TGT Earnings Play: Strong Bearish Setup – $100 Put🛒💥 TGT Earnings Alert – $100 Put (Aug 22, 2025) 🚨🔥

Earnings Snapshot

📉 Revenue Momentum: -2.8% TTM ❌

📊 Margins: Profit margin 4.0%, Gross margin 28.1% ⚠️

📈 Forward EPS Growth: 15.5% (aggressive) 💡

💵 Debt-to-Equity: 130.21 ⚖️

🏬 Sector Context: Discretionary retail under pressure, consumers shifting to essentials 🛒

Technical & Market Context

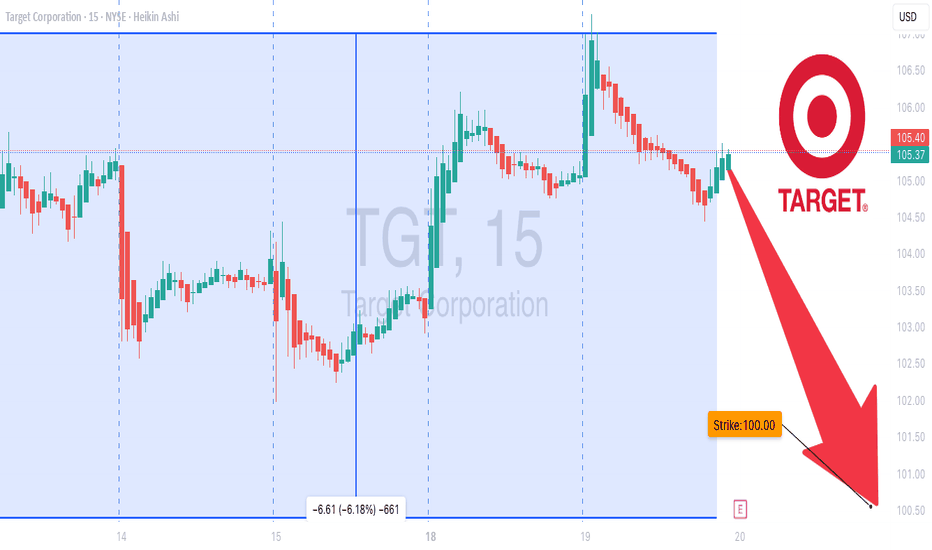

Price: $104.95, above 20-day MA ($103.40) but below 200-day MA ($115.47) ⚖️

RSI: 58.35 → neutral momentum

Volume: 3.8M, below average 📉

Options Flow: Expected bearish put skew 📉

Macro: Inflation & rising costs = headwinds 🚨

💥 Trade Recommendation

🎯 Strategy: Earnings Put

🏦 Instrument: TGT

💵 Strike: $100 Put

🗓️ Expiry: Aug 22, 2025

💰 Entry Price: $1.85

🎯 Profit Target: $5.50 (200%+)

🛑 Stop Loss: $0.92 (50% of premium)

⏰ Entry Timing: Pre-earnings close

📈 Confidence: 90% 🔥

⚠️ Key Risks:

Rapid IV crush post-earnings ⏳

Unexpected upside surprise 🚀

High leverage; manage sizing carefully ⚖️

Multiple Exit Scenarios

Profit Target Hit: Exit at $5.50 💰

Stop Loss: Exit at $0.92 ❌

Time-Based: Close within 90 mins post-earnings ⏱️

Trade JSON

{

"instrument": "TGT",

"direction": "put",

"strike": 100.0,

"expiry": "2025-08-22",

"confidence": 90,

"profit_target": 5.50,

"stop_loss": 0.92,

"size": 1,

"entry_price": 1.85,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-21",

"earnings_time": "BMO",

"expected_move": 5.0,

"iv_rank": 0.85,

"signal_publish_time": "2025-08-19 15:20:01 UTC-04:00"

}

📊 Quick Trade Recap:

🎯 PUT $100 | 💵 $1.85 → 🎯 $5.50 | 🛑 $0.92 | 📅 Aug 22 | 📈 90% Confidence

⏰ Entry: Pre-Earnings Close | 📆 Earnings: Aug 21 BMO | 📊 Expected Move: 5%