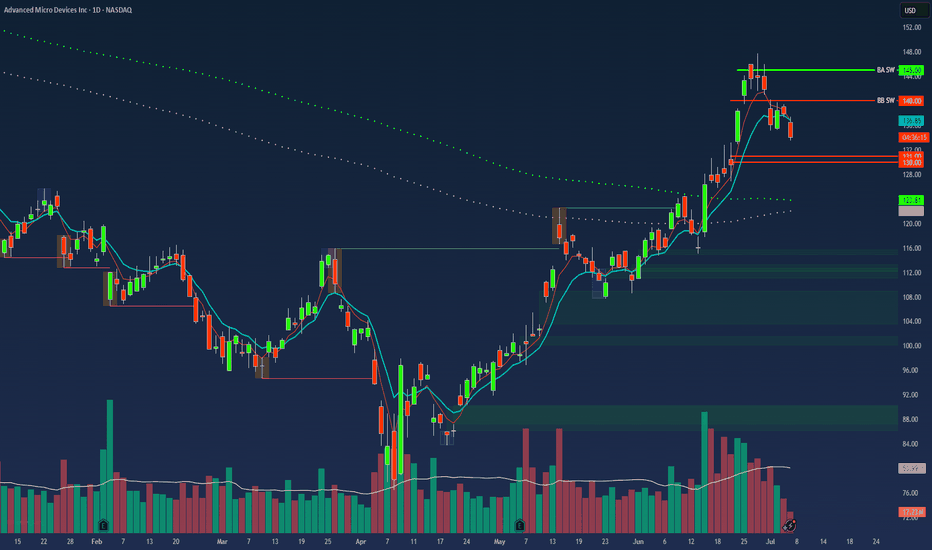

$AMD Swing Trade – Put Debit Spread Setup🔻 NASDAQ:AMD Swing Trade – Put Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025

🛠 Strategy: Buy to Open (BTO) Put Debit Spread

📉 Strikes: $31 / $30 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.21

🎯 Trade Thesis

This setup aims to capture short-term downside in NASDAQ:AMD via a low-cost, defined-risk spread. The trade fits within my broader portfolio of OTM spreads under $0.25.

Key Drivers:

🔻 Semi sector under pressure – NASDAQ:AMD showing relative weakness.

📉 Breakdown below key support near $31 and rejection at VWAP.

🧾 Weak momentum – MACD trending down, RSI near 44.

🔄 Trade enters into earnings season volatility.

📊 Technical Setup (Daily)

EMA(4) < EMA(8) < EMA(15): Bearish structure fully intact.

VWAP: Price rejected from 30-day VWAP zone.

MACD/RSI: Momentum still fading, no signs of bullish divergence.

⏳ Strategy Notes

Max loss: $0.21

Max gain: $0.79

Risk/reward structured for a drop into or below $30

Expiration: July 18

🧠 Journal Note

Most of my trades are swing-based using OTM debit spreads with tight risk control. No same-day entries — setups must have defined technical compression and short-term catalysts.

Technical-setup

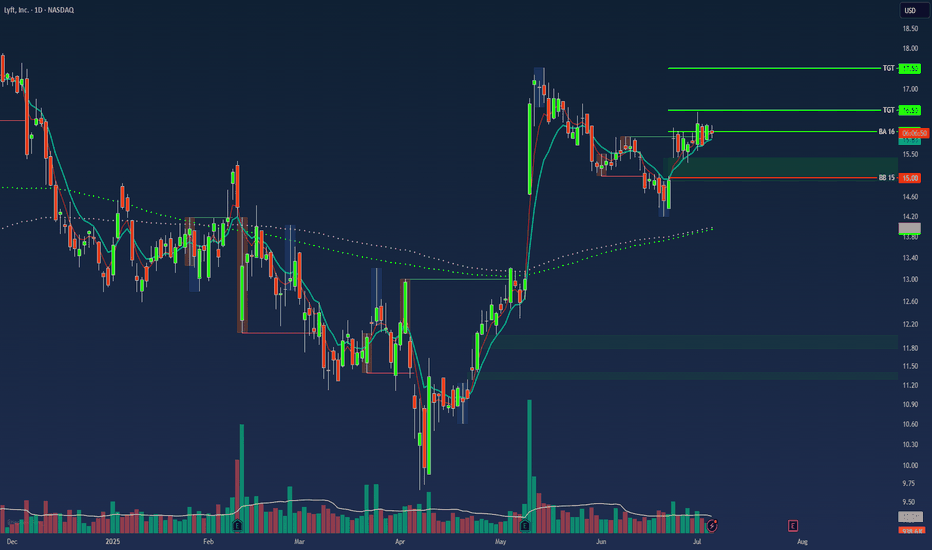

$LYFT Swing Trade – Low-Cost Call Debit Spread Setup🚗 NASDAQ:LYFT Swing Trade – Low-Cost Call Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025, 2:53 PM

🛠 Strategy: Buy to Open (BTO) Call Debit Spread

📈 Strikes: $16.5 / $17.5 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.25

🎯 Trade Thesis

This swing trade targets a short-term bullish move in NASDAQ:LYFT based on improving fundamentals and favorable technical setup. The structure uses a low-cost OTM call spread to define risk and limit exposure while capturing directional potential.

Catalysts supporting the move:

🚙 Autonomous vehicle rollout beginning this summer (Atlanta) and expanding to Dallas (2026) via Mobileye partnership.

🗳 Activist investor Engine Capital pushing for governance changes and strategic alternatives.

💵 Gross bookings at record levels, with net income and free cash flow turning positive.

📈 Analyst upgrade from TD Cowen with a $21 target (+30% upside from entry).

📊 Technical Setup (Daily Chart)

📉 EMA(4) < EMA(8) < EMA(15): Bearish alignment beginning to flatten – potential compression signal.

⚖ VWAP (30‑day): Price consolidating near long-term VWAP – watching for reclaim.

🔄 MACD: Bullish crossover emerging.

📉 RSI: ~36 – approaching oversold territory, setting up possible reversal.

⏳ Strategy Notes

Position type: OTM vertical call debit spread.

Risk defined: Max loss = $0.25 per contract.

Max gain: $0.75 if LYFT closes at or above $17.5 by expiration.

Timeframe: 2-week swing through July 18, ahead of Q2 earnings (~Aug 6).

🧠 Journal Note

This position aligns with a broader strategy focused on OTM spreads priced under $0.25, using technical compressions and fundamental tailwinds. Trade was opened not on an entry signal day - this avoids front-running momentum shifts.

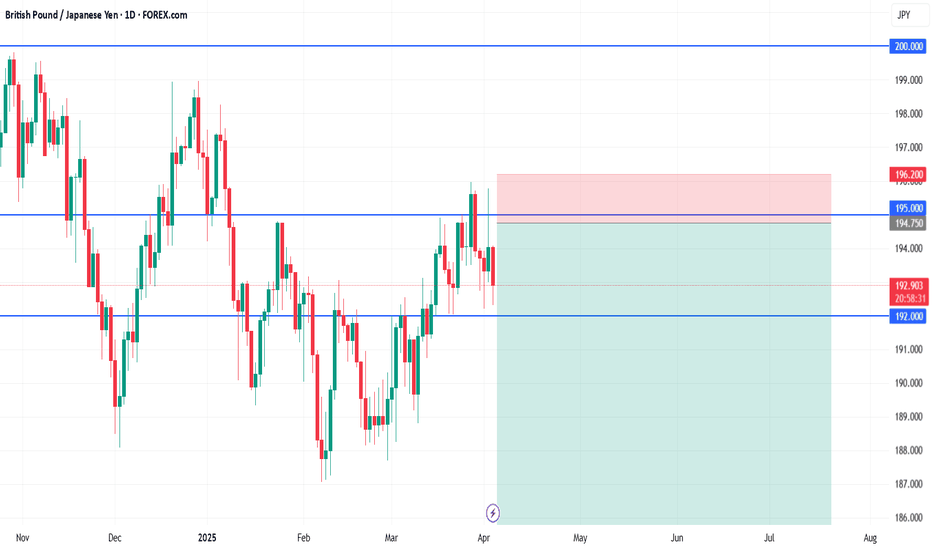

GBP/JPY short🧩 GBP/JPY Swing Short Setup

📍 Entry:

Sell Limit: 194.75

🛡️ Stop Loss (Above Resistance Wick):

SL: 196.20

→ Covers minor breakout/fakeout above 195 zone while protecting against invalidation

🎯 Take Profits:

TP1: 190.00

(Structure floor + first major reaction zone)

TP2: 185.00

(Clean horizontal support and demand zone)

TP3 (Swing Target): 180.00

(Large macro target — monthly structure retest)

🧠 Rationale Recap:

Price is consolidating just under multi-year resistance (195–200)

Fundamentals align: GBP weakening, JPY strengthening in risk-off environment

Strong R:R, clean rejection zone, and macro pressure potential

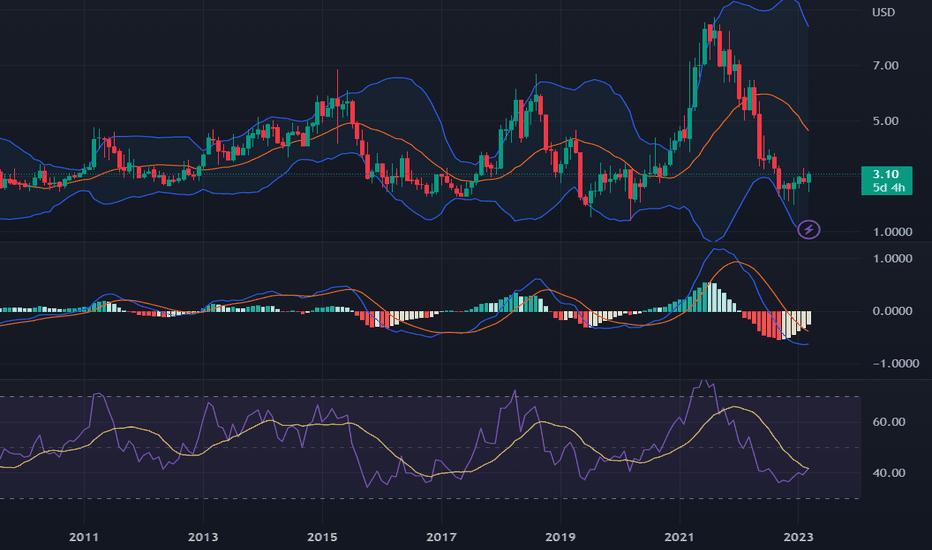

Harvard Bioscience: Bouncing Higher From Multiple-Year SupportI zoomed all the way out to the monthly chart to show the long-term support levels. We can see that HBIO is bouncing higher from a multi-year support level in the $2 range. The MACD (middle of the chart) didn't confirm an upward trend yet. However, the MACD did confirm the upward trend on the weekly chart. It looks like the blue monthly MACD line is close to crossing above the red signal line. The purple RSI line on the bottom of the chart is pointing upward, which is bullish. This indicates that we could see a long-term continuation of the rally which began in December/January. Click on the link below for a detailed article. HBIO has a low valuation with strong expected EPS growth. This is likely to drive the stock higher IMO.

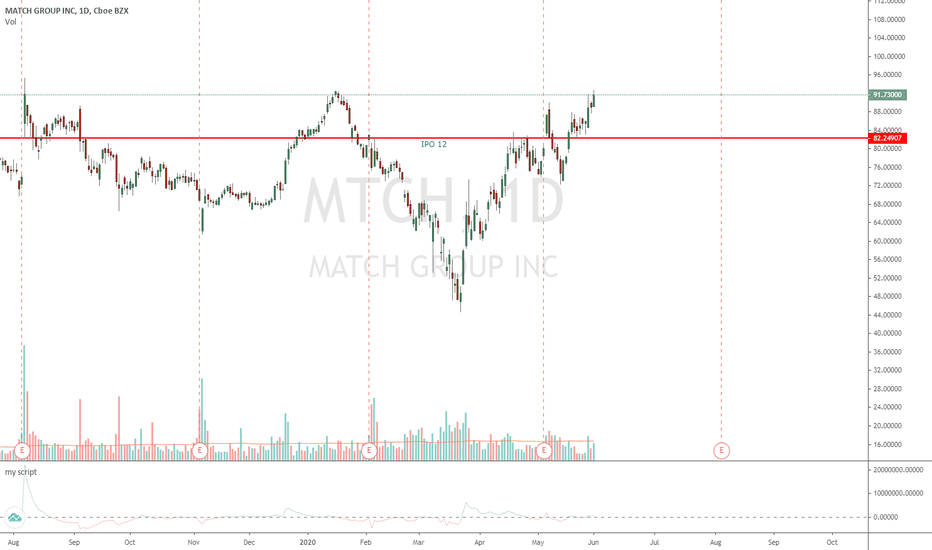

MTCH: SETTING UP for a breakMATCH is at an attractive level for a short.

BUT

- be patient for a set up.

- there has been signs of exhaustion, first on April 27, second on May 8, and third on may 22, however,

- the first one has been reversed May 5

- the second one has been reversed on May 18

- and the third one has not been coupled with the RIGHT price action, and was above the important support level.

- the first two were actionable, meaning that I would have traded them, but I hadn't been closely watching until the third sign.

- If I had, it would have been a very small loss, but I would consider them good trades.

The current price has reached a strong resistance, but this should never be the sole reason to short.

I am waiting for a sign of exhaustion to short, may it be a divergence, a price action, or my custom indicator.

But there is no need to get involved just yet.