Technicals

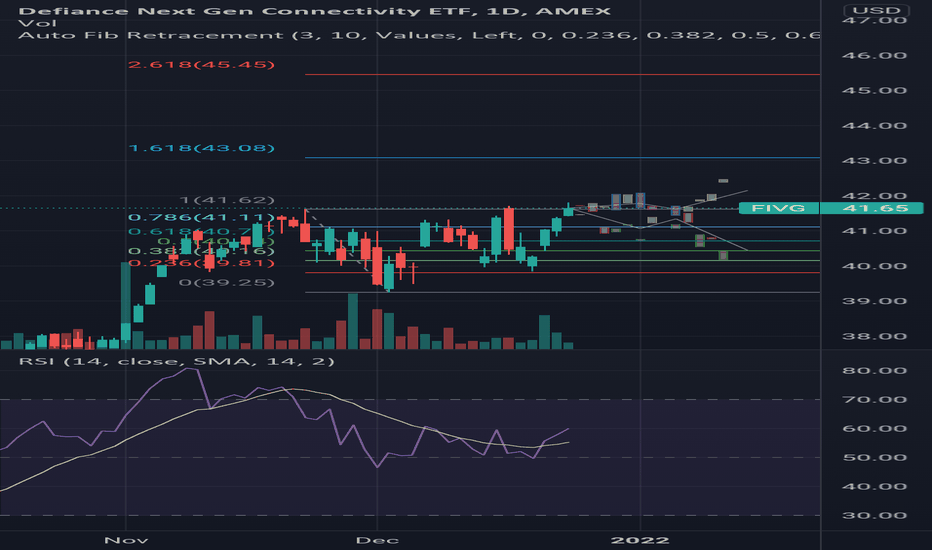

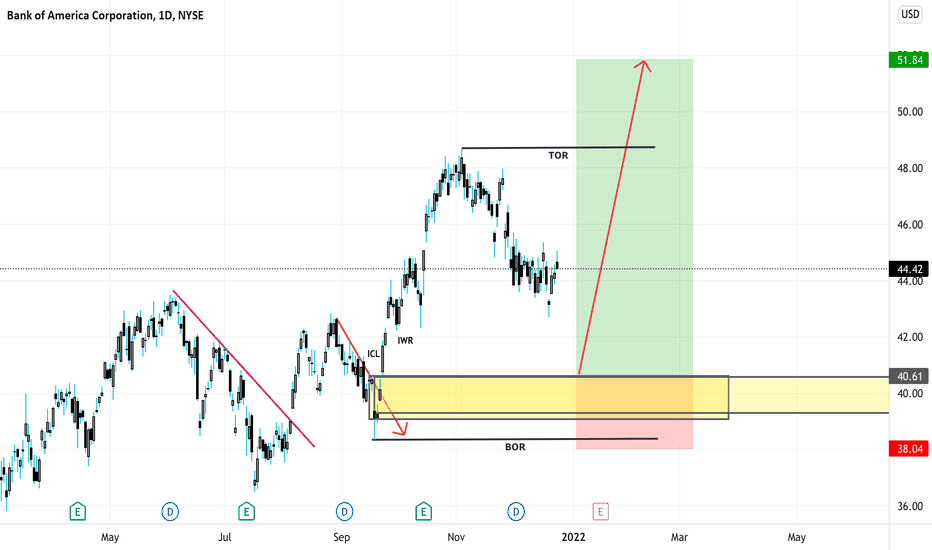

two different directions for five g stocks (fivg)either were in for immediate continuation of the breakout pattern to above the 42 area or, if the nasdaq isnt doing as well, a pullback to revisit the 40.5 area

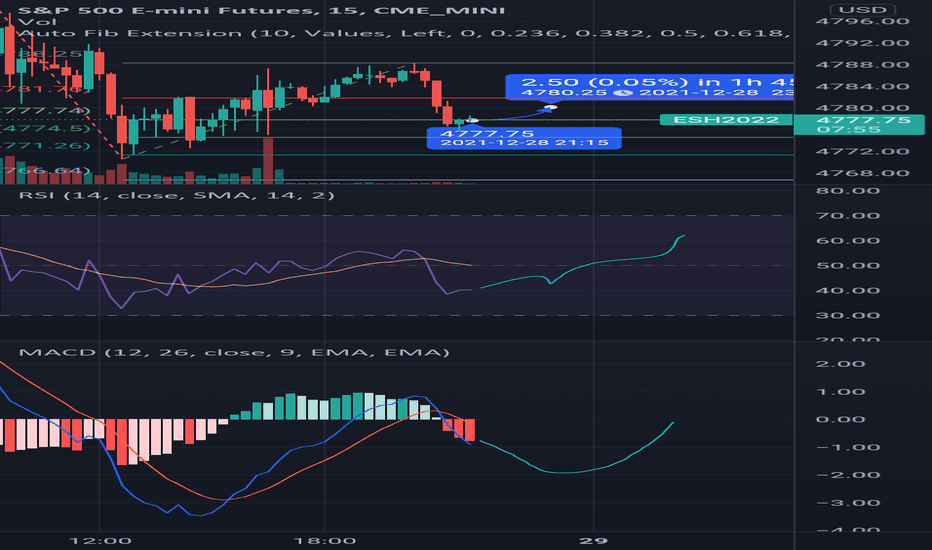

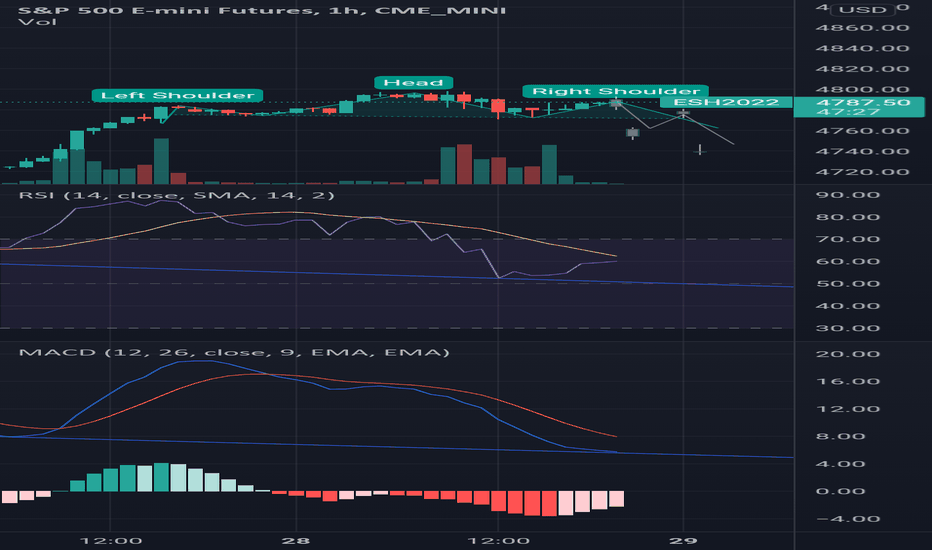

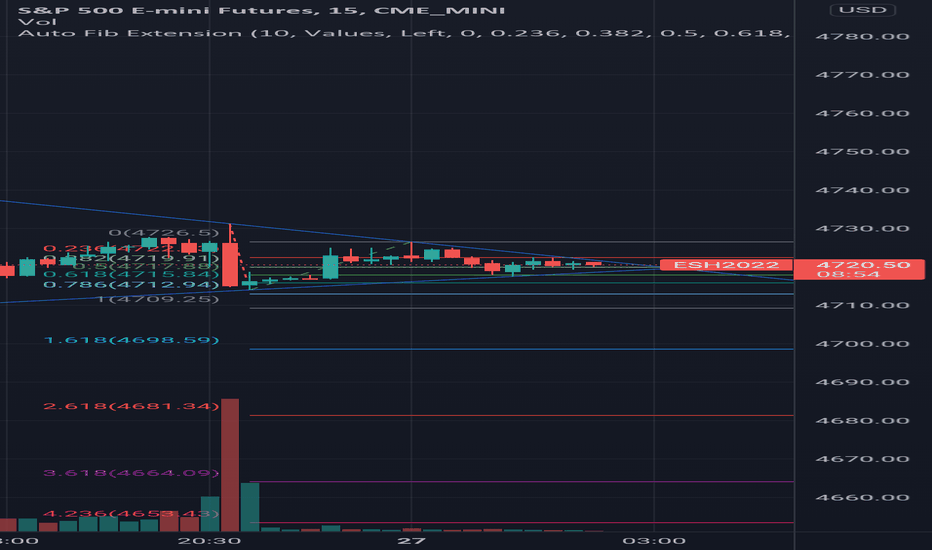

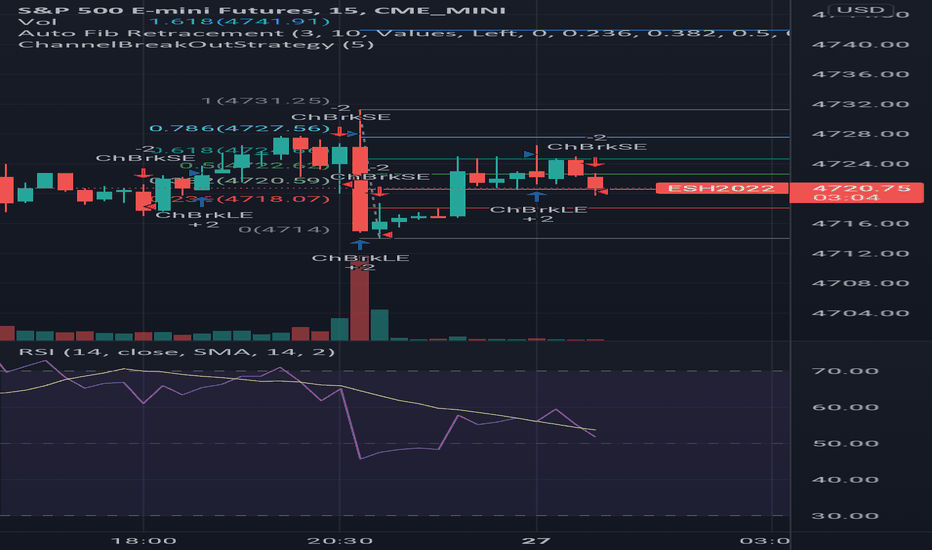

s&p500 futures still have bull momentumas long as we respect the 1-4 hr neckline, and we dont roll over breaking to new lows there are still lots of attractive areas of price above 4783

the bottom line is that calls are still cheap as long as we keep consolidating, so shooting for a intraday high above 4800 is a sound judgement

this means quick profit can be taken as we snap back to higher prices on the 15 minute

4780.25 is a decent target

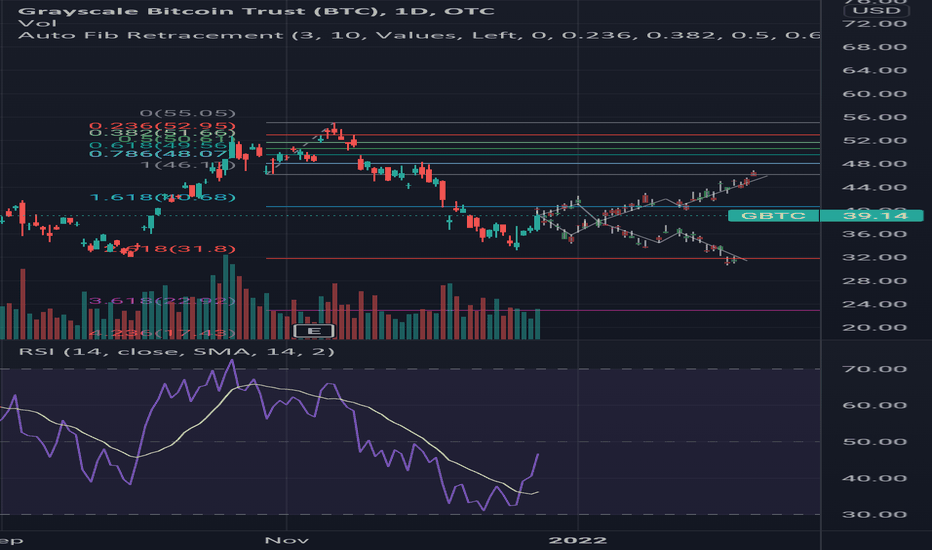

two directions for bitcoin (gbtc)the worlds largest, most popular crypto currency is headed for a break of the 42.5 area

or were headed back beneath the 34.5 region soon

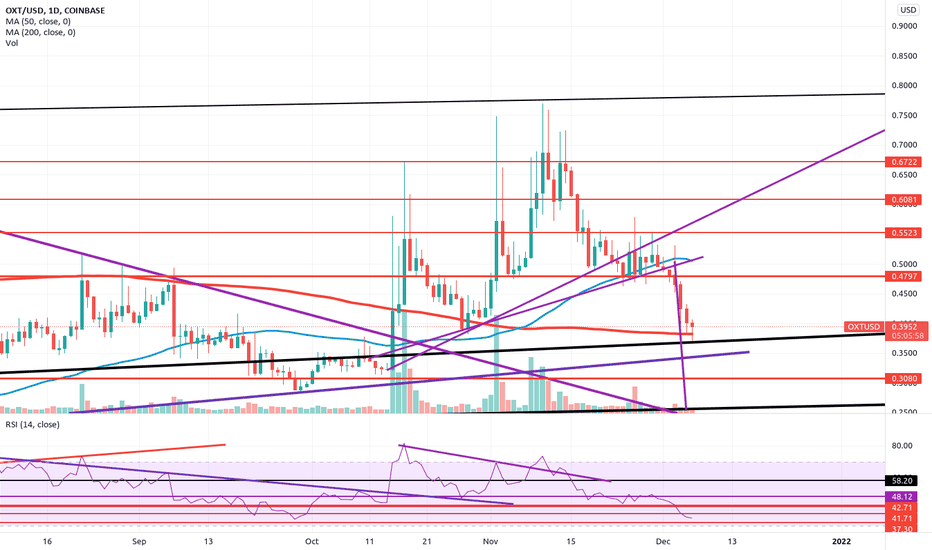

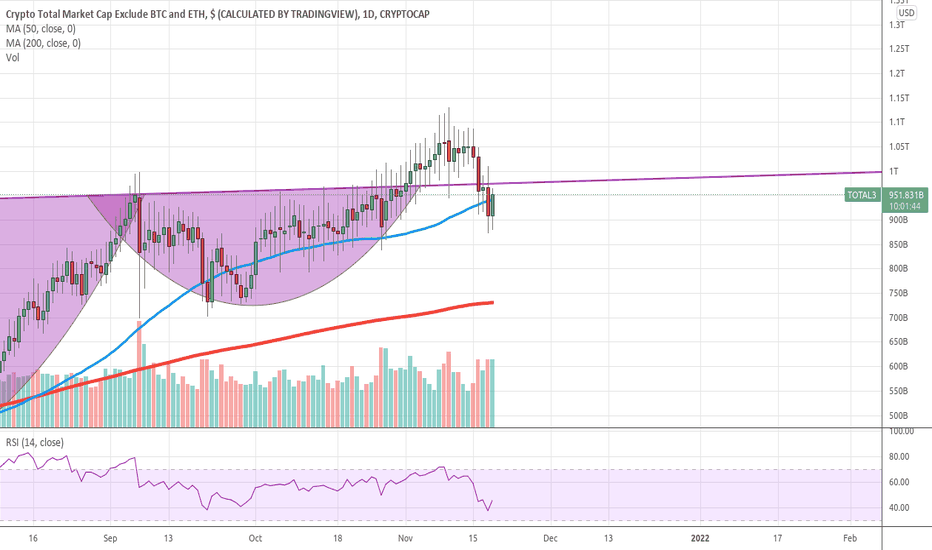

Daily Crypto Market Update - Showing Bullish Signs Again - OXTIn this video:

A discussion of the overall crypto market sentiment

A discussion of future price action

A look at the altcoins market

Is sentiment beginning to turn bullish again?

Orchid OXTUSD charted with levels for paid subscribers at substack

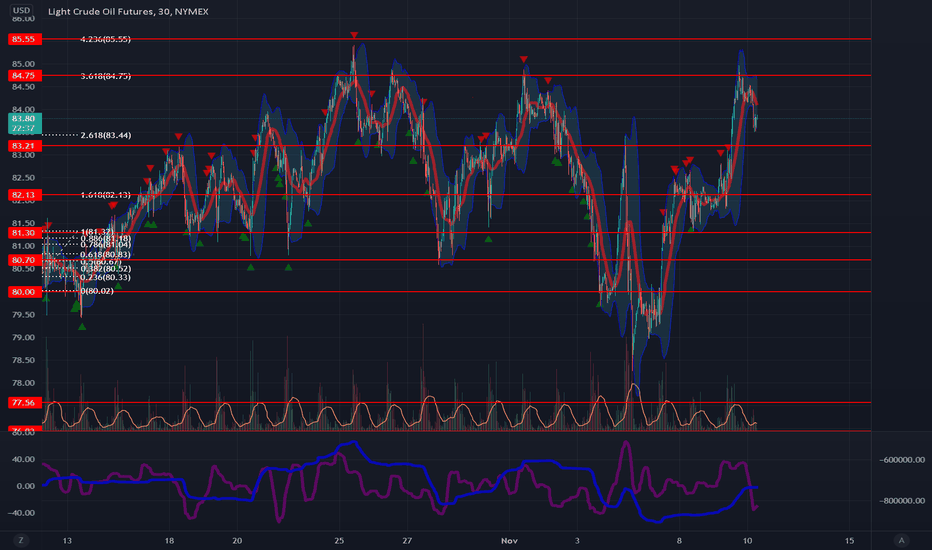

Oil Gains Strength After API DrawOil has regained strength, rebounding nearly to highs again. We have blasted through all levels of resistance in the 82's and 83's, and are currently just below the high at 85.55. We seem to be hovering around 84.75, which has been tested and rejected before, therefore we are adding it as a new technical level. Oil appears to be in a sideways corrective pattern for the longer term, ranging from the high 70's to 84.75. If we are able to break out then 87.21 is the next target.

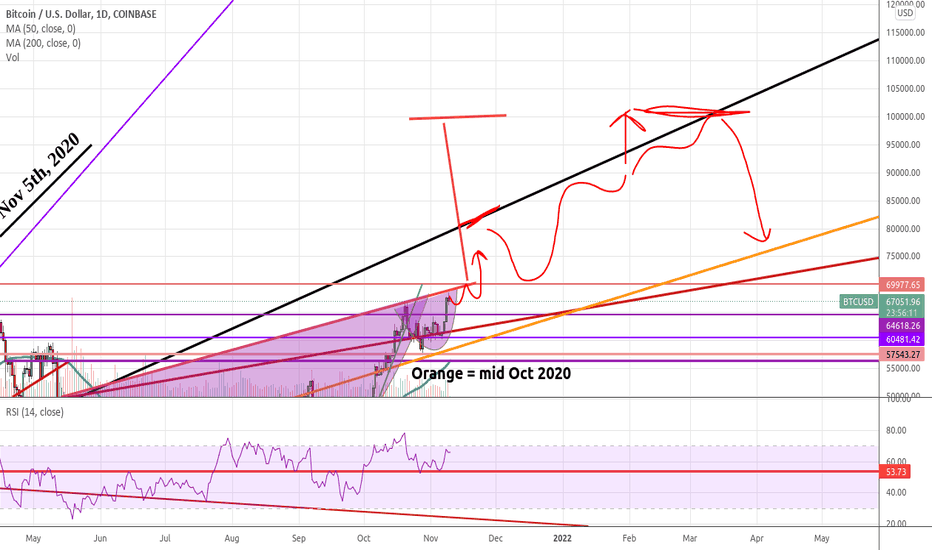

New Pattern Spotted on Bitcoin Chart!!! TARGET $100,000!In this video:

We discuss a NEW Cup and Handle Pattern Spotted

Old C&H Patterns may have been legit, but are completed now

New C&H Pattern makes much more sense mathematically and in conjunction with the Bitcoin Dominance chart

New Cup and Handle pattern puts us at a target of $100,000!

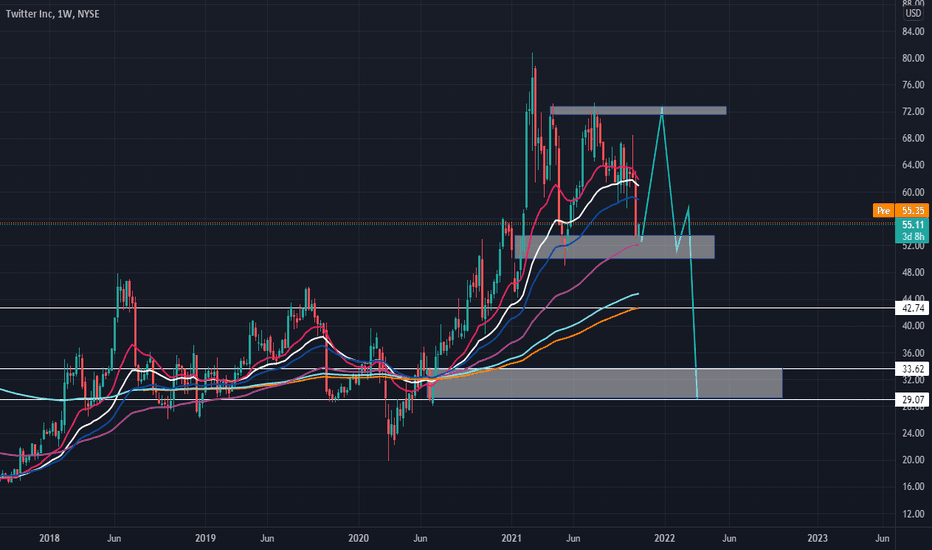

Twitter bull & bust Casetwitter has recently made a sharp downside move towards 100EMA on the weekly chart which looks like will hold for a couple of upside sessions as of now as the market is over all in strong upside momentum with daily record close across the board. That being said, the over all picture for the company and stock looks a bit shaky with sharp sell off from the past week. if the stock does manage to climb back towards the 70/72ish area i believe it can still dive down towards the 2019 Area all over again. which will be an Ideal place to go long on this stock. but for Day traders this stock can be a real treat as the daily volume is high so the volatility is there to make money both ways. Personally i would go long with $48 as the stop loss area and $70 as Take profit and would be a seller at $70 with stop loss at $76 and all the way towards $30/35$ take profit.