Tether Rakes in $4.9B Q2 Profit, Cementing Its Reign as Crypto’sTether Q2 Net Profit Hits $4.9 Billion, Pushing Total Earnings to $5.7 Billion: What It Means for the Crypto Industry

Tether Holdings Ltd., the issuer of the world’s largest stablecoin USDT, has once again made headlines with its Q2 2025 earnings report, revealing a staggering net profit of $4.96 billion. This brings the company’s total profits for the first half of the year to $5.7 billion—a record-breaking milestone for both the company and the broader stablecoin ecosystem.

This article explores the implications of Tether’s Q2 performance, the sources of its revenue, its impact on the crypto markets, and the growing significance of stablecoins in the evolving financial landscape.

________________________________________

A Record-Setting Quarter for Tether

Tether’s Q2 2025 results have astonished even seasoned analysts. The company’s reported $4.96 billion in net profit in a single quarter represents one of the most profitable periods in the history of any fintech or crypto-native company. What’s even more remarkable is that this profit was not driven by speculative trading or token sales, but by conservative, yield-generating strategies rooted in traditional finance.

The company’s Q1 earnings were already impressive at $0.76 billion, but Q2’s results eclipse those numbers entirely. Tether’s cumulative profit year-to-date now stands at $5.72 billion, putting it on track to potentially exceed $10 billion in earnings for the full year if current trends continue.

________________________________________

What’s Driving Tether’s Massive Profit?

Tether’s incredible profitability is primarily fueled by one key factor: the interest earned on its reserves. As the issuer of USDT, Tether is responsible for maintaining a 1:1 backing of every token in circulation. These reserves are primarily held in short-term U.S. Treasury Bills (T-Bills), reverse repos, and cash equivalents.

Here’s a breakdown of the main profit drivers:

1. High Interest Rates on U.S. Treasuries

With the U.S. Federal Reserve maintaining elevated interest rates to combat inflation, short-term T-Bills have become highly lucrative. Tether holds tens of billions of dollars in these instruments, generating billions in annual interest income.

For example, the yield on a 3-month Treasury bill in Q2 2025 averaged around 5.2%, and Tether’s reserve base has hovered near $90 billion to $100 billion. Even a conservative allocation can earn several billion dollars in annual yield.

2. Reverse Repurchase Agreements (Reverse Repos)

Tether has also expanded its use of reverse repos, which allow it to lend cash to counterparties in exchange for securities, earning a premium on the transaction. This has contributed significantly to its earnings, especially in a high-yield environment.

3. Gold Holdings and Bitcoin Exposure

Tether has acknowledged that a small portion of its reserves includes gold and Bitcoin holdings. These assets appreciated in Q2, contributing to the overall profit. While not the primary revenue source, their performance added notable value during the quarter.

4. Equity Investments

The company has begun investing in infrastructure and technology firms related to blockchain and AI. While these investments are not liquid, mark-to-market gains may have also contributed to the net profit figure.

________________________________________

A Closer Look at Tether’s Reserve Report

Tether’s Q2 attestation report, published alongside its earnings update, provides transparency into how its assets are allocated. Here are some highlights:

• Over 85% of reserves are held in U.S. Treasury instruments

• $5.4 billion in excess reserves—a buffer above the value of circulating USDT

• $3.3 billion in gold and Bitcoin holdings

• Minimal exposure to unsecured commercial paper or riskier debt instruments

Tether has continuously emphasized its commitment to transparency and risk management. Unlike in its early years, when it faced criticism over opaque reserve practices, the company now releases quarterly attestations audited by third-party firms such as BDO Italia.

________________________________________

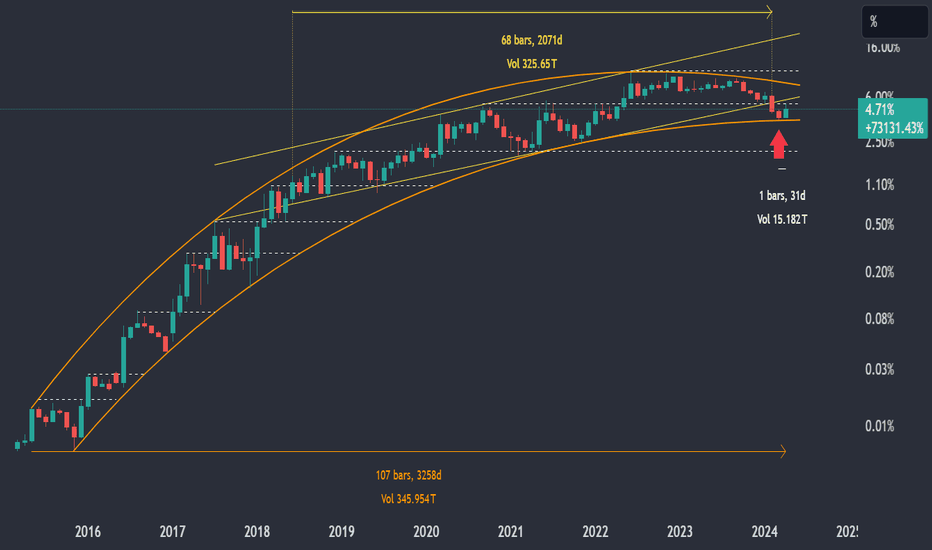

USDT’s Growing Dominance

Tether’s profits are closely tied to the growth of its flagship product: USDT, the world’s largest stablecoin by market cap. As of August 2025, USDT has a circulating supply exceeding $110 billion, giving it a dominant share of the stablecoin market.

This growth can be attributed to several factors:

1. Increased Adoption in Emerging Markets

USDT is widely used in countries with unstable fiat currencies, such as Argentina, Nigeria, and Turkey. For many users, USDT represents a dollar-denominated safe haven in environments plagued by inflation and capital controls.

2. DeFi and Cross-border Payments

USDT continues to be a core asset in decentralized finance (DeFi) protocols, serving as a stable medium of exchange and collateral. It's also a preferred tool for cross-border remittances, given its speed and low transaction costs compared to traditional banking systems.

3. Institutional Integration

Major crypto exchanges, custodians, and payment processors have incorporated USDT into their platforms, driving further liquidity and utility. In many cases, USDT is preferred over fiat due to its 24/7 availability and blockchain-native nature.

________________________________________

What Does This Mean for the Crypto Industry?

Tether’s Q2 performance is more than just a corporate milestone—it’s a bellwether moment for the crypto industry. It signifies the maturation and institutionalization of digital assets and stablecoins. Here’s what it means for the broader ecosystem:

1. Stablecoins as Profitable Financial Products

Tether’s profitability proves that stablecoins are no longer just “crypto plumbing.” They are now financial products generating billions in yield, much like money market funds. This is reshaping how investors and regulators think about stablecoins—not as speculative tools, but as interest-bearing assets backed by real-world securities.

2. Regulatory Scrutiny Will Intensify

With Tether generating profits that rival traditional banks, expect regulators to increase oversight. Stablecoins have long been in the crosshairs of the U.S. Treasury, SEC, and global central banks, and Tether’s dominant market share will likely place it under further examination.

However, Tether’s transparency efforts, including quarterly attestations and reserve disclosures, may help it navigate these regulatory waters more effectively than in the past.

3. Competition Will Escalate

Tether’s extraordinary profits will likely attract new entrants and existing competitors to the stablecoin arena. Circle’s USDC, PayPal’s PYUSD, and even central bank digital currencies (CBDCs) are all vying for market share.

Tether’s early-mover advantage, global reach, and deep liquidity make it hard to displace, but increased competition could pressure margins in the long term.

4. Decentralized Alternatives Will Seek Market Share

Decentralized stablecoins like DAI, FRAX, and USDD aim to offer alternatives to centralized issuers like Tether. While they remain relatively small, the ethos of decentralization might gain appeal, especially in regulatory-heavy environments.

Still, decentralized stablecoins have struggled to maintain pegs during market stress, giving Tether an edge in terms of trust and resilience.

________________________________________

The Road Ahead for Tether

As Tether moves into the second half of 2025, several strategic themes will define its trajectory:

Continued Profitability

If interest rates remain elevated and USDT circulation continues to grow, Tether’s annual profit could reach or exceed $10 billion—putting it in league with the most profitable fintech firms globally. This surplus could be reinvested in:

• Infrastructure expansion

• Strategic acquisitions

• Reserve diversification

• R&D for stablecoin innovation

Expansion into Emerging Markets

Tether has hinted at expanding its presence in Latin America, Africa, and Southeast Asia, where demand for dollar-denominated assets is high and banking infrastructure is limited. Expect to see more localized partnerships and on-ramp/off-ramp solutions.

Embracing Blockchain Innovation

Tether is already deployed on multiple blockchains—Ethereum, Tron, Solana, and more. The company is likely to support new Layer 1s and Layer 2s to enhance speed, reduce costs, and maintain competitiveness in the DeFi space.

There are also rumors that Tether may be exploring tokenized asset offerings and programmable money features, allowing USDT to integrate more deeply with smart contracts and enterprise use cases.

________________________________________

Criticisms and Controversies: Still Lingering?

Despite its success, Tether continues to face criticism from parts of the crypto community and regulatory world. Concerns include:

• Lack of full audits (attestations are not the same as full financial audits)

• Opaque ownership structure

• Past legal issues, including settlements with the New York Attorney General and the U.S. CFTC

However, it’s worth noting that Tether has addressed many of these concerns over the past two years. Its transparency has improved, and its operations have become more conservative and professional.

Still, its scale and impact on the crypto market mean that any misstep could have systemic consequences. Investors and regulators alike will continue to scrutinize its activities.

________________________________________

Final Thoughts: Tether’s Moment of Ascendance

Tether’s Q2 2025 net profit of $4.96 billion doesn’t just reflect a successful quarter—it marks a paradigm shift in crypto finance. What began as a controversial stablecoin project has evolved into a global financial powerhouse, rivaling traditional banks and asset managers in profitability.

More than just a win for Tether, this moment signals the growing legitimacy of stablecoins in the global financial system. It shows that crypto-native firms can not only survive but thrive in traditional financial environments, leveraging yield, transparency, and blockchain infrastructure to create sustainable business models.

As the world watches, Tether’s next chapters will likely be shaped by innovation, regulation, and global expansion. But for now, with $5.7 billion in profits in just six months, one thing is clear:

Tether is no longer just a stablecoin issuer—it’s one of the most powerful financial entities

in the digital age.

________________________________________

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Always conduct your own research before making investment decisions.

Tetherdollar

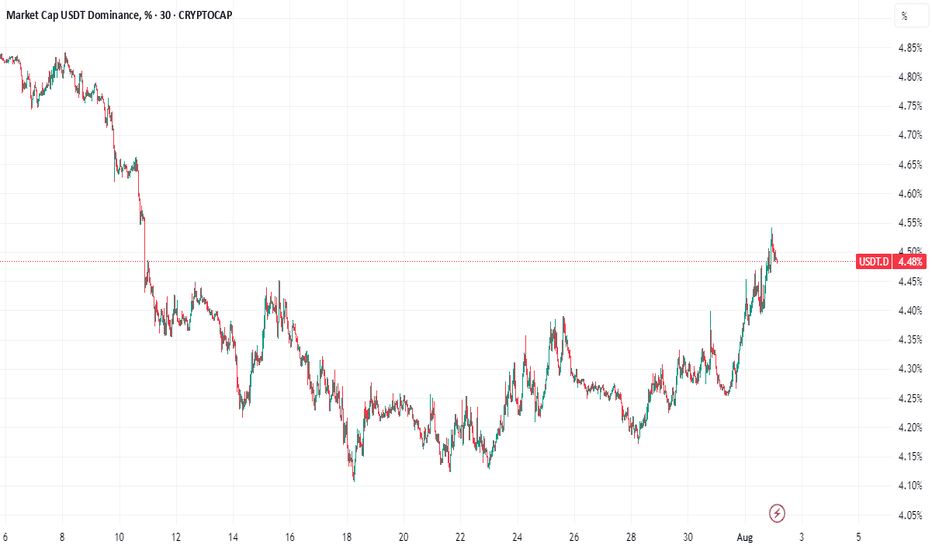

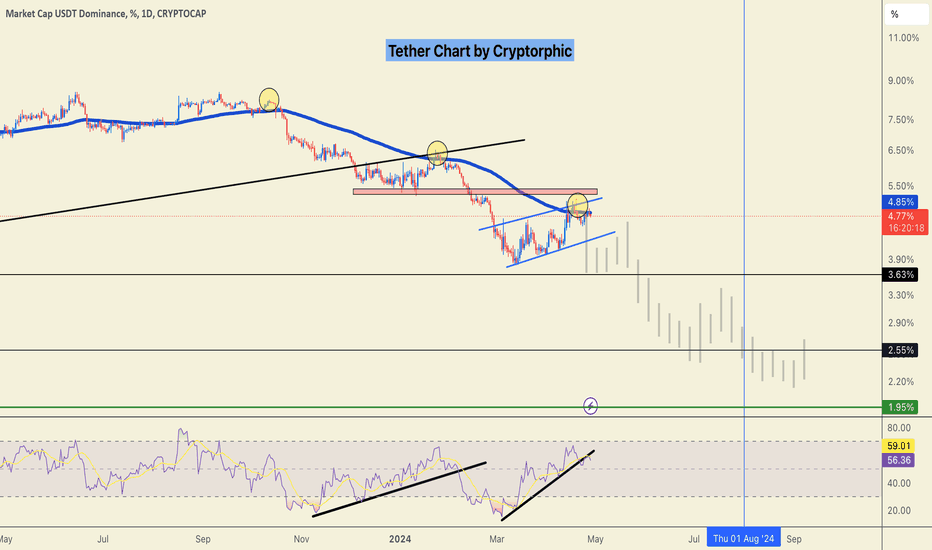

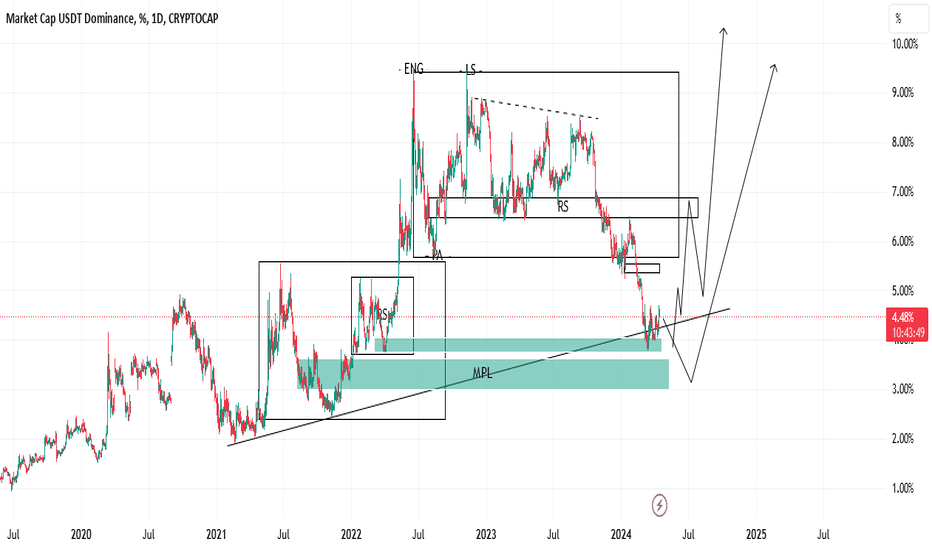

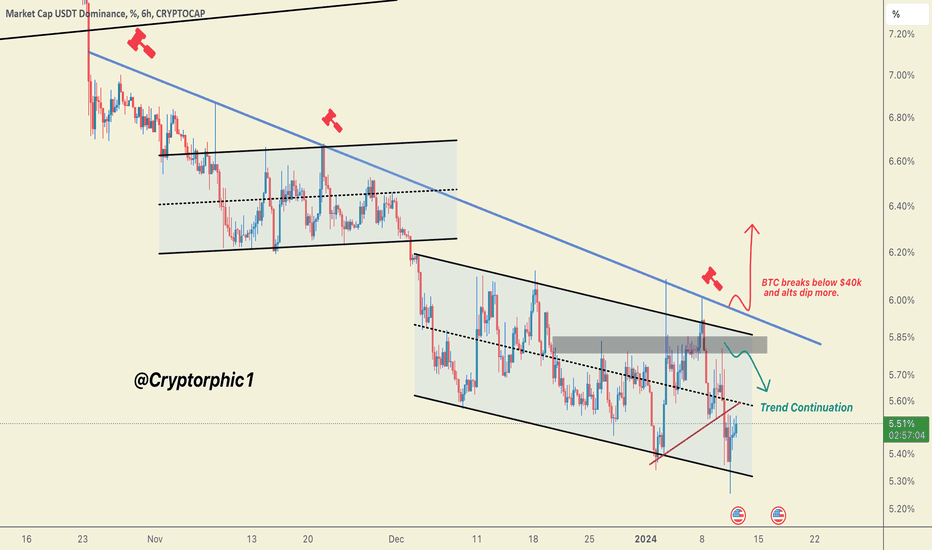

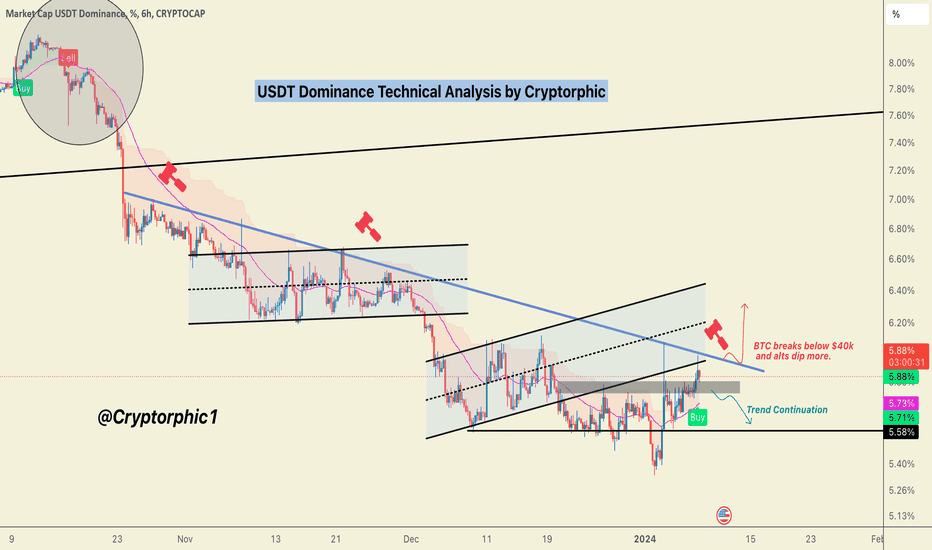

100% Win Rate on BTC & Alts! Where’s the Next Breakout?USDT Dominance Update:

While the herd chases the latest hype, we called this before it even unfolded. BTC’s recent surge was lightning-fast.

These were the trades shared in the last 30 days. I'm just saying we could've had more wins!

Our setups didn’t just hit targets…

They exploded through them 🚀

These are spot gains, imagine trading wth leverage with these.

There's more to come in the next week.

✅ MIL:ENA +53%

✅ HOSE:VIC +50%

✅ $CHILLGUY +40%

✅ NASDAQ:HUMA +35%

✅ CRYPTOCAP:XRP +34%

✅ $VOXEL +32%

✅ OMXTSE:MAGIC +30%

✅ CRYPTOCAP:RENDER +25%

✅ CRYPTOCAP:AVAX +24%

✅ SEED_DONKEYDAN_MARKET_CAP:FLOKI +25%

✅ CRYPTOCAP:LINK +17.65%

✅ CRYPTOCAP:SUSHI +17.3%

✅ AMEX:MBOX +15%

✅ $MAVIA +14.7%

✅ TVC:MOVE +11.66%

✅ $EPT +11%

✅ BME:ETC +10.3%

✅ PSX:POL +20%

✅ CRYPTOCAP:SUI +20%

✅ LSE:ONDO +7.5%

✅ SET:PORT +6.17%

✅ CRYPTOCAP:TON +3%

📈 These aren’t just simple trades; they’re alpha-backed calls.

If you’re still watching from the sidelines…

You’re watching others print.

Be patient and precise with your entries and exits. Never FOMO.

The market will bait you into bad timing if you let it.

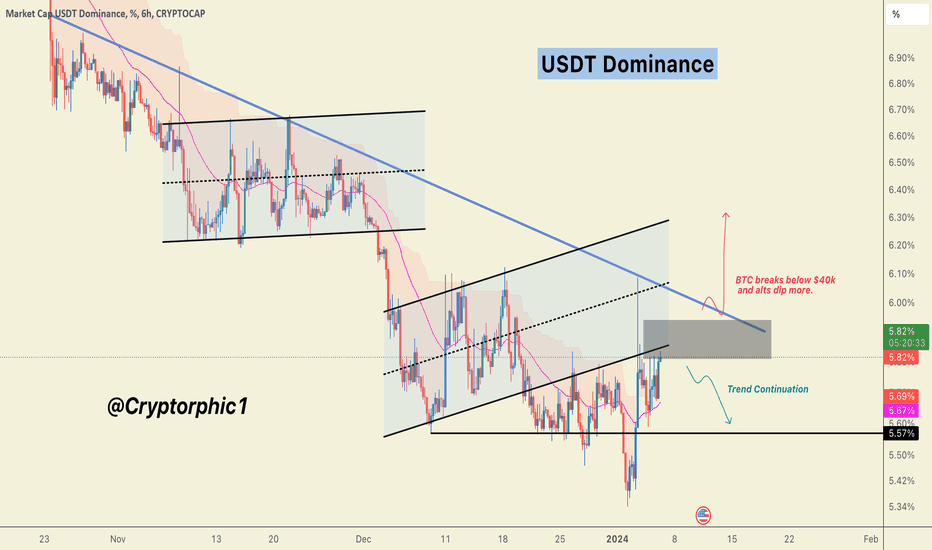

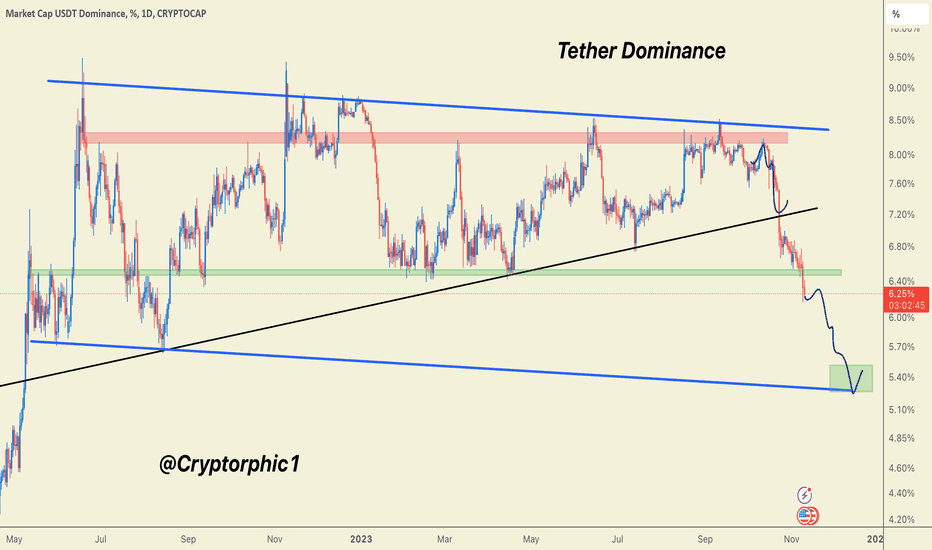

A 4.4% drop in USDT dominance marks the start of a new altcoin season, but remember, BTC will steer this cycle.

More setups on the way.

Stay tuned.

Do hit the like button and share your views in the comments.

Thank you

#PEACE

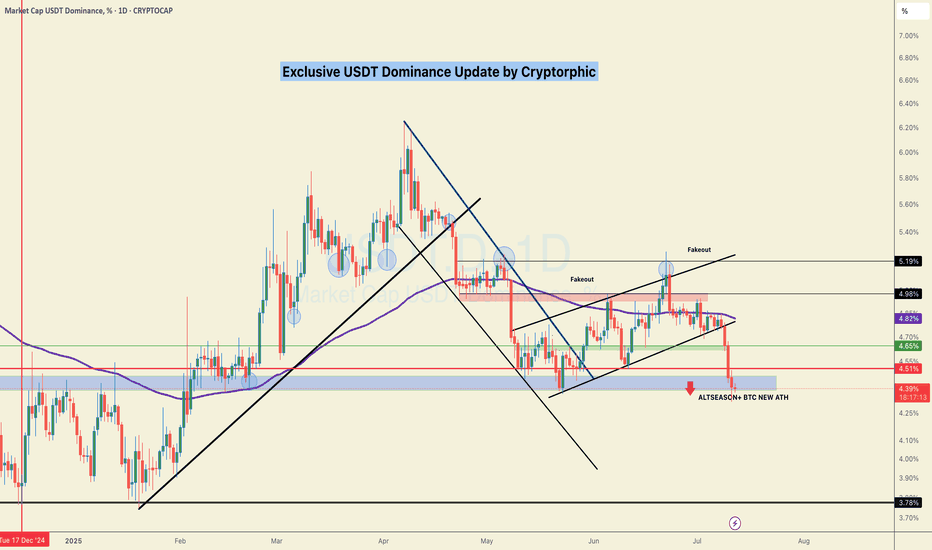

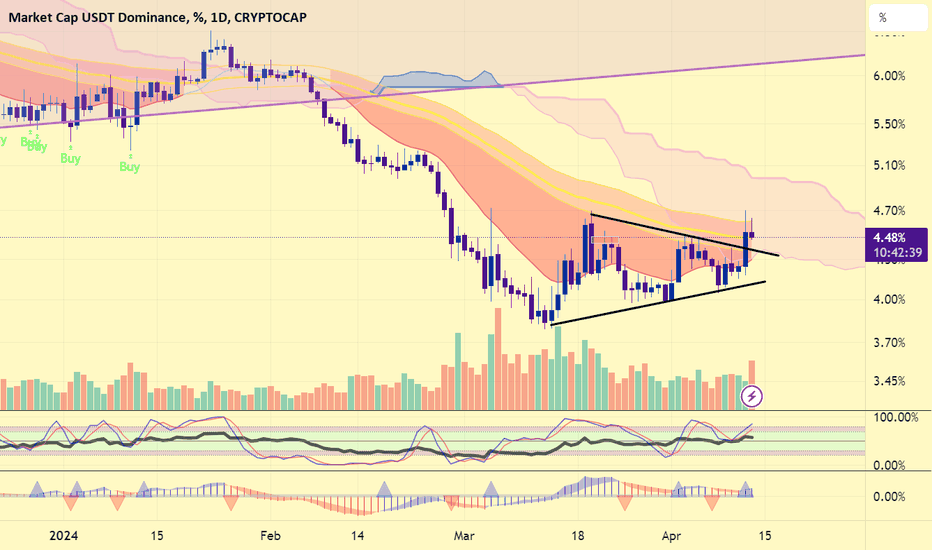

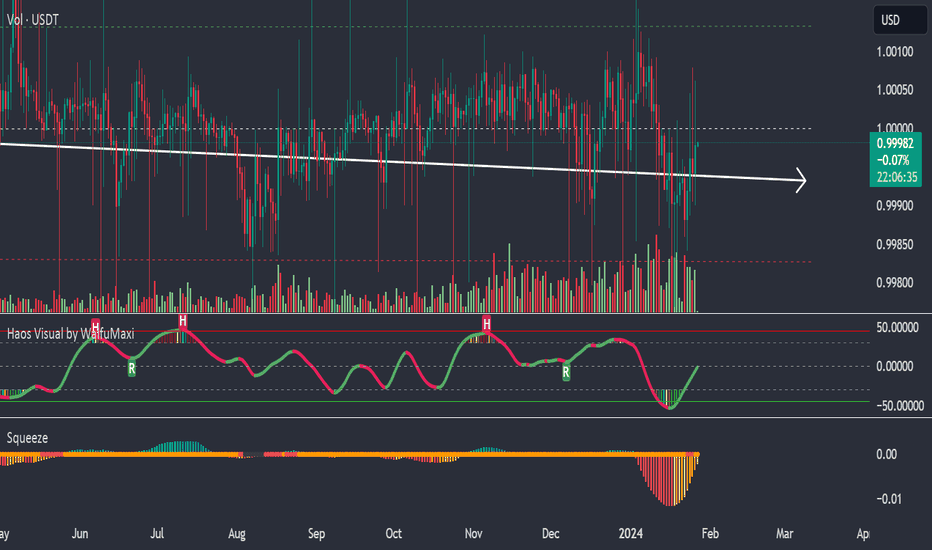

BREAKING: Tether at Decisive point! Rejection means Reversal!$Tether is approaching a key resistance level.

A rejection here could trigger a temporary recovery in the broader market.

This rejection may signal a potential trend reversal if confirmed on higher timeframes.

However, a break above this resistance would likely mean no altseason for the next few months possibly until the end of the year.

If you found this helpful, please hit that like button.

I’ll update this chart and share insights you can use in your trading decisions.

Also, drop your thoughts in the comments I’d love to hear what you think.

Thank you.

#Peace ✌️

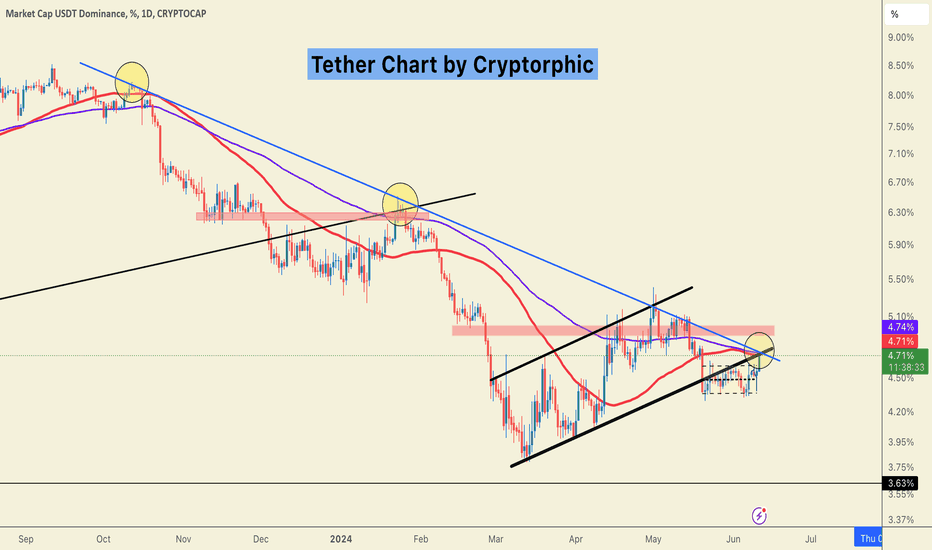

#USDT.D This is what you need to know!#Tether is facing multiple daily rejections. As long as we stay below the red resistance zone, altcoins will experience some relief while BTC will move within a narrow range.

Close above this resistance could push BTC below 64k.

Keep an eye on the 5.05% level.

Let me know what you think in the comment section and do hit the like button if you like these short updates.

Follow me if you haven't yet!

#PEACE

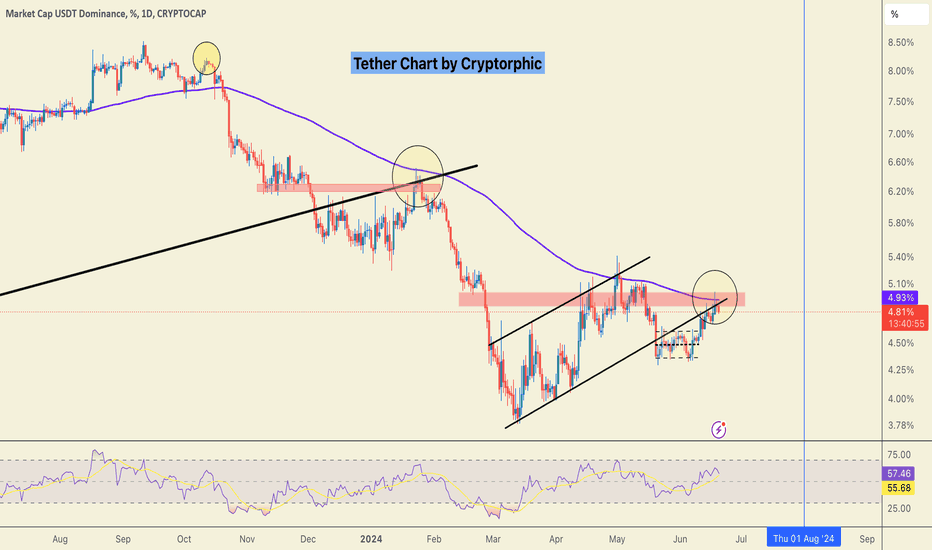

Market update: Relief or more Dump?USDT dominance is currently hitting three major resistance levels:

1. 100 EMA (blue)

2. 50 SMA (red)

3. 8-month-old trendline resistance (blue)

This confluence of resistance makes this level crucial. Taking into account the channel breakdown and retest, a rejection seems more likely at the moment, suggesting a potential market relief rally.

Invalidation:- Close above the red zone.

dyor, nfa

Do hit the like button if you like it and share your views in the comment section.

Thank you

#PEACE

#USDT Tether Update and Altcoins!#USDtether Considering this scenario plays out, you'll see green across the market, especially Altcoins!

I am working on a list of Altcoins you must consider adding to your portfolio with charts and deep fundamental analysis.

Previously the Alts like CREO ML ORAI AITECH did 5x to even 40x!

If you want me to make it public, like this post and retweet.

200 likes, and I'll consider posting the private list of gems!

#Crypto #Bitcoin #USDT

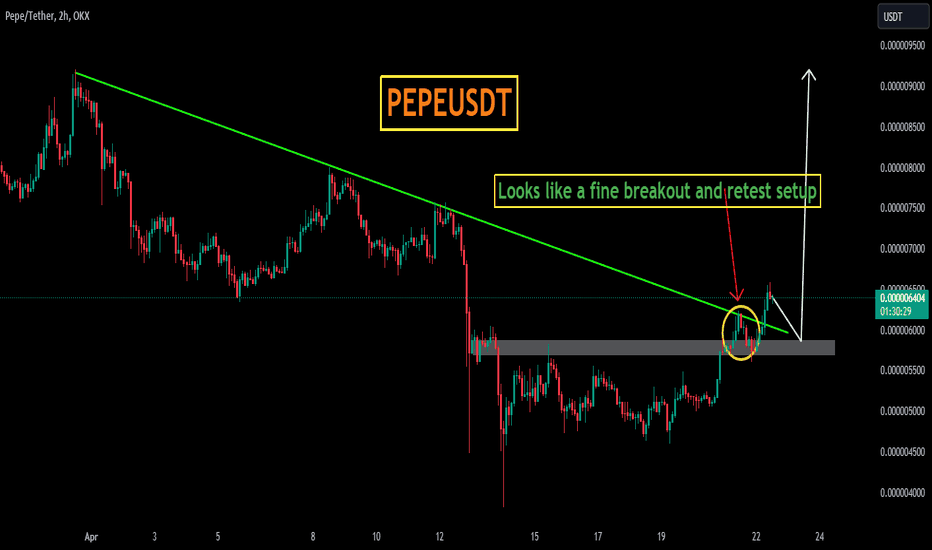

PEPEUSDTPEPEUSDT was trading under the declining trendline. The price was reacting well the support and resistance of trendline

Currently the price has given the breakout from declining trendline with confluence to strong bullish divergence and now seems like the bulls are getting ready for some strong upside movement.

If the bulls sustain to upside the optimum target could be 0.000009500.

What you guys think of this idea?

USDT dominance analysis in daily time frame

Due to the lack of price action area in the price ceiling of Bitcoin, I am forced to do dominance analysis to check the behavior of the market

The green areas are my main support area for the start of sharp upward movement for Dominance, and the price action patterns at the ceiling of the Dominance number indicate for me the registration of new ETH in Dominance.

For now, the good days of the market are over

ALGOUSDTALGOUSDT is in strong bullish trend.

As the market is consistently printing new HHs and HLs.

currently the market is retracing a bit after last HH, which is 50% Fib retracement level and local support as well. if the market successfully sustain this buying confluence the next leg up could go for new HH.

What you guys think of this idea?

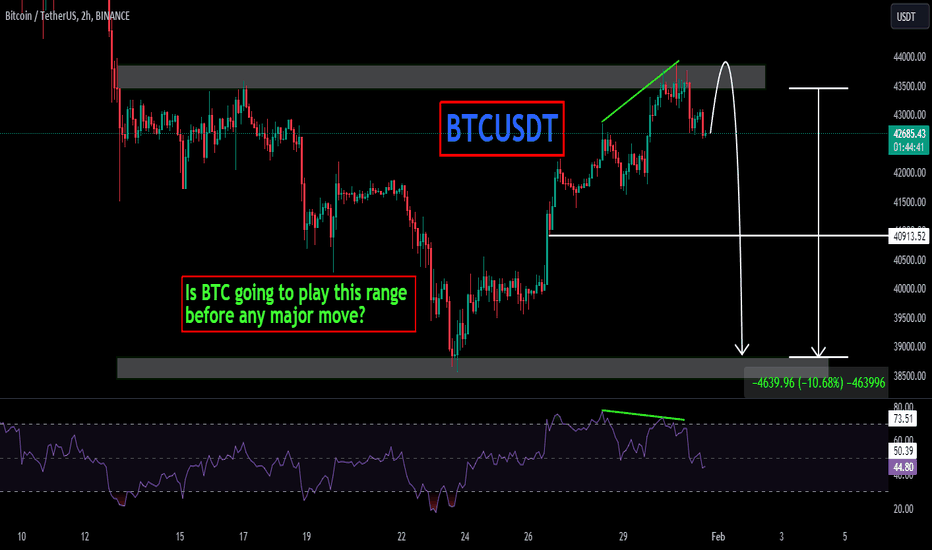

BTCUSDTBTCUSDT is trading in range bound with 10% range.

some time ranges are the best things to play just buy the support and sell the resistance.

as this one is 10% range which can deliver fine risk to reward.

currently the price is at resistance level and being rejected due to sell pressure.

will the pair head back to support area ?

what you guys think of this idea ?

TETHER is becoming increasingly more unstable.Tether is the biggest Ponzi scheme in the history of crypto and is becoming increasingly more unstable every day. USDT is subject to many factors, such as the rising and falling value of the dollar and the constant increase of Tether into Infinium to manipulate the price of other cryptocurrencies that are solely reliant upon USDT for purchase.

I do believe that we will see a day in the very near future when Tether (USDT) will collapse and lose the vast majority of its value overnight, much like the TerraUSD/LUNA collapse, except it will be orders of magnitude more extreme as Tether has a market cap that TerraUSD could only dream of, even in its heyday.

If you hold large amounts of TETHER on any blockchain, you're taking massive, unseen risk.

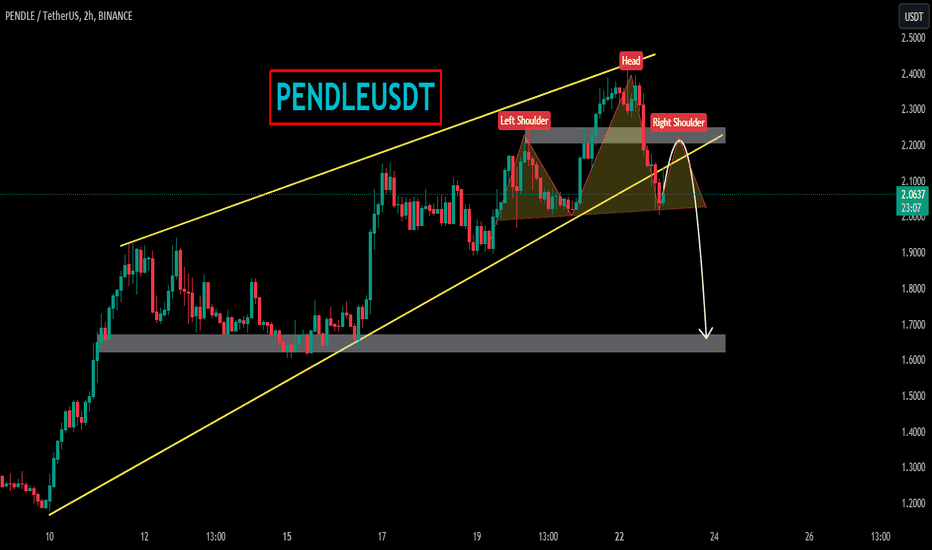

PENDLEUSDTIs PENDLEUSDT exhausting at highs?

As the price is been on high bull run but now it seems like price is lacking bullish momentum after printing double top pattern at resistance level and bearish divergence on lower time frame suggesting the sell pressure is about to start.

If the bears took control , the 1st target could be 1.600 followed by 1.200

What you guys think of it

#Tether Will $48k be the top or $52k is still on the cards?The rejection of USDT Dominance from the grey area recently contributed to the upward movement, pushing the price to $48k.

To sustain the momentum and reach the FWB:52K - FWB:54K level, the index must break below this channel.

In the event of a breach in the grey level area, FWB:48K could become the local top.

Let's hope we break down!

DYOR, NFA

Do hit the like button if you like my updates!

#PEACE

#USDT Dominance signalling a Buy Signal, EXIT ALTCOINS OR WAIT?Tether Dominance Analysis:

☑️ A slight rejection is visible; historically, rejection leads to continuation, while a breakout triggers an exit from the market.

☑️ G-Trend has already triggered a buy signal, implying a shift to selling altcoins for USDT.

☑️ For confirmation, altcoins might dip a bit more.

☑️ The blue trendline and the 6% level are crucial points to observe.

I exited 40% of my altcoins which had vertical moves on the 4th Jan right before the bleeding started.

I have plans to buy back lower but not unless I see some confirmation!

Do hit the like button if you like my updates and share your views in the comment section.

If you do, I will let you know when the sentiment changes!

#PEACE

#USDTether Your Altcoins are Dumping? What to do?

Let's analyze:

Dominance Update: Even though Altcoins aren't reacting as expected while BTC remains relatively stable, Tether (USDT) is in a tricky spot.

The uncertain situation, often called the "grey area," is holding things together for now to some extent. If the dominance goes above 6%, it could signal a trend reversal.

Keep a close eye on this chart – it's like your crystal ball for market insights.

For the current trend to continue, we need a rejection at this level.

Breaking through won't be easy, but it's possible.

Stay alert for signs that support or challenge this analysis.

DYOR, NFA

#BitcoinETFs #Bitcoin

Do hit the like button to support my content/

Thank you

#PEACE

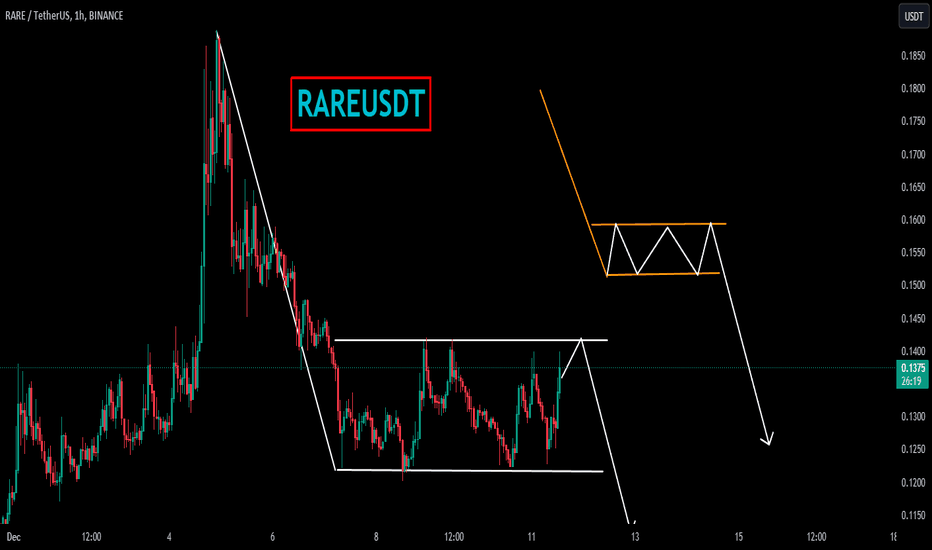

RAREUSDTRAREUSDT is in strong bearish trend and also form bearish flag pattern. Recently the instrument has break through important support zone.

Now the price is trading within the bearish flag and seems like it getting ready to break it.

Will the sellers took benefits from these bearish confluences?

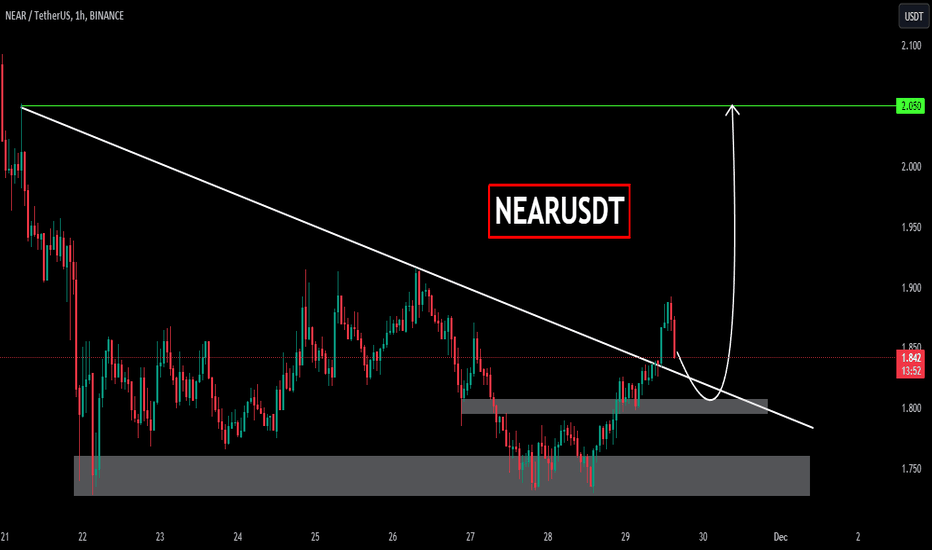

NEARUSDT NEARUSDT was trading under declining trendline and recently it seems like the sellers are bit exhausted then bulls took the charge and break through declining trendline.

Currently the price has given the breakout from falling trendline and now forming a local support around 1.80 region.

Will the bulls take charge again continue for leg higher?

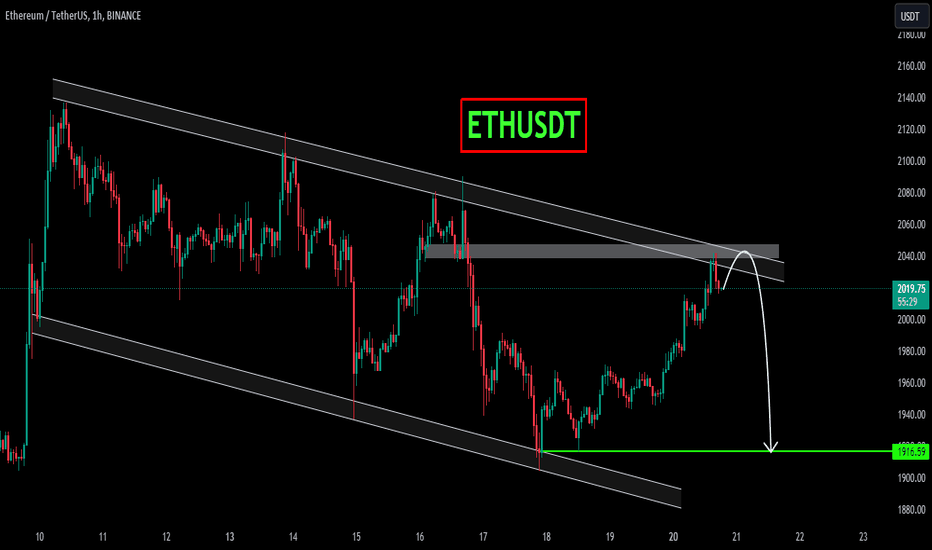

ETHUSDTIs ETHUSDT exhausting at strong resistance level?

As the price is been on high bull run but now it seems like price is lacking bullish momentum after reaching at resistance level and bearish divergence suggesting the sell pressure is about to start.

If the bears took control , the 1st target could be 1900

What you guys think of it

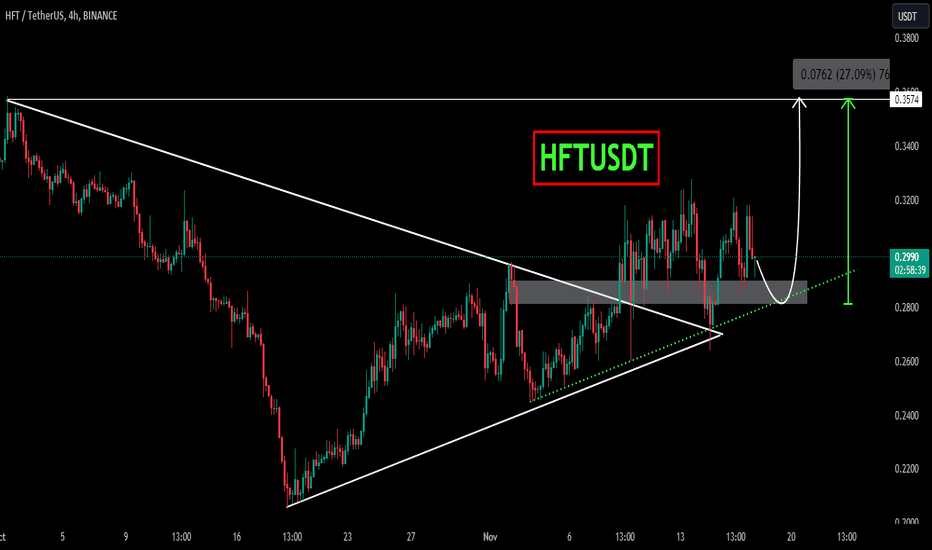

HFTUSDTHFTUSDT was trading in symmetrical triangle pattern. The price was reacting well the support and resistance of triangle.

Currently the price has given the breakout of triangle and now retesting the broken level where it is also forming a local support zone and seems like the price may go for another leg higher.

If the breakout sustain to upside the optimum target could be 0.3575

What you guys think of this idea?

#USDT dominance giving us a hit to our Bitcoin's Local TOP!#USDT Update: Tether has shattered every support, mirroring Bitcoin's breakthrough of resistance. The 5.26% area emerges as a potential next target, hinting at further upside for Bitcoin.

While Bitcoin's chart signals a local top near $40.2k, this breakthrough could spark a rally to $42.8k, a significant long-term support turned resistance level. So, our $40k+ target remains plausible as long as $35k holds.

Cheers! 🚀

PEPEUSDTPEPEUSDT is in strong bullish trend.

As the market is consistently printing new HHs and HLs.

currently the market is being respected by inclining trendline and has also formed bullish flag pattern which is also being supported by inclining trendline.

These two to gather putting strong bullish confluence for the pair.

What you guys think of this idea