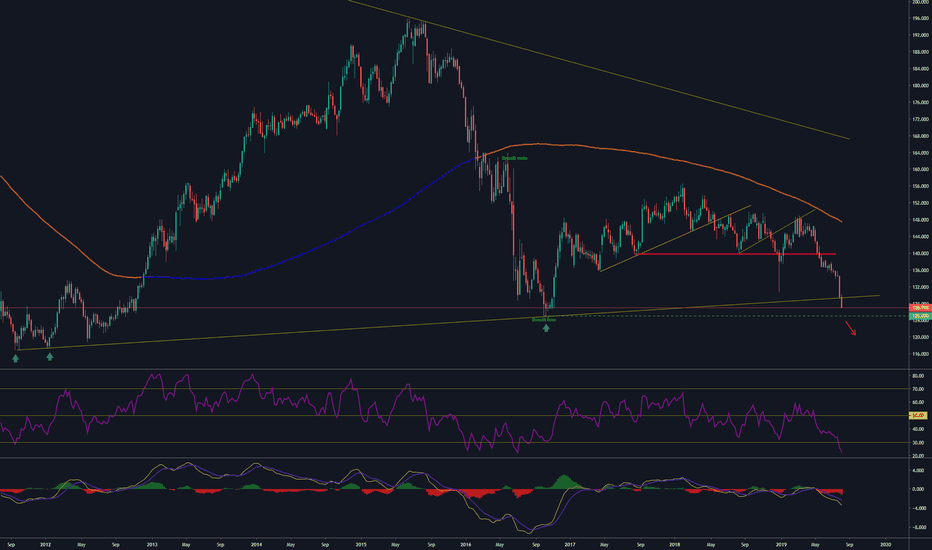

Is Southwest Airlines a Hidden Gem?This is my first TradingView video, hope you guys enjoy! Be sure to leave a like, follow, and comment!

Southwest Airlines is a potential gem in this market as trade wars with China escalate. As Boeing ramps up production of their Max jets, Southwest also ramps up their flights as they are a primary user of the Boeing Max jets. Southwest did beat their earnings, however fell a little short on revenue, but if this is any indication towards Q3 earnings, I would feel bullish as these Boeing jets become more available. Southwest is also increasing their Hawaiian travel routes so this is great fundamental news for the airline!

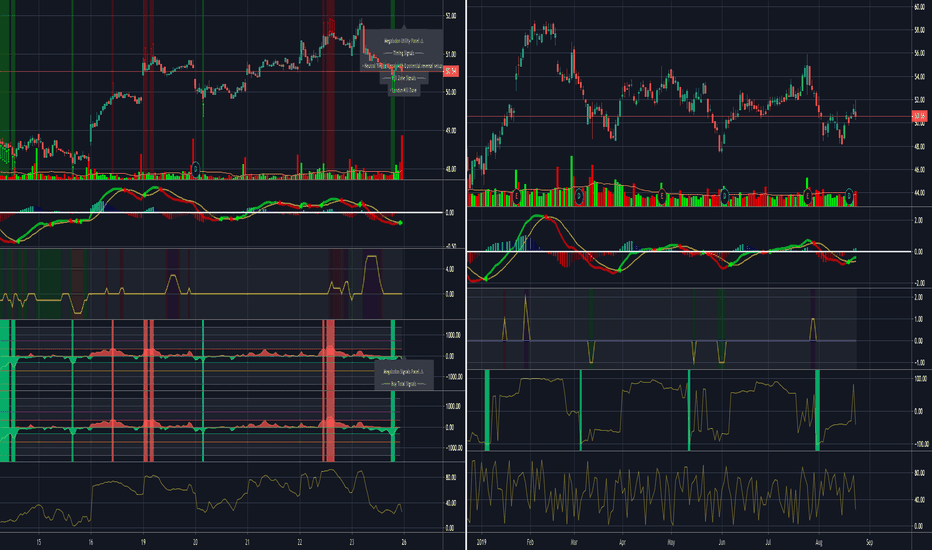

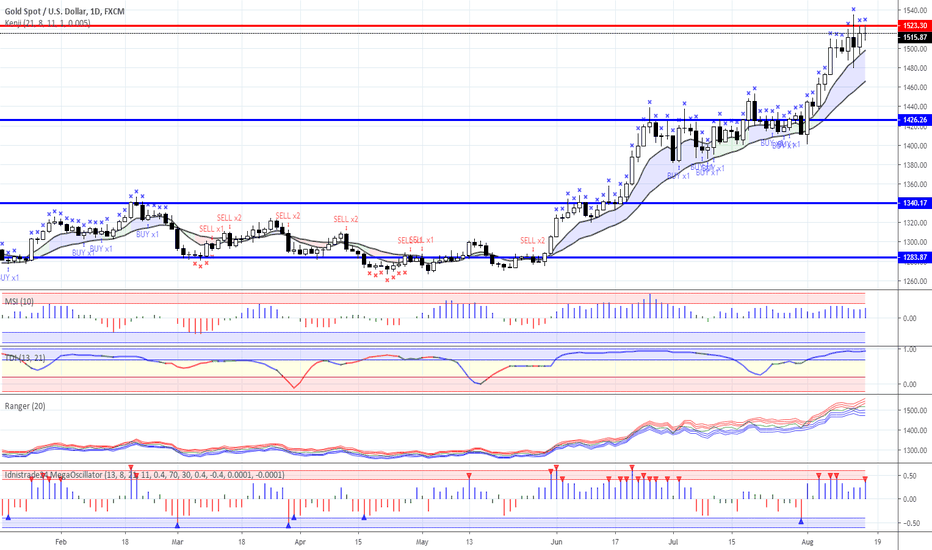

The Megalodon indicator uses a machine learning algorithm, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! You will also receive real time buy and sell signals for the stock market, cryptocurrency, as well as forex markets! We also completed our cryptocurrency automated trade bot. It trades for you, using our backtested indicator with phenomenal results! Click the link in my bio and try out the megalodon indicators today!

Tradewar

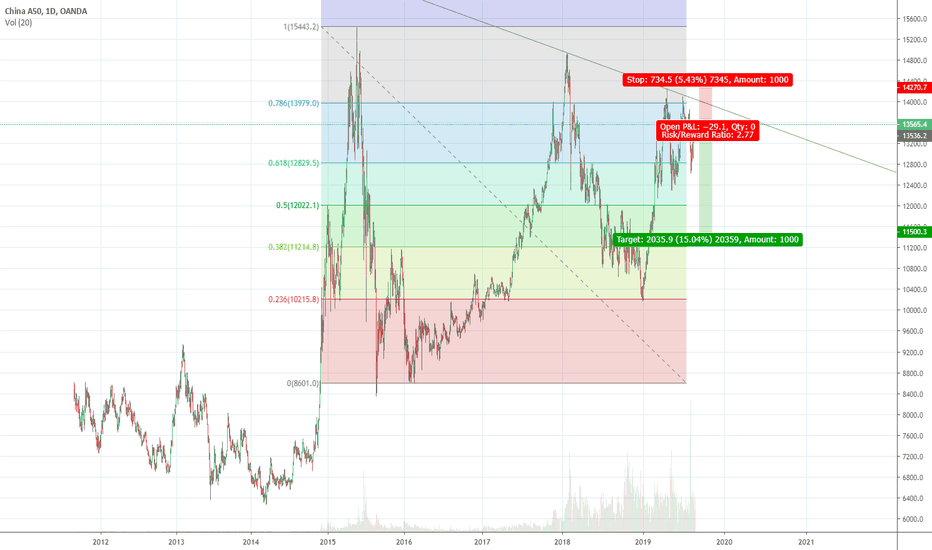

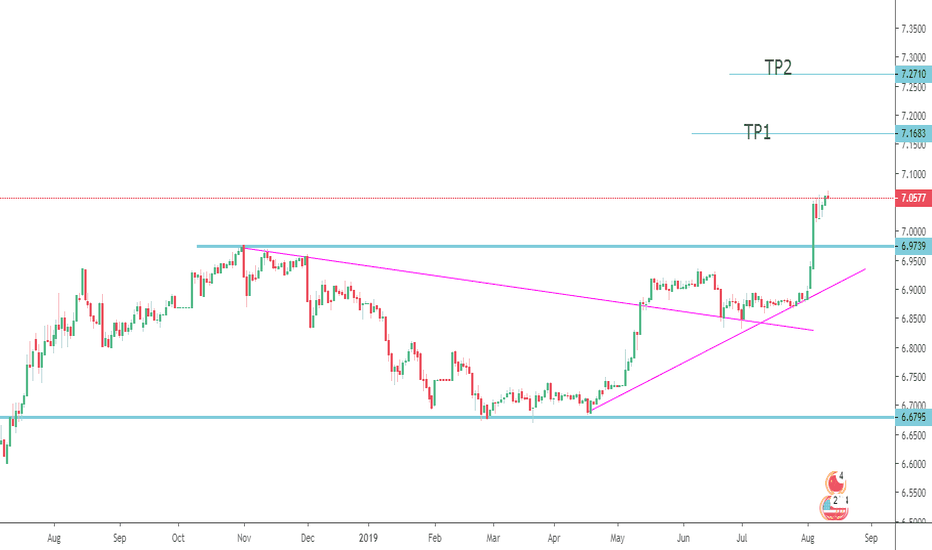

Pre-emtively Short Chinese StocksSo China imposed tariffs on 75 US Billion of US imports, of soya, oil , etc..

The drama will occur again and Trump will spit back with tariffs or measures on a surprise,

so as an anticipation shorting Chinese stocks index is recommended.

SL is set based on shown trend line acting as resistance,

TP on Fibonacci sequence.

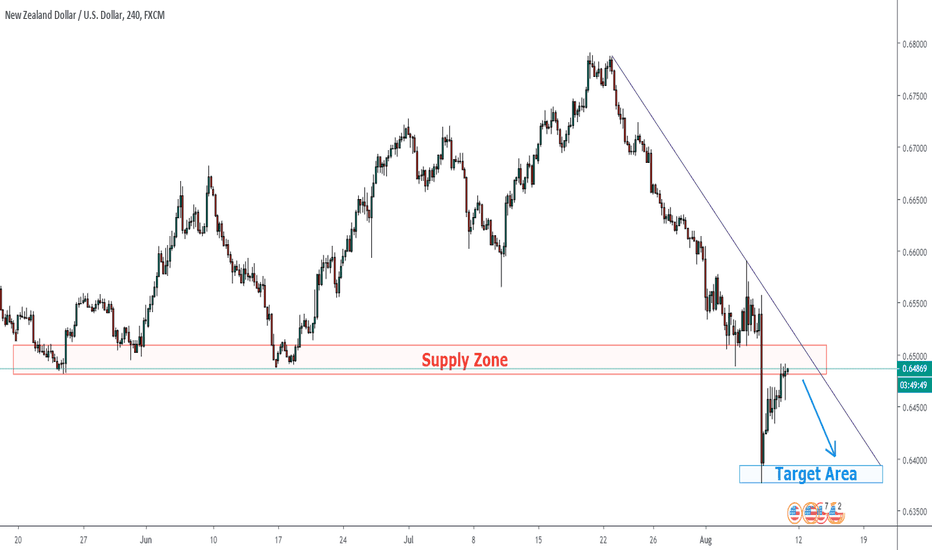

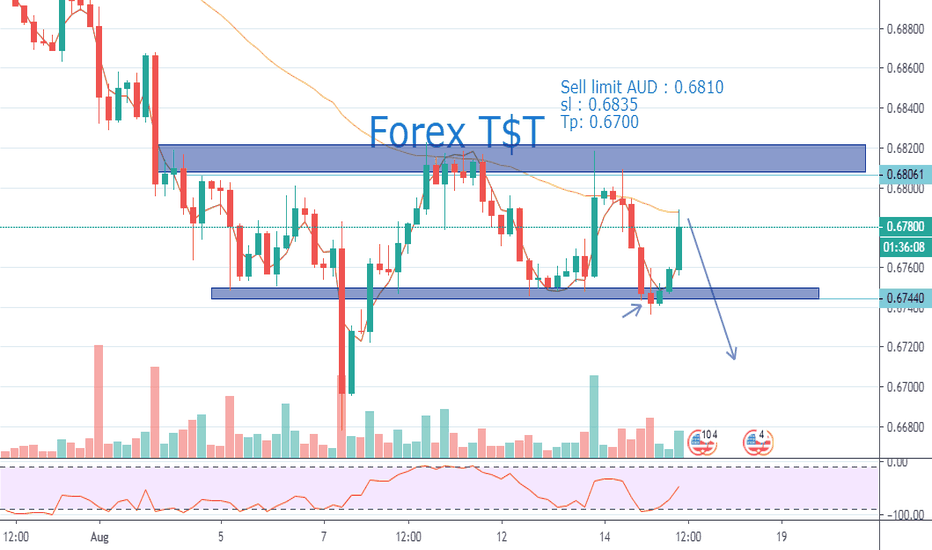

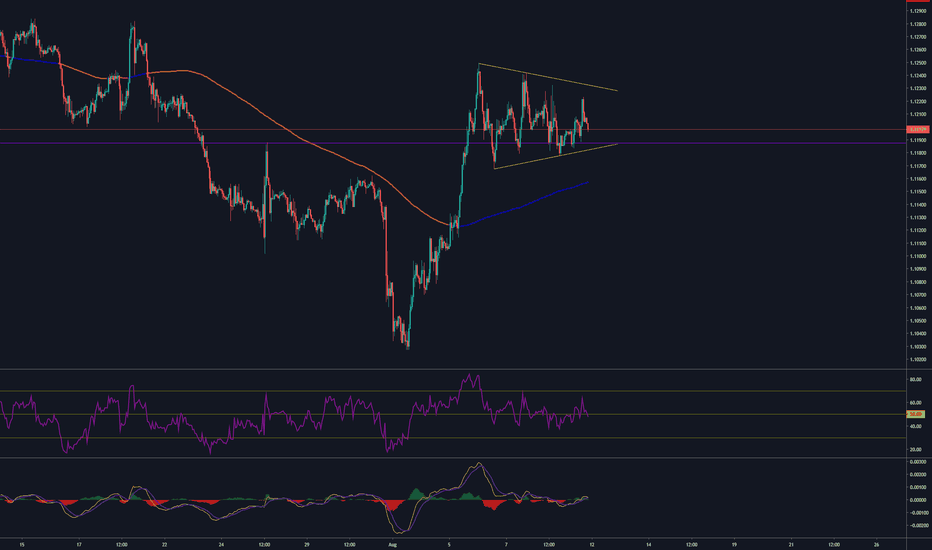

Go Short as NZDUSD Pullback Reaches Supply Zone

- Good risk-off opportunity as NZDUSD pullback after larger-than-expected rate cut by RBNZ

- Kiwi to be pressured by trade war

- In contrast to the RBNZ, the Fed was not as dovish as expected

This week we saw the RBNZ delivering a 0.5% rate cut, 0.25% more than what the market had estimated, and said that rates might go into negative territory. The kiwi plunged across the board but still managed to rebound slightly despite such surprise. But with such a shock and dovish message, I think it is hard for this pullback to sustain.

Furthermore, trade tensions are apparently worsening since last week. This will add more downside pressure to risk-on currencies (AUD & NZD).

On the other hand, the Fed delivered a mixed message last week which was not as dovish as anticipated. Until further news is released regarding the Fed's stance on rates, NZDUSD should continue its march downwards to around 0.6380-90.

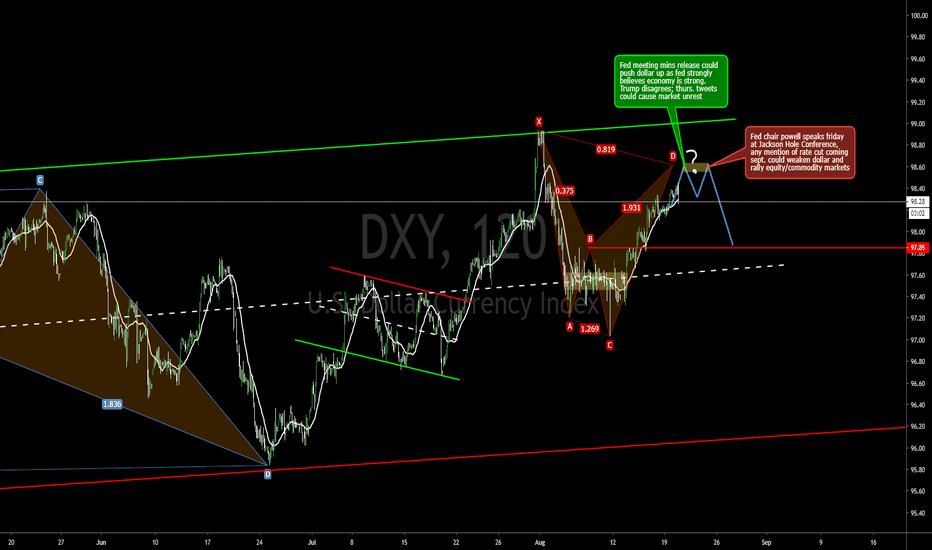

FED vs. POTUS... who will push the dollar more? Find out on the next episode of Dragon Ball DXY...

Or we could just guess with what we know now like any analyst. Expecting fed meeting minutes to state what the fed members are stating already, they believe the economy is still resilient and does not need too much expansionary policy, cuts above standard aren't necessary, etc. These statements will reassure many regional institutional investors who put faith in the FED and are confident in their outlook... but investors in other parts of the world who don't like the current leadership of the country or what said leadership is doing to economic relations may not feel the same. It's possible we could see similar unrest in the markets like last week depending on whatever tweet happens to be sent out between Thursday and Friday. While I believe were no where near a scenario where a 100bp cut is necessary, with bond yields inverting and Trump's war on China grinding the global economy, international outlook for the dollar may not be as optimistic.

All the same I've drawn out a possible double top scenario I'm picturing as the dollar approaches exhaustion towards the upperside of its range and supply pressure increases from international investors searching for better options. Previous bearish analysis was invalidated so I'll be watching with a neutral perspective as I avoid the dollar this week. But I wouldn't be surprised to see an overall bearish move by end of the week.

Should We Ignore USDCAD Head & Shoulders?Reasons for buying USDCAD:

- Disappointing Canadian employment data last Friday

- Price bounced off both the demand zone and support trend line

- Crude Oil Futures price rejected resistance trend line

Last Friday, Canadian employment posted a huge drop and unemployment increased by 0.2% to 5.7%, both missing estimates by a wide margin. Despite this, the CAD still managed to maintain some strength, supported by the rise in oil prices. But at this point of time, the chart is showing that maybe, the market has not fully priced in the weak data yet.

In the 4-hour USDCAD chart, we can see that the price plunged but bounced off the demand zone and support trend line after the US announced a delay to impose tariffs. Crude Oil Futures price also approached and rejected resistance trend line.

Although the announcement on tariffs is a positive news, tariffs are still set to be imposed and not totally removed. The trade war has been creating a lot of volatility in the market, so we should always keep a lookout for the latest developments and manage risks accordingly. The head and shoulders pattern may form and play out, but I don't trade solely on chart patterns, that is why in this case, I will go long on the USDCAD.

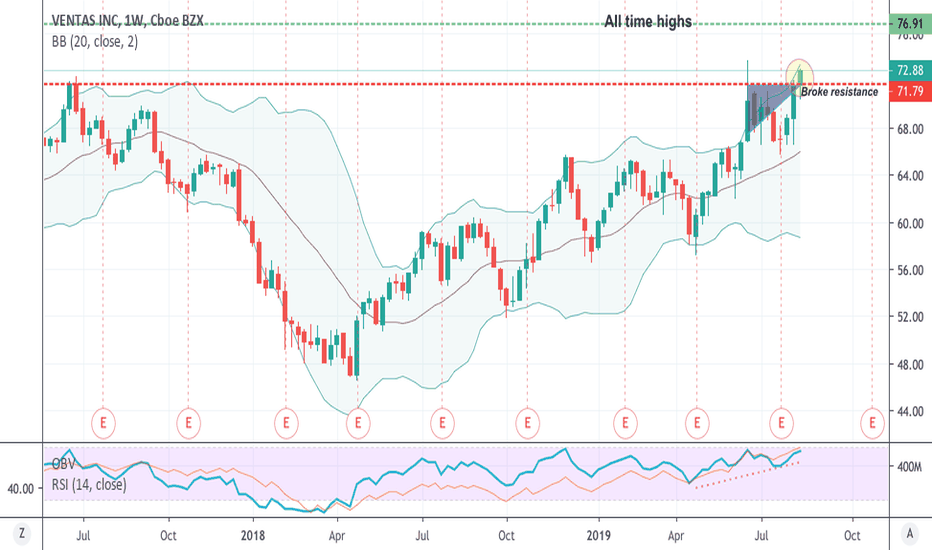

Ventas Inc - Bullish defensive ideaVTR is real estate investment trust (REIT). The technicals are great (check chart).

Market analysis:

Generally after an inversion in a yield curve , the following sectors tend to outperform the market:

XLU (Utilities)

XLRE (Real Estate)

XLP (Consumer Staples)

The following tend to underperform :

XLK (Technology)

XL (Industrials)

XLB (Materials)

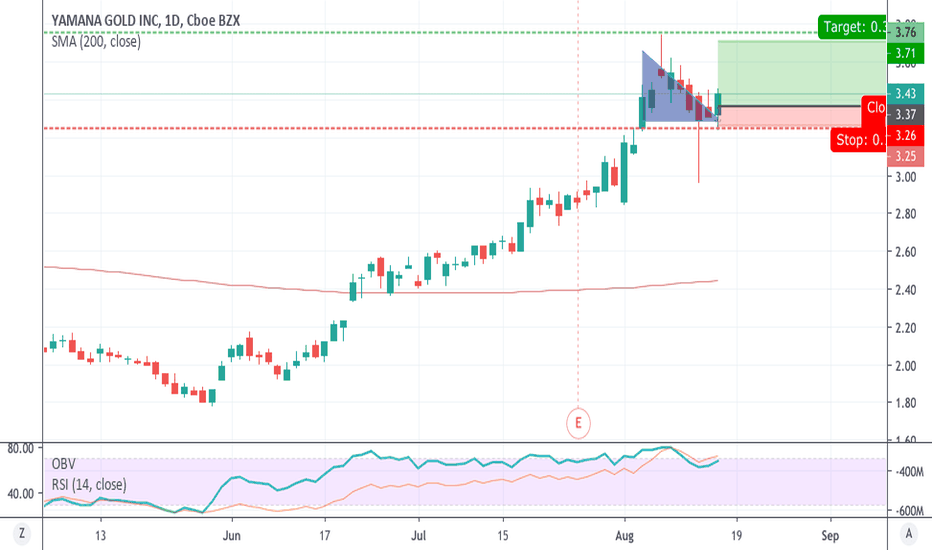

One way to play Gold... YAMANA (miner)With all of the market uncertainties (trade war, cutting rates), gold is profiting heavily.

We are seeing a very nice flag, with bounce-back at support.

Analysis in chart.

TRADERSAI - A.I. Powered Model Trades for Today, THU 08/15The Doublespeak from China and our Politicians Driving the Markets Yo-Yo

The naive and clueless policy-by-tweet politicians (not "leaders" - we seem to have no leadership anywhere anymore at this moment) driving our economic governance (or, lack thereof), and the cunning opponent's deeply strategic moves defining the trade war, investors are being left dazed and confused with the whiplashes the markets are experiencing of late.

As we stated earlier this week, "tread (and, trade) carefully, leaving enough room for sudden spikes in either direction". Today is likely going to be yet another day of empty-headed tweets and headlines about the trade war feeding knee jerk moves in the markets.

Of course, our job here is not to idly pontificate about politicians and leadership but to try to identify potential investment and trading opportunities emerging from their speech and actions. Read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Tariffs #Tradewar #recession

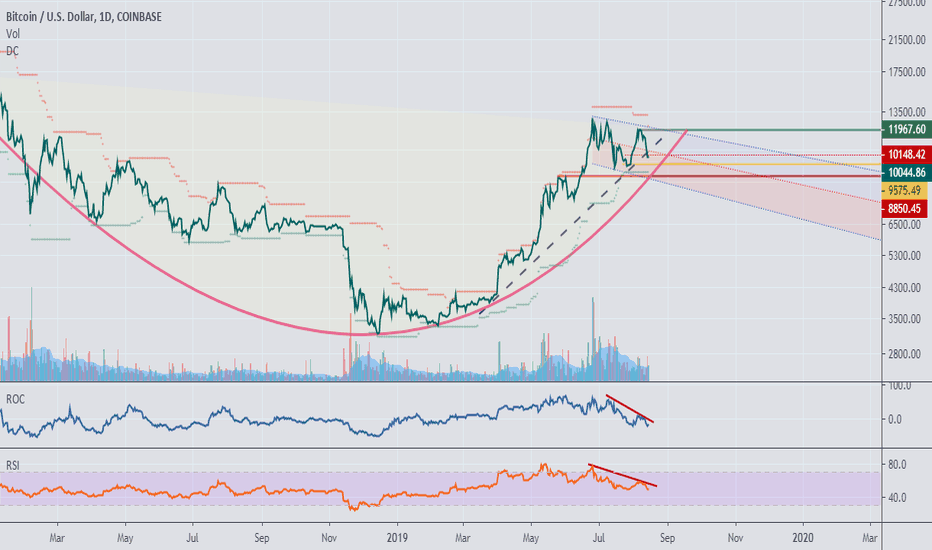

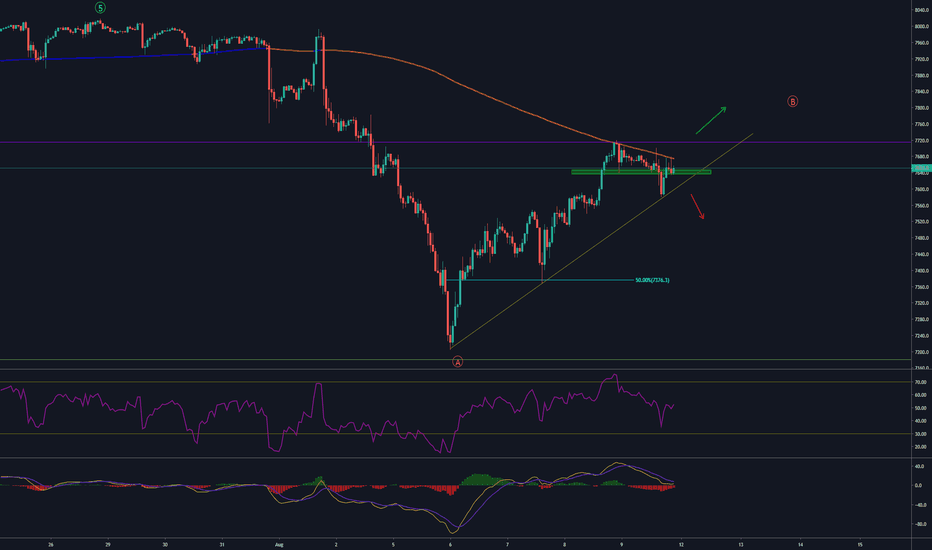

Bitcoin medium-term negative outlook based on economic risksBitcoin is a valuable property. In future we need this kind of exchange mediums. So long-term trend still positive but its price is closely related to business cycles. This is for it being as an exchange medium. In trade war situation, more secure commodities like gold are more interesting and exchange medium ones are not.

Technically, below 9575$ and 8850$ strong sell signals. above 1200$ the analysis isn't relevant and positive trend will continue.

Pause in trade war shifts market focus on another dataA temporary truce in the trade war was announced. Well, of course, a “truce” is not the right word we prefer a “pause”. The appreciation of the renminbi, as well as the decline in the VIX Index, are further evidence of tensions easing in the financial markets.

Against this background, we again pay attention to the sale of gold. But we note that sales with the random points may turn out to be unprofitable, so we select the entry points carefully, taking into account at least an hour overbought and along daily maximum.

Recall that the dollar is still very strong, which is bothers Trump. And in itself, it is an opportunity for its sales in the foreign exchange market. But the markets are more interested in the Fed’s further actions - will the Central Bank cut the rate again&? What could spur the Fed on easing monetary policy? First of all, weak macroeconomic data. So today's retail sales data may well give rise to dollar sales.

Retail sales report is a monthly measurement of the retail industry. Monthly retail sales data is a chain indicator. That is, The report shows the total sales for the prior month. This specificity leads to the fact that chain indicators tend to fluctuate around the zero and after a strong growth period a decline period follows, and vice versa. So, over the last two months, US retail sales have been growing. To show better results this time too, the indicator must rise quite significantly concerning the three months periods. The US economy has been weak recently, there is a reason to expect weak data on retail sales. Since markets react not to the essence, but to the gossips, the outcome of the indicator in the negative zone (although this may be an increase relative the period of two months ) can trigger dollar sales. In this regard, today we will sell the dollar. First of all, against the pound.

Eurozone GDP grew by 0.2 %, however, industrial production decreased, and quite significantly (-1.6% m / m), which is the worst result over the last 3 years. China also showed weak industrial production data: plus 4.8% expected plus 5.8% (the minimum growth rate since 2002). Retail sales in Sino are also worse than expected.

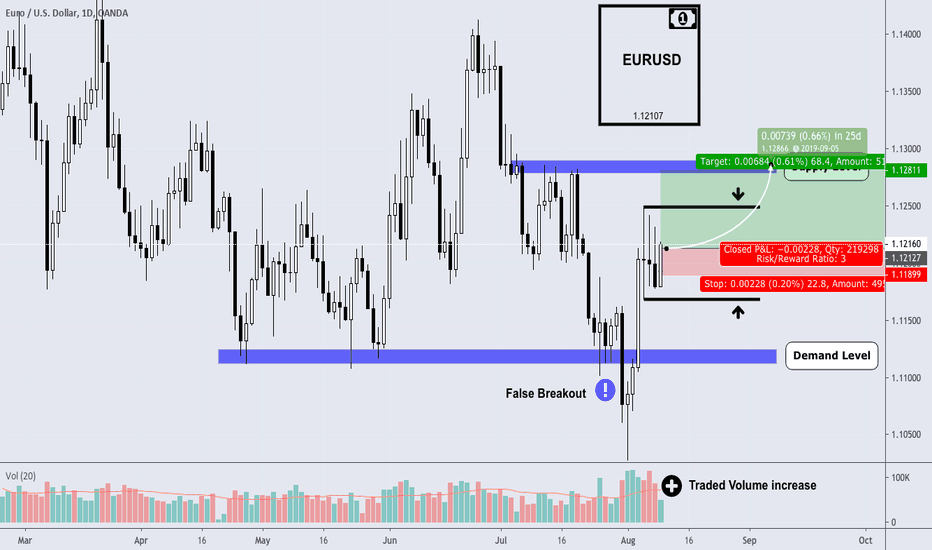

Overall view of EURUSD - Update of August the 5th's weekFundamental: US President Donald Trump tweeted his disappointment in the Fed on Thursday which caused some volatility but did not break EUR/USD from its range. His tweet stated that he was not happy about the dollar’s strength and attributed this to the Fed, stipulating that they have kept interest rates high compared to other countries. Trump's eagerness to lower DXY's value will probably give some punch to the FOREX pair which will seek for higher prices.

Technical: After a false breakout of the long run demand level resulting to the new low of the year, EURUSD soared to higher levels and is now consolidating on a tight range. The pair is strongly bullish and in case of a range breakout will settle back at the supply level .

Advice: Stay bullish and buy any low points while we don't break downside @1.11500. The first target could be viewed around @1.13000.

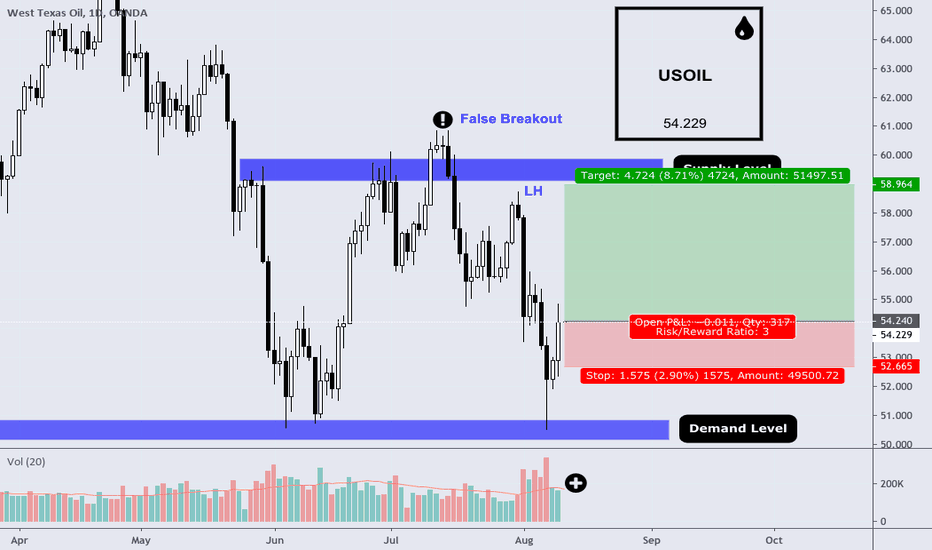

Overall view of WTI Crude Oil - Analysis of August 12th's weekFundamental: International-Brent crude oil futures closed higher on Friday despite an International Energy Agency report that showed demand growth dropping to its lowest level in 11 years. The IEA said global demand to May from January grew at its slowest pace since 2008, hurt by mounting signs of an economic slowdown and a ramping up of the U.S.-China trade dispute. Buyers instead were motivated by Euroilstock data that showed total crude and product inventories of 16 European nations in July were slightly lower than in June. Likewise, the commodity is strongly correlated to the US dollar index which showed lately a bear spike and increased odds of oil soaring.

Technical: the energy commodity settled several times at the demand level forming a head and shoulder formation (or Triple bottom). An increase of traded volume coupled by a strong momentum made oil increased 7.42%. USOIL began a bullish trend and will attempt a breakout of the supply level.

advice: Stay bullish and buy any low points while we don'T break downside 51.000. The target should be set at 60.000 or higher.

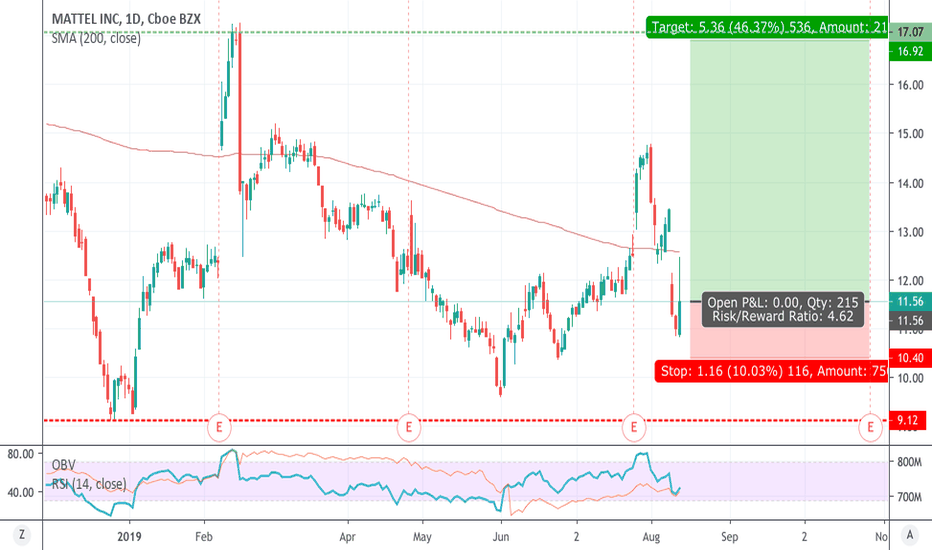

Delayed tariffs "for Christmas" might help HASBRO

News/fundamental

The USTR says that the tariffs on some items, including “certain toys,” will be delayed until Dec. 15.

September is a key shipping month for those companies as they prepare for the holiday shopping season, when the majority of the industry’s business occurs.

Hasbro told CNBC earlier this month that it would have “no choice but to pass along the increased costs to our U.S. customers” if the tariffs were put into place.

--

Great risk reward ratio.

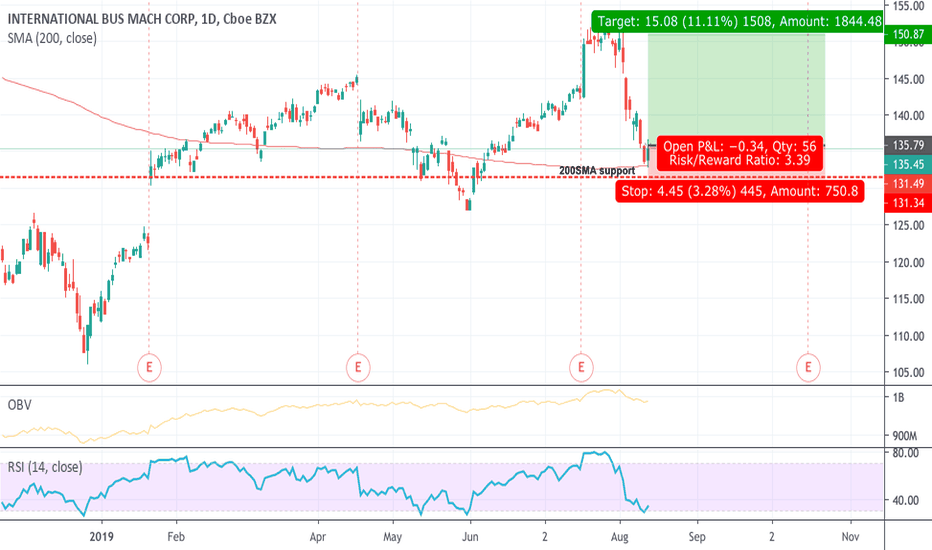

IBM due for a pullbackFundamental data

IBM reported earnings and reaffirmed guidance. It was up over 5% on the news.

Trade-war:

"The U.S. Trade Representative said Tuesday 10% tariffs on about $300 billion in Chinese imports will go forward, but tariffs on some goods will be delayed until Dec. 15. Those items include cellphones, laptop computers , video game consoles, some toys, computer monitors, shoes and clothing."

The cellphones could be the reason for AAPL rallying today.

--

There is a good risk reward ratio (check out chart).

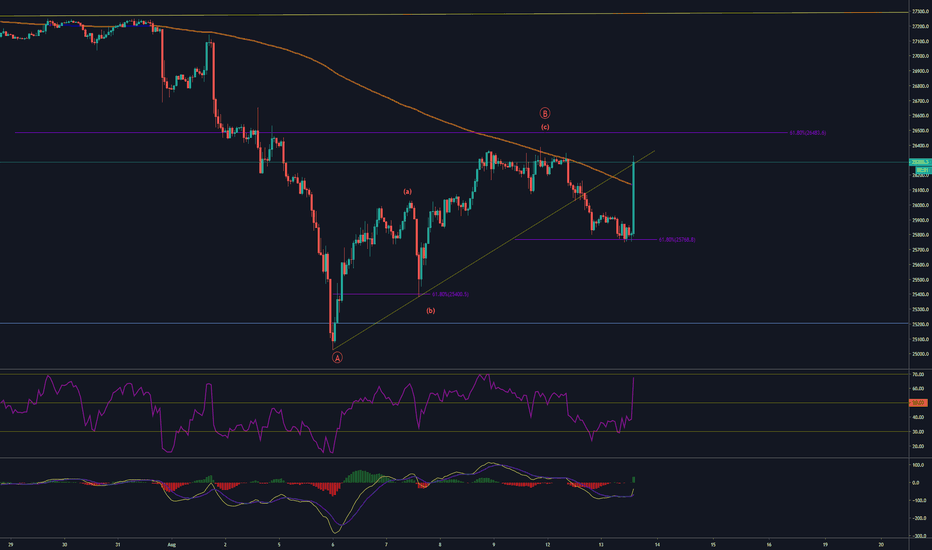

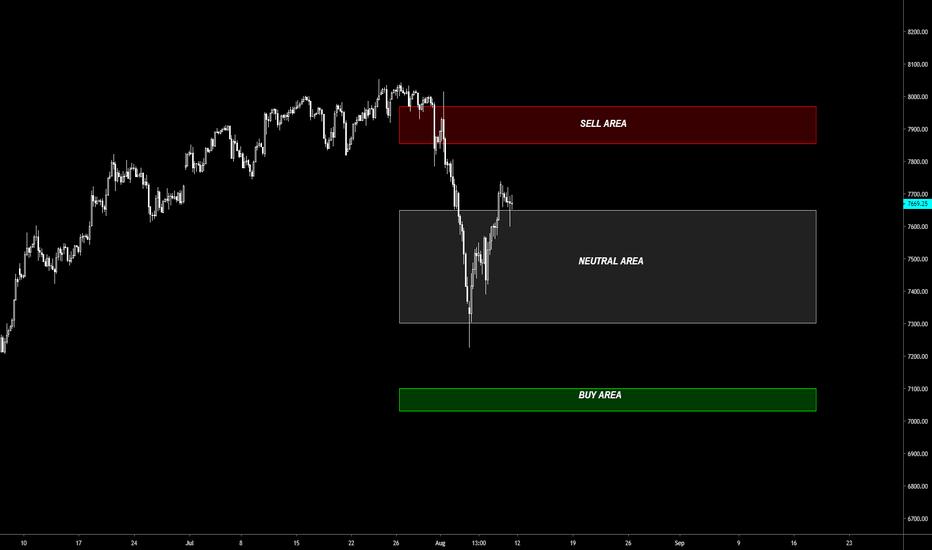

Dow Jones - Trade war tariffs delayed!!!Ok so good news just now from US as the tariffs will be delayed until December 15. Immediate massive reaction, shares and indices flying. Now waiting for the volatility to come down before adding more long trades on pullbacks.

Here are quotes from US Trade Representative (USTR) Lighthizer, according to Reuters:

"Some products are being removed from China tariff list based on health, safety, national security and other factors; will not face additional tariffs of 10%."

"It intends to conduct an exclusion process for products subject to the additional tariff."

"Other products for which tariffs are delayed are video game consoles, certain toys, computer monitors, and certain items of footwear and clothing."

"Will publish on its website today and in the federal register as soon as possible more details, lists of the tariff lines affected."

Good Luck!

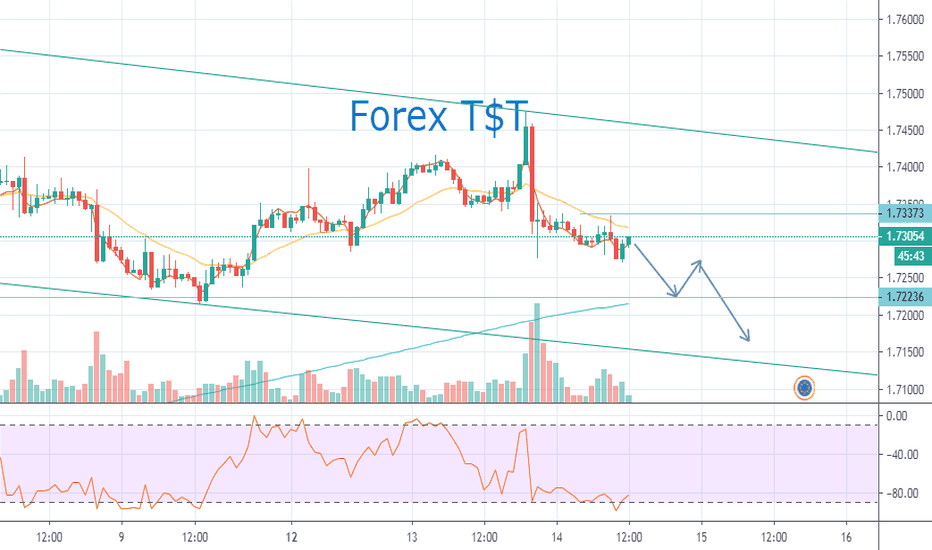

GBPJPY update Much like cable, GBPJPY approaches 125, the low of the aftermath of the Brexit vote. Broken weekly trend line shows more potential on the sell side. Trade war and geopolitical tensions cause investors to dump risky assets and go for safe havens, massively boosting JPY.

This week continue to sell to 125 and watch for next setups at the level, we could retest the broken trend line first. With current economic and political situation both in regard to Brexit and global economy, this pair seems set to break below 125 despite oversold technicals.

Unless we see progress in Brexit or trade war, this has further sell potential. Good Luck!