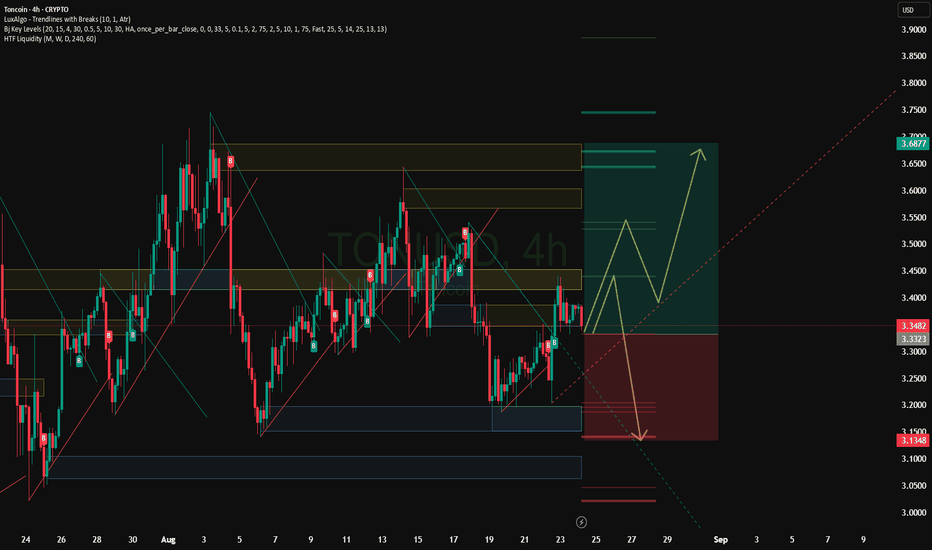

TONCOIN Neutral dynamics prevail on most timeframesOverall technical sentiment

Today's signal: Neutral — neutral dynamics prevail on most timeframes and technical indicators. 1-week rating is also balanced, and 1-month — shows "Sell"

Technical indicators

Overall technical conclusion: Strong Sell

Moving Averages: 5 Buy, 7 Sell

Oscillators: 1 Buy, 8 Sell

Summary: Strong Sell — technical indicators and averages point to downward pressure.

Main indicators:

RSI (14): ~46 — neutral

Stochastic: neutral

StochRSI: Sell

MACD: Buy

ADX: Sell

Williams %R: Sell

CCI: Sell

ROC: Sell

Most oscillators are on the sellers' side.

Moving Averages:

MA5/MA10/MA20: Sell

MA50/MA100/MA200: Buy — several mid-term MAs support a possible reversal.

Pivot levels (Classic):

S1: $3.3368

Pivot: $3.3472

R1: $3.3526 — nearest resistance.

Volume and Market Data

Current TON Price: ~$3.34

24-hour range: $3.33–$3.41

Trading Volume: about $170–200 million

Capitalization: ~$8.58 billion,

Toncoinprediction

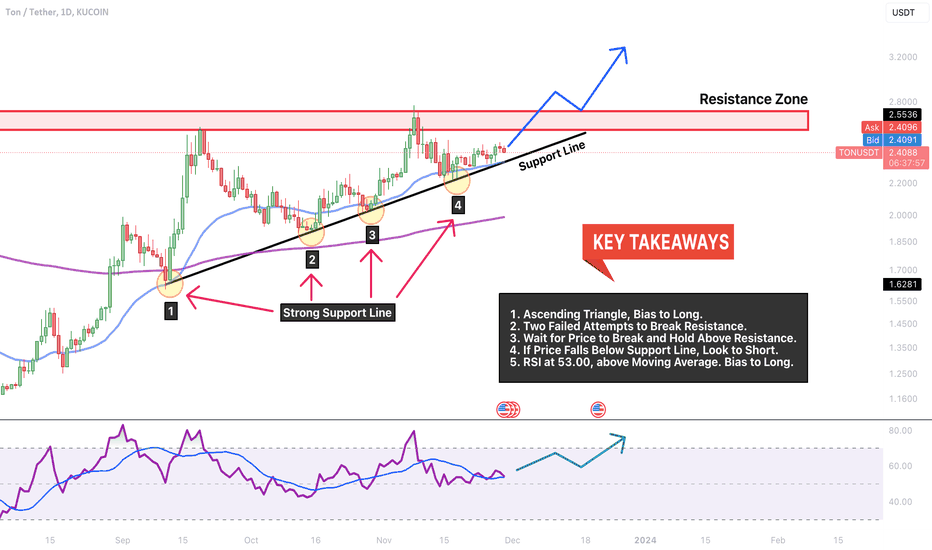

TON → Break Resistance or Flop? Hold Your Entry! Lets Review.Toncoin is racing upward to break resistance in this perfect ascending triangle! Is there enough momentum for the pattern to play out? Or will the price surprise us and reverse down to the 200EMA?

How do we trade this?

If you're not already in a trade, do not enter . There is pain in either direction; we're too close to resistance to long and we don't have a bear signal bar or any strong data to support a reversal. Best to wait on the sidelines until one of two scenarios happens.

1. If the price breaks the Resistance Zone and shows support after the breakout, a long entry is reasonable. It would be a bonus if we see Bitcoin break its Weekly Resistance and make its way toward the $40,000 price range, which brings bullish sentiment to the Crypto market.

2. If the price fails to break resistance and shows us a strong bear signal bar; pin top with the small body closing on or near its low, then a short entry may be reasonable. The probability would be greater if you waited until the support line was broken and a strong bear candle closed below it.

Until then, let's see where the price action goes. FOMO (Fear of Missing Out) is your worst enemy. You're making more money by not falling for the seduction of market profit.

Trade Ideas

Short Entry : $2.33

Stop Loss: $1.39

Take Profit: $2.65

Risk/Reward Ratio: 1:1

Long Entry: $2.82

Stop Loss: $2.50

Take Profit: $3.47

Risk/Reward Ratio: 1:2

Key Takeaways

1. Ascending Triangle, Bias to Long.

2. Two Failed Attempts to Break Resistance.

3. Wait for Price to Break and Hold Above Resistance.

4. If Price Falls Below Support Line, Look to Short.

5. RSI at 53.00, above Moving Average. Bias to Long.

You are solely responsible for your trades, trade at your own risk!

If you found this analysis helpful, click the Boost button and let us know what you think in the comment section below!