Today

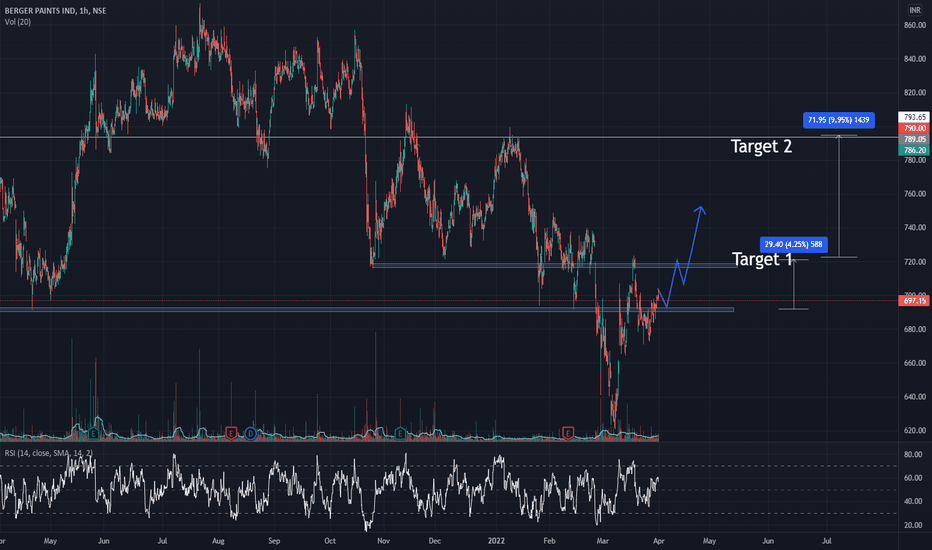

BERGEPAINT impotent levels #BERGEPAINT Berger Paints Ltd is an Indian multinational paint company, based in Kolkata, Bengal, India. This company has 16 manufacturing units in India, 2 in Nepal, 1 each in Poland and Russia. Wikipedia

Customer service: 1800 103 6030

CEO: Abhijit Roy (2012–)

Headquarters: Kolkata

Revenue: 6,365.82 crores INR (US$850 million, 2020)

Founded: 17 December 1923

Parent organization: U. K. Paints India Private Limited

Subsidiaries: Saboo Coatings Pvt. Ltd., STP Limited, Bolix S.A., MORE

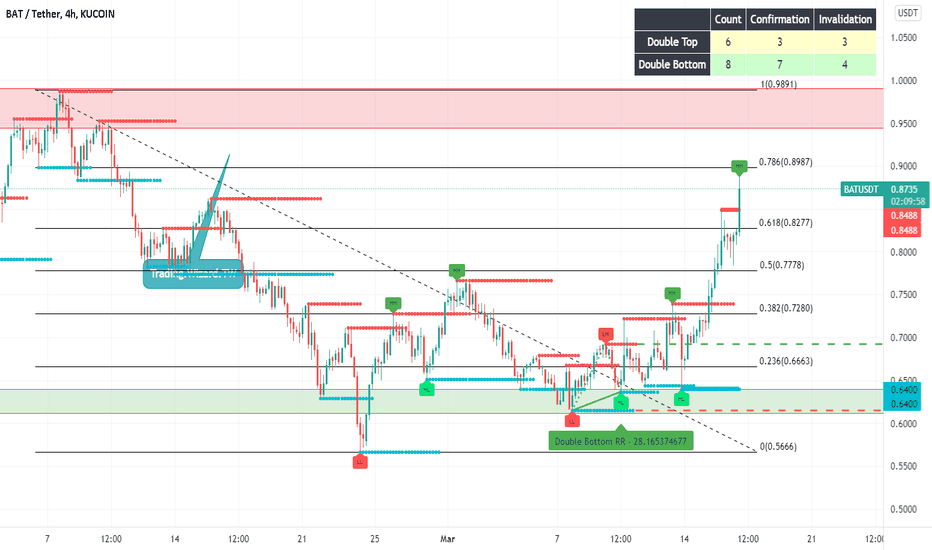

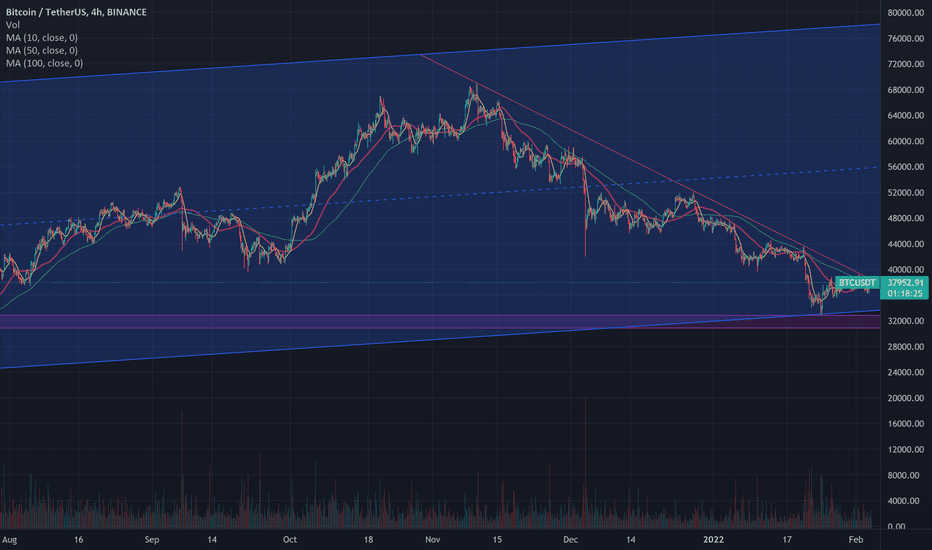

BAT/USDTYesterday I published an Idea to buy BAT in deep I don't know how many of you guys got it, Our first target was filled yesterday now we are waiting for the second one

What do you guys think after the second target we should sell or hold?

I was checking the holders of BAT it is increasing and it's 443,370 less than 1 million

Let me know your opinion guys.

Good luck

Dizoor be dostan rajebe arze BAT goftam nemidonam chan nafareton kharidin / target avalemon anjam shod montazere target dovom hastim.

be nazareton bayad in arzo hold kard ya forokht bade residan be atrget ? holderhash zire 1 million hastesh va 443,370 hold kardan in arzo. baram nazareton benevisid .

movafagh bashid

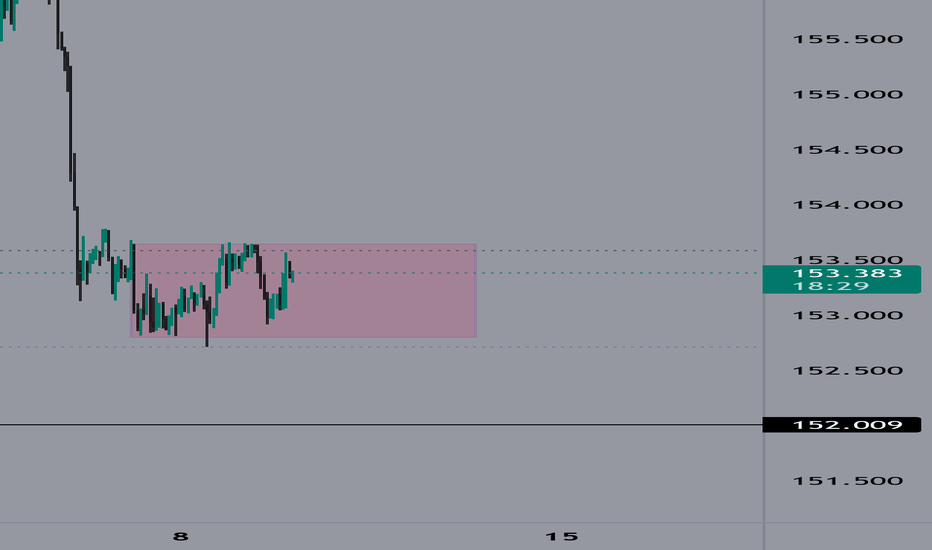

MSFT Put And Call Options Investors in Microsoft Corporation (Symbol: MSFT) saw new options begin trading this week, for the October 21st expiration. One of the key data points that goes into the price an option buyer is willing to pay, is the time value, so with 245 days until expiration the newly trading contracts represent a possible opportunity for sellers of puts or calls to achieve a higher premium than would be available for the contracts with a closer expiration. At Stock Options Channel, our YieldBoost formula has looked up and down the MSFT options chain for the new October 21st contracts and identified one put and one call contract of particular interest.

The put contract at the $280.00 strike price has a current bid of $22.40. If an investor was to sell-to-open that put contract, they are committing to purchase the stock at $280.00, but will also collect the premium, putting the cost basis of the shares at $257.60 (before broker commissions). To an investor already interested in purchasing shares of MSFT, that could represent an attractive alternative to paying $289.44/share today.

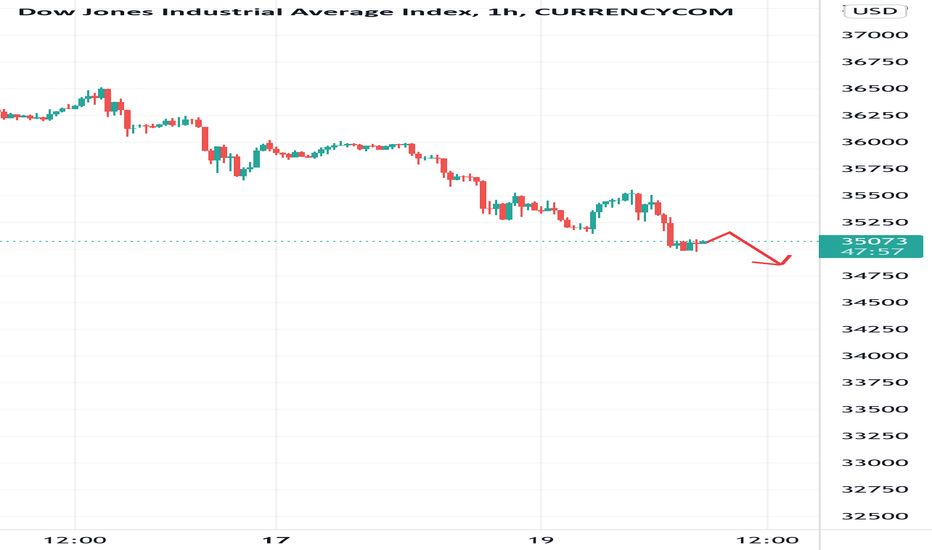

GBPJPY CONSOLIDATIONGBPJPY currently in a consolidation (sideways channel), best advice is to sit this one out and let it play out. Direction of breakout can’t be predicted and is based more on fundamentals than TA. Japan has 2 news event coming up later today so let’s watch but their last few news event didn’t affect the market much either so don’t go crazy with position based off the news. Good luck!

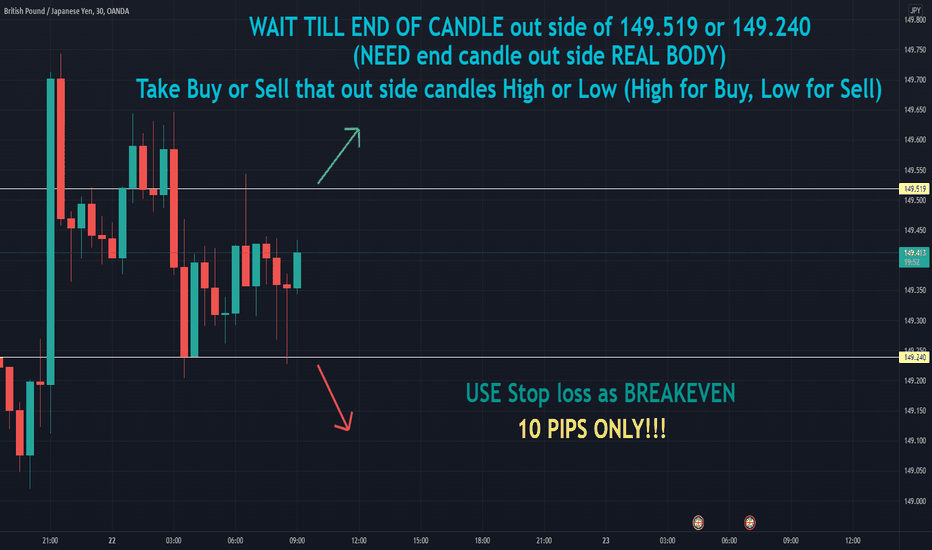

GBP / JPY Today 10pips trade! **Educational purpose only**

Wait till break this WHITE Lines, After break AND end candle out side of this zones,

Take Buy on new candle. (Buy is high of Zone break candle)

Take Sell on new candle. (Sell is Low of Zone break candle)

IF Market doesn't drive to these zones, Please abandon it after NY session.

I appreciate to see your feedbacks! Thank you.

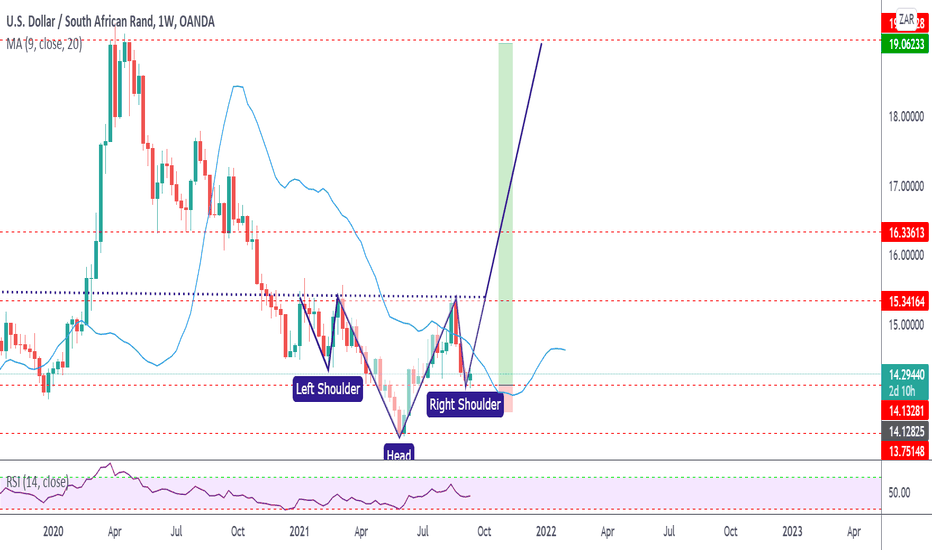

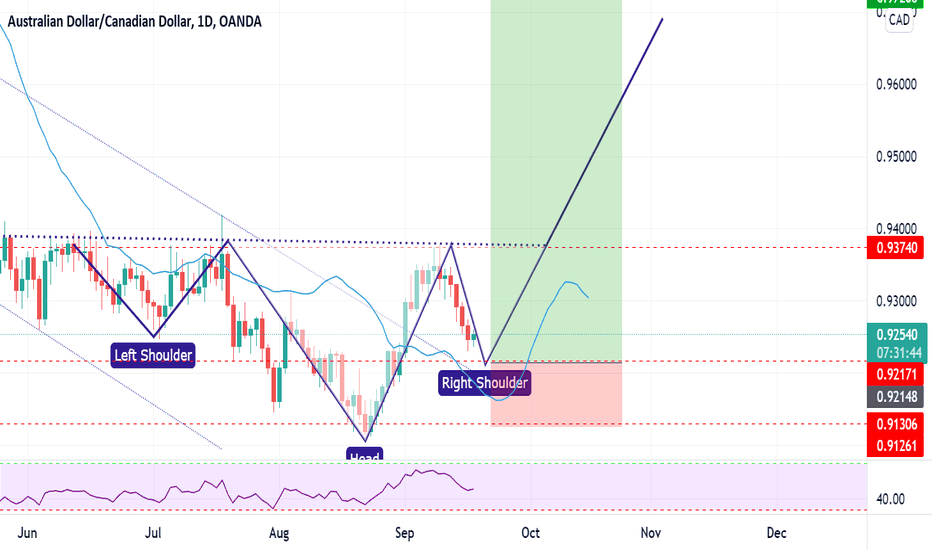

Audcad Buy Good afternoon All,

Hope you are all enjoying this weeks trades. To close the week, I want to share with you all this opportunity that we will be looking to take advantage of come Monday. An Inverse H&S pattern is forming on the D1 chart and with anticipation of bearish oil, this is one trade i would definitely be looking to take advantage of.

Entry and sl marked.

As always, comments, Likes, shares and welcome.

Many Thanks

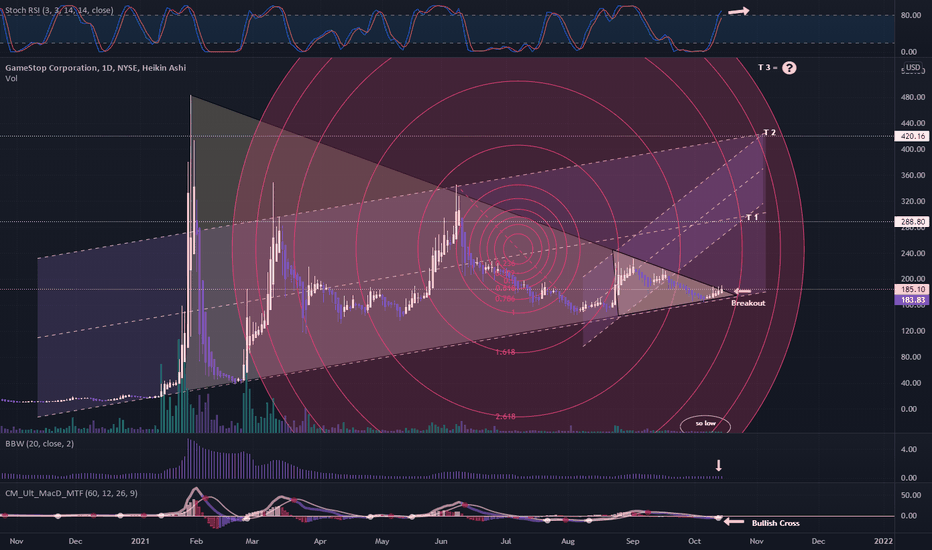

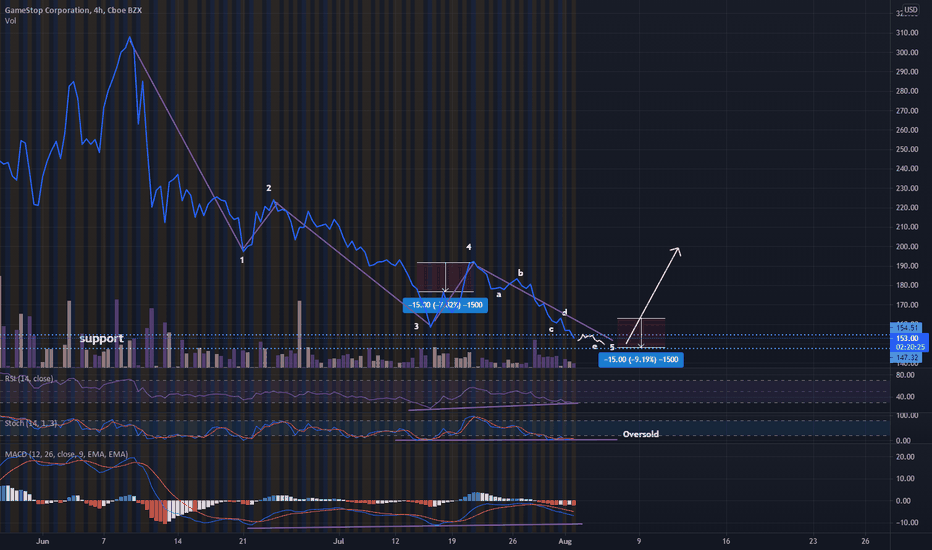

YoU SAIiD GME wOuLD' MOON ToDaY!!I say that everyday :)

GME is almost there and ready for the turn back up.

Indicators continue to support a turn up soon and the presented EW count has wave 5 dn ending later this week.

Expectation is e of 5 will be similar to a . See Chart.

GME has high volume support in this price range from May and earlier this year. Idea = HODL

Not financial advice.