FOMC'S OVER -- WHAT TO DO WITH MY TESTED CREDIT SPREADS -- PT 2(Cont'd from Part I).

I then look at selling an oppositional side (in this case, the short put "wing") (1) for at least .10 more in credit than it cost me to roll the tested side; (2) with the highest probability of profit I can do that for; and (3) that does not result in an "inverted" iron condor (trust me, you do not want to try to work an inverted iron condor; an inverted short strangle is a different matter; I'll discuss that in some other post if I'm ever presented with that situation with a live trade I've posted here).

In the event that you cannot sell an oppositional side against for at least .10 ($10) more in credit than you received for rolling the tested side, consider (1) not attempting to improve the tested side at that point in time (i.e., rolling it for duration "as is"); (2) other expiries that are farther out in time; or (3) both.

Lastly, be mechanical with the way in which you "take off" rolled out setups. You can do one of two things: (a) look to take off the sides (rolled or otherwise) for near worthless as you would with any original setup (doing things this way relieves you of the burden of calculating all the credits collected and debits for a particular setup, rolls, and the sale or oppositional sides against); (b) examine your "options trade chain", total the credits and debits collected, subtract the total debits paid from the credits collected, and determine what your "scratch point" is for the original setup, rolls, etc. (i.e., where debits paid = credits received) (my options platform does this neatly for me, so I can generally determine this with a glance, thank goodness).

Naturally, there are other things you can do to "assist" your tested sides, but they usually entail additional risk (e.g., laddering out spreads in time, selling additional spreads in the same expiry, widening your spreads, etc.). I confess that I do some of those things, but I usually confine them to core position trades, such as in the index ETF's where I'm probably going to have positions on anyways, so it's not as though I'm putting on additional risk solely for the sake of working my way out of a tested side (although it can also have that welcome side effect).

Testedsides

FOMC'S OVER -- WHAT TO DO WITH MY "TESTED" CREDIT SPREADS? PT 1(I have to do this in two posts since I'm verbose, and can't fit it into one ... ).

Now that March FOMC is over, I'm ready to wait back in ... in a bit.

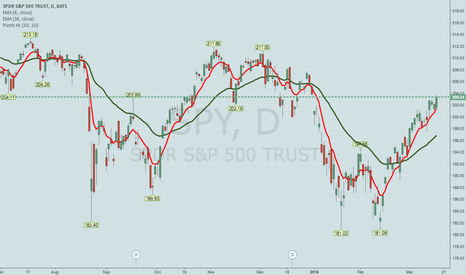

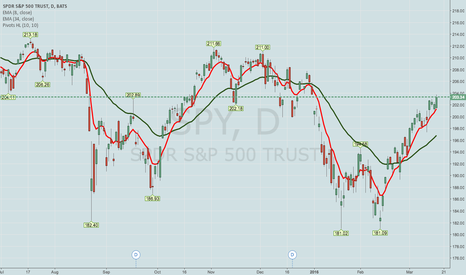

Before Draghi, I rolled my March 18th expiry SPY short call verticals out to the April 1st expiry to buy some more time, selling short put credit spreads to finance a slight strike improvement of those to 196/200, after which I proceeded to peel off the short put spreads, because, well, they were worthless after this upmove ("worthless" is a good thing for a premium seller). Now, those puppies are sitting out there "naked," unprotected by any short put wings.

A couple of things to consider: first, there's only 18 DTE in those April Fool's spreads; second, they're in "max loss" territory, because current price is above 200, so it's not like I'll experience any greater loss if I just leave them hanging out there for a bit; third, they've still got some extrinsic value left in them that will still decay; and fourth, VIX broke 15 today, which is not good for premium selling in broad-based market indices.

So, then, what to do?

First, be mechanical ... always. Naturally, sometimes it's painful to be mechanical (like, um, right here with those April Fool's credit spreads). As a general matter, wait until shortly before expiry (4-7 DTE) or when there is iittle or no extrinsic value left in the spread (your platform should tell you how much is left) and then look at it to see what you can do with it in terms of rolling, improving strikes, selling an oppositional side against to finance the roll and such, but not before. For the vast majority of setups that started as 45 DTE plays, resist the urge to start "repairing" tested sides that have less than 25 DTE in them when you've peeled off the opposing side because it was "near worthless" ($5 for a naked; $10 for a spread).

(With earnings plays, which are intended to be extremely short duration (<14 DTE) plays, I will fairly immediately attempt to start working the play back to scratch if there is a test of a side. However, I still approach any rolling of the tested side mechanically, waiting until about 4 DTE to do that, since so many of these earnings are pop and drop or drop and pop affairs, which means that they have the potential to work out fairly immediately without a roll, which is why you want to be just as "paintfully patient" with those as with any 45 DTE setup).

Second, while being mechanical, watch for opportunities to roll for a cheaper debit. For example, my SPY spreads are 196/200 and current price is 203. It will be more expensive for me to roll here than if SPY is at 202 or 201 or 200. None of those bring my spread into profit, but it makes the roll cheaper such that when I go to sell an oppositional side to finance the roll of the tested side, my job is that much easier ... . A lot of crap can happen in the 18 days remaining until expiry, so it pays to be attentive.

Third, not only be mechanical with how long you wait before rolling, but to a consideration of the expiries you roll to. With setups that started out as 45 DTE arrangements, I generally start out by looking to roll out to an expiry that's 45 DTE. A little short or longer is fine as starting point. With iron condors in particular, I first start looking at how much it will cost to roll the spread and improve the strikes by just one (e.g., improving my 196/200 to 197/201). I look at the cost of improving the strikes by a mere "1" at the outset because if that proves too pricey, well, there's absolutely no point in trying to improve the spread by 2 strikes to 198/202, is there? I write that number down (for the sake of argument, let's say it's a .50 debit to roll the April 1st 196/200 to the May 20th expiry).

(Continued in Part 2)