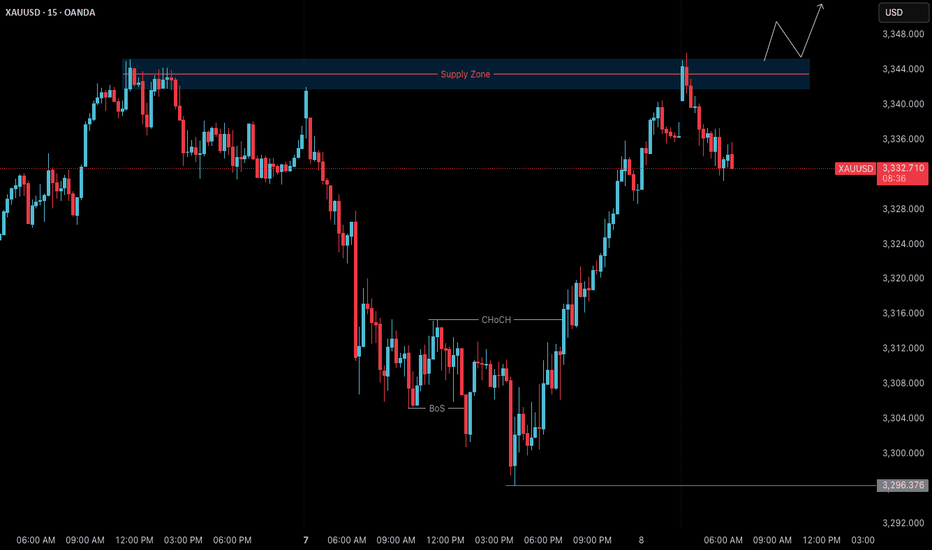

Gold (XAUUSD) – July 8 Analysis | Decision Day at H4 Supply Zone

Gold is currently trading inside a key H4 supply zone (3342–3345) , and today’s session could act as a pivotal turning point for the ongoing structure.

We are now in a region where the H4 may either complete its pullback and resume the uptrend — or allow price to drop deeper toward 3280 before any bullish continuation.

Market Structure Overview

• H4 Trend: Still in a pullback

• M15 Trend: Gave a Change of Character (ChoCh) in the previous session

• Break of Structure (BoS): Not yet confirmed on M15

This puts us in a state of unconfirmed reversal . Without a clean BoS, this could still be a liquidity grab .

Key Levels & Current Setup

📍 H4 Supply Zone: 3342–3345

→ This is where price is currently reacting

→ Sellers may step in here if the broader pullback continues

📍 M15 Structure Status:

→ ChoCh already occurred

→ Price is in a retracement phase

→ BoS is needed to confirm a shift and signal the end of H4 pullback

What Today’s Session Will Decide

🔸 If M15 breaks structure upward (BoS):

→ H4 pullback may be complete

→ Bias turns bullish

→ We’ll plan long setups from M15 POIs with M1 confirmation

🔸 If M15 fails to break and reverses:

→ This could be a liquidity grab

→ Sellers may push price lower

→ Next downside target: 3280 H4 order block , still valid

⚠️ Reminder: Be Prepared for Both Scenarios

• No M15 BoS = No bias

• Wait for structure, not emotion

• Do not force long trades without confirmation

• 3280 remains a high-probability target if rejection confirms

Final Thoughts

This is a structure-led market — we don’t predict, we prepare.

Today’s price action may bring directional clarity.

Structure over speculation.

Let price show intent.

Then act with process, not impulse.

📘 Shared by @ChartIsMirror

Thechartisthemirror

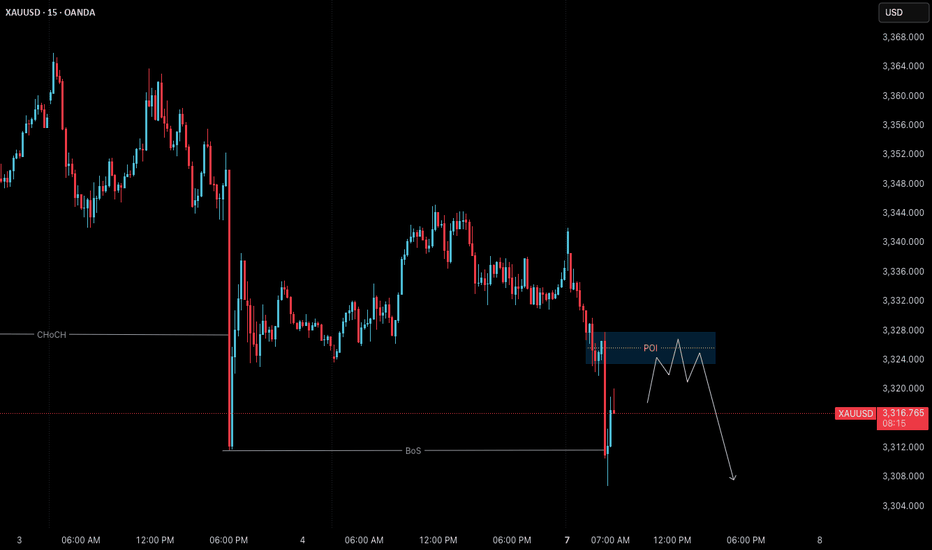

Gold (XAUUSD) – July 7 | Watching 3326 POI for Short Setup🟡 Gold (XAUUSD) – July 7 Bias | Short Setup Developing at 3326 POI

The Gold market remains in a pullback phase on the H4 timeframe , and price may still revisit the 3280 H4 order block before resuming its broader uptrend.

On the M15 timeframe, structure has now shifted clearly.

After an initial Change of Character (ChoCh) , we’ve seen a confirmed Break of Structure (BoS) , placing M15 officially in a downtrend .

✅ Why This Matters:

With both ChoCh and BoS complete, we no longer treat this move as a potential liquidity grab — it now reflects a valid structural reversal in the short term.

But instead of reacting impulsively, we study this shift as a live example of structure-based price action — and how entry zones form after confirmation.

🔍 M15 Order Block in Focus:

• 3323.500 – 3327.800 → Valid M15 POI for short setups

→ This is where we expect price might retrace before resuming its move

→ We’ll observe this zone for M1 confirmation (ChoCh + micro BoS) before taking any action

🎯 Target Zone:

• 3280 – H4 Demand

→ A clean structure-based target aligned with higher timeframe pullback

→ Our model requires minimum 1:3 RR , anchored to price structure

🔁 Key Takeaways:

• H4: Pullback phase remains intact

• M15: Downtrend confirmed (ChoCh + BoS complete)

• Execution plan: Observe 3326 POI; respond only if structure confirms again on M1

• No anticipation. No prediction. Just process.

📖 This is structure-based learning in real time.

We don’t chase setups — we observe shifts.

Let structure teach you. Let price confirm it.

The chart is the mirror.

📘 Shared by @ChartIsMirror

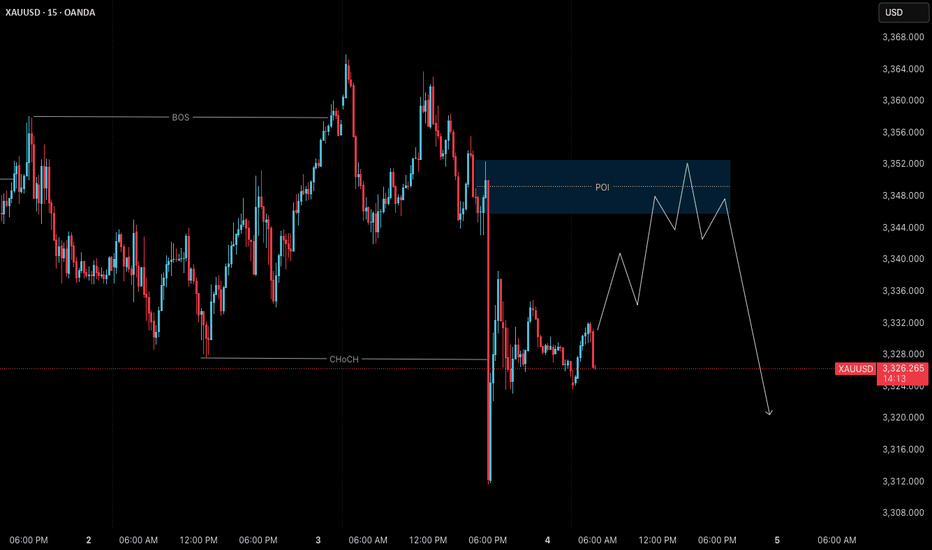

Gold (XAUUSD) – July 4: Structure Shift & Short BiasYesterday’s price action (July 3) delivered a crucial structure break that changes our short-term trading outlook.

We were expecting a bullish continuation with a clean break above the 3365 M15 swing high .

Price reached as high as 3364, but failed to break the high — showing early signs of exhaustion.

Then came the PMI news release, triggering a sharp drop that broke the M15 Higher Low and shifted structure.

🔻 Structure Has Shifted

As of today, July 4, the intraday market structure has flipped from bullish to bearish.

✅ M15 trend: Now in a confirmed downtrend

✅ H4 trend: Entering a pullback phase

❌ Previous bullish continuation setup is invalidated

We now adjust our approach to align with the new structure — not the old expectation.

📉 Updated Bias: Short

With M15 and H4 now aligned in pullback, our active bias is bearish.

This means:

• We are not planning any long trades until structure shifts back

• Focus shifts to short setups only, executed with discipline

🔍 Intraday Short Setup Plan – July 4

We are watching for price to retrace into valid M15 POI zones before resuming the downtrend.

🔸 First zone to watch:

• 3348–3352 → M15 POI with strong probability for rejection

🔹 Execution Rule:

→ If price enters this zone

→ And we see M1 confirmation (ChoCh + micro BoS)

→ We will plan a short entry, with structure-based SL and minimum 1:3 RR

🎯 Downside Levels Ahead:

If bearish momentum continues, the next potential reversal/support zone is:

📍 3280–3285

→ This will be a key area to observe for signs of exhaustion or base formation

→ Until then, trend remains valid to the downside

🧭 Final Thoughts:

This shift from bullish to bearish bias is a textbook example of why we follow structure — not predictions .

The market gave a clean BoS at 3358, but failed to follow through.

Instead of forcing the long, we’ve now flipped bias in line with the chart’s reflection.

📖 Let the chart guide your thinking.

Structure reveals the direction.

Confirmation controls the execution.

The chart is the mirror.

📘 Shared by @ChartIsMirror

Author of The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action