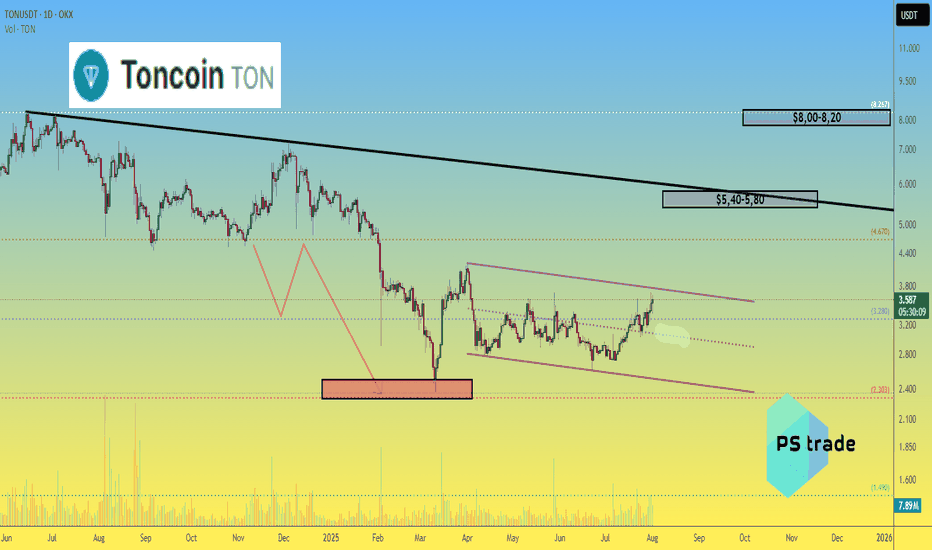

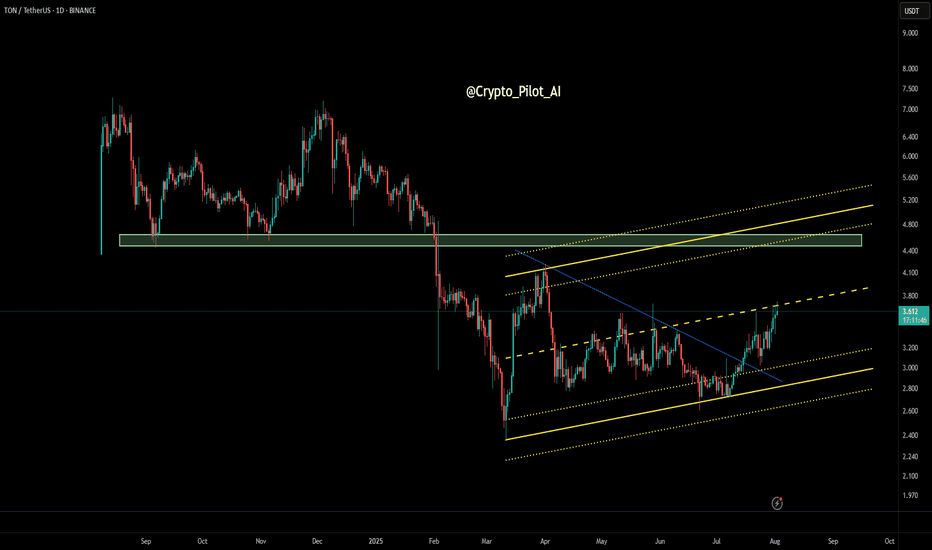

Toncoin TON price analysis💎 CRYPTOCAP:TON didn’t become a legend over the past 9 months — but at least our correction target of $2.30–2.50 played out with precision.

While most of the crypto market is currently going through a correction, #Toncoin keeps pushing upward. Still, we remain realistic:

🎯 First target: $5.40–5.80

🎯 Second target: $8.00–8.20

🚀 It’s not a “to the moon” scenario, but a potential 2x–3x from current levels is attractive.

The key support level OKX:TONUSDT remains at $3.00 — as long as it holds, the bullish trend remains valid.

Tonusdt

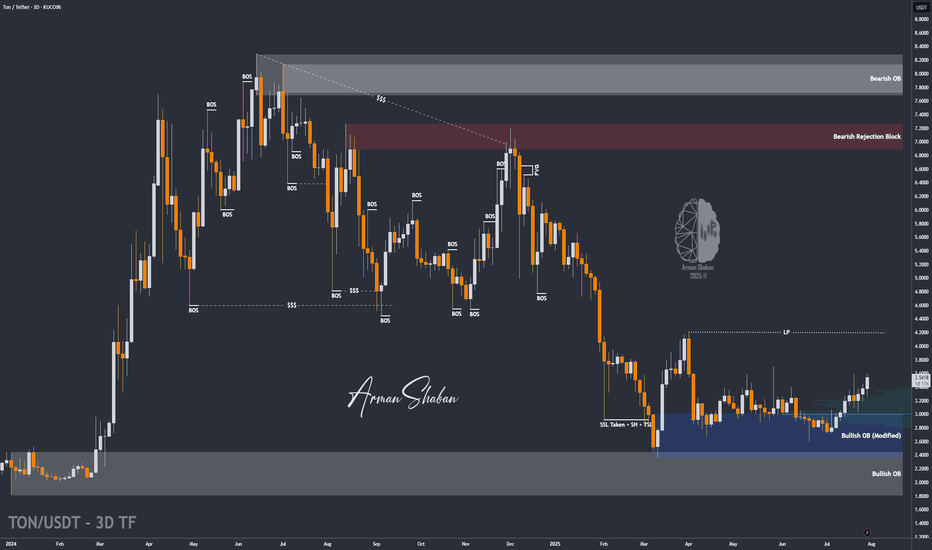

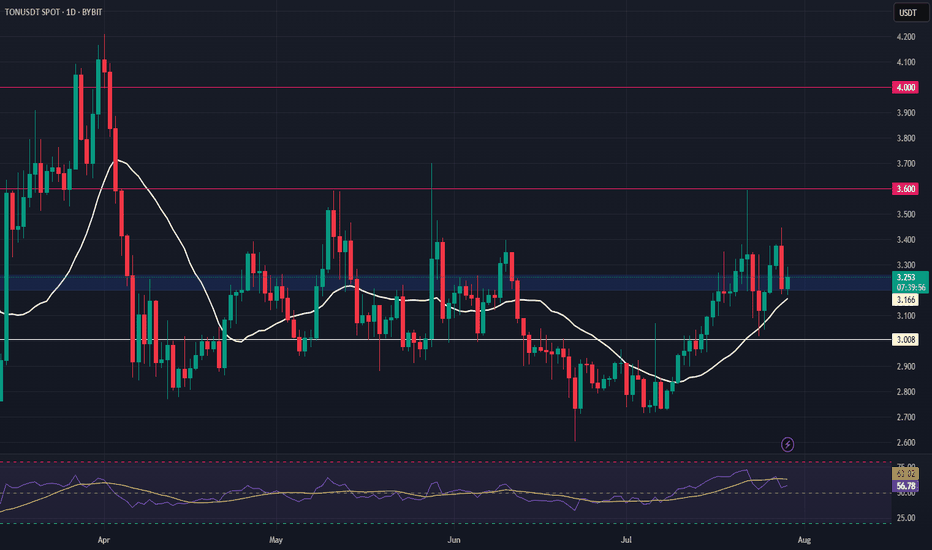

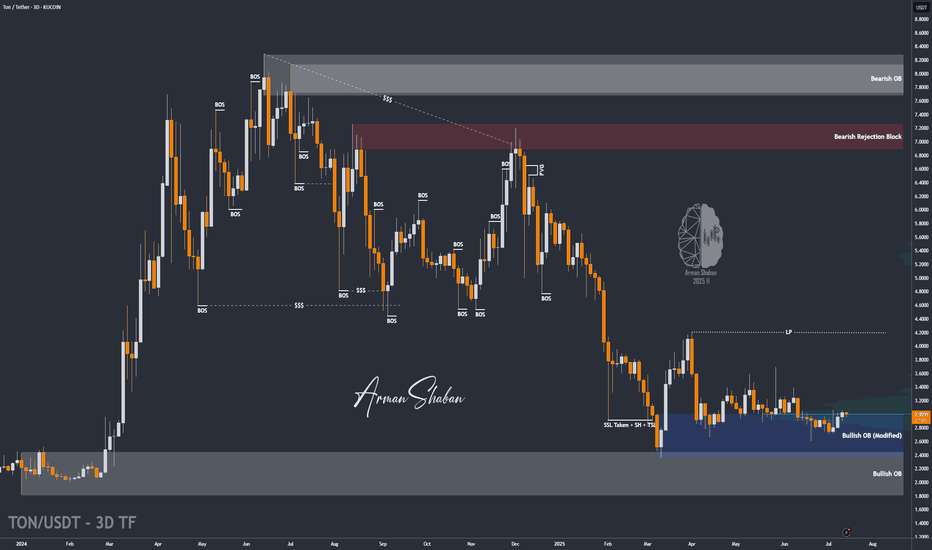

TON/USDT | Surges 18% – Eyes on $3.63, Then $4.20 and $4.68!By analyzing the Toncoin chart on the 3-day timeframe, we can see that after a pullback to the $3 area, strong demand kicked in, and within just one week, the price surged over 18%, reaching above $3.5. Toncoin is currently trading around $3.53, and I expect it to hit the $3.63 target soon. The next bullish targets after that are $4.20 and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

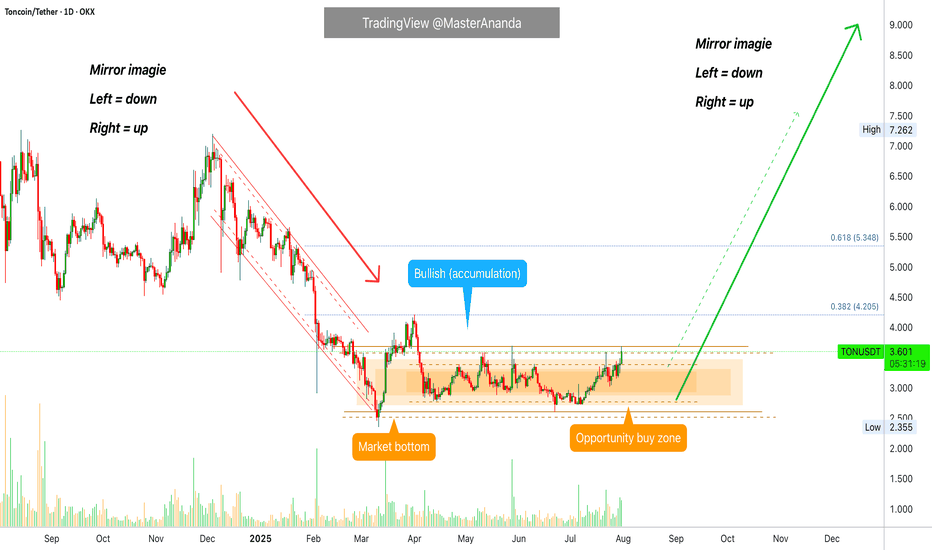

Toncoin Goes Bullish · 4X Leverage · Bottom Prices · OpportunityToncoin is breaking the sideways consolidation pattern. Today we have the highest price since late May, already two months ago, and rising volume. When you see how flat the action at the bottom is, you can tell how strong the bullish breakout that follows will me.

This is a friendly reminder because Toncoin will be huge in this altcoins market bullish cycle. I want you want you to be in, I want you to collect big projects, 1,000%+. That is why I am reminding you now. This trade setup can be approached both with leverage and spot, both options will do great.

After years of bearish action and months of consolidation, Toncoin is ready and the recovery is happening slowly but surely. Prices are rising slowly, no new lows. Prices are moving sideways but knowing the bottom is in the only logical conclusion is a break up. It is on the chart. It is inevitable, it is confirmed; profits and success.

Timing is really essential when trading. If you can get the right entry timing, a great price, trading becomes easy long-term. Once the bullish move shows up, you will be happy sitting in a strong position that only grows. That is because you bought the bottom. We are still looking at bottom prices, the last chance at the "opportunity buy zone."

We are doing 4X but we have positions with higher leverage from where prices were lower. You need to decide your own risk tolerance. If in doubt, zero leverage please. Only when you are 100% certain and you accept the full risk. The full risk is the liquidation of your position, all money gone. Are you ready to lose everything? If you are, better start trading spot. The chances of losing are very low. If prices drop, you get to pick a small paper loss and nothing more. Your number of altcoins stay the same. When the market starts to move, your money grows and the paper loss turns into a gain. You can't lose if you don't sell when prices are down. Buy when prices are low. Hold strong through the bullish wave. The time to buy is now. Buy and hold. You will be happy with the results.

Namaste.

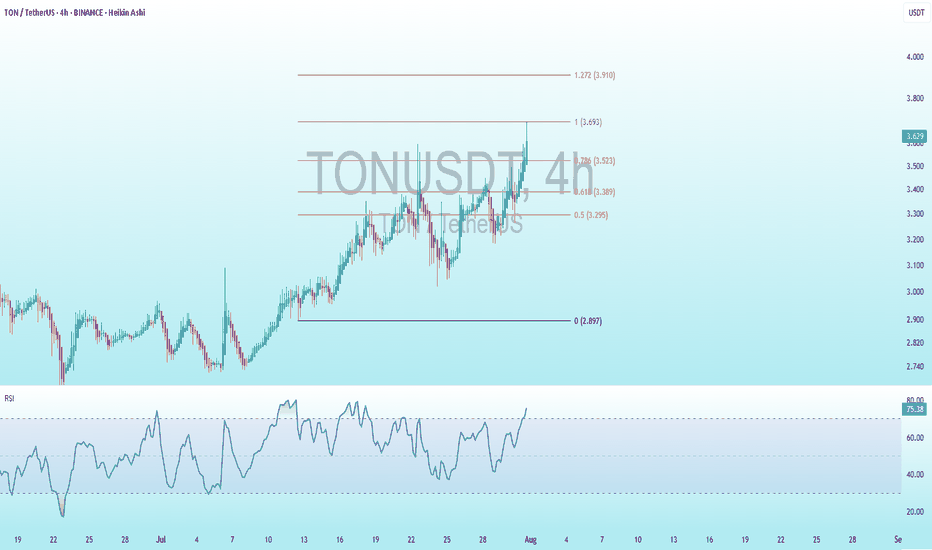

TON Bearish DivergenceBINANCE:TONUSDT

Trade Setup:

Target 1: 3.523 (0.786 Fibonnaci Golden Zone).

Target 2: 3.389 (0.618 Fibonnaci Golden Zone).

Target 3: 3.295 (0.786 Fibonnaci Golden Zone).

Target 4: 2.897 (0 Fibonnaci).

Stop Loss: 3.910 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 75.44, approaching overbuy territory, so caution is advised.

TONUSDT Forming Falling WedgeTONUSDT is forming a classic falling wedge pattern, which is widely recognized in technical analysis as a bullish reversal signal. After a period of consistent downward price compression, the narrowing structure on the chart signals that selling pressure may be weakening. This setup often precedes a significant bullish breakout, especially when accompanied by growing interest and steady volume—as is currently being seen in TON’s market behavior.

The fundamentals behind TON (The Open Network) are also strengthening, with increasing adoption across the Web3 ecosystem and a growing number of partnerships tied to Telegram's user base. The synergy between Telegram and the TON blockchain has created an environment where real-world utility is beginning to align with on-chain momentum. This alignment often catalyzes strong upward price moves, making TONUSDT one of the more promising altcoin setups in the current market landscape.

The expected gain of 140% to 150% from current levels is not just speculative—it aligns well with the technical breakout projection based on the wedge’s height and the last key swing high. If TON can maintain support above the lower boundary of the wedge while volume continues to increase, the likelihood of a breakout followed by a strong upward rally becomes much higher. Historical breakout moves from similar wedge patterns often show explosive growth in relatively short timeframes.

TONUSDT is a high-potential chart right now and should be closely monitored by traders and investors looking for large-cap altcoin opportunities with bullish technical setups. This could be the start of a major trend shift for TON, especially as broader crypto sentiment begins to tilt bullish again.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

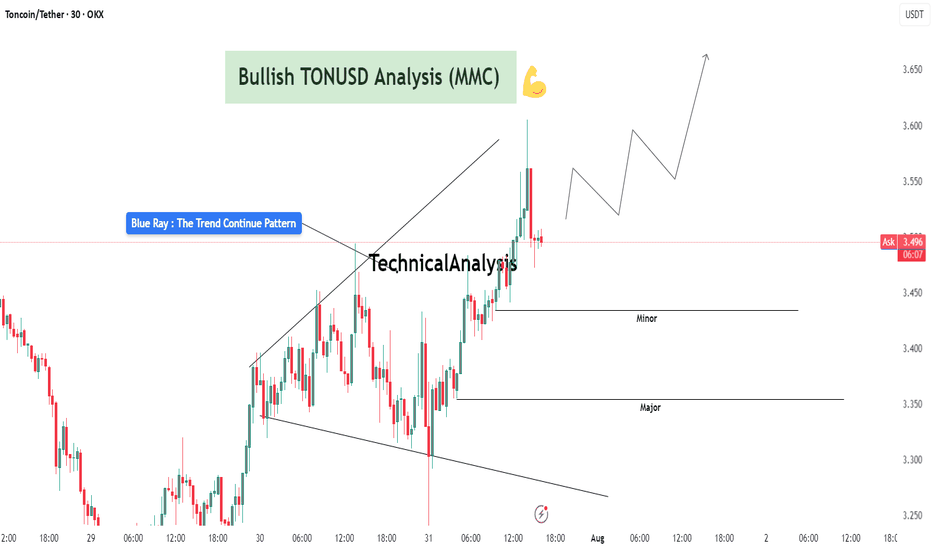

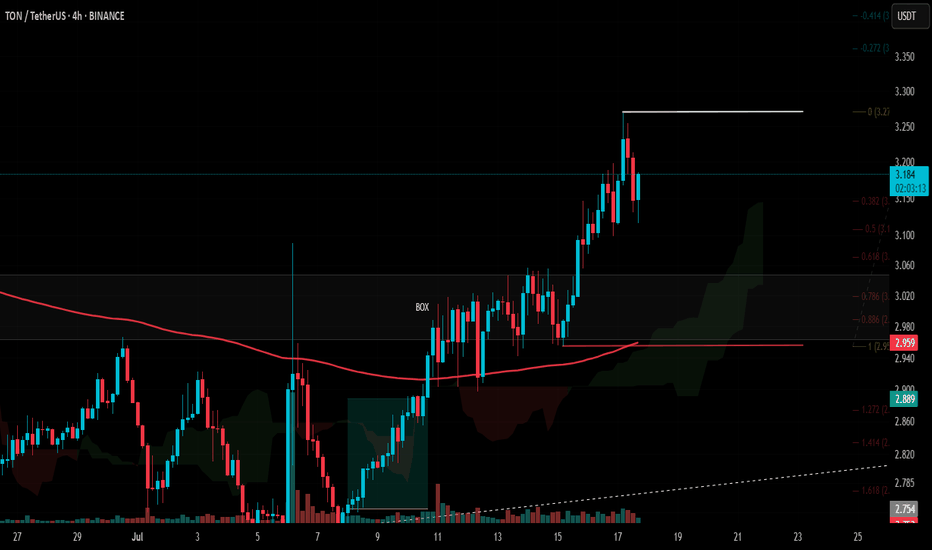

TONUSDT Analysis : Bullish Setup Breakout – Advanced MMC Analyze“Blue Ray Pattern Breakout Confirms Bullish Trend Continuation”

The 30-minute chart of TONUSDT highlights a clean and structured bullish setup based on the MMC (Mirror Market Concepts) methodology. The price action exhibits disciplined market behavior, respecting structural levels, breakout dynamics, and volume-based reactions.

🔷 1. Blue Ray Pattern – Trend Continuation Phase

This chart begins with the formation of the Blue Ray, a visual representation of trend consolidation and energy buildup. This pattern functions as a trend continuation flag or wedge. Prices compressed within a narrowing range, forming higher lows and lower highs, signaling accumulation under buyer control.

Once the pattern matured, we witnessed a decisive bullish breakout, where the price closed above resistance with conviction. This event marked a clear market intention shift and established a new impulsive leg.

🔍 2. Breakout Confirmation and Follow-Through

Post-breakout, TONUSDT experienced:

High-volume candles with elongated bodies, indicating increased buyer participation.

Immediate upside momentum that pushed the asset into a short-term overextended condition – often a healthy sign of strength when followed by a controlled pullback.

The breakout wasn’t just a false move – it was sustained, and the price held above the broken structure, proving that supply was absorbed and buyers were dominant.

🔑 3. Demand Zones (Minor and Major)

Two key MMC demand zones are highlighted:

🔹 Minor Demand Zone (~3.43–3.45):

This is the most immediate support and current price is hovering just above it. It's the first zone of interest for buyers and may serve as a re-entry or scaling point.

🔸 Major Demand Zone (~3.34–3.36):

In case of deeper retracement or volatility, this zone is expected to act as a strong bounce region based on past structure and MMC’s reversal logic. Price memory here suggests accumulation or reactive interest.

📐 4. Structure, Momentum, and Higher Timeframe Confluence

TONUSDT is in a confirmed uptrend, forming a clear sequence of higher highs and higher lows.

The structure supports a bullish flag breakout with minimal overhead resistance.

The projected path drawn on the chart illustrates a stair-stepping price pattern with continuation toward 3.60–3.70, if current levels hold.

📊 5. MMC Strategy Bias – Bullish

Using the MMC lens:

Blue Ray breakout confirms continuation

Volume absorption succeeded at the base of the flag

No signs of dominant supply entering post-breakout

Wave projection supports ongoing momentum

Structure favors buying dips, not shorting spikes

💡 Trader’s Takeaway:

TONUSDT is providing a textbook bullish opportunity under the MMC framework. As long as price stays above the Minor Demand Zone, continuation upward toward 3.60 and beyond remains in play. If price dips to the Major Zone, watch for strong buyer reactions for fresh entries.

Ideal for MMC traders and technical analysts looking to align with structured, logic-based entries and exits. This setup reflects market strength, technical clarity, and volume confirmation – a powerful trio for continuation plays.

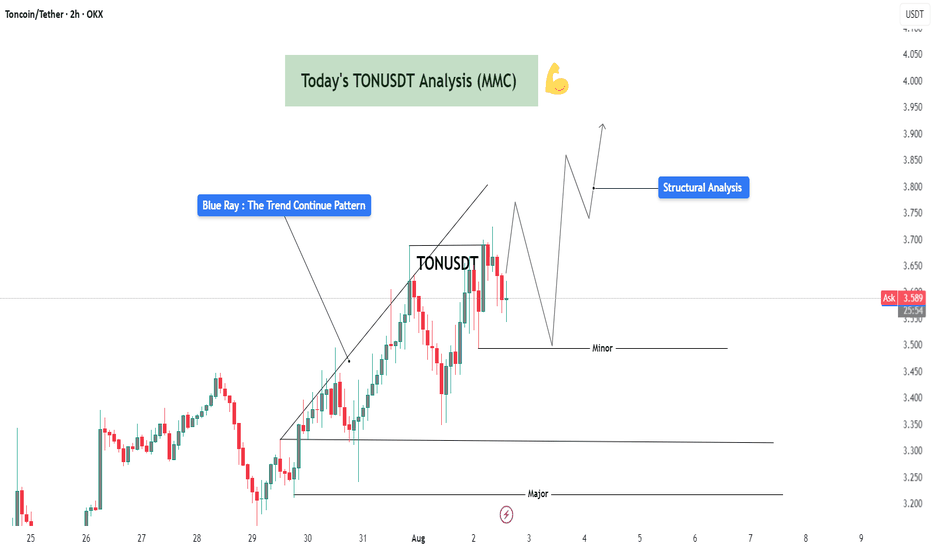

TONUSDT Bullish Structure Continuation – Minor Pullback Leg Up🧾 1. Overview of the Chart Setup:

The current TONUSDT (Toncoin/USDT) 2-hour chart exhibits a strong bullish market structure, characterized by a clear sequence of higher highs and higher lows. This confirms bullish momentum and suggests that the market is in a well-established uptrend.

The key highlight here is the "Blue Ray – Trend Continuation Pattern", which signals sustained bullish pressure following a clean breakout. This breakout was preceded by a consolidation phase, indicating accumulation by smart money before the expansion move.

🔍 2. Technical Structure and Pattern Breakdown:

🔵 Blue Ray – Trend Continuation Pattern:

This diagonal support trendline captured the initial breakout after the market bottomed near July 29–30.

Price respected this ascending line multiple times before accelerating, confirming bullish control.

Once the price broke above the previous swing high, it completed the pattern and triggered a momentum-driven rally.

🔲 Structural Zones – Major and Minor:

Minor Support Zone (~3.50 USDT):

Currently acting as short-term demand.

Price is showing early signs of rejection here, suggesting bulls may reload for a second impulsive move.

If this zone holds, we expect a new higher high to form, potentially targeting 3.80–4.00+ USDT.

Major Support Zone (~3.20–3.25 USDT):

Acts as long-term bullish defense.

In case of deeper retracement or shakeout, this is the key level to watch for possible trend continuation and re-entry.

📈 3. Structural Analysis and Price Projection:

The projected path on the chart shows a classic price action structure:

Impulse

Correction (toward minor support)

Next Impulse (break of recent high)

Higher low (continuation within trend channel)

Potential final push toward the 3.90–4.00 range

This type of Elliott Wave-inspired behavior suggests we're in wave 3 or 5 of a bullish sequence, with minor dips offering low-risk long setups.

📊 4. Candlestick & Market Behavior:

Recent candles show long lower wicks, suggesting buyers are stepping in during dips.

Bearish candles are relatively smaller and followed by immediate bullish response.

This indicates buy-the-dip sentiment, common in a trending market.

🔄 5. Trading Plan & Scenarios:

✅ Bullish Continuation (Base Case):

Wait for a clear bullish engulfing or price bounce at the minor support zone (~3.50 USDT).

Enter with confirmation: bullish candle close, volume spike, or trendline reaction.

Targets:

TP1: 3.80 USDT

TP2: 4.00–4.10 USDT

Stop Loss: Below 3.45 (or structure-based trailing stop)

⚠️ Bearish Case / Deeper Pullback:

If 3.50 fails, look for signs of accumulation around the major support (~3.20–3.25).

This zone can serve as the ultimate defense for trend continuation and provide a second long opportunity with better R:R.

🧠 6. Mindset for Traders:

Don’t chase: Let price come to your level, and focus on confirmation.

Trade with the trend: Structure supports bullish movement — trade in the direction of strength.

Use proper risk management: Define SL and TP before entering. Partial profits at key resistance zones are a smart strategy.

Avoid overtrading : Wait for structural retests or confirmation candles to stay on the right side of the market.

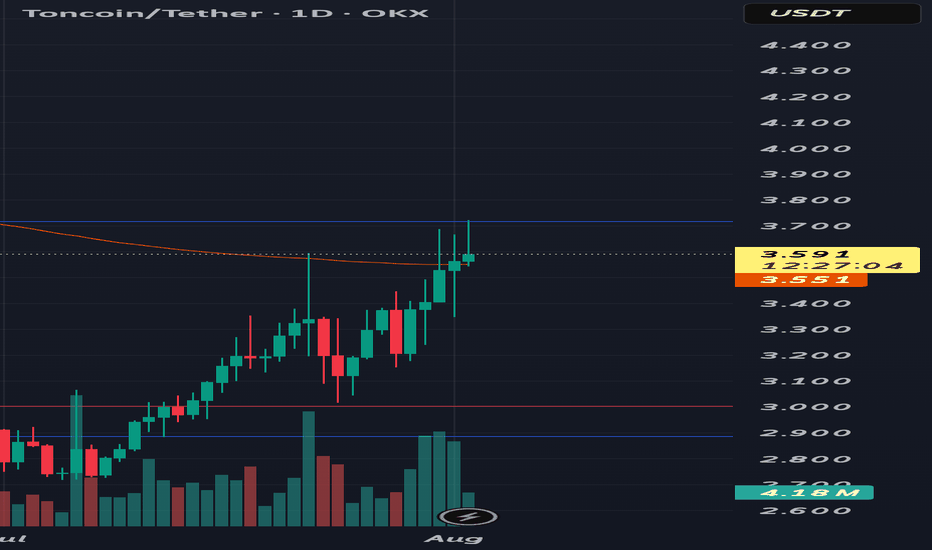

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

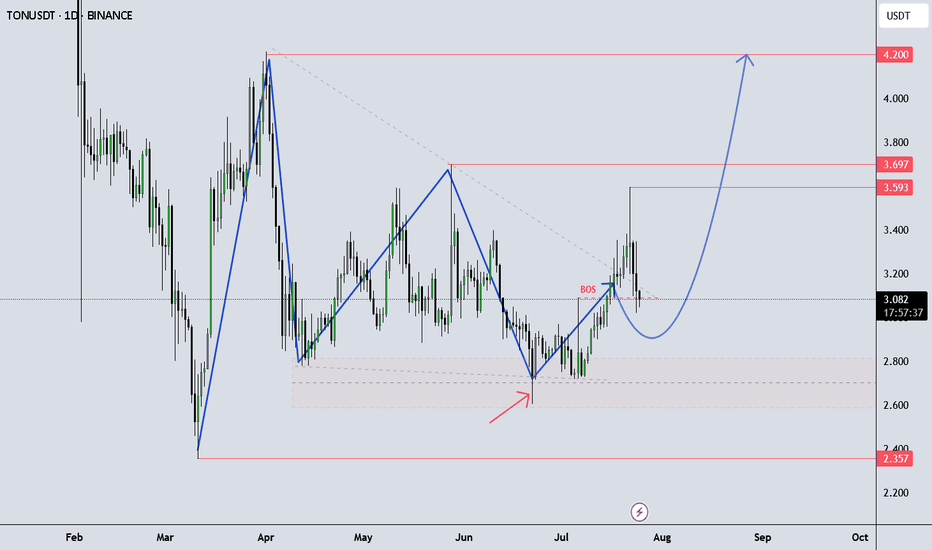

TON/USDT – Daily Price Action Analysis🔹 Price has broken a major descending trendline and entered an ascending channel.

🔹 Currently testing the mid-range resistance zone around $3.60 – $3.70.

🔹 If buyers hold above this area, the next targets could be $4.40 – $4.80.

🔹 If rejected, key supports are at $3.20 and $2.90.

TON Swing Trade – Support Zone in FocusTON is holding a major support level, setting up for a potential bounce. With structure intact, this offers a favorable long entry for swing traders looking to capitalize on the next leg up.

📌 Trade Setup:

• Entry Zone: $3.20 – $3.35

• Take Profit Targets:

o 🥇 $3.60

o 🥈 $4.00

• Stop Loss: $3.088

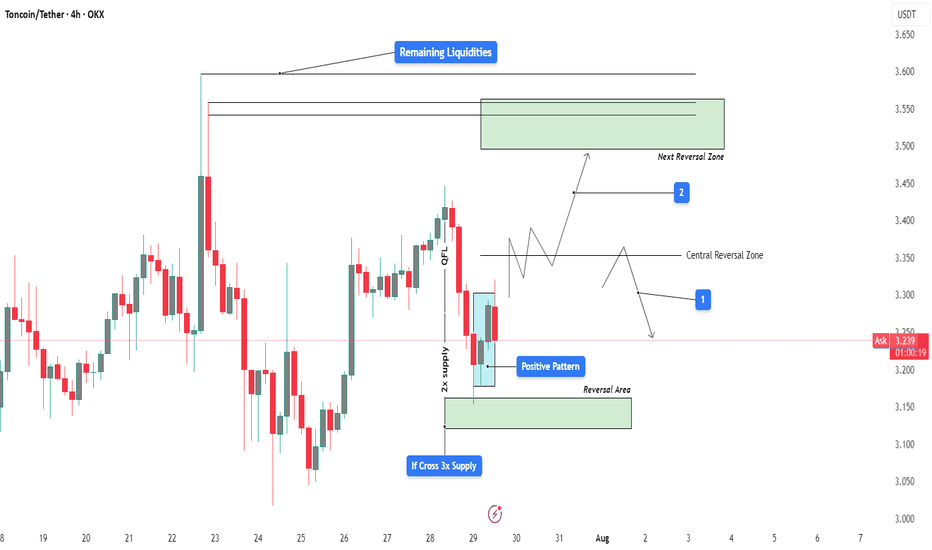

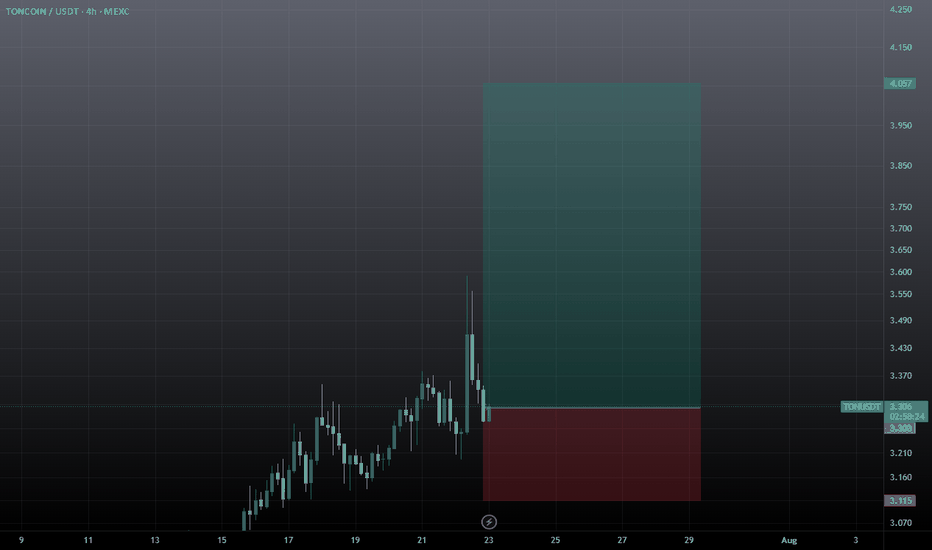

TONUSDT Bullish Reversal from Demand with QFL Base | MMC Setup📊 Technical Breakdown – 4H Chart

✅ Overview

TON/USDT is exhibiting early signs of a bullish reversal after a structured decline into a key smart money demand zone. The setup reflects multiple layers of confirmation—QFL base, multi-supply absorption, liquidity inefficiencies, and a positive reversal pattern—suggesting a high-probability opportunity for upside.

🔹 1. Impulsive Move & Liquidity Sweep

Price rallied aggressively on July 22–23, pushing toward $3.60, breaking short-term highs and triggering liquidity grabs above recent consolidation zones.

This surge absorbed significant buy-side liquidity, leaving a supply zone behind, now marked as the Next Reversal Zone.

After liquidity was collected and orders filled, the market reversed sharply, consistent with institutional profit-taking or engineered liquidation traps.

🧠 Smart Money Insight: Institutions often push price into illiquid zones (above highs) to trap retail and fill large orders. This marks the first phase of the trap.

🔻 2. QFL Base and Multi-Supply Absorption

The price structure created a Quick Flip Level (QFL) — a smart money concept where price forms a base, drops, then rallies, leaving behind an institutional demand zone.

The current pullback has revisited this exact QFL base, now reinforced by 3x supply absorption, enhancing the zone's strength.

This confluence increases the probability of a strong reaction to the upside from this level.

📌 Note: The “If Cross 3x Supply” label shows that this zone has absorbed multiple attempts to break down. It's now acting as a demand pocket.

🔄 3. Reversal Area – The Engine Room of Smart Money

The Reversal Area is carefully marked at $3.20–$3.28 — the ideal discounted price zone where large buyers tend to step in.

This zone is structurally important:

Past breakout level

Aligned with QFL base

Beneath stop levels of breakout traders

A Positive Pattern has now formed within this area—likely a bullish engulfing, morning star, or pin bar, depending on candle confirmation.

📌 Psychology: This zone acts as a trap. Retail traders often panic sell here, while smart money accumulates quietly before launching price upward again.

🧭 4. Dual Scenario Structure – Projected Paths

You’ve beautifully mapped two valid future price scenarios based on reaction to the Central Reversal Zone (~$3.35):

🔵 Scenario 1 – Healthy Pullback Before Continuation

Price climbs toward the central zone, then pulls back slightly to retest support near $3.28–$3.30 (label 1).

This allows further accumulation before price breaks higher.

This is a safer re-entry scenario for patient traders looking for a retest.

🟢 Scenario 2 – Direct Impulsive Rally to Next Reversal Zone

Price continues with bullish momentum, slicing through $3.35 and aiming for the Next Reversal Zone at $3.52–$3.60 (label 2).

This zone contains remaining liquidity, left uncollected from the previous impulse.

Price is likely to reverse or pause at this level again due to heavy supply.

📌 Key Tip: If price reaches that zone without significant resistance or exhaustion, it may signal continuation potential with minor corrections.

💼 Strategic Trade Plan (High-Probability Setup)

Entry Zone: $3.20 – $3.28 (Reversal Area)

Stop-Loss: Below $3.15 (beneath structure + QFL base invalidation)

Target 1: $3.35 (Central Reversal Zone)

Target 2: $3.52–$3.60 (Liquidity Completion & Next Reversal Zone)

🧮 Risk-Reward Estimate:

Conservative: 1:1.8

Aggressive: 1:2.5 or better if price reaches high liquidity zone.

🔄 MMC Flow Summary – What the Market Makers Are Doing:

Create a trap at the top (collect liquidity and fake the trend)

Force price down into demand (scare retail + grab stops)

Absorb sell orders in bulk at QFL/demand zone

Form bullish reversal pattern (positive structure)

Push price upward again, aiming for uncollected liquidity above

📌 This is a classic MMC cycle — engineered by large players, and now you’re aligned with their strategy.

🧠 Why This Matters

This chart isn’t just about entry and exit; it’s about understanding the underlying psychology and structure. By aligning with the smart money footprint — QFL, supply absorption, and liquidity targeting — you're maximizing edge and minimizing guesswork.

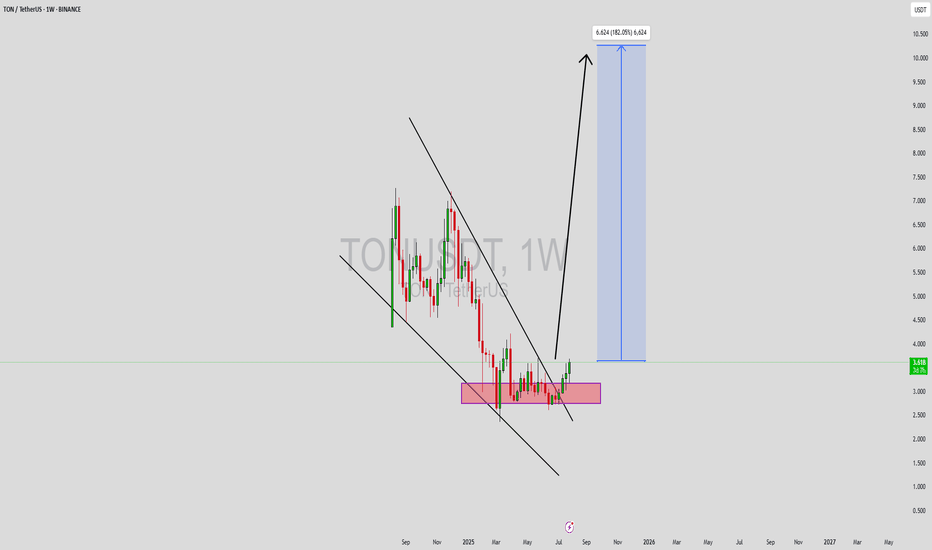

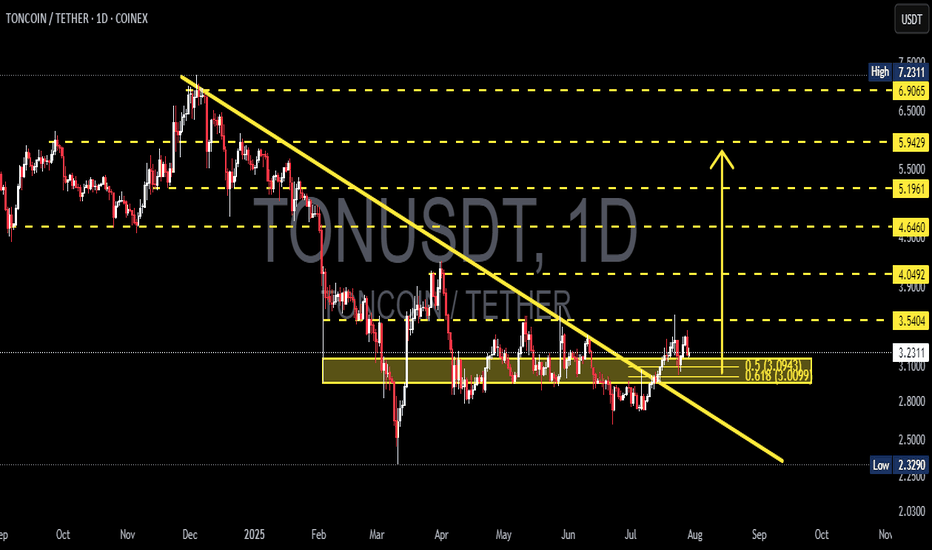

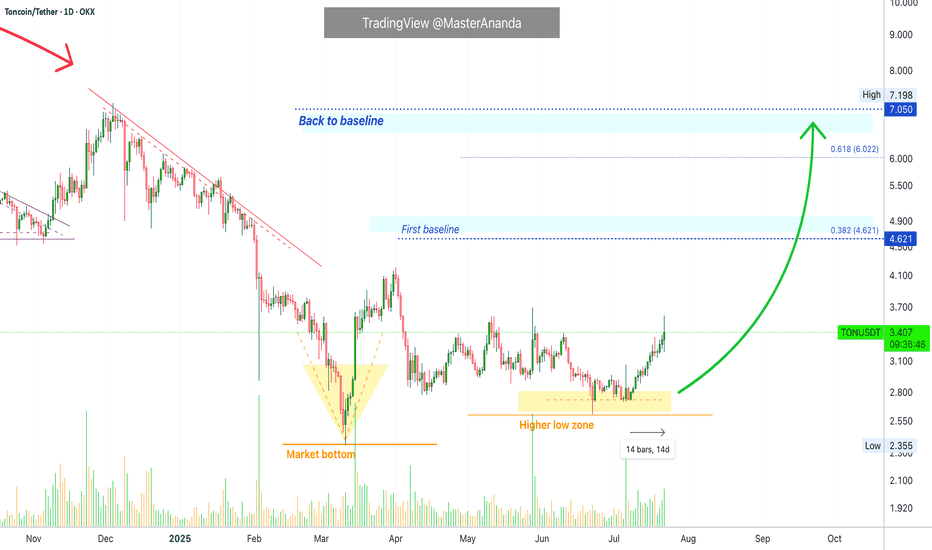

TONUSDT Breaks Out of Bearish Grip! Is a Bullish Rally?🔎 1. Key Pattern: Descending Trendline Breakout + Reaccumulation Zone

After months of downward pressure, TONUSDT has successfully broken above a dominant descending trendline that has been acting as resistance since December 2024.

✅ This breakout occurred with a strong bullish candle and aligns perfectly with a significant historical resistance zone (around $3.00–$3.12).

📌 The area also overlaps with the Fibonacci retracement levels (0.5–0.618) — a zone where trend reversals often occur.

This indicates that the move isn't just noise — it might be the start of a mid-term bullish trend.

---

🧱 2. Consolidation Box = Reaccumulation Zone

TONUSDT spent nearly 4 months ranging sideways between $2.80 and $3.20, forming a clear reaccumulation range.

🔁 This kind of price action often precedes a strong breakout, as smart money accumulates before the next leg up.

🟨 This box now acts as a critical demand/support zone for any potential pullbacks.

---

📏 3. Key Levels to Watch (Support & Resistance)

✅ Bullish Targets (Resistance Levels):

🔹 $3.5404 → Immediate resistance

🔹 $4.0492 → Major resistance to break

🔹 $4.6460

🔹 $5.1961

🔹 $5.9429

🔹 $6.9065

🔹 Local High: $7.2311

🔻 Support Levels:

🔸 $3.1248 – $3.0099 → Key Fibonacci support (0.5–0.618)

🔸 $2.8000 → Bottom of reaccumulation range

🔸 $2.3290 → Major support (also the cycle low)

---

📈 Bullish Scenario (Primary Bias)

If price holds above the key zone at $3.00–$3.12, we could see:

A move towards $3.54 USDT

Breakout above $3.54 opens the door to $4.05 → $4.64 → $5.19 and beyond

A clear structure of higher highs and higher lows confirms trend reversal

Momentum remains strong as long as price respects the breakout zone.

---

📉 Bearish Scenario (Alternative Case to Watch)

If price fails to hold above $3.00 and breaks back below $2.80:

This would suggest a false breakout

Momentum may shift bearish again

Price could revisit the $2.32 support, negating the bullish setup

A return to sideways or even downtrend structure is possible

---

🧩 Strategic Conclusion

TONUSDT has broken out of a key descending trendline and reclaimed a strong structural zone, indicating early signs of a bullish cycle.

📊 Key Levels to Monitor Closely:

Support (validation zone): $3.00–$3.12

Immediate resistance: $3.54

Mid-term targets: $4.05 → $5.19 and higher

> As long as TON stays above the golden zone (Fibonacci 0.5–0.618), bulls have the upper hand.

---

📘 Pro Tips for Traders:

Watch for volume confirmation during retests

Be patient for pullback entries or breakout confirmations

Manage risk — don’t FOMO blindly

#TONUSDT #TONCOIN #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #CryptoTrading #TON #Reaccumulation #BreakoutSetup #FibonacciSupport #BullishReversal #TONBullish

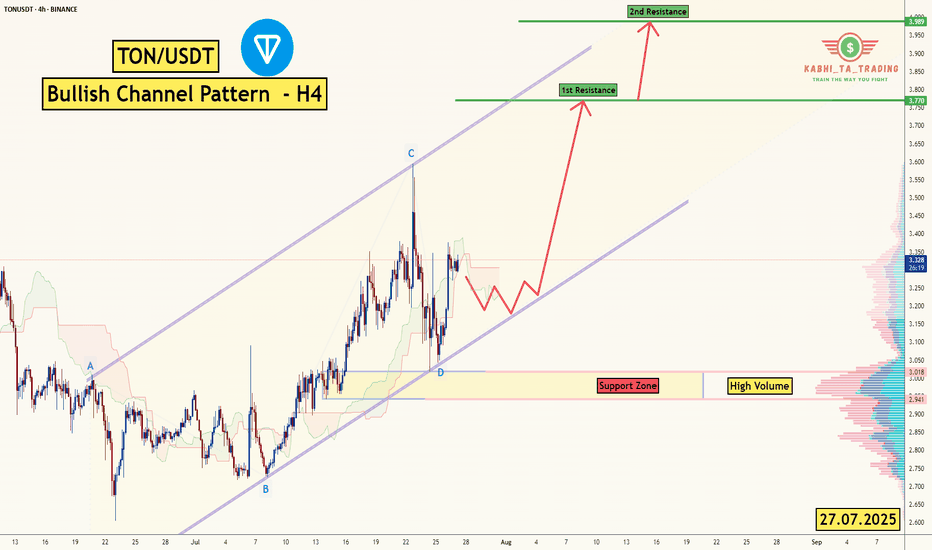

TON/USDT - Bullish Channel in H4 (27.07.2025)The TON/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3.770

2nd Resistance – 3.989

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

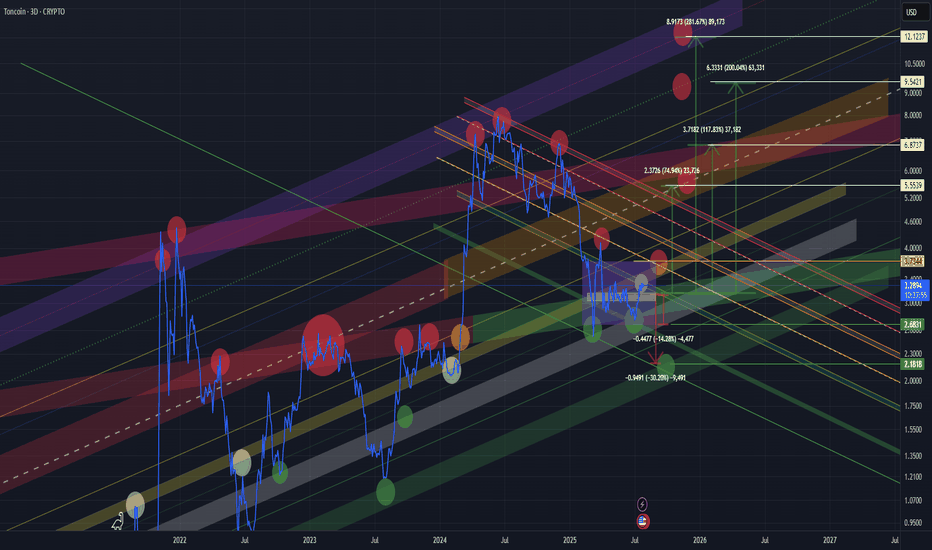

TONUSD TONUSDT TONCOIN mid- to long-termIn my view, we are still in the accumulation phase. The current price action and reactions at key levels suggest ongoing accumulation.

🔻 Bearish Scenarios:

In the short term, a retest of the lower boundary of the accumulation zone (purple box) is possible if the market weakens.

The worst-case scenario would be a move down to the lower green support zone, which has historically triggered strong bullish reactions. This is a critical demand area.

🔼 Bullish Scenarios:

A confirmed breakout and hold above the white line (within the purple box) would signal strength and a potential move higher.

We would then likely see a retest of the upper boundary of the accumulation zone.

A breakout and consolidation above the yellow line would open the door for a move toward the wider yellow channel, which could act as a final target zone

🚨 High-Risk Zone:

The yellow channel might represent the final phase of the current move.

From there, we could see either a sharp correction

Or, if trend strength and macro conditions allow, a continuation towards a new ATH (purple line).

📌 📌 📌 :

All marked lines and zones represent key support and resistance levels.

Price reaction at these areas will be crucial for decision-making.

As always, risk management and trend confirmation are essential.

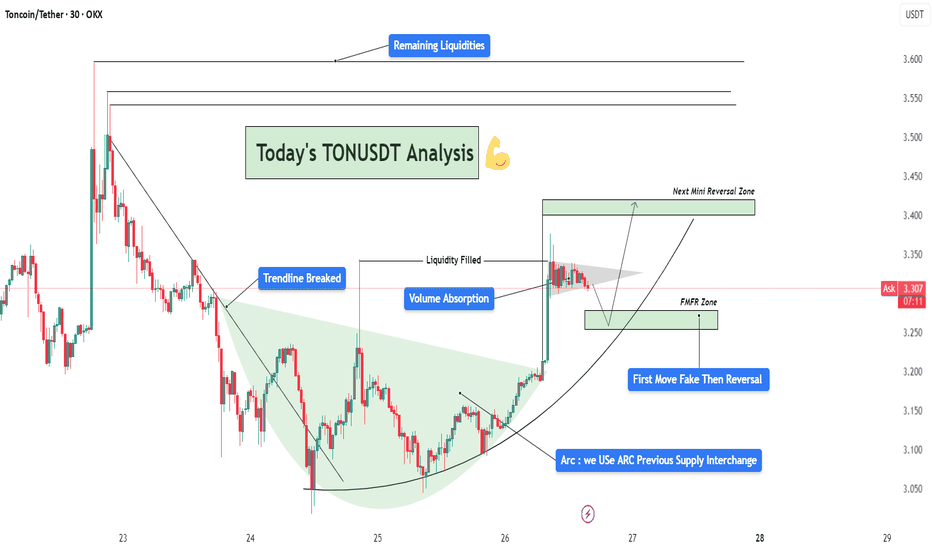

TONUSDT Analysis – Trendline Breakout | Liquidity| Arc + Target📈 Chart Summary:

The TONUSDT 30-minute chart presents a clean smart-money setup after a trendline breakout, volume absorption, and liquidity fill, supported by a beautifully formed ARC accumulation pattern. This structure hints at institutional involvement and a strategic roadmap for the next probable moves.

🔎 Technical Components Breakdown

1️⃣ Trendline Breakout – Shift in Structure

Price had been following a descending trendline with multiple touches, establishing bearish market structure.

Eventually, that trendline was violently broken to the upside, signaling a change in character (CHOCH) – one of the first signs of a potential bullish reversal.

The breakout candle was strong, with a wide body and notable bullish volume. This often indicates institutional interest or engineered breakout via a stop-hunt.

2️⃣ Volume Absorption – Smart Money Accumulation

After the breakout, the price didn't immediately rally. Instead, it consolidated with wicks on both sides – a sign of volume absorption.

This is where smart money absorbs opposing orders, typically absorbing sellers before a larger directional move.

This consolidation confirmed the idea of liquidity engineering – they trap liquidity (shorts) and use it as fuel.

3️⃣ Liquidity Filled – Stop Hunt Behavior

A sharp wick into previous highs grabbed resting liquidity, filling orders and sweeping stop losses.

This action invalidated weak resistance, setting up the platform for a larger move.

🧠 Conceptual Structure – ARC Play & Reversal Dynamics

✅ ARC Formation – Rounded Accumulation Base

The light green arc highlights the rounded bottom, a common technical pattern representing accumulation over time.

This kind of base often indicates that smart money is building positions silently, especially after a significant downtrend.

In this context, the ARC acts as a dynamic support, and the structure mimics the reversal of market sentiment from bearish to bullish.

🌀 FMFR Zone – “First Move Fake, Then Reversal”

Labeled FMFR zone between 3.22–3.26 signifies a potential trap setup.

The expectation is a manipulated downward move (fakeout) that will be quickly reversed, catching breakout sellers off-guard.

Smart traders can use this as a high-probability re-entry zone by waiting for wick rejection, engulfing candles, or bullish divergences.

📍 Short-Term Targets & Zones

🟩 Next Mini Reversal Zone – 3.38 to 3.42

This is a probable area for minor pullback or distribution, especially for scalpers or short-term trades.

Price may stall here due to earlier supply and psychological round levels.

🟦 Remaining Liquidity Zones – 3.55 to 3.63

Higher timeframe liquidity remains uncollected above.

If bullish momentum continues with support from volume and structure, expect price to sweep these levels next.

These zones are ideal for medium-term swing targets.

🧾 Trade Setup Idea (Not Financial Advice)

Item Details

Entry On rejection/confirmation within FMFR zone (3.22–3.26)

Stop-Loss Below arc support or structural low (3.18 area)

TP1 3.38 (Mini reversal zone)

TP2 3.55 (Liquidity target 1)

TP3 3.63+ (Extended target)

📘 Market Psychology in Action

Fear/Greed Play: Initial selloff invited fear, smart money accumulates quietly via the arc. Fakeout traps greed and late shorts.

Trap-Reversal Model: FMFR zones exploit retail stops, offering entries for institutional players.

Liquidity Mapping: The chart clearly maps how price is attracted to uncollected liquidity zones – a classic order flow approach.

TONUSDT continue up!Looking for an Impulse Up – TONUSDT Outlook

TONUSDT is showing momentum to the upside as it continues its current structure, possibly developing another impulsive leg.

It’s important to follow your own trading plan and maintain proper risk-reward (RR) discipline.

This idea is shared for educational purposes only to support your learning.

Got questions? Feel free to drop them in the comments!

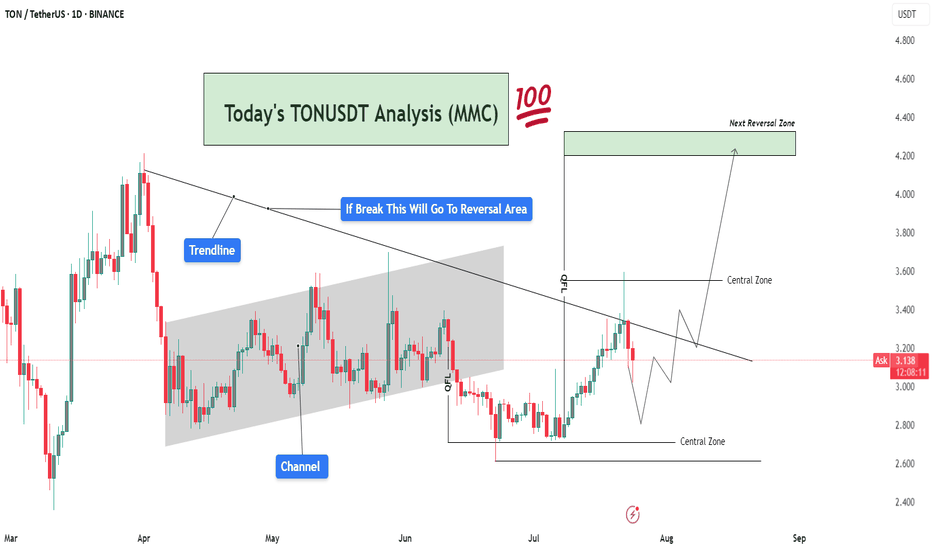

TONUSDT Analysis – Trendline Breakout Target To Reversal Area🧠 Market Sentiment & Context:

TONUSDT (Toncoin vs USDT) is currently trading at $3.13, showing signs of compression within a well-defined MMC structure. After forming a clear QFL (Quick Flip Level) base, the market is approaching a decisive breakout level, with a strong rejection or breakout likely in the coming days.

This chart displays confluence from trendlines, channel breaks, central zones, and QFL demand zones, providing multiple layers of structure-based decision-making. Here's a deeper dive 👇

🔍 Technical Breakdown – What the Chart Is Telling Us:

🔸 1. Major Trendline Resistance – Bearish Control Zone

The descending trendline drawn from prior highs is acting as dynamic resistance.

Price tested this line recently and faced rejection, showing that sellers are still active.

However, the consolidation below the trendline suggests accumulation, not panic selling — a classic sign of smart money positioning before a breakout.

🔸 2. Previous Channel Structure – Broken & Retested

The price previously moved inside a slightly rising parallel channel, reflecting a slow and steady bullish phase.

The channel has now been broken, but TON quickly reclaimed structure via a strong bullish engulfing candle from the QFL base, hinting that this was a liquidity grab (stop hunt) before the real move.

🔸 3. QFL (Quantity Following Line) – Institutional Demand Zone

The QFL base at around $2.85–$3.00 was created after a swift sell-off followed by immediate bullish response.

This is a high-probability MMC reversal structure, where large buyers typically enter.

Since this QFL held firm, it has created a solid foundation for bullish momentum, provided the trendline is eventually broken.

🧭 What's Happening Now – Price Action Update:

Price is caught between two major Central Zones:

Lower Zone: $2.85 – $3.15 (Support)

Upper Zone: $3.50 – $3.70 (Resistance)

The current movement shows price creating higher lows, indicating bullish pressure building beneath the trendline.

Volume remains low, which means the market is waiting for a catalyst (news or breakout) before a directional push.

📌 Key Reversal Zone Ahead – Eyes on $4.20 to $4.40

If price breaks and closes above the descending trendline and crosses the upper central zone, we can anticipate a strong bullish move toward the Next Reversal Zone marked around $4.20–$4.40.

This zone has historical confluence as:

Previous strong supply zone

Psychological round number

Fibonacci extension alignment

This will likely be the profit-booking area for swing traders and early buyers from the QFL zone.

📈 Trade Scenarios Based on MMC:

✅ Bullish Scenario (High Probability If Breakout)

Price breaks the trendline → Pullback → Retest of $3.50–$3.60 zone

Bullish continuation to $4.20–$4.40 Reversal Zone

Ideal entry on retest after breakout

Stop-loss below $3.00

❌ Bearish Scenario (If Rejected Again)

Rejection from trendline leads to re-test of lower Central Zone

Breakdown of QFL level (~$2.85) would invalidate bullish setup

Potential drop toward $2.60 zone for liquidity sweep

🧠 MMC-Based Observations:

🔹 MMC Element 📍 Explanation

🔺 Trendline Key resistance from macro downtrend

🟩 Central Zones Neutral battleground for buyers/sellers

🔻 Channel Break Confirmed bearish momentum earlier, now tested

✅ QFL Strong base, showing early smart money entries

🎯 Reversal Zone High-risk area, expect volatility and profit-taking

📌 Strategic Summary:

Bias: Bullish (as long as price holds above $3.00)

Confirmation Needed: Daily candle close above trendline & $3.50 zone

Target 1: $3.85

Target 2: $4.20–$4.40 (main reversal)

Invalidation: Close below $2.85 (QFL loss)

🚨 Final Thoughts:

TONUSDT is showing clear smart money footprints via the QFL formation and trendline pressure. The setup is ideal for MMC-based breakout traders waiting for confirmation before entering. Volume spike + trendline break will likely spark the next impulsive rally.

Stay patient, and trade the reaction, not the prediction.

Toncoin Update · A Closer Look · Major Move in the MakingConsider this, Toncoin has been growing steadily for fourteen days straight. The growth is slow, steady and patterned, but it keeps on happening. Notice no strong sudden jump but still, straight up. This is how the bottom is missed.

At times, we buy and we are waiting for a sudden jump but this almost never happens. The way it works, in a bull market, we get a long drawn out build-up of bullish momentum. After weeks, or sometimes even months, of prices slowly rising, then we get the sudden jump. This is to say that we are getting close.

Toncoin will continue in this pattern for days, can be weeks or even months; but at one point, there will be a major advance producing such amazing growth. Consider Bitcoin Cash on the daily timeframe for an example.

There is one more thing we need to do but I will leave this for a different publication. We need to consider the true all-time high potential.

As you might be aware, we've been looking together at "conservative" and "easy" targets for the next high and bullish wave, we are leaving this approach behind. Now it is wise for us to consider 'true' potential, 'optimistic' and 'real' targets, the highest possible, etc. So we are going to be looking at how far up Toncoin can go in the coming years and months.

Your support is highly appreciated.

The action now indicates that a major move is in the cards for this pair. If you want to catch one of those waves where you see +100% or +200% within weeks, you can sit on your TON tokens, this will be it.

It is going to happen but keep in mind that patience is key.

After you buy you hold, wait long and the market takes care of the rest. The wait is worth it when you consider the amazing profits and results that can be achieved. You deserve the best.

Keep going; keep in insisting; keep trying, keep learning, keep pushing, keep growing. We are going to achieve our goals. If you stay around long enough, the market will give you exactly what you want.

Money? peace of mind? More time to do the things you like?

Not having to leave your home to work? It is possible with Crypto.

Thanks a lot for your support.

Namaste.

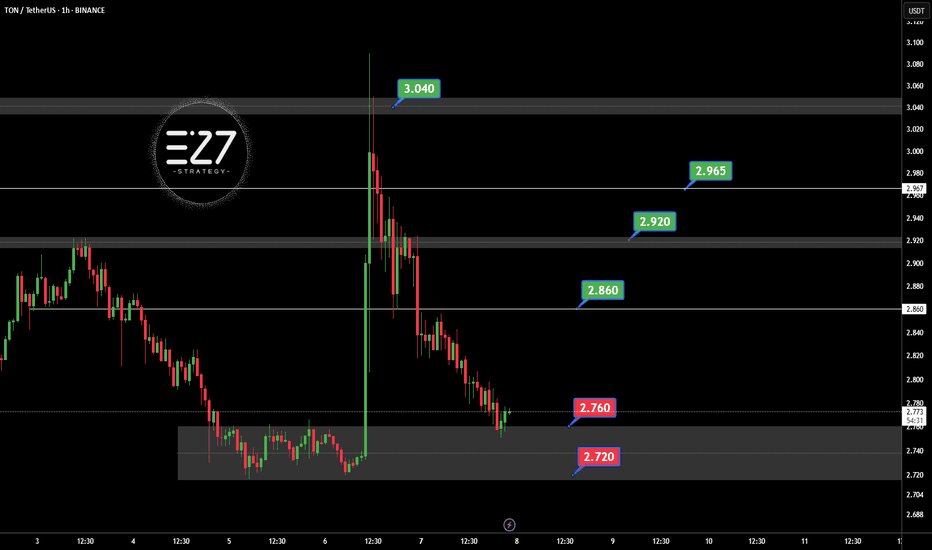

#TON Update #4 – July 18, 2025#TON Update #4 – July 18, 2025

Toncoin (TON) has completed its correction following the last impulsive move and is now pushing upward again. Technically, the next major target sits around the $3.35 level.

However, before reaching that level, TON faces a resistance at $3.27 — a level that has been tested multiple times in the past and may cause a temporary pullback.

On the TON/BTC pair, the price still hasn’t broken above the 200 MA band, which remains a limiting factor for bullish momentum.

For short-term traders:

Entry: $3.17

Target: $3.27

Potential Gain: 3%

This setup may offer a quick profit opportunity, but caution is advised.

TON/USDT : Get Ready for a new Rally! (READ THE CAPTION)By analyzing the Toncoin chart on the 3-day timeframe, we can see that the price has finally managed to grow over 3% as expected, and is currently consolidating above the $3 level. We’ll have to see how far this bullish momentum can continue — but to be honest, I expected a stronger move considering the market rally and Bitcoin repeatedly hitting new ATHs. Still, no worries — once Bitcoin takes a breather, altcoins will likely begin their powerful runs! Based on previous analysis, the next targets are $3.15, $3.63, $4.20, and $4.68 respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

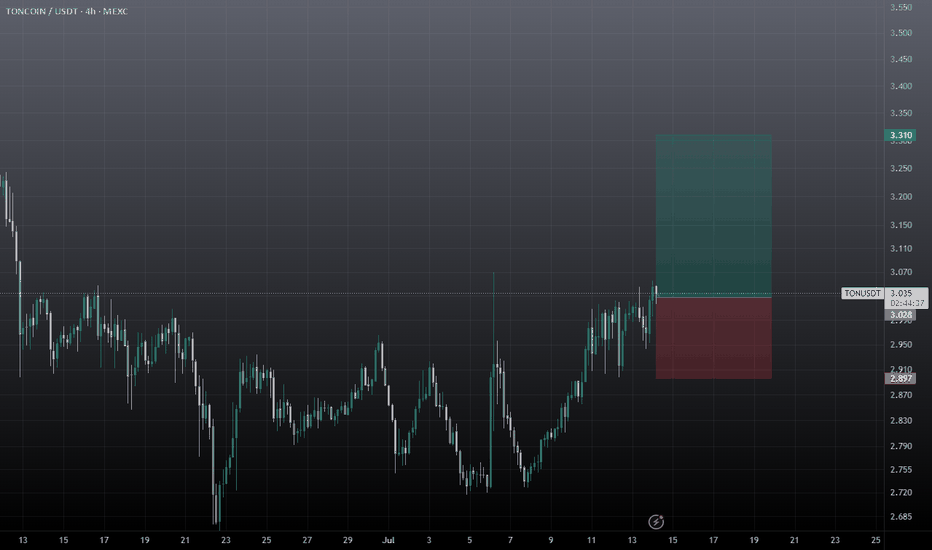

TONUSDT Following the official denial by UAE authorities regarding the possibility of obtaining a golden visa through staking OKX:TONUSDT , the bullish momentum driven by that rumor has faded. Selling pressure has increased, and TON is now consolidating within the key support zone of 2.720 to 2.760 USDT. If this support breaks, further downside is likely. However, if the price holds and reclaims the 2.860 USDT resistance, it could trigger a recovery toward 2.920 and 2.965 USDT. For now, the market sentiment remains bearish with a corrective bias.

Key Points:

UAE officially denied TON-based golden visa claims, weakening sentiment.

Current support zone: 2.720–2.760 USDT.

Key resistance: 2.860 USDT, then 2.920 USDT.

Break below 2.720 = further decline.

Break above 2.860 = potential bullish reversal.

⚠️ Please Control Risk Management in trades.