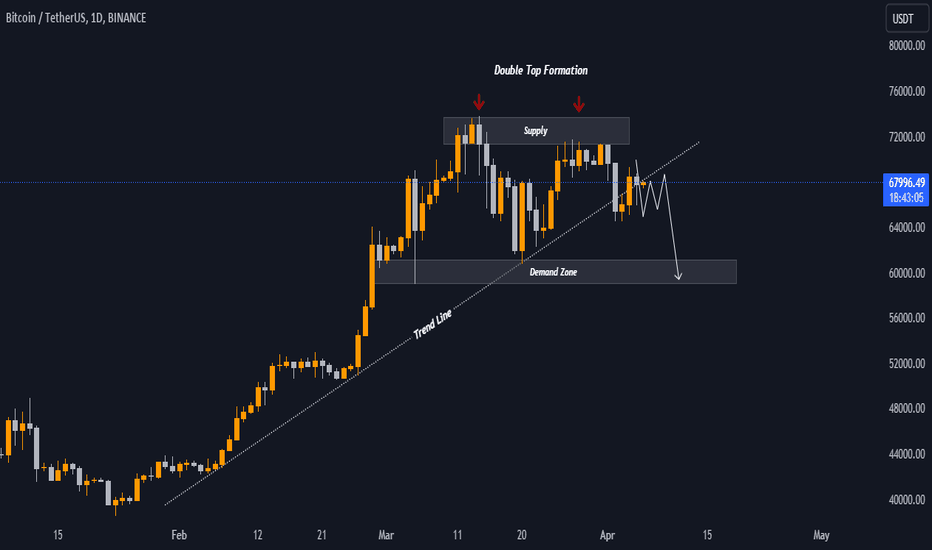

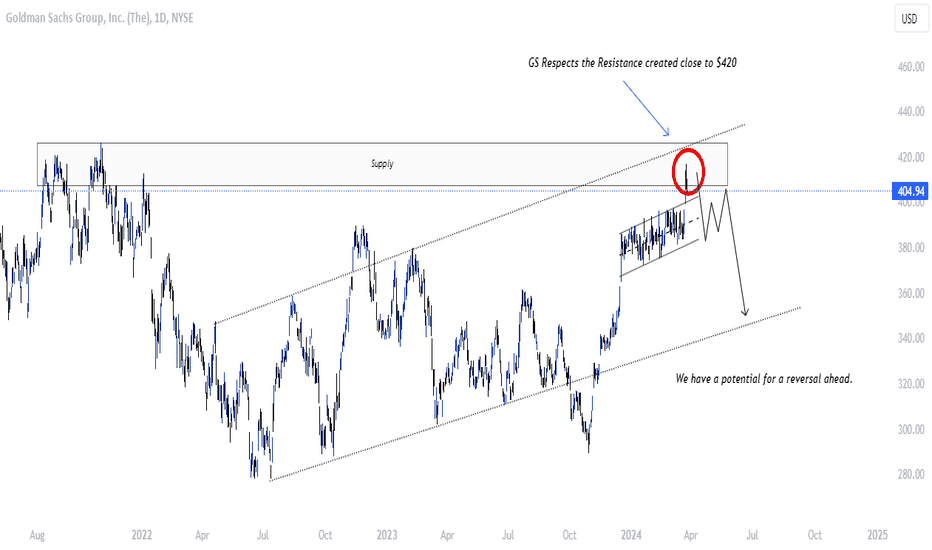

BTCUSDT POTENTIAL DOWNSIDE MOVE AHEAD!!Bitcoin has confirmed a trend breakout recently, But for the moment price still remains above the level with the pullback created by the price. Here we are expecting a downward shift in the prices towards the bottom level of support identified. Since there we witness a possible retracement back towards the 100MA as well. The following pattern is a clear double top formed over the resistance identified at $71k to FWB:73K region

Traderchamp

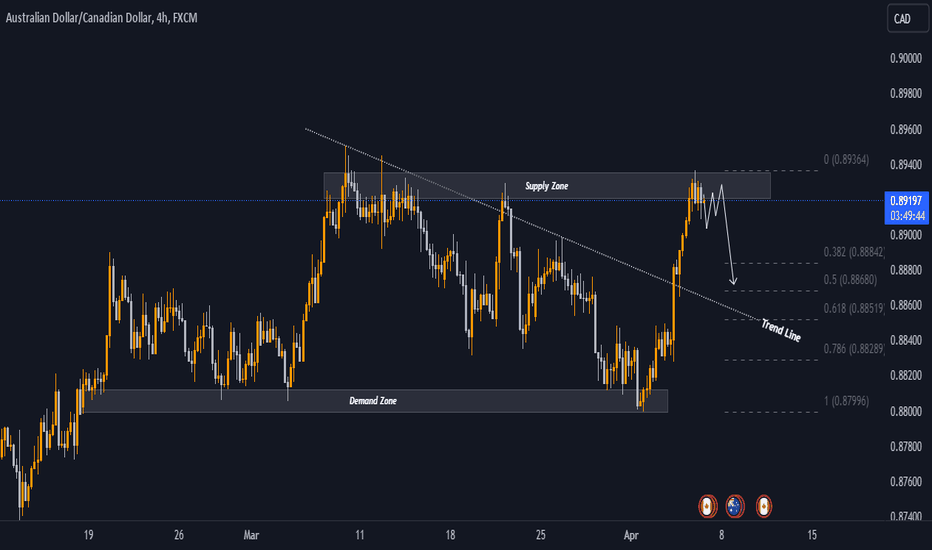

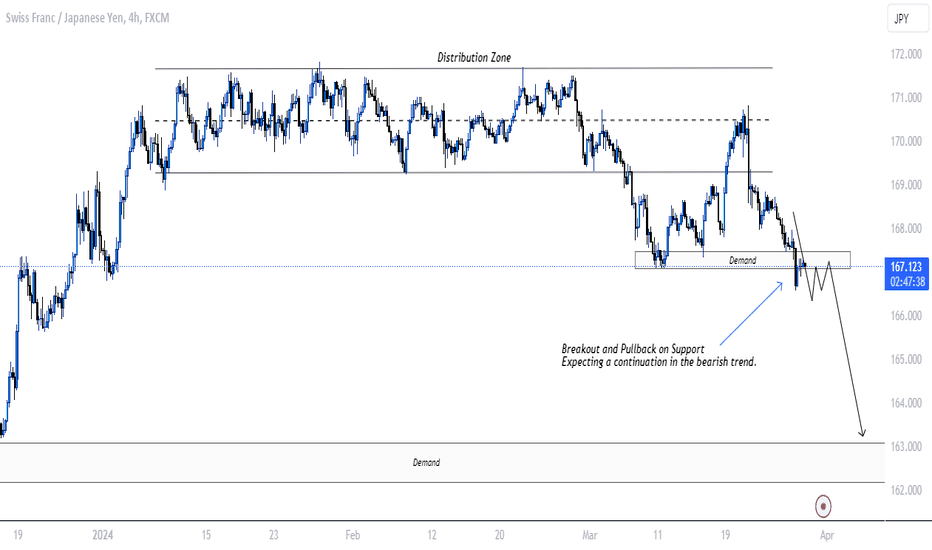

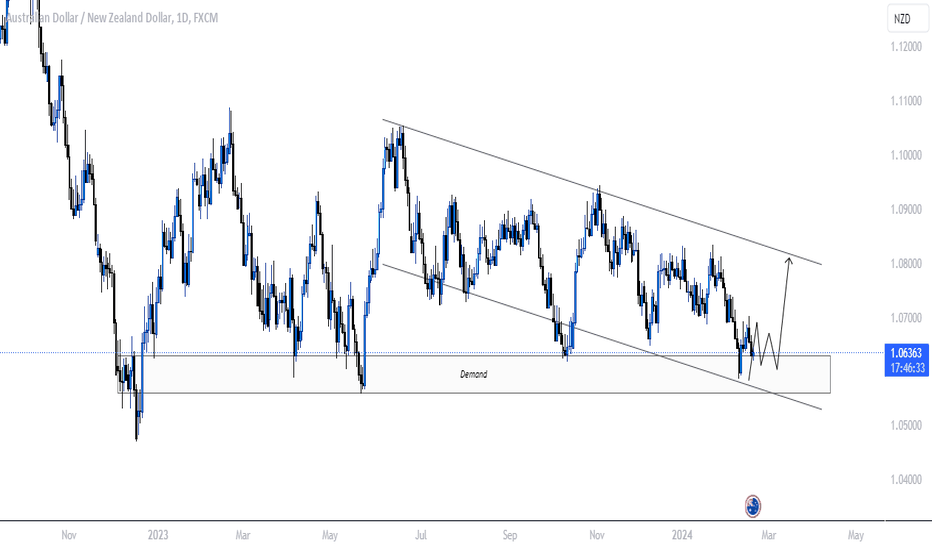

AUDCAD 4H SUPPLY ZONE ( REVERSAL )AUDCAD has approached the 4h supply zone created with the recent trend breakout identified. Here we expect to see a potential reversal back towards the trend line or previous OB following the selling pressure. This is expected to follow a retracement close to 38%-50% on the Fibonacci.

BITCOIN TREND BREAKOUT & DOUBLE TOP FORMATIONPrice of BTC has dumped with a bearish breakout on the previously identified consolidation.

Here once again we witness a clean trend breakout with a double top formation, which is likely to create a further decline up ahead. We expect a revisit back on the bottom support highlighted.

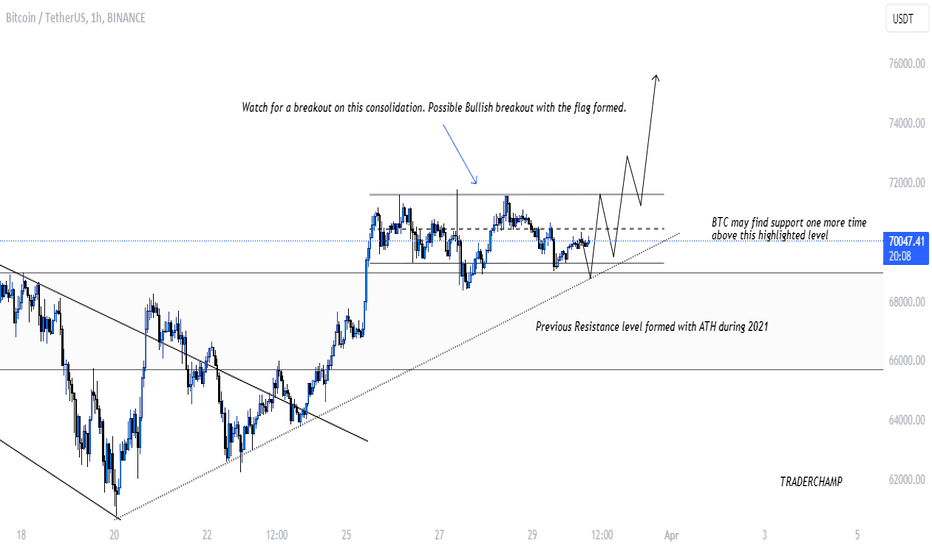

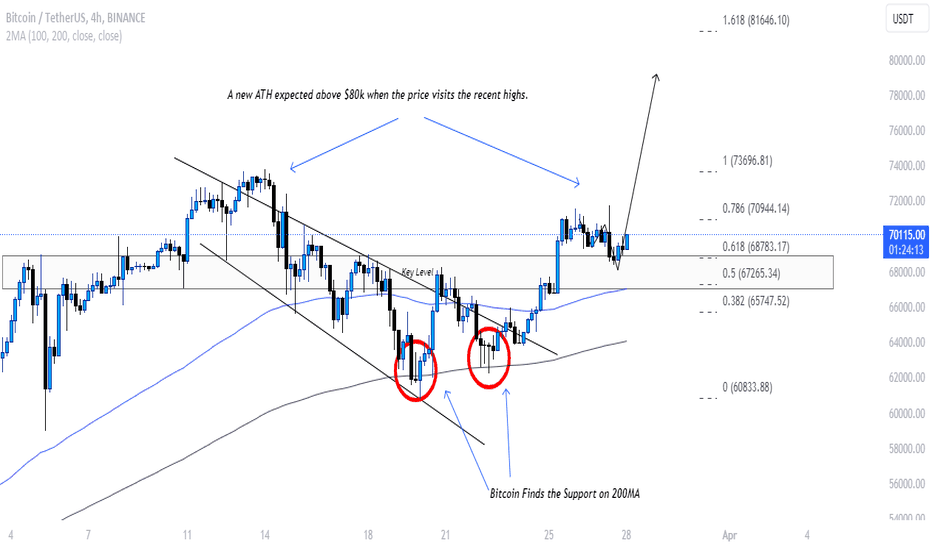

BITCOIN RALLY TO A NEW ALL TIME HIGH?📈Bitcoin has respected the highlighted key area and looking for a possible reversal back up. Here we expect to see another revisit back towards the all time high region or even a higher level close or above $80k next.

We are required to identify a valid bullish setup under the lower timeframes.

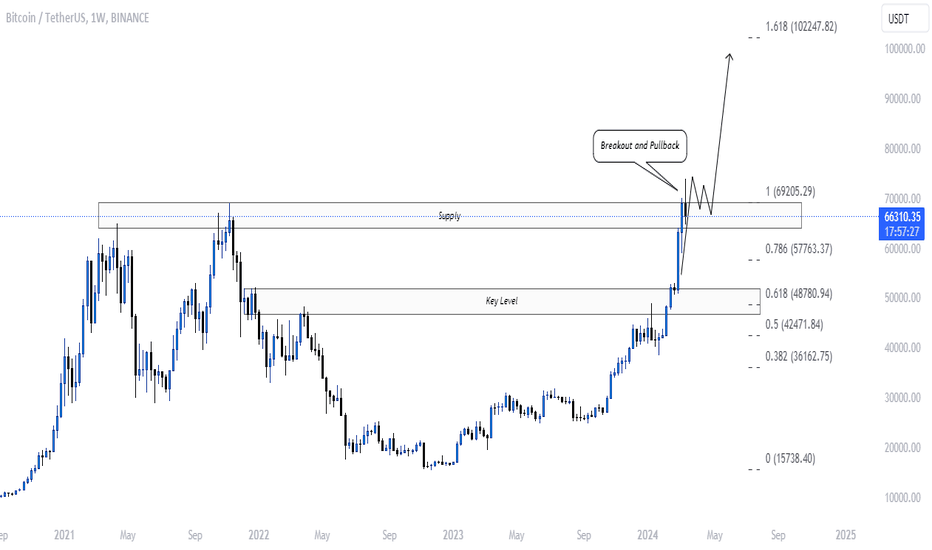

🔥BITCOIN MAY HIT 100K NEXT FROM HERE🚀Bitcoin has recently surpassed its previous all-time high and breached the resistance level that had formed. However, there appears to be a minor selling pressure, suggesting a potential pullback to retest the previous resistance level before initiating the next rally. Notably, during the previous sell-off, a target level around $102k was maintained, corresponding to the Fibonacci 1.618% retracement. Presently, the current price of Bitcoin seems to be respecting the previous resistance level as a support, indicating a reluctance for the price to retreat back inside or below the previous resistance zone, at least for the time being.

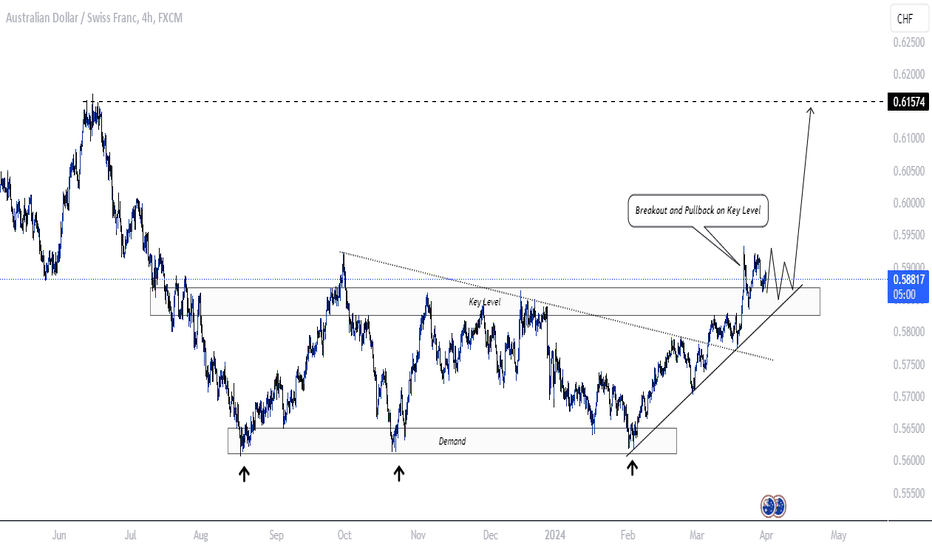

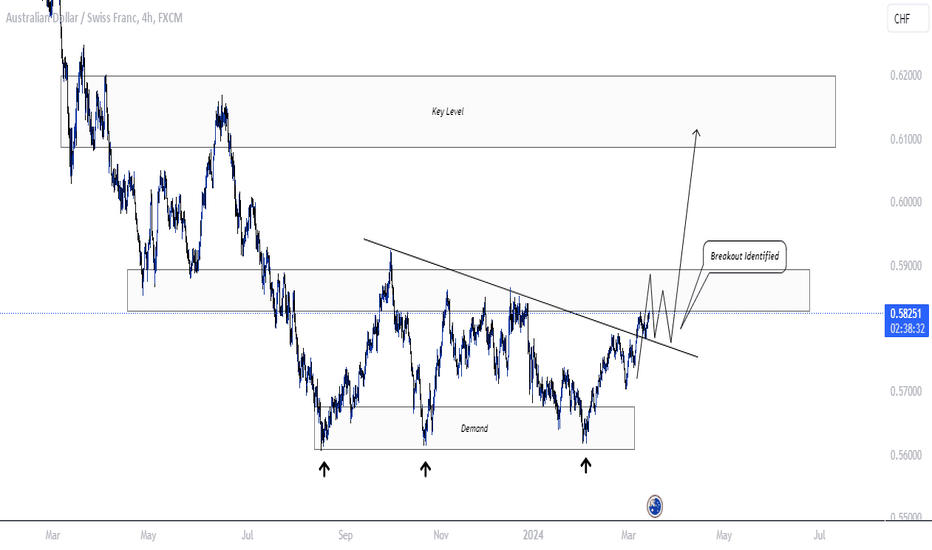

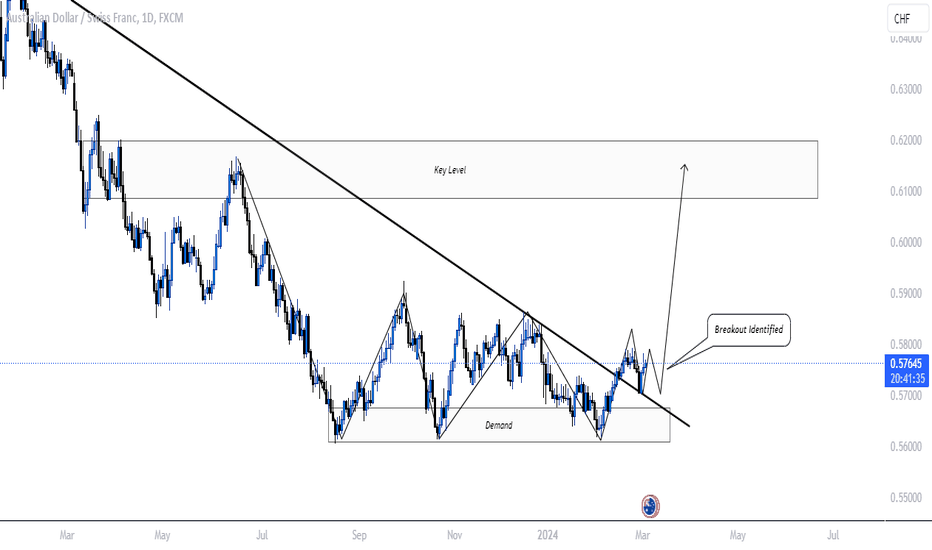

AUDCHF TRIPLE BOTTOM PATTERN The AUDCHF has formed a triple bottom pattern, suggesting a potential bullish breakout pending confirmation on the highlighted neckline/key level. Additionally, there has been a recent breakout of the trend, indicating the possibility of a bullish rally towards the $0.61500 region.

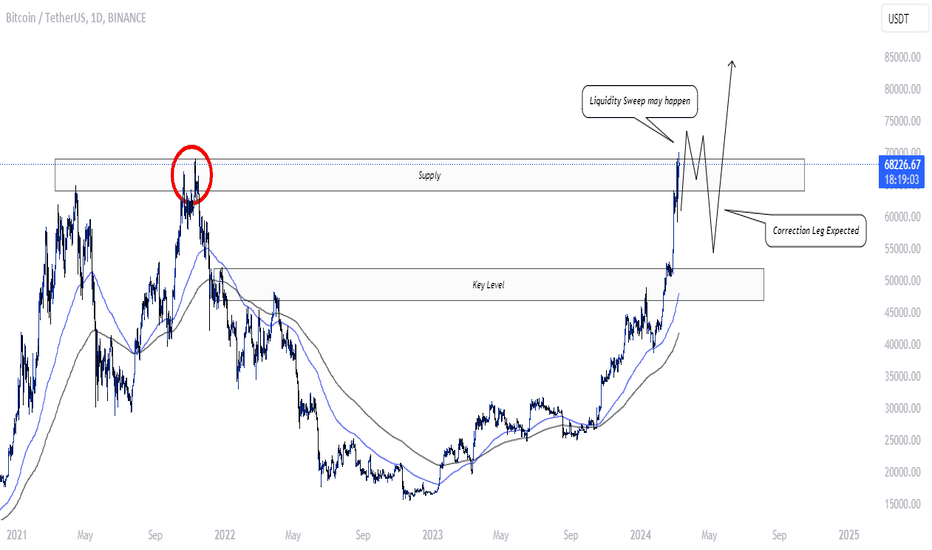

🔥BTC MAY FOLLOW A LIQUIDITY SWEEP & A CORRECTION BEFORE NEW ATHBitcoin has approached a significant resistance point near $68,000, where previous selling pressure has been observed. There is a possibility of a false breakout at this level, potentially followed by a liquidity sweep and a subsequent correction phase before the next upward surge towards a new all-time high. A retracement towards the $60,000 to $50,000 range may be necessary to solidify the current bullish trend.

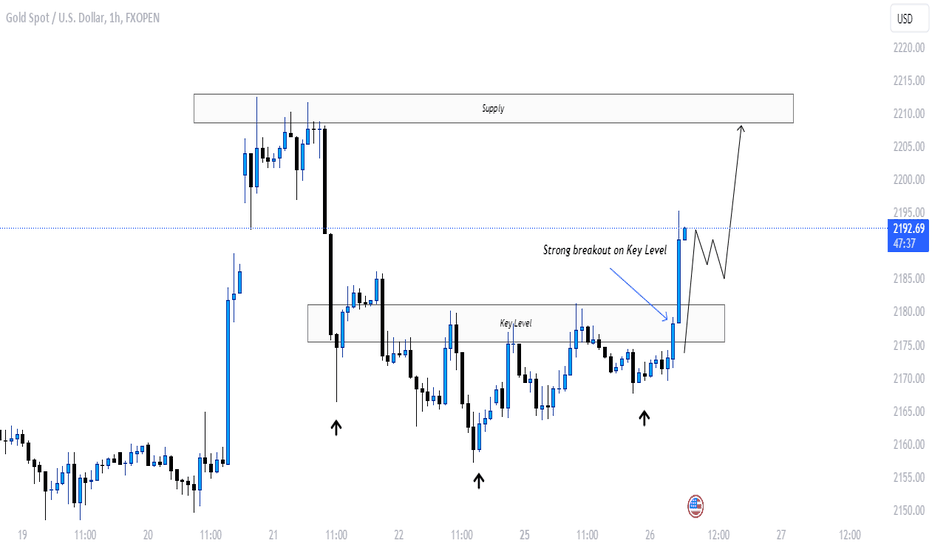

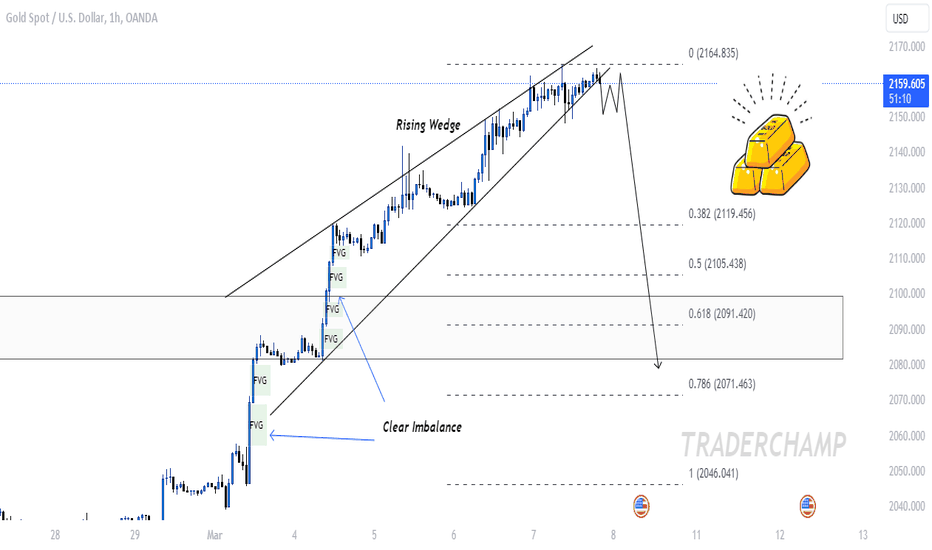

GOLD SHOULD FILL THESE IMBALANCE BEFORE THE RALLYOn the hourly timeframe, gold has formed a rising wedge pattern, suggesting a possible downward movement from its recent peak near $2160. Additionally, there's a distinct gap below $2120 indicating an imbalance that necessitates a retracement to fill it. This retracement is likely to target levels around 50% to 61% on the Fibonacci retracement scale.

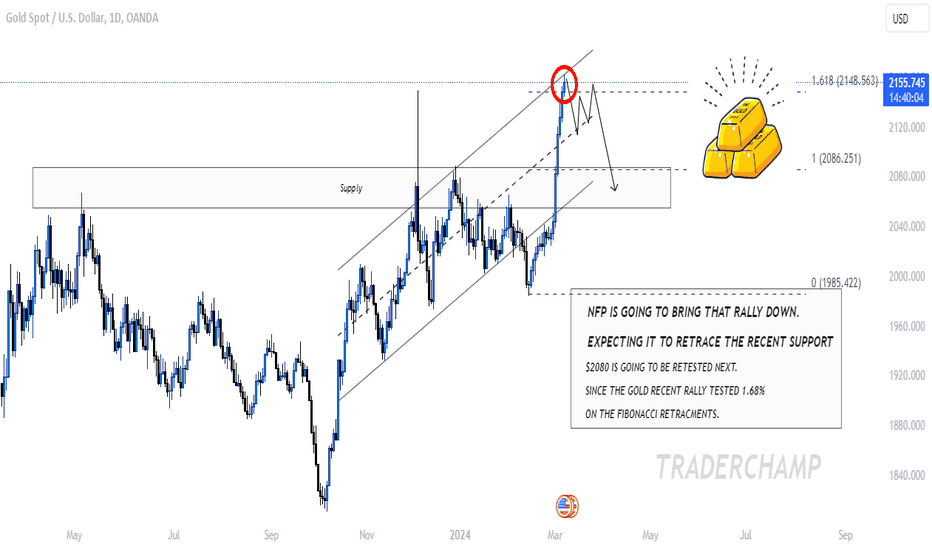

GOLD MAY RETEST $2080 NEXT WITH NFP AND UNEMPLOYEMENTGold has experienced remarkable growth lately following a breakout in the supply zone. The impulses have completed the 5th wave, signaling a potential downward shift, especially with the anticipation of positive NFP data. We foresee a retracement towards the highlighted supply zone, notably around the $2080 mark, a significant price level. Testing both the upper boundary of the channel and the 1.68% Fibonacci retracement, we have reasonable expectations for a forthcoming bearish movement.

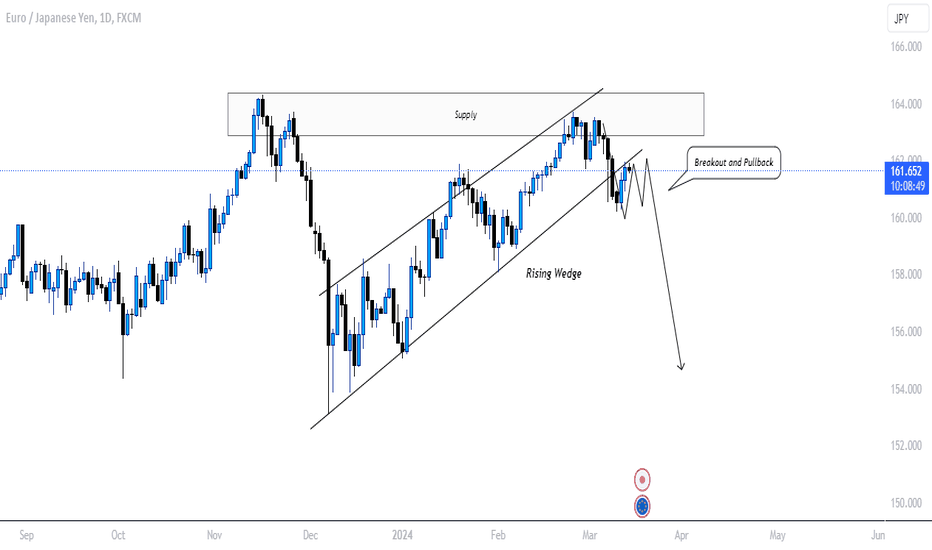

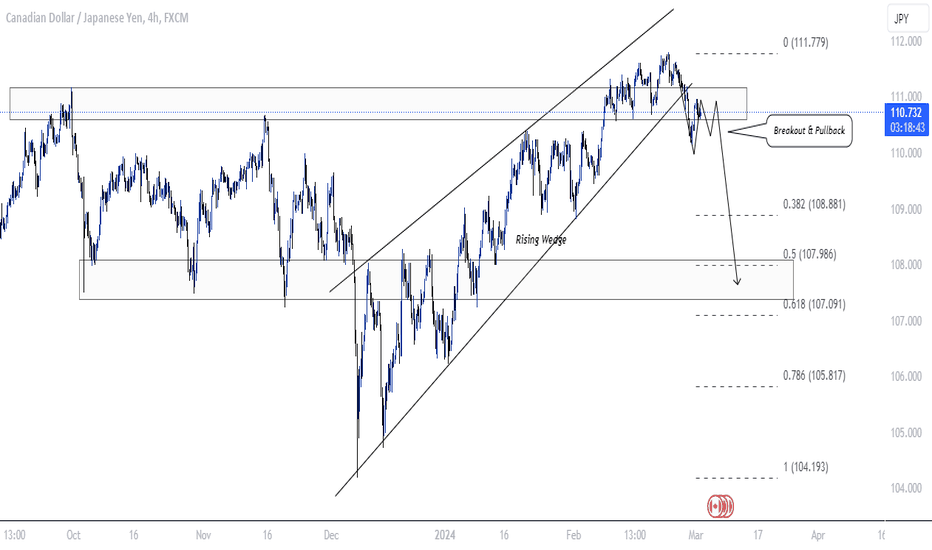

CADJPY RISING WEDGE BREAKOUTThe CADJPY has recently confirmed a bearish breakout from a rising wedge pattern. This breakout follows a prolonged period of strong bullish momentum. With this bearish setup confirmed, we anticipate a retracement in price. Furthermore, a significant supply level has formed at the peak, suggesting increased selling pressure may ensue.

AUDCHF MAJOR TREND BREAKOUTThe AUDCHF pair has validated a trend breakout on the daily timeframe, indicating a potential shift towards bullish momentum. This is further supported by the identification of a triple bottom formation within the daily demand zone. Anticipated is a bullish rally targeting the highlighted key level.

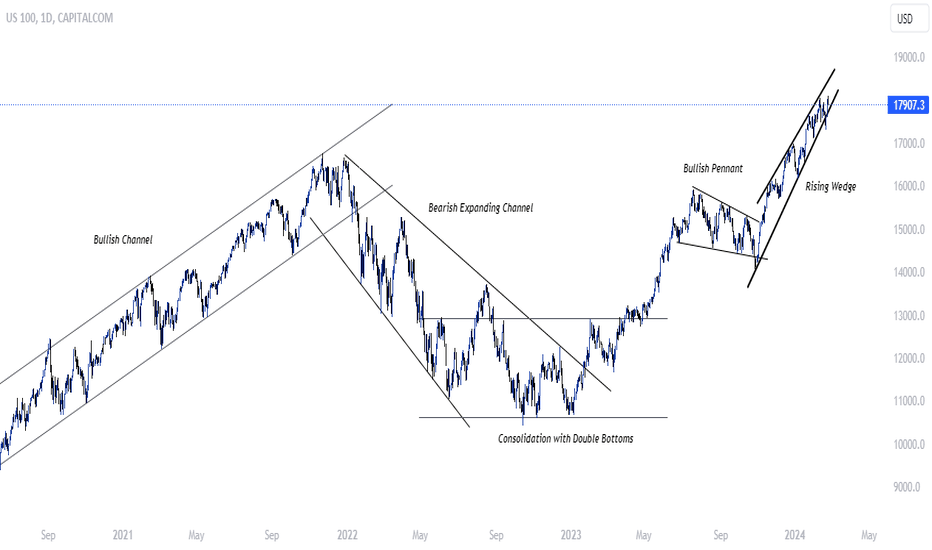

US100 MARKET STRUCTURES SINCE MARCH '20Since March 2020, the US100 index has shown a robust market structure. However, there's now the emergence of a rising wedge pattern under the daily timeframe, indicating a potential short to mid-term bearish trend. If a breakout occurs below the lower boundary of this rising wedge pattern, there's a possibility of a retracement or revisiting of the previous resistance level near $16500.

JPYX WILL REVERSE ON THE DEMAND ZONEJPYX has returned to the earlier demand zone highlighted across both hourly and daily timeframes. Additionally, we've observed the fulfillment of a five-wave count within the current bearish trend, suggesting the potential for a reversal at this established demand zone.

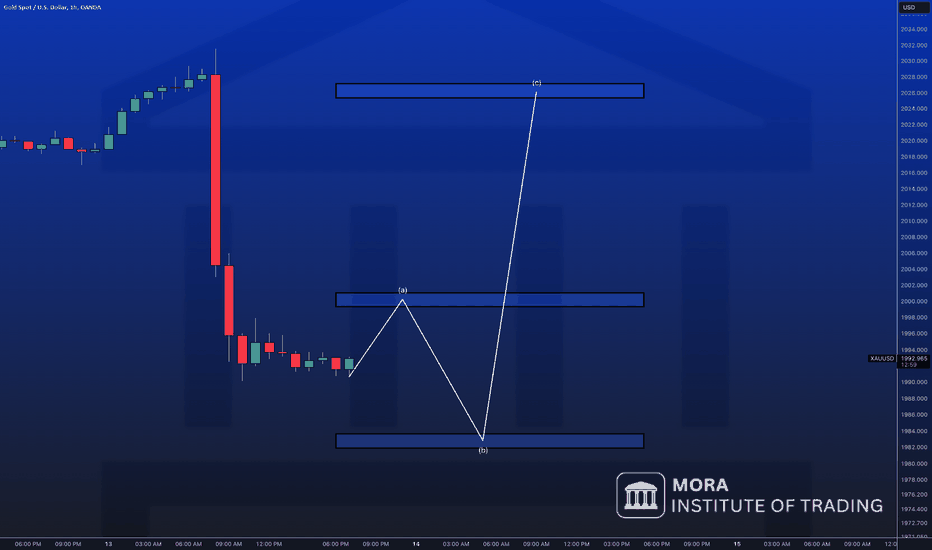

GOLD TRICKING BUYERS!Most traders seen on gold chat have purchased yesterday's lows and promised to hold till end of week, after seeing such a "large drop" in a single day, they believe this is the best course of action.

From my perspective price will trade below yesterday's low and then up to the projected target.

#XAUUSD