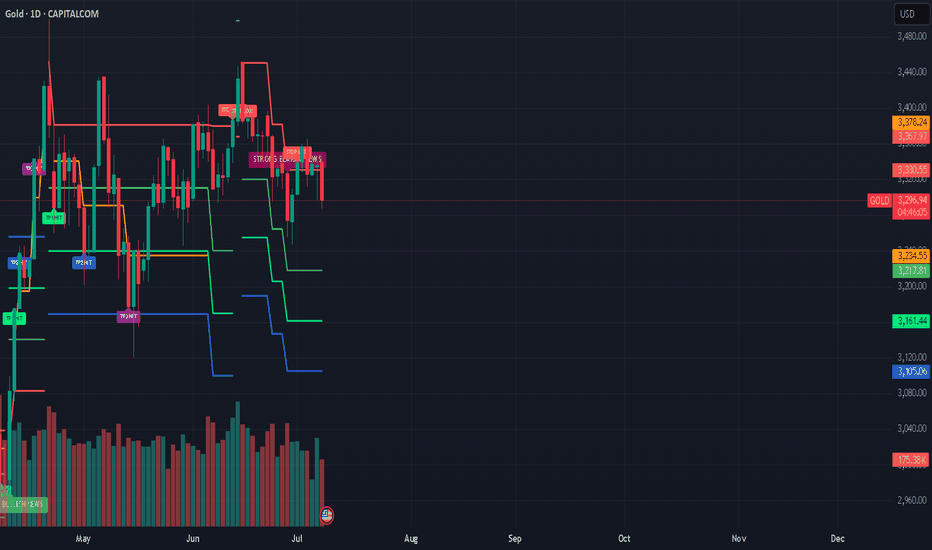

Is a Reversal on the Horizon or a Deeper Correction? 🔘Gold Faces Strong Resistance at 3300 – Is a Reversal on the Horizon or a Deeper Correction? ⭐️

Gold has recently faced a significant price correction after bouncing off key resistance levels. As geopolitical events settle and economic data comes in, the market is now testing crucial support levels. Today’s session could provide important insights into whether gold will maintain its bullish momentum or continue to correct further.

🔹Market Overview – USD Rebounds, Creating Short-Term Pressure on Gold

The US dollar has seen a strong rebound following positive developments in the global trade talks. Several key agreements between major nations, including the US, have been signed, which seem to support the USD in the short term. This has put downward pressure on gold, as traders shift their focus towards a stronger dollar and risk appetite returning to the market.

🔹US inflation data has come in lower than expected, creating room for the Fed to hold off on rate hikes, which helps the dollar further.

🔹FOMC meeting minutes later this week could reveal insights into the Fed's stance on interest rates, which could be key for market direction.

🔹Geopolitical tensions are cooling off slightly, which has reduced demand for safe-haven assets like gold.

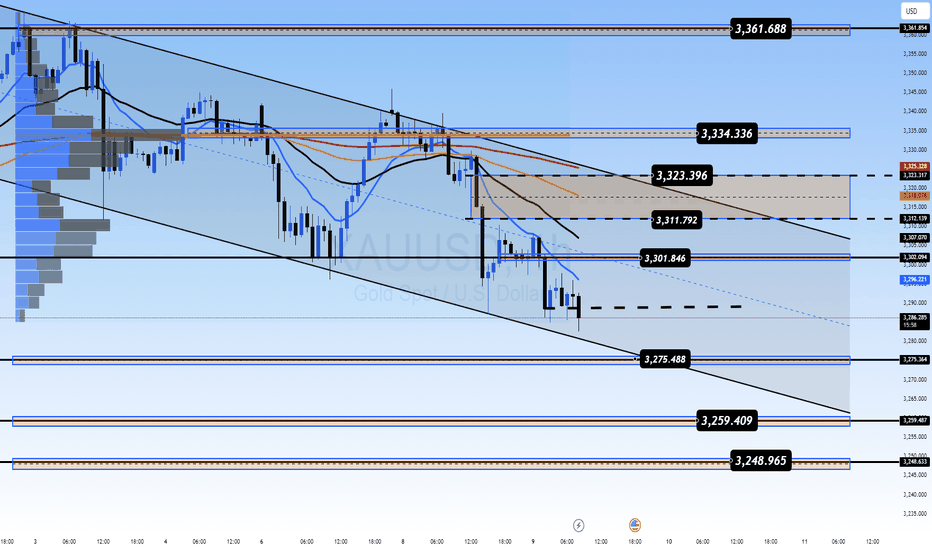

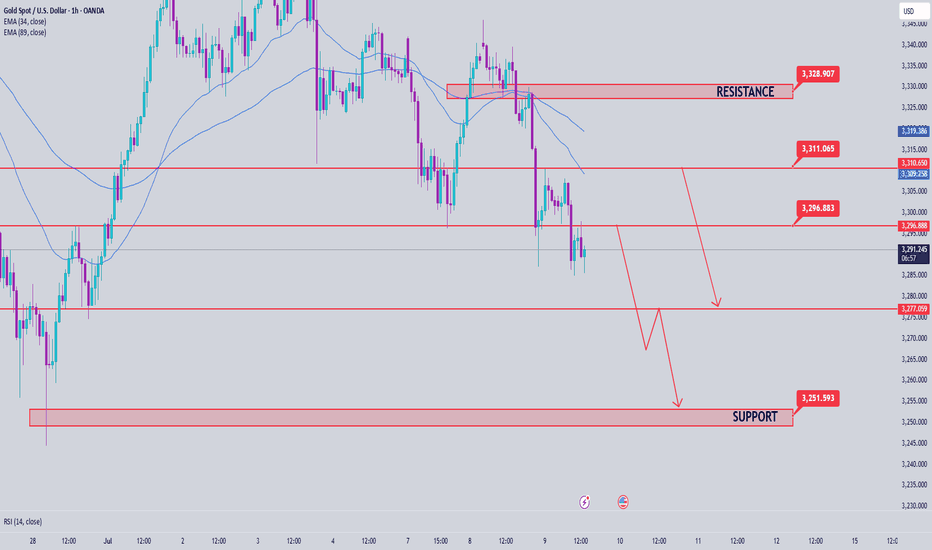

🔹Technical Analysis – Gold in a Range-Bound Market, Testing Key Levels

On the H1 chart, gold is forming a clear downward channel between 3360 and 3290, suggesting that the price could continue its correction within this range. If the price stays within this zone, we might see a deeper pullback toward the 3250 region.

However, as always, waiting for confirmation signals before entering any trades is crucial. The false breakout risk is high when the price moves quickly and without clear confirmation from higher timeframes.

🔹Buy Bias in the Short-TermGiven the current technical structure, a buy bias seems more likely than further selling. The market may test 3320-3325 in the near term, with the potential to bounce back if the buying momentum continues to build. Additionally, the rejection wick on the D1 candle from yesterday suggests that sellers are losing control, and we may see more buying pressure in the coming sessions.

🔹Resistance and Support Levels to Watch:

🔺Key Resistance Levels: 3302 – 3310 – 3324 – 3335 – 3361

🔻Key Support Levels: 3275 – 3259 – 3248

⬜️Trading Strategy – Buy and Sell Zones

🔺BUY ZONE:3250 – 3248

🔹Stop Loss: 3244

✔️Take Profit: 3254 → 3258 → 3262 → 3266 → 3270 → 3280 → ????

🔺SELL SCALP: 3303 – 3305

🔹Stop Loss: 3310

✔️Take Profit: 3298 → 3294 → 3290 → 3286 → 3280 → 3270 → 3260

🔺SELL ZONE:3334 – 3336

🔹Stop Loss: 3340

✔️Take Profit: 3330 → 3326 → 3320 → 3315 → 3310 → 3305 → 3300 → ????

🕖Important Notes for Today: FOMC and Trade Policy Updates

With FOMC minutes and other important trade policy updates expected today, it’s crucial to stay alert for any sudden changes in market sentiment. Always ensure that you are adhering to your TP/SL levels to safeguard your account.

Trading

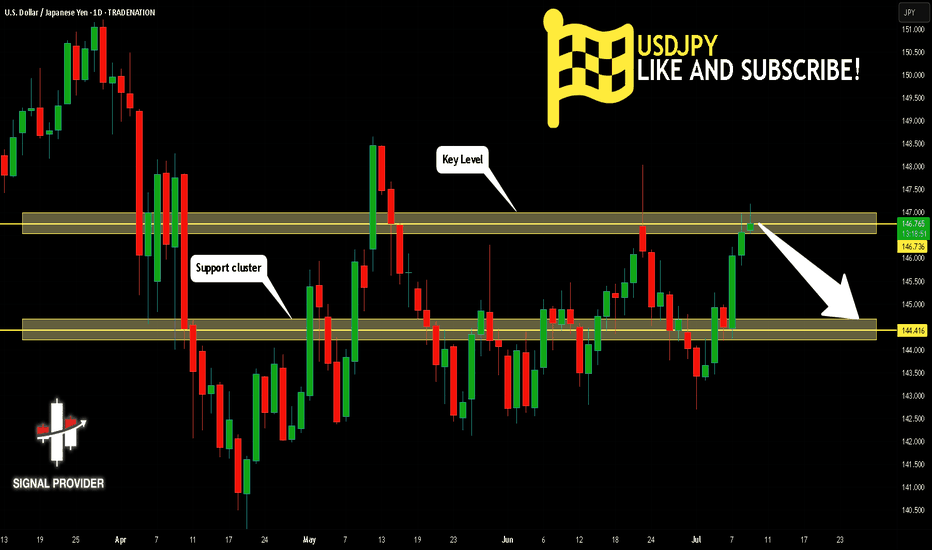

USDJPY Will Go Down! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 146.736.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 144.416 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

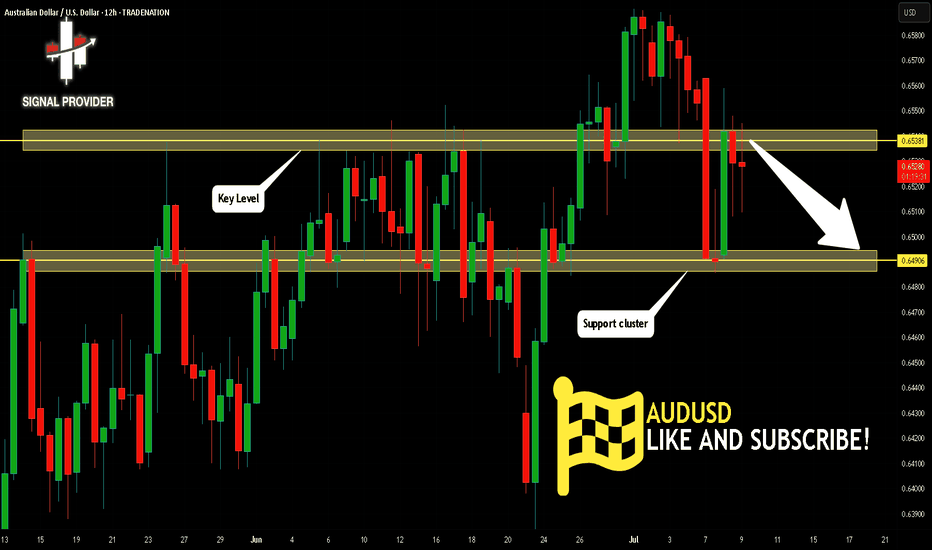

AUDUSD Will Move Lower! Short!

Take a look at our analysis for AUDUSD.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.653.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.649 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

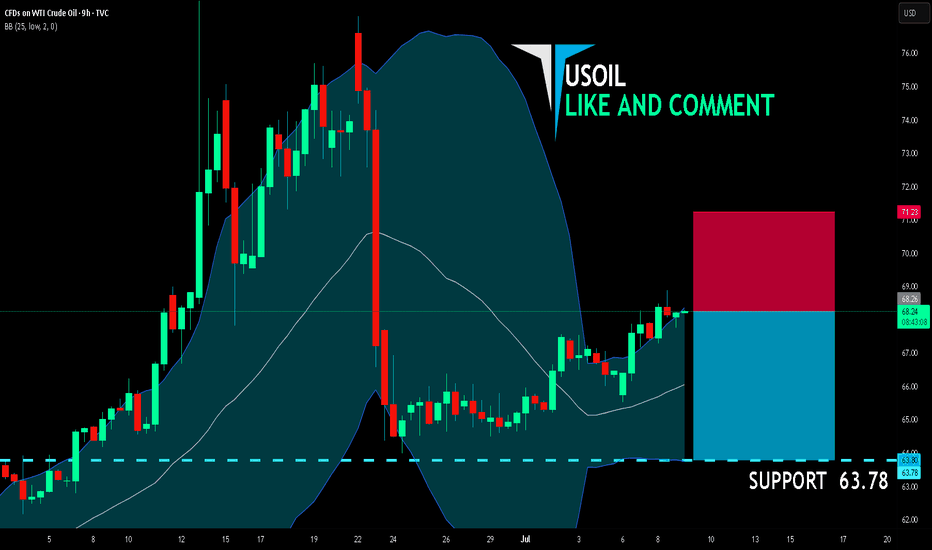

USOIL BEST PLACE TO SELL FROM|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.26

Target Level: 63.78

Stop Loss: 71.23

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

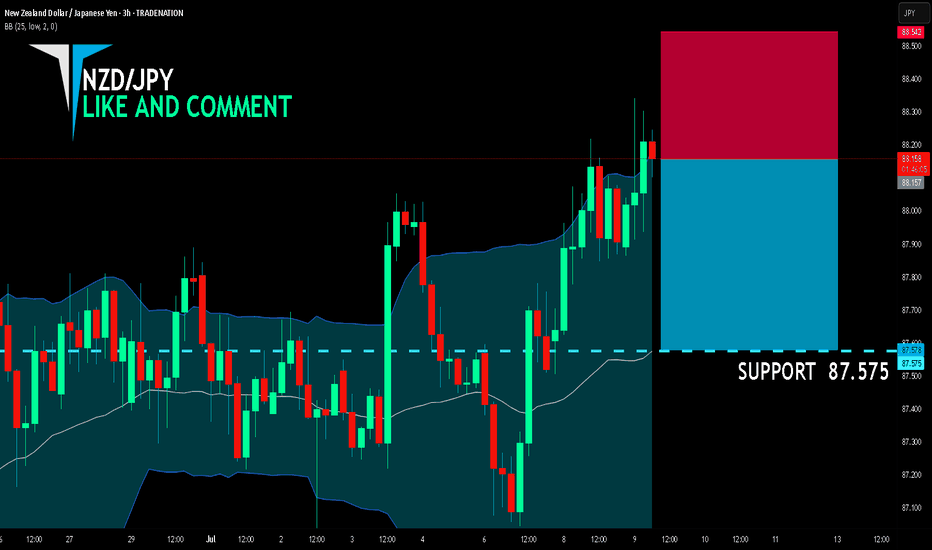

NZD/JPY BEARS ARE STRONG HERE|SHORT

NZD/JPY SIGNAL

Trade Direction: short

Entry Level: 88.157

Target Level: 87.575

Stop Loss: 88.542

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

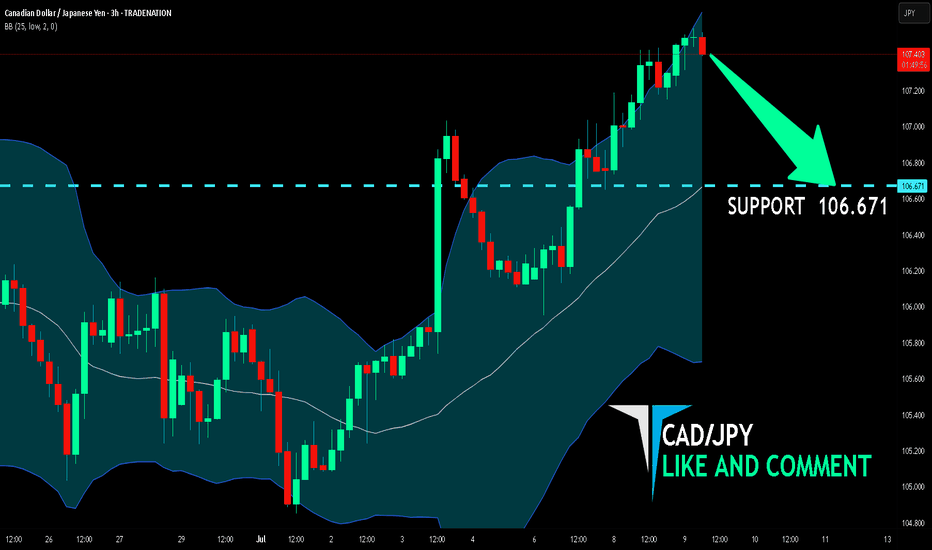

CAD/JPY SHORT FROM RESISTANCE

Hello, Friends!

CAD/JPY is making a bullish rebound on the 3H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 106.671 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

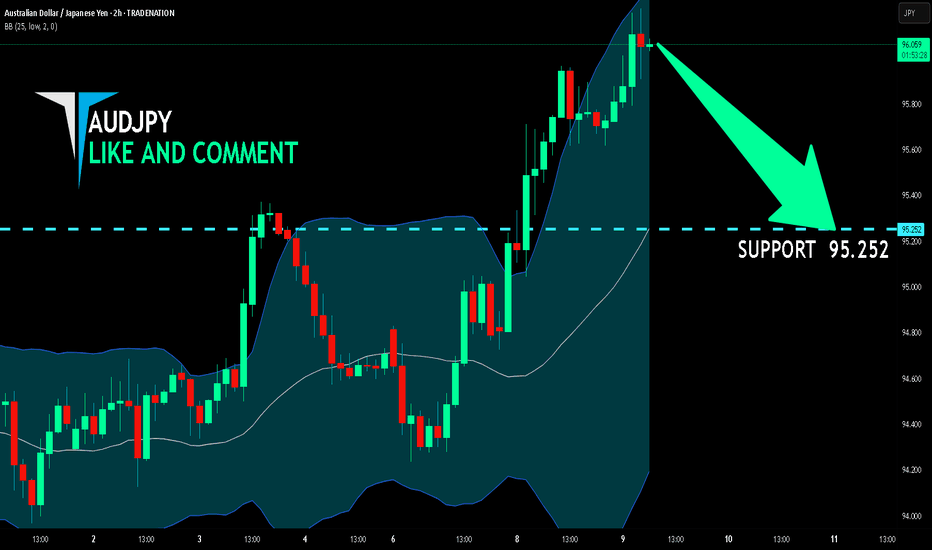

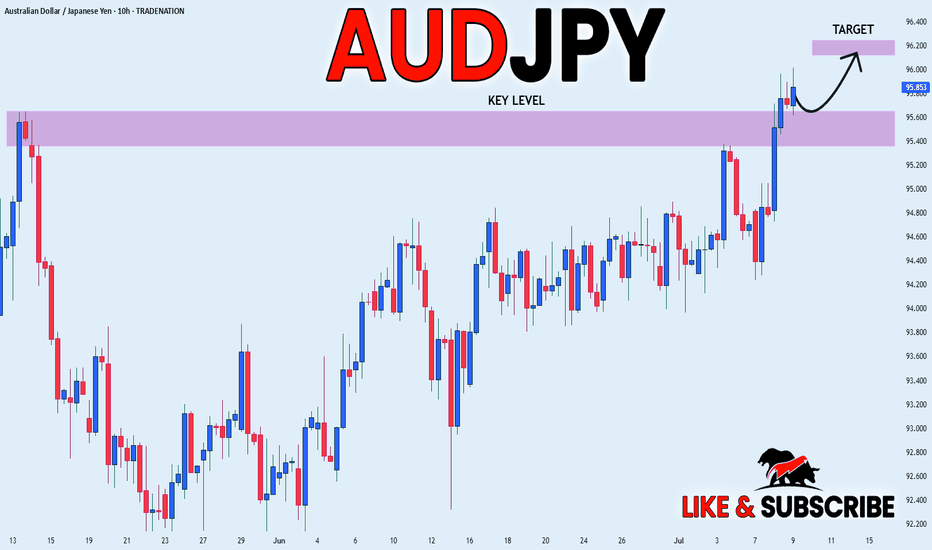

AUD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so AUD/JPY is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 95.252.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

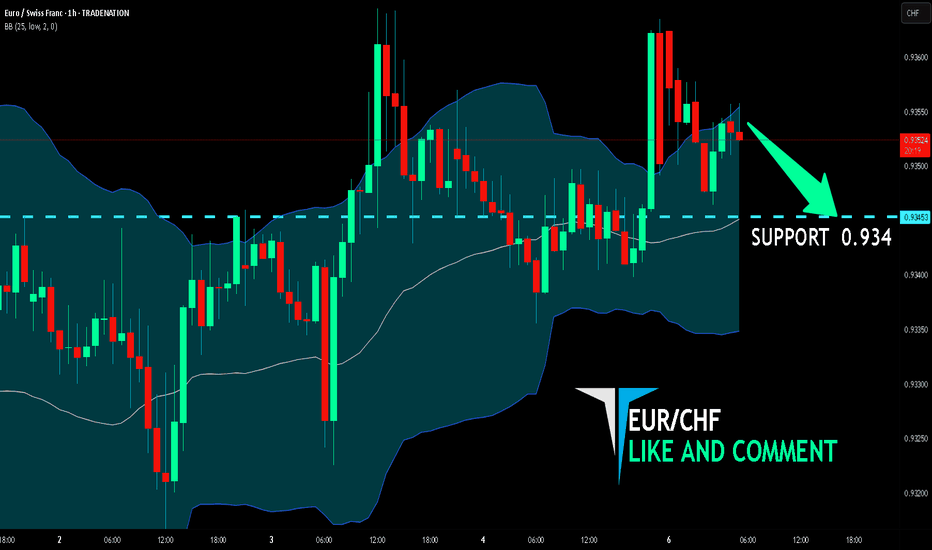

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/CHF pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.934 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

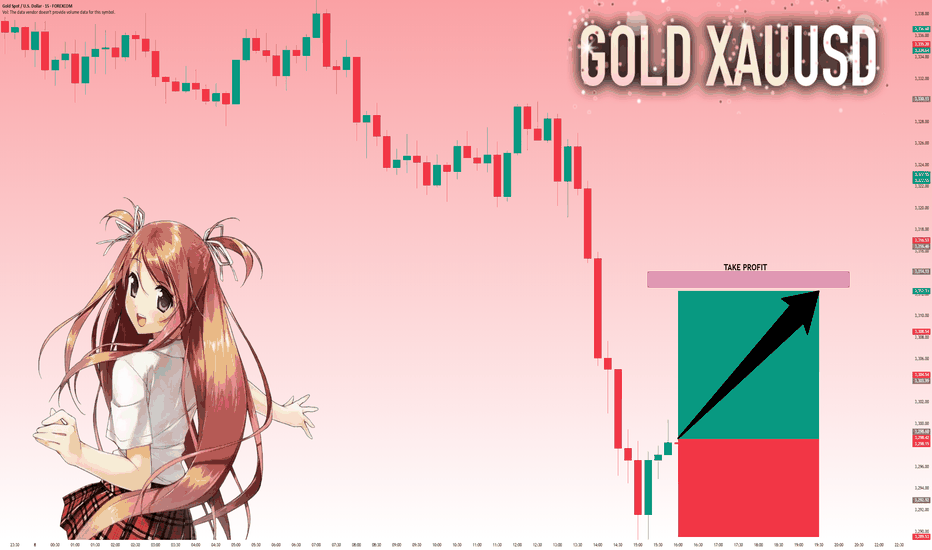

Gold Price Analysis July 9GOLD XAU/USD ANALYSIS – CONFIRMING THE CONTINUATION OF THE BEARISH WAVE

Yesterday's D1 candle confirmed the downward momentum of gold when the selling pressure returned strongly below the liquidity candle wick. This shows that the selling pressure is still dominant and the downward momentum is likely to continue in today's session.

🔹 IMPORTANT RESISTANCE ZONE: 3297

The 3297 zone – which was a strong support in yesterday's session – has now turned into a resistance zone. This is a potential SELL zone for the day, especially if there is a confirmation signal from the sellers at this price zone.

🔹 CONFUSION RESISTANCE ZONE: 3310

The 3310 area is the confluence between the downtrend line and the resistance zone of the US session – which needs special attention in the SELL strategy. If the price approaches this zone, expect a reaction from the selling side to return.

🎯 SUGGESTED STRATEGY:

SELL when price does not break through 3297 (confirm selling pressure at resistance)

SELL DCA if price breaks down to 3276

Target: 3250

BUY only considered if price holds 3276 and has a bullish reaction

📌 Key Levels:

Support: 3277 – 3250

Resistance: 3297 – 3310 – 3328

Important reaction zone: 3377 (if price rebounds)

AUD_JPY WILL KEEP GROWING|LONG|

✅AUD_JPY is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 95.600 and the breakout

Is confirmed so we are bullish

Biased and further growth

Is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

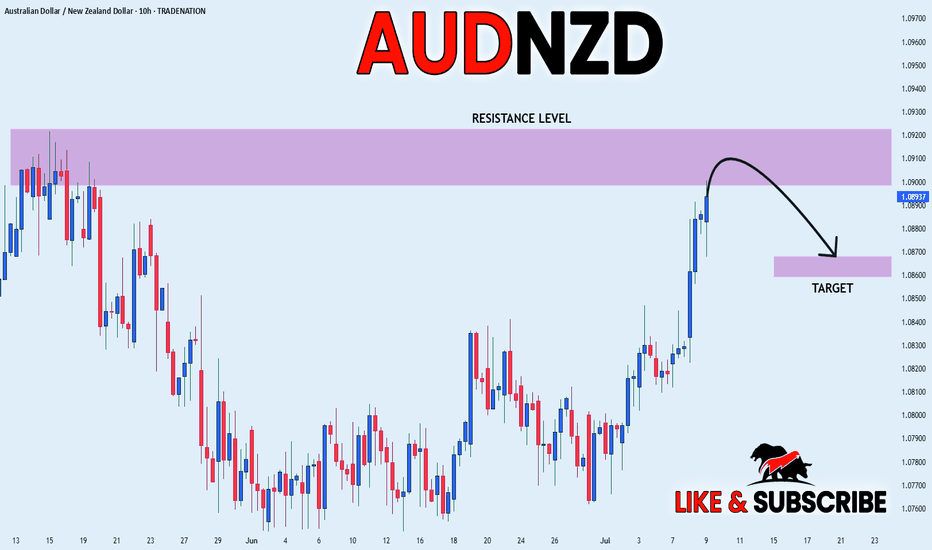

AUD_NZD SWING SHORT|

✅AUD_NZD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 1.0920

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

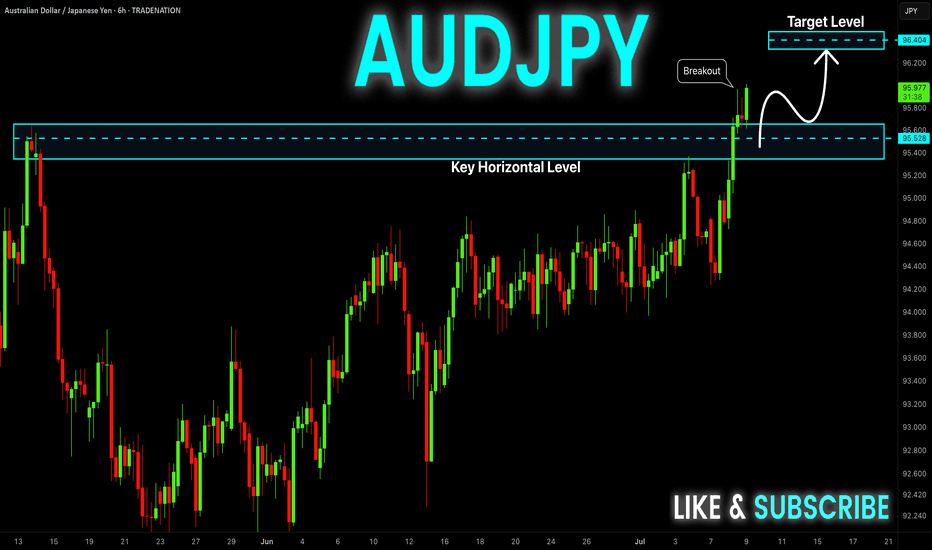

AUD-JPY Bullish Breakout! Buy!

Hello,Traders!

AUD-JPY is trading in a

Strong uptrend and the pair

Made a bullish breakout of

The key horizontal level

Of 95.650 which is now a

Support and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

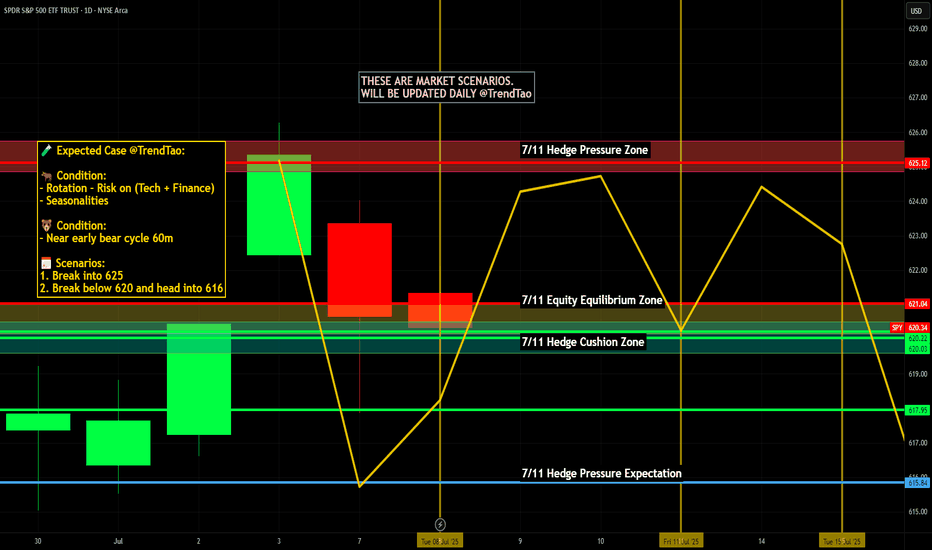

Nightly $SPY / $SPX Scenarios for July 9, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 9, 2025 🔮

🌍 Market-Moving News 🌍

📦 Tariff Pause Extended to August 1

President Trump delayed the July 9 tariff deadline, pushing negotiations into early August. Markets reacted with muted volatility, suggesting growing comfort that deals will be struck—yet widespread uncertainty remains

💵 Junk Bonds Rally Amid Tariff Tangling

Despite ongoing tariff risks, investors are doubling down on U.S. high-yield (junk) bonds. They anticipate the Fed may refrain from tightening further—favoring spread-tightening to around 7–8% yields—reflecting confidence in credit quality

🏦 Fed Faces Tough Call on Rate Path

New business surveys show conflicting signals: mixed revenue outlooks, cautious spending, and ongoing tariff pressures. The Fed must weigh slower growth against inflationary risks—keeping the door open to rate cuts in the autumn but unlikely before September

📊 Equities Firm Amid Tariff Uncertainty

Stocks showed resilience—S&P 500 and futures held position—after Monday’s tariff-triggered dip. Dip-buying and expectations of extended trade talks kept markets steady despite policy noise

📊 Key Data Releases & Events 📊

📅 Wednesday, July 9:

All Day – Ongoing U.S.–tariff negotiations; markets focused on any progress toward formal deal-making or extension terms.

Midday – Watch for headlines on tariff letters to 14 countries and any movement in trade discussions.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tariffs #Fed #fixedincome #credit #technicalanalysis

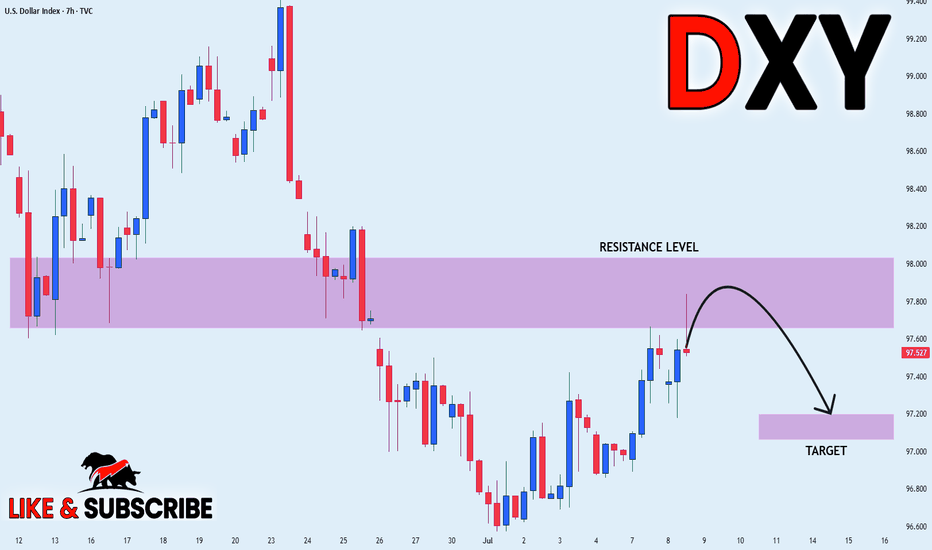

DXY LOCAL SHORT|

✅DXY is about to retest a key structure level of 98.000

Which implies a high likelihood of a move down

As some market participants will be taking profit from long positions

While others will find this price level to be good for selling

So as usual we will have a chance to ride the wave of a bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

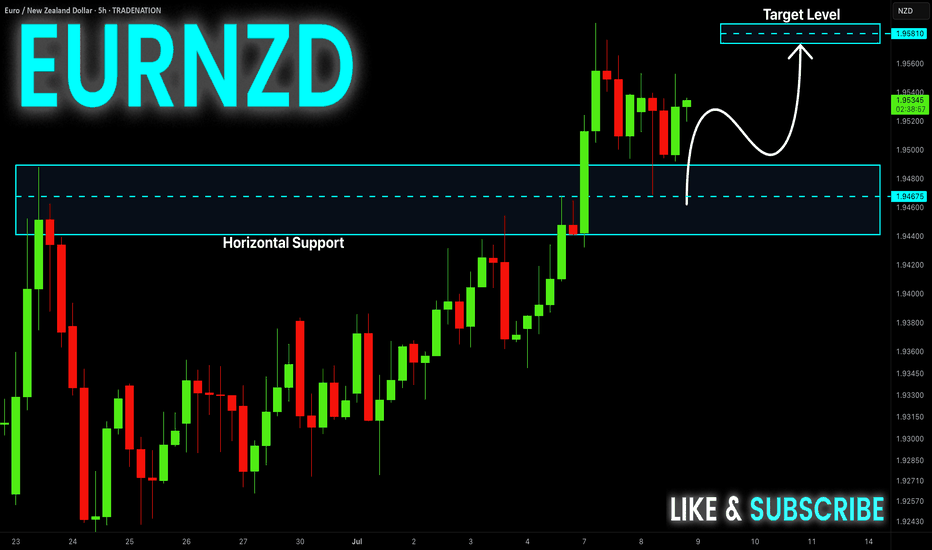

EUR-NZD Will Keep Growing! Buy!

Hello,Traders!

EUR-NZD keeps growing in a

Strong uptrend and the pair

Made a retest and a rebound

From the horizontal support

Of 1.9480 so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

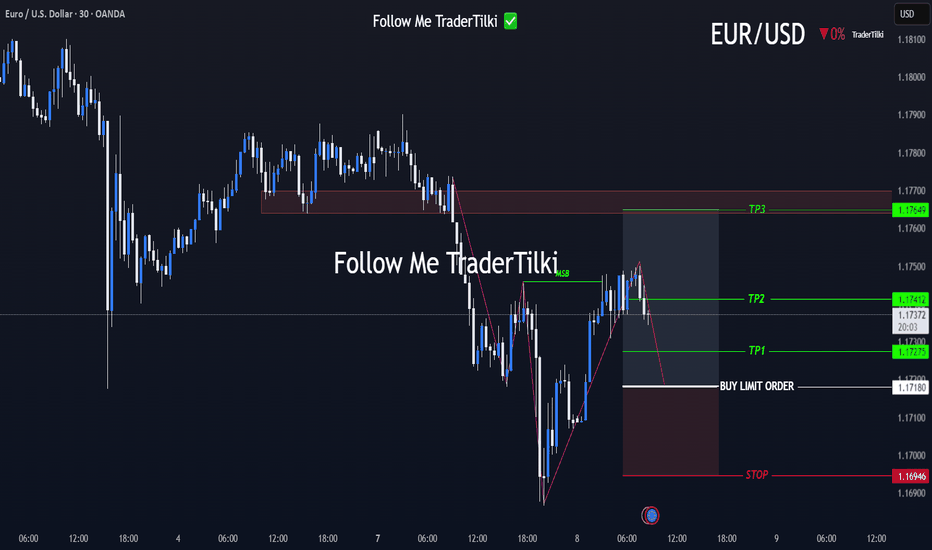

30M Insight: EURUSD Buy Limit ReadyGood Mornıng Traders;☀️

Based on a 30-minute analysis, I’ve identified a shift in EURUSD market structure. I’ll be waiting for price to reach my level with a buy limit order.

📥 BUY LIMIT ORDER: 1.17180

🛑 STOP LOSS: 1.16946

🎯 TP1: 1.17275

🎯 TP2: 1.17412

🎯 TP3: 1.17649

📊 Risk / Reward Ratio: 2.00

Patience meets precision. Let the market come to you.

🧠 Master your mindset with iron discipline.

Never fear the trade—let the trade fear you.

Keep your motivation high and your focus sharper than ever.

-----

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

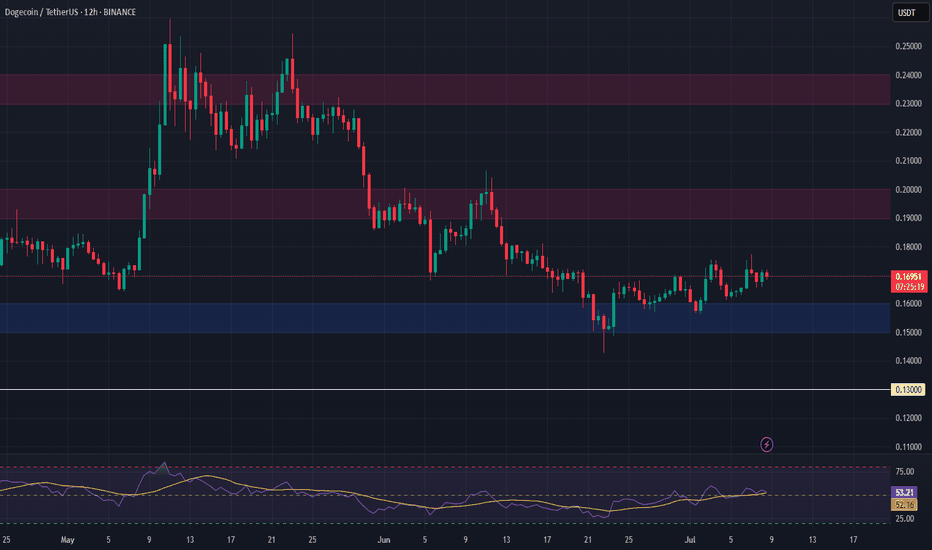

DOGE Long Swing Setup – Musk-Fueled Hype & Political BuzzElon Musk’s launch of the “America Party” is reigniting interest in his potential impact on crypto—especially Dogecoin. With his history of moving DOGE’s price, this political pivot could stir volatility and renewed upside. We’re watching for a dip into the $0.15–$0.16 zone for a possible long entry.

📌 Trade Setup:

• Entry Zone: $0.15 – $0.16

• Take Profit Targets:

o 🥇 $0.19 - $0.20

o 🥈 $0.23 – $0.24

• Stop Loss: Daily close below $0.13

Gold: Potential Correction on the Horizon?Gold has long been regarded as a safe haven asset, drawing the attention of investors during periods of economic uncertainty. In recent years, gold prices have reached historic highs, fueled by inflation concerns, geopolitical tensions, and shifts in monetary policy. However, as with any asset experiencing a prolonged rally, the question arises: Is a correction in gold prices imminent?

Understanding the Recent Gold Rally

Several factors have contributed to gold’s impressive performance:

Inflation Hedge: Persistent inflation has driven investors toward gold as a store of value.

Geopolitical Risks: Ongoing conflicts and global tensions have increased demand for safe haven assets.

Monetary Policy: Central banks’ dovish stances and low interest rates have made non-yielding assets like gold more attractive.

Several scenarios could catalyze a correction in gold prices:

Unexpected Economic Recovery: Stronger-than-expected economic data could reduce demand for safe haven assets.

Aggressive Rate Hikes: Faster-than-anticipated interest rate increases could shift investor preference away from gold.

Resolution of Geopolitical Tensions: Any de-escalation in major geopolitical hotspots may dampen gold’s appeal.

#gold #commodity #commodities #metals #trading #portfolio

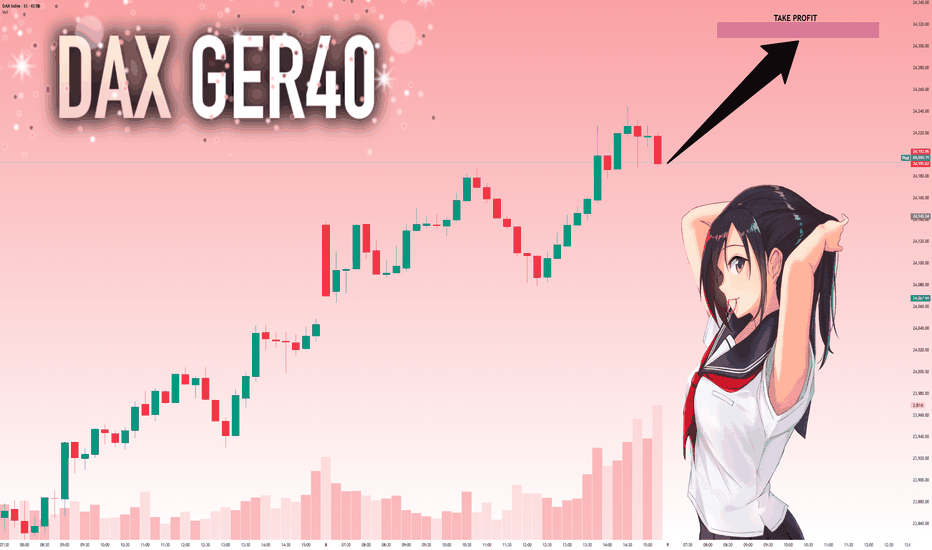

DAX: Target Is Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 24,193.11 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

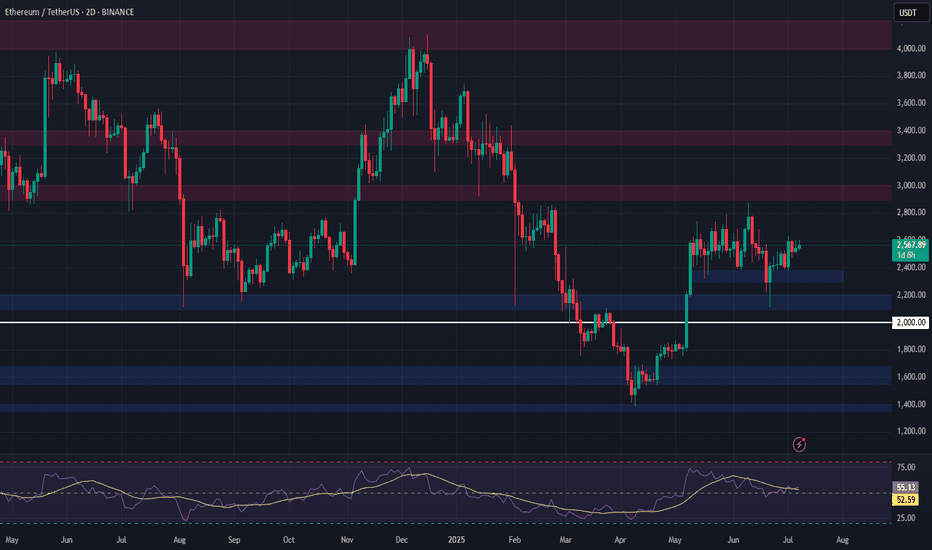

ETH Long Swing Setup – Sideways Hold with Dip-Buy OpportunityETH continues to hold above the key $2,300 support, showing resilience and consolidating within range. We’re watching for one more dip into the $2,300–$2,375 zone to trigger a long entry, with momentum building for a potential breakout.

📌 Trade Setup:

• Entry Zone: $2,300 – $2,375

• Take Profit Targets:

o 🥇 $2,900 – $3,000

o 🥈 $3,300 – $3,400

o 🥉 $4,000 – $4,200

• Stop Loss: Daily close below $2,000

GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,298.60 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 3,312.65.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️