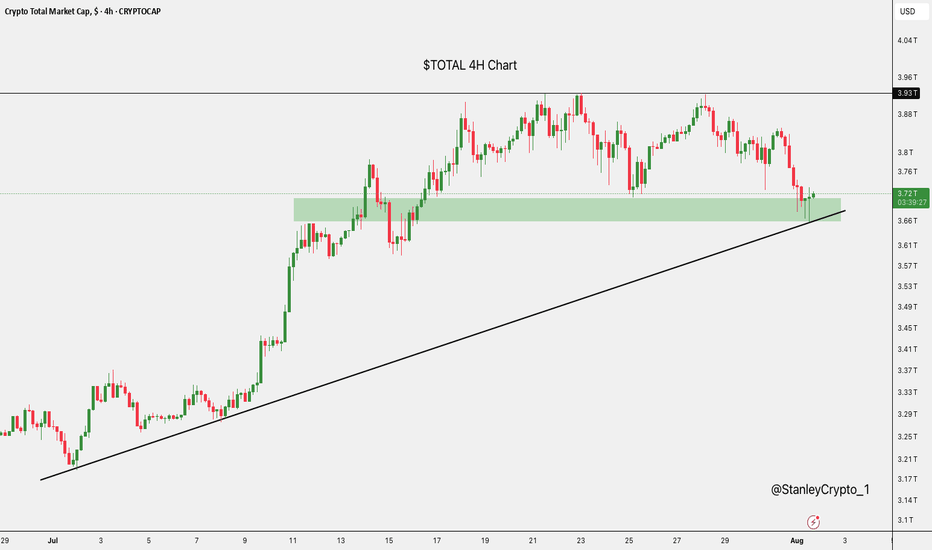

$TOTAL at Key SupportThe crypto market cap has just bounced off a strong support zone around $3.67T, right where it aligns with the rising trendline.

This area has held firm before, and it's doing the same now.

If it continues to hold, we could see a nice recovery.

But if it breaks down, there’s a risk of more downside ahead.

Totalmarketcap

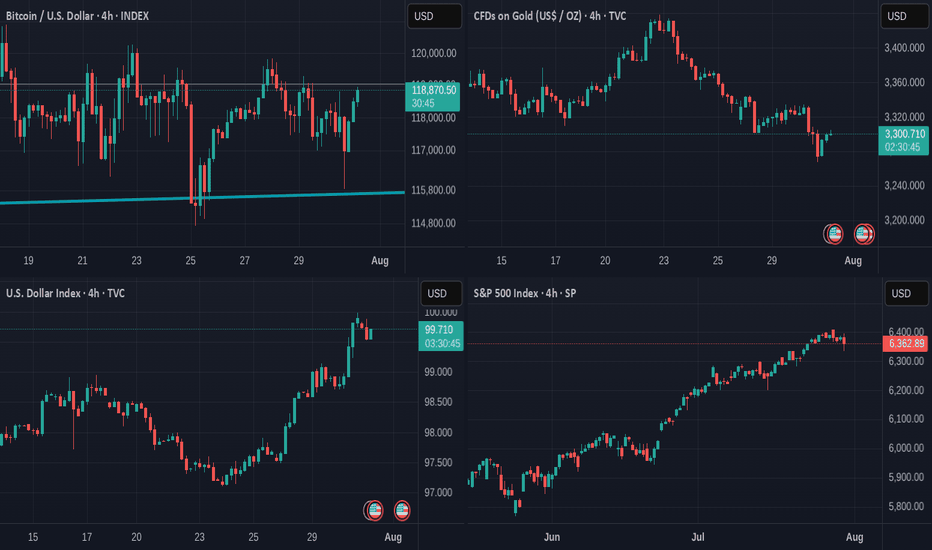

Has Bitcoin become a "SAFE" asset ? These charts show that......

After we heard the US Federal Reserve hold rates yesterday, Markets Fell some.

And Bitcoin joined them for a couple of hours but Look now.

While the $ falls, the S&P Falls, GOLD is the traditional haven of safety and we can see how it Rose in Value over the last 12 hours

The $ has Fallen over the last 8 hours

S&P Stalled for the last 24 hours

And the STRONGEST positive moves over the last 12 hours were from BITCOIN rising, though it is taking a breather for the moment.

SO, has it become a SAFE HAVEN ?

Put it like this. Bitcoin has NOT lost value like it used to when under pressure.

We have yet to see what would happen once it reaches its cycle Top. Will it retreat as it has historicaly...

But for now, it does seem to be a strong store of Value and remains with potential and likelihood of further rises.

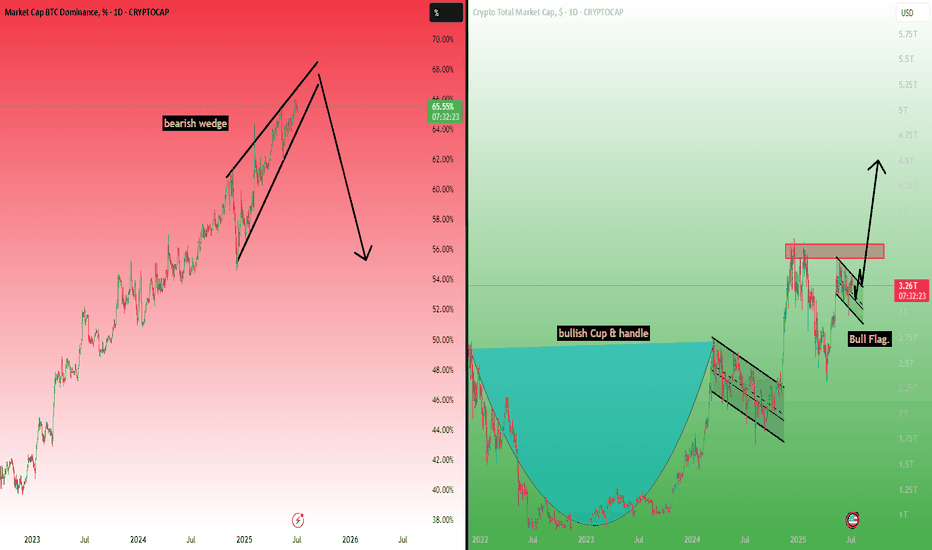

The TOTAL CRYPTO MARKET CAP chart below

This shows us that the investor market seems Very confident in the Crypto Market,,Just going from strength to strength.

The TOTAL 2 Market Cap chart shows us something very interesting.

The TOTAL2 chart is the Total Market Cap MINUS BITCOIN

Compare the 2 charts and you will see how the TOTAL chart has risen way over its previous cycle ATH but the TOTAL2 is currently being rejected off its previous ATH line.

This clearly shows us that BITCOIN is the strength in the Crypto Market.

It is the same story on the TOTAL3 chart ( TOTAL minus BTC & ETH )

It is the same on the OTHERS chart ( Top 125 coins minus top 10 by market Cap )

BITCOIN CARRIES THE MARKET

These are early days but the Future of Bitcoin does seem VERY good

So far this cycle, the largest retrace was -31%

This drop was NOT a sharp Drop over a short period of time. It was an expected and controlled drop over 112 days.

But the zoomed out version of that chart tells us something VERY GOOD

PA has risen above and Tested and held that line of resistance that had rejected PA at Cycle Top ATH in 2017 and 2021.

That is a HUGE move and we wait to see if we Hold and move higher away from this line.

SO, Is Bitcoin a Safe Haven ?

It is certainly looking more and more like it.

PA is secure, has held position well and is in Price discovery...slowly and with caution...but always moving forward.

The traditional 4 yeat Cycle would end in late Q4 this year and so we have to wait and see what happens then.

But Bitcoin PA has moved into New ground on so many fronts now.

The traditinal BEAR market may not appear, in which case, YES, Bitcoin could become a New SAFE HAVEN

Buy Bitcoin

Hold Bitcoin

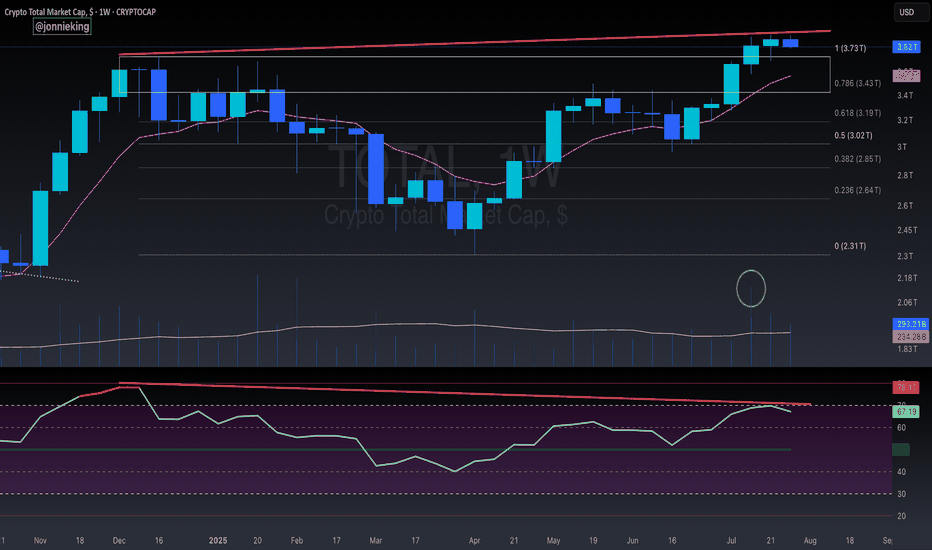

$TOTAL Market Cap Highest Weekly Close - Bearish Divergence?!Once again, highest Weekly Close on the Crypto CRYPTOCAP:TOTAL Market Cap ever.

PA continues to trend above the EMA9 and POI.

It’s worth noting Bearish Divergence on this local level.

I do not believe this is much to worry about however and have discussed this in prior analysis which I will post in the comments.

Strong Volume has shifted in the Bulls favor.

Bulls want to keep PA above $3.7T

Total #002 ( Look at the Future !!! )Hello dear traders.

Good days.

First of all thanks for your comment and support.

---------------------------------------------------

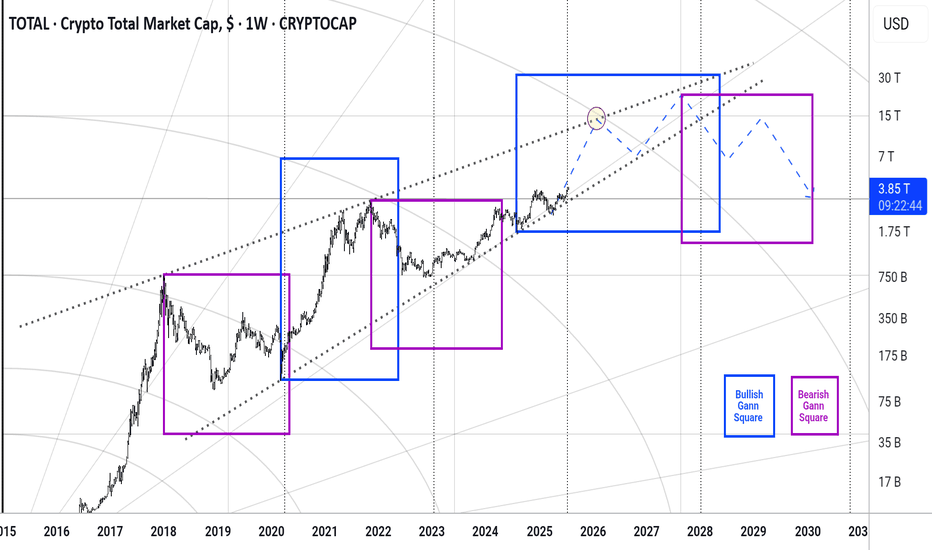

In beautiful rising wedge of total market cap , the total market in this month broken 0.5 monthly Gann Square price level which means will be ready for test and retest 0.618 for final round befor market collapse.

With refer to the daily Bullish Gann Square ( Blue Square ) and Bearish Gann Square it is expected to within a year market will grow fast .

Safe trades and good luck.

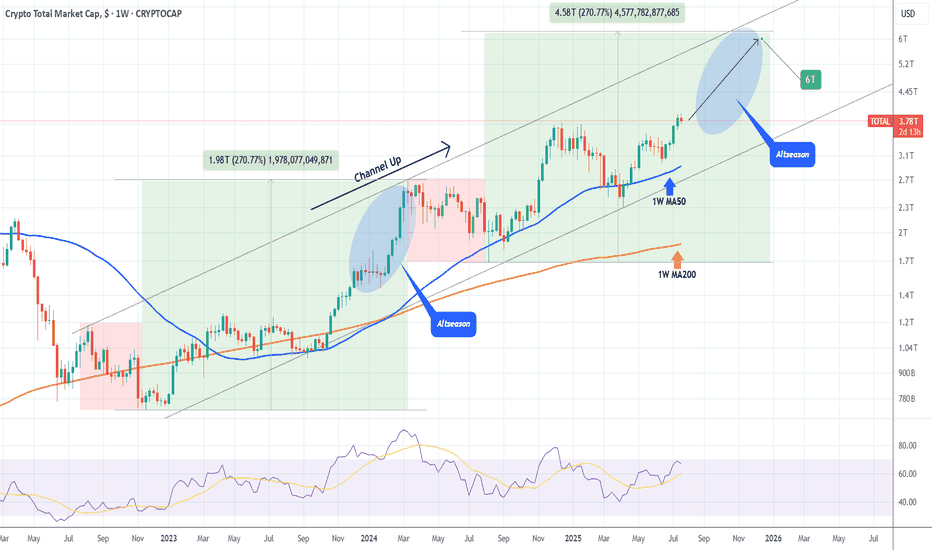

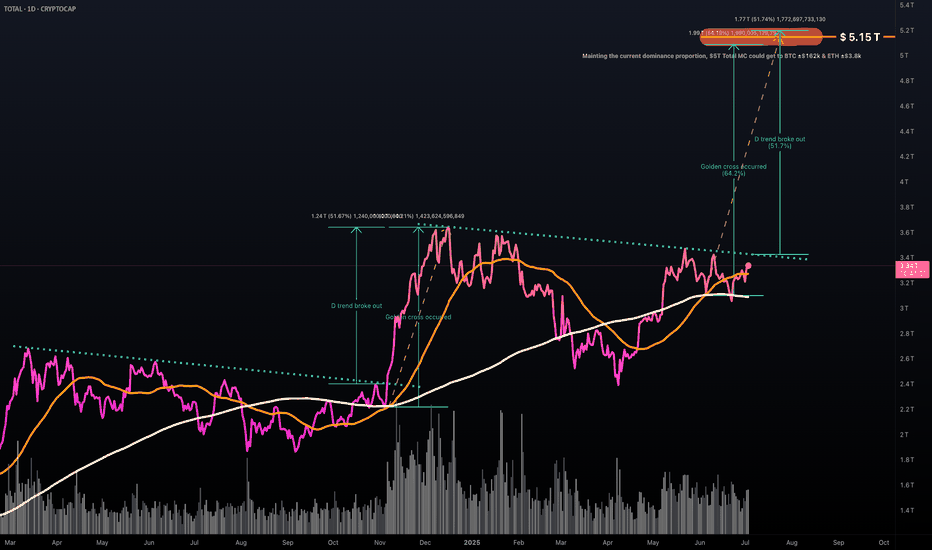

TOTAL CRYPTO MARKET CAP expected to hit $6 Trillion!The Crypto Total Market Cap (TOTAL) has been on a Channel Up since the 2022 market bottom and since the April 07 2025 Low (Higher Low for the pattern), it's initiated the new Bullish Leg, already turning the 1W MA50 (blue trend-line) into Support.

As long as this holds, we expect it to complete a +270% rise from the August 05 2024 Low, similar to the Bull Cycle's first Green Phase, and reach at least a $6 Trillion Market Cap!

More importantly, we expect this final part (blue ellipse) to be what is commonly known as an Altseason, where the lower cap coins show much higher returns and disproportionate gains to e.g. Bitcoin.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

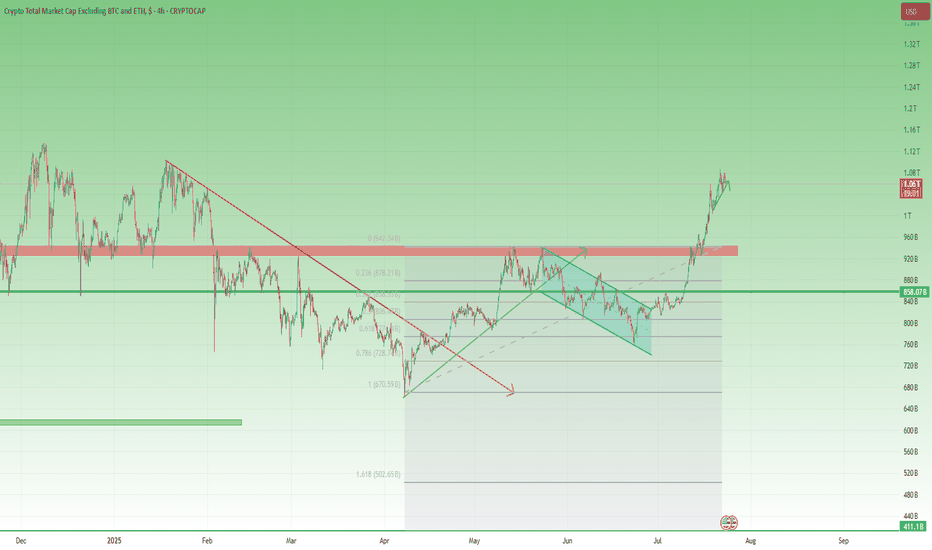

Total3 – Back Above 1T, but Will It Offer a Second Chance?📈 What happened since April?

After the sharp low in early April, Total3 began to recover steadily.

Toward the end of the month, it broke above the falling trendline that had been holding since January — a key technical shift.

This triggered a strong recovery rally, pushing total altcoin capitalization (excluding BTC & ETH) to the 930–940B resistance zone.

📉 Then came the pullback…

Price printed a double top near resistance, followed by a drop — but not a bearish one.

Instead, the correction was orderly, forming a bullish flag, with the low landing right on the 61.8% Fibonacci retracement. Classic healthy structure.

🚀 The latest breakout

Earlier this month, Total3 launched a very impulsive leg up, reclaiming the 1 trillion level with strength.

At the time of writing, we’re trading back above 1T, and momentum remains on the bulls’ side.

However, the chart does look a bit overextended in the short term, suggesting a correction could follow soon.

🧭 Trading Plan – Will We Get a Retest?

The textbook play would be to wait for a deep pullback toward previous support levels.

BUT – I don’t believe we’ll get a full retest of the breakout. Altcoins may stay elevated or correct only modestly.

Instead, I’ll be watching the 1T zone and slightly below — that’s where I’ll look to load up on interesting altcoins.

📌 Conclusion:

Total3 has broken structure, reclaimed key levels, and is showing classic bullish continuation behavior.

The market may not offer you the perfect entry — but small dips near 1T could be all we get before another move higher. 🚀

Be prepared. Don’t wait for perfection in a market because rarely gives it.

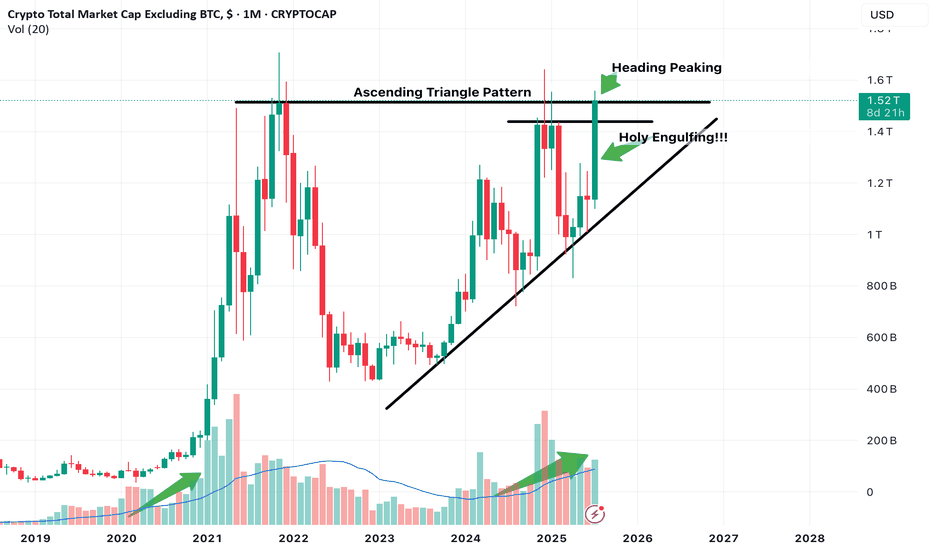

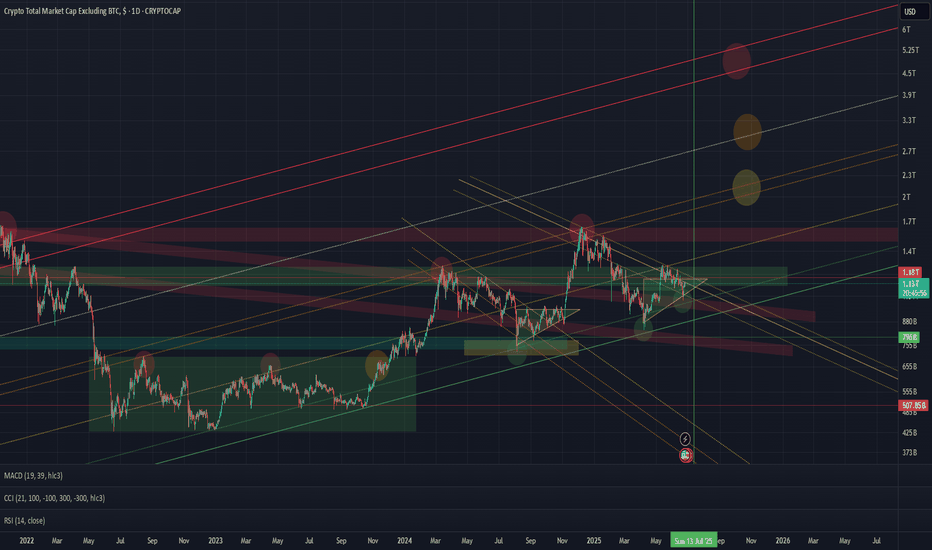

When Altseason? Clues in other chart Ex) #1Hi guys.

So Its no secret bitcoin has been ripping.

We are at new all time highs, and in full on price discovery mode.

I recently posted an ongoing macro analysis on ADA (Cardano) supporting my theory that it is one of the better alts to be investing in for alt explosion.

I want to look elsewhere to see if i can find supporting evidence that its time to invest or trade altcoins.

One chart that can be used is the Total Market Cap of Crypto excluding Bitcoin.

This chart showcases total altcoin market capitalization and its movements.

I believe certain Technical developments can really help us gauge at whats to come.

NOte this is on the 1 Month timeframe aka looking into Macro developments.

Just focusing on Candlestick action.

Notice we have been in this ascending channel trend, along with a potential Ascending triangle pattern development which if breakout occurs with confirmation can push Altcoin market cap higher indicating that liquidity is entering altcoins which indicates potential Uptrend.

The month of July so far is in position to print a massive engulfing Bullish candle, which is a great sign.

The upper part is also peaking its head above the Horizontal resistance line. Need to observe confirmation of this breakout. Look for it in smaller timeframes, ill look for it in the 3 day or 5 day.

We are also in position to print a higher high first time in a while.

Notice also Volume. We are seeing currently similar increasing volume as previous alt coin market cap expansion.

Keep an eye out on more posts to add to evidence that supports we are in the verge of potential altcoin season.

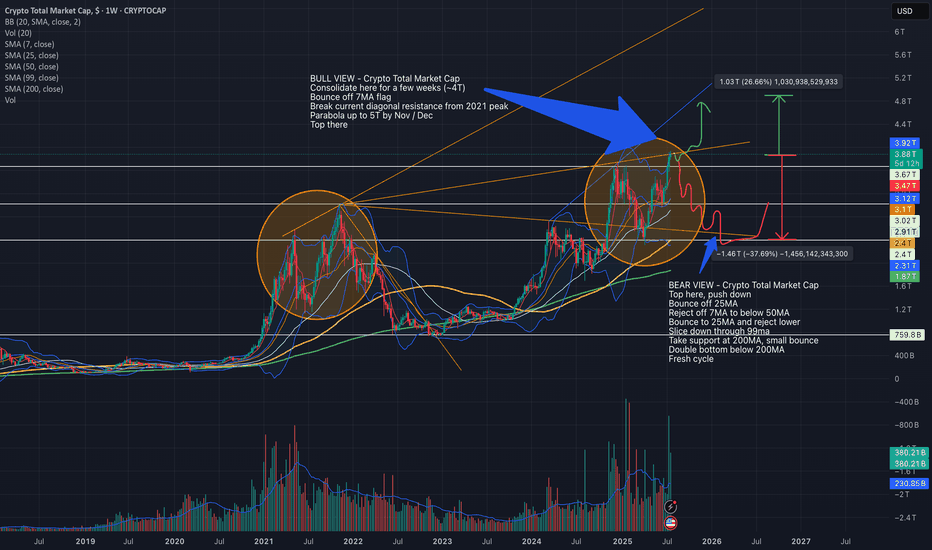

Bull and Bear Cases for Crypto Total Market Cap as of July 2025This chart outlines my views of where Total might go in the next few months - considering both Bull and Bear possibilities.

We are in a similar spot to 2021 peak at the moment, but still not as euphoric so it's a toss up as to which direction Total may move.

Current Total Market Cap - ~4T

Bull Case - Crypto Total Market Cap:

Consolidate here for a few weeks (~4T)

Bounce off 7MA flag

Break current diagonal resistance from 2021 peak

Parabola up to 5T by Nov / Dec

Top there

Bear Case - Crypto Total Market Cap:

Top here, push down

Bounce off 25MA

Reject off 7MA to below 50MA

Bounce to 25MA and reject lower

Slice down through 99ma

Take support at 200MA, small bounce

Double bottom below 200MA

Fresh cycle

These are just ideas. The future doesn't mimic the past but it does move in a mathematically sound manner. TA accuracy in forecasting can be affected by several real-world events, specially considering how volatile the world is at the moment.

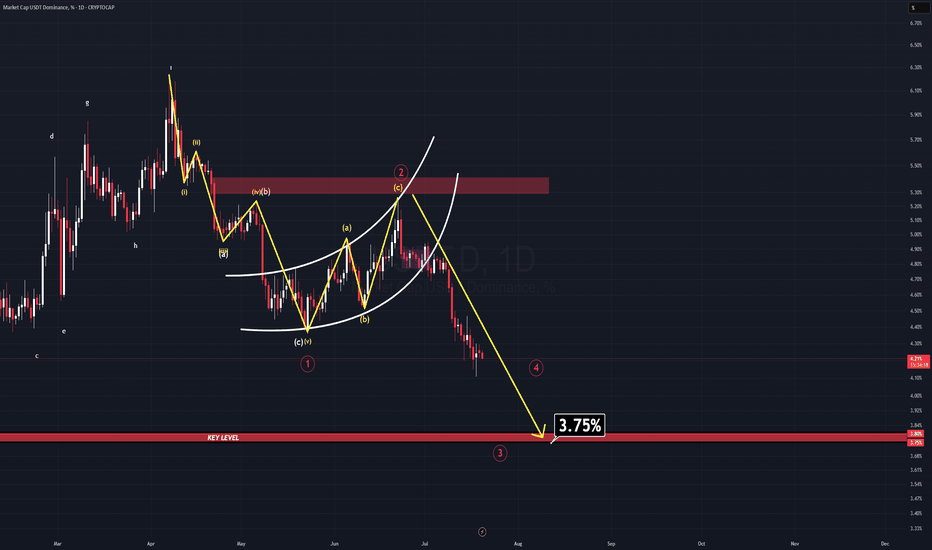

USDT DOMINANCE NEW UPDATE (1D)In a previous analysis, I mentioned that the long-term outlook for this parameter (USDT.D) remains extremely bearish. At the time, a bear flag was clearly visible—but it hadn’t been broken yet.

Well, now it has.

The breakdown confirms the bearish continuation, and there’s still more room to fall. As USDT.D continues to descend towards the projected target for Wave 3, we are likely to see a new All-Time High in Bitcoin, accompanied by a strong rally in many altcoins.

The main target for Wave 3 sits at 3.75%—a historically critical level. For years, USDT.D has never fallen below this zone, making it an extremely strong support area.

⚠️ Reminder: Consider taking profits when USDT.D approaches the 3.80–3.75% region. A reversal or temporary bounce is highly likely there.

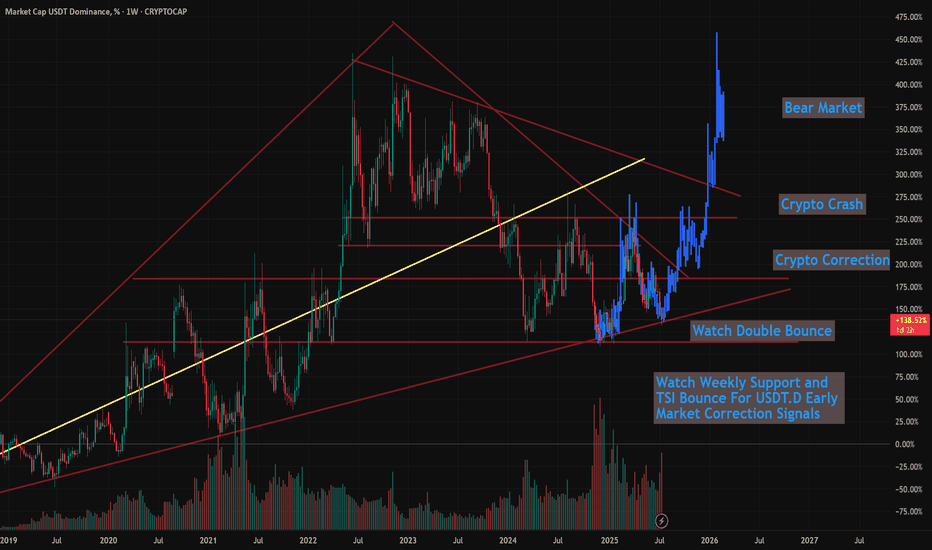

USDT.D Showing Troubling Signs of a Market Top SoonIn this video, I revist the USDT.D study I've talked about a few times before showing that when Tether Dominance comes down to this multi-year trendline support (since 2018), that's typically the beginning of a correction.

It's inversely related for obvious reasons. Money flowing out of Bitcoin and crypto flows into stablecoins (Like Tether), so when one is up and peaking, the other is down and correcting.

This video shows the relationship between both, and how we are likely setting up for a near term correction in the coming weeks.

My best guess is we continue to rally hard into early to mid-August, potentially getting close to $150k, followed by a 20-25% correction into September.

The BIG question is...

Will that mark the top, or will get a 2nd (and maybe 3rd) pump to $200k - $245k as my other models have been showing.

Let me know what you think!

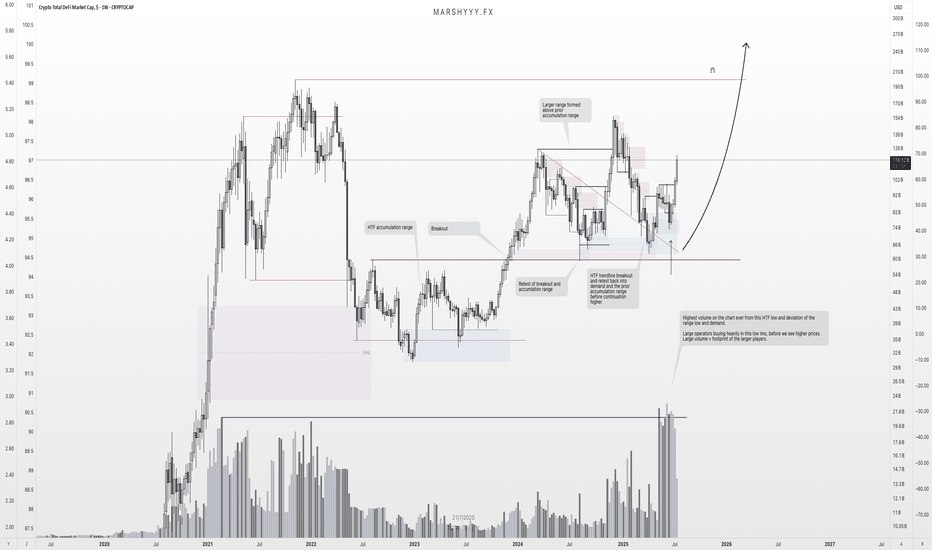

TOTAL DEFI: HTF Reaccumulation Underway — $200B+ In SightThis is one of the cleanest HTF setups in the market right now — and it’s flying under the radar.

We're looking at TOTAL DEFI market cap, and it’s showing all the signs of strong reaccumulation following a textbook breakout–retest structure off a larger HTF accumulation base.

Price broke out from the 2023–2024 accumulation range, retested that breakout zone and range highs in August 2024, swept liquidity, and tapped into unmitigated demand within the accumulation range — before climbing back to the $155B region, creating a larger range above the prior accumulation range it broke out from.

Since then, price pulled all the way back to range lows and HTF demand at $65B, forming a new bullish reversal from this key region and retesting the trendline breakout before continuing another leg higher — as we’re now seeing unfold.

But here’s the key:

🧠 That recent deviation came with the highest volume ever recorded on this chart — right off the range low and HTF demand.

That’s not retail. That’s large operators loading up, leaving their footprint ahead of the next expansion leg.

We’ve now:

- Broken the descending trendline cleanly

- Flipped key SR levels back into support

- Started pushing higher with strong HTF closes

📈 Expectation:

This is a spring + test setup within a reaccumulation range. I’m targeting continuation toward the range highs, followed by a macro breakout that could take DeFi market cap to $200B+ — especially once the prior distribution zone is reclaimed.

This aligns with the broader cycle narrative — liquidity rotating back into altcoins, particularly DeFi, as stablecoin dominance declines and the market shifts fully risk-on into the final phase of the bull cycle.

Key Structure Summary:

- HTF accumulation base → breakout → retest → demand sweep

- Largest volume spike = operator footprint

- Higher lows forming = market structure flipping

- Expecting expansion to $200B+ as trend continues

One to watch closely.

Don’t fade the volume. Don’t fade the structure.

Deep Dive Part III – The Next BIG Whale Play UnfoldsDeep Dive Part III – The Next BIG Whale Play Unfolds

📍In Parts I & II of this Deep Dive, we broke down the psychology of whale behavior — from “Buy the Rumors, Sell the News” to the critical breakout zones that echoed historical patterns.

🐋 Back then, we spotted the whales' playbook early. The strategy was simple:

Buy the Rumors – Sell the News.

🧠 But now, the script has changed.

“The trap is where you’re most bored… 🌴📵

Their exit — on your liquidity — comes when you’re least ready. 💰🏄♂️💼”

Let’s break this moment down into what’s really unfolding.

We are officially entering the next stage of the cycle — not just in price, but in psychology.

This is no longer just about charts.

This is about human behavior on autopilot.

Here’s what I see happening right now — broken into three truths:

1️⃣ People Are On Holiday 🌞

From my community to the broader market, the energy is low.

People are either sunbathing on a beach or mentally checked out.

The focus is not there. The reflex to take action is dulled.

📉 The trap is where you’re most bored… 🌴📵

💰 Their exit — on your liquidity — comes when you’re least ready. 🏄♂️💼🚀

We’re seeing it unfold now:

1. Set the Bear Trap

2. Trigger the FOMO (will be down the road, yes)

3. Exit on Liquidity (the closing act of the play)

🕶️ But when everyone is away or asleep, that’s when the trap is laid.

It’s during these quiet, lazy days that the big moves get built.

2️⃣ This is a Disbelief Rally 🎢

The market trained everyone with a rhythm:

pump ➝ dump, pump ➝ dump, pump ➝ dump…

So what happens now?

People don’t trust the breakout. They’re frozen.

“We’ll dump again,” they say.

Except… what if this time, we don’t?

That disbelief becomes fuel.

It becomes hesitation — and hesitation becomes missed opportunity.

3️⃣ Bears Are Shorting Into Strength 🧨

This is key. While retail is confused, the bears are pressing in hard.

Their shorts are adding fuel to the pump they don’t see coming.

That’s why I posted recently:

“Shorting isn’t the problem. Being a psycho bear is.”

It’s not about being bullish or bearish —

It’s about timing , discipline , and narrative awareness .

Whales love this moment.

They lure in shorts, set the trap, then ignite the breakout straight into FOMO.

🧠 The Game:

Set the Trap → Trigger the FOMO → Exit on Liquidity 💥

This is what you’re seeing on the chart.

Not just price action — psychological choreography.

🕰️ In 2020–2021, we saw the exact same structure.

Part I warned about early accumulation and baiting behavior.

Part II showed how whales manipulated expectations with layered waves of doubt.

Now in Part III — the explosion few are ready for.

Zoom into the chart and it’s all there:

The curve, the trap, the trigger… and yes — the Final Boss.

🎯 The Final Boss: 6.51T

That’s the ultimate liquidity zone.

If this cycle plays out, we’re headed toward it.

“Sell the Rate Cuts” will be the new “Sell the News.”

It’s not the headlines that matter — it’s who’s left holding the bag.

🔚 Final Thought

The real exit — the one that traps most of retail — will come not when you’re euphoric,

but when you’re still saying:

“Surely we must dump now…”

So stay sharp.

Trade the chart — but don’t forget to read the behavior.

One Love,

The FXPROFESSOR 💙

Part1:

Part2:https://tradingview.sweetlogin.com/chart/idea/VgMBPsp3/

The Bear Trap:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

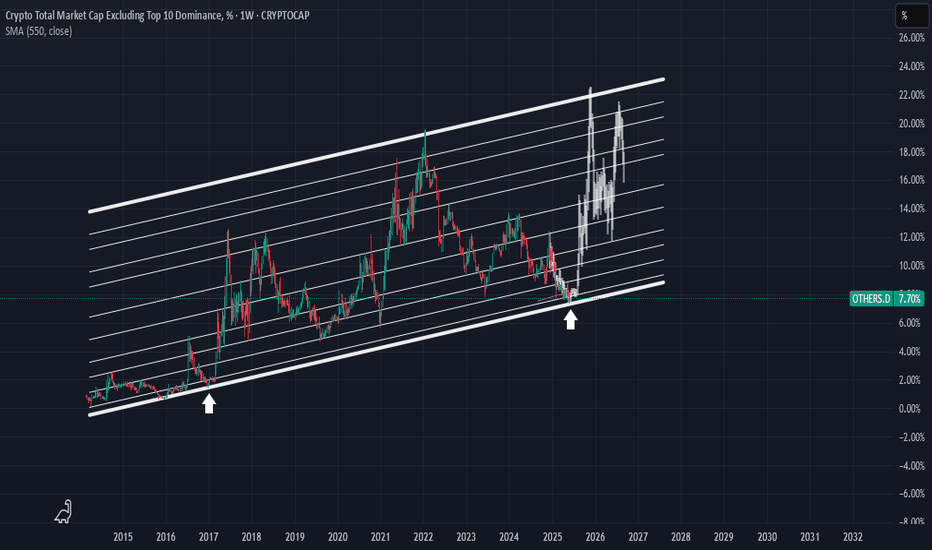

Do you believe in miracles?Others dominance is crazily undervalued way beyond anyone's imagination, it's been a crazy 4 year bear market for alts. Big question is, when will it end. Can't fathom this industry getting killed by exchanges, just look at others.d go man, crazy low.

If this were the equivalent to 2019/2020 and 2015/2016, any buy in this range is a one in a lifetime opportunity.

If this is like December 2016, well, that would save us years of struggle. Hard to tell what's going to happen but I still believe Trump will give us an extended bullrun that will peak when the FIFA world cup is on somewhere around July 4th 2026.

Great depression? this goes way beyond that, what more of a great depression do you want. Just brutal.

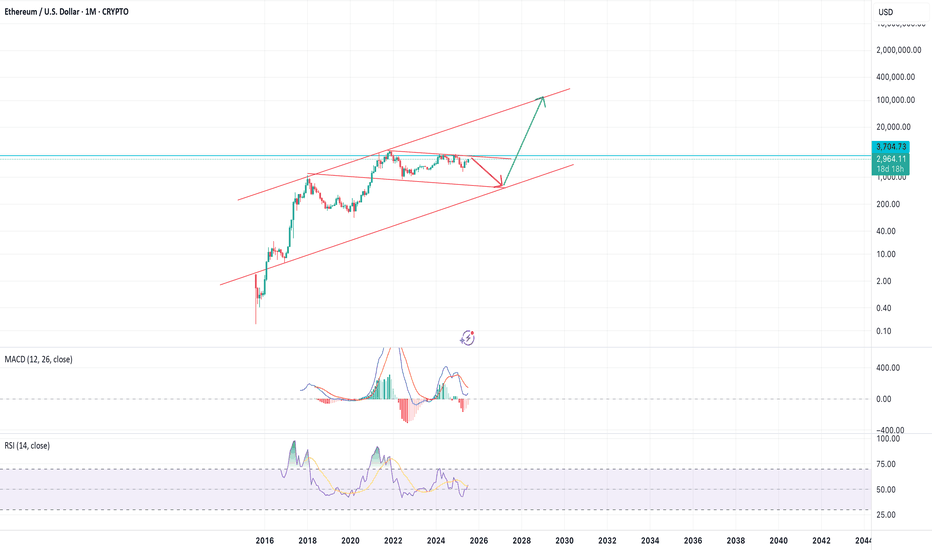

[CRYPTO] - Last Pump of the BULL CYCLE is ComingWe can see a highly organised bull cycle , with each multi-month consolidation wedge followed by a major leg upward, ending in breakout and continuation.

At the moment the CRYPTOCAP:TOTAL is breaking through the descending resistance again and ready to break thorough the 0.786 Fibo level as well - clear sign of the new up-rally beginning. Prior patterns (Q3 2023 and Q2 2024) led to vertical rallies , and the current structure suggests another leg may target the $6T+ zone in coming quarters.

What makes this different from past cycles is the underlying strength in Ethereum and other Altcoins. CRYPTOCAP:BTC.D has started to roll off highs, while projects like CRYPTOCAP:SOL , CRYPTOCAP:SUI and AI-related chains ( NYSE:FET , GETTEX:TAO , EURONEXT:RNDR ) are gaining TVL and developer traction. This is not just retail speculation—institutional capital is increasingly driving flows.

Moreover , Bitcoin ETF keeps getting huge daily inflows, the narrative of Coinbase including in S&P500 and Stablecoins velocity rising helps in spreading the crypto narrative between insituational & retail investors.

You can read more about why I expect a ton of money to inflow crypto in the next 6 - 12 months in one of the previous ideas: Again/

Overall , the chart structure, macro catalysts, and expanding adoption point toward a potential parabolic leg into late 2025 or early 2026. As long as the market holds above $3.3T, the breakout is valid and bulls are in control. The target is $5.5T —and possibly higher.

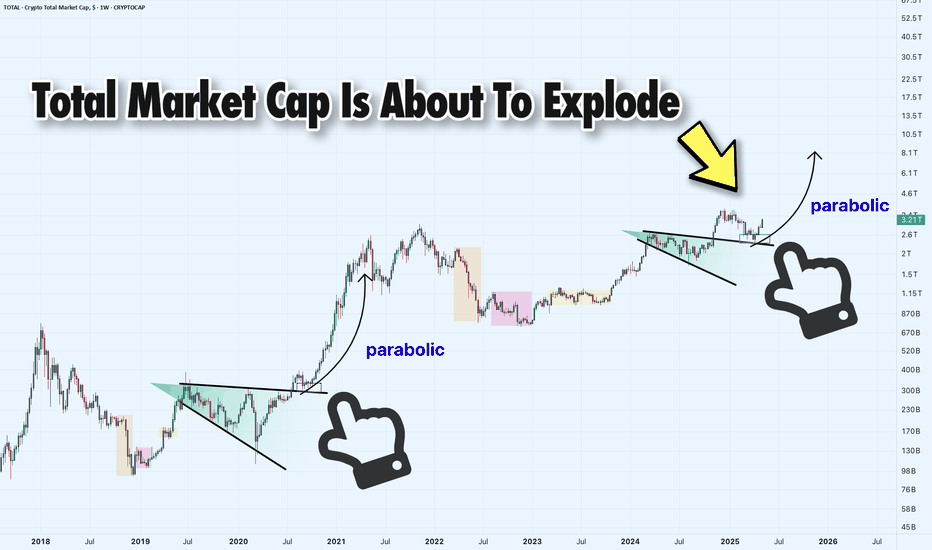

Total Market Cap Weekly Chart: Ready to Explode?Hey traders! Let’s dive into this weekly TOTAL Crypto Market Cap chart. The headline says it all— Total Market Cap Is About to Explode , and we’re here to break it down!

We’re seeing a massive expanding triangle formation, with the market cap currently at 3.21T , right at retest of triangle resistance. Historically, these patterns have led to parabolic moves — check out the 2019 - 2020 breakout! If history repeats, a breakout could send the market cap soaring toward 8.0T or even higher!

However, if the breakout fails, we might see a pullback to the previous level of support around 2T .

Key Levels to Watch:

Resistance: 3.66T (ATH)

Support: 2T

Breakout Target: 8.1T+

Breakdown Risk: 1.20T (latest strong resistance below 2.6T)

Is the market cap about to go parabolic, or are we in for a fakeout? Let’s hear your thoughts below!

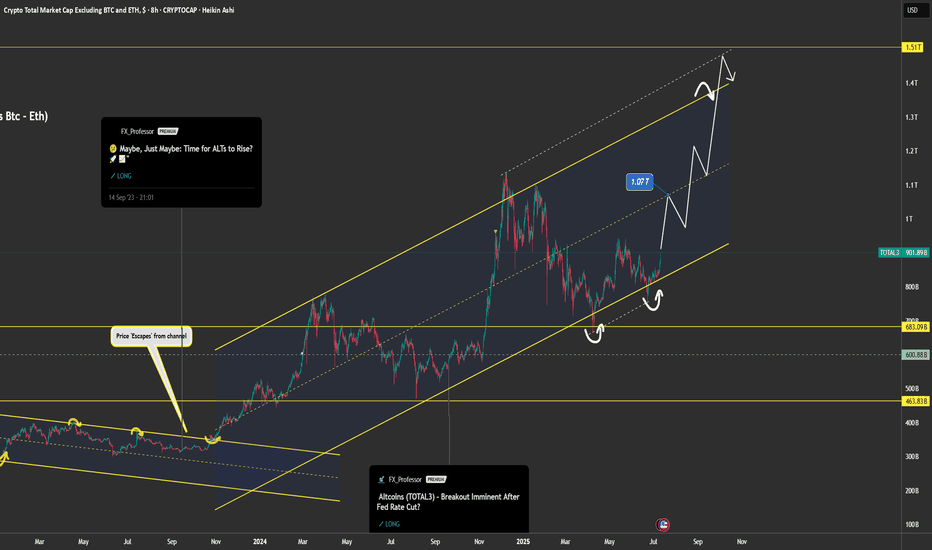

Altcoins Rise Again – Off to 1.07T and 1.51T?🌊🚀 Total Market Cap (excluding BTC & ETH) is showing strength again, pushing off support and heading back into the heart of the channel.

💥 The bullish structure has been respected beautifully:

✅ Double bottom near channel base

✅ Clean bounce and new higher low

✅ Momentum building on macro trend

📈 As long as this channel holds, we're eyeing the next targets:

🔹 Mid-channel target: $1.07 Trillion

🔹 Channel top extension: $1.51 Trillion

From the "Escape" back in late 2023 to the clean retest — it’s now about confirmation and continuation.

This could be the altseason move everyone forgot about...

🛑 Long bias stays intact as long as the bottom channel support is respected.

Time to respect structure over noise.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

BEARISH DOM + BULLISH CAP = ALT SEASONsimple TA analysis with simple arithmetic operation :

decline of bitcoin Dominance with the rise of market capitale = the season of altcoins and price explosions.

the year 2025 will be profitable, enjoy the summer

CRYPTOCAP:BTC.D CRYPTOCAP:TOTAL BINANCE:BTCUSDT INDEX:BTCUSD BITFINEX:BTCUSD COINBASE:BTCUSD

Crypto Tide Rising: Will TOTAL Market Cap surf past $5T?In November 2024 the crypto ocean was calm, hovering near $2.25T . Then, in a short time, fresh capital poured in, daily volume spiked, and the tide lifted us to $3.65T by mid-December .

Two bullish buoys popped up:

▶️ The daily down-trend snapped on Nov 4th, triggering a 51 % climb;

▶️ The 50-day MA (orange) crossed above the 200-day MA (white) on Nov 7th, after a 64 % rally.

Fast-forward to June 4th 2025 . Another Golden Cross has just flashed, and price is again nudging that descending trend-line. If History rhymes: the line breaks and momentum matches 2024’s move, the TOTAL MC could vault toward $5T .

Keeping today’s dominance ratios, that target implies roughly $162 k BTC and $3.8 k ETH . Add rising Global M2 and stablecoin liquidity, a supportive macro backdrop, and we may be staring at the next great crypto swell.

Will the market catch this wave or will macro headwinds keep the tide in check?

Not financial advice. DYOR, Arrr!

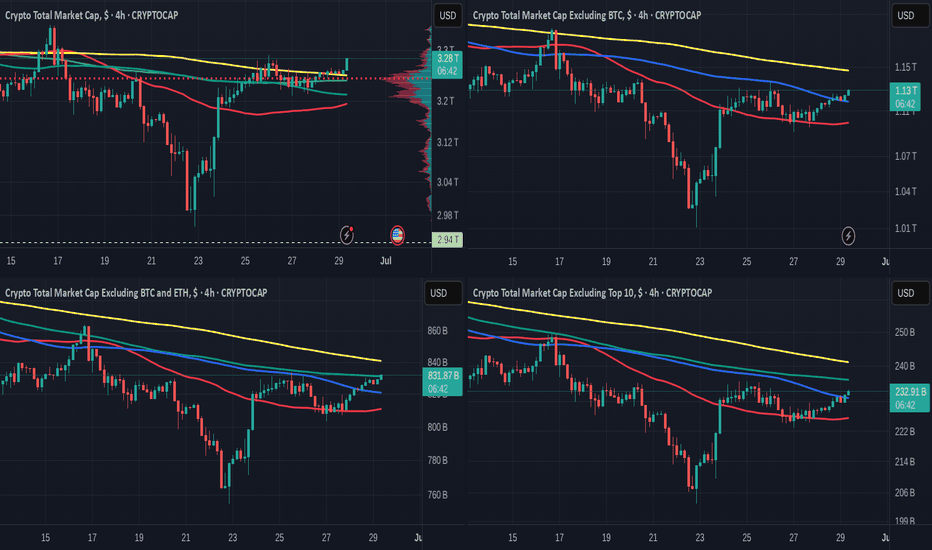

Really quick TOTALS charts - possible WARNINGS

It is Very clear when you look at these 4 charts

TOTAL - TOTAL2

TOTAL 3 _ OTHERS

The Top Left chart is the TOTAL chart and is the only one that includes BITCOIN and it is the ONLY one that is above all of its MA's

All of the other charts are heading into resistance on one or more MA's

ALT coins are sailing in to headwinds.

THIS DOES NOT MEAN THEY WILL GET REJECTEWD BUT IT OOES MEAN YOU SHOULD BE CAUTIOUS

Simple as that

TOTAL2, TOTAL MARKET CUP without BTCTOTAL2, TOTAL MARKET CUP without BTC

Reasonable targets are within the yellow zone — these are high-probability levels based on current price action, volume, and market structure. They offer the best risk/reward and are ideal for primary take-profit planning.

Targets outside the yellow zone are still possible but come with higher risk. They typically require extended time, increased volatility, or external catalysts. These should be treated as secondary or speculative targets, best approached with reduced size or active trade management.

Summary:

Yellow zone = high probability, balanced risk/reward.

Beyond yellow = lower probability, higher risk, use with caution.

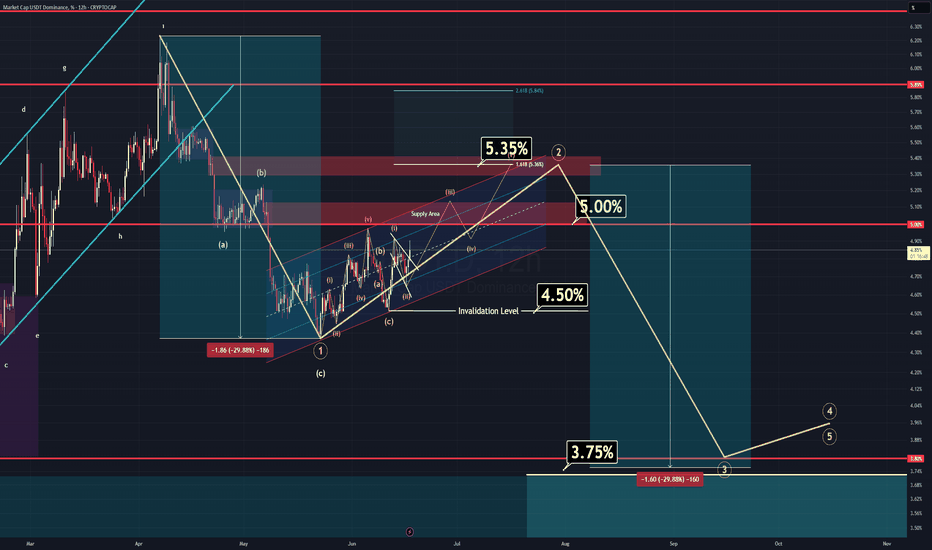

Do you wanna see the bigger picture? (USDT.D Analysis 12H)After counting many waves for many days, I have a senario for USDT dominance which will lead the entire market on its way.

For those whose not fimiliar with this parameter, there is a very simple explanation.

It's the reversed way to see the market. If this parameter drops, your alts will skyrocket and if it rises, you're gonna be crying on somebody's X post's comments.

First of all, the short term wiev is bearish. We are currently in an impulsive wave 3 which is expected to be hardest for altcoins at the moment. There will be crash unless the value of this parameter drops below %4.50 and invalidates the analysis (you'll like this senario better, trust me).

All right, we got rid of the scalpers who bothered to read this far and now I'm here to explain what I see for the golden future.

Currently, USDT.D is forming a BEARISH impulsive wave for higher time frames. As long as you stick with 4H candles, you won't be able to see it.

USDT.D is trying to forming its bearish flag, by doing so it will be its second wave and will prepare its very own collapse.

Last summer, BTC has done the same thing (Check for daily time BTC).

There is more.

If we calculate the depth of this incoming flag pattern, breaking this flag would lead USDT to %3.75 which is the yearly support (Check in weekly, you'll see it).

If we calculate the time needed to past for this flag to work, it's the same amount of time needed for previous flag to break from last summer.

We also need to add fundementals in it. Currently people started to talk about a senario which will lead world to WW3. I don't think that will happen. But the problem in here is it will market throguh downside.

Furthermore, there is FED.

FED is insisting to leave interest rates on its own without a change. I believe that we won't be seeing any rate cuts till the end of this summer.

I believe that the FED will cute rates between Agust and September. This will be the fuel for our rocket to fly and ignite the wave 3.

I know it's a long script but you know it's necessary.

Thanks for reading.