Tenable Holdings: Is Goldman wrong about TENBA cyber-security company offering tech expertise and SaaS platforms to assess and manage data vulnerability.

Tenable’s subsidiaries provide cloud solutions for businesses worldwide, in the education, energy, finance, healthcare, and retail sectors.

Tenable, like many small-cap tech companies, operates at a net loss. The company reported a loss of 24 cents per share in the last quarter, beating the forecast by 4 cents.

That beat highlights another feature of the company’s quarterly reports: it has beaten the estimates consistently for the last six quarters.

Revenues are growing, at the $97 million reported in Q4 represented 29% year-over-year growth.

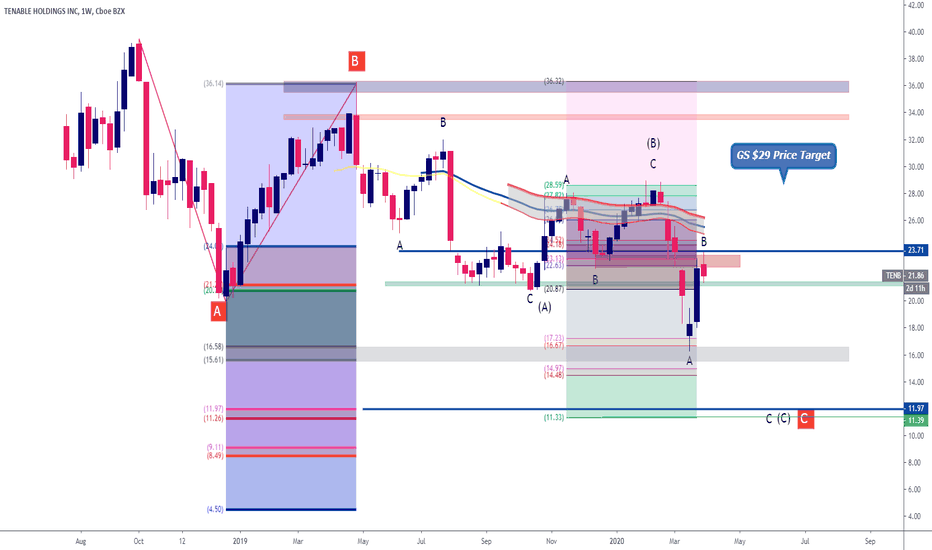

Brian Essex, tech sector expert for Goldman Sachs, reviewed this company and was impressed enough to initiate his coverage with a Buy rating.

His $29 price target indicates a 29% upside potential, backing the bullish outlook.

In his comments, Essex says, “We believe Tenable is well-positioned to leverage its best-of-breed reputation in vulnerability assessment to gain further traction among enterprises

looking to evaluate their risk exposure and adopt a formal vulnerability assessment program.

Tenable has been growing rapidly over the past several years, is among the fastest-growing companies in our coverage universe, and remains a critical provider for continuous monitoring,

which is an important compliance-related focal point. While the company has yet to turn profitable, it has made meaningful progress, and we expect this to continue as we believe that

the company has demonstrated discipline with regard to meeting profitability targets . (Source: yahoo finance)

(Source: yahoo finance)

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

Tenable

Tenable IPO - $TENB - just do it.A new IPO here.

Tenable Holdings, ticker TENB .

Starting trading 26.07.2018

Price range $20-22, should be filled for $22.

I expect it to open at $27 and then to go 40%+ ($30-31) in first day.

Here is why:

Growing revenues at 50.9% y/y, $19 or 5.7x forward sales. Competitors are trading at 11.22x

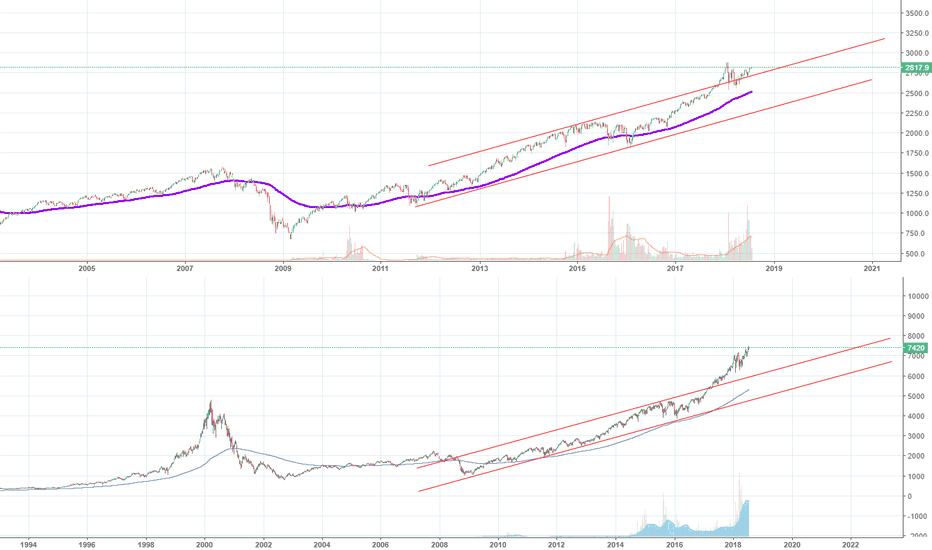

Previous Cyber security IPOs skyrocketing last half year. As do many leading cybersecurity companies, see $HACK etf's chart.

As of December 31, 2017, the company had 24,000 customers including 53% of the Fortune 500.

the firm has increased the price range from $17.00 - $19.00 to $20.00 - $22.00 and has increased the number of shares to be sold from 9.2 million to 10.9 million. (thats usually bullish!)

the company has almost no financial debt.

Research&Dev, Cost of revenue and Sales&Marketing costs are growing slower than revenue. Eventually the company will be profitable someday ;) But who needs profitable company in the market? ha-ha

p.s. Keep calm and buy Tech. We are in the bull market (everyone except the Zerohedge readers).