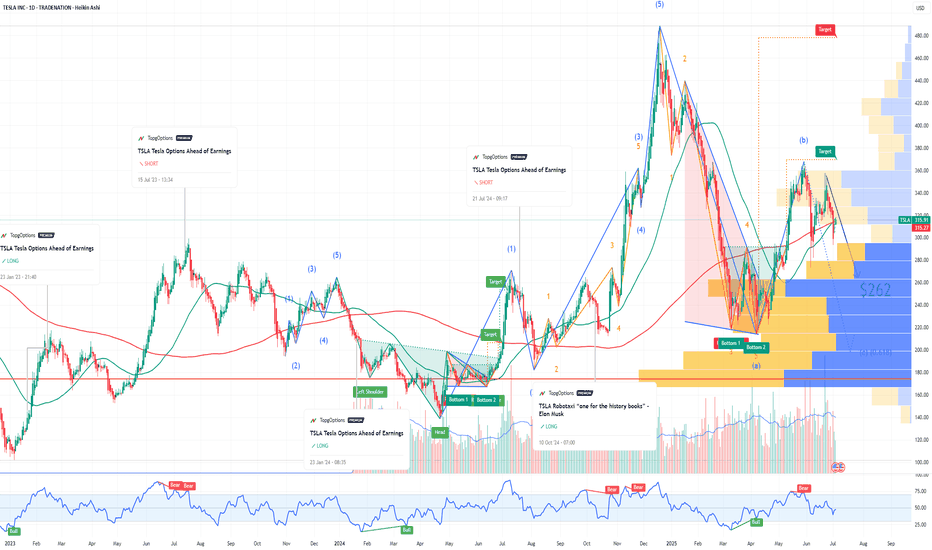

TSLA bearish: Musk vs Trump! Subsidy Spotlight & Sentiment RisksIf you haven`t bought TSLA before the recent breakout:

Now you need to know that Tesla (TSLA) is sitting around $315, but the vibe is getting shakier. Elon Musk’s feud with Donald Trump — complete with jokes about “putting the DOGE on him” if deported — might feel like another meme moment, but it spotlights Tesla’s huge dependency on federal and state support.

Estimates show Tesla could face up to $48 billion in lost government contracts and incentives over the next decade if the political tide turns. With Trump’s base calling out “green subsidies” as wasteful, Tesla’s funding pipeline could get squeezed — just as competition ramps up and margins get tighter.

Key Bearish Points

1) Political Risk Is Real

Musk’s public fight with Trump is a double-edged sword: he risks losing goodwill on both sides of the aisle. If the next administration decides to gut EV credits, Tesla could take a huge hit — far more than its rivals who rely less on U.S. incentives.

2) Subsidy Dependence

Tesla’s success is partly built on a foundation of tax credits, carbon credits, and favorable policies. $48B in potential lost value is nothing to shrug off — especially when competitors like BYD are gaining ground.

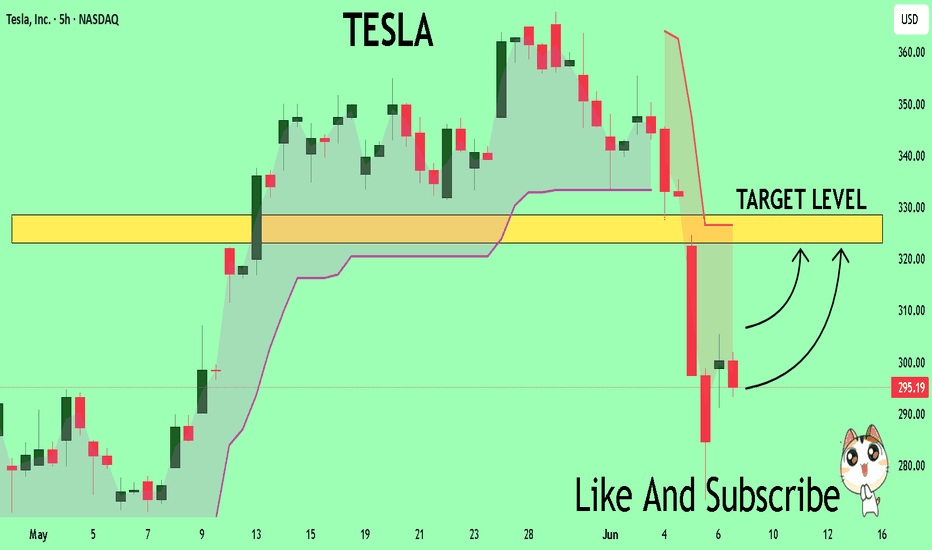

3) Bearish Technical Setup

TSLA’s chart is rolling over inside a bearish channel. It recently failed to hold the $330 level and now sits around $315. A clean breakdown below $300 could open the door to your target zone at $262 — a major support area from earlier this year.

Catalysts:

Any new comments from Trump’s camp about EV subsidies

Weak delivery/margin numbers from Tesla

Broader tech/equity pullback

Musk’s crypto distractions no longer propping up sentiment

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Tesla

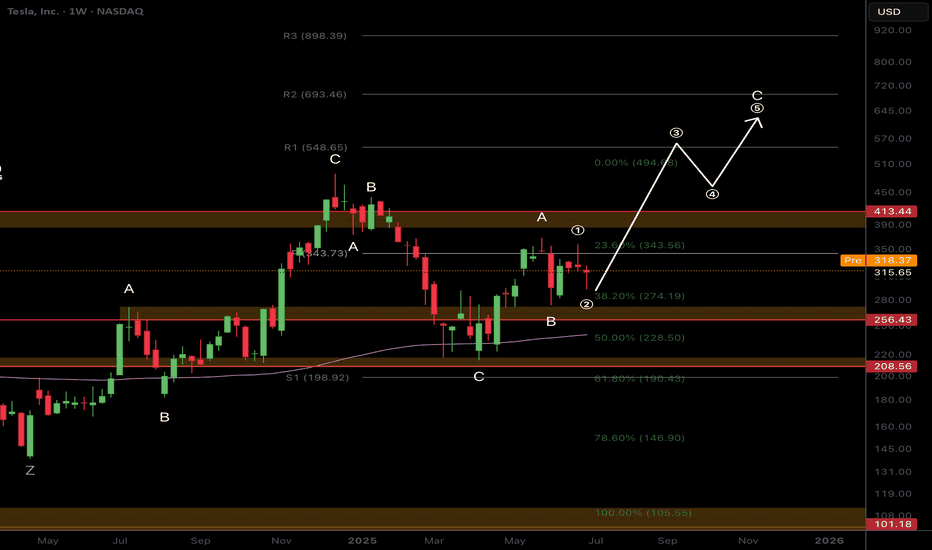

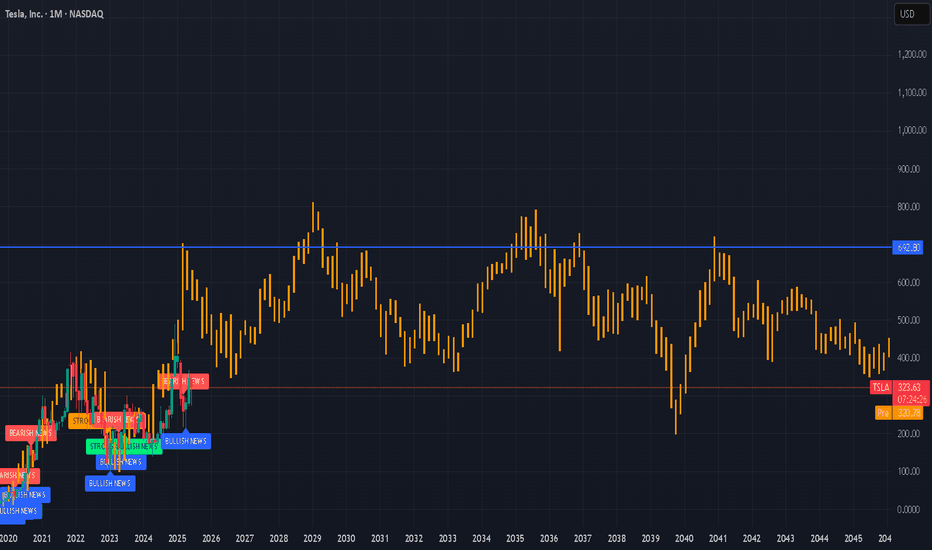

$TSLA Time to Fade or..?NASDAQ:TSLA (like NASDAQ:GOOG ) is standing out to me as bullish, yet, corrective Elliot Waves a higher degree series of ABCs appear to be underway.

A final wave C appears to be underway which would take price too all time highs in an expanded flat correction pattern. My count could be wrong and the interference could be from the increase it sentiment volatility connected to the US headlines lately and Trump posting on socials. Things may get back to normal after the summer and a clearer pattern may emerge.

Price is struggling to get past the weekly pivot point bullishly or the weekly 200EMS bearishly and is trapped within that range.

For now long term target is the R2 daily pivot at $693 as the higher probability is continued upside

Safe trading

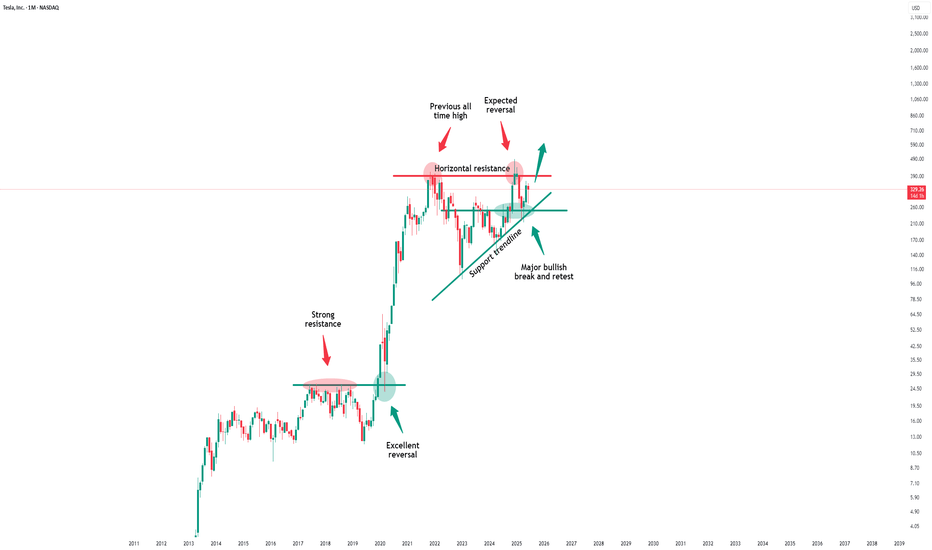

Tesla - This bullish break and retest!Tesla - NASDAQ:TSLA - confirmed the bullish reversal:

(click chart above to see the in depth analysis👆🏻)

Tesla recently created a very bullish break and retest. Therefore together with the monthly bullish price action, the recent rally was totally expected. But despite the short term volatility, Tesla remains bullish, is heading higher and will soon create new highs.

Levels to watch: $400

Keep your long term vision!

Philip (BasicTrading)

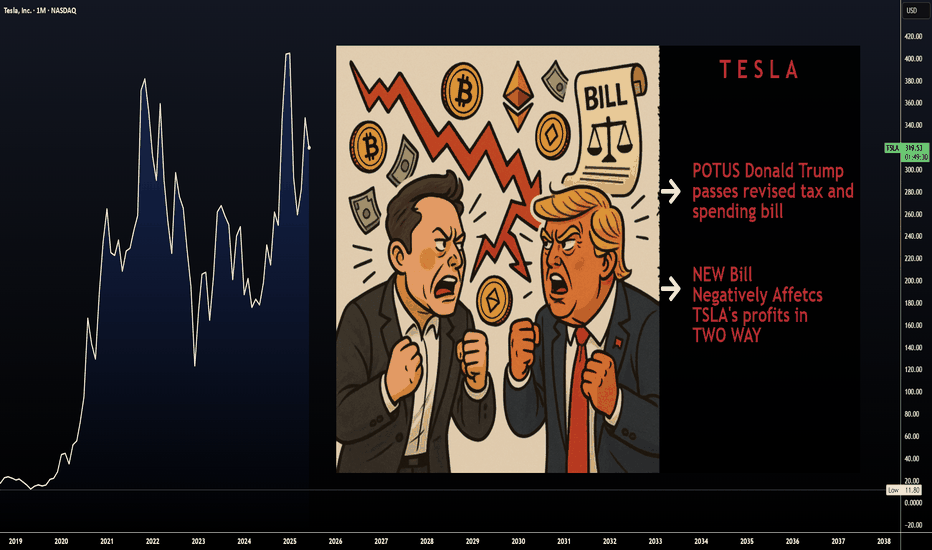

MUSK on TRUMP's Bill | "outrageous, disgusting abomination"Elon Musk’s sided against the latest Trump-backed tax-and-spending package, in a plot twist between the recent partners turned enemies.

Musk called the legislation a “massive, outrageous, pork-filled Congressional spending bill” and a “disgusting abomination,” publicly shaming senators and representatives who backed it.

With such a strong opinion against it one may wonder, is this going to negatively affect Tesla?

Together with this strong reaction, the price has already been trading lower for the past few days.

The administration has defended it as the “One Big Beautiful Bill,” insisting it will stimulate growth, even though Elon Musk warned the bill would swell the U.S. budget deficit by roughly $2.3–2.5 trillion over the next decade, calling the added debt “crushingly unsustainable”.

When I first read this, it made me think of Tesla's long generated “green credits”, which in 2024 alone, brought in roughly $2.76 billion. “green credits” (officially, zero-emission or regulatory credits) work by building more clean vehicles than required and selling the excess allowances to other automakers that need them to comply with emissions mandates.

Now I'm no expert on US policy, and so I roped in GPT to help me explain how this new bill implicates TESLA's profit:

Under the Senate’s “big, beautiful” tax-and-spending bill, Tesla’s regulatory-credit business faces two assaults:

❗ Repeal of CAFE- and ZEV-mandates

The bill would eliminate penalties for automakers missing Corporate Average Fuel Economy targets and roll back zero-emission vehicle mandates that currently force legacy manufacturers to buy credits if they fall short. Remove those penalties and mandates, and there’s no structural need for credits—undercutting the very market that funds Tesla’s $2–3 billion-a-year credit-sales business

❗ End of consumer EV tax incentives

By phasing out the $7,500 new-EV credit (and the $4,000 used-EV credit) within months of enactment, the bill dampens U.S. EV demand overall. A smaller EV market means fewer opportunities for Tesla to leverage fleet-wide ZEV regulations against higher-emitting rivals—further squeezing credit prices and volume

Bottom line: Without CAFE/ZEV obligations and with EV purchase subsidies gone, Tesla’s “green-credit” line—a major profit driver in recent quarters—would likely collapse, removing a key buffer against manufacturing and pricing pressures.

This could be the beginning of a bear market for Tesla lasting throughout the rest of the Trump administration.

________________________

NASDAQ:TSLA

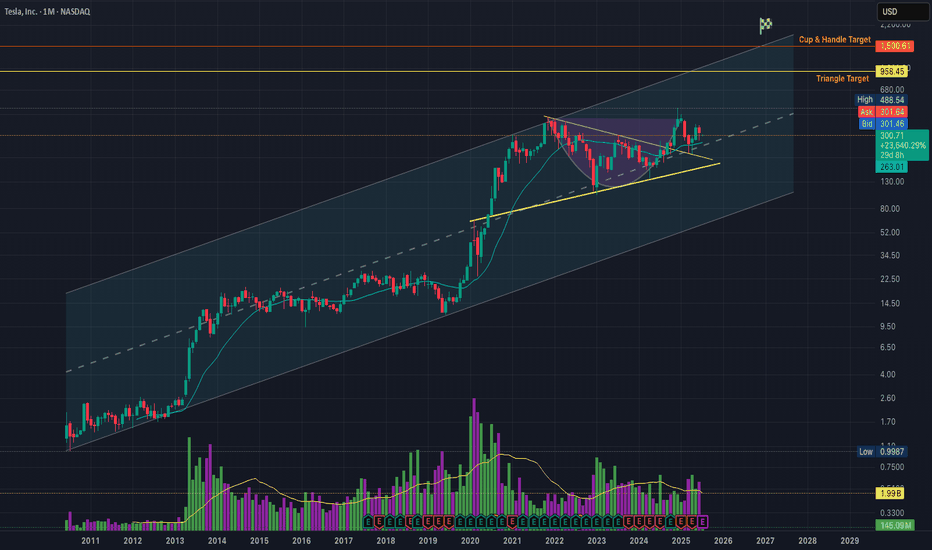

Adam & Eve on the Chart:Will They Bless Us with a $1,500 MiracleI don’t have much to say — it’s pretty straightforward.

We’ve got two potential structures on the chart:

✅ First, the symmetrical triangle that already broke out, aiming for a target around $958 to $1,000.

✅ Then we’ve got the “Adam & Eve” structure (gotta flex sometimes 😎), see it as a cup & handle pattern, aiming for a crazy $1,500 target. This one hasn’t broken out yet — but if the first triangle breakout plays out fully, it basically sets the stage for this one to break out too.

Some quick facts:

The bounce zone around ~$245 is a huge multi-timeframe confluence level.

Volume profile support is literally chilling right at $245.

Multiple moving averages are backing this move, even on lower timeframes than the "1M"

Triangle retest? Check.

0.786 fib support? Check.

(And to name a few)

Overall, the chart looks Fine to me.

Negative news might affect the short term, but the trend should stay intact.

Unless the macro changes.

That's it, that's the idea" - Good night !

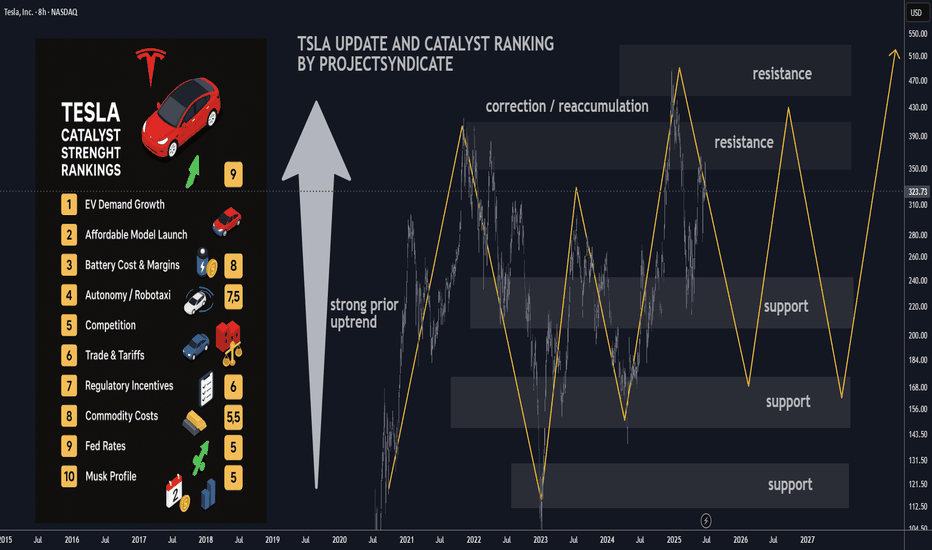

TLSA Catalyst Ranking and Market Update: June 2025Here's an updated/revised outlook for TSLA including all the primary

catalyst ranking and analyst ratings and overview of latest developments

🔋 1. EV Demand Growth

Strength: 9/10 → 9/10

Global electric vehicle adoption remains the dominant pillar. Tesla faces softer comp in Europe (–40.5% drop in May) wsj.com, but overall trend remains firmly upward. 🌍

🚗 2. Affordable Entry Level Model

Strength: 8.5/10 → 8.5/10

Tesla still on track to launch a < $25K EV in first half of 2025. Any delays or execution issues could pressure sentiment.

⚡ 3. Battery Cost & Margin Improvement

Strength: 8/10 → 8/10

Margins saw slight relief Q1, driven by cost cuts f, but macro headwinds persist.

🤖 4. Autonomy & Robotaxi Rollout

Strength: 7.5/10 → 8.5/10

Robotaxi debuted in Austin in June, sparking a ~10% one-day stock surge. Benchmark raised its target to $475/buy on the rollout—strong tailwind.

🚩 5. Competition

Strength: 7/10 → 6.5/10

Rivals like Xiaomi’s new YU7 are gaining ground. Tesla must maintain differentiation.

📉 6. Trade Policies & Tariffs

Strength: 6.5/10 → 6.5/10

Still relevant due to Tesla’s global footprint, though less front-page than before.

💰 7. Incentives & Subsidies

Strength: 6/10 → 6/10

U.S. IRA tax credit policies remain supportive; evolving eligibility remains a swing factor.

🛢️ 8. Commodity Costs

Strength: 5.5/10 → 5.5/10

Raw-material swings affect margins. Inventory hedges help but not wholly mitigate.

📈 9. Fed & Interest Rates

Strength: 5/10 → 5/10

A higher-rate environment still limits valuation multiples for growth-tier companies.

🎭 10. Musk Profile & Governance

Strength: 4/10 → 5/10

Analysts (e.g., Bradley Tusk) warn of being “massively overvalued” tied to Musk’s persona. Musk’s renewed focus on Tesla vs. other ventures (DOGE, SpaceX) will be watched.

________________________________________

🚀 Refreshed Catalyst Rankings

Rank Driver Score

1 EV demand growth 9

2 Affordable model 8.5

3 Battery costs/margins 8

4 Autonomy/robotaxi execution 8.5

5 Competition 6.5

6 Trade & tariffs 6.5

7 Regulatory incentives 6

8 Commodities 5.5

9 Fed Rates 5

10 Musk reputation/governance 5

________________________________________

📊 Latest Analyst Ratings & Targets

• Benchmark / Mickey Legg: Buy, target $475 (from $350) — cites robotaxi safety-first rollout, automation upside

• Wedbush / Dan Ives: Outperform, target $500 — labels TSLA as an “embodied AI compounder”

• Morgan Stanley / Adam Jonas: Buy, target $410 — bullish on AI/self driving positioning

• Cantor Fitzgerald / Andres Sheppard: Overweight, target $355 — optimism rooted in robotaxi and FSD rollout

• UBS / multiple: Sell, target $215–225 — skeptical on demand and valuations

Consensus snapshot (FactSet):

• Mean price target ≈ $311–$312

• Mean rating between Hold–Buy (~2.7/5)

________________________________________

🗞️ Recent Headlines

• “Tesla completes first fully autonomous Model Y delivery ahead of schedule”

• “Tesla robotaxis launch in Austin” boosting momentum

• “EU Tesla sales slump” May registrations down 40.5%

• “Tesla fires longtime insider as Europe slump deepens”

________________________________________

🔍 Summary Outlook

Tesla shares are navigating a volatile interplay of strong tech promise and unfolding execution risks:

• Overweight view (Legg, Ives): Robotaxi rollout and AI thrust fuel upside. Automation transition seen as transformative.

• Bullish base (Jonas, Sheppard): AI, FSD rollout, affordable model support core thesis.

• Skeptical view (UBS, Tusk): Slumping deliveries in Europe/China, heavy valuation, Musk's external focus seen as emotional dampener.

Upcoming triggers to watch:

1. Q2 delivery and production results (mid July).

2. Robotaxi rollout execution/regulatory clearance.

3. Margin trajectory as costs evolve.

4. FSD reliability and expansion in new markets.

________________________________________

✅ What This Means for You

• Bull case: Robotaxi + AI momentum may drive TSLA back toward targets in the $475–500 range.

• Bear case: Weak deliveries, macro and competition pressures could cap shares or trigger pullback toward prior support ($330–350).

• Neutral: Watch near-term delivery and autonomy news to shape next move.

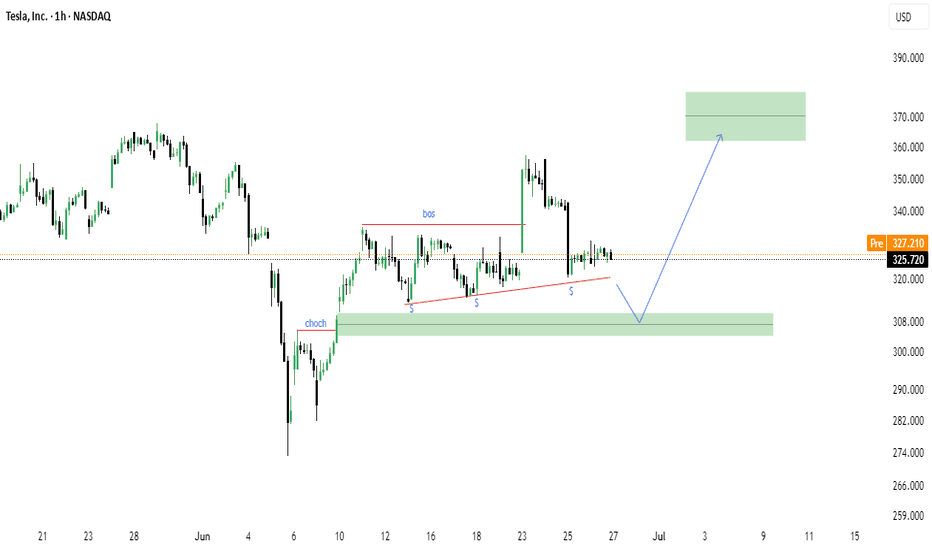

Tesla (TSLA) -Bullish Reaccumulation Setup | Smart Money conceptTesla shows a clean CHoCH followed by BOS structure, indicating a potential bullish continuation. The market is forming equal lows into a demand zone (green box), suggesting a possible liquidity sweep before a move higher.

Key Technical Points:

CHoCH (Change of Character) confirmed on strong bullish impulse.

BOS (Break of Structure) signals market intent to continue upward.

Ascending triangle structure with multiple support tests (marked "S").

Anticipated sweep into demand zone: $308–$312 area.

Potential upside target: $365–$375 supply zone.

Bias: Bullish on confirmation of demand reaction.

Disclaimer:

This is not financial advice. Always do your own analysis before investing.

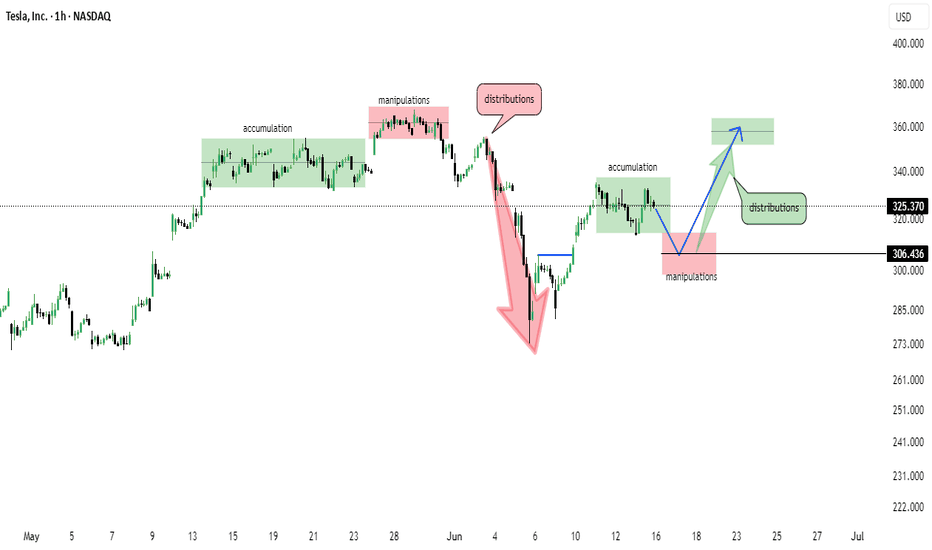

Tesla (TSLA) 1H Chart – Wyckoff Cycle in ActionThis chart reflects a textbook Wyckoff pattern unfolding on TSLA’s 1-hour timeframe:

🔹 Accumulation Phase observed early May

🔹 Followed by Manipulation & Distribution – classic trap before markdown

🔹 Sharp selloff led to another Accumulation zone around $305

🔹 Further manipulation wicks indicate smart money involvement

🔹 Now projecting a move towards $360–$370 distribution zone

📌 Structure breakdown:

Smart Money Accumulation ➡️ Manipulation ➡️ Distribution

Bullish momentum building from $306 support

Eyes on reaction near the marked green distribution box 📦

📅 As of June 15, 2025 – chart aligns with Wyckoff theory and institutional behavior.

Launch of Robotaxi Service Boosts Tesla Share Price by Over 8%Launch of Robotaxi Service Boosts Tesla (TSLA) Share Price by Over 8%

As previously announced by Elon Musk, Tesla has launched its robotaxi service in Austin, Texas. The cost of a ride is $4.20.

The service is not yet fully operational. It is more of an extended testing phase, as access is currently by invitation only, and a Tesla employee may be present in the back seat.

Nevertheless, the market responded positively — Tesla (TSLA) shares rose by more than 8% (comparing the closing prices of daily candlesticks).

Technical Analysis of TSLA Share Price Chart

In our 11 June publication, we:

→ identified an ascending channel;

→ highlighted the May support level (marked with an arrow), suggesting it could act as resistance following a bearish breakout.

Since then:

→ the channel has remained relevant;

→ the aforementioned level acted as resistance but was broken by the bulls yesterday.

As a result, the TSLA share price has reached the median of the current ascending channel, where it may find equilibrium and form a consolidation zone once the initial positive reaction to the robotaxi launch subsides.

It is also worth noting the stock’s resilience following Elon Musk’s controversy with President Trump — the price has already risen more than 28% from the June low, indicating the potential for a scenario in which resistance at $365 is tested.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tesla Rolls Out Much-Awaited Robotaxis. Buy or Sell the Stock?They’re here. After years of tweets, teasers, and timelines that aged like unrefrigerated dairy, Tesla NASDAQ:TSLA officially launched its long-awaited robotaxi service in Austin, Texas.

The self-driving revolution, we were told, would arrive like a lightning bolt. Instead, it quietly rolled up to the curb with a safety monitor riding shotgun.

On Sunday, ( as promised ) a small, highly curated fleet of Teslas — fully driverless, but not entirely unsupervised — began picking up paying passengers in an isolated section of Austin. CEO Elon Musk, as usual, led the cheer squad, declaring victory on X.

“Super congratulations to the Tesla AI software and chip design teams on a successful robotaxi launch!! Both the AI chip and software teams were built from scratch within Tesla.”

Investors, naturally, perked up. Tesla shares edged higher by more than 5% Monday morning as Wall Street tried to figure out whether this was the long-awaited catalyst for another rally… or just another “sell-the-news” moment that fizzles as quickly as the hype fades.

🔔 The Soft Launch Heard Around The Internet

Let’s not get carried away. This wasn’t a citywide revolution. Tesla’s launch was extremely limited — more of a PR exercise than a true market rollout. Only a handful of Teslas were involved, operating in a tightly controlled, geofenced area.

The riders? Carefully selected influencers, many of whom were more excited to film TikToks than analyze technical driving capability. In other words, this wasn’t exactly New York City rush-hour stress testing.

The rides cost a flat fee of $4.20, because, of course they did. And while the cars drove themselves, safety monitors sat in the front passenger seats — a very human reminder that the project is still very much in beta mode.

The bigger question for investors: Does this prove Tesla’s technology is ready for prime time? Or is it simply an appetizer served years before the main course?

📈 The Market Reaction: Buy the Rumor, Sell the Launch?

Here’s where things get tricky for traders.

The stock market, as always, is forward-looking. Tesla stock didn’t just wake up bullish on Monday because of a few rides in Austin — it’s been rallying for months because of the promise of robotaxis.

Since Tesla’s big October 10 robotaxi event — where Musk laid out plans to launch a self-driving cab service in 2025 — shares have climbed roughly 35%. Much of that gain is already baked into expectations for Tesla finally delivering on what Musk has been promising since at least 2016.

Now that the product is technically “live,” even in tiny demo form, some traders are wondering: is this the start of an even bigger rally?

The answer probably depends on how fast Tesla can scale. And that’s where reality gets stickier.

🤔 The Scaling Problem: A Long Road Ahead

As exciting as Sunday’s launch may have been for influencers and Tesla superfans, it’s not exactly proof of scalability. Deploying 10 carefully monitored cars in a tiny slice of Austin is one thing; blanketing entire metro areas, or states, or countries is another beast entirely.

Tesla’s AI software may be improving, and its in-house chip design gives it some vertical integration advantages. But scaling fully autonomous fleets will require navigating a minefield of regulatory, safety, and logistical challenges — not to mention stiff competition.

Alphabet’s Waymo is already operating robotaxi services in Phoenix, San Francisco, and Los Angeles, with years of public road testing under its belt. Cruise (General Motors) ran its own driverless service before recently pausing operations after high-profile safety incidents. The technology arms race is fierce — and far from settled.

Industry experts continue to caution that mass-market robotaxis may take years — if not decades — to fully materialize. And while Tesla loves to move fast and break things, cities, regulators, and insurance companies tend to prefer a bit more caution when thousands of driverless vehicles are involved.

📝 What’s Actually Priced Into Tesla Stock?

Here’s where this gets existential for Tesla bulls.

A huge chunk of Tesla’s market valuation — some would argue most of it — now rests on the idea that it isn’t just a car company. It’s an AI company. A software company. A robotics company. A future robotaxi empire. If those narratives start to weaken, so does the multiple.

Tesla remains dominant in EV production and it still benefits from profit margins (about half of the profits coming from selling regulatory credits to other carmakers). But even Musk himself has made clear that Tesla’s long-term valuation depends heavily on successfully delivering robotaxis and humanoid robots.

If Sunday’s soft launch is the start of something truly scalable, then maybe the valuation holds up. If it stalls — either due to regulatory hurdles, technological ceilings, or public skepticism — the market may need to reevaluate just how much of Tesla’s price reflects reality versus dreams.

👀 Bottom Line: Revolutionary or Just Another Test Ride?

So, should you buy or sell Tesla after its long-awaited robotaxi debut?

That depends on how you frame this moment. The bulls see a trillion-dollar industry being born, with Tesla perfectly positioned. The bears see a carefully staged PR event masking how far away true autonomy still is.

For now, Tesla gets credit for being bold — even if it’s bold enough to roll out a very small, very managed test.

But markets eventually ask: “What’s next?” And unless Tesla can quickly scale from 10 cars in Austin to fully functioning fleets in major cities, a victory lap here could feel a little premature.

As always with Tesla: the story is thrilling, the stock is volatile, and the future is still very much under construction.

And with its earnings just around the corner — you’re following the earnings calendar , right? — things might just be getting exciting.

Off to you : Which side are on? The bullish traders looking to add to their long positions or the bearish sellers who’ve been calling “overvalued” for years? Share your thoughts in the comments!

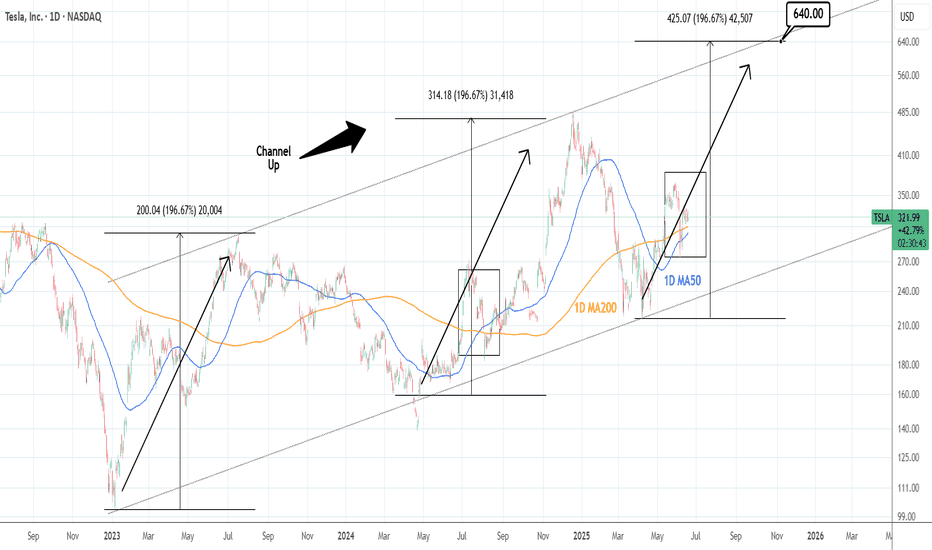

TESLA: Can double its price ($640) by the end of the year.Tesla is neutral on its 1D technical outlook (RSI = 51.064, MACD = 4.910, ADX = 24.971), consolidating for the past week, but remains over its 1D MA50 and 1D MA200 nonetheless. Since the major market bottom on January 6th 2023, it's been trading inside a Channel Up and this is its 3rd bullish wave. The 2 prior rose by +196.67% from the bottom of the pattern (despite the 2nd breaking marginally under it). Consequently, this suggests that Tesla can rise by +100% from the current $320 level, before the Channel Up tops (HH) again. We are bullish, TP = 640.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

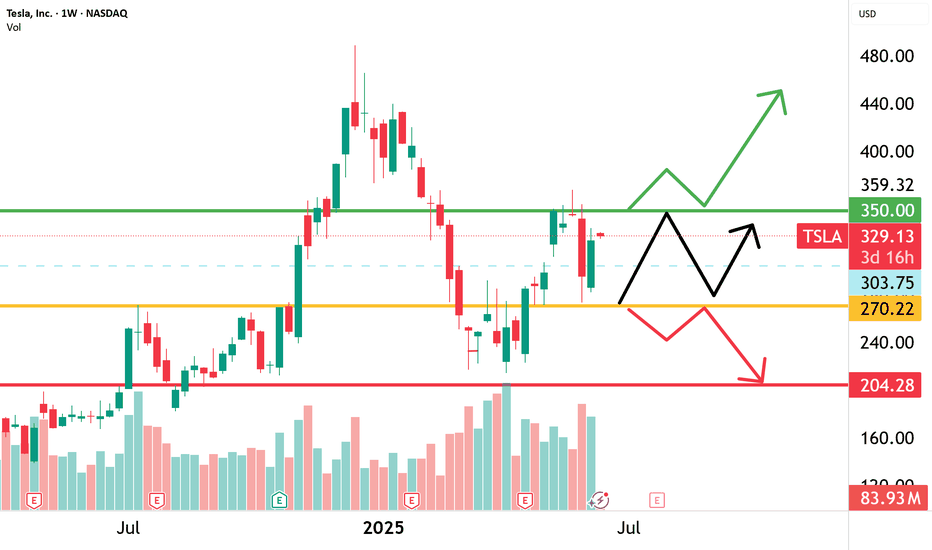

$TSLA | Robotaxi Launch Incoming? - Plan Rock Solid w/ 3 TradesNASDAQ:TSLA

Launch could be as soon as Sunday, June 22. However, Musk has emphasized safety as priority. There is the potential to undercut traditional taxi services at less than $0.20 per mile. Tesla’s government and military contracts are key growth drivers but further clash between Musk and President Trump could cause further volatility in price action. Long-term $271 is a critical price point. There are several ways to play Tesla:

* Range between $270 and $350

* $330 to $400 into price discovery

* Breakdown under $270 targeting $212 and $204

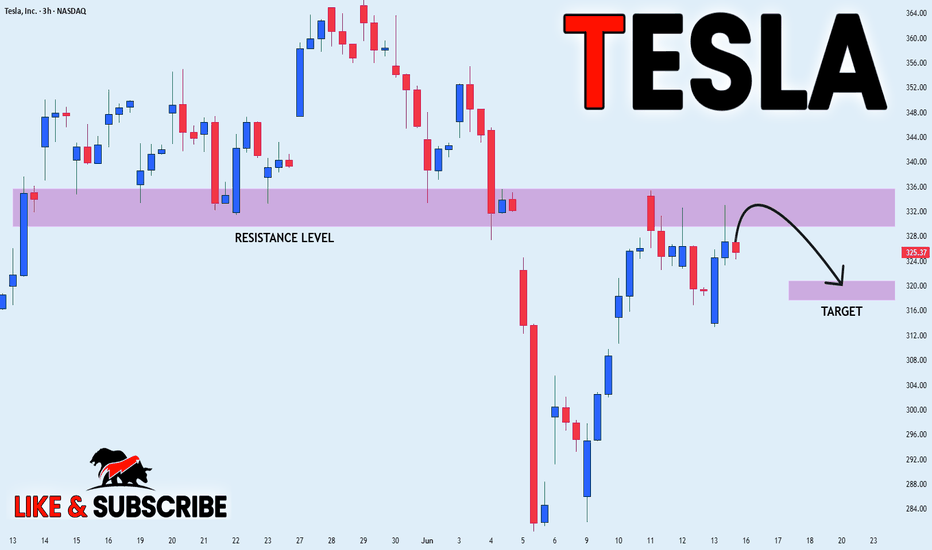

TESLA WILL GO DOWN|SHORT|

✅TESLA is going up now

But a strong resistance level is ahead at 336$

Thus I am expecting a pullback

And a move down towards the target of 320$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TESLA Will Fall! Sell!

Hello,Traders!

TESLA went up from the

Horizontal support but has

Hit a horizontal resistance

Of 335$ and we are already

Seeing a bearish pullback

So we will be expecting

A further local move down today

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TESLA Technical Analysis! BUY!

My dear subscribers,

My technical analysis for TESLA is below:

The price is coiling around a solid key level - 295.19

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 323.17

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

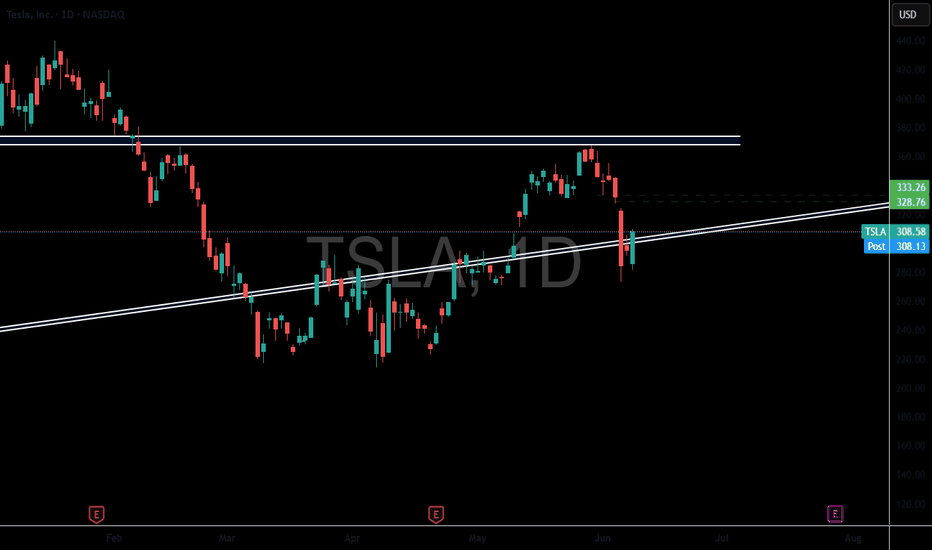

Tesla (TSLA) Shares Rebound After Sharp DropTesla (TSLA) Shares Rebound After Sharp Drop

When analysing the Tesla (TSLA) stock price chart six days ago, on the morning of 5 June, we:

→ highlighted Elon Musk’s critical comments regarding the spending bill promoted by the US President;

→ noted that a potential rift between Musk and Trump could have long-term implications, including for TSLA shares;

→ outlined an ascending channel (marked in blue);

→ suggested that the price might correct from the upper to the lower boundary of the channel.

This scenario played out rather aggressively: later that same day, during the main trading session, Tesla’s share price dropped sharply to the lower boundary of the channel amid a scandal involving Musk and Trump.

However, the lower boundary of the channel predictably acted as support. Yesterday, TSLA shares were among the top five performers in the S&P 500 index (US SPX 500 mini on FXOpen), gaining around 5.6%.

As a result, TSLA stock price climbed back above the psychologically important $300 mark, recovering from the previous week’s sell-off.

Why Are Tesla (TSLA) Shares Rising?

Bullish drivers include:

→ The upcoming launch of Tesla’s robotaxi service, provisionally scheduled for 22 June. Elon Musk has stated he intends to use the service himself.

→ Easing of tensions with the US President. Donald Trump declared that he has no intention of "getting rid of Tesla or Starlink" should he return to the White House.

→ Continued support from Cathie Wood, the prominent asset manager, who once again reaffirmed her confidence in Tesla’s future success.

Technical Analysis of TSLA Chart

Today, TSLA’s share price is hovering near the median line of the previously identified ascending channel – a zone where supply and demand typically seek equilibrium.

Also worth noting is the $320 level: in May, it acted as support, which suggests it may now function as resistance.

Given these factors, it is reasonable to expect that the sharp recovery from the 5 June low may begin to lose momentum, with the price likely to stabilise and form a consolidation range following the recent spike in volatility.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

The Trump & Musk Friends Again - Tesla RippingAnalysts attribute the recovery to cooling tensions between Elon Musk and President Donald Trump, which had previously weighed on investor sentiment.

Additionally, Tesla's upcoming robo-taxi launch on June 12 is generating excitement, with some analysts predicting it could be a major revenue driver. However, concerns remain about Tesla's valuation, as it trades at a price-to-earnings ratio of 192, significantly higher than traditional automakers.

Tesla - There's more after the +60% rally!Tesla - NASDAQ:TSLA - will blow even further:

(click chart above to see the in depth analysis👆🏻)

It is almost incredible to see such a large cap stock rally more than +60% in less than two months. But Tesla is clearly the exception and therefore we should expect the unexpected. What's quite likely is at least another rally of about 25% from here and a retest of the previous all time high.

Levels to watch: $250, $400

Keep your long term vision!

Philip (BasicTrading)

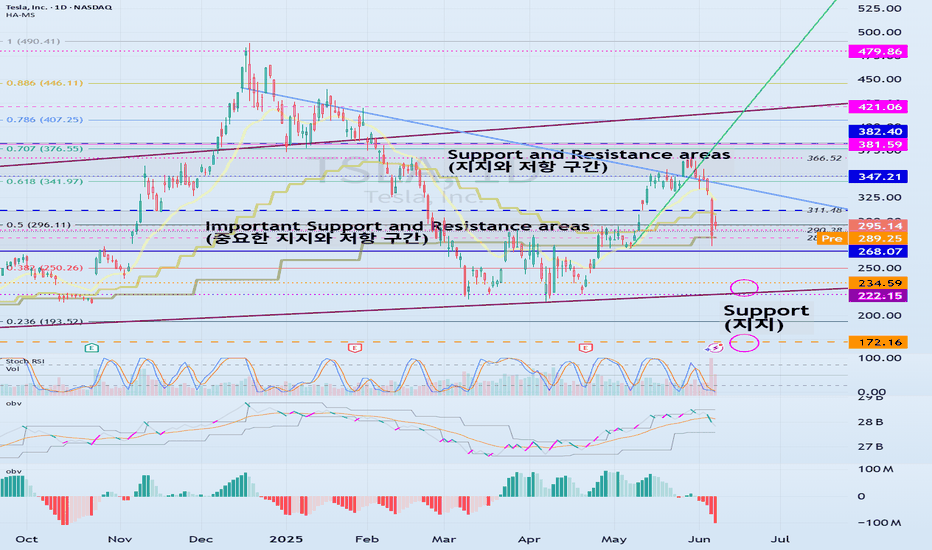

Important support and resistance sections: 267.07-311.48

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(TSLA 1D chart)

If you see support within the important support and resistance sections, it is a time to buy.

However, if a strong decline occurs, strong buying is expected around 172.6-234.59.

It is expected to be an important buying period for long-term investment.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

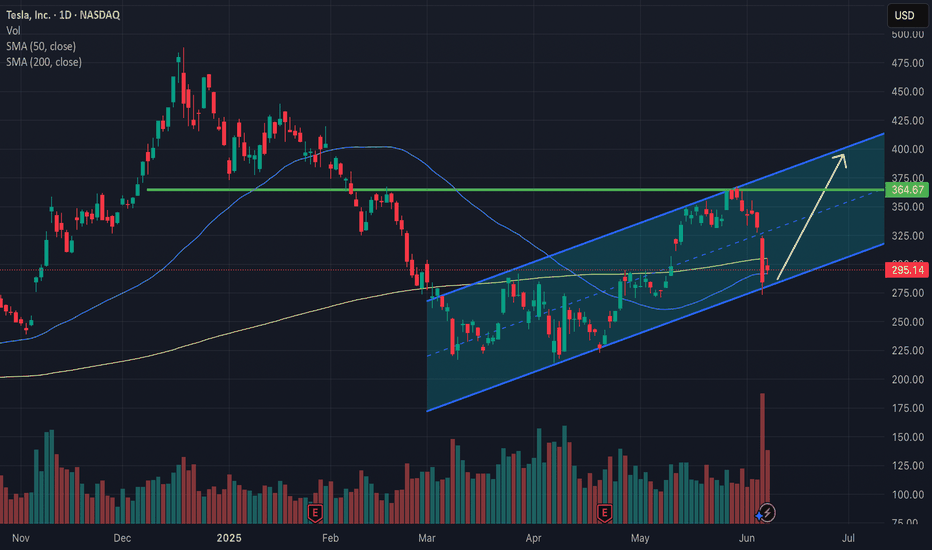

TSLA: Uptrend channel bounce, trading between 50 and 200-day SMAHey guys/gals!

So we all know that Tesla took a massive drop last week. It fell about 14%, and was down even 3% after hours at one point. I think we can all agree this crash wasn't technicals driven - it was clearly headline impacted. This was a clear black swan even t, and even in my case, nothing like this has ever happened to me as a trader. It was unforeseeable, forced me to hedge overnight and I'm still having nightmares (lol). Definitely one to remember as I don't think something like this would happen with any other stock. Tesla is truly unique in this sense.

But looking at the bigger picture, the bounce that we experienced on Friday must've been technicals driven, and psychologically influenced, as I am almost certain that the crash was a massive overreaction. People woke up the next day and thought this was severely discounted over a couple social media tweets (I won't go into the politics of things).

As you see on the chart, Tesla may in a new upward channel. At first I figured this may be a bear flag, however due to the upcoming catalyst like the Robotaxi launch - this would likely only be a bear flag if prices crashes below the lower support trend line.

As long as price is within the channel, I'd say things are holding up. We'd likely see a jump towards the upper side of the channel - however it's important to note that $300 and £360 are major resistance points. Robotaxi launch and any future tweets will definitely move price, and I think those will be a factor in determining whether price goes up or crashes below the trend line.

Another thing to point out is that price is currently trading between the 50-day and 200-day moving averages. The 50-day SMA is acting as vital support, whereas the 200-day SMA is the resistance. If there is a break above the 200-day SMA, price will likely go higher. The opposite may happen if price crashes below the 50-day SMA.

Either way, headlines and technicals mentioned above will continue to influence price.

Note: not financial advice.