Traders

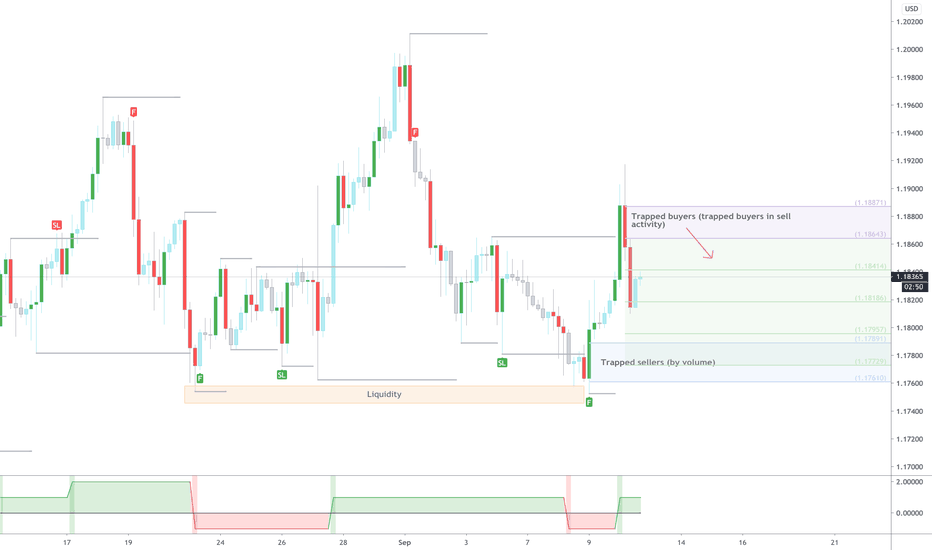

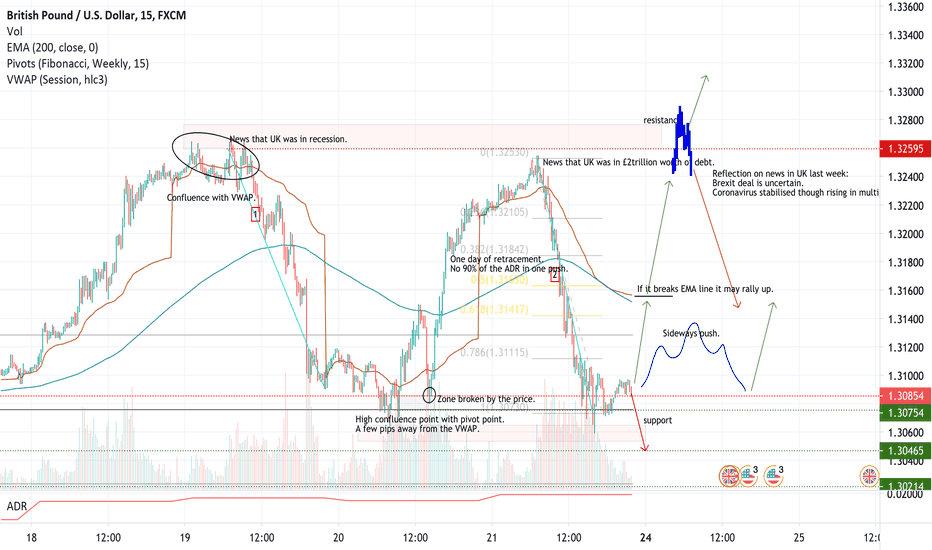

GBPUSD Consolidation Negative BiasFUNDAMENTALS

UK: Despite a small increase in the CPI due to easing lockdown measures, the BofE is unlikely to change its stance. The market will react in consolidation to last week's news in the UK of the uncertainty of a post-Brexit trade deal with the EU, the UK's debt being larger than GDP and the figures casting a recession.

USA: Unemployment figures start to weaken and US geopolitical tensions rise between Biden/Harris and Trump/Pence. The Fed still will not change its attitude and will continue to purchase assets at least at the same rate that it has done in the past few months. Coronavirus new cases begin to fall.

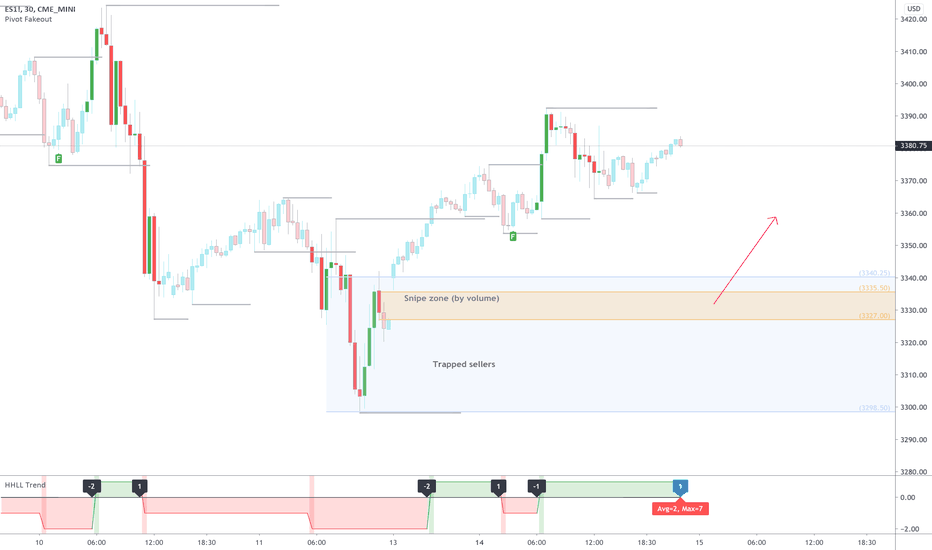

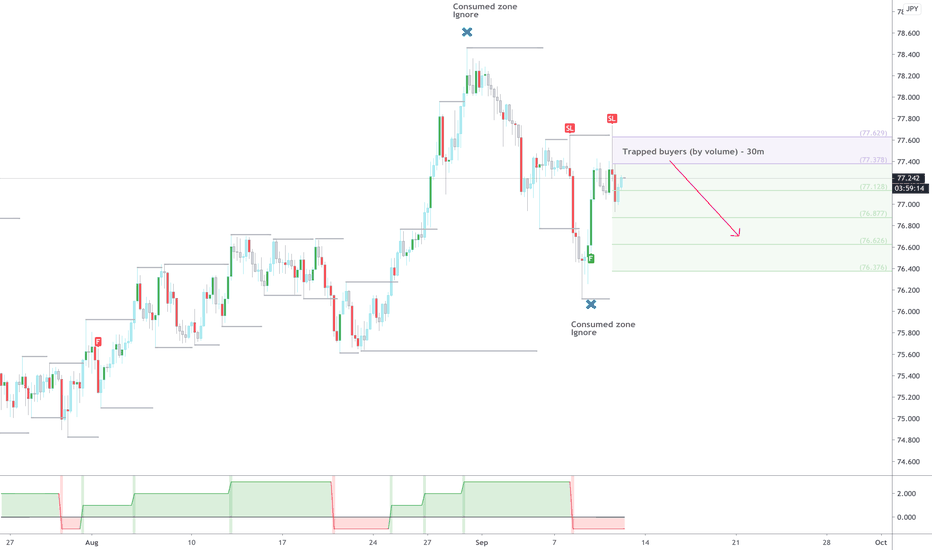

TECHNICALS

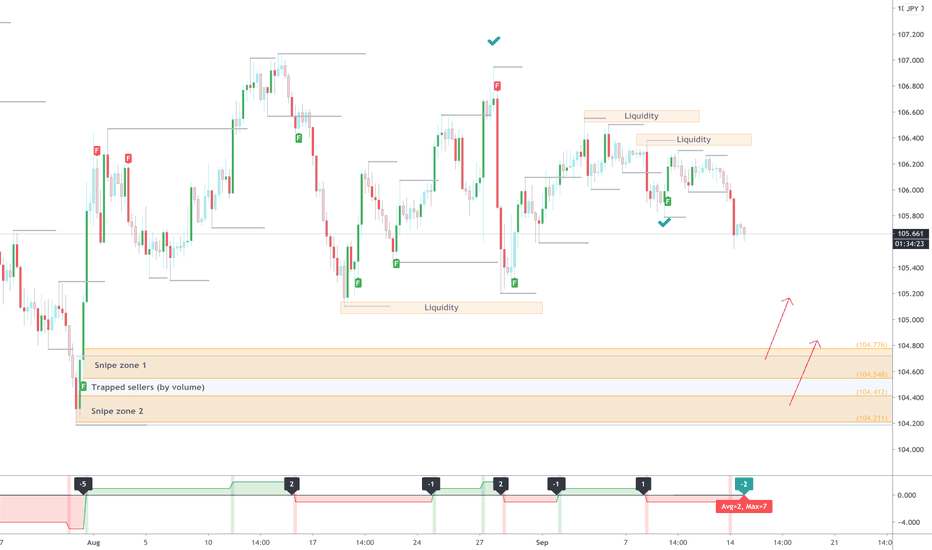

This leads me to believe the market will not rise above the resistance level, though it will come close to reaching resistance if the price pierces through the 200period EMA - therefore it is unlikely a trade will arise in the next few days on this pair. Possible price movements are displayed on the chart.

Overall, I have a negative outlook on this pair; news in the UK seems to be more prominent than news in the US and with 2 consecutive daily pushes downward a third is easily on the horizon.

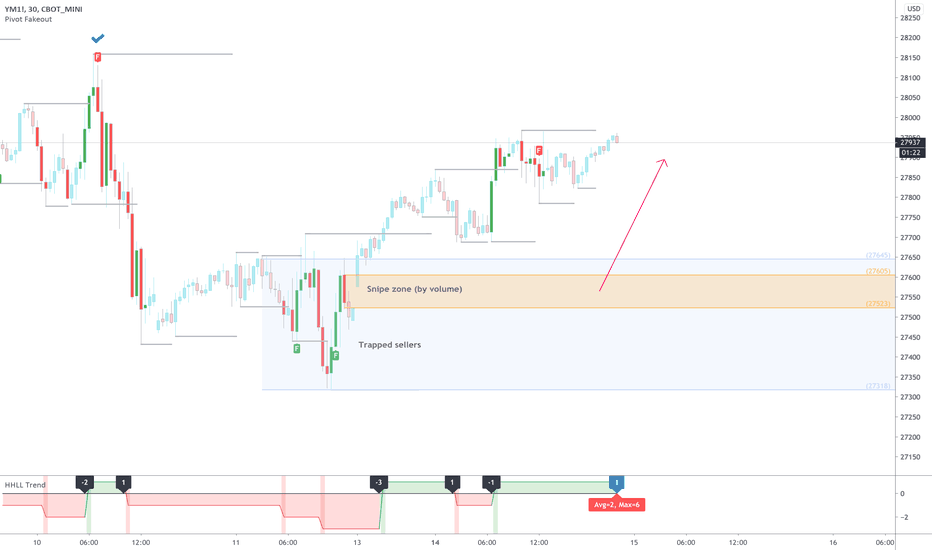

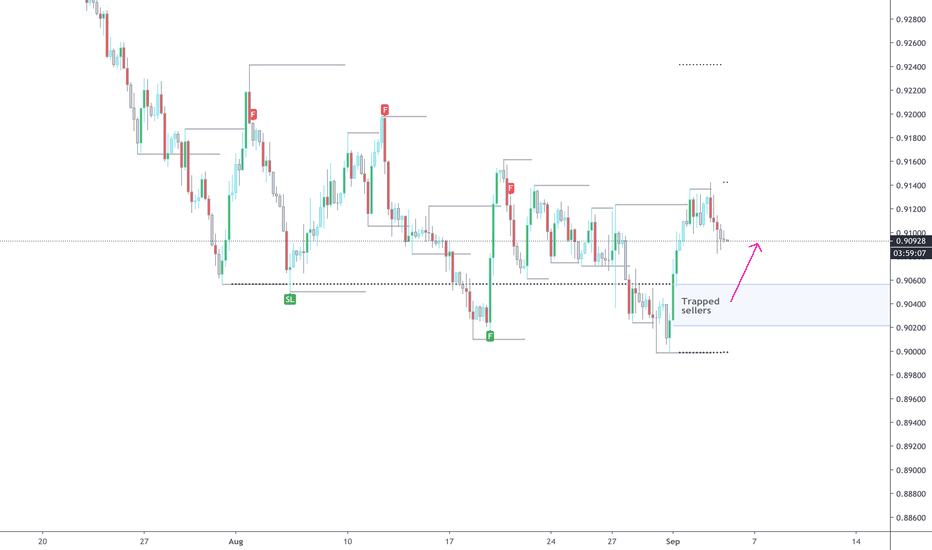

EURUSD- NEVER OPEN A TRADE AGAINST THE TRENDHello Traders,

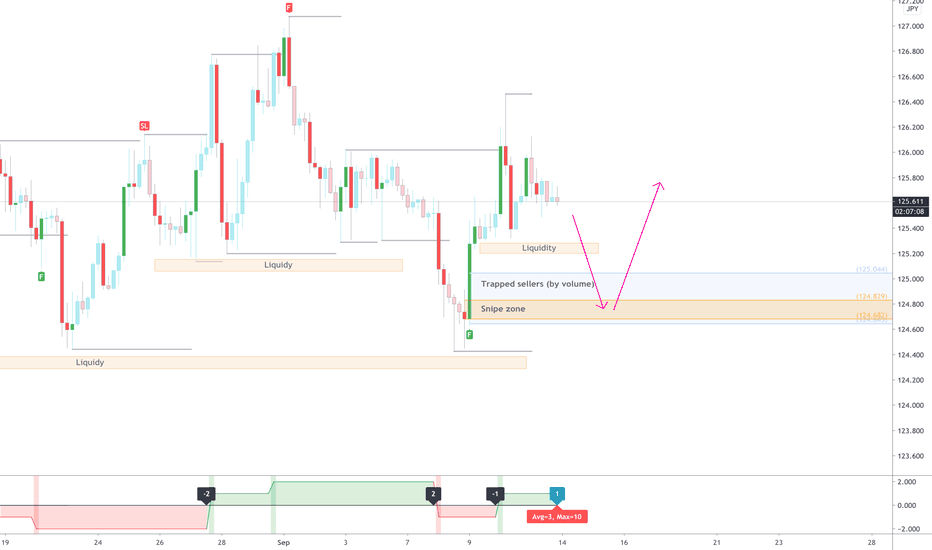

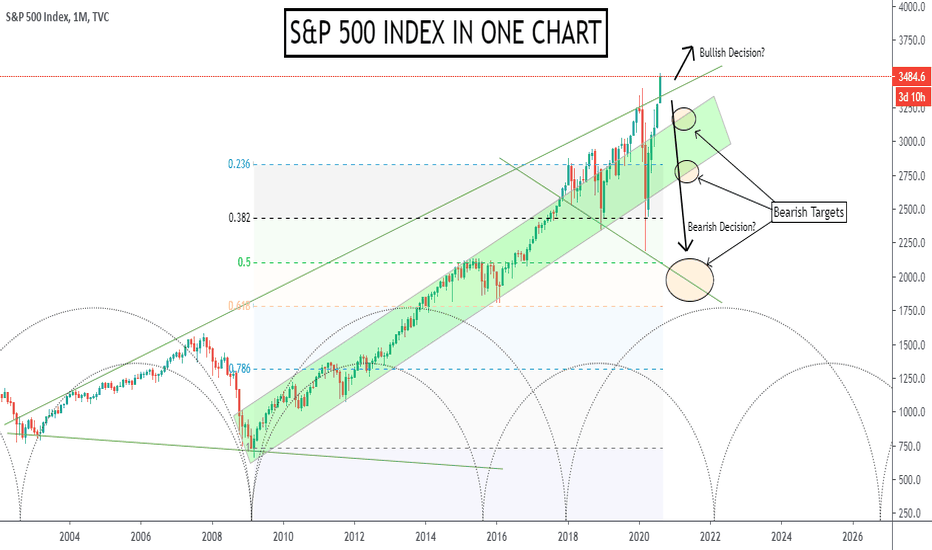

Again the same point of view. Two scenarios, the price couldn't consolidate for a long time specially on this pair which is the most volatility one. Therefore, follow the main rule never fight the trend, we trade on Foreign Market, we don't create the trend , obviously we don't change it, we can't. Just follow the wave. The rules are on the chart. Lets see the paint.

Thank You.