TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

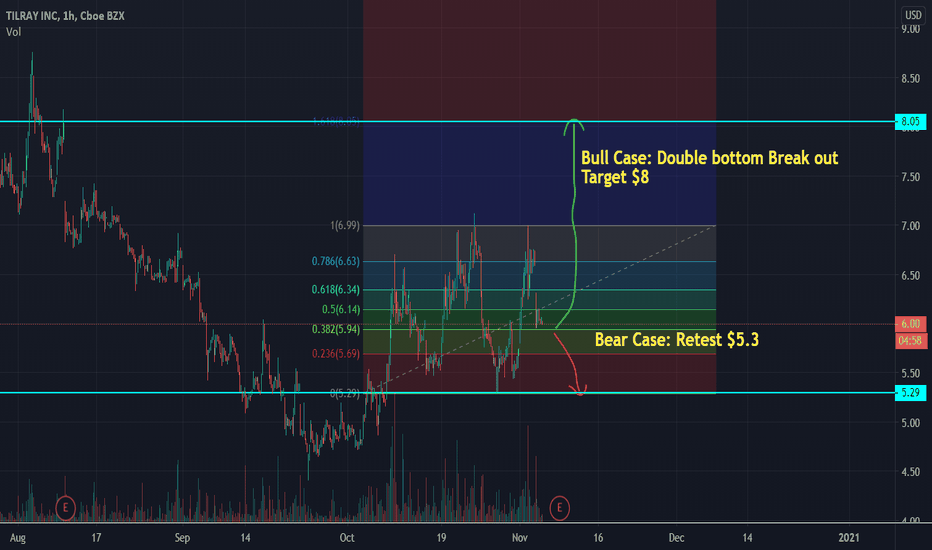

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

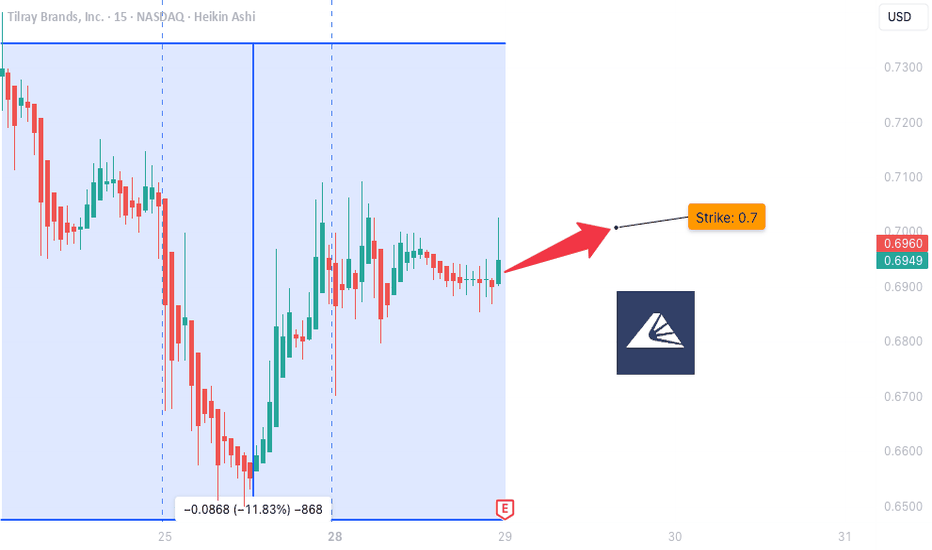

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

Tlryshort

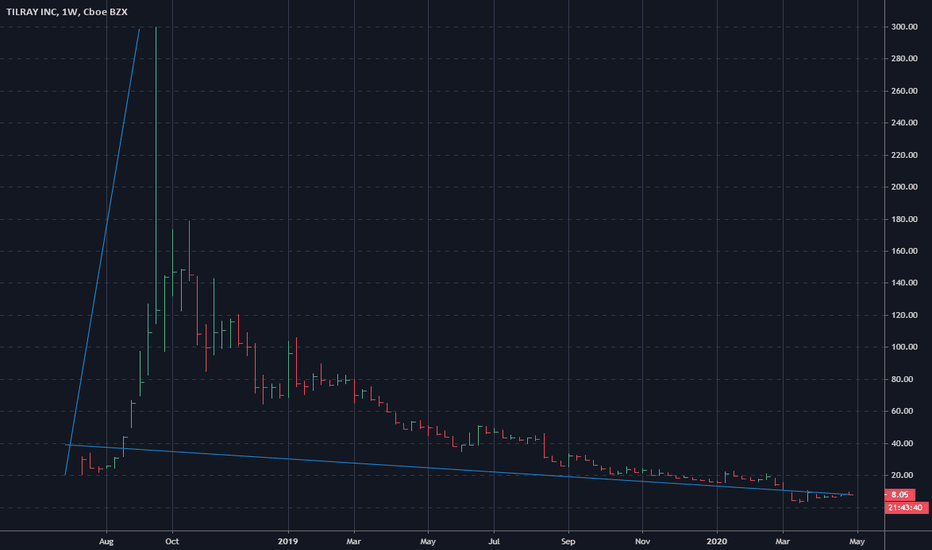

$TLRY: $10 Short Potential [Currently < than IPO Price]First off, please don't take anything I say seriously, or as financial advice. That being said, let me get into a few of my key insights. Tilray is currently only $8.05 which is lower then the $17 price it was entry into the market. The stock peaked at $240 before starting to tumble down bearishly entering into 2019. Cannabis was a fad or bubble waiting to be popped. That being said, as a 750+ employee company that is revamping, it isn't a bad stock pick and may be a steal at its current price. Many analyst are neural on it, but I think it has light in the tunnel for growth. Today it had a high of $9.75, before going down to $8.05. Overall, day over day, the stock's close price went down -0.74%. Today was a notoriously bad day for the market, and this performance was better than expected. Overall, a short of $10 is reasonable, and this is one of those stocks that can likely be flipped multiple times for a day trader or trading bot. It seems to also have long potential, and I believe it will likely reach another bullish run.