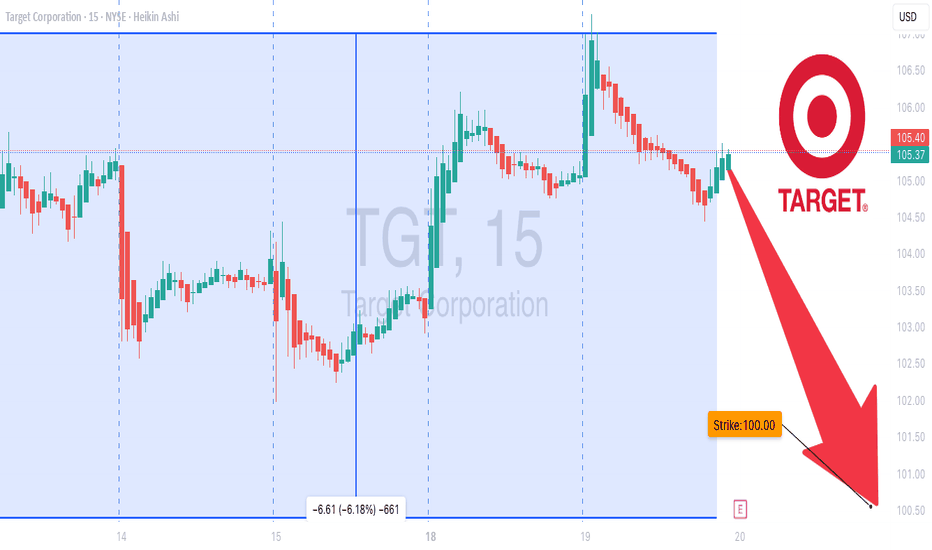

TGT Earnings Play: Strong Bearish Setup – $100 Put🛒💥 TGT Earnings Alert – $100 Put (Aug 22, 2025) 🚨🔥

Earnings Snapshot

📉 Revenue Momentum: -2.8% TTM ❌

📊 Margins: Profit margin 4.0%, Gross margin 28.1% ⚠️

📈 Forward EPS Growth: 15.5% (aggressive) 💡

💵 Debt-to-Equity: 130.21 ⚖️

🏬 Sector Context: Discretionary retail under pressure, consumers shifting to essentials 🛒

Technical & Market Context

Price: $104.95, above 20-day MA ($103.40) but below 200-day MA ($115.47) ⚖️

RSI: 58.35 → neutral momentum

Volume: 3.8M, below average 📉

Options Flow: Expected bearish put skew 📉

Macro: Inflation & rising costs = headwinds 🚨

💥 Trade Recommendation

🎯 Strategy: Earnings Put

🏦 Instrument: TGT

💵 Strike: $100 Put

🗓️ Expiry: Aug 22, 2025

💰 Entry Price: $1.85

🎯 Profit Target: $5.50 (200%+)

🛑 Stop Loss: $0.92 (50% of premium)

⏰ Entry Timing: Pre-earnings close

📈 Confidence: 90% 🔥

⚠️ Key Risks:

Rapid IV crush post-earnings ⏳

Unexpected upside surprise 🚀

High leverage; manage sizing carefully ⚖️

Multiple Exit Scenarios

Profit Target Hit: Exit at $5.50 💰

Stop Loss: Exit at $0.92 ❌

Time-Based: Close within 90 mins post-earnings ⏱️

Trade JSON

{

"instrument": "TGT",

"direction": "put",

"strike": 100.0,

"expiry": "2025-08-22",

"confidence": 90,

"profit_target": 5.50,

"stop_loss": 0.92,

"size": 1,

"entry_price": 1.85,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-21",

"earnings_time": "BMO",

"expected_move": 5.0,

"iv_rank": 0.85,

"signal_publish_time": "2025-08-19 15:20:01 UTC-04:00"

}

📊 Quick Trade Recap:

🎯 PUT $100 | 💵 $1.85 → 🎯 $5.50 | 🛑 $0.92 | 📅 Aug 22 | 📈 90% Confidence

⏰ Entry: Pre-Earnings Close | 📆 Earnings: Aug 21 BMO | 📊 Expected Move: 5%

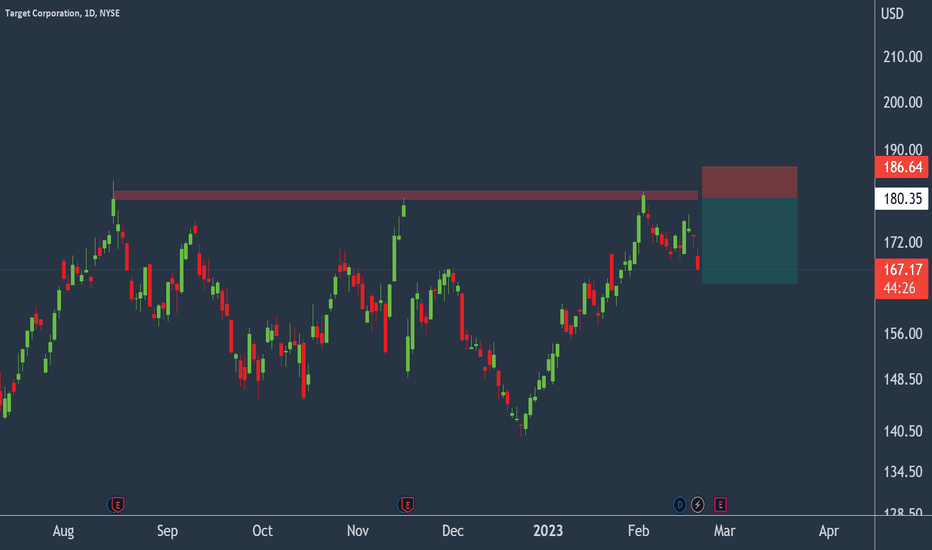

Tgtshort

Target levels above 180 continue to attract sellers.Target - 30d expiry - We look to Sell at 180.35 (stop at 186.64)

Levels above 180 continue to attract sellers.

183.89 has been pivotal.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

This stock has seen poor sales growth.

Preferred trade is to sell into rallies.

Posted a Treble Top formation.

Our profit targets will be 164.64 and 161.64

Resistance: 170.00 / 175.00 / 180.00

Support: 166.84 / 165.00 / 158.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.