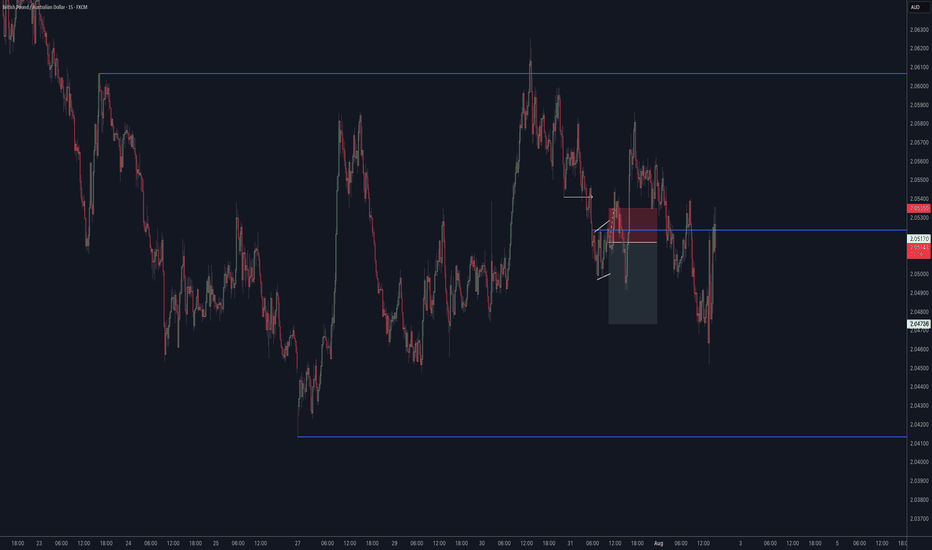

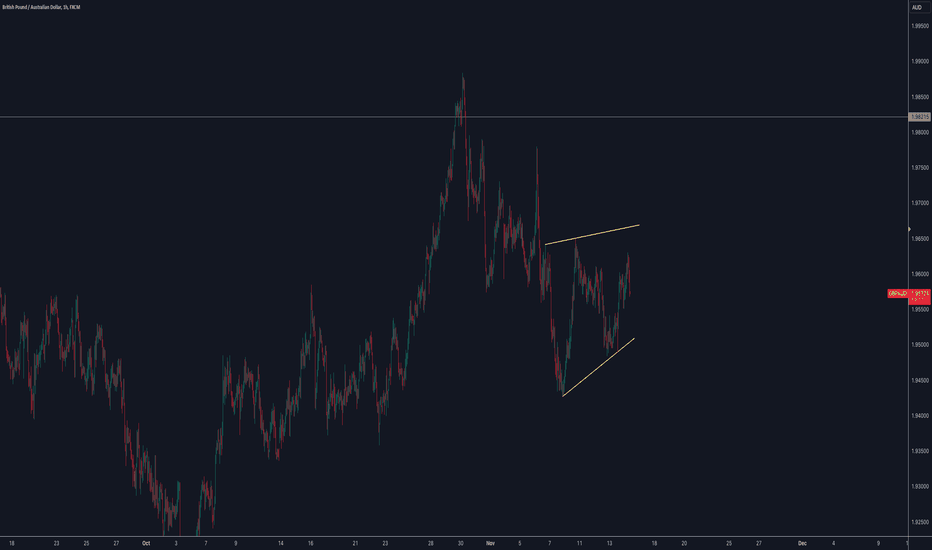

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

Traderecap

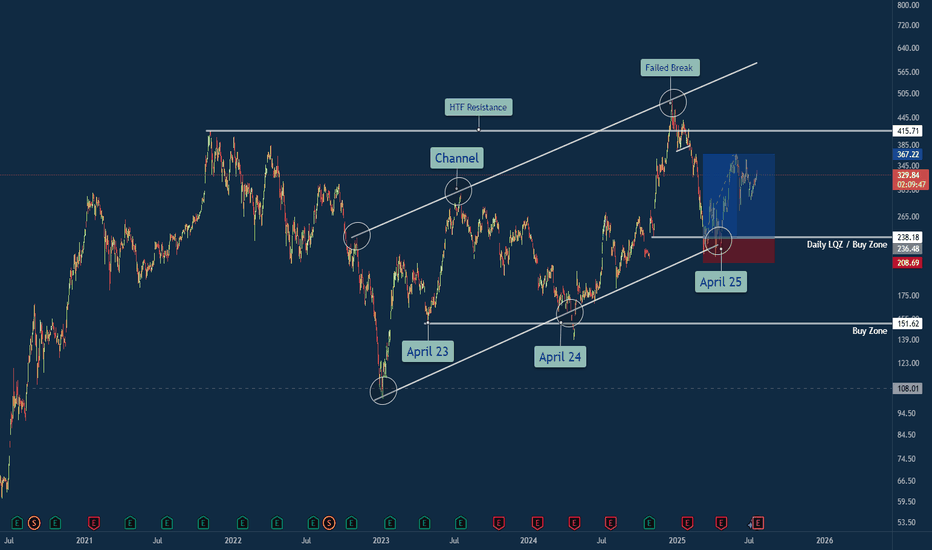

Tesla Trade Breakdown: The Power of Structure, Liquidity & ...🔍 Why This Trade Was Taken

🔹 Channel Structure + Liquidity Trap

Price rejected from a long-standing higher time frame resistance channel, making a false breakout above $500 — a classic sign of exhaustion. What followed was a sharp retracement into the lower bounds of the macro channel, aligning with my Daily LQZ (Liquidity Zone).

🔹 Buy Zone Confidence: April 25

I mapped the April 25th liquidity grab as a high-probability reversal date, especially with price landing in a confluence of:

Demand Zone

Trendline Support (from April 23 & April 24 anchor points)

Volume spike + reclaim of structure

🔹 Risk/Reward Favored Asymmetry

With a clear invalidation below $208 and targets at prior supply around $330+, the R:R on this trade was ideal (over 3:1 potential).

Lessons Reinforced

🎯 Structure Always Tells a Story: The macro channel held strong — even after a failed breakout attempt.

💧 Liquidity Zones Matter: Price gravitated toward where stops live — and then reversed sharply.

🧘♂️ Patience Beats Precision: The best trades don’t chase. They wait. This was one of them.

💬 Your Turn

How did you play TSLA this year? Were you watching the same channel? Drop your insights or charts below — let’s compare notes 👇

#TSLA #Tesla #SwingTrade #PriceAction #LiquidityZone #FailedBreakout #TechnicalAnalysis #TradingView #TradeRecap #ChannelSupport #SmartMoney

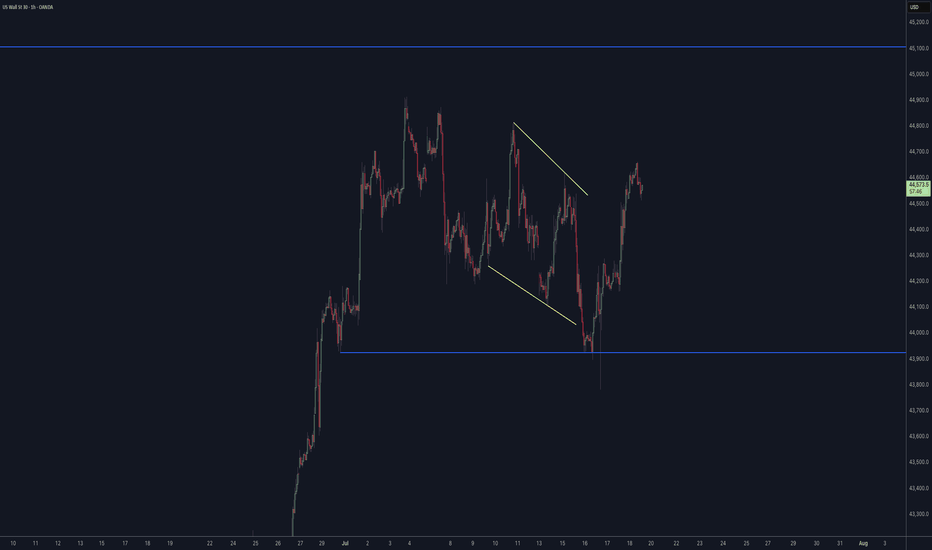

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

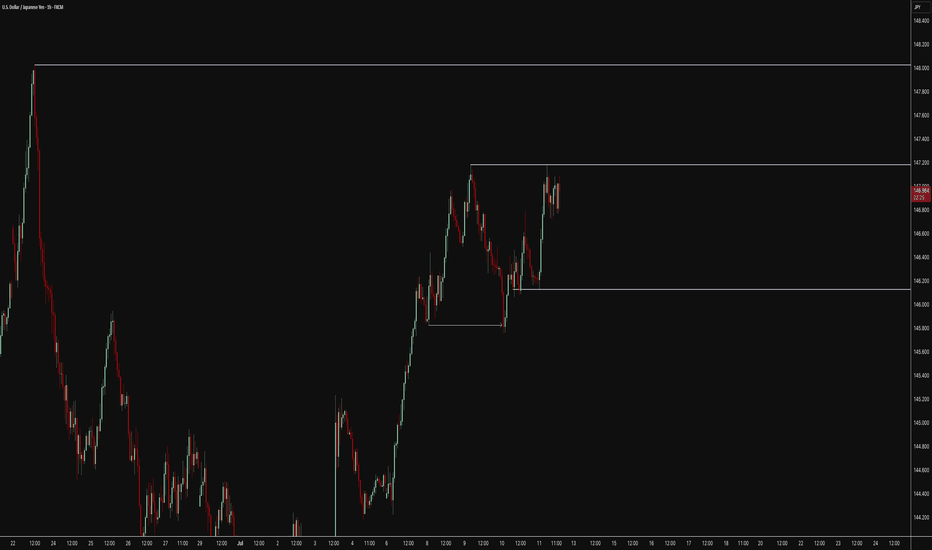

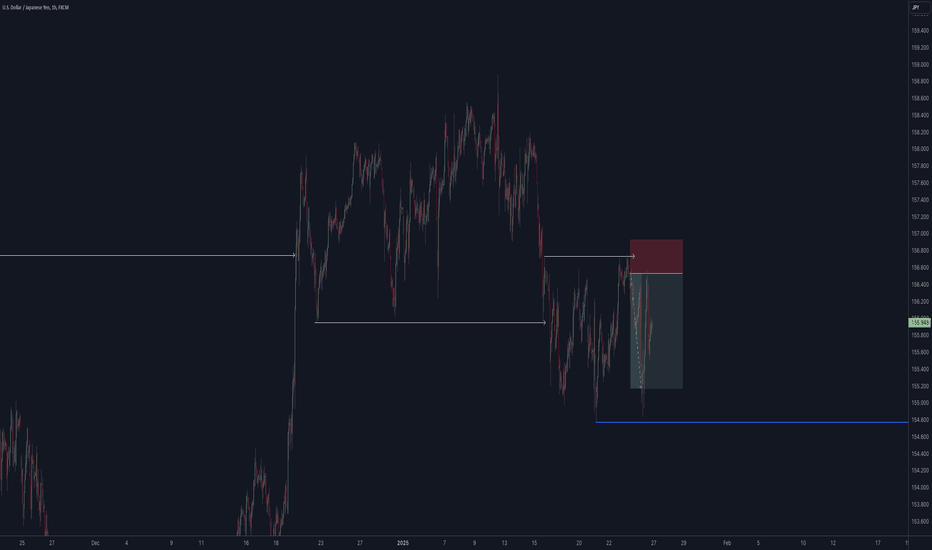

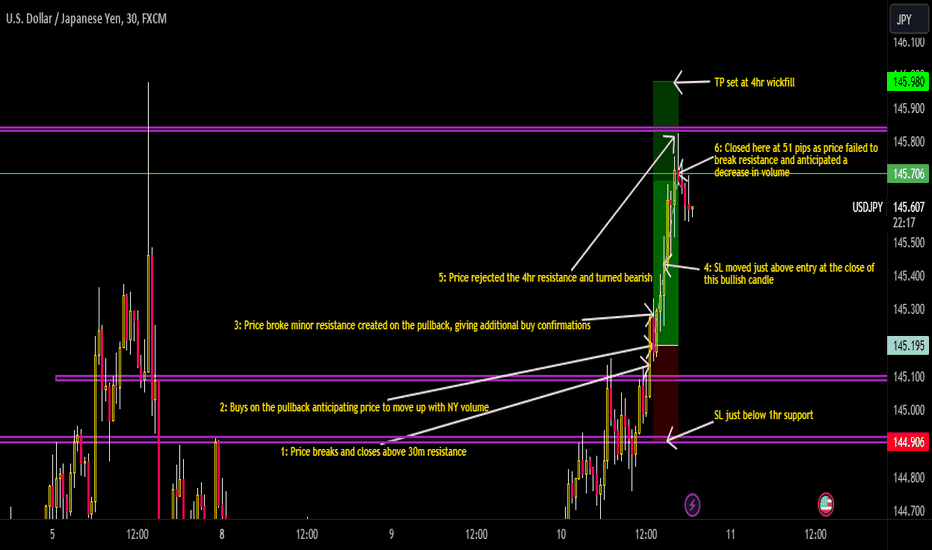

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

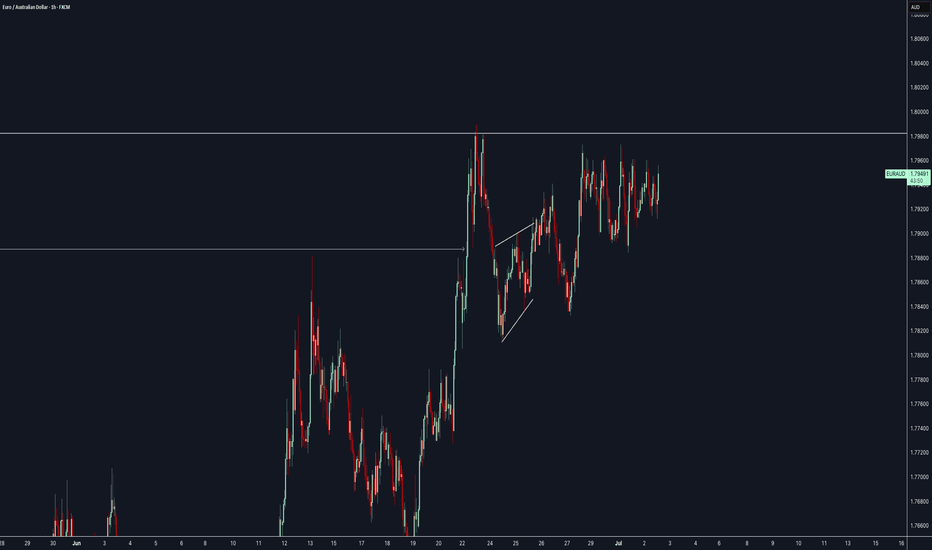

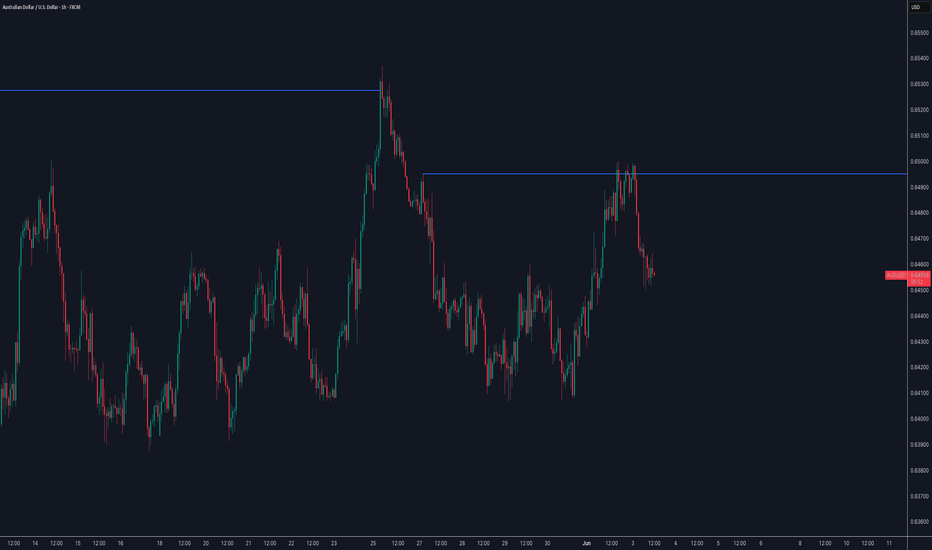

EURAUD -0.7% Short and AUDUSD MistakeA short position taken on EURAUD for a small loss after manually closing before swaps. I have also included a breakdown of a +4% AUDUSD long I was looking at taking but a small error on my behalf that caused me to stay out of the trade. Full explanation as to why I executed on this position and made the decision to manually close at the level I did.

Any questions you have just drop them below 👇

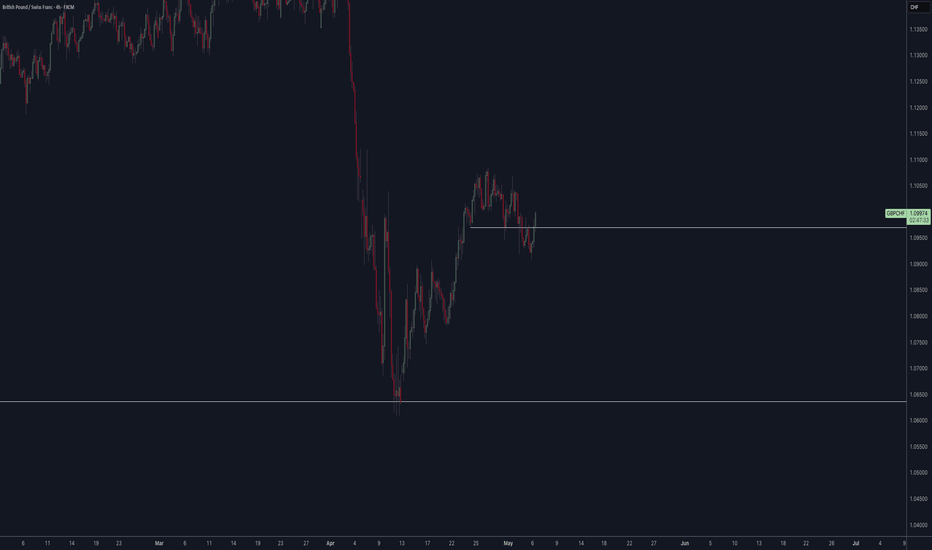

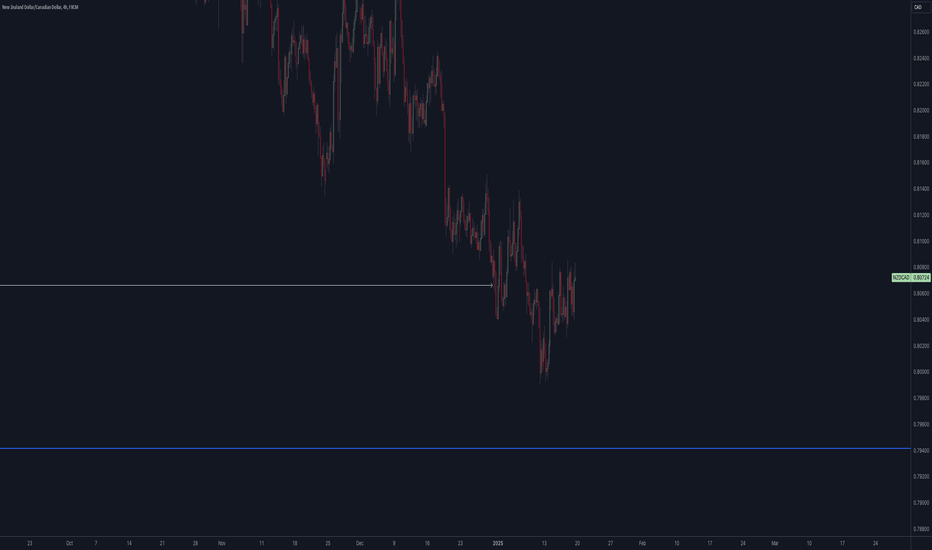

-1% GBPAUD & +2.5% GBPCHF Trade RecapsTwo positions I took over the last 10 trading days, both 4H entries, one long and one short.

FX:GBPAUD Short -1%

FX:GBPCHF Long +2.5%

Top down analysis explained in the video and also my thought processes behind playing both entries as limit orders to maximise R:R and protect stops much better.

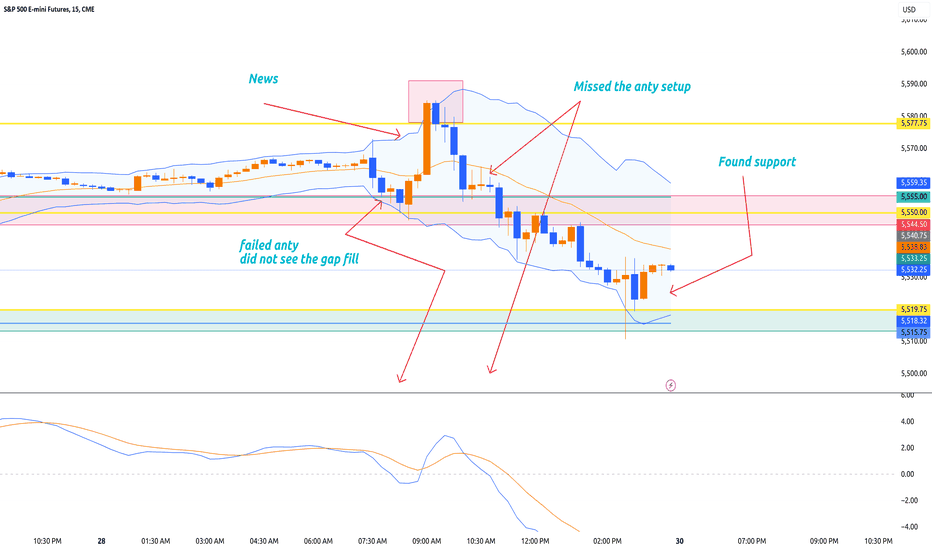

post market analysis/Trade recap 6/28/24Market Recap:

Great technical analysis this week with my predictions in the market.

Yesterday my levels of:

5583.00 (bullish) & 5518.50 (bearish) were almost spot on.

Price went bullish to the level of:

5584.25

Price retreated back to the levels of:

5518.25

Trades Recap:

Not so solid on the trade entries as I got faked out, not seeing the gap being filled rather than an anty setup. That is okay, however soon after I also missed a real Anty setup. It could have been a much better trading day but all in all I am not upset and feeling good for next week.

Sunday I will be posting an analysis for the following week and potential levels to be looking out for. These are levels that I believe have merit and strength.

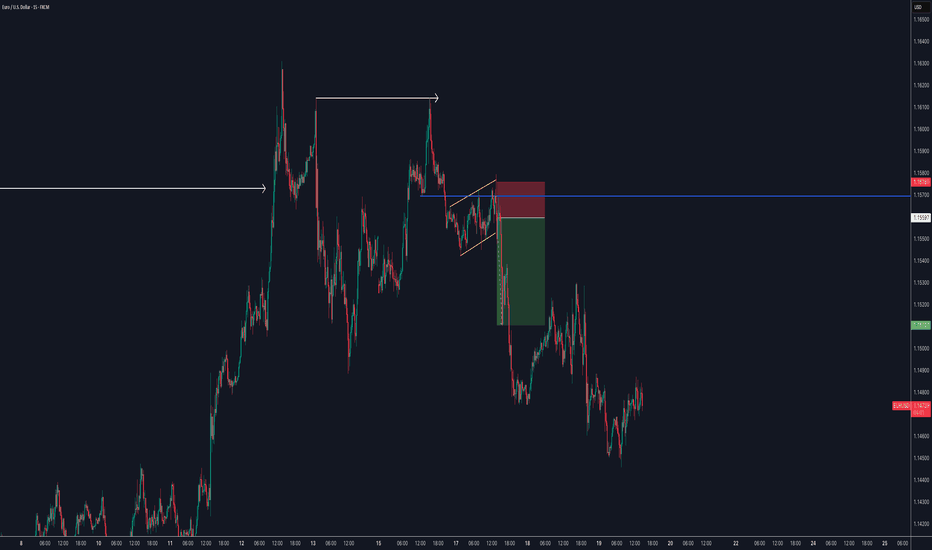

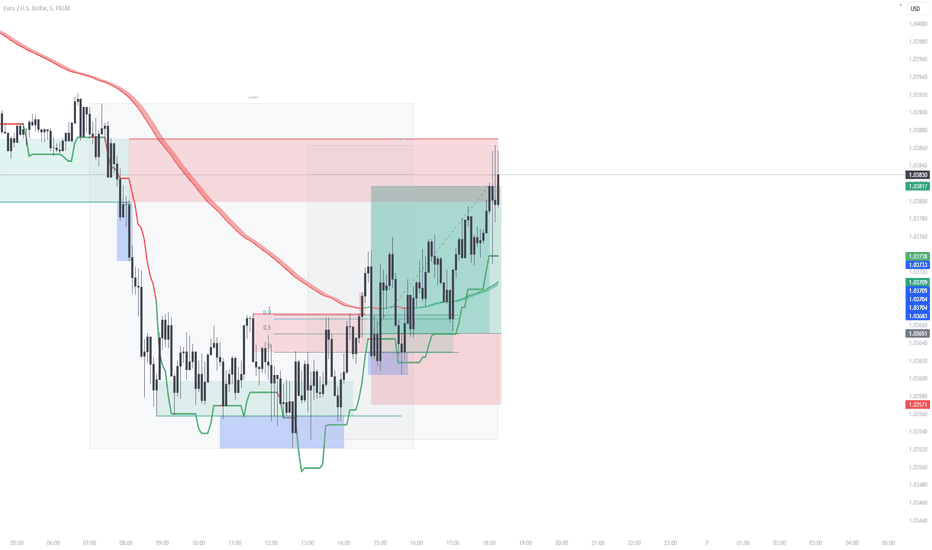

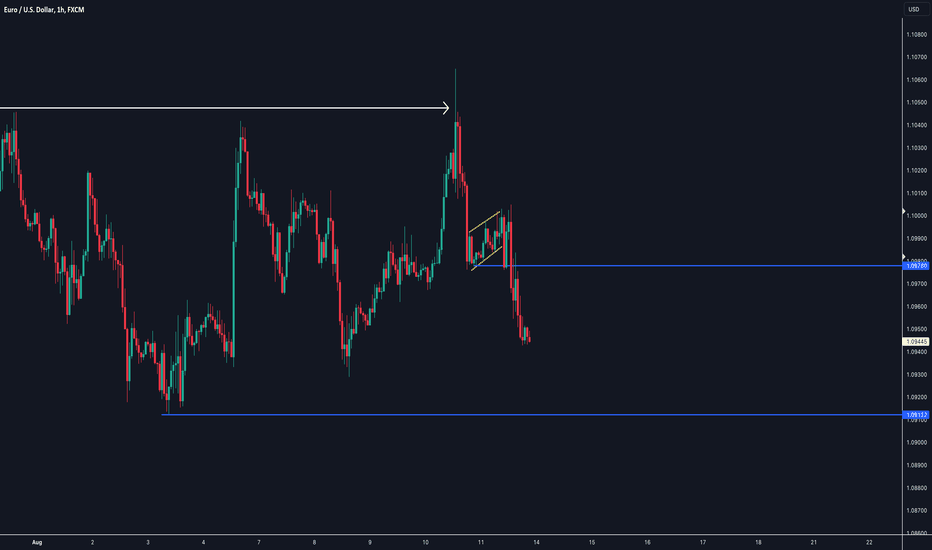

EURUSD Trade Recap 11th August 2023Breakeven taken on EURUSD last Friday, very happy with the management. Full explanation in the recap.

🧠Emotional Log

---

**Pre-Trade**

I understand all the confluences within my thesis, I accept this risk as I know if it is a loss I clearly understand exactly why I took to the trade. My stop is protected and if price takes me out there is a chance it is forming something else anyway. Do not be greedy, but also do not hesitate. These are the trades I must allow myself to take.

**During Trade**

My stop is protected, allow price to do its thing. My entry is valid, and I understand structure over candlesticks. I utilised the timeframes as best I could, working from the 1H structure filtering down to the 15M without jumping in. Do not choke the trade, mini 90% rule is in play so let price do its thing.

**Post-Trade**

I understand that price created a mini scoop for a much sharper entry, however, how can we guarantee this will always happen. My entry was valid, and stop was protected, I understood the 90% rule kicking in and managed risk accordingly to price action on the 1H. Nothing more I could have done in this situation and capital was protected.

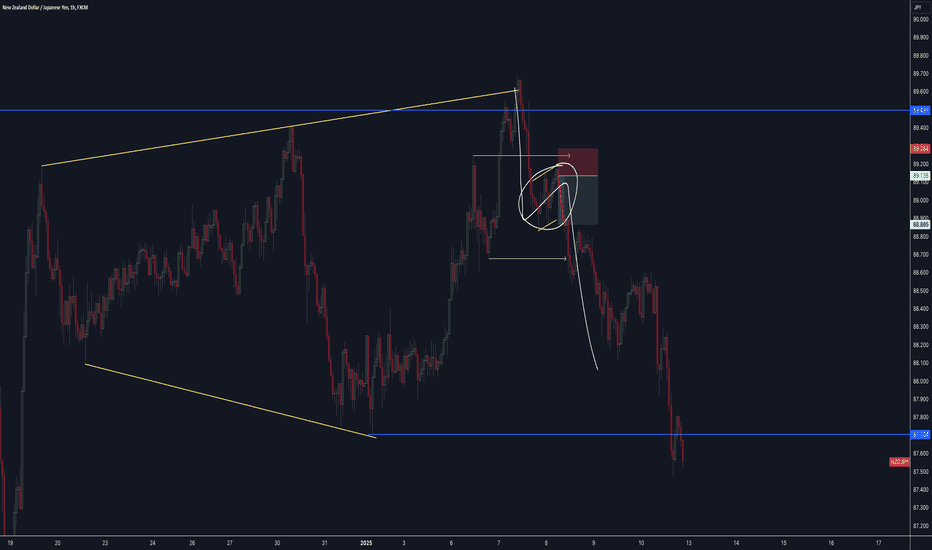

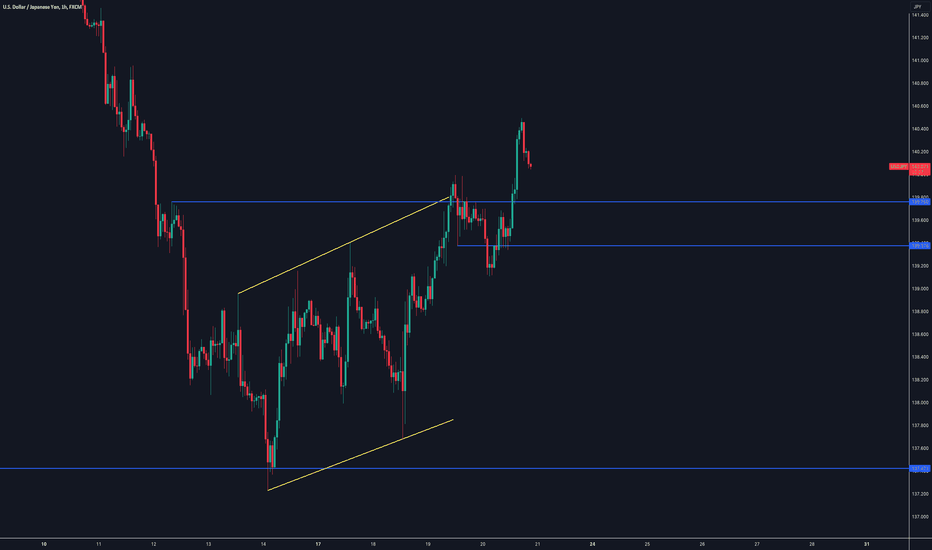

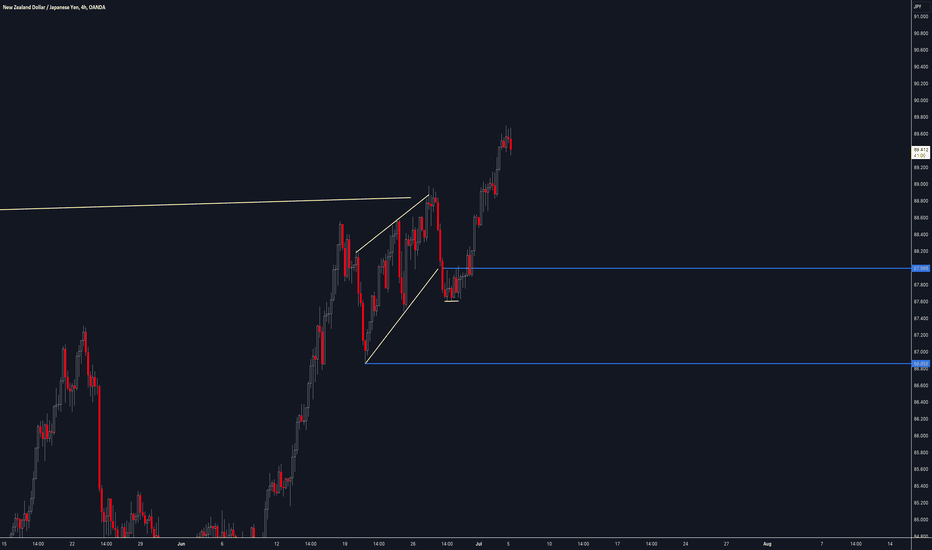

USDJPY Trade Recap 19th July 2023How am I feeling pre-trade?

I am feeling confident in my mind, I forecasted the risk entry and not allowed little things to put me off the trade. Normally I would be saying things like ‘its gone past the hook’, ‘there needs to be a nice retrace or pin bar’ but ultimately it has all of the ingredients to sell. Ascending channel, meets AT hook with a 1H retrace candle. I am happy I did not allow these past issues to overcome my decision, this is also helping with my entry criteria and structure over candlesticks.