Market breakdown: SPY & Current TradesIn today’s update, I go over the general outlook on the indexes, focusing on SPY, Nasdaq, and Dow Jones — all still moving in bullish confluence. Even after three distribution days, there’s been no major downside move, but we are seeing drying volume, so caution is key.

I also break down some of my current trades:

A few aren't performing as expected, and that’s part of trading. We won’t win every setup, and that’s okay.

Red-marked trades have been removed from the watchlist and will be monitored closely for irrational moves. I may cut losses if needed.

Green-marked trades are still active and aligned with my criteria, so I’ll likely continue to invest in them.

Lastly, I cover a trade that recently hit my take-profit (TP), specifically KEROS, which has now also been removed from the list. ✅

Thanks for watching another one of my videos, I hope you gained value from the breakdown!

Comment below if you have questions or your own thoughts on the market.

Let’s grow together.

Tradebreakdown

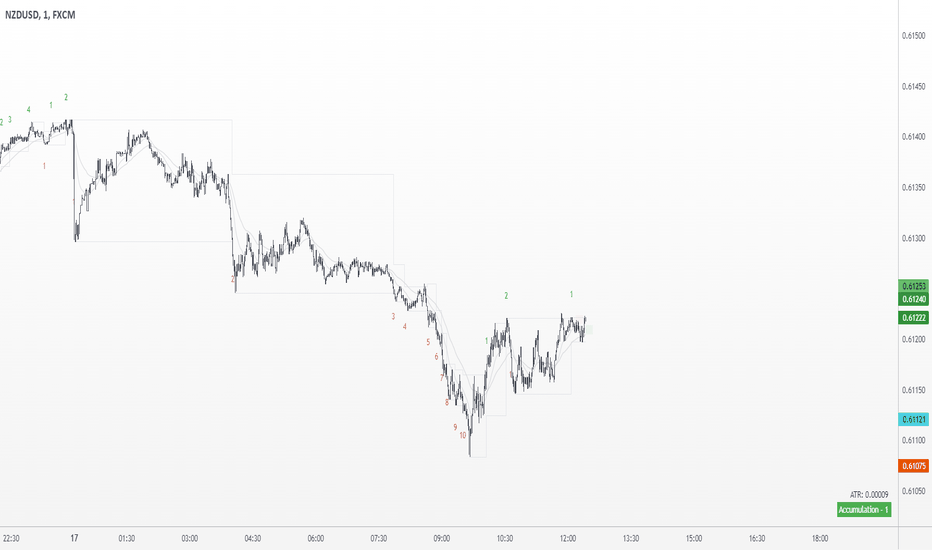

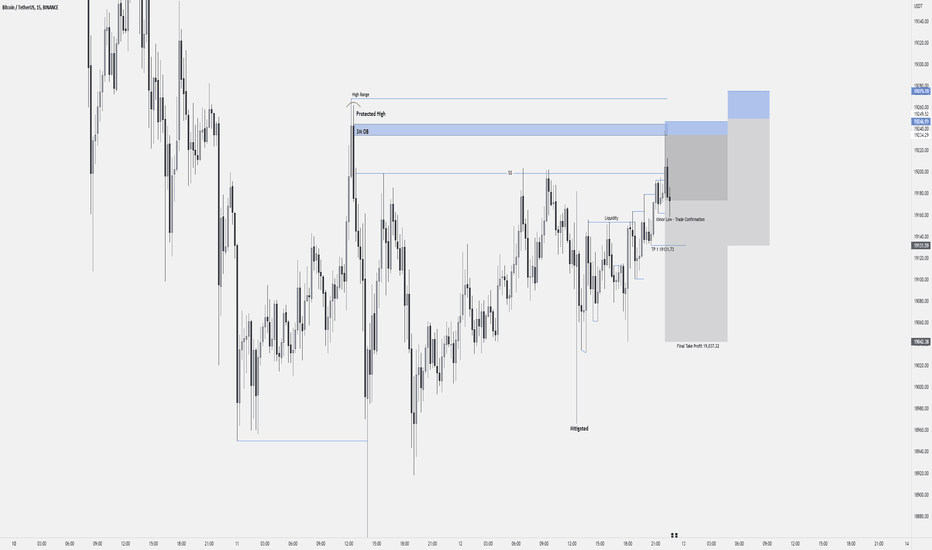

+4R Tricky NZDUSD BreakdownAnother trade breakdown

☝️Do not act based on my analysis, do your own research!!

The main purpose of my resources is free, actionable education for anyone who wants to learn trading and improve mental and technical trading skills. Learn from hundreds of videos and the real story of a particular trader, with all the mistakes and pain on the way to consistency. I'm always glad to discuss and answer questions. 🙌

☝️ALL ideas and videos here are for sharing my experience purposes only, not financial advice, NOT A SIGNAL. YOUR TRADES ARE YOUR COMPLETE RESPONSIBILITY. Everything here should be treated as a simulated, educational environment. Important disclaimer - this idea is just a possibility and my extremely subjective opinion. Do not act based on my analysis, do your own research!!

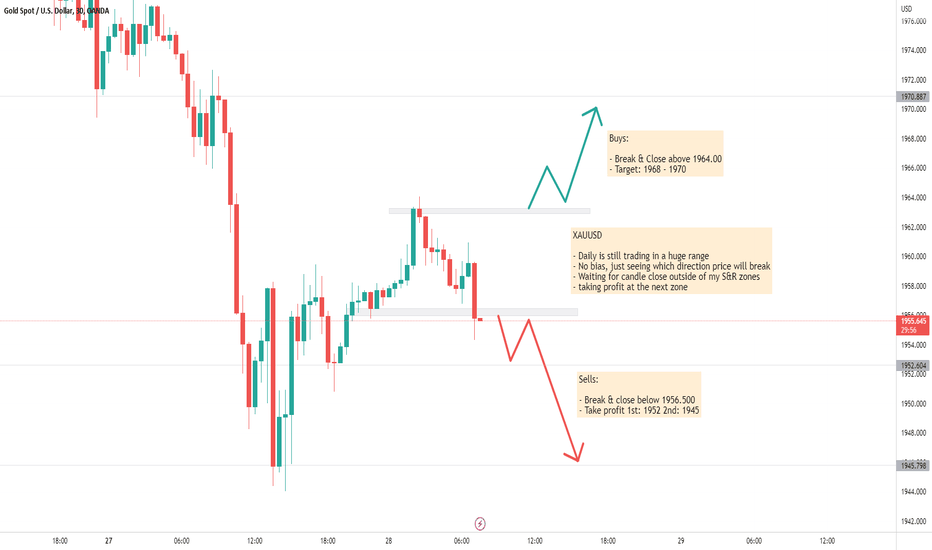

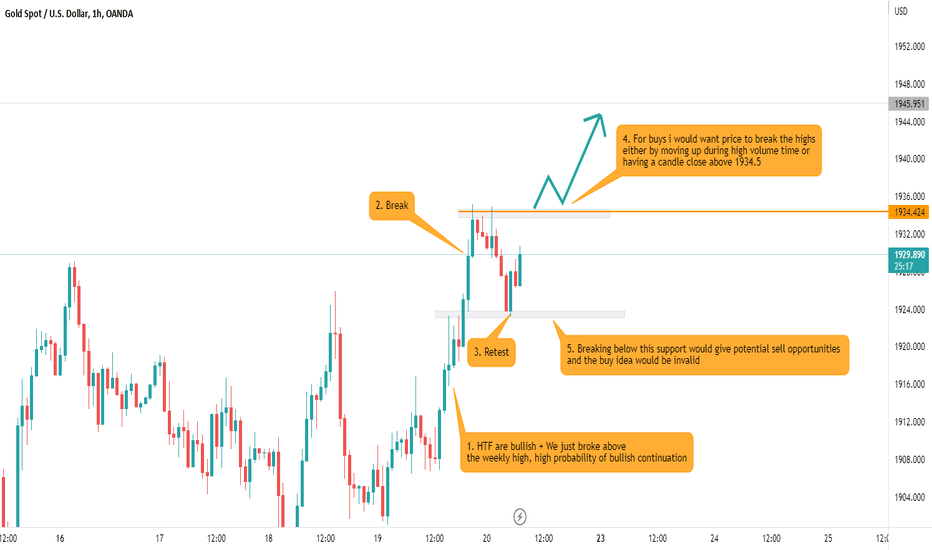

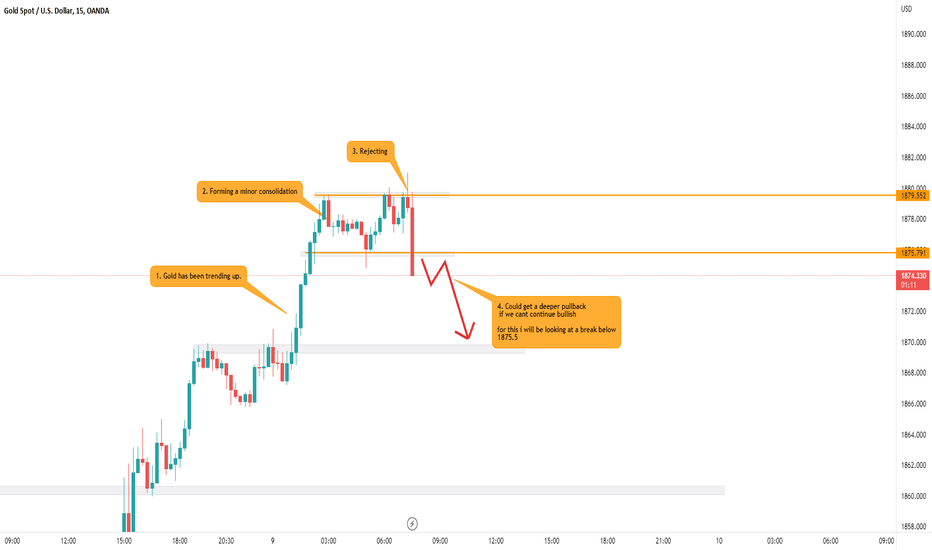

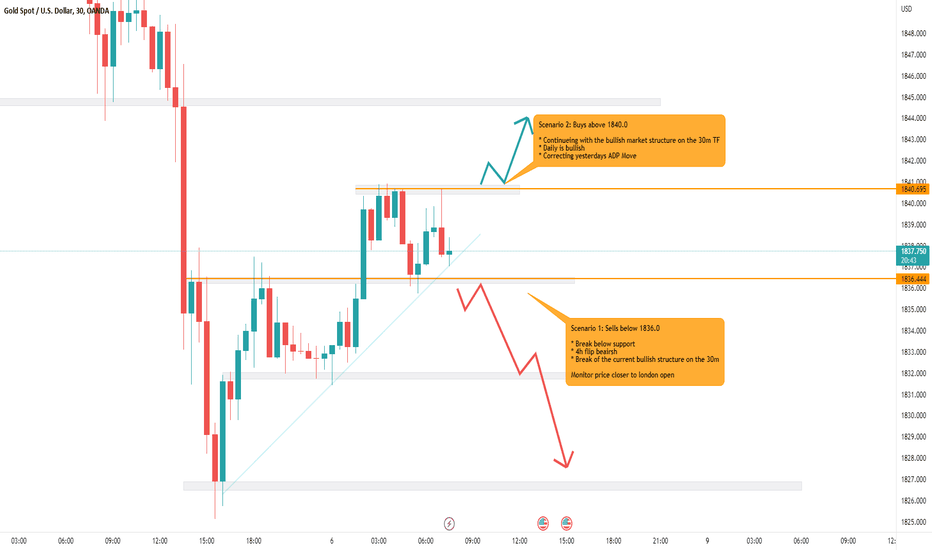

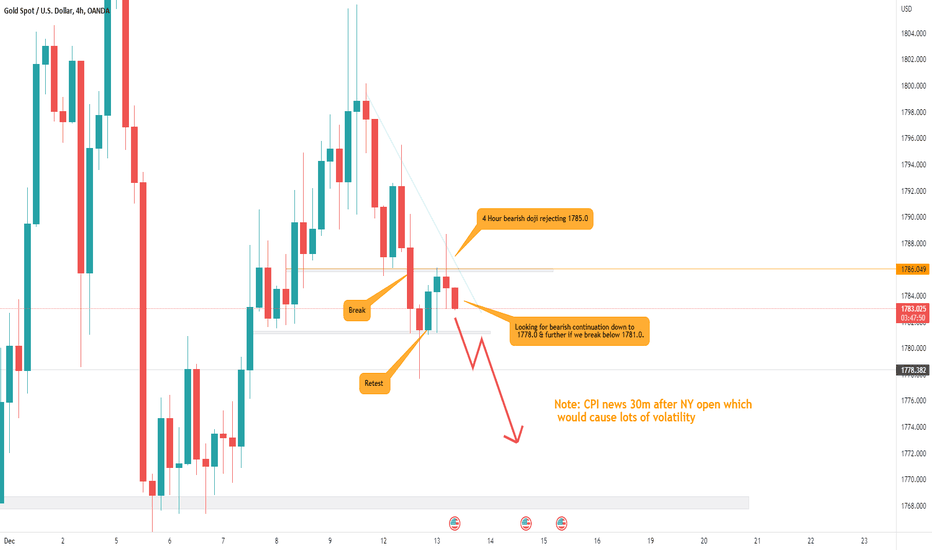

XAUUSD Pre-London Analysis (6th Jan 2023)Summary:

* LTF are forming bullish structure

* Already corrected most of ADPs Move

* Price will either break sturcture to go bearish since 1840 is a strong level

* Or price will continue to further correct the move up to 1845.0

Waiting for London Open to bring the move

NOTE: Lots of news later on today aswell

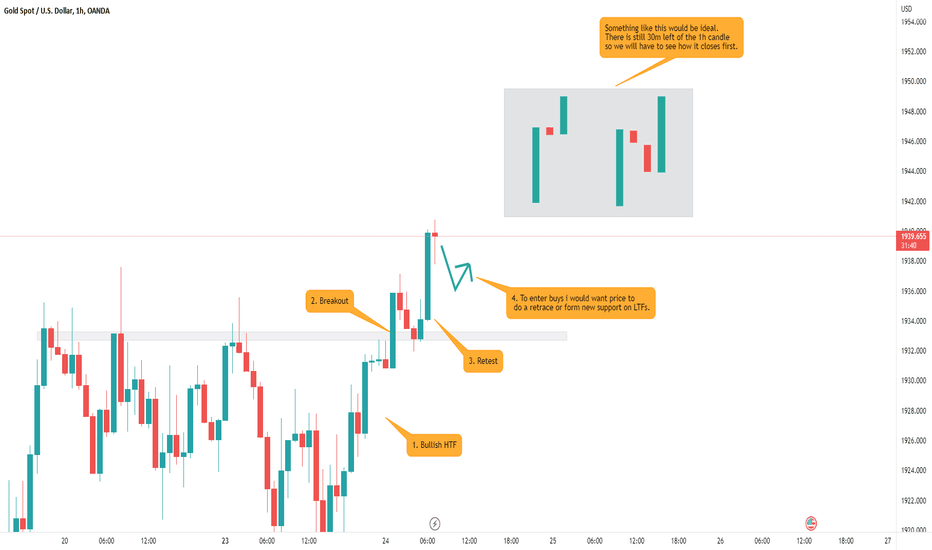

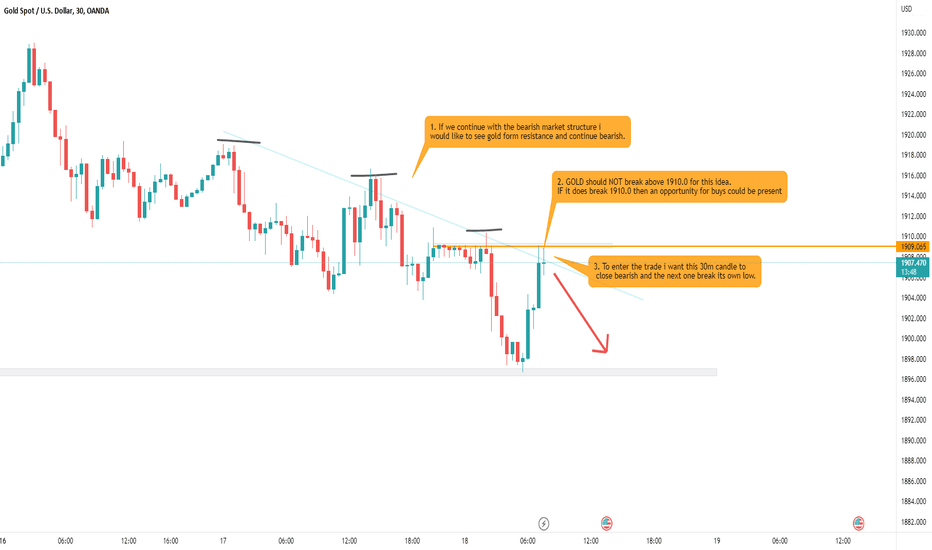

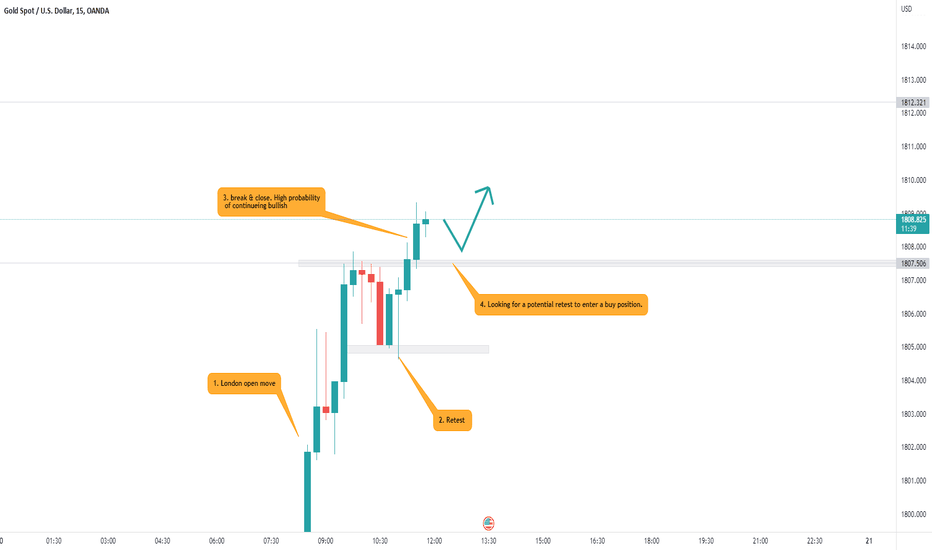

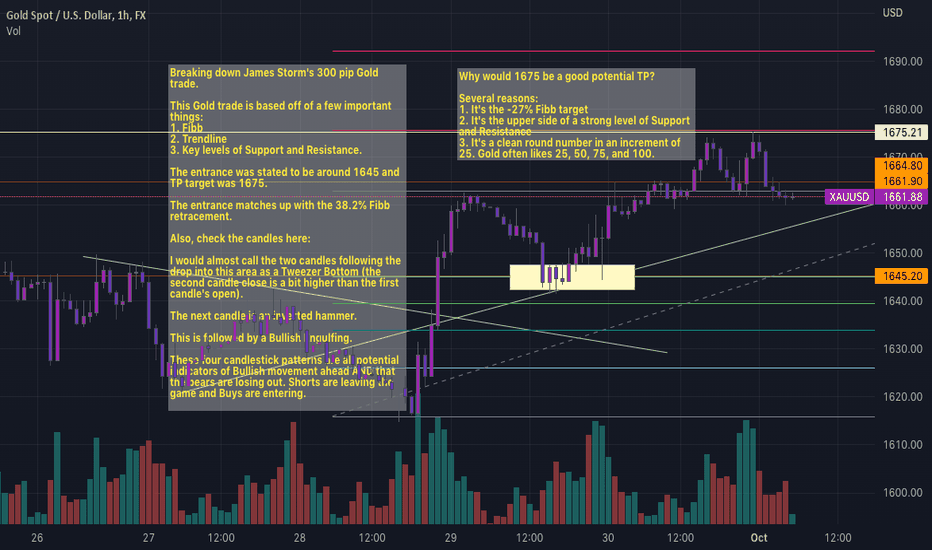

Breaking down James Storm's trade Breaking down James Storm's 300 pip Gold trade.

This Gold trade is based off of a few important things:

1. Fibb

2. Trendline

3. Key levels of Support and Resistance.

The entrance was stated to be around 1645 and TP target was 1675.

The entrance matches up with the 38.2% Fibb retracement.

Also, check the candles here:

I would almost call the two candles following the drop into this area as a Tweezer Bottom (the second candle close is a bit higher than the first candle's open).

The next candle is an inverted hammer.

This is followed by a Bullish Engulfing.

These four candlestick patterns are all potential indicators of Bullish movement ahead AND that the bears are losing out. Shorts are leaving the game and Buys are entering.

Why would 1675 be a good potential TP?

Several reasons:

1. It's the -27% Fibb target

2. It's the upper side of a strong level of Support and Resistance

3. It's a clean round number in an increment of 25. Gold often likes 25, 50, 75, and 100.

Bro's a fantastic trader.

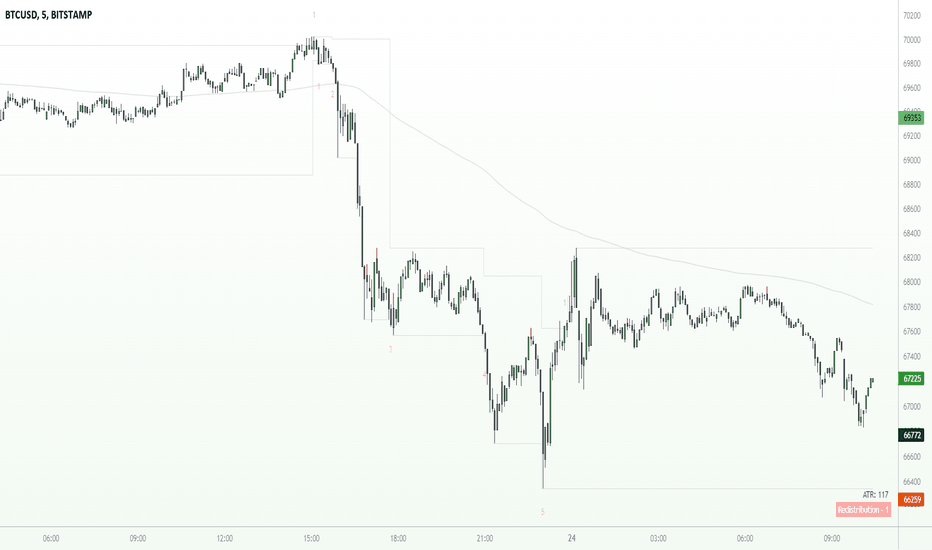

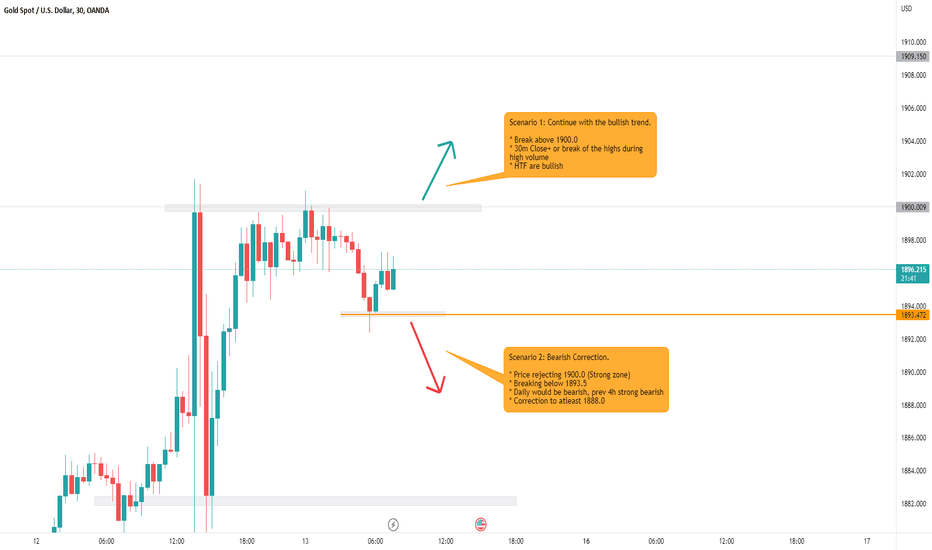

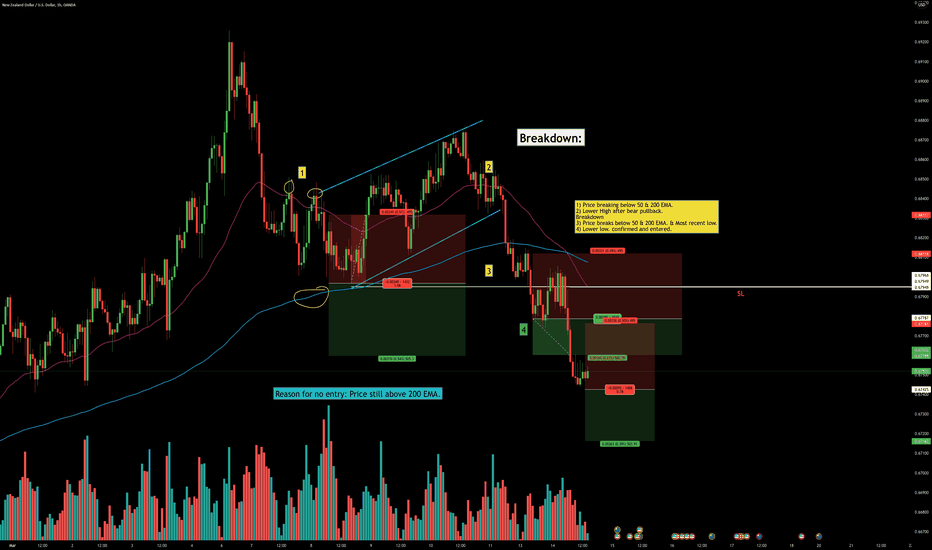

NZDUSD ShortBreakdown of NZDUSD.

First entry was no entry. Just used the short tool to gage entry levels for future entries. - Did not take that because PA stayed above 200 EMA (Light blue line).

1) Price breaking below 50 & 200 EMA.

2) Lower High after bear pullback.

Breakdown

3) Price breaks below 50 & 200 EMA. & Most recent low.

4) Lower low. confirmed and entered.

5 ) Waiting for second live entry if price creates a Lower low.