ORBEX: Trump Signs HK Bills, Denting Trade Optimism AGAIN!In today’s market insights I talk about Trump’s latest move to support HK protesters by signing two bills, denting optimism around the recent trade war optimism!

The shift in sentiment was expected but how risk vs havens performed may seem confusing to some when looking at CADJPY and AUDCHF.

Here I explain how the yen and franc are likely to perform against high beta commodity currencies Canadian dollar and Swiss Franc!

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

Tradewar

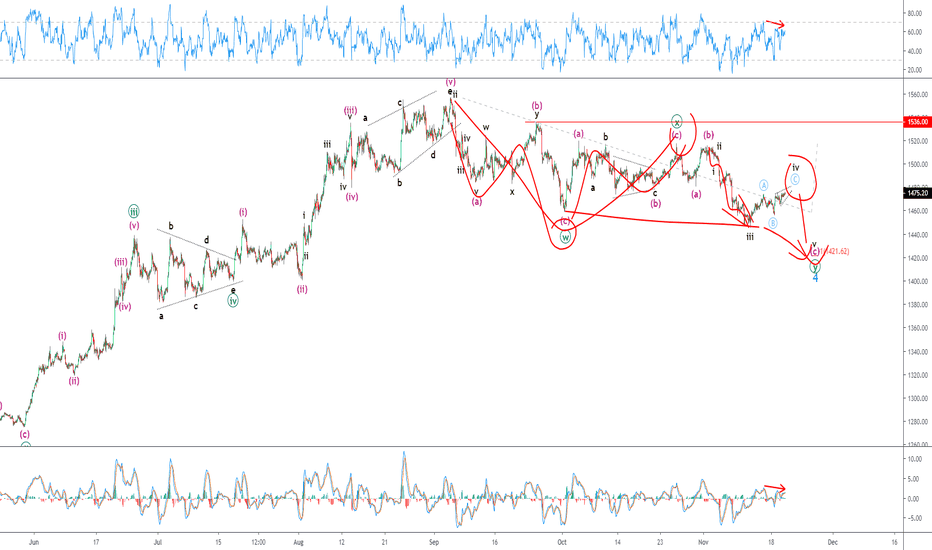

GOLD UPSIDE IMMINENT ?Good morning traders

As I sit at my desk this morning looking at my pairs I trade I’ve realized the need of “sitting on your hands”

For me gold has been a very good example of this.

Providing you with a 4H chart we can see that price made 3 drives into the low around 1450.00 . There has been multiple spikes based on trade developments that has just caused the market to build pressure. Where will this pressure take us in my professional opinion I foresee a new leg to the upside. Though before that I expect a drop lower into the liquidity region displayed at 1452.00 to enter this long trade.

My overall target for this setup would be 1600.00 with a lower target at 1550.00

Remember to stay patient and looking at the bigger picture. Regardless of the news there has been no concrete DEAL and any SIGNATURES or MEETING to take place. So therefore investors do not like UNCERTAINTY and for these reasons I don’t see GOLD DROPPING.

There’s many pips on offer 800+ pips towards our target so patience and psychology is key.

Trade safe , cheers !

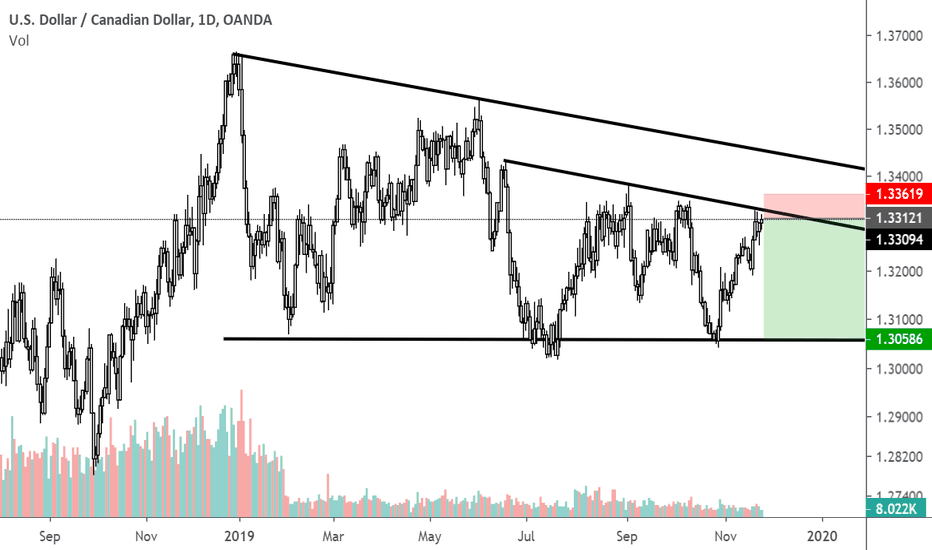

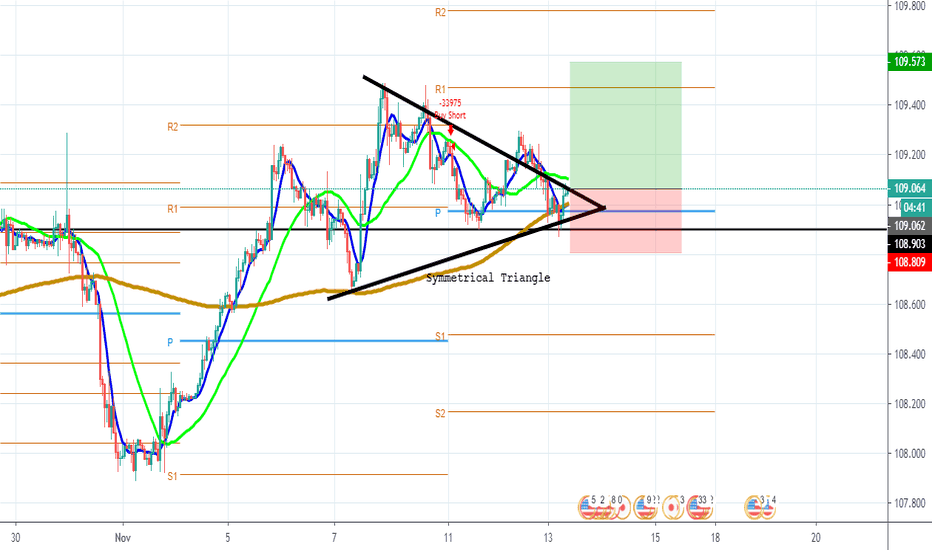

5:1 R/R Short Setup - 250PIPS!Simple setup here where the daily price action is showing initial rejection of an established trend line. Volume isnt suggesting enough strength to push through this resistance in the approach to the trendline, inviting sellers to enter without too much opposition.

Stop Loss above both the trendline and recent high in order to place two solid barriers between the entry and a failed trade.

TP at the previous lows and next significant support.

In terms of supporting fundamentals and reasons to enter:

- Oil has been trending steadily higher over recent weeks and this supports CAD strength.

- There are still significant barriers to cross on US-China trade talks with further tariffs looming on the 15th December. Negative news from these talks or any imposed tariffs will have a negative effect on US economy and subsequently the strength of USD.

- The recent bullish price action has been very strong which could suggest overbought conditions and some correction due.

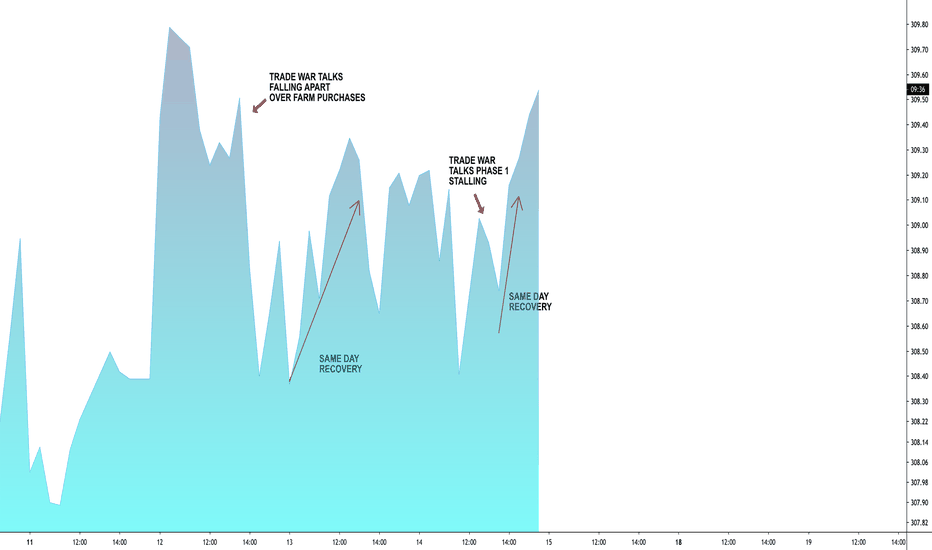

ORBEX: Weekend Trade News Likely to Affect SPX, DXY!In today’s marketinsights video recording, I talk about SPX and DXY .

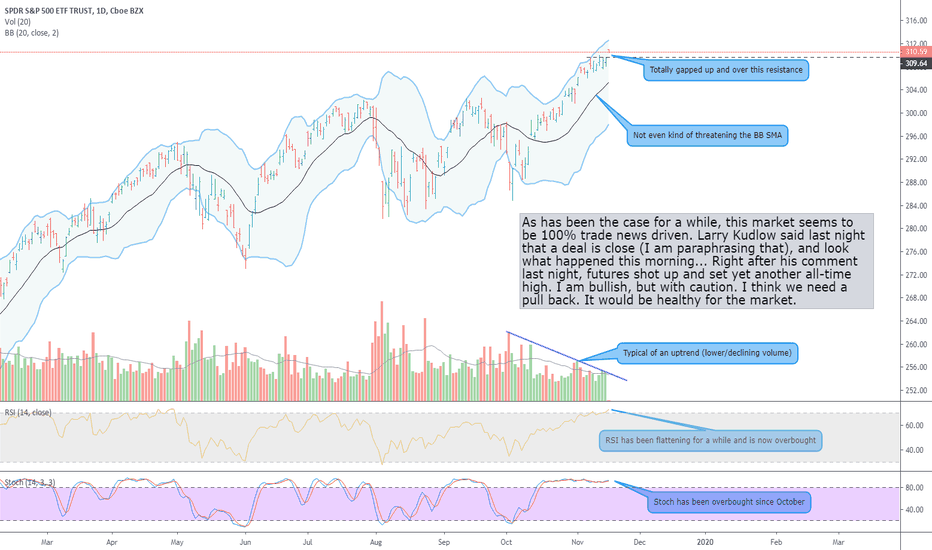

SPX takes a breather from all-time highs offering some pocket-relief to short-term bulls, however, with weekend trade headline news the rally could continue higher.

The US index looks bid too despite the medium-term bearishness as the economy performs incredibly well, supporting the dollar.

From a technical perspective, there's more room to the upside for both. The index, however, will most likely have a harder trip moving higher as its upside is limited. Unless if of course a sharp bullish move occurs, taking out breakeven stops and then reversing rapidly to everyone's surprise.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

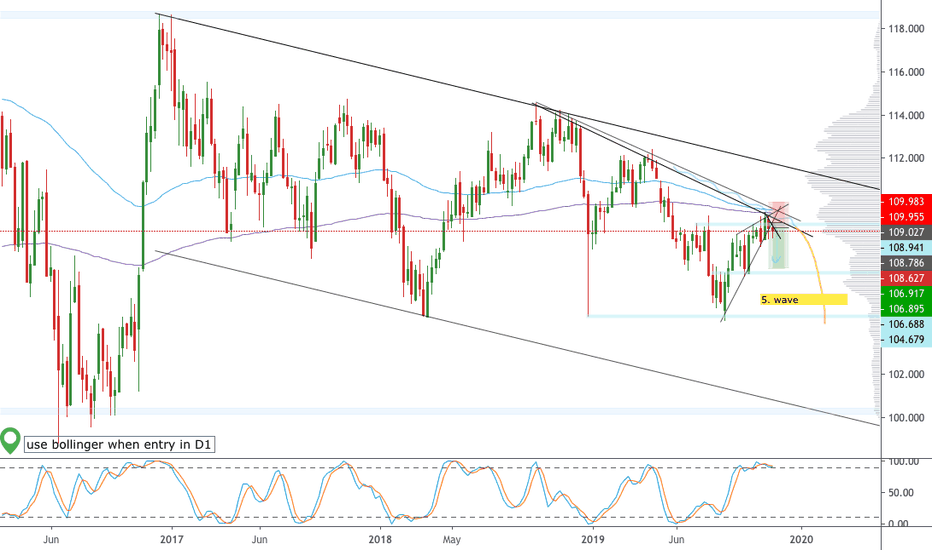

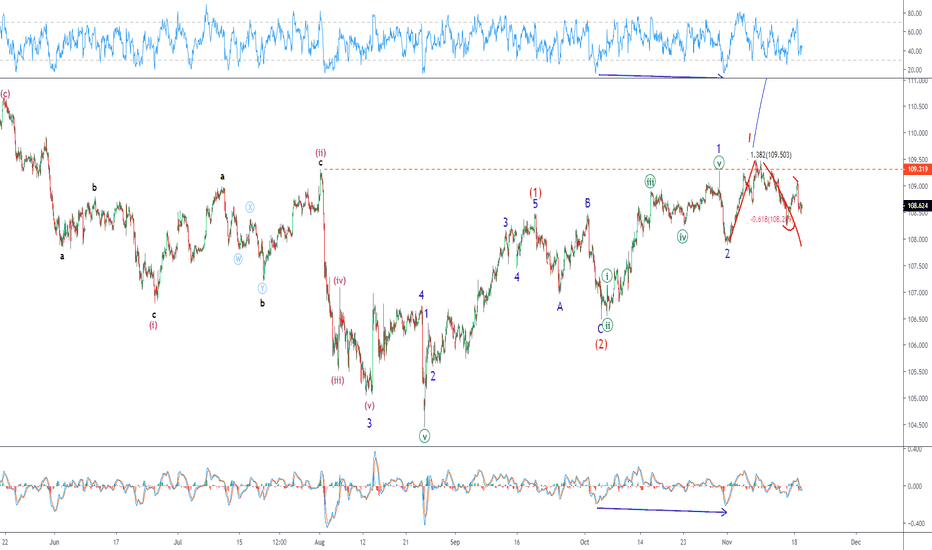

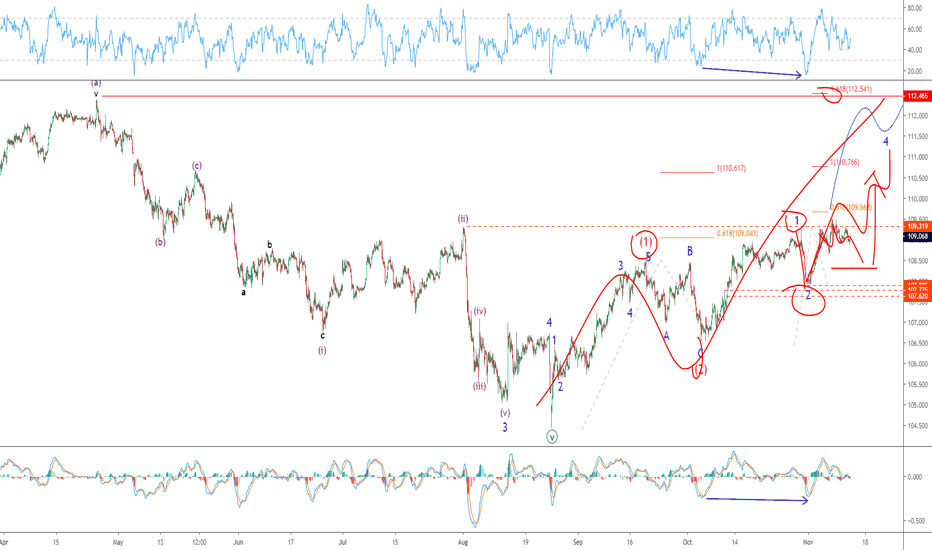

Short USDJPYThe fundamentals doesn't look as good as the weeks before. There are more uncertainties of no trade deal and normally that means stronger safe haven currencies like the JPY or CHF.

On the technical perspective we can see clearly that we have downside momentum. I'm currently waiting for the 5th elliot wave to the downside.

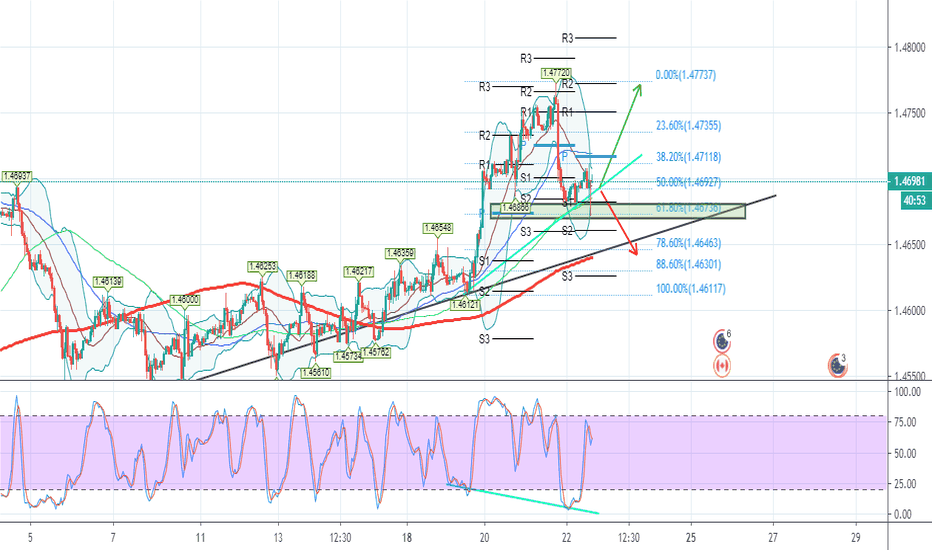

EURO Vs Loonie (EUR/CAD) Trade Idea and Plan: Bullish biasEUR / CAD has developed higher lows connected by a longer-term upward trend line and also displays lower stochastic lows. This bullish divergence indicates a rebound may occur.

With little eye-catching improvements for leading indicators for the eurozone, in this session, I'm hoping to catch a quick bounce for the shared currency. On the flip side, there might be enough expectations for another dip in Canadian retail sales figures to keep the Loonie on a weak footing.

On top it all off, the resurfacing uncertainty surrounding trade talks between the U.S. and China could hold a veil on gains for commodity currencies and the dollar, reversing the euro may have chances in that case.

ORBEX:Loonie Bid on Poloz As Impeachment Hearing Goes Unnoticed!In today’s market insights video recording I talk about markets’ muted reaction to the impeachment hearings and focus on the assets that moved!

USDCAD was bid on a hawkish Poloz as he lowered down markets' expectations of a Dec rate cut. Loonie was also supported by OPEC+ likely production cut extension.

While at it, I also analyse EURUSD despite it ended the session somewhat muted as volatility increased. We are also minutes before German GDP and Lagarde’s speech!

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

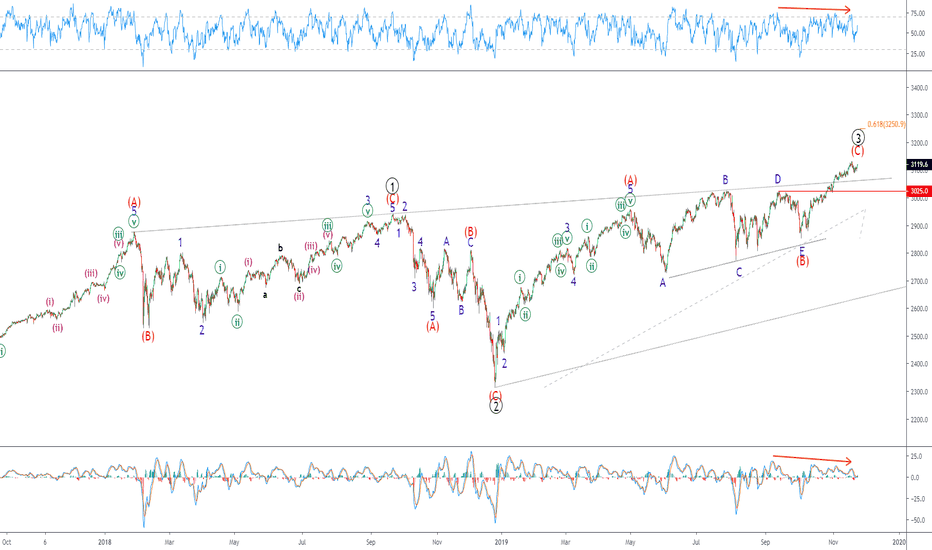

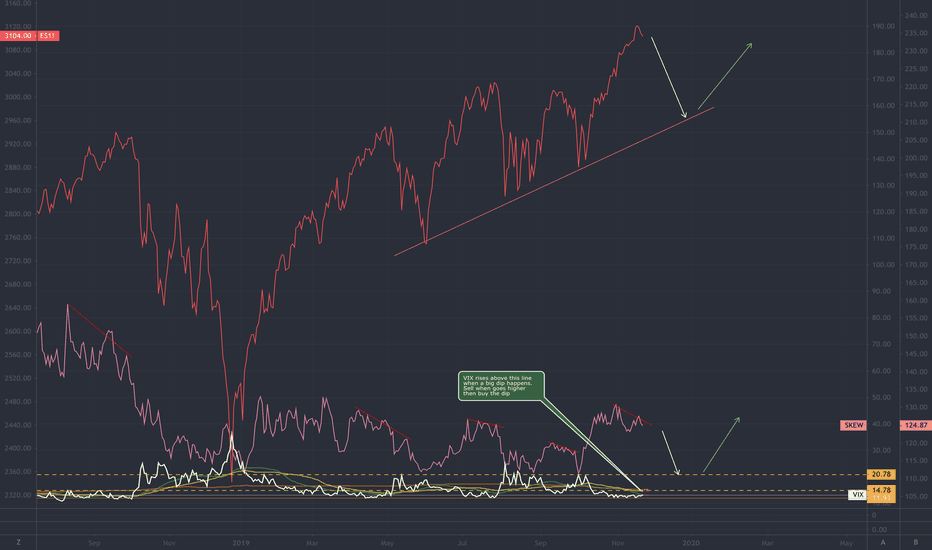

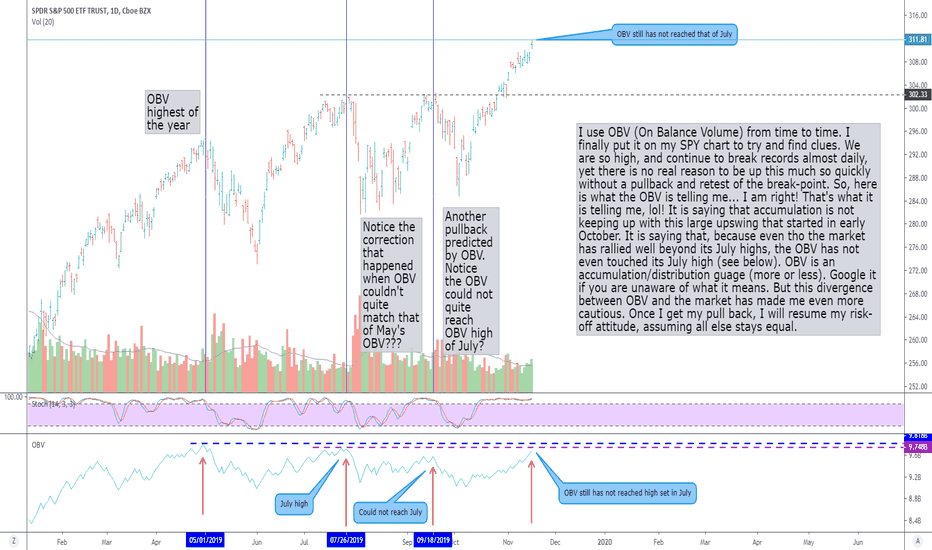

SPX, VIX and SKEWThe movement of the SPX are reflected in the VIX (volatility index) but the signal seem to arrive when the SPX index is already too advanced in the retracement. The SKEW signals earlier on. The signal from SKEW starts with lower lows, then the volatility increases and SPX dips.

Sell when the SKEW starts hitting lower highs, then BUY when the VIX index is peaking.

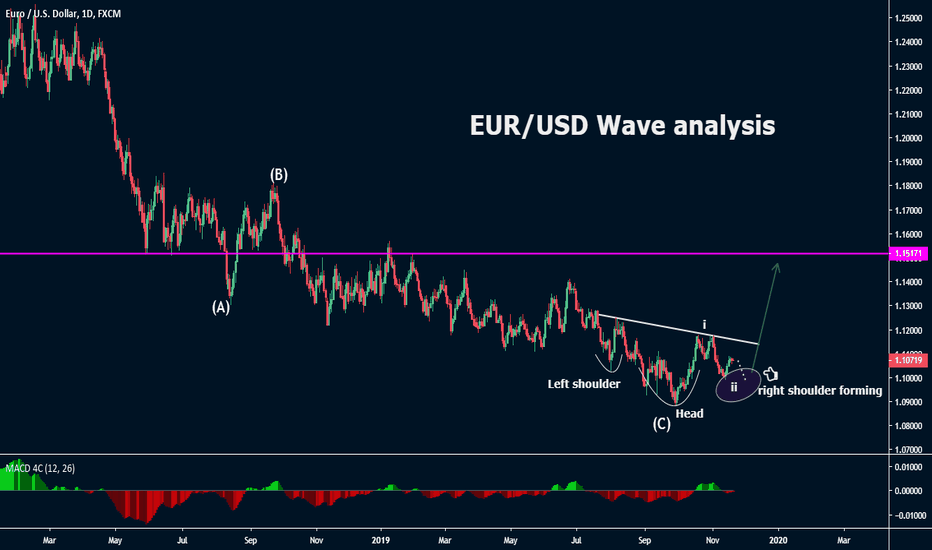

EUR/USD Wave analysisEUR/USD has been declining for ages. The long-term downtrend in the counter could come to a halt at this price zone.

Technically, the long-term ABC wave could be completed and the short-term charts are forming an inverse head and shoulder pattern.

However, the counter still needs more accumulation at the current price and could create a near-term low, which is good long entry points.

Further, the Euro economy is showing signs of revival whereas the US economy is showing signs of exhaustion.

ORBEX: EURGBP Ready To Reverse? AUDJPY Still Correcting!In today’s market insights video recording, I talk about EURGBP and AUDJPY FX Minors.

Euro is affected by a report that a phase-1 deal is highly unlikely by the end of this year as the Chinese want rollbacks pushed to May 2020 and the US Congress just passed a bill supporting Hong Kong protesters; going against China again!?

Safe-haven flows were also increasing of course, following the report, allowing yen to appreciate against risk assets with AUDJPY attracting our attention once again!

Pound, on the other hand, is somewhat muted as the first televised debate between Boris and Corbyn was seen as a draw. This means that the euro's somewhat better performance could allow EURGBP reverse and move higher!?

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

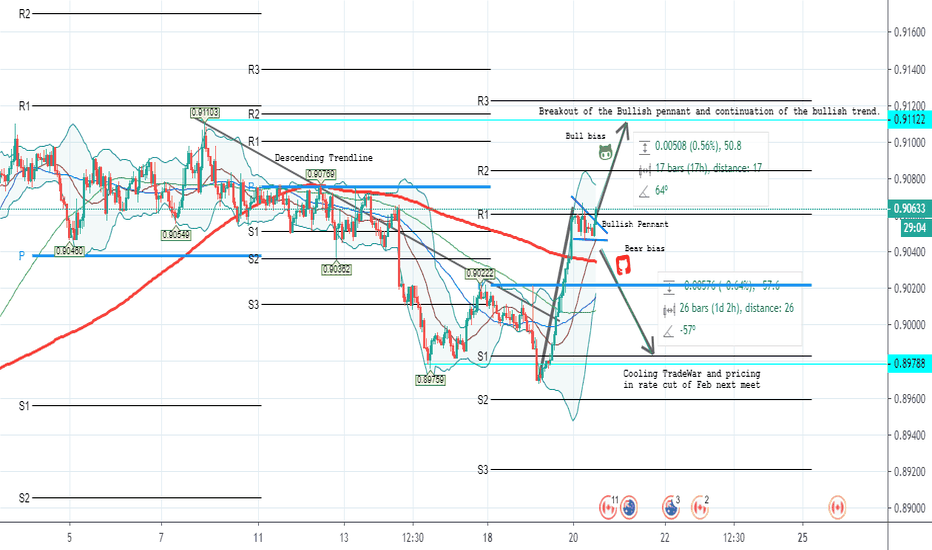

Aussie Vs Loonie (AUD/CAD) Trade Strategy and PlanTraders sold the Aussie like no tomorrow when the minutes of RBA's meeting indicated members expected another rate cut in November.

We are worried about Australia's major trading partners ' economic slowdown; contraction in housing construction activity; outlook for consumption; wage growth; inflation; and domestic growth. Ultimately, the latest papers point out that when they meet next, RBA leaders will slash their rates in February.

Trade tensions in the U.S .- China pressured crude oil prices and lead it to fall lower further. Also, Russia isn't inclined to cut production more deeply at the December 5 OPEC meeting and that means the market is likely to remain oversupplied in early-2020 .

Carolyn A. Wilkins (Speech):

The market is focusing on the line that there is 'room to maneuver'. Don't think she's sending a signal here but any time there is the talk of cuts (and QE), that's the knee-jerk. USD/CAD touched a session high of 1.3264 from 1.3230 before the comments and AUDCAD had an effect too.

Canada also did not publish outstanding posts. Canada’s manufacturing sales took a step back in September. CPI reports (Nov 20), Poloz Speaks (Nov 21) and Retail Sales (Nov 22) will clearly provide additional optimism or pessimism hint to traders for the loonie. Positive turn in global risk sentiment may also help traders to think to get out of safe havens and into risk currencies like the Loonie. Flash manufacturing and services PMIs (Nov 21) from Australia should be taken care of. We should take this information in mind throughout the week if we trade in this cross pair or any Aussie or Loonie being as base or variable (counter).

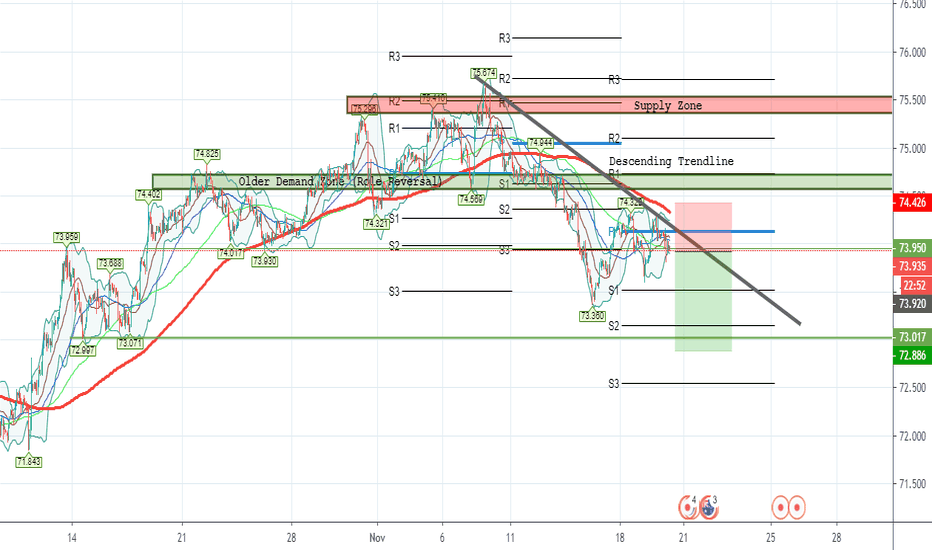

Aussie Vs Japanese Yen (AUD/JPY) Trade Plan Traders seem to be in risk aversion mode to start the week off of negative developments in the U.S.-China trade story. With fear on whether or not we’ll see tariff rollbacks on China, odds have risen that the trade deal may not go forward. This has sent equities, bond yields and oil lower, and seems to be supporting the safe-haven currencies like the Japanese yen.

Ascending wedge/ Head and Shoulders - SHORT NZDUSDGood morning traders,

Trade War negotiations appear to be breaking down which will put pressure on the NZD.

The NZDUSD is about to break an ascending wedge formation.

There is also a nice head and shoulders forming.

We are looking to sell down to the 0.6300 level.

Any thoughts and comments let us know.

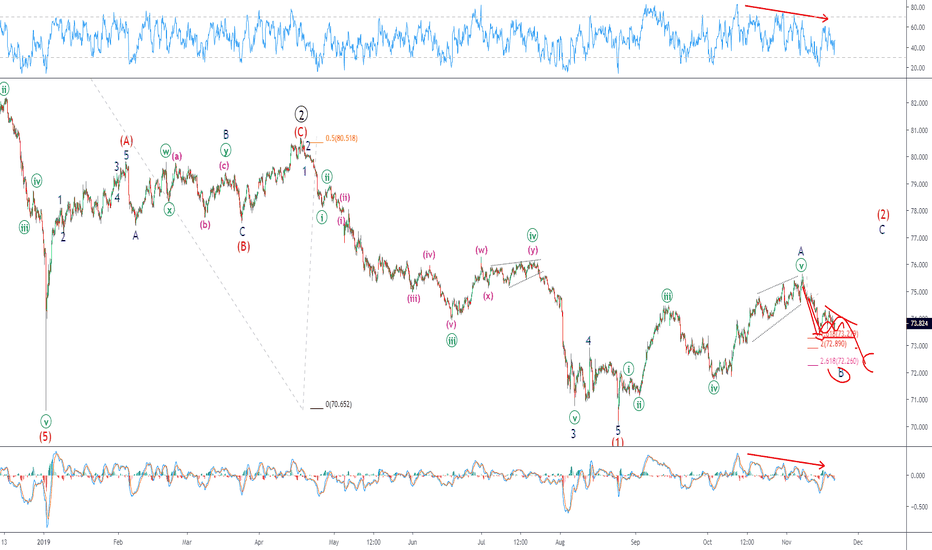

ORBEX: Tradewar Sentiment Reverse! What's Next for Gold and Oil?In today’s marketinsights I talk about how the latest trade war and API developments affected the prices on gold and oil.

Watch as I identify certain #elliottwave patterns that can’t go unmissed ahead of today’s FOMC minutes and EIA’s WTI report!

XAUUSD is still expected to turn lower after the completion of this subminute correction, whereas US Oil, could correct slightly before sliding lower.

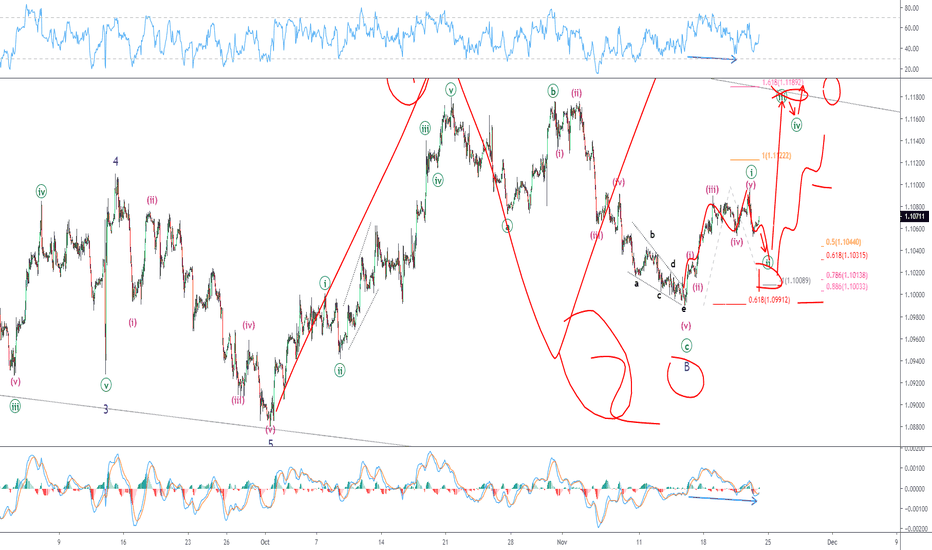

ORBEX: Dollar Weakness Drives Euro and Yen Higher!In today’s #marketinsights video recording, I talk about EURUSD and USDJPY FX Majors

Both major pairs were affected by incoming trade war flows, following China's rather pessimistic view on proceeding with a phase-1 of a potential trade deal.

Euro could move towards 1.11 round resistance and yen could push the dollar down near the 108 round support.

The above scenarios have validating signals that you can find watching this video!

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

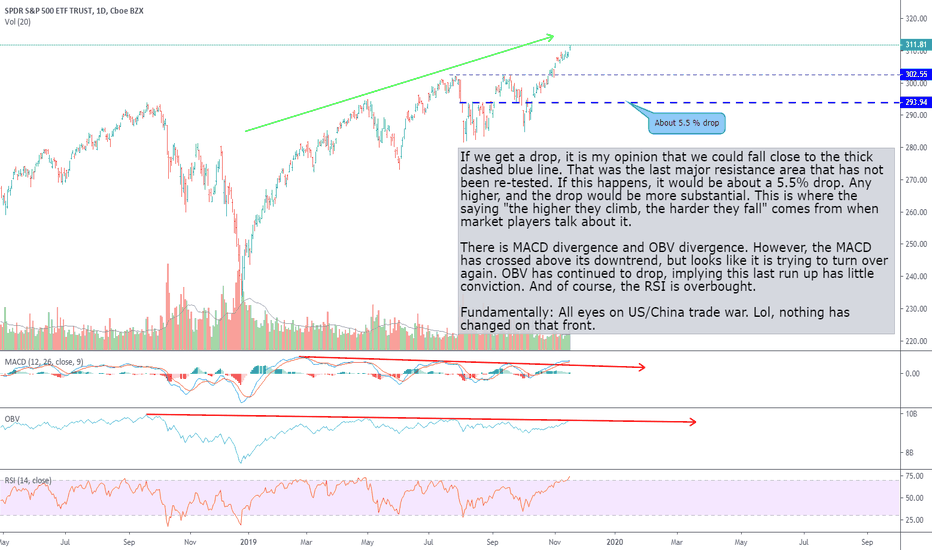

ORBEX: EQUITIES REACH FRESH ALL TIME HIGHS!In today’s marketinsights video recording, I talk about SPX and DXY .

SPX keeps hitting fresh highs despite Fed's message to keep rates on hold until 2020. Trade wars do seem to be influencing flows more than anything else right now? Whatever the case, sharp upside and overbought hints to exhaustion!

The DXY's recent upside though should be watched closely. It's either an expanded flat or a zig-zag correction, so, could expect either a decline or a correction.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

ORBEX: NZDUSD, USDJPY: Traders Taken By Surprise #RBNZ #TrumpIn today’s #marketinsights video recording, I talk about NZDUSD and USDJPY FX Majors

Not only markets expected with 80% chance that RBNZ will cut rates which they never got, but the central bank also said that kiwi is expected to be supported in the medium term by the low exchange and interest rates.

USDJPY on the other hand, remained somewhat muted as Trump didn't provide any insights on the trade war situation. Despite the dollar's early gains, yen managed to win back some strength following a report that the US is considering imposing tariffs on EU automakers!

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

Greenback Vs Yen (USD/JPY) Trade Strategy and Plan-Industries have not been hurt by the administration's trade actions.

-There is no uncertainty with regard to trade worse.

-The cost of doing nothing was killing us as a country.

-China starting big agricultural buys if they don't make a deal with China they will substantially raise tariffs on China imports.

-The situation between China and the US involves more conflict than the world has seen before, but eventually, we'll resolve it because this is the best way for both.

-There will be a trade deal.

-There will be one deal after another, and one issue after another will be resolved but it can take a lot of time.

"They are dying to make a deal. We're the ones that are deciding whether or not we want to make a deal," Trump said of China. "We're close. A significant Phase One trade deal with China could happen. It could happen soon. But we will only accept a deal if it's good for the United States and our workers and our great companies."

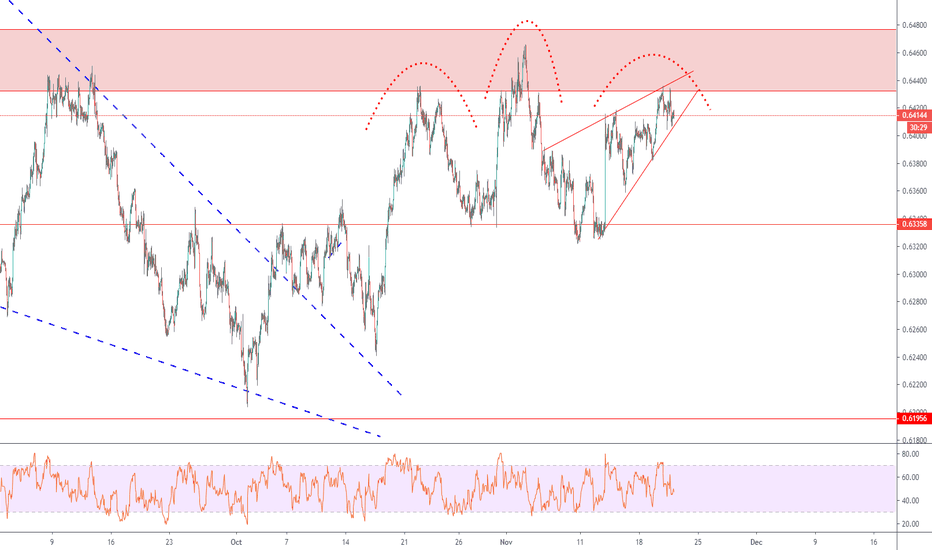

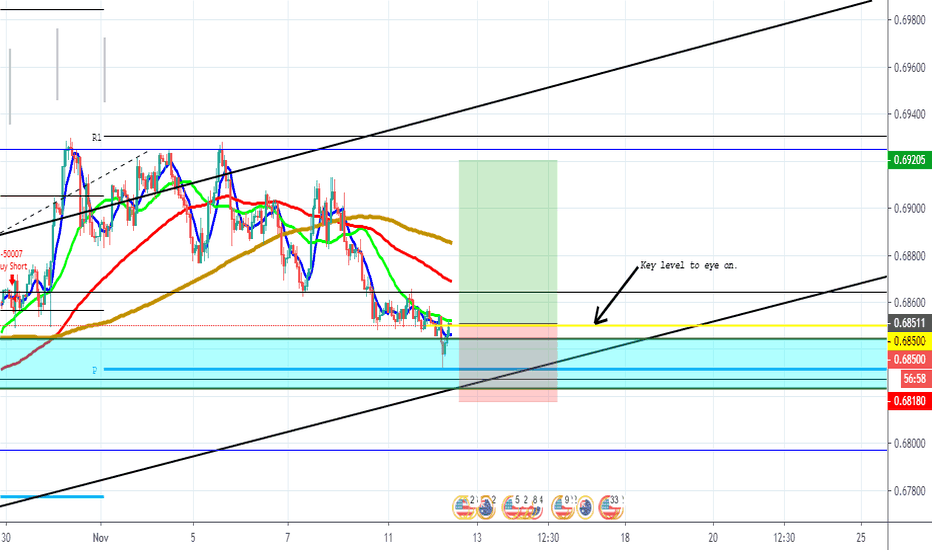

Aussi Vs Greenback (AUD/USD) Intraday Trading Strategy & IdeaWe had a negative tone to fear to feel at the beginning of the week, perhaps after Trump's news playing down positive China trade talks (incorrect coverage of US willingness to lift tariffs as part of a "step one" agreement). For now, the key level which I mention in chart 0.6850 had a break earlier and is now testing. The message to look for is a bearish one as long as the mood of the U.S .- China's trade front remains sour. NAB Business confidence data had been downtrend in past couple of months and morning it was better than last month though. If the U.S .- China feeling reverses (which is a very possible scenario), then a break above the key level 0.6850 zone is the technical signal to be interested in the role of long bias.