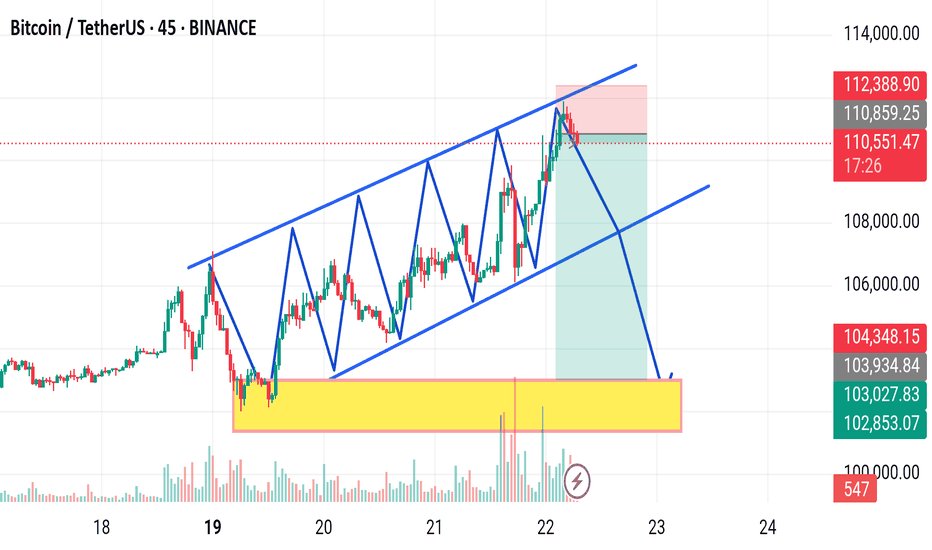

BTCUSD UPDATE - 22- 05- 2025This chart illustrates a potential rising wedge pattern in the Bitcoin/USDT (BTC/USDT) 45-minute timeframe on Binance. Here's a breakdown of the key elements:

Chart Analysis:

Rising Wedge Pattern (Bearish):

The price is moving within converging trend lines (marked in blue), forming a rising wedge — typically a bearish reversal pattern.

The projected breakdown (blue arrow) suggests a move downward out of the wedge.

Support Zone (Yellow Box):

A strong historical support zone is highlighted, around the $103,000–$104,500 range.

This is the likely target if the price breaks down from the wedge.

Bearish Target:

If the breakdown occurs, the price may fall to the yellow support zone.

Volume spikes on recent candles suggest increasing interest or volatility.

Stop Loss Zone (Red Area):

The red shaded area at the top of the wedge likely represents a stop-loss for a short trade setup.

Current Price: Around $110,708.20 at the time of the snapshot.

Summary:

The chart implies a potential short opportunity based on the rising wedge breakdown, targeting the yellow support zone. Confirmation would be needed from a strong bearish candle closing below the lower wedge boundary with increased volume.

Would you like help identifying entry/exit points or risk management strategies for this trade setup?

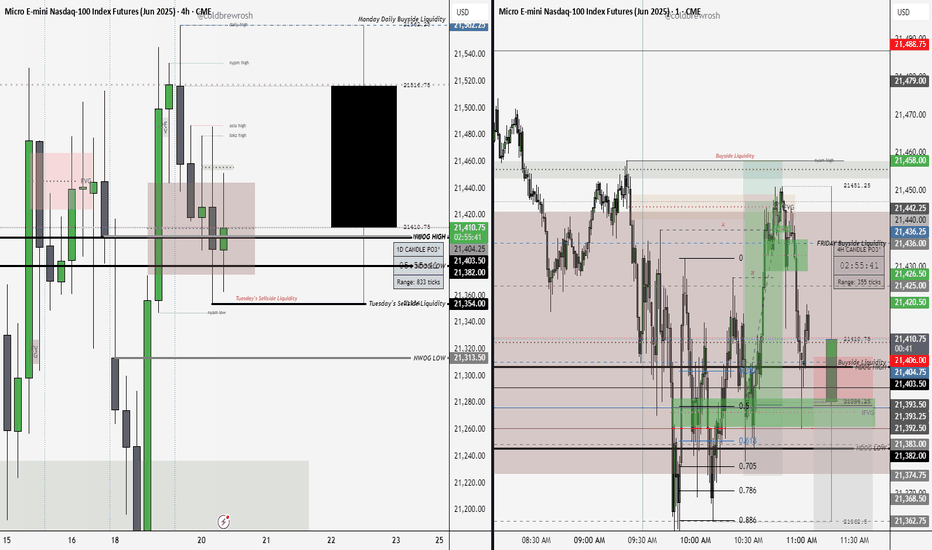

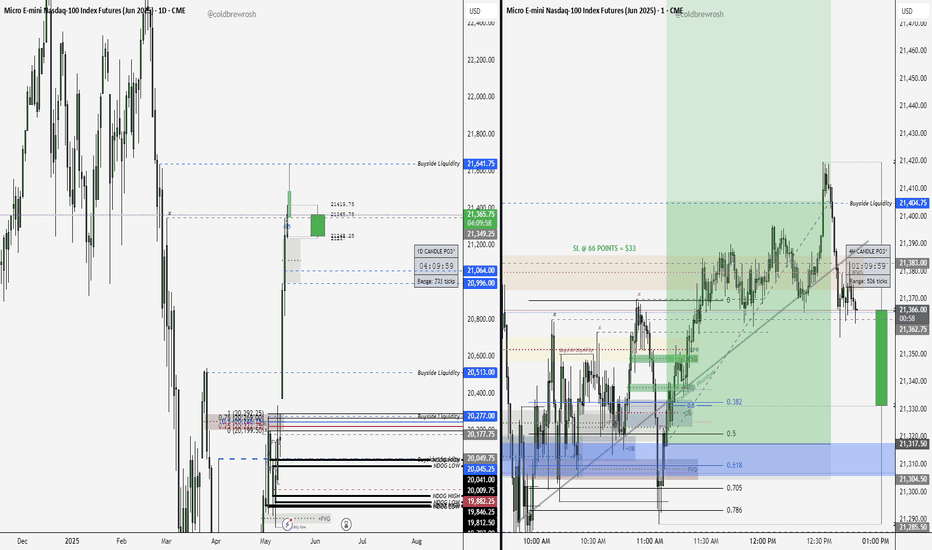

Trade Management

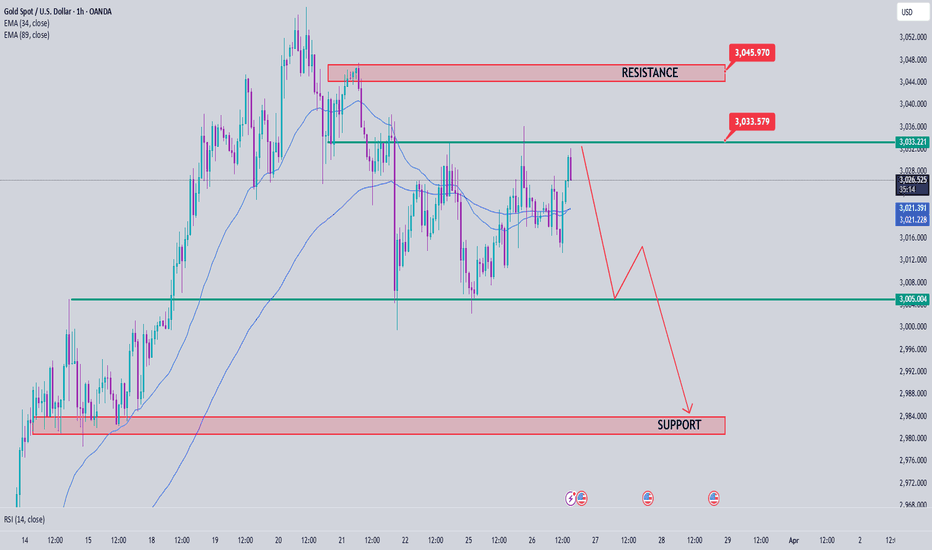

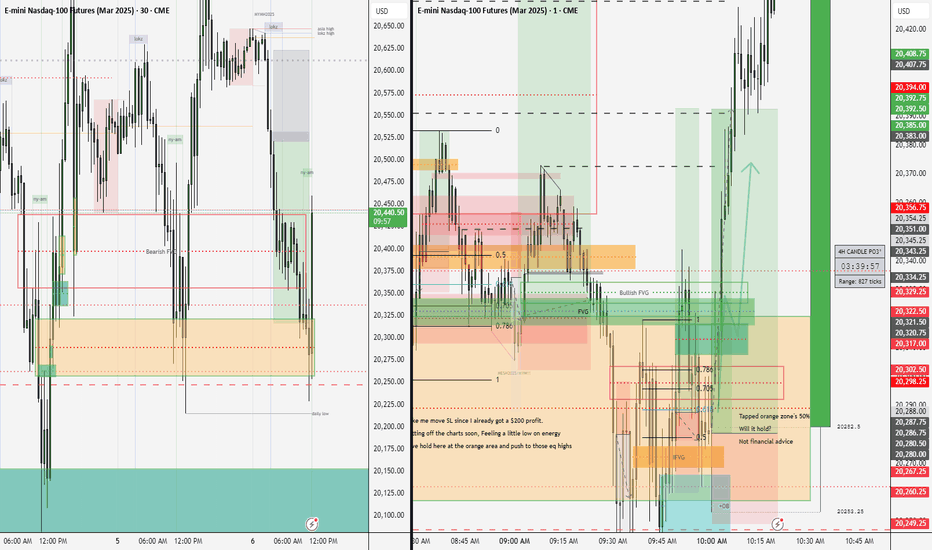

MNQ 5.20.25 Trade Idea (2)Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys.

I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting.

Closing the day out with $110 in profits, Which you will see on Video #3

MNQ Trade Idea Continuation (3)Continuation into the trade idea we were sharing, we traded through the Daily high level we were targetting of 21,404.75 then rushed lower under the Trendline Phantom line and under the IFVG that was used as support for price to reach 21,419.75.

Will this be another manipulation below 21,362.00 lows before continuation higher, or should I have set a TP at the 21,404.75 highs and called it a day?

European Stocks Rise Amid Positive NewsEuropean stock markets are experiencing a steady rise, buoyed by a series of encouraging developments that have boosted investor confidence and driven share prices higher. This wave of optimism is being fueled by both internal economic signals and an improving global environment, including stabilized interest rates and signs of a business rebound.

What's Driving the Growth?

One of the primary catalysts behind the rally is recent economic data showing a slowdown in inflation across the eurozone, alongside a revival in consumer demand. These indicators have strengthened expectations that the European Central Bank may soon pivot from a tight monetary stance to a more accommodative approach. Investors have welcomed these signals as evidence that the regional economy is adjusting well to challenging conditions and avoiding a deeper downturn.

Additionally, stronger-than-expected quarterly earnings reports have played a key role in lifting stock prices, particularly in the banking, technology, and industrial sectors. Major players such as Siemens, BNP Paribas, and SAP have posted solid gains, reflecting broader confidence in corporate resilience.

Renewed Investor Interest in Europe

Improving macroeconomic indicators are drawing renewed attention to European assets. With risks appearing more contained and equity yields remaining attractive, many investors are beginning to view the region as a compelling opportunity. Stock exchanges in Germany, France, and the Netherlands have stood out, showing consistent growth and high trading volumes.

Geopolitical factors are also contributing to the market’s upbeat tone. Gradual normalization of trade relations with key partners and the strengthening of the euro on foreign exchange markets are adding to investor enthusiasm.

What’s Next?

Analysts suggest that if current trends continue, European indices could reach new yearly highs. Key factors to watch in the near term include upcoming central bank decisions and fresh data on GDP growth and employment. Nevertheless, the present sentiment points toward confidence in the ongoing recovery.

Conclusion

The European stock market is entering a phase of stable growth, driven by favorable economic indicators, manageable inflation, and an improving business climate. Positive news continues to give investors reasons for optimism, and if momentum holds, Europe could emerge as one of the top-performing investment regions in the coming months.

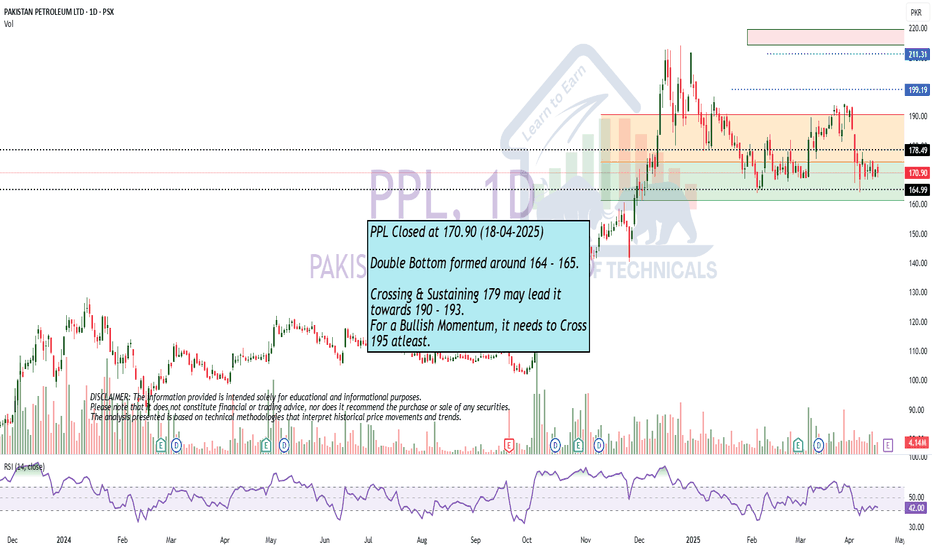

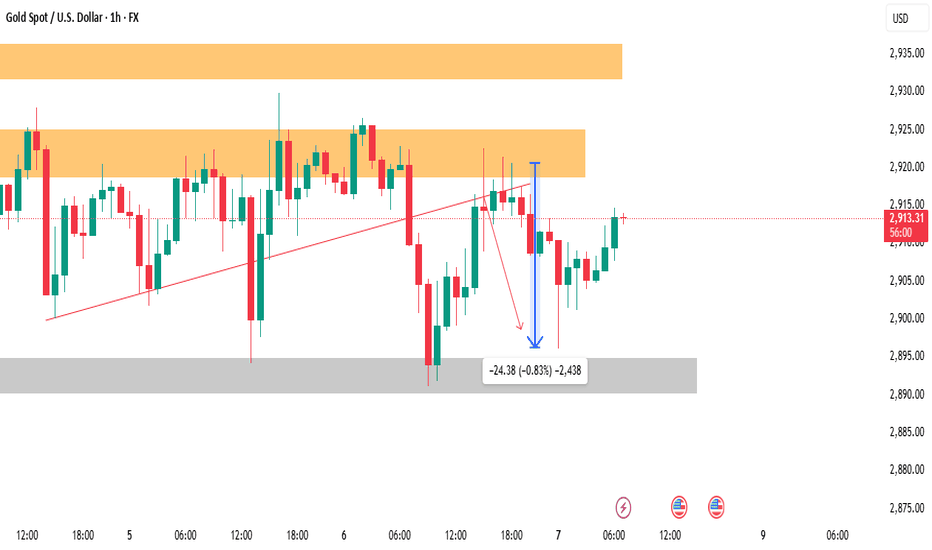

Gold Analysis March 26Candle D still shows that the battle between buyers and sellers has not yet been defeated.

3033 Plays an important role in the current downtrend structure. H4 Closes above the 3033 zone, officially breaking the wave and giving priority to the BUY side.

Gold is pushing up and wants to break the dynamic resistance of 3027. Closes above 3027, gold is heading towards 3033-3035. If it does not break this zone, you can SELL to 3005 and if the US breaks 3005, hold to 2983. If the 3033 zone is broken, wait for BUY to break 3033, the daily target is towards 3045.

MNQ 9:30 Open Trade Idea 💡 Trade Idea shown live here, beautiful setup that was respected very nicely during the 9:30 open.

The area we pointed out on the previous video:

Where I stated price was likely trading up to fill in that FVG before dropping lower was respected perfectly. I was rendering the video above when it happened. Hence, why you see me enter late here.

I could have been more patient and waited to enter at the 50% of the bearish fvg level. But regardless, I was able to profit $31 and make back the $30 I was in drawdown for. Had this been NQ we would've made over $695 on this one trade.

This is teaching us discernment in our decision making and how to trust our bias and trade ideas.

We caught over 130 points on this one MNQ trade and the potential was over 400 points as shown on this video.

We were targeting the bullish 1h fvg and sellside liquidity (equal lows)

If you guys found this insightful give it a like and comment down below. I would also love to know if any of you guys would like me to share any specific ideas or go over anything in particular. Let me know!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

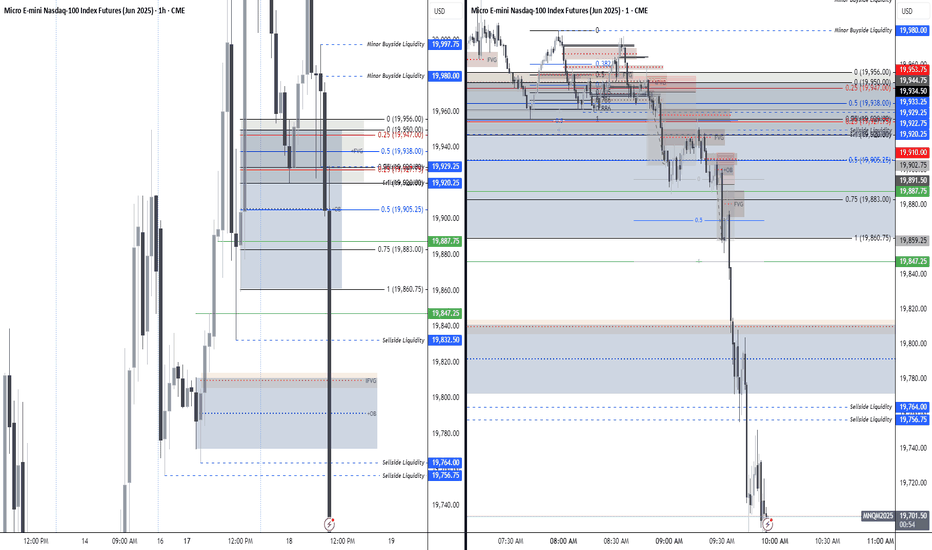

Different Ways to Manage Your TradesFinding the perfect trade setup is just one part of the equation. How you manage that trade can be the difference between consistent profits and missed opportunities. In this video, I’ll break down the different ways you can manage your trades and how each method impacts your results.

We’ll cover essential trade management techniques, including setting fixed take-profits and stop-loss levels, using trailing stops to lock in gains, scaling out of positions with partial profits, and actively monitoring trades for dynamic adjustments. Each method has its own strengths and weaknesses, and the key is finding what aligns with your trading style, risk tolerance, and market conditions.

I’ll also share insights on how I utilize trade management to maximize returns while keeping risk under control. Whether you prefer a hands-off approach or actively managing your trades in real time, this video will help you refine your execution and make smarter decisions.

Watch the full breakdown now, and let me know in the comments, how do you manage your trades?

- R2F Trading

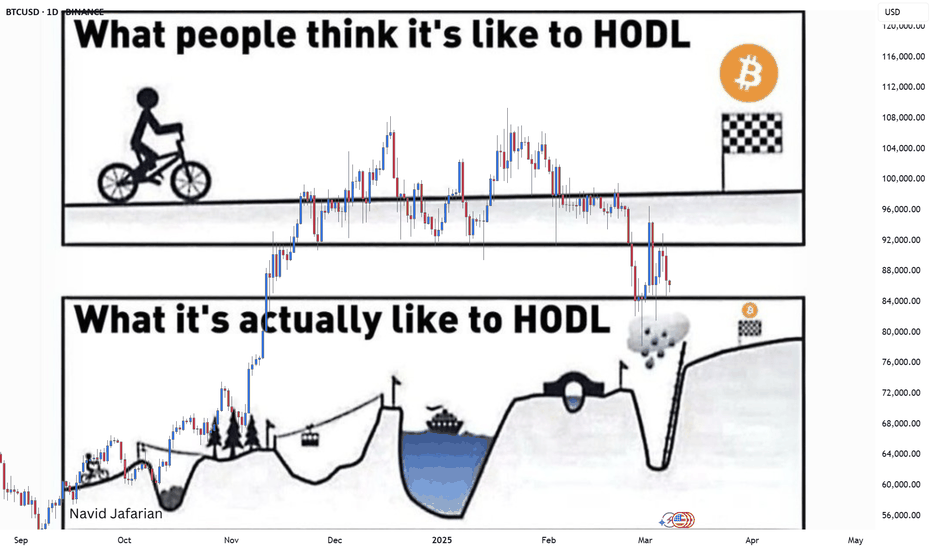

123 Quick Learn Trading Tips #5: To HODL, or not to HODL?123 Quick Learn Trading Tips #5:

To HODL, or not to HODL: That is the question

Alright, crypto adventurers, let's talk about HODLing! 🎢

Ever seen this meme?

It perfectly captures the reality of holding onto your Bitcoin! 😂

What newbies think HODLing is: A smooth bike ride to the finish line! 🚴♂️💨

Easy peasy, right? Just buy and wait for the moon! 🚀🌕

What HODLing actually is: A wild rollercoaster through mountains, valleys, stormy seas, and even a cloud with a face! 😱🌊🏔

It's a journey filled with dips, peaks, unexpected turns, and maybe even a few moments where you question your life choices! 😅

But here's the secret sauce: The good news is that the more you learn about Bitcoin, the easier it becomes to HODL. 🧠📈

Why? Because understanding the technology, the fundamentals, and the long-term vision of Bitcoin gives you the conviction to weather the storms. ⛈

You start to see the dips as buying opportunities, not as reasons to panic-sell! 📉➡️📈

So, dive into the world of Bitcoin! Learn about its history, its technology, and its potential! 📚💡

The more you know, the stronger your hands will be, and the smoother that HODL journey will feel! 💪💎

Remember, it's not just about getting to the finish line, it's about enjoying the crazy ride! 🎉

500+ Points caught on NQ! IFVG + OB Support.

Caught a massive 500+ point move on NQ, entering off an Inverted Fair Value Gap (IFVG) and Order Block (OB) support. The setup was clean, and price respected key levels perfectly. Watch the breakdown of my trade and how it played out!

💯 100 likes and I’ll post the full trading session with all trades!

Disclaimer:

This video is for educational and entertainment purposes only. Trading futures involves significant risk and is not suitable for all investors. Past performance is not indicative of future results. Always conduct your own research and trade responsibly.

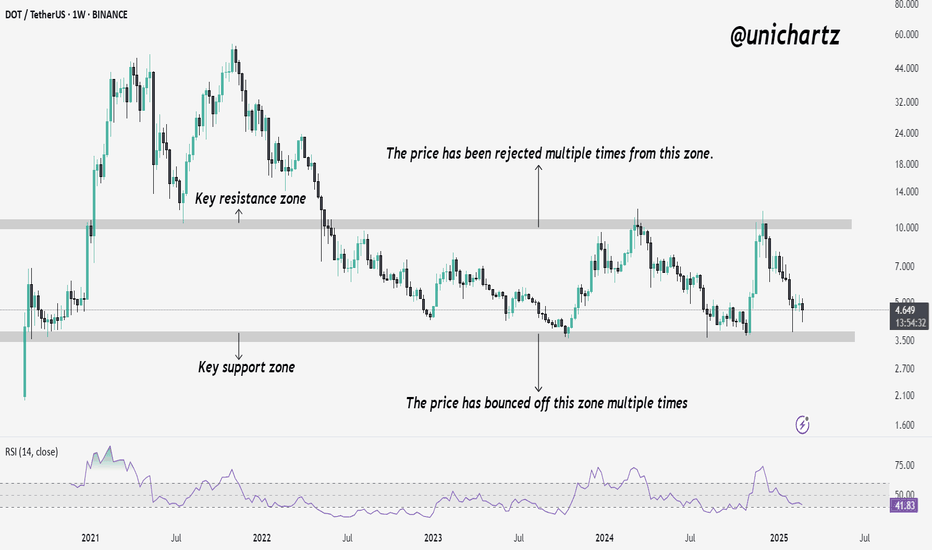

DOT Reaching Oversold Levels – Buy the Dip?DOT/USDT is currently trading within a well-defined range, with a key support zone around $3.50 - $4.00 and a major resistance zone near $10 - $11. The price has bounced multiple times from support and faced repeated rejections at resistance, highlighting a strong consolidation phase.

The Stochastic RSI is oversold, indicating that a potential reversal from support could be in play. If buyers step in at this level, DOT may attempt another move toward the resistance zone.

DYOR, NFA

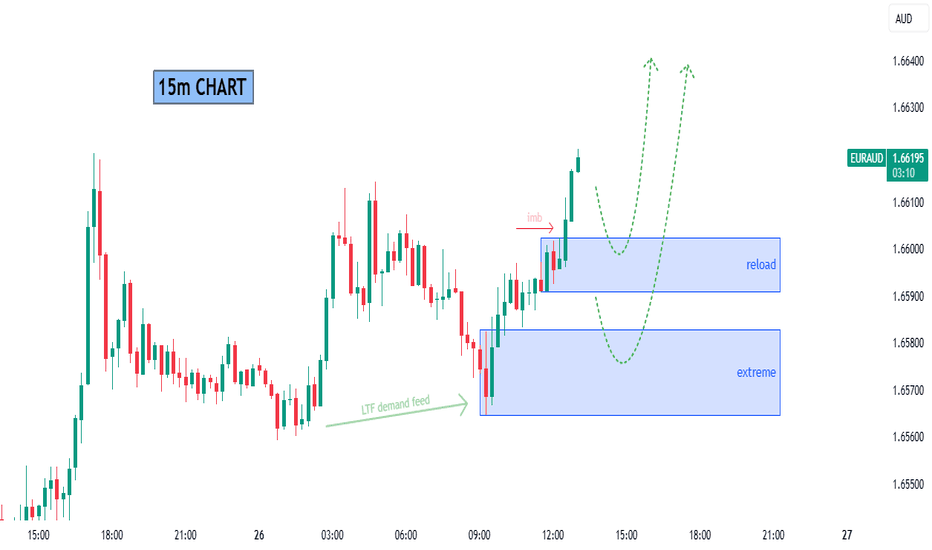

EURAD - Analysis and Potential Setups (Intraday- 26.02.25)Overall Trend & Context:

This pair is in an overall uptrend since last week.

Technical Findings:

Price is trading above 25, 50,100 and 200 EMA's on the daily chart.

Bullish price action is evident during London, we may see manipulation during NY (keep an eye out on the LTF demand levels).

Notes:

Relatively aggressive entry considering we're currently trading at a HTF supply zone, so make sure to manage your risk accordingly.

Sorry for being MIA for a minute!

I'm still here and the setups will continue to come.

Happy Hunting Predators!

Apex Out!

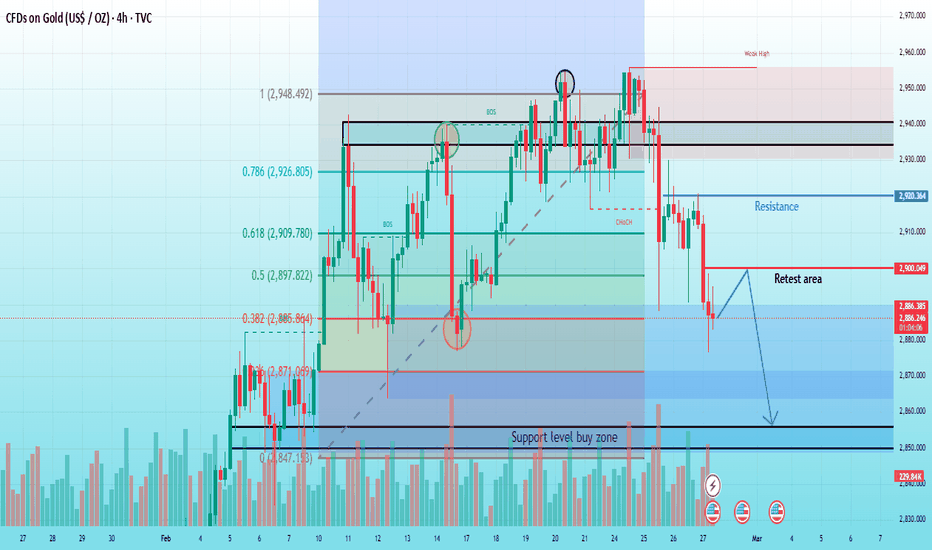

GOLD UPCOMING TREND READ IN CAPTIONThis 4-hour chart of Gold (XAU/USD) shows a recent pullback from the resistance level at 2,920.364, with a key support zone around2,847.153, highlighted as a buy zone. Fibonacci retracement levels are also shown, with the price currently testing the 0.382 level at 2,871.969. The chart suggests a potential retest in the area between2,887.470 and $2,890.000 before a possible bounce toward higher resistance levels. The breakout above the recent high could lead to further gains, but a pullback toward support levels is expected first

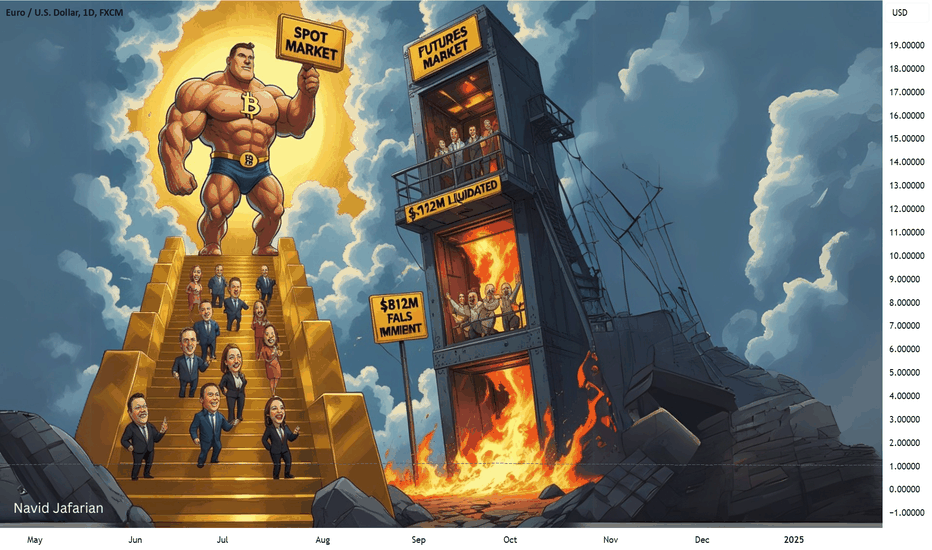

123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake?123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake? 🧐

News : $1.3 Billion has been liquidated 💥 from the FUTURES market within the past 24 hours, as Bitcoin plummeted to $86,000. 📉

Futures leveraged traders were forced to close their positions, realizing a collective loss of $1.3 Billion.

This shows how risky trading with leverage (borrowed money) can be. 💸 ⚠️

Traders who use leverage enter into a gambling game with exchanges, which always win the game. In other words, in the last 24 hours, several crypto exchanges made $1.3 billion in profits.

On the other hand, people who bought Bitcoin directly (spot market) only lost a small amount of profit. This shows that owning the actual asset is more stable. 💎

Traders using leverage lose their money. But for spot investors, this is a good chance to buy more Bitcoin at a low price and make their long-term position stronger. 💰

Like I always tell my students and friends:

Let's go up the spot market stairs, step by step. 🪜 Don't think about the futures elevator. 🏢 It has crashed many times, 📉 and it will crash again. ⚠️

Instead of gambling in the "fake" futures game,

invest your money in the "real" spot market. 💎

Build your investments by owning assets, not by risky leverage. 🚫

Have a nice trading journey!

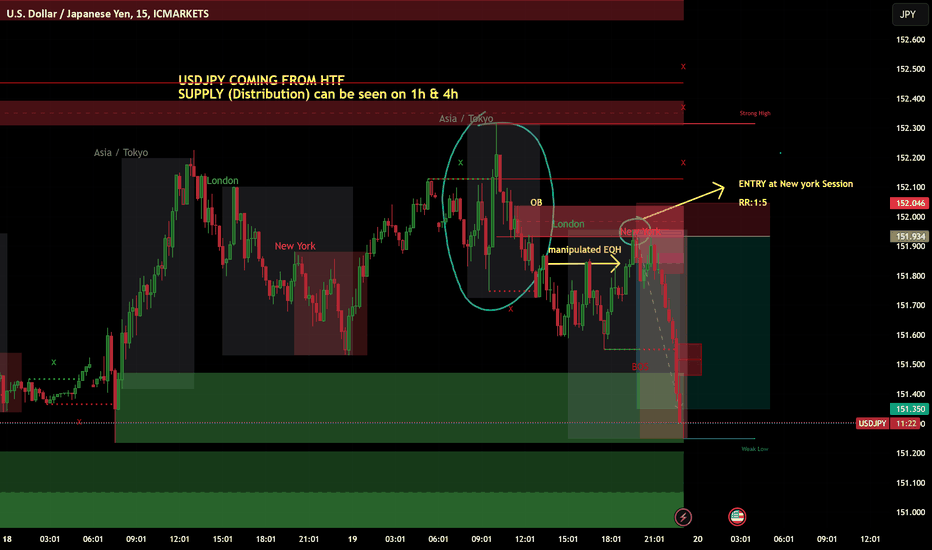

USDJPY - Feb 19 2025 Sell position- CLASSIC!Hey everyone!

It's been a while since I last posted—I've been busy refining my prop firm account this 2025.

Since January 9, USDJPY has been in a successful distribution phase, so I'm now shifting my HTF bias to a sell position.

- Currently riding sell positions targeting 1:2R, 1:3R, and 1:5R (intraday trades).

Check the charts for details—just a simple price manipulation setup. This time, though, London got manipulated instead of the Asian session. Classic 1:5RR move!

#consistency

#tradeforaliving

#rightpsychology

How I am approching scaling my account to the next level💰 Introduction

I have been actively investing for over seven years. When I started in 2017, I had no idea what I was doing. My first trade was a short/mid-term win on an altcoin skyrocketing in a straight line—it felt unbelievable. But the truth was, I was completely clueless.

Still, I was hooked. I started reading everything I could and expanded my focus to stocks and Forex. Six months later, I had developed some ideas about Forex, though I was still lost when it came to stocks. I funded a Forex account with €8,000 to test my skills, using a simple 1:1 risk-to-reward 0.5% per trade system. A few months later, I was up about 15% - a solid start.

From there, my goal was clear: design a great strategy first, then scale it. But things didn’t go as planned.

I suffered a serious injury, which got progressively worse, making it impossible to hold a regular job. I spent everything I had on rent and medical bills. To make matters worse, I stubbornly clung to a terrible strategy for years - even after developing better ones. I ignored huge unrealized gains, constantly chasing the “holy grail” of investing. Ironically, today, I trade every single strategy (or a modified version to add to winners) I’ve ever designed since 2019 - except the one I stubbornly stuck with for years.

Through all this, I learned a crucial lesson:

💡 A strategy should work from day one. You backtest it to verify, then refine it, but you don’t trade it live until it’s ready.

Now, after years of experience, mistakes, and lessons learned, I have several proven strategies and a fresh perspective. The next step? Scaling up aggressively.

Of course, I can’t cover everything in one article, a full book wouldn’t even be enough. Some aspects of growing an account, like tax implications, aren’t discussed here.

But my goal is simple: to inspire investors to think creatively about scalability and strategy development. The process of building an investment strategy - including a scaling plan - is all about creativity.

💰 The Challenge of Scaling: Why Gains Lag Behind Losses

Your gains will always lag behind your losses - this is a fundamental reality in investing. If you scale too fast, your winners from months ago may not be enough to cover your new losses, even if you're performing well overall.

I am not talking about drawdowns, those makes things even worse. I am talking about how looking for asymmetric returns means the time it takes will be asymmetrical too. For mid-term strategies, traders typically risk 1 unit to gain 5, 10, or even 15. However, the time required for returns grows exponentially as reward targets increase. If you're aiming for 10x or more, your losing trades might last only 2–3 days, but your winners could take six months or longer to materialize.

I experienced this firsthand in 2024. I started the year strong, accelerating my risk after solid returns from trading the Yen. Then I hit the gas again, but things turned bad - primarily because I was experimenting with a new strategy alongside my proven ones. In November, I realized a 15x profit on gold, which could have significantly changed my situation. However, I had entered the position back in February, before I began scaling, so the gains didn’t have the impact I needed at the time.

💰 Scaling Only Works for the Few Who Are Ready

Most traders either stagnate or lose, and even the best often learn the hard way early on. You’ve probably heard the common statistic: only 10% of FX investors win, and only 10% of stock investors beat the market. But even within that elite group, only a third outperform significantly enough to consider trading as a full-time career rather than just a supplement for retirement.

From the data I've seen, only about 3% of investors should even consider aggressive scaling. Attempting to scale without a proven track record is a recipe for disaster. Even the most famous market wizards often had to learn the hard way early on.

A good analogy is chess - not everyone is a young prodigy, and even for those who are, it often takes 7–8 years to reach master level. The same applies to investing: skill and experience take time to develop, and rushing the process can lead to avoidable mistakes.

💰 No shortcut but there are ways to increase scalability

A path one might follow is the investment fund. However these are very restrictive, George Soros once said to make money you had to take risk. No matter how good you are you are still subject to the same laws and I know no one that has 100% win rate. If your max drawdown is 5% how much can you realistically risk per operation? Perhaps 0.25% So your 10X winner will be 2.5%. We know the returns, drawdowns and Sharpe ratios of the biggest (and supposedly best) funds, I never heard of a fund with a tiny max drawdown and huge returns except Medallion fund you got me.

The problem I personally have, or shall I say had, is that I can sometimes go 6-12 months without a winner, or with just 1-2. It is spread very non-homogeneously. In the last 3 months I have (finally!) designed a short term strategy that will smooth the curve, I risk 1 to make 5 and have opportunities in all market conditions. I was not even trying to, I just randomly felt creative and went "Eureka".

I am currently running my proven strategies on my main accounts, and the new one on a smaller account - of course I keep winning on these small amounts. This short term strategy might not be my best one, although it might be the second best, however it was exactly what I needed to help smooth the drawdowns and more boring market conditions.

💰 Balancing Creativity and Risk in Scaling Strategies

I believe designing a successful scaling strategy requires a combination of creativity and pessimism. From my experience, it's essential to explore different ways to scale while always keeping the worst-case scenario in mind.

To illustrate this, let’s consider an example - not necessarily the exact approach I will take, but a concept that reflects my thinking. Suppose I allocate €25,000 to a brokerage account and divide it into 25 "tokens" of €1,000 each. Every time the account grows, I would redistribute the balance into 25 equal parts, each representing 4% of the total.

This setup ensures that I always have capital available for new opportunities. Even if I lose 10 times in a row and have 5 tokens tied up in winning trades (or disappointing breakevens), I would still have 10 tokens left to reinvest. Based on my calculations, 25 is the minimum number required for this method to work efficiently. That said, 4% risk per trade is significantly higher than what I have ever risked, and I may adjust it downward.

💰 Risk Management and Personal Goals

If someone were able to triple a €25,000 account each year, they could theoretically reach €2 million in just four years. However, such exponential growth is rare and unsustainable over the long term. Jesse Livermore achieved extraordinary gains - but ultimately lost everything and took his own life. This is a stark reminder that extreme financial risk can have devastating consequences.

I would never attempt this kind of aggressive scaling with essential funds - certainly not with rent money, without a financial cushion, with large amounts, or without a clear Plan B.

My personal objectives:

If investing my own money: My goal is to build a €2M–€3M account while continuing my regular job - possibly reducing to part-time work.

If managing investor funds: I would aim to start with €10M AUM, with at least €500K of my own capital in the fund. My ultimate target is to grow AUM to €100M.

💰 The Crypto Factor : A Different Beast

The extreme volatility combined with long term aspect of crypto makes for a very different experience. In the past it has shown incredible returns, I know this first hand my brother started mining Ethereum I think in 2019 when the price was below $150 I guess and then he has been buying cryptos on the way up, in euros I might add, with the crypto/euro charts looking much better than the USD ones.

But there is no reason why it cannot all go to zero, or crash 95% and remain here for years. And even if the whole crypto market does not crash, several of them die each year. I am not a perma bear I do not wish my younger brother to lose everything, this is all he has, he got no diploma not interesting career.

For crypto to fit in a structured investment strategy I personally would only put small amounts. So it sort of follows the idea of a separate account with huge risk. An amount that one can afford to lose.

💰 Final words

I believe I have the experience, the rigor and the strategies to increase my risk and invest more aggressively. In a near future - maybe starting 2026 - I want to really grow my account.

My scaling will be gradual, I won't jump from an amount to 3 times that in 3 months, I will manage my risk strategically; And before even starting the battle I will have clearly defined objectives.

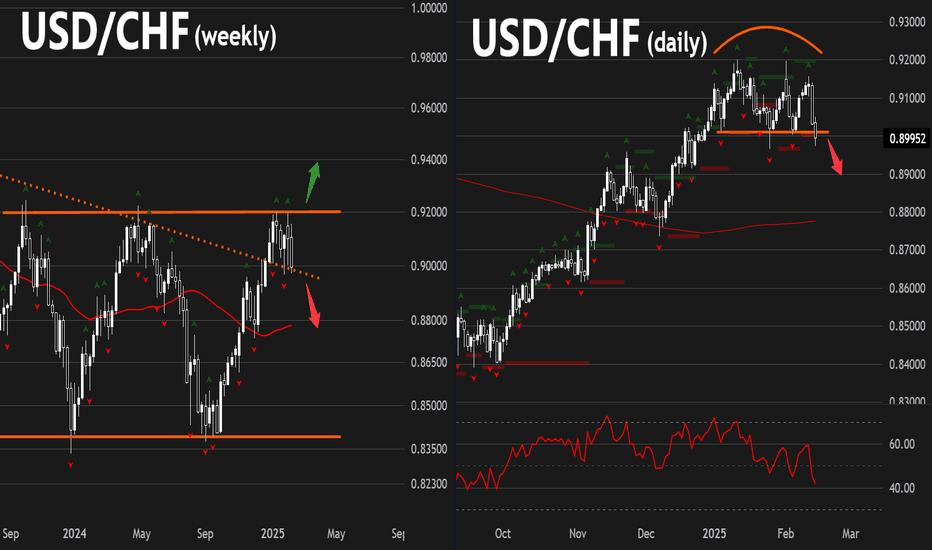

USD/CHF: Avoiding a false dichotomyThe US dollar is in a correction of its uptrend (see EUR/USD, GBP/USD, AUD/USD etc)

Do we really face a linear option of fade or no trade?

Actually, it might be a false dichotomy .

Going long EUR/USD and GBP/USD (i.e. selling USD) would mean fading the major trend (as per the weekly charts).

But going short USD/CHF (i.e. also selling USD) would not be a counter trend trade because USD/CHF is in a trading range. Selling below resistance in a trading range is a high probability setup.

We can see the topping process on the daily chart, with 0.90 as the broken neckline.

Here the risk is well defined - if the price pops back over 0.90 - the breakdown trade is no longer on but while below 0.90, 0.88 is a natural target as the last major support area and the 30 week moving average.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

Drop a comment

cheers!

Jasper

123 Quick Learn Trading Tips #3: Better turn up the heat123 Quick Learn Trading Tips #3: Better turn up the heat 🔥

Ever wonder why some traders seem to have all the luck? 🤔 They're not just lucky; they've built an iceberg of hard work, discipline, and even failures beneath the surface of their "success." Don't just chase the tip – build your own solid foundation.

Here's what that iceberg looks like in trading:

Hard work: 📚 Studying markets, developing strategies, and always practicing. No shortcuts here! 🚫

Patience: ⏳ Giving up short-term gains for long-term strategies. Don't rush. Good traders wait for the best opportunities.

Risks: 🎲 Take smart trades, not reckless ones. Be brave, but not foolish.

Discipline: 🎯 Follow your trading plan. Don't let your feelings make you change it. Trust what you learned before. Trust your strategy.

Failures: 🤕 Everyone loses money sometimes. Learn from your losses. It's important to get back up and keep going.

Doubts: 😟 Managing emotions and fear is crucial. It's normal to have doubts.

Changes: 🔄 The market always changes. You need to change your strategies too. Be ready to adapt.

Helpful habits: 📈 Consistent analysis and risk management are your bread and butter. Stick to good routines.

Want to build a success iceberg? 🧊

Better turn up the heat 🔥

– it's going to be a long, cold journey beneath the surface.

👨💼 Navid Jafarian

So, stop scrolling through my TESLA pics 🚗 and get back to analyzing those charts! 📊 Your iceberg isn't going to build itself. 😉

Live execution and insights to my MNQ POI The Bias we had was perfect, and it panned out just right. We were a little late to the party, I had just walked into my room after taking my dog outside. As soon as I saw it at my zone I felt the urge to enter so I did.

I recommend you guys check out the previous video I posted of my MNQ POI

Over 120 points SL which I am not a fan of but on MNQ that is about $65 risk. We took our profits early for precaution and to keep our greed in check.

Give a like and thumbs up if you enjoyed the video and my personal insights!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.