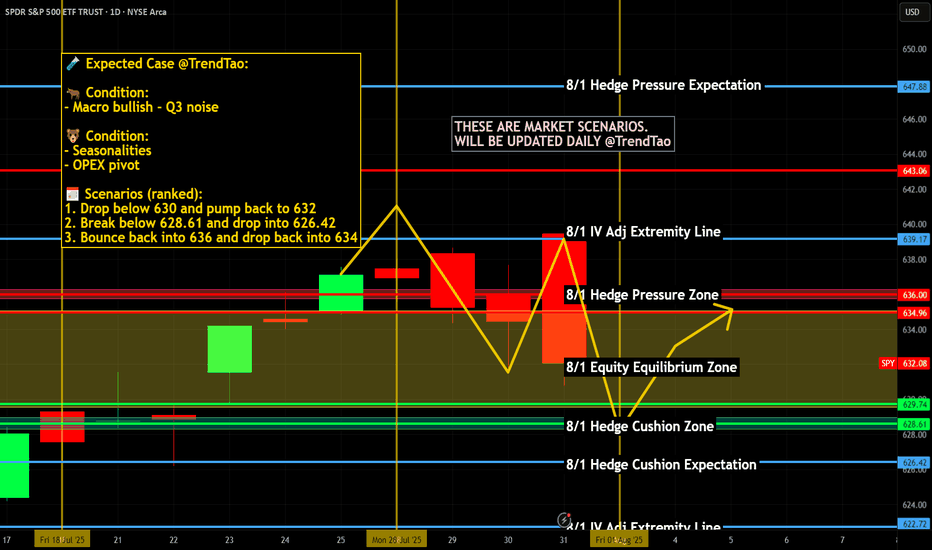

Nightly $SPY / $SPX Scenarios for August 1, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Imposes New Tariffs as Deadline Passes

Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity markets slipped modestly, led by declines in Asia-Pacific regions. AMEX:SPY futures also eased on mounting geopolitical and trade pressures.

🏦 Fed Uncertainty Mounts Despite Calm GDP

Despite robust Q2 GDP growth and a hold on interest rates this week, Fed Chair Jerome Powell faced growing unrest. Comments acknowledged downside labor risk amid trade uncertainty—investors are now assigning just a 39% chance of a rate cut in September.

📊 Key Data Releases & Events 📊

📅 Friday, August 1:

8:30 AM ET – Nonfarm Payrolls (July):

Payrolls rose by 106,000, less than June’s 147,000 but still positive. Wage growth slowed, easing inflation concerns slightly.

8:30 AM ET – Unemployment Rate:

Unemployment ticked up to 4.2%, from 4.1% in June—reflecting modest labor softness.

8:30 AM ET – Average Hourly Earnings (MoM):

Wages rose +0.2%, down from +0.4% in June, signaling wage pressure easing.

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #tariffs #inflation #technicalanalysis

Techncialanalysis

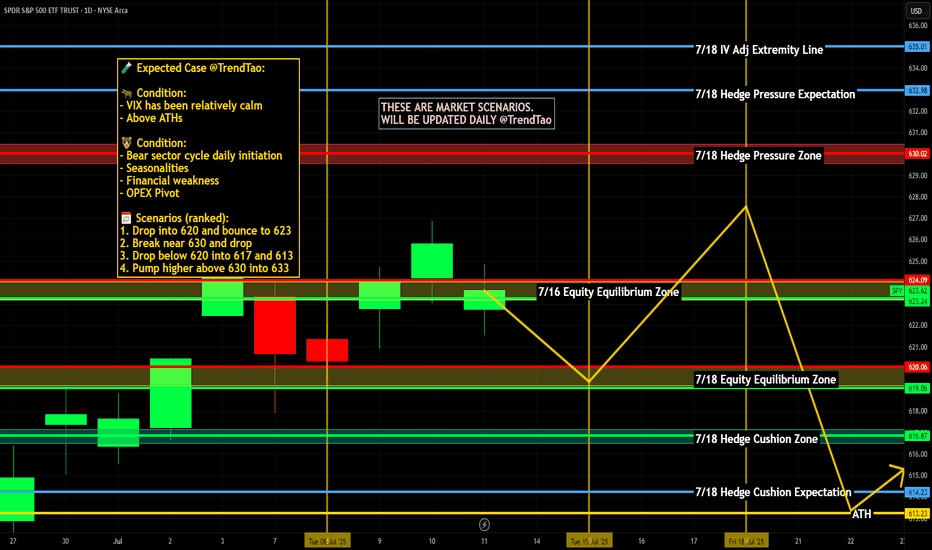

Weekly $SPY / $SPX Scenarios for July 14–18, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 14–18, 2025 🔮

🌍 Market-Moving News 🌍

⚖️ Powell Faces ‘Epic’ Trade‑Inflation Dilemma

Former Fed economists warn Chair Powell is navigating nearly unprecedented terrain: tariffs are pushing up prices even as the labor market cools. Striking a balance between inflation control and growth support remains a formidable challenge

📊 Tariff‑Driven Inflation May Peak This Week

June’s CPI is expected to show a 0.3% month-on-month increase, potentially lifting core inflation to ~2.7%—its highest level in 18 months. These data will heavily influence the Fed’s decision-making process

🏦 Big Bank Earnings Kick Off

Earnings season begins with JPMorgan ( NYSE:JPM ), Goldman Sachs ( NYSE:GS ), Wells Fargo ( NYSE:WFC ), and Citigroup ($C) reporting. Strong results could offset trade and inflation anxieties; expect volatility in financials

📈 Goldman Sees Broader S&P Rally

Goldman Sachs projects the S&P 500 to climb roughly 11% to 6,900 by mid‑2026, underpinned by firm earnings and expected Fed rate cuts. But warns that breadth remains narrow, increasing downside risk without robust participation

⚠️ Summer Volatility Risk Lingers

Deutsche Bank warns that summer’s low liquidity and the looming Aug 1 tariff re‑imposition deadline may spark sudden market turbulence—even amid bullish sentiment

📊 Key Data Releases & Events 📊

📅 Monday, July 14

Quiet start—markets digest back-to-back CPI, tariffs, and clearing post‑earnings.

📅 Tuesday, July 15

8:30 AM ET – Consumer Price Index (June)

Watch for potential tariff impact in CPI; core inflation data are crucial.

8:30 AM ET – Core CPI (June)

10:00 AM ET – Empire State Manufacturing Survey (July)

Early view on Northeast factory trends.

📅 Wednesday, July 16

8:30 AM ET – Producer Price Index (June)

Wholesale inflation signals to validate CPI trends.

10:00 AM ET – Housing Starts & Building Permits (June)

📅 Thursday, July 17

8:30 AM ET – Initial & Continuing Jobless Claims

A gauge on labor-market resilience amid talks of cooling.

📅 Friday, July 18

10:00 AM ET – Federal Reserve Beige Book Release

Fed’s regional economic snapshot ahead of next FOMC.

⚠️ Disclaimer:

This is for educational/informational use only—not financial advice. Consult a licensed professional before investing.

📌 #trading #stockmarket #economy #tariffs #inflation #earnings #Fed #CPI #technicalanalysis

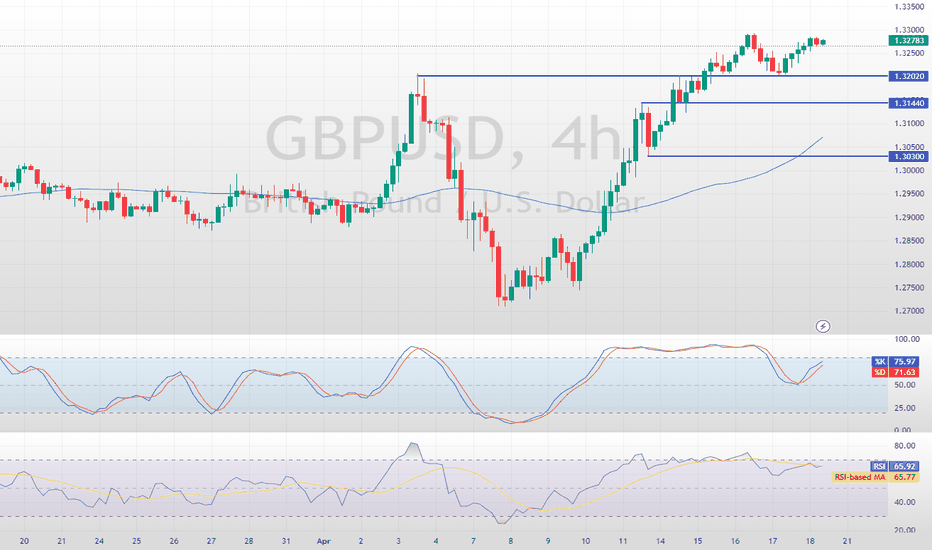

GBP/USD AnalysisFenzoFx—The GBP/USD pair rebounded from $1.3202 support, currently trading around $1.3277 and continuing its bullish trend.

As long as it stays above $1.3144, the next target could be $1.3435. On the flip side, a break below $1.3144 may trigger a bearish move towards $1.3030.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

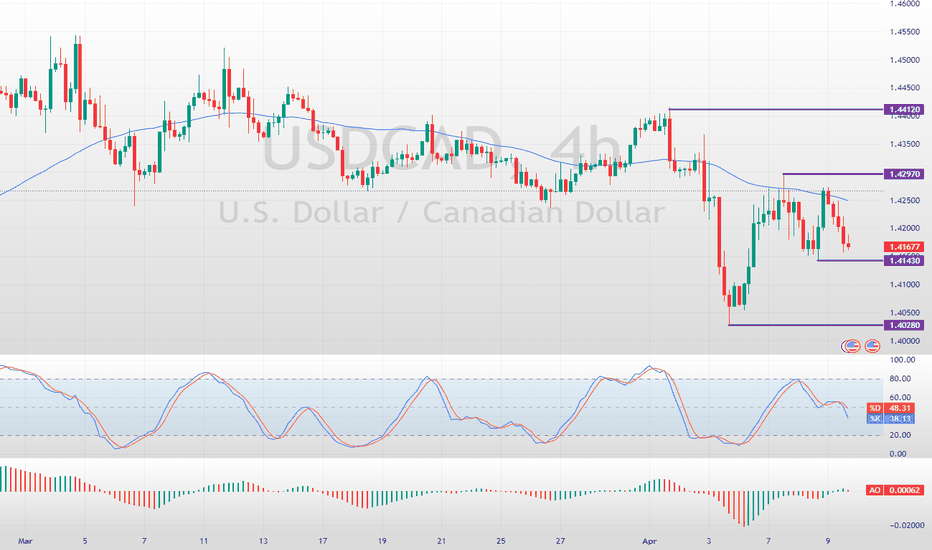

USDCAD Downtrend Hinges on This SupportFenzoFx—USD/CAD is trading bearishly and failed to form a new higher high above the 1.4297 resistance. A new bearish wave could be triggered if selling pressure drives the price below the 1.4143 support level.

In this scenario, the next bearish target will likely be 1.4028. Please note that the bearish outlook should be invalidated if USD/CAD exceeds 1.4297.

>>> Trade USDCAT at FenzoFx Decentralized Forex Broker

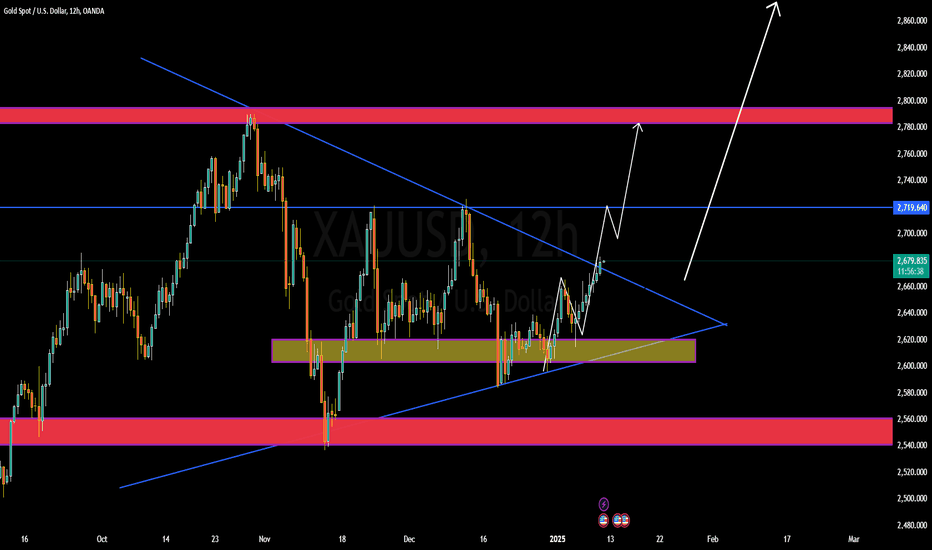

Case Study of XAUUSD : Symmetrical Triangle BreakoutsXAUUSD, representing gold against the US dollar, is currently trading at 2680 and is expected to rise to a target price of 2800. The pair is breaking out of a main symmetrical triangle pattern, a technical indicator signaling a potential continuation of the bullish trend. This pattern forms during a consolidation phase, where price action narrows before a decisive breakout. Following the breakout, it is anticipated that the price will retest the breakout level to confirm its strength and establish a new support zone. Retesting is a common occurrence in technical analysis, reinforcing the breakout's validity and providing traders with confidence in the upward momentum. Once the retest is complete, the price is expected to resume its ascent toward the target. This scenario reflects a strong technical setup, attracting both short-term and long-term traders seeking to capitalize on the projected move. The symmetrical triangle breakout and subsequent retest indicate a well-structured path toward achieving the 2800 target.